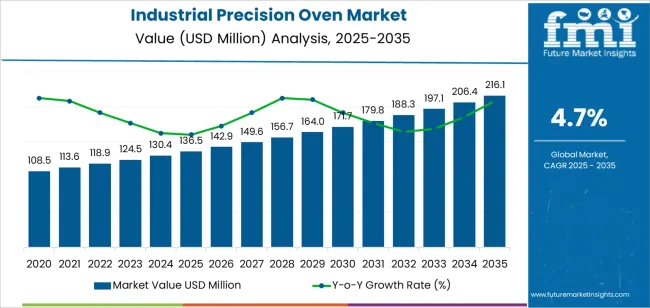

The global industrial precision oven market is forecasted to reach USD 216.0 million by 2035, recording an absolute increase of USD 79.6 million over the forecast period. The market is valued at USD 136.5 million in 2025 and is set to rise at a CAGR of 4.7% during the assessment period. The market size is expected to grow by nearly 1.6 times during the same period, supported by increasing demand for controlled thermal processing in advanced manufacturing operations, growing adoption of precision temperature control systems in electronics assembly and materials testing applications, and expanding investment in quality assurance infrastructure across automotive and medical device manufacturing sectors driving utilization of reliable thermal processing equipment.

The market expansion reflects growing requirements for accurate temperature uniformity and process repeatability in industrial heating applications, where precision ovens deliver superior thermal control and measurement consistency compared to conventional industrial heating systems. Manufacturing facilities across electronics production lines, automotive component testing laboratories, and medical device sterilization centers are implementing precision oven technology to achieve reliable thermal processing outcomes and stringent quality control protocol compliance.

The market demonstrates strong momentum across developed and emerging industrial economies, where manufacturing quality systems are transitioning from basic heating equipment to advanced thermal processing platforms that offer superior temperature uniformity and programmable control capabilities. Industrial precision oven technology addresses critical manufacturing challenges including thermal profile consistency in heat treatment operations, temperature distribution uniformity across processing chambers, and documentation requirements for regulated manufacturing environments.

The electronics manufacturing sector's focus on lead-free soldering processes and thermal reliability testing creates steady demand for heating solutions capable of providing precise temperature control, minimal thermal gradients, and comprehensive process monitoring with traceable documentation capabilities. Quality assurance specialists and manufacturing engineers are adopting precision ovens for thermal processing applications where temperature accuracy directly impacts product reliability and regulatory compliance requirements.

Industrial facilities and contract manufacturing operations are investing in precision oven systems to enhance thermal processing capabilities through improved temperature control and expanded chamber configuration options. The integration of advanced control systems and digital interface technologies enables these platforms to achieve temperature uniformity specifications within 3-5 degrees Celsius across processing zones while maintaining programmable setpoint accuracy standards. The initial capital investment requirements for precision thermal equipment and facility infrastructure needs for proper installation and ventilation may pose challenges to market expansion in small-scale manufacturing operations and regions with limited access to industrial equipment financing programs and technical support resources.

Between 2025 and 2030, the market is projected to expand from USD 136.5 million to USD 163.9 million, resulting in a value increase of USD 27.4 million, which represents 34.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for precision thermal processing in electronics manufacturing and materials testing laboratories, product innovation in programmable control systems and thermal uniformity enhancement technologies, as well as expanding integration with Industry 4.0 platforms and automated production environments. Companies are establishing competitive positions through investment in advanced heating element designs, intelligent temperature control algorithms, and strategic market expansion across semiconductor packaging facilities, automotive testing laboratories, and medical device manufacturing operations.

From 2030 to 2035, the market is forecast to grow from USD 163.9 million to USD 216.0 million, adding another USD 52.1 million, which constitutes 65.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized thermal processing systems, including cleanroom-compatible configurations and custom-engineered platforms tailored for specific manufacturing processes and temperature range requirements, strategic collaborations between equipment manufacturers and industrial automation providers, and an enhanced focus on energy efficiency optimization and process documentation capabilities. The growing focus on manufacturing quality and regulatory compliance will drive demand for advanced, high-performance industrial precision oven solutions across diverse thermal processing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 136.5 million |

| Market Forecast Value (2035) | USD 216.0 million |

| Forecast CAGR (2025-2035) | 4.7% |

The industrial precision oven market grows by enabling manufacturers to achieve accurate thermal processing and consistent product quality while reducing process variability in controlled heating operations. Manufacturing facilities face mounting pressure to meet stringent quality specifications and regulatory documentation requirements, with precision ovens typically providing temperature uniformity within 3-5 degrees Celsius compared to 10-15 degrees with standard industrial ovens, making these advanced thermal systems essential for quality-critical manufacturing processes. The electronics and medical device industries' need for precise temperature control creates demand for advanced heating solutions that can deliver programmable thermal profiles, uniform heat distribution, and comprehensive process validation across diverse material types and processing requirements.

Industrial automation initiatives promoting smart manufacturing and process optimization drive adoption in electronics assembly operations, automotive component testing facilities, and pharmaceutical manufacturing environments, where thermal processing precision has a direct impact on product reliability and regulatory compliance. The global shift toward quality management system certification and traceability requirements accelerates precision oven demand as manufacturing facilities seek thermal processing equipment that enables comprehensive process documentation and validation protocol support. High equipment costs compared to conventional industrial ovens and specialized installation requirements for proper operation may limit adoption rates among small-scale manufacturers and regions with traditional manufacturing practices and limited access to precision thermal processing expertise.

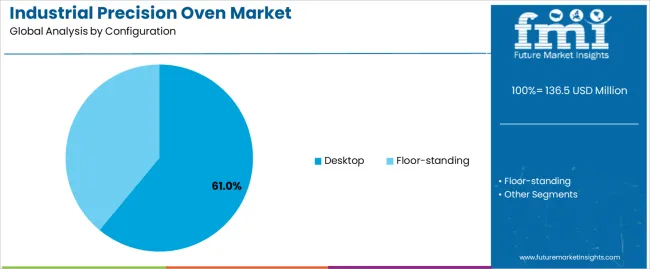

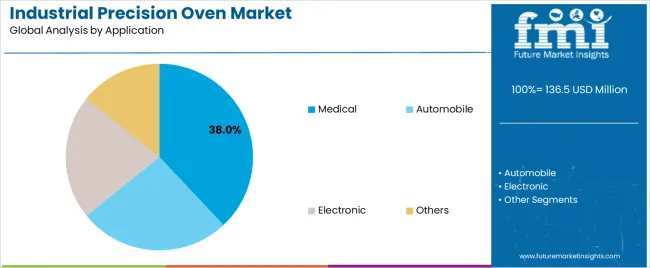

The market is segmented by configuration, application, and region. By configuration, the market is divided into desktop and floor-standing. Based on application, the market is categorized into medical, automobile, electronic, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

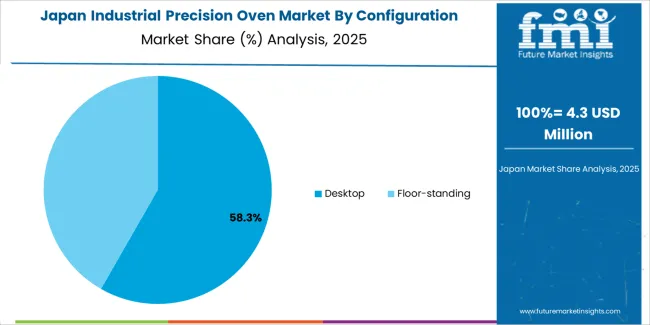

The desktop segment represents the dominant force in the market, capturing approximately 61.0% of total market share in 2025. This versatile category encompasses compact benchtop models, laboratory-scale configurations, and space-efficient designs optimized for research and development applications, delivering accessible thermal processing capabilities and practical footprint considerations in laboratory and small-scale production environments. The desktop segment's market leadership stems from its cost-effective acquisition pricing, minimal facility infrastructure requirements, and compatibility with standard laboratory bench layouts across materials testing facilities, quality control departments, and research institutions.

The floor-standing segment maintains a substantial 39.0% market share, serving manufacturers who require larger processing volumes through industrial-scale chamber configurations, high-capacity batch processing systems, and production-oriented platforms that enable throughput optimization in manufacturing operations.

Key advantages driving the desktop segment include:

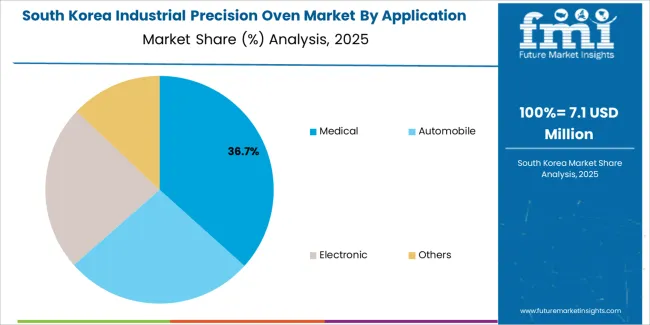

Medical applications dominate the market with approximately 38.0% market share in 2025, reflecting the extensive adoption of precision thermal processing across medical device sterilization, pharmaceutical stability testing, and laboratory specimen preparation operations. The medical segment's market leadership is reinforced by widespread implementation in medical device manufacturing (16.0%), pharmaceutical quality control (13.0%), and laboratory testing protocols (9.0%), which provide essential thermal processing capabilities and regulatory compliance support in controlled healthcare manufacturing environments.

The automobile segment represents 27.0% market share through specialized applications including component curing processes (11.0%), materials testing procedures (9.0%), and coating application operations (7.0%). The electronic segment accounts for 24.0% market share, driven by adoption in printed circuit board processing (10.0%), semiconductor packaging operations (8.0%), and component reliability testing (6.0%). Other applications constitute 11.0% market share, encompassing aerospace component processing, materials research, and specialty manufacturing requirements.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to manufacturing quality requirements and regulatory compliance needs. First, electronics manufacturing expansion creates increasing requirements for precision thermal processing equipment, with global electronics production exceeding USD 2 trillion annually across major manufacturing regions, requiring reliable precision ovens for reflow soldering, component burn-in testing, and thermal cycling applications in consumer electronics, automotive electronics, and industrial equipment production. Second, medical device manufacturing growth and stringent regulatory requirements drive adoption of validated thermal processing systems, with precision ovens enabling sterilization cycle validation, stability testing protocols, and process documentation that satisfy FDA, ISO 13485, and other regulatory framework requirements. Third, quality management system implementation and Industry 4.0 integration accelerate deployment across manufacturing facilities, with precision ovens incorporating data logging capabilities, network connectivity, and process monitoring features that support comprehensive quality documentation and traceability requirements.

Market restraints include high equipment costs affecting manufacturing budget allocations in cost-sensitive operations, particularly where conventional heating equipment remains adequate for less demanding applications and where capital constraints limit acquisition of specialized thermal processing systems. Facility infrastructure requirements for proper installation pose adoption challenges for existing manufacturing spaces, as precision ovens often require dedicated electrical circuits, adequate ventilation systems, and controlled environmental conditions that necessitate facility modifications and additional investment. Limited technical expertise for optimal operation and maintenance in certain manufacturing regions creates additional barriers, as precision thermal processing equipment requires trained personnel for proper programming, calibration procedures, and preventive maintenance protocols to achieve specified performance levels.

Key trends indicate accelerated adoption in Asian electronics manufacturing hubs, particularly China, Vietnam, and Thailand, where consumer electronics production concentration and automotive electronics growth are driving systematic precision oven deployment through foreign direct investment in manufacturing capacity and technology transfer programs. Technology advancement trends toward energy-efficient heating systems, rapid thermal cycling capabilities, and IoT-enabled process monitoring are driving next-generation product development. The market thesis could face disruption if alternative thermal processing technologies achieve breakthrough capabilities in providing equivalent heating precision through novel energy transfer mechanisms, potentially reducing dependence on conventional resistive heating approaches in specific industrial applications.

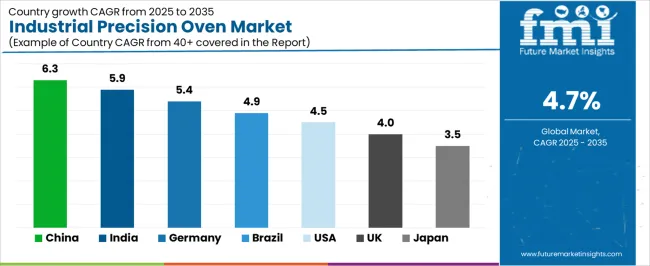

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

The market is gaining momentum worldwide, with China taking the lead to aggressive electronics manufacturing expansion and industrial automation initiatives. Close behind, India benefits from growing manufacturing infrastructure development and foreign investment in electronics assembly operations, positioning itself as a strategic growth hub in the Asia-Pacific region. Brazil shows strong advancement, where expanding automotive component production and medical device manufacturing strengthen its role in South American industrial markets. The USA demonstrates robust growth through established quality systems and advanced manufacturing technology adoption, signaling continued utilization in precision thermal processing applications. Japan stands out for its advanced electronics manufacturing capabilities and stringent quality control standards, while UK and Germany continue to record consistent progress driven by automotive engineering excellence and pharmaceutical manufacturing operations. China and India anchor the global expansion story, while established markets build stability and technology leadership into the market's growth path.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

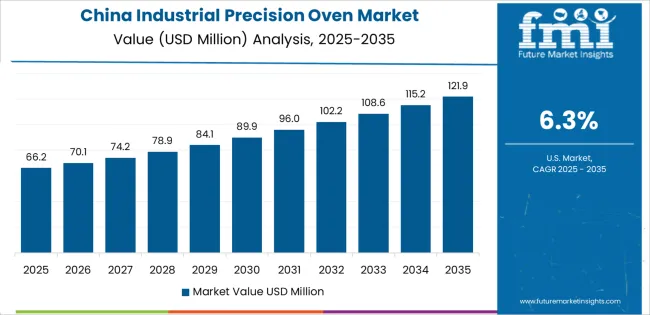

China demonstrates the strongest growth potential in the market with a CAGR of 6.3% through 2035. The country's leadership position stems from comprehensive electronics manufacturing concentration, intensive automotive production expansion, and aggressive industrial modernization programs driving adoption of precision thermal processing technologies. Growth is concentrated in major manufacturing regions, including Guangdong, Jiangsu, Zhejiang, and Shanghai, where electronics assembly facilities, automotive component suppliers, and medical device manufacturers are implementing precision oven systems for quality control and production process optimization. Distribution channels through industrial equipment distributors, manufacturing equipment specialists, and direct manufacturer relationships expand deployment across electronics production clusters, automotive industrial parks, and pharmaceutical manufacturing zones. The country's Made in China 2025 initiative provides policy support for advanced manufacturing equipment adoption, including incentives for precision testing equipment procurement and quality system infrastructure development.

Key market factors:

In major industrial development zones, including Gujarat, Tamil Nadu, Karnataka, and Maharashtra, the adoption of precision oven systems is accelerating across electronics manufacturing facilities, automotive component producers, and pharmaceutical manufacturing operations, driven by Make in India initiatives and increasing focus on manufacturing quality enhancement. The market demonstrates strong growth momentum with a CAGR of 5.9% through 2035, linked to comprehensive industrial sector expansion and increasing investment in quality control infrastructure capabilities. Indian manufacturers are implementing precision oven technology and quality management protocols to improve production consistency while meeting international quality standards in export-oriented manufacturing sectors serving global supply chains. The country's National Manufacturing Policy creates steady demand for precision thermal processing solutions, while increasing focus on quality certification drives adoption of validated heating equipment that enhances manufacturing credibility.

Germany's advanced manufacturing sector demonstrates sophisticated implementation of precision oven systems, with documented case studies showing 40-50% reduction in thermal process variability through systematic equipment calibration and process control protocols. The country's industrial infrastructure in major manufacturing regions, including Baden-Württemberg, Bavaria, North Rhine-Westphalia, and Hesse, showcases integration of precision thermal processing technologies with existing quality management systems, leveraging expertise in automotive engineering and medical device production. German manufacturers emphasize process validation and measurement traceability, creating demand for precision oven solutions that support ISO 9001 certification requirements and stringent quality documentation standards. The market maintains strong growth through focus on Industry 4.0 integration and manufacturing excellence principles, with a CAGR of 5.4% through 2035.

Key development areas:

The Brazilian market leads in Latin American precision oven adoption based on expanding automotive component manufacturing and growing pharmaceutical production infrastructure in major industrial centers. The country shows solid potential with a CAGR of 4.9% through 2035, driven by automotive sector investment and increasing domestic demand for quality-controlled manufacturing across medical device, electronics, and industrial equipment production sectors. Brazilian manufacturers are adopting precision oven technology for compliance with international quality standards, particularly in automotive tier-one supplier operations requiring process validation and in pharmaceutical manufacturing where thermal processing documentation impacts regulatory approval. Technology deployment channels through industrial equipment distributors, technical representatives, and equipment financing programs expand coverage across automotive supply chains and pharmaceutical manufacturing facilities.

Leading market segments:

The USA market leads in advanced precision oven applications based on integration with sophisticated manufacturing execution systems and comprehensive quality documentation platforms for regulated manufacturing environments. The country shows solid potential with a CAGR of 4.5% through 2035, driven by medical device manufacturing expansion and increasing adoption of advanced thermal processing technologies across electronics, aerospace, and pharmaceutical production sectors. American manufacturers implement precision oven systems for validated thermal processing requirements, particularly in FDA-regulated medical device production requiring equipment qualification and in aerospace component manufacturing where process documentation impacts certification compliance. Technology deployment channels through equipment manufacturers' direct sales, industrial distributors, and equipment leasing companies expand coverage across diverse manufacturing operations.

Leading market segments:

The UK market demonstrates consistent implementation focused on automotive component testing and pharmaceutical manufacturing operations, with documented integration of precision ovens achieving 35-40% improvement in thermal process repeatability through systematic calibration and maintenance programs. The country maintains steady growth momentum with a CAGR of 4.0% through 2035, driven by pharmaceutical manufacturing presence and automotive engineering requirements for materials testing capabilities. Major industrial regions, including West Midlands, North West England, and Southeast England, showcase deployment of precision thermal processing technologies that integrate with existing quality management infrastructure and support certification requirements in automotive and pharmaceutical manufacturing operations.

Key market characteristics:

Japan's market demonstrates sophisticated implementation focused on electronics manufacturing and automotive component production, with documented integration of precision thermal systems achieving 45-50% improvement in process capability indices through advanced control algorithms and preventive maintenance protocols. The country maintains steady growth momentum with a CAGR of 3.5% through 2035, driven by manufacturing excellence culture and focus on continuous improvement principles aligned with total quality management philosophies. Major industrial regions, including Aichi, Kanagawa, Osaka, and Shizuoka, showcase advanced deployment of precision thermal processing technologies that integrate seamlessly with automated production systems and comprehensive statistical process control programs.

Key market characteristics:

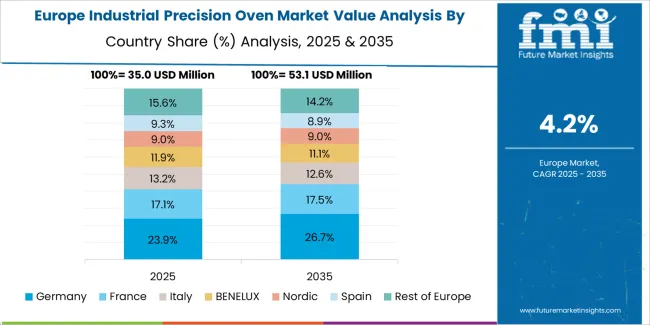

The industrial precision oven market in Europe is projected to grow from USD 51.7 million in 2025 to USD 108.5 million by 2035, registering a CAGR of 7.7% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 29.8% by 2035, supported by its extensive automotive manufacturing infrastructure and major industrial regions, including Baden-Württemberg, Bavaria, and North Rhine-Westphalia.

France follows with a 17.9% share in 2025, projected to reach 18.6% by 2035, driven by comprehensive pharmaceutical manufacturing operations and automotive component production facilities. The United Kingdom holds a 15.4% share in 2025, expected to reach 16.1% by 2035 through automotive testing laboratories and pharmaceutical manufacturing sites. Italy commands a 13.8% share in 2025, maintaining 14.2% by 2035, backed by automotive component production and specialized manufacturing operations. Spain accounts for 10.6% in 2025, rising to 11.0% by 2035 on expanding automotive assembly operations and medical device manufacturing growth. The Rest of Europe region is anticipated to hold 11.1% in 2025, expanding to 10.3% by 2035, attributed to increasing precision oven adoption in Nordic pharmaceutical facilities and emerging Central & Eastern European electronics manufacturing operations.

The Japanese market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of desktop precision oven systems with existing laboratory and quality control infrastructure across electronics manufacturers, automotive testing facilities, and materials research institutions. Japan's focus on manufacturing precision and measurement accuracy drives demand for thermal processing equipment that supports rigorous quality standards and continuous improvement initiatives established by Japanese Industrial Standards and quality management frameworks. The market benefits from strong partnerships between international equipment manufacturers and domestic industrial distributors including major trading companies, creating comprehensive service ecosystems that prioritize technical training and calibration support programs. Industrial centers in Aichi, Kanagawa, Osaka, and other major manufacturing prefectures showcase advanced thermal processing implementations where precision oven systems achieve 98% temperature uniformity compliance through comprehensive preventive maintenance programs and calibration verification protocols.

The South Korean market is characterized by growing international equipment manufacturer presence, with companies maintaining significant positions through comprehensive technical support and application engineering capabilities for electronics manufacturing facilities and automotive component testing laboratories. The market demonstrates increasing focus on manufacturing automation and quality system integration, as Korean manufacturers increasingly demand precision thermal processing solutions that integrate with factory automation systems and comprehensive manufacturing execution platforms deployed across semiconductor packaging facilities and display panel production operations. Regional industrial equipment distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including technical training programs and application-specific thermal processing consultation for electronics and automotive manufacturing operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean industrial automation specialists, creating hybrid service models that combine international product development expertise with local technical support capabilities and rapid response systems.

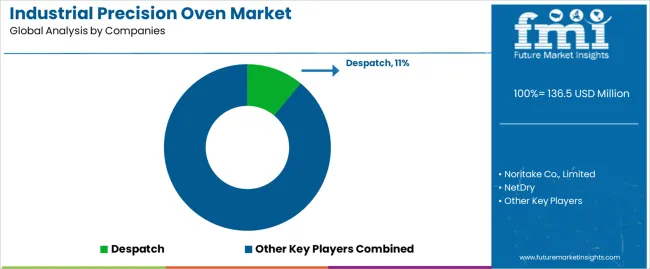

The market features approximately 30-40 meaningful players with moderate fragmentation, where the top three companies control roughly 25-32% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on temperature uniformity performance, control system capabilities, and application engineering support rather than price competition alone. Despatch leads with approximately 11.0% market share through its comprehensive thermal processing solutions portfolio and global manufacturing presence. Memmert GmbH maintains strong positioning with approximately 9.0% market share through precision laboratory oven platforms and established relationships in research institutions.

Market leaders include Despatch, Memmert GmbH, and Carbolite Gero Ltd., which maintain competitive advantages through global distribution infrastructure, advanced temperature control technologies, and deep expertise in application engineering across electronics manufacturing, automotive testing, and pharmaceutical production sectors, creating trust and reliability advantages with quality-critical manufacturing operations and regulated industry applications. These companies leverage research and development capabilities in heating element design and ongoing technical support relationships to defend market positions while expanding into emerging manufacturing markets and specialized application segments.

Challengers encompass Wisconsin Oven Corporation, Pyradia, and Noritake Co., Limited, which compete through specialized product offerings and strong regional presence in key manufacturing markets. Product specialists, including CSUN, NetDry, and Thong & Ong Engineering Sdn Bhd, focus on specific configuration types or regional markets, offering differentiated capabilities in custom thermal processing solutions, rapid delivery services, and competitive pricing structures.

Regional players and emerging thermal equipment manufacturers create competitive pressure through localized manufacturing advantages and application-specific expertise, particularly in high-growth markets including China and Southeast Asia, where proximity to electronics manufacturing clusters provides advantages in technical support responsiveness and customer relationships. Market dynamics favor companies that combine proven thermal performance with comprehensive validation support offerings that address the complete thermal processing cycle from equipment qualification through process optimization and ongoing calibration maintenance.

Industrial precision ovens represent advanced thermal processing solutions that enable manufacturers to achieve accurate temperature control and consistent heating uniformity, delivering superior process repeatability and quality assurance with programmable thermal profiles and comprehensive documentation capabilities in quality-critical manufacturing applications. With the market projected to grow from USD 136.5 million in 2025 to USD 216.0 million by 2035 at a 4.7% CAGR, these thermal processing systems offer compelling advantages - temperature uniformity, process validation support, and regulatory compliance enablement - making them essential for medical applications (38.0% market share), automobile testing operations (27.0% share), and manufacturing facilities seeking alternatives to conventional industrial ovens that compromise process control through inadequate temperature uniformity and limited documentation capabilities. Scaling market adoption and technology deployment requires coordinated action across industrial policy, manufacturing infrastructure development, equipment manufacturers, quality system providers, and manufacturing technology centers.

How Governments Could Spur Manufacturing Adoption?

How Industry Bodies Could Support Market Development?

How Equipment Manufacturers Could Strengthen the Ecosystem?

How Manufacturing Facilities Could Navigate Technology Adoption?

How Investors Could Unlock Manufacturing Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 136.5 million |

| Configuration | Desktop, Floor-standing |

| Application | Medical, Automobile, Electronic, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA., UK, Japan, and 40+ countries |

| Key Companies Profiled | Pyradia, Noritake Co., Limited, NetDry, CSUN, Thong & Ong Engineering Sdn Bhd, Despatch, Carbolite Gero Ltd., Memmert GmbH, CEC, Wisconsin Oven Corporation, Nutec Bickley, Westran Thermal Processing, LLC, Chiu, Vention, Dongguan Zhengsheng Intelligent Technology Co., Ltd., Symor Instrument Equipment Co., Ltd., Guangdong Atmars Test Equipment Co., Ltd., Guangdong Kejian Instrument Co., Ltd., WEISUN Industrial Co., Ltd., Guangdong Yuanyao Test Equipment Co., Ltd., Dongguan Huanyi Instruments Technology Co., Ltd., Guangdong Sanwood Technology Co., Ltd., Dongguan Kubao Testing Equipment Co., Ltd., Group Up Industrial Co., Ltd., Guangdong Grande Automatic Test Equipment Limited |

| Additional Attributes | Dollar sales by configuration and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with thermal processing equipment manufacturers and distribution networks, manufacturing facility requirements and specifications, integration with quality management systems and process documentation platforms, innovations in temperature control technologies and heating element designs, and development of specialized thermal processing solutions with enhanced uniformity and energy efficiency capabilities. |

The global industrial precision oven market is estimated to be valued at USD 136.5 million in 2025.

The market size for the industrial precision oven market is projected to reach USD 216.1 million by 2035.

The industrial precision oven market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in industrial precision oven market are desktop and floor-standing.

In terms of application, medical segment to command 38.0% share in the industrial precision oven market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Industrial & Commercial HVLS Fans Market Size and Share Forecast Outlook 2025 to 2035

Industrial Robot Controller Market Size and Share Forecast Outlook 2025 to 2035

Industrial Wired Routers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Evaporative Condensers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Energy Management System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Insulation Market Size and Share Forecast Outlook 2025 to 2035

Industrial Safety Gloves Market Size and Share Forecast Outlook 2025 to 2035

Industrial Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Pepper Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Film Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA