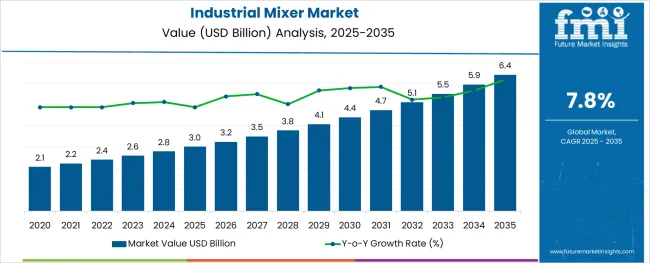

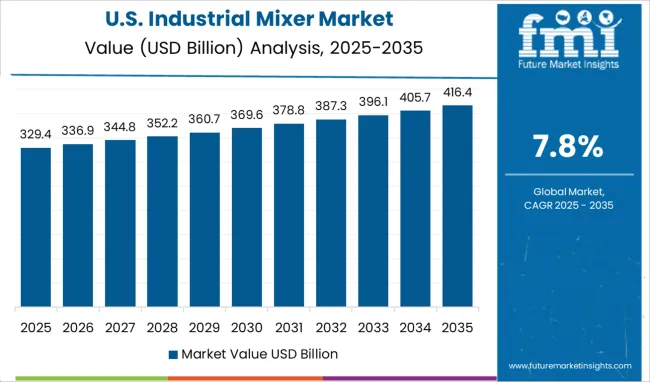

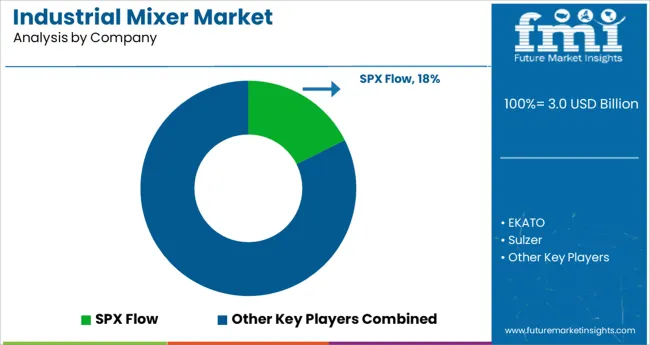

The Industrial Mixer Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

The industrial mixer market is experiencing steady growth as manufacturers across various sectors prioritize operational efficiency, product consistency, and process automation in their production lines. The increased demand for customized and high-performance mixing solutions has been propelled by the expansion of end-use industries such as chemicals, food and beverages, pharmaceuticals, and construction. Current market dynamics indicate heightened investment in advanced mixers equipped with variable speed control, automated cleaning systems, and precision monitoring capabilities, reflecting an industry-wide shift toward improving production quality while reducing operational costs.

Looking ahead, market prospects remain favorable as regulatory emphasis on process hygiene, product uniformity, and energy-efficient machinery strengthens. The adoption of Industry 4.0 frameworks and the integration of smart, sensor-based mixers capable of real-time performance analysis are also expected to accelerate market evolution. Additionally, rising investments in infrastructure and industrial facilities, particularly across Asia Pacific and Latin America, are anticipated to boost equipment demand.

Collectively, these factors position the industrial mixer market for consistent growth, driven by technological advancements and evolving production requirements in process-centric industries.

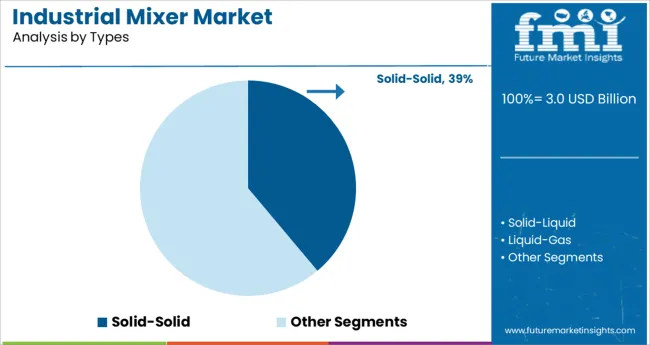

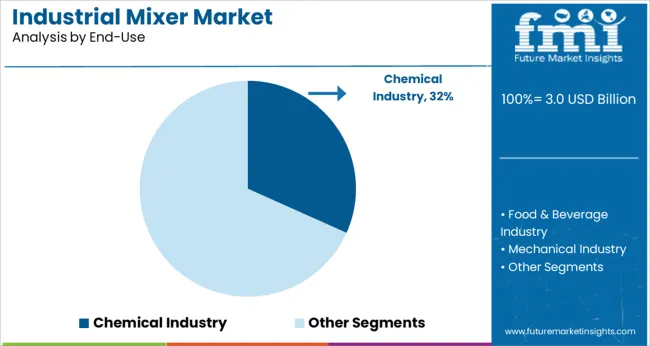

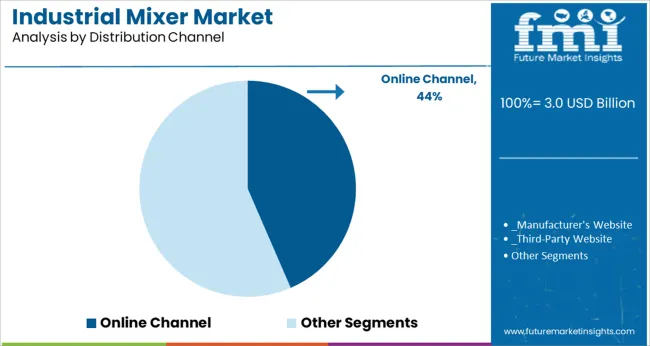

The market is segmented by Types, End-Use, and Distribution Channel and region. By Types, the market is divided into Solid-Solid, Solid-Liquid, Liquid-Gas, and Liquid-Liquid. In terms of End-Use, the market is classified into Chemical Industry, Food & Beverage Industry, Mechanical Industry, Pharmaceutical Industry, Water & Wastewater Industry, and Others. Based on Distribution Channel, the market is segmented into Online Channel and Offline Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The solid-solid segment held a dominant 38.9% share within the industrial mixer market, affirming its widespread application across bulk material handling and dry powder processing operations. This segment’s growth has been primarily driven by escalating demand from industries such as chemicals, construction, and pharmaceuticals, where uniform blending of dry solids remains a critical process requirement. The ability of solid-solid mixers to deliver homogenous mixtures of powders, granules, and particulate materials has ensured their extensive use in applications ranging from pigment blending to composite material preparation.

Equipment advancements, such as improved rotor designs, reduced mixing times, and contamination-free processing capabilities, have further supported this segment’s adoption. Additionally, manufacturers are increasingly emphasizing mixers with enhanced energy efficiency and automation compatibility to meet the evolving needs of high-throughput production environments.

As material innovation continues across sectors like chemicals and construction, the requirement for reliable and precise solid-solid mixing equipment is projected to sustain this segment’s strong market position in the years ahead.

Among end-use industries, the chemical industry emerged as the leading contributor with a 31.7% market share, reflecting the sector’s intensive reliance on industrial mixers for blending raw materials, additives, and compounds. The chemical industry’s stringent quality standards and demand for product consistency have heightened the necessity for robust and high-capacity mixing equipment capable of handling diverse viscosities and material properties. This segment’s growth has also been fueled by increased chemical production activities, particularly in Asia Pacific and the Middle East, alongside the modernization of legacy production facilities in mature markets.

Industrial mixers in the chemical sector are extensively utilized in processes such as emulsification, homogenization, and suspension formation, where precision and contamination-free performance are paramount.

Furthermore, rising environmental and safety regulations have encouraged manufacturers to invest in mixers with closed-system designs, minimizing emissions and enhancing workplace safety. As global chemical demand continues to climb, the sustained need for efficient, durable, and automated mixing solutions positions this segment for consistent market leadership.

Within the distribution landscape, the online channel captured a notable 43.5% share of the industrial mixer market, signaling a significant shift in purchasing behavior among industrial buyers. This dominance has been supported by the growing preference for digital procurement platforms offering a broad selection of mixer types, transparent pricing, and access to technical specifications, enabling informed decision-making. The convenience and efficiency associated with online transactions, particularly for standardized equipment models and replacement units, have made this channel increasingly attractive for both small enterprises and large industrial buyers.

Furthermore, equipment suppliers and manufacturers have strengthened their digital presence through e-commerce platforms, direct-to-customer portals, and industrial procurement marketplaces, expanding their reach across regional and international markets. The availability of detailed product information, virtual demonstrations, and after-sales support through online platforms has reinforced buyer confidence in digital procurement.

As industrial procurement continues to digitalize, and as supply chain transparency and transactional convenience remain priorities, the online distribution channel is expected to maintain its dominant market position.

According to Future Market Insights (FMI), industrial mixer sales increased with the burgeoning need for high-performance mixing devices to improve production performance. Surging demand for energy-efficient devices, growing focus on flow maximization, and equipment adaptability are considered to be the key industrial mixer market trends.

Furthermore, as they are cost-effective and with rapid developments in design technology, the demand for industrial mixers is expected to surge. Also, with increased government backing for sophisticated technology, small and medium-sized firms are extensively using industrial mixers.

Subsequently, the advent of automation in industries to minimize mistake rates and offer consistent quality is likely to boost demand for programmable logic controller-based mixers over the forecast period. According to FMI, the overall industrial mixer sales are expected to expand by 2.1x between 2025 and 2035.

Industrial mixer manufacturers are expected to witness lucrative growth prospects on the back of rising applications in the food and beverage industry. This is due to the rising demand for packaged foods across the globe.

Rising preference for ready-to-eat food goods such as dairy and pastry products, especially in China and India will boost the industrial mixer market. Furthermore, with rapid urbanization, the demand for packaged food goods will propel the sales of industrial high-shear mixers.

In the chemical and pharmaceutical industries, these mixers are used to mix a variety of items such as hazardous chemicals, viscous fluids, and other materials. These mixers are being adopted at an alarming pace to minimize health issues and enhance production rates.

Hence, demand for vertical mixers and horizontal industrial mixers will accelerate industrial mixer sales over the forecast period. On account of this, the sales of vertical and horizontal industrial mixers will gain traction at a robust pace between 2025 and 2035.

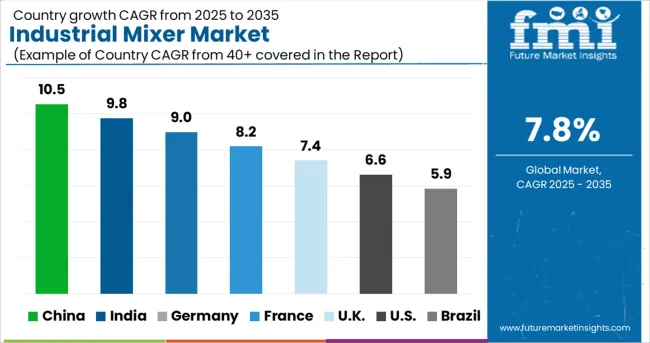

China Industrial Mixer Market to Witness Robust Growth Amid Rising Application in Pharmaceutical Industry

According to FMI, China is expected to emerge as the most lucrative industrial mixer market over the forecast period. Industrial mixer sales in China are expected to increase amid growing applications in the chemical industry and pharmaceutical industries.

As China's chemical industry and pharmaceutical industries are considered to be the world's largest, the sales in China's industrial mixer market will surge at a rapid pace through 2025 & beyond.

Industrial Mixer Sales to Gain Tailwinds as Application in Food and Beverage Industry Rises

As per the study, demand for industrial mixer in the food and beverage industry is increasing steadily in the USA Industrial mixer sales are surging with growing applications in the meat processing business. Hence, with the growing consumption of meat-based food products in the USA, the industrial mixer market will witness steady growth in the USA

Industrial Mixer Manufacturers to Capitalize on Rising Demand for Eco-Friendly Mixers in Chemical Industry

Industrial mixer manufacturers are concentrating on new technology to make these mixers function quicker and use less energy. For the chemical industry and pharmaceutical industries, manufacturers are investing in making these mixers even more sanitary.

For an environmentally responsible product, several manufacturers are developing these mixers with recyclable metal. A slew of such product launches and development will create remunerative growth opportunities in Germany industrial mixer market.

Online Channel Segment to Account for Significant Share in Industrial Mixer Market

During the assessment period, the offline retail segment is expected to witness significant growth in the industrial mixer market. However, with ease in convenience and availability of a variety of products, industrial mixer sales are expected to surge through online channels as well.

Demand for Vacuum Industrial Mixers to Outpace the Vertical Industrial Mixer Sales

Based on product type, the industrial mixer market is sub-segmented into vertical mixer, horizontal mixer, jacketed mixer, vacuum mixer, continuous mixer, and others. According to FMI, vertical industrial mixer sales are expected to increase at a considerable pace.

However, demand for vacuum industrial mixers is projected to rise over the forecast period.

In terms of end-use, the industrial mixer market is segmented into the chemical industry, food & beverage industry, mechanical industry, pharmaceutical industry, water & wastewater industry, and others.

As per the study, maximum industrial mixer sales are expected to be contributed by the food and beverage industry during the forecast period.

Top players in the industrial market are pursuing a variety of methods, including mergers and acquisitions to gain a competitive edge. Furthermore, numerous firms are working focusing on product launches and development to expand their capacity and strengthen their foothold in the industrial mixer market.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; Oceania; and MEA |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, and UAE |

| Key Segments Covered | Type, Material to be mixed of industrial mixers, End Line Use, Distribution Channel and Region |

| Key Companies Profiled | SPX Flow; EKATO; Sulzer; Xylem; National Oilwell Varco; ALFA LAVAL; Dover; Shenyin; Philadelphia; Zhejiang Great Wall Mixers; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global industrial mixer market is estimated to be valued at USD 3.0 billion in 2025.

It is projected to reach USD 6.4 billion by 2035.

The market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types are solid-solid, solid-liquid, liquid-gas and liquid-liquid.

chemical industry segment is expected to dominate with a 31.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA