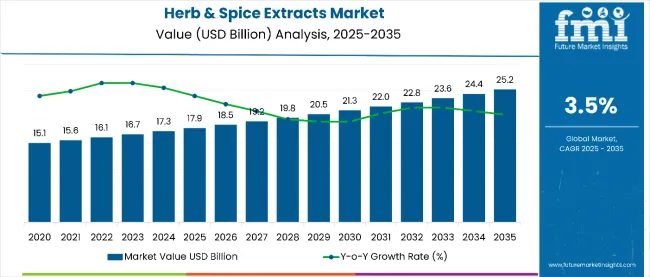

The global herb & spice extracts will reach USD 25.2 billion by 2035, reflecting a CAGR of 3.5%. The market is valued at USD 17.9 billion in 2025. Factors driving this growth include the increasing demand for functional foods, rising consumer health awareness, and the growing popularity of ethnic and spicy cuisines worldwide.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 17.9 billion |

| Market Size (2035) | USD 25.2 billion |

| CAGR (2025 to 2035) | 3.5% |

Additionally, advancements in extraction technologies and the shift toward natural and clean-label ingredients are expected to boost market expansion over the forecast period.

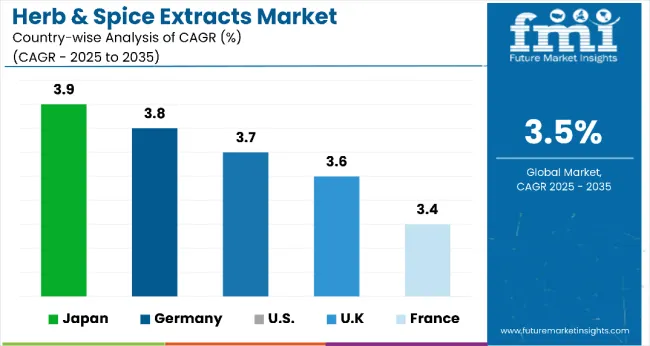

A CAGR of 3.8% is projected for Germany between 2025 and 2035, driven by rising demand for clean-label and ethnic food products, along with its strong position as a key importer and distributor of herb and spice extracts in Europe.

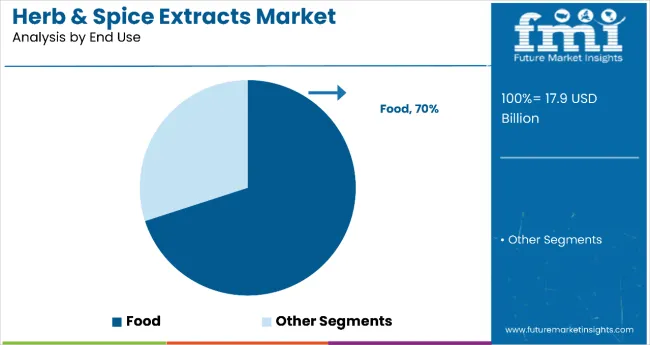

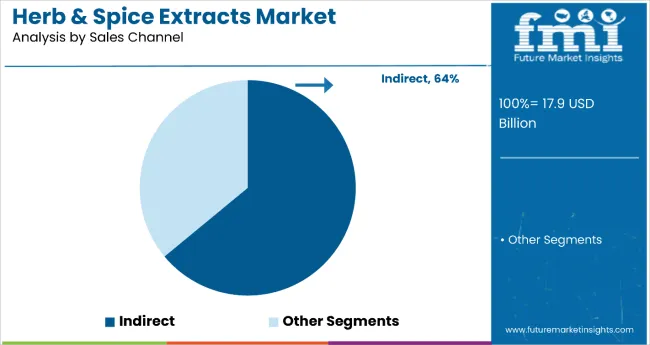

The UK market is expected to expand at 3.6%, while France is projected to grow at 3.4%, both supported by increasing interest in organic and functional ingredients. The food and beverage sector is anticipated to lead the end-use segment with a 70% share, while indirect sales are expected to command the sales channel segment with a 64% share.

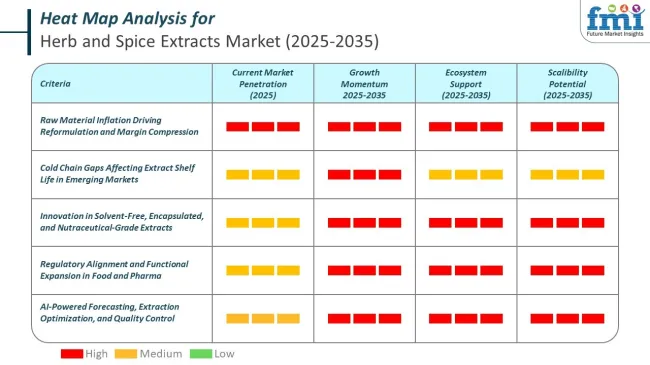

Advanced extraction methods, such as supercritical CO₂ and ultrasonic-assisted techniques, are being more widely adopted in the herb and spice extracts industry to improve yield and retain bioactive compounds. Manufacturers are also introducing microencapsulation technologies to improve shelf life and stability of volatile oils used in food and personal care products.

The market holds a significant position across multiple parent markets due to its broad applicability. Within the natural food additives market, it accounts for approximately 18-20%, owing to its role in flavoring and preservation. In the functional food ingredients market, it contributes around 15%, driven by rising health awareness.

In the flavor and fragrance market, herb and spice extracts hold nearly 12%, primarily through essential oils and aromatic compounds. Within the nutraceutical ingredients and cosmetic ingredients markets, their shares are estimated at 10% and 8% respectively, due to increasing demand for natural and clean-label formulations.

Food‑use extracts and essential oils are regulated globally under hygiene, safety, and quality frameworks, with Codex standards serving as international baselines and national laws adding specific conditions.

Border controls under Reg. (EU) 2019/1793 target high‑risk spice shipments (e.g., from certain origins), with increased sampling for aflatoxins and Salmonella.

The market segments include product type, end use, form, sales channel, nature, and region. The product type segment covers herbs, spices, paprika, and cumin. The end-use segment comprises food, beverages, food service, and retail.

The food segment includes biscuits, breads/cakes, candies, other baked goods, snacks, butter ice creams, cheese/cheese products, flavored milk, other dairy products, flavored/infused oils, processed food, sauces, dressings, condiments, snacks & savory products, soups, and others such as ready meals and marinades.

The form segment includes flakes, paste, powder & granules, whole/fresh. The sales channel segment encompasses both direct and indirect channels, including online retail and store-based retailing. The nature segment covers conventional, natural, non-GMO, organic, and vegan. The regional segment includes North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

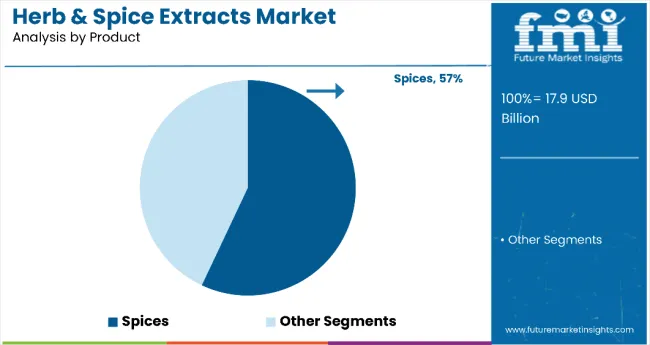

Recent innovative segment in the herb & spice extracts market, capturing a 57% market share in 2025.

The food segment is projected to dominate the herb & spice extracts market in 2025 with a 70% market share, driven by the rising demand for natural flavor enhancers and clean-label ingredients.

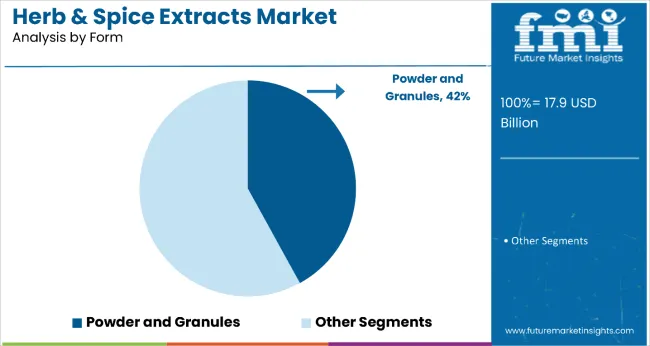

Powder & granules are expected to be the most lucrative segment in 2025, accounting for a 42% market share.

The indirect segment is projected to lead in 2025 with a 64% market share, primarily driven by the dominance of store-based retailing.

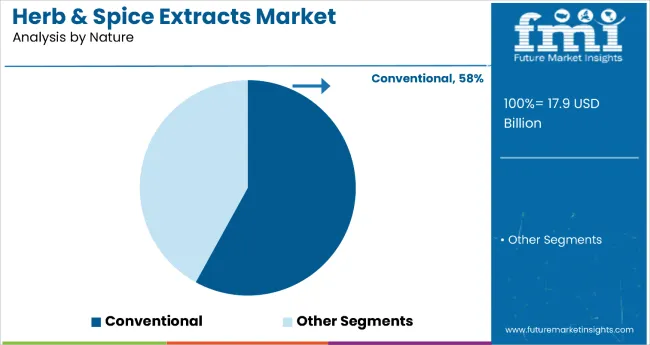

The conventional segment is expected to dominate the herb & spice extracts market in 2025, accounting for a 58% market share.

The market is growing steadily, driven by increasing consumer demand for clean-label ingredients, a rising preference for ethnic and functional foods, and advancements in extraction technologies, such as supercritical CO₂ and ultrasonic-assisted methods, that enhance flavor, potency, and shelf life.

Recent Trends in the Herb and Spice Extracts Market

Challengesin the Herb and Spice Extracts Market

Japan is expected to register the highest growth among the listed countries, expanding at a CAGR of 3.9% from 2025 to 2035. Germany follows closely with a CAGR of 3.8%, driven by its role as a European trade hub. The USA market is projected to grow at 3.7%, supported by clean-label and ethnic food trends.

The UK is set to grow at 3.6%, fueled by multicultural cuisines and rowing use of botanical extracts in personal care formulations. France, while growing steadily at 3.4%, reflects slower momentum compared to others due to its mature food and cosmetic sectors.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA herb & spice extracts market is projected to grow at a CAGR of 3.7% from 2025 to 2035.

The UK herb & spice extracts revenue is anticipated to expand at a CAGR of 3.6% between 2025 and 2035.

Germany’s herb and spice extracts salesare expected to grow at a CAGR of 3.8% from 2025 to 2035.

Sales of herb and spice extracts in Franceare projected to witness steady growth at a CAGR of 3.4% from 2025 to 2035.

Japan’s herb & spice extracts revenue is forecast to grow at a CAGR of 3.9% between 2025 and 2035.

The market is moderately consolidated, with leading global players such as Givaudan S.A., Kerry Group Plc., and McCormick & Company, Inc. commanding substantial shares due to their strong global distribution networks, advanced extraction technologies, and wide-ranging product portfolios.

Top firms in the market are competing through product innovation, partnerships with regional food manufacturers, and strategic acquisitions. Companies like Givaudan and Sensient are investing in advanced extraction methods such as supercritical CO₂ and solvent-free extraction to preserve bioactive compounds.

Recent Herb and Spice Extracts Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 17.9 billion |

| Projected Market Size (2035) | USD 25.2 billion |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in Metric Tons |

| By Product Type | Herbs, Spices, Paprika, and Cumin |

| By End Use | F ood (Biscuits, Breads/Cakes, Candies, Other Baked Goods, Snacks, Butter Ice Creams, Cheese/Cheese Products, Flavored Milk, Other Dairy Products, Flavored/Infused Oils, Processed Food, Sauces, Dressings and Condiments, Snacks & Savory Products, Soups, Others such as Ready Meals, Meal Kits, Marinades, Frozen Entrées ), Beverage, Food Service, a nd Reta il. |

| By Form | Flakes, Paste, Powder & Granules, Whole/Fresh |

| By Sales Channel | Direct, Indirect (Online Retail, Store-based Retailing) |

| By Nature | Conventional, Natural, Non-GMO, Organic, Vegan |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Givaudan S.A.,Kerry Group Plc., Takasago International Corporation, Sensient Technologies Corporation, Archer Daniels Midland Company, Ajinomoto Co., Inc., Symrise AG, Firmenich SA, Kalsec Inc., Olam International, McCormick & Company, Inc., Frutarom Industries Ltd, Robertet SA, Synthite Industries Ltd, and International Taste Solutions Ltd. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global herb & spice extracts market is estimated to be valued at USD 17.9 billion in 2025.

The market size for the herb & spice extracts market is projected to reach USD 24.8 billion by 2035.

The herb & spice extracts market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in herb & spice extracts market are herb extracts and spice extracts.

In terms of form, powder segment to command 42.7% share in the herb & spice extracts market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Herb & Spice Extracts in EU Size and Share Forecast Outlook 2025 to 2035

Herb and Spice Market Size and Share Forecast Outlook 2025 to 2035

Assessing Herbs and Spices Market Share & Industry Trends

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Europe Herbs and Spices Market Analysis – Size, Share & Forecast 2025–2035

Australia Herbs and Spices Market Growth – Trends, Demand & Forecast 2025–2035

Latin America Herbs and Spices Market Insights – Demand, Size & Industry Trends 2025–2035

Spice Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Herbal Medicinal Products Market Size and Share Forecast Outlook 2025 to 2035

Spice Oils and Oleoresins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spice Coated Casing Market Analysis - Size, Share & Forecast 2025 to 2035

Herbal Personal Care Products Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Herbal Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Herbicides Market Growth - Trends & Forecast 2025 to 2035

Herb Oil Market Size, Growth, and Forecast for 2025 to 2035

Herbal Tea Market Analysis by Raw Material Type, Product Type, Flavor Type, Packaging Type, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA