The industrial film market is experiencing steady growth driven by the rising need for durable, high-performance materials across manufacturing, packaging, and construction sectors. Increasing emphasis on lightweight, flexible, and cost-effective film solutions has strengthened demand across both developed and emerging economies.

Current market dynamics are influenced by advances in polymer science, growing environmental regulations promoting recyclable and sustainable films, and technological improvements in extrusion and coating processes that enhance product functionality. The future outlook is positive as industries increasingly rely on films for barrier protection, insulation, and lamination purposes.

Growth rationale is based on the expanding adoption of specialty films in industrial applications, the integration of digital printing and automation in production facilities, and the strategic shift toward circular economy models Market participants are expected to continue investing in material innovation and production scalability to meet evolving customer requirements, ensuring consistent revenue growth and global market expansion.

| Metric | Value |

|---|---|

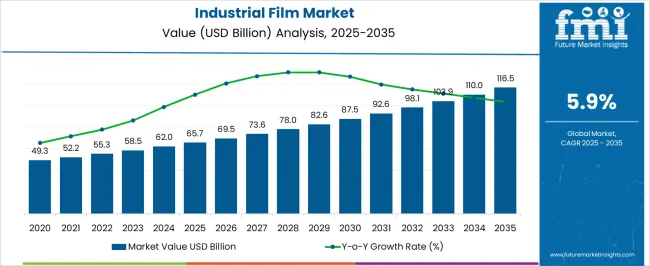

| Industrial Film Market Estimated Value in (2025 E) | USD 65.7 billion |

| Industrial Film Market Forecast Value in (2035 F) | USD 116.5 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

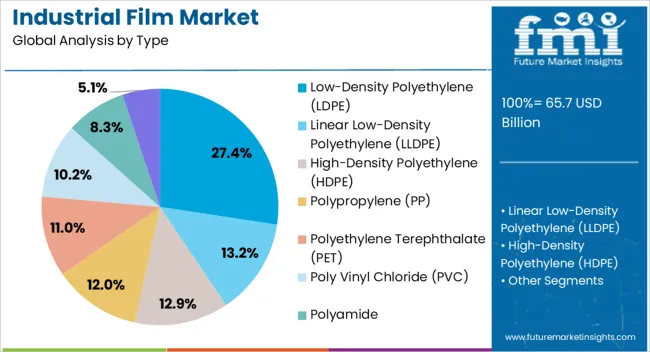

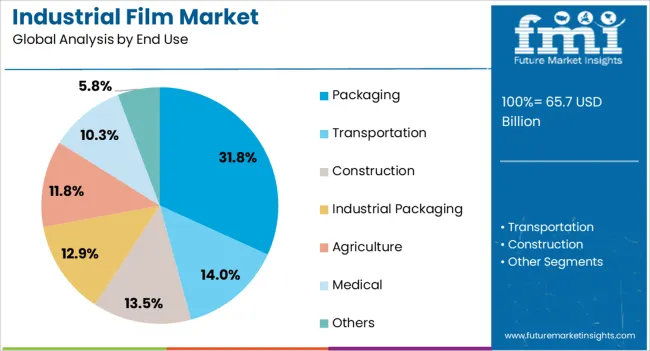

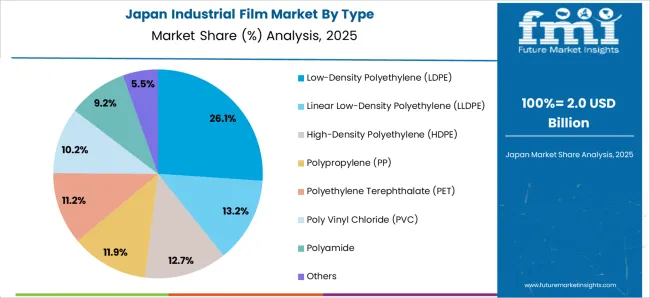

The market is segmented by Type and End Use and region. By Type, the market is divided into Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), High-Density Polyethylene (HDPE), Polypropylene (PP), Polyethylene Terephthalate (PET), Poly Vinyl Chloride (PVC), Polyamide, and Others. In terms of End Use, the market is classified into Packaging, Transportation, Construction, Industrial Packaging, Agriculture, Medical, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low-density polyethylene (LDPE) segment, accounting for 27.40% of the type category, has been leading the market due to its superior flexibility, moisture resistance, and ease of processing. Its widespread use across packaging, agriculture, and construction applications has sustained demand.

The segment’s growth is reinforced by ongoing technological advancements in film extrusion, enabling enhanced transparency, mechanical strength, and recyclability. LDPE films are being increasingly utilized for industrial wrapping, surface protection, and liner applications, owing to their cost-effectiveness and adaptability to varying temperature conditions.

Market stability is supported by steady raw material availability and production efficiency, while initiatives focused on developing bio-based LDPE variants are expected to strengthen the segment’s long-term competitiveness and environmental compliance.

The packaging segment, representing 31.80% of the end-use category, continues to dominate the industrial film market due to the critical role of films in preserving product integrity, enhancing shelf life, and improving visual appeal. Demand has been driven by rapid growth in e-commerce, food and beverage processing, and consumer goods manufacturing.

The segment’s expansion is supported by continuous innovation in multi-layer film structures, improved printability, and increased adoption of recyclable and biodegradable packaging materials. Industrial users are prioritizing packaging films that combine strength with sustainability, aligning with regulatory mandates and brand environmental commitments.

The integration of automation and digital quality control systems in packaging production is further optimizing operational efficiency and consistency These factors collectively ensure that the packaging segment maintains its leading position, driving sustained growth within the industrial film market.

Sales of linear low-density polyethylene are expected to surge at a 5.8% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top Type | Linear Low-Density Polyethylene |

| CAGR ( 2025 to 2035) | 5.8% |

The segment’s rising popularity is attributed to:

The transportation segment is poised to exhibit a robust 5.6% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top End Use | Transportation |

| CAGR ( 2025 to 2035) | 5.6% |

This rising popularity of the segment is attributed to:

The section analyzes the industrial film market by country, including the United Kingdom, the United States, China, South Korea, and Japan. The table presents the CAGRs for each country, indicating the expected market growth through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

| South Korea | 6.8% |

| Japan | 6.3% |

| China | 6.2% |

| United States | 6.1% |

The United Kingdom remains a key contributor to the market. It is expected to rise at a CAGR of 7.1% through 2035.

The United Kingdom has a thriving manufacturing sector, particularly in the automotive, aerospace, and construction industries. The country's focus on advanced manufacturing technologies and materials innovation has led to the increasing adoption of industrial films for packaging, protection, and insulation purposes. The UK's strategic location as a gateway to European markets also gives it an edge in the global industrial film market.

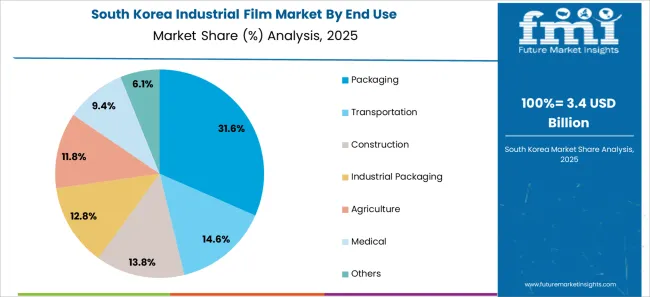

The market in South Korea is expected to grow at a CAGR of 6.8% from 2025 to 2035.

South Korea has advanced manufacturing capabilities and technological expertise, leading to growth in its market. The presence of major players in industries drives the demand for industrial films for protective wrapping, insulation, and electronic component packaging. The country's focus on research and development and its commitment to innovation contribute to developing specialized industrial films tailored to specific industries' needs.

The market in Japan is expected to rise at a CAGR of 6.3% through 2035.

Japan is known for its quality and innovation in manufacturing, leading to its growth in the market. Japanese companies excel in producing high-performance industrial films with advanced functionalities such as barrier protection, heat resistance, and optical clarity.

The adoption of industrial films in Japan is driven by industries like automotive, electronics, and healthcare, which require reliable and durable packaging solutions to ensure product integrity and safety. Japan's focus on environmental sustainability and stringent quality standards further bolster the growth of the country's industrial film market.

The market in China is expected to grow at a CAGR of 6.2% from 2025 to 2035.

China's rapid industrialization and urbanization have created a high demand for industrial films for packaging, construction, agriculture, and automotive applications. The country's booming manufacturing sector and expanding consumer market are the primary drivers of the market's growth.

Government initiatives promoting sustainable development and the adoption of advanced materials are propelling the market by encouraging the use of eco-friendly and high-performance industrial films in various industries across China.

The United States is emerging as a significant contender in the market, with a projected CAGR of 6.1% until 2035.

The United States has a strong industrial base and has made significant investments in infrastructure development, leading to growth in the market. The e-commerce industry's growth and demand for efficient packaging solutions are driving the adoption of industrial films in the USA market, and advancements in material science and manufacturing technologies enable USA companies to produce high-performance industrial films that cater to diverse industrial applications.

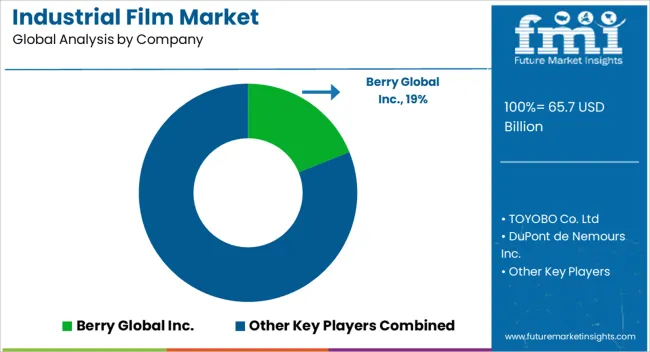

The industrial film market is witnessing significant growth, owing to the strategic contributions of several major companies and manufacturers. Leading players such as Berry Global Inc., Dow Inc., Exxon Mobil Corporation, DuPont de Nemours Inc., and Mitsubishi Chemical Holdings Corporation invest extensively in research and development to develop new formulations and technologies.

These companies are also focusing on enhancing the sustainability and performance of industrial films to meet evolving market demands.

Strategic partnerships, mergers, and acquisitions facilitate market expansion, enabling companies to broaden their product portfolios and geographical presence. Through targeted marketing initiatives and robust distribution networks, key players are effectively reaching diverse industrial sectors and capitalizing on emerging opportunities in regions with high demand growth.

The competitive landscape is characterized by intense competition among major players striving for market dominance. Companies are vying for market share through product differentiation, pricing strategies, and technological advancements. By leveraging market insights and adapting to changing consumer preferences, leading companies stay ahead of the curve and position themselves for sustained growth in the market.

Recent Developments

The global industrial film market is estimated to be valued at USD 65.7 billion in 2025.

The market size for the industrial film market is projected to reach USD 116.5 billion by 2035.

The industrial film market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in industrial film market are low-density polyethylene (ldpe), linear low-density polyethylene (lldpe), high-density polyethylene (hdpe), polypropylene (pp), polyethylene terephthalate (pet), poly vinyl chloride (pvc), polyamide and others.

In terms of end use, packaging segment to command 31.8% share in the industrial film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial X-ray Films Market Analysis by Oil and Gas, Automotive, Aerospace and Defense

Industrial Dust Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Vertical Washing Tower Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronics Packaging Market Forecast and Outlook 2025 to 2035

Industrial Absorbent Market Forecast and Outlook 2025 to 2035

Industrial Furnace Industry Analysis in Europe Forecast and Outlook 2025 to 2035

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Electronic Pressure Switch Market Size and Share Forecast Outlook 2025 to 2035

Industrial WiFi Module Market Size and Share Forecast Outlook 2025 to 2035

Industrial Security System Market Forecast Outlook 2025 to 2035

Industrial Floor Mat Market Forecast Outlook 2025 to 2035

Industrial Insulation Market Forecast and Outlook 2025 to 2035

Industrial Process Water Coolers Market Forecast and Outlook 2025 to 2035

Industrial Grade Ammonium Hydrogen Fluoride Market Forecast and Outlook 2025 to 2035

Industrial Grade Sodium Bifluoride Market Forecast and Outlook 2025 to 2035

Industrial Evaporative Condenser Market Size and Share Forecast Outlook 2025 to 2035

Industrial Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Industrial Crystallizer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA