About The Report

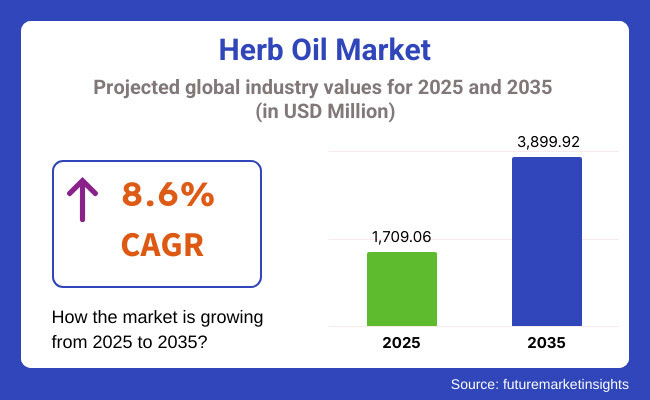

The global herb oil market is estimated to be worth USD 1,709.06 million by 2025 and is projected to reach a value of USD 3,899.92 million by 2035, reflecting a CAGR of 8.6% over the assessment period 2025 to 2035.

Rising health consciousness, evolving consumer preferences for clean-label products, and growing demand across food, cosmetics, and therapeutic applications are steering market expansion. Herb oils-derived from botanicals such as basil, mint, rosemary, and oregano-have gained prominence not just as natural flavoring agents but as functional ingredients offering antimicrobial, antioxidant, and mood-enhancing properties. This broader functional perception, reinforced by scientific validation, has increased their acceptance in both mass-market and premium formulations.

The food and beverage industry currently dominates herb oil consumption, leveraging these oils to meet consumer demand for natural preservatives and authentic flavor experiences.

With consumers increasingly scrutinizing ingredient labels, food processors are substituting synthetic additives with essential oils from herbs known for their purity, traceability, and wellness alignment. Moreover, consumer migration toward organic and plant-based foods has strengthened the appeal of herb oils in sauces, marinades, baked goods, and convenience meals.

Outside of food, the cosmetics and personal care industries have embraced herb oils for their therapeutic potential in skin, hair, and aromatherapeutic formulations. The demand is being amplified by a global shift toward self-care rituals, wellness routines, and “green beauty” standards.

Herb oils are now integrated into face serums, deodorants, bath oils, and hair care blends-particularly those certified as cruelty-free and sustainably sourced. Simultaneously, the pharmaceutical and nutraceutical sectors are exploring herb oil applications in formulations targeting inflammation, immunity, and stress relief, further widening the market's scope.

However, the herb oil supply chain faces risks associated with seasonal crop yields, regional climate variability, and adulteration of low-grade oils, which makes sourcing transparency and quality assurance vital differentiators for leading companies.

Manufacturers such as Givaudan, Symrise, Divi’s Laboratories, and Synthite Industries have responded by investing in vertical integration, traceability platforms, and advanced cold-extraction technologies to ensure consistent quality and meet stringent regulatory standards across global markets.

Looking forward, growth will be shaped by innovation in extraction techniques, partnerships with herb cultivators, and new product formats customized for diverse industries. The market’s trajectory remains robust, underpinned by the convergence of natural product demand, regulatory encouragement for clean-label alternatives, and consumer interest in health-supportive botanicals. Herb oils are no longer niche-they are becoming foundational across multiple wellness-oriented industries

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) in the global herb oil market. The analysis demonstrates significant shifts in the business and various growth trends that help the stakeholders realize the company's market growth and product offer.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 8.4% |

| H2 (2024 to 2034) | 8.5% |

| H1 (2025 to 2035) | 8.6% |

| H2 (2025 to 2035) | 8.7% |

H1, the first half of the year, ranges from January to June, while H2, the second half of the year, is from July to December. The first half of the decade (H1) of 2025 to 2035 is projected to record 8.5% CAGR, followed by H2, with a slight increase to 8.7%. In the following period, between H1 2025 and H2 2035, the rate is expected to be 8.6% in H1 and remain stable at this value in H2. H1 brought an increase of 30 basis points (BPS), whereas in H2, a decrease of 20 BPS occurred.

Accounting for the largest share of global herb oil demand in 2025, the food and beverage segment is forecast to expand steadily through 2035, propelled by its alignment with clean-label trends and a CAGR in line with the overall market at 8.6%.

The segment has emerged as a key volume driver as processors intensify efforts to replace synthetic preservatives and artificial flavors with natural, traceable alternatives. Herb oils derived from basil, rosemary, thyme, and oregano have increasingly become the go-to solution for delivering both antimicrobial functionality and authentic flavor enhancement in processed foods, sauces, and ready-to-eat products.

This segment's strategic relevance lies in its dual appeal-addressing consumer calls for health-supportive, chemical-free ingredients while also offering formulators extended shelf life and culinary versatility.

As consumers scrutinize ingredient lists more closely and associate botanical oils with natural preservation, herb oils have transitioned from niche applications to formulation essentials across premium and private-label SKUs alike. The movement toward organic, vegan, and minimally processed diets has only strengthened this adoption curve.

Over the next decade, innovation in cold-extraction, water-soluble delivery systems, and regional herb sourcing will enable further customization across beverage, dairy, and savory categories. In short, food and beverage is not just leading in volume-it is redefining herb oil’s commercial baseline.

With a projected CAGR closely mirroring the market average of 8.6% from 2025 to 2035, the cosmetics and personal care segment is positioned as a high-value growth contributor in the global herb oil market.

Demand is being driven by increasing consumer orientation toward “green beauty,” wellness rituals, and ethical sourcing-trends that favor natural, multi-functional ingredients over synthetic or petrochemical alternatives. Herb oils have gained ground not only as aroma agents but also as bioactive components that deliver antioxidant, anti-inflammatory, and antimicrobial benefits across a range of topical applications.

This segment’s strategic significance stems from its synergy with self-care, mindfulness, and skin health trends. Product innovation is being influenced by the rising inclusion of essential oils like lavender, rosemary, peppermint, and tea tree in face serums, shampoos, deodorants, and bath oils-particularly those positioned as clean-label, cruelty-free, and sustainably sourced. Consumers are associating these botanicals with purity, efficacy, and therapeutic value, further elevating their usage in prestige skincare and emerging indie brands alike.

Manufacturers are expected to invest in traceability, allergen-free formulations, and encapsulation technologies to retain herb oil potency and improve sensory appeal. As personalization and wellness-centric beauty formats accelerate, herb oils are poised to evolve from traditional aromatherapy tools into functional pillars of the modern cosmetic toolkit.

Health-Promoting Concentrated Herb Oil

Shift: People are inclined to resource highly effective herb oil concentrates that are more concentrated and cost-efficient than the regular. Applications in aromatherapy, pharmaceuticals, food, and other areas are finding a significant rise in concentrated oils such as rosemary and peppermint, of which North America and Europe are leading the trend.

Strategic Response: The manufacturers make the move by releasing ultra-concentrated herb oils of the purer variety. The companies fund projects that are based on intricately performed steam distillation and CO2 extraction techniques, guaranteed to retain bioactive compounds.

Primary brands venture into high-potency herbal blends that will later be incorporated into pharmaceutical and Nutraceutical formulations. Moreover, several players are presenting premium-grade concentrates for skincare as their main target, with luxury beauty brands emphasizing ingredient potency and purity.

Aromatherapy and Added Functionality

Shift: Herb oils are more often used in hybrid applications, functioning in a combination of aromatherapy and functional benefits. The market needs essential oils that are not only for relaxation but also have antimicrobial, anti-inflammatory, or mood-enhancing properties. This is now thriving in the personal care, household cleaning, and holistic wellness segments, particularly in the Asia-Pacific and North American regions.

Strategic Response: Manufacturers are developing the concept of incorporating herb oils into other products, such as disinfectants, therapeutic skincare, and wellness supplements. Leading brands also get involved and launch hybrid formulas along with adaptogenic and stress-relief benefits. Additionally, companies are stepping up their research to prove the functional advantages of herbal oils, providing consumers with a more scientific basis for the products they choose.

Region-Specific Herb Oil Formulations

Shift: The demand for herbal oils is increasingly grounded in local norms and cultural practices. In Asia, turmeric and holy basil oils are the most popular by medicinal property, while European and American markets are dominated by lavender and chamomile for their relaxing and soothing properties. Markets in the Middle East are showing an interest in oud and frankincense products.

Strategic Response: Manufacturers are now embracing traditional methods and sourcing the herbs required to create culturally relevant applications. Brands are building their credibility through local sourcing and by ensuring the authenticity of the ingredients. The same holds for companies that adopt this concept by launching region-specific product lines that promote traditional herbal remedies, thereby catering to customers who seek genuinely old-established and natural solutions.

Personalized Herb Oil Blends for Effectiveness

Shift: Consumers are not only interested in specific single, pitch, and flavoring of oils. They prefer customized blends such as sleep improvement, immune support, or cognitive enhancement, among others. The increasing availability of these personalized wellness solutions in the market is accelerating this movement, particularly in premium skincare, aromatherapy, and holistic health.

Strategic Response: Companies have been investing in innovative technology, such as AI-driven customization tools, which have made it possible for audiences to create their own herb oil blends. Brands are also partnering with wellness influencers to promote a co-designed product line. More than that, producers are augmenting their offerings by including ready-made synergy blends which are a quick and convenient approach to addressing health and lifestyle issues.

The period from 2020 to 2024 has seen a rise in global herb oil sales at a compound annual growth rate (CAGR) of 8.2%. It is foreseen that in the next ten years (2025 to 2035) expenditures on herb oils will continue to rise at this same CAGR of 8.6%. The main factor affecting both the increase in demand for herb oils in different sectors is the ever-widening scope of plant-based medicinal systems and instruments.

The fact that consumers are changing to herb essential oils that provide their healing/curative properties is the//is just one step ahead in alignment with holistic health and the need for chemical-free formulations.

As a result of the development, manufacturers are also acting based on this trend by broadening their product portfolios with high-purity essential oils and functional herb oil blends. The development of cutting-edge technology, such as CO2 distillation, is enabling oils to be purer and more sustainable.

Moreover, the increased knowledge among consumers about the use of herbal oils in pharmaceuticals and functional foods has contributed to the enlargement of the market. Marketing strategies that stress educating customers about the benefits of essential oils are the main vehicles that secure brand positioning and guarantee customer trust. The mode of sales through online platforms, specifically direct-to-consumer ones, is another factor that enhances market growth, thereby making herb oils accessible for global consumption.

Green marketing, good manufacturing practices, and resource management are the key elements that stakeholders must implement to maintain a competitive edge.The global herb oil market is characterized by moderate fragmentation, with a blend of international companies (MNCs), small local firms, and Chinese producers competing for a market share of the herb oil market. MNCs are the big players in the industry relying on their extensive distribution networks, state-of-the-art extraction equipment, and excellent brand positioning.

These companies promote their herb oils, which are certified as organic and therapeutic-grade, thereby responding to consumer demand for the highest quality essential oils in various areas, including aromatherapy, cosmetics, and food. Their global reach and partnerships with retailers and wellness brands pave the way for competitiveness.

A considerable proportion of the market is occupied by the regional players, especially in North America and Europe, where the interest in locally sourced and sustainably produced herb oils is increasing. They focus on authenticity, farm-to-bottle traceability, and specific regional preferences with customized blends.

Many regional producers are opting for small-batch production and direct-to-consumer sales channels to capitalize on the current trend of artisanal products and pure essential oils. They also have an expansion strategy in place by introducing functional food, beverages, and pharmaceutical-grade herbs.

The Chinese manufacturers by selling herb oils in bulk at very low prices have a competitive edge and are making progress. The budget-friendly pricing and high-volume production capabilities make them essential partners for international companies in need of materials.

However, they face difficulties such as quality issues, and some customers believe it is better to make a deal only with certified suppliers. To establish their reputation, tea companies are adopting quality assurance, organic certifications, and compliance with international safety standards, little by little improving their positioning in the global market.

| Country | United States |

|---|---|

| Market Volume (USD Million) | USD 395.29 Million |

| CAGR (2025 to 2035) | 8.4% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | USD 191.28 Million |

| CAGR (2025 to 2035) | 8.2% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | USD 144.91 Million |

| CAGR (2025 to 2035) | 8.0% |

| Country | China |

|---|---|

| Market Volume (USD Million) | USD 130.42 Million |

| CAGR (2025 to 2035) | 10.0% |

| Country | India |

|---|---|

| Market Volume (USD Million) | USD 81.55 Million |

| CAGR (2025 to 2035) | 9.0% |

The country is forecasted to be the global leader in herb oil sales in 2025, at roughly USD 395.29 million, accounting for 23.0% of the total sales worldwide. It is expected that the herb oil market in the country will grow at a compound annual growth rate (CAGR) of 8.4% from 2025 to 2035. The primary driver of market growth is the growing consumer interest in natural and organic products, particularly in the fields of personal care and cosmetics.

Due to their holistic connection with herbs, people have begun to use these oils not only in massage and therapy but also as food supplements and cosmetic products. The USA is the main leader in the herb oil business market and this is why it has all these trends in place, which is why the USA is the one to benefit the most from these developments also in the future.

With a market volume of approximately USD 191.28 million in 2025, Germany is expected to rank high in the global herb oil market, accounting for 13.2% of the total market. Between 2025 and 2035, the market is projected to grow at a compound annual growth rate (CAGR) of 8.2%. The growing awareness of the environmental impacts and health benefits of people is driving demand for clean-label, sustainably produced herb oils, setting German buyers apart from others.

The German government's stable legal framework guarantees quality standards that promote consumer trust. They also look for new events or opportunities, such as the enhancement of integrating herb oils into traditional German cuisine dishes and the wellness sector.

The changing market dynamics make Germany a key player in the fast-growing herbal oil industry, where a bright future is anticipated.

The estimated value of the herb oil market in China is about USD 130.42 million, and that will take 9.0% of the global market. The herb oil market is anticipated to register remarkable growth with a CAGR of 10.0% for the period 2025 to 2035.

The dynamic demand for the herb oil market can be attributed to the increased application of herb oils in traditional Chinese medicine and a growing preference among people for natural and holistic healthcare solutions. The upgrading of Chinese cuisine involves the introduction of premium herb oils, which is why a significant change is taking place.

This mix of cultures and flavors reflects the vibrant market environment, which in turn makes China a leading player in the global herb oil market, alongside its rapid development and expansion in the sector.

The global herb oil market has been experiencing tremendous growth, driven by a surge in consumer preference for natural and organic products across various sectors, including food and beverages, personal care, and pharmaceuticals. The major actors are focusing on expanding the scope of their products, ensuring the stability of their sourcing, and funding the development of new extraction processes that demonstrate a pathway to a competitive stronghold.

The market is a mixture of multinational corporations, which mostly deal with the professional market, and local advertisers, who work more on the personal product sectors; both strive to overcome the other by establishing strategic partnerships and technological innovations.

The herb oil market is segmented into dehydrated dried soups and instant dried soups.

Packaging types include pouches, cups, and boxes.

Sales channels comprise HORECA, modern trade, convenience stores, online stores, and others.

The market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global herb oil market is expected to grow at a CAGR of 8.6% during the forecast period from 2025 to 2035.

The market is projected to reach a value of approximately USD 3,899.92 million by 2035.

The instant dried soups segment is anticipated to witness the fastest growth due to increasing consumer demand for convenient and quick meal solutions.

Key factors include rising consumer preference for natural and organic products, expanding applications of herb oils in various industries such as food and beverages, personal care, and pharmaceuticals, and increasing awareness of the health benefits associated with herb oils.

Dominant players in the market include Givaudan, Symrise, Divi's Laboratories, Synthite Industries, Wilmar International, and Naturex.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Litre) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 6: Global Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 8: Global Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 16: North America Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 18: North America Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 26: Latin America Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 28: Latin America Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 36: Western Europe Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 38: Western Europe Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 46: Eastern Europe Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 48: Eastern Europe Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 66: East Asia Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 68: East Asia Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Litre) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Litre) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2018 to 2033

Table 76: Middle East and Africa Market Volume (Litre) Forecast by Application , 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Extraction , 2018 to 2033

Table 78: Middle East and Africa Market Volume (Litre) Forecast by Extraction , 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Litre) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Litre) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 15: Global Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 19: Global Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Application , 2023 to 2033

Figure 28: Global Market Attractiveness by Extraction , 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 45: North America Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 49: North America Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Application , 2023 to 2033

Figure 58: North America Market Attractiveness by Extraction , 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 75: Latin America Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 79: Latin America Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 88: Latin America Market Attractiveness by Extraction , 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 105: Western Europe Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 109: Western Europe Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application , 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Extraction , 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 135: Eastern Europe Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 139: Eastern Europe Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application , 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Extraction , 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application , 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application , 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Extraction , 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application , 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 195: East Asia Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 199: East Asia Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application , 2023 to 2033

Figure 208: East Asia Market Attractiveness by Extraction , 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application , 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Extraction , 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Litre) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Litre) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application , 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Litre) Analysis by Application , 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Extraction , 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Litre) Analysis by Extraction , 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Extraction , 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Extraction , 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Litre) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application , 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Extraction , 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Breakdown of Herb Oil Providers

The Oil & Gas Terminal Automation Market is segmented by Offering (Hardware, Software, Services) and Region by FMI.

Herbicides Market Growth - The Herbicides Market is segmented by Type (Synthetic and Bio-based), Mode of Action (Selective and Non-Selective), Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others), and Region, with a forecast period from 2026 to 2036 by FMI. & Forecast 2025 to 2035

The Herbal Beauty Product Market is segmented by Product Type (Skincare, Hair Care, Color Cosmetics, Fragrances, and Bath & Body), Source (Botanical Extracts, Essential Oils, Plant-Based Actives, and Herbal Formulations), Distribution Channel (Specialty Stores, Online Retail, Supermarkets & Hypermarkets, and Direct Sales) and Region. Forecast for 2026 to 2036.

Herb and Spice Market Size, Growth, and Forecast for 2026-2036

Herbal Tea Market Analysis Size and Share Forecast Outlook 2026 to 2036

The Oil and Gas Fittings Market is segmented by Product Type (Flanges, Elbows, Tees, Reducers, Couplings, and Others), Material (Carbon Steel, Stainless Steel, Alloy Steel, and Others), Application (Upstream, Midstream, and Downstream), and Region. Forecast for 2026 to 2036.

Herbal Medicinal Products Market forecast and outlook 2026 to 2036

Oil-to-Milk Solid Cleansers Market Size and Share Forecast Outlook 2026 to 2036

Oil and Gas Flow Control Equipment Market Size and Share Forecast Outlook 2026 to 2036

Herb & Spice Extracts Market Analysis Size and Share Forecast Outlook 2026 to 2036

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.