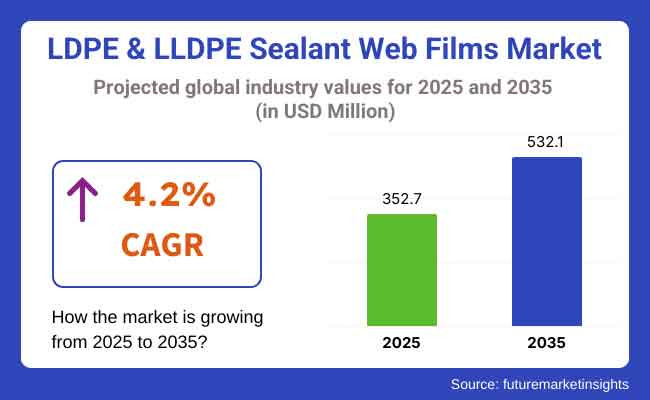

The global LDPE & LLDPE sealant web films market is projected to reach USD 352.7 million by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% to reach USD 532.1 million by 2035.

The expansion is being fueled by growing demand for flexible, high-barrier, and recyclable packaging materials across diverse industries, including food and beverage, pharmaceuticals, personal care, and industrial applications.

These sealant web films serve critical roles in modern packaging by helping preserve freshness, extend shelf life, and enhance moisture resistance. Their lightweight composition and compatibility with high-speed packaging lines make them an ideal solution for a wide range of products.

Key market players are actively investing in eco-friendly formulations, automated production lines, and smart packaging technologies. These initiatives are improving the performance, cost-efficiency, and environmental footprint of LDPE and LLDPE-based films. In an official statement, Berry Global’s CEO emphasized, “Our focus remains on delivering high-quality sealant web films that not only enhance product protection but also align with environmental standards.” This signals a broader industry trend toward sustainable and value-driven innovation.

Among the fastest-growing segments is high-barrier LDPE & LLDPE sealant films, which are projected to account for approximately 34.7% of the global market share by 2025. These films are known for their ability to prolong shelf life, maintain product integrity, and offer exceptional resistance to oxygen, moisture, and contaminants.

Manufacturers are making significant R&D investments in multi-layer co-extrusion, metal-free oxygen barrier coatings, and nano-layered bio-barrier formulations to improve packaging performance.

For example, companies like Amcor and Berry Global have adopted advanced co-extrusion technology that reduces oxygen permeability by up to 90%, significantly boosting the lifespan of packaged products.

In addition, recyclable high-barrier films and biodegradable alternatives are receiving increased attention. Our report forecast a 22.5% rise in adoption of sustainable high-barrier films by 2025, reflecting greater regulatory scrutiny and consumer demand for environmentally friendly packaging.

The food packaging industry continues to be the primary end-user, accounting for approximately 64.5% of the total LDPE & LLDPE sealant web films demand by 2025. The rise in convenience food consumption, ready-to-eat meals, and frozen food products has necessitated the adoption of advanced packaging solutions that offer both durability and protection.

These films deliver critical performance benefits such as strong heat-sealing capabilities, oxygen barrier protection, and moisture resistance, making them indispensable in the packaging of snacks, bakery products, dairy, and frozen meals. A noticeable shift toward mono-material structures-which simplify recycling processes-is further supporting the segment’s growth. Industry reports suggest that around 60% of food packaging films currently incorporate LDPE & LLDPE due to their flexibility, clarity, and sealing properties. Food safety remains a key priority.

The integration of antimicrobial coatings on sealant films has surged by nearly 18% since 2021, driven by heightened consumer health awareness and stricter hygiene regulations, especially in post-pandemic supply chains.

The pharmaceutical industry is expected to hold a 22.8% share of the market by 2025. LDPE & LLDPE sealant web films are increasingly being adopted in applications such as blister packaging, sachets, strip packs, and sterile pouches for medical devices.

Their ability to deliver tamper-evident, moisture-resistant, and contamination-proof packaging aligns with global standards for pharmaceutical safety. Medical-grade films are being engineered with high-barrier layers, UV resistance, and sterilisable coatings to meet stringent regulatory requirements and extend product usability under various storage conditions.

Rapid industrialization, high demand for flexible packaging, and government policies on the use of sustainable materials will result in Asia-Pacific being the number one region in demand for LDPE & LLDPE sealant web films. An ever-rising demand for high barrier, lightweight films in the applications of food preservation, pharmaceutical packaging, and logistics is being seen in countries including China, India, and Japan.

Market growth will be further supported by investments in low-cost bio-based polymers, innovations in solvent-less adhesives, and automation in flexible packaging production processes. These drivers cover regulatory initiatives promoting recyclable packaging and the extended producer responsibility (EPR) program, which are encouraging manufacturers to move towards the development of next-generation sealant films.

Growth in local production operations will also be supported by the emerging presence of well-established global packaging firms and food processors in the region. Besides, advancements in ultra-thin high-barrier coatings as well as biodegradable sealant web films are expected to generate new avenues in the Asia-Pacific region.

The LDPE & LLDPE sealant web films market in North America is substantial, driven by demand in food & beverage, pharmaceutical, and personal care packaging. The technological advancements in recyclable, high-strength, and tamper-proof sealant films are being spearheaded by the USA and Canada. With investments into automation and AI-driven defect detection, film production efficiency is being improved and material wastes minimized.

The movement towards biodegradable, compostable, and high-barrier films is gaining further momentum due to stringent FDA regulations and sustainability objectives. Various developments geared towards the improvement of functionality and compliance are in the works, including moisture resistant films, antimicrobial coatings, and AI powered production monitoring.

Further impetus for product innovation is coming from rising demand for premium vacuum-sealed food packaging, pharmaceutical-grade pouches, and transparent barrier films. RFID-enabled tracking, multi-layer co-extrusion, and oxygen-resistant films will further change the North American sealant web films market.

Europe now controls a huge portion of the LDPE & LLDPE sealant web films market, thanks to stringent environmental regulations, consumer demand for recyclable films, and demand for environmentally friendly packaging. Germany, France, and the UK have been class leaders in developing low-carbon film production, solvent-free coatings, and circular economy packaging.

The future of the market is being shaped by stringent policies enforcing plastic reduction, extended producer responsibility (EPR), and food safety compliance. Collaborations between film manufacturers and food processors are on the rise in the region, along with the regulatory bodies concerned about next-generation sustainable packaging development.

Innovations in mono-material packaging, compostable sealant layers, and digital authentication films are gaining momentum. On top of that, several research institutions run by Europe are investing heavily in AI-driven defect detection, high-barrier nanocoatings, and ultra-thin sustainable film materials for the industry's growth.

Challenges

Opportunities

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on improving recyclability of sealant films. |

| Material and Formulation Innovations | Development of lightweight, durable sealant web films. |

| Industry Adoption | Widely used in food, pharmaceuticals, and personal care. |

| Market Competition | Dominated by traditional flexible packaging manufacturers. |

| Market Growth Drivers | Growth driven by demand for extended shelf-life packaging. |

| Sustainability and Environmental Impact | Early-stage transition to recyclable and compostable films. |

| Integration of AI and Process Optimization | Limited AI use in film inspection and quality control. |

| Advancements in Film Technology | Basic improvements in moisture resistance and heat sealing. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies promoting fully recyclable, biodegradable, and mono-material films. |

| Material and Formulation Innovations | Expansion of compostable, antimicrobial, and ultra-high-barrier film materials. |

| Industry Adoption | Increased adoption in high-value medical packaging, AI-monitored production, and luxury branding. |

| Market Competition | Rise of sustainability-focused startups and AI-driven packaging firms. |

| Market Growth Drivers | Expansion fueled by automation, AI integration, and high-barrier flexible films. |

| Sustainability and Environmental Impact | Large-scale shift to fully compostable, fiber-reinforced, and low-carbon sealant films. |

| Integration of AI and Process Optimization | AI-driven predictive analytics, real-time defect detection, and digital authentication tracking. |

| Advancements in Film Technology | Development of IoT-enabled, RFID-tracked, and AI-powered sealant film solutions. |

Flexible, durable, and high-barrier packaging solutions have found applications in food, pharmaceuticals, and industries that are in strong demand in the United States for the LDPE & LLDPE sealant web films market. With increasing regulations highlighting the need for sustainable and recyclable packaging materials, manufacturers are engaged in the development of advanced films based on polyethylene with improved mechanical strength, puncture resistance, and heat-seal properties.

On the other hand, technological developments in multilayer co-extrusion, solvent-free lamination, and bio-based polymer blends have aided the market growth. Companies are also working with digital printing, smart packaging features, and nano-coating technologies to improve functionality and branding. The rapid growth of e-commerce and the increasing demand for lightweight, high-performance packaging materials are additional drivers for demand for LDPE & LLDPE sealant web films in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The UK LDPE and LLDPE sealant web films market is prospering against a backdrop of sustainability, regulatory compliance, and packaging efficiency. The government is backing a strong agenda for circular economy principles, plastic reduction, and increased recyclability; this trend will favor the adoption of environment-friendly and biodegradable polyethylene-based films.

Ultra-thin high-barrier sealant films, which exhibit high sealing integrity as well as extended shelf-life, are also proving to be popular innovations. The food and beverage sector is seeing an increase in applications for LDPE and LLDPE sealant films in flexible pouches, stand-up bags, and vacuum packages. The advent of solvent-free adhesives, anti-fog coating, and recyclable mono-material packaging solutions is another driver behind the market growth in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.8% |

The market for LDPE & LLDPE sealant web films in Japan is steady and growing with precision-engineered, high-performance packaging materials being increasingly demanded in the food, electronics, and medical sectors. Japanese manufacturers are now producing ultra-thin, high-clarity, and thermoformable polyethylene films with improved puncture resistance and oxygen barrier properties.

The food safety and hygiene regulations of the country are thus enforcing the implementation of advanced sealant films with anti-microbial properties, temperature resistance, and moisture control. In addition, the research on biodegradable polyethylene substitutes, bio-based sealant coatings, and AI-based packaging defect detection are further contributing to the market growth. The introduction of smart packaging applications such as RFID-enabled labels and interactive packaging designs is also fuelling the demand for highest quality LDPE & LLDPE films in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The latest surge of South Korea's LDPE and LLDPE sealant web films market, though, continues to be significantly increasing because of the growing demand for flexible packaging applications in the processing of food items, electronics, and personal care. The upsurge in the emphasis on high-barrier, recyclable, and lightweight packaging formulations have provoked innovations in developing co-extruded, biodegradable, and solvent-free sealant films. Government policies promoting sustainable packaging, waste reduction, and highly recyclable materials have brought further impetus to the market.

Innovations are now being embraced by using advanced polymer blending techniques, UV-resistant coatings, and even the latest AI-driven quality control technologies to maximize product durability and performance. The promising trend of moving towards smart packaging, QR-coded authentication, and associated anti-counterfeiting features is accelerating the driving force behind demand for technologically advanced LDPE & LLDPE sealant webs.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

The high-barrier, transparent, and recyclable LDPE & LLDPE sealant web film segments are actively driving market growth as industries seek lightweight, cost-effective, and sustainable packaging solutions. Manufacturers are enhancing sealant film strength, heat resistance, and moisture barrier properties to meet industry demands.

Additionally, companies are focusing on ultra-thin, puncture-resistant, and high-seal-strength films to improve packaging efficiency. Furthermore, advancements in solvent-free lamination, AI-driven material testing, and compostable polyethylene alternatives are enhancing product performance and environmental sustainability.

High-Barrier LDPE & LLDPE Films Gain Traction with Enhanced Protection and Shelf-Life Extension

High-barrier LDPE & LLDPE films are gaining popularity due to their ability to extend shelf life, preserve product freshness, and provide excellent resistance against moisture, oxygen, and contaminants. These films are widely used in food packaging, pharmaceuticals, and industrial applications. Manufacturers are investing in nano-layer coatings, multilayer co-extrusion technology, and bio-barrier formulations to enhance packaging performance. Additionally, research into metal-free, high-barrier flexible films is driving sustainability efforts in this segment.

Transparent LDPE & LLDPE Films Expand Adoption for High-Visibility Packaging Solutions

Transparent sealant web films are witnessing increased demand in consumer packaging, medical, and electronics industries where product visibility and clarity are crucial. The development of ultra-clear, scratch-resistant, and anti-fog LDPE & LLDPE films is improving market appeal.

Companies are focusing on high-gloss, printable, and tamper-evident film solutions to enhance branding and security. Moreover, the shift toward solvent-free coatings, optical brighteners, and anti-static technologies is driving innovation in transparent polyethylene-based sealant films.

Recyclable LDPE & LLDPE Films Experience Growth with Increased Focus on Circular Economy Initiatives

The recyclable LDPE & LLDPE film segment is expanding as businesses seek sustainable, mono-material, and low-waste packaging solutions. The integration of fully recyclable polyethylene films with high-seal strength, moisture resistance, and downgauging capabilities is driving adoption.

Companies are developing bio-based polyethylene films, post-consumer recycled (PCR) content films, and compostable alternatives to align with sustainability goals. Additionally, AI-driven sorting technologies, advanced de-inking methods, and high-efficiency polymer processing are improving the recyclability and performance of these films.

Research into AI-powered defect detection, UV-resistant coatings, and nano-barrier formulations is transforming the LDPE & LLDPE sealant web films market. AI-driven supply chain optimization is also improving production efficiency, reducing waste, and ensuring consistent film quality.

As industries prioritize lightweight, flexible, and environmentally responsible sealant films, the LDPE & LLDPE sealant web films market is expected to grow steadily. Innovations in material science, smart packaging, and sustainable film manufacturing will continue to shape the future of this market, making these films essential across various consumer, industrial, and high-performance packaging applications.

Despite growing competition from alternative materials, the LDPE & LLDPE sealant web films market remains crucial for industries requiring high-barrier, flexible, and cost-effective packaging solutions. These films are widely used in food packaging, pharmaceuticals, personal care, and industrial applications due to their superior sealability, puncture resistance, and moisture barrier properties.

With the increasing demand for sustainable packaging, manufacturers are innovating with recyclable, bio-based, and downgauged films to meet stringent environmental regulations. Studies show that more than 70% of flexible packaging solutions now incorporate LDPE & LLDPE-based films due to their lightweight nature and enhanced protective capabilities.

Advancements in extrusion technology, multilayer film development, and solvent-free lamination are further driving market growth. The rising adoption of AI-driven quality control and automation in film production is also improving efficiency and consistency in packaging performance.

LDPE & LLDPE sealant web films hold a significant share in food and pharmaceutical packaging due to their ability to extend product shelf-life, prevent contamination, and maintain freshness. The market is also witnessing a rise in demand for microwave-safe, freezer-compatible, and high-clarity films.

As consumer demand for convenience foods and ready-to-eat meals grows, the food industry remains a key driver of the LDPE & LLDPE sealant web films market. These films offer excellent heat-sealing properties, oxygen barrier functionality, and extended shelf-life benefits, making them essential for snack foods, dairy, frozen foods, and bakery items.

Market trends indicate a shift toward mono-material film structures to facilitate recyclability, along with the integration of antimicrobial coatings to enhance food safety. Research shows that over 60% of food packaging films incorporate LDPE & LLDPE for their flexibility, clarity, and protective benefits.

The pharmaceutical sector is also a major contributor to market growth, utilizing sealant films in blister packaging, sachets, and medical device pouches. The need for tamper-evident, sterile, and moisture-resistant packaging solutions is driving innovation in film formulations.

Despite advantages such as high durability and superior sealing, challenges such as fluctuating raw material costs, recyclability concerns, and regulatory compliance persist. However, advancements in bio-based resins, advanced barrier coatings, and AI-powered defect detection are addressing these issues, ensuring continuous market expansion.

The shift towards sustainability has led manufacturers to develop recyclable and compostable LDPE & LLDPE films. Companies are incorporating PCR (post-consumer recycled) materials, downgauging film thickness, and improving film recyclability to align with global sustainability goals.

Incorporation of smart packaging technologies, including QR codes for traceability, NFC-enabled authentication, and AI-driven performance monitoring, is further enhancing packaging efficiency and consumer engagement.

While the market faces challenges such as increasing regulatory pressures and the need for advanced sorting technologies for film recycling, ongoing R&D in sustainable film innovations, multilayer barrier properties, and automation are ensuring long-term market resilience.

The LDPE & LLDPE sealant web films market is driven by applications in food, pharmaceuticals, personal care, and industrial sectors. Innovations in multilayer structures, downgauged films, and bio-based materials are shaping industry trends. Companies are investing in automation, recyclability solutions, and smart packaging technologies to enhance product performance and sustainability.

The integration of AI-powered defect detection and real-time monitoring systems is improving quality control and production efficiency. Additionally, advancements in solvent-free lamination and downgauged film technology are helping manufacturers reduce material consumption and enhance environmental sustainability.

The shift towards mono-material film structures is gaining momentum to support circular economy initiatives. Moreover, increasing investments in high-barrier coatings and antimicrobial properties are driving demand for premium-grade sealant web films. Expanding applications in flexible e-commerce packaging and medical-grade film solutions are further strengthening the market’s growth trajectory.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Amcor Plc | 10-14% |

| Berry Global Inc. | 8-12% |

| Sealed Air Corporation | 6-10% |

| Mondi Group | 4-8% |

| Uflex Ltd. | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Amcor Plc | Develops high-barrier, recyclable LDPE & LLDPE sealant films with lightweight designs. |

| Berry Global Inc. | Specializes in multilayer, flexible packaging films with enhanced sealing and sustainability features. |

| Sealed Air Corporation | Produces high-performance, puncture-resistant films for food and pharmaceutical applications. |

| Mondi Group | Focuses on mono-material film development and circular economy packaging innovations. |

| Uflex Ltd. | Expands its portfolio with recyclable and biodegradable LDPE & LLDPE films for various applications. |

Key Company Insights

Amcor Plc (10-14%)

Amcor leads in high-barrier, recyclable LDPE & LLDPE films, focusing on lightweight and flexible designs.

Berry Global Inc. (8-12%)

Berry Global specializes in multilayer films with superior sealing and sustainability features.

Sealed Air Corporation (6-10%)

Sealed Air develops puncture-resistant films for food and pharmaceutical applications.

Mondi Group (4-8%)

Mondi focuses on mono-material film solutions and circular economy innovations.

Uflex Ltd. (3-7%)

Uflex pioneers recyclable and biodegradable LDPE & LLDPE films for diverse applications.

Other Key Players (45-55% Combined)

Several specialty packaging manufacturers contribute to the expanding LDPE & LLDPE sealant web films market. These include:

The overall market size for LDPE & LLDPE Sealant Web Films Market was USD 352.7 Million in 2025.

The LDPE & LLDPE Sealant Web Films Market is expected to reach USD 532.1 Million in 2035.

The market will be driven by increasing demand from food, pharmaceutical, and industrial packaging sectors. Innovations in sustainable films, smart packaging, and improved barrier properties will further propel market expansion.

Key challenges include recyclability concerns, fluctuating raw material prices, and increasing environmental regulations. However, advancements in bio-based films, AI-driven production, and mono-material packaging solutions are mitigating these challenges.

North America and Europe are expected to dominate due to strong demand for sustainable packaging solutions and regulatory support for recyclability. Meanwhile, Asia-Pacific is experiencing rapid growth due to expanding food and pharmaceutical sectors.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Thickness, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Thickness, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Thickness, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Thickness, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LDPE Films Market

Sealant Web Film Market Size and Share Forecast Outlook 2025 to 2035

Sealant Films Market

Bio-based sealant films Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in Bio-based Sealant Films

Web Development Outsourcing Services Market Size and Share Forecast Outlook 2025 to 2035

Website Builder Tool Market Size and Share Forecast Outlook 2025 to 2035

Web Scraping Software Market Size and Share Forecast Outlook 2025 to 2035

Web Real-Time Communication (WebRTC) Solution Market Analysis - Size, Share, and Forecast 2025 to 2035

Webbing Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Web Performance Optimization (WPO) Solution Market Size and Share Forecast Outlook 2025 to 2035

Web3 Gaming Market Report - Growth & Forecast 2025 to 2035

Web3 Messaging Tools Market Report - Growth & Forecast 2025 to 2035

Web Conferencing Market Analysis 2025 to 2035 by Component, Deployment, End-Use, and Region-Forecast from 2025 to 2035

Web Content Management Market Insights – Growth & Forecast through 2034

LDPE Container Market Growth & Demand Trends 2024-2034

Web 3.0 Blockchain Market Report – Growth, Demand & Forecast 2024-2034

Web Based e-Detailing Market

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA