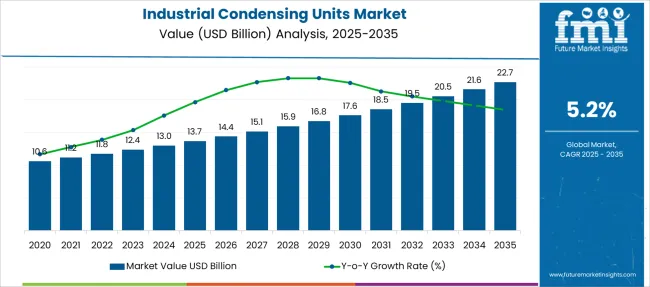

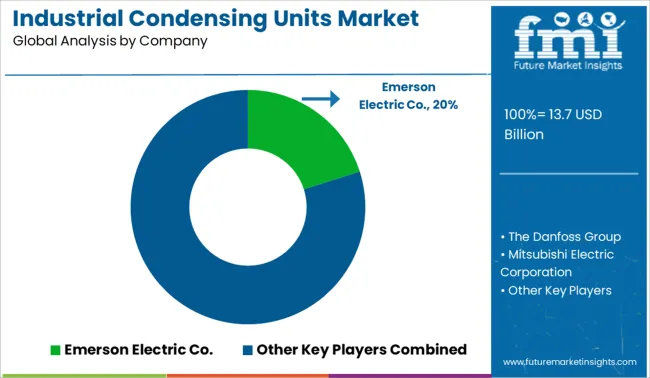

The Industrial Condensing Units Market is estimated to be valued at USD 13.7 billion in 2025 and is projected to reach USD 22.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Condensing Units Market Estimated Value in (2025 E) | USD 13.7 billion |

| Industrial Condensing Units Market Forecast Value in (2035 F) | USD 22.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The industrial condensing units market is expanding steadily due to increasing demand for efficient cooling solutions in various industrial applications. Industry reports have highlighted the growing preference for energy-efficient technologies that reduce operational costs and comply with environmental regulations.

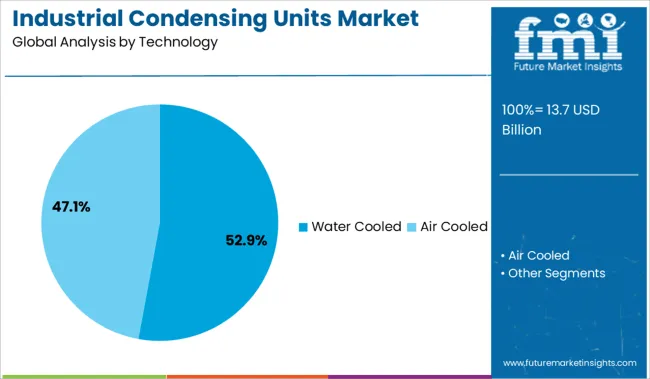

Water-cooled technology has gained traction for its superior heat dissipation and suitability in large-scale refrigeration systems. Industrial sectors, particularly those relying on indoor refrigeration such as food processing and pharmaceuticals, have driven demand due to the need for precise temperature control and reliable equipment.

Additionally, the trend of expanding manufacturing facilities and new infrastructure developments has spurred growth in new installations. Technological advancements in condensing units that improve performance and lower emissions are expected to further boost market adoption. Segment growth is anticipated to be led by water-cooled technology, indoor-based refrigeration applications, and new installations.

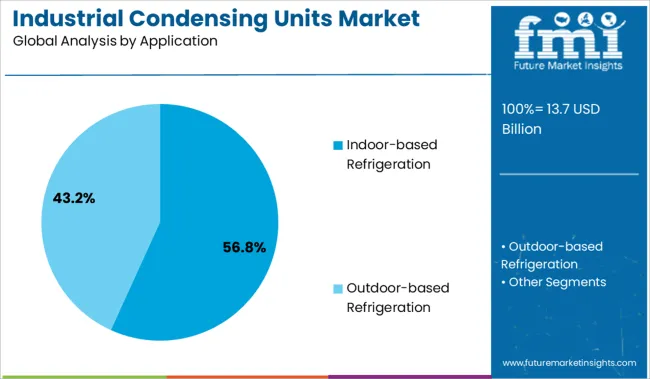

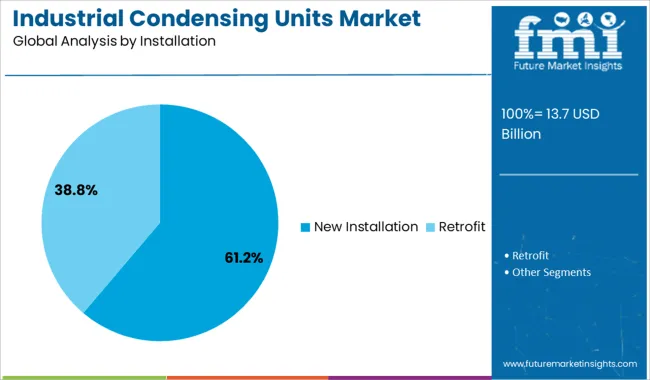

The market is segmented by Technology, Application, Installation, End Use, Compressor Type, Sales Channel, and Capacity and region. By Technology, the market is divided into Water Cooled and Air Cooled. In terms of Application, the market is classified into Indoor-based Refrigeration and Outdoor-based Refrigeration. Based on Installation, the market is segmented into New Installation and Retrofit. By End Use, the market is divided into Domestic Appliances, Indoor Based Air Conditioners, Commercial Refrigeration, and Industrial Refrigeration. By Compressor Type, the market is segmented into Reciprocating, Screw, Centrifugal, Rotary, and Scroll. By Sales Channel, the market is segmented into OEM and Aftermarket. By Capacity, the market is segmented into Up to 1 kW, 2 – 10 kW, 11 – 40 kW, and Above 40 kW. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water-cooled technology segment is projected to hold 52.9% of the industrial condensing units market revenue in 2025, leading technology adoption. This preference has been driven by water-cooled units’ ability to provide efficient heat transfer, especially in environments where space constraints limit air-cooled system performance.

The cooling efficiency of water-cooled units reduces energy consumption, helping industries meet stricter environmental and energy-saving regulations. Moreover, water-cooled systems are favored in large industrial setups where consistent and reliable refrigeration is critical.

These units also offer benefits in terms of quieter operation and longer equipment lifespan, which adds to their appeal. As industries continue to prioritize sustainability and operational efficiency, the water-cooled technology segment is expected to remain dominant.

The indoor-based refrigeration application segment is projected to account for 56.8% of the market revenue in 2025, maintaining its lead in usage. This segment’s growth is linked to the expanding need for temperature-controlled environments in sectors like food storage, cold chain logistics, and pharmaceuticals.

Indoor refrigeration systems require reliable and precise cooling to maintain product quality and comply with safety standards. Growing consumer demand for fresh and perishable goods has increased the deployment of industrial condensing units in warehouses and processing facilities.

The indoor setting also allows for optimized system design and maintenance, further supporting this segment’s growth. With the rise of e-commerce and cold supply chains, indoor-based refrigeration remains crucial for industrial refrigeration needs.

The new installation segment is expected to contribute 61.2% of the industrial condensing units market revenue in 2025, marking it as the primary installation category. Market expansion is being driven by ongoing industrial growth and infrastructure projects requiring the deployment of modern refrigeration systems.

New constructions in manufacturing plants, cold storage warehouses, and food processing units have increased the demand for condensing units. The installation of new units allows industries to leverage the latest technology advancements, improving energy efficiency and compliance with regulations.

Replacement and retrofit installations continue but new installation projects dominate due to increasing industrialization, particularly in emerging markets. The focus on long-term operational cost savings and environmental standards supports the continued preference for new installations.

| Market Statistics | Details |

|---|---|

| H1,2024 (A) | 5.0% |

| H1,2025 Projected (P) | 5.1% |

| H1,2025 Outlook (O) | 4.8% |

| BPS Change : H1,2025 (O) - H1,2025 (P) | (-) 30 ↓ |

| BPS Change : H1,2025 (O) - H1,2024 (A) | (-) 16 ↓ |

Future Market Insights presents a half-year comparison and insightful analysis of the industrial condensing unit's market growth outlook. Rapid industrialization, urbanization, changing weather conditions, infrastructure developments, and increasing demand from the residential, industrial, and commercial sectors are some of the influences driving the global industrial condensing units market.

The construction industry, as well as the growing hotel, restaurants, and cafes around the world, are enhancing the sales.

The global sales for industrial condensing units witnessed a growth rate of 5.0% over the first half of 2024, as compare to the current estimation, the market had witness a decline of 16 bps points. Further the market growth outlook is expecdt to witness a decrease in the growth rate of 30 BPS as compare to the earlier projecetions for the first half of 2025.

This decrease in the growth outlook is mainly attribute to shutdown of a large area in China, as the country accounts for a key share of the market, overall growth had been impacted to a certain extent.

The rising need for advanced refrigeration across various application areas such as hospitals, power plants, transportation containers, and cooling systems is anticipated to create lucrative prospects within the industrial condensing units market. The year-over-year growth of the market is expected to increase in the coming years.

The development of novel industrial condensing units with low carbon emission potential refrigerants, good energy performance ratios, and trouble-free installation has been aided by advancements in condensing technology is expected to remain a key market trend.

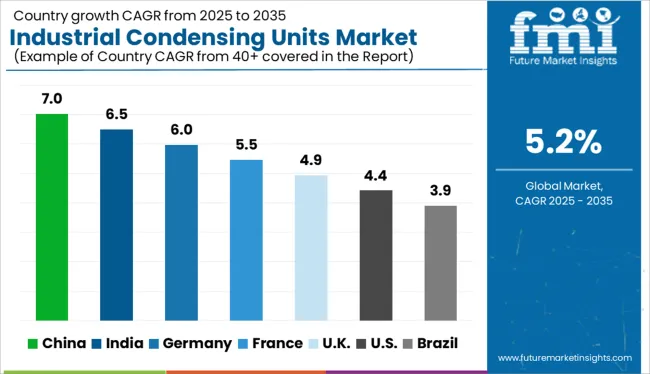

The global industrial condensing units market is set to grow at a steady CAGR of 5.2% between 2025 and 2035, in comparison to the 5.0% CAGR registered from 2013 to 2024.

As per FMI, rapid industrialization, changing weather conditions, increasing expenditure on infrastructure development and surging demand from the industrial, residential and commercial sectors are some of the factors driving the global industrial condensing units market.

Expansion of the construction industry along with the booming HoReCa sector across the globe is boosting the sales in the market.

Growing need for advanced refrigeration across various application areas such as hospitals, power plants, transportation containers and cooling systems is anticipated to create lucrative prospects within the industrial condensing units market.

Advancement in condensing technology has paved way for the development of innovative industrial condensing units with low GWP (global warming potential) refrigerants, high energy performance ratio and trouble-free installation. Leading manufacturers are investing in research and development to improve their product portfolios, which is expected to boost the market in the forthcoming years.

Backed by the aforementioned factors, the market volume for industrial condensing units market is set to expand 1.3X through 2035.

Expansion of the commercial sector across both developed and developing countries due to increasing investment, growing population, rapid urbanization, and economic boom is expected to have a profound impact on the industrial condensing units market.

Rising number of retail stores, restaurants, warehouses, offices, data centers and hotels is spurring demand for industrial condensing units.

Growing food insecurity issue due to excessive wastage of food is prompting manufacturers to adopt better storage facilities. According to the Food and Agriculture Organization of the United Nations, an estimated 1/3 (approx. 1.3 billion tonnes) food produced globally is lost or goes to waste.

Lack of better storage and cooling facilities mainly at the early stages of food value chain is one of the major factors which increases food waste. To address this issue, large number of industrial condensing units are being employed across retail stores, colling facilities, transportation containers, restaurants, and warehouses.

These units provide a suitable temperature and help to extend the shelf life of food products.

Similarly, adoption of industrial condensing units in commercial buildings and data centers will continue to create growth prospects within the industrial condensing units market over the forecast period.

Booming Real Estate Sector is Boosting Sales of Industrial Condensing Units in India

India is emerging as one of the most lucrative markets for industrial condensing units across South Asia. Increasing need for energy saving refrigerant condensing units in industrial and commercial sectors, presence of leading domestic and international market players, and changing climatic conditions are some of the factors driving the India industrial condensing units market.

With rising population and growing food concerns, the Indian government is putting various efforts to develop the country's industrial and commercial infrastructure. Expansion of real estate industry is playing a key role in driving the industrial condensing units market.

The Indian real estate sector has witnessed significant growth in recent times due to increasing establishments of office as well as residential spaces According to the Indian Brand Equity Foundation (IBEF), real estate sector in India, comprising housing, retail, hospitality and commercial sub sectors, is projected to reach around USD 1 trillion by 2035.

Rising adoption of industrial condensing units across diverse applications such as blood banks, food storage facilities, pharmacies and retail stores is anticipated to boost the growth of industrial condensing units market in India during the forecast period.

As per FMI, the South Asia industrial condensing units market, spearheaded by India is set to expand at a robust CAGR of 7.5% between 2025 and 2035.

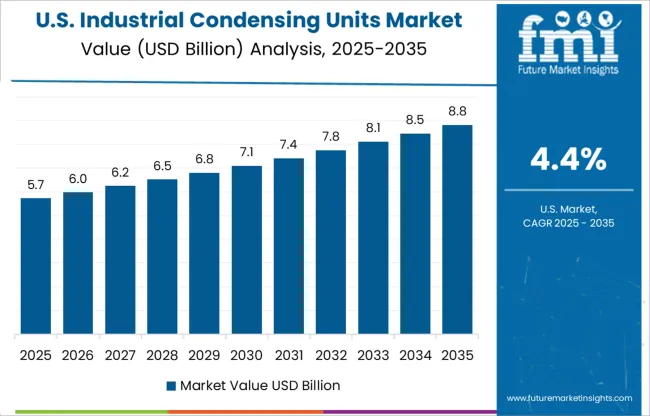

Rising Food Waste Concerns are Boosting Sales in the USA Industrial Condensing Units Market

Owing to rapid industrialization, heavy presence of leading market players and surging demand for commercial refrigeration, the USA will continue to remain the hub of industrial condensing units during the forecast period.

Rising disposable income coupled with changing lifestyle is creating huge demand for processed and packaged food items across the country. However, unsuitable temperature during transportation and storage of food items is resulting in the food wastage.

According to the United States Department of Agriculture (USDA), around 30-40% of the food supply is lost or goes to waste in the USA in order to minimize this loss, large number of industrial condensing units are being employed in food manufacturing industry, retail stores, transportation containers, restaurants and hotels. This is in turn accelerating the growth in the market.

Moreover, continuous advancement in refrigeration technology along with increasing adoption of modern ecofriendly industrial condensing units across diverse industries will continue to boost the growth in the USA market over the forecast period.

Based on the aforementioned factors, a CAGR of 4.5% has been predicted for North America industrial condensing units market between 2025 and 2035.

China is estimated to account for the lion’s share in the East Asia condensing units market, in terms of value. The government of China is encouraging the use of natural refrigerants in many applications. These refrigerants are particularly preferred in heat pumps, room air conditioners, industrial and commercial uses.

The construction industry forms an important pillar of the China's national economy. Rapid industrialization, urbanization and growth of commercial sector are creating significant demand for better cooling and refrigeration systems such as HVAC.

Technological advancements across the country have paved way for the development of advanced air conditioning units with low noise, high efficiency, and cost-effective features.

Amid increasing adoption for industrial conditioning units across most of the industrial and commercial structures in China, East Asia market is forecast to grow at a healthy CAGR of 5.6% over the forecast period.

Based on installation, the global industrial condensing units market is segmented into new installation and retrofit. Among these, new installation segment dominates the global industrial condensing units market and is projected to dominate the market during the forecast period.

Installation of new industrial conditioning units offer various advantages including higher efficiency, proper sizing and helps in saving money. For these reasons, majority of the people prefer new installations over retrofit.

Increasing adoption of new industrial condensing units across various end-use sectors is anticipated to boost the growth of industrial condensing units market through 2035.

End Users Prefer Air-cooled Industrial Condensing Units in Most Cases

The air-cooled condensing segment is anticipated to grow at the highest CAGR over the forecast period. These are usually smaller in size, easy to install and require low maintenance. Moreover, they do not require cooling water for the condensing or refrigeration process. Thus, they promote the idea of water conservation.

Thanks to its various advantages, air cooled industrial condensing units remain the most preferred product across commercial applications. Additionally, scarcity of water globally is fueling the adoption of air-cooled industrial condensing units and the trend is likely to continue in the future.

In terms of application, the outdoor-based refrigeration segment is expected to dominate the market over the forecast period.

Growing popularity of outdoor condensing units for addressing drastic climatic changes across various counties will drive the global industrial units market over the forecast period. Moreover, recent advances in outdoor condensing unit technology is positively impacting the growth in this segment.

Majority of Sales to Remain Concentrated in Commercial Refrigeration

As per FMI, commercial refrigeration segment will continue to dominate the global industrial condensing units market over the forecast period.

With increasing number of malls, hotels, restraints, offices, warehouses, and retail stores, sales of industrial condensing units are surging rapidly. These condensing units are being extensively utilized for providing advanced refrigeration across commercial applications.

Superior performance benefits offered by industrial condensing units make them a viable investment for commercial refrigeration applications. Expansion of the commercial sector across the globe, coupled with increasing adoption of industrial condensing units for food storage will continue to boost the sales during the forecast period.

Scroll Compressor Remains the Most Preferred Type

On the basis of compressor type, the global industrial condensing units market has been segmented into reciprocating, screw, centrifugal, rotary and scroll. Among these, scroll compressor remains the most preferred type used in industrial condensing units. They have gained wide acceptance in commercial application during the last few years.

Scroll compressors run quieter and smoother than other compressor types as they have only two moving parts. The presence of lesser parts make scroll compressor energy efficient more reliable and less prone to mechanical failure.

Moreover, compactness and lightweight of scroll compressors is fueling their adoption in industrial condensing units.

The industrial condensing units market is highly competitive in nature. Leading market players are constantly upgrading their product portfolios. Besides this, they are adopting various organic and inorganic strategies such as mergers, partnerships, collaborations and acquisitions to gain a competitive edge. For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | Units for Volume and USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; India; and the Middle East & Africa |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The UK, France, Italy, Spain, Russia, Poland, China, Japan, South Korea, India, ASEAN, Turkey and South Africa |

| Key Segments Covered | Capacity, Installation, Technology, Application, End Use, Compressor Type, and Region |

| Key Companies Profiled | Emerson Electric Co.; Embraco; Tecumseh Products Company LLC; The Danfoss Group; Mitsubishi Electric Corporation; GEEA Group AG,; Bitzer SE; Daikin Applied Systems Co. Ltd.; Hasegawa Refrigeration Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global industrial condensing units market is estimated to be valued at USD 13.7 billion in 2025.

The market size for the industrial condensing units market is projected to reach USD 22.7 billion by 2035.

The industrial condensing units market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in industrial condensing units market are water cooled and air cooled.

In terms of application, indoor-based refrigeration segment to command 56.8% share in the industrial condensing units market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA