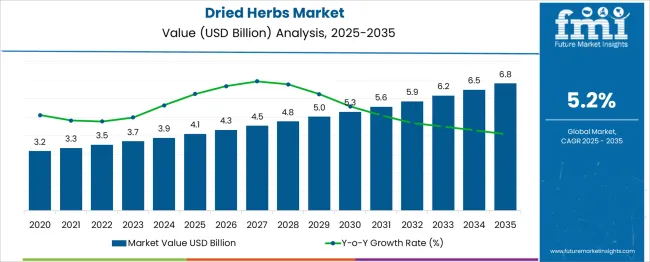

The Dried Herbs Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 6.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period. A Year-on-Year (YoY) Growth Analysis reveals a stable yet gradually tapering expansion trajectory. This analysis evaluates the incremental change in market value each year to assess how consistently demand grows across the forecast period.

Between 2025 and 2026, the market grows from USD 4.1 billion to USD 4.3 billion, indicating a YoY growth of approximately USD 0.2 billion or 4.9%. In subsequent years, the YoY absolute increase ranges between USD 0.2 billion and USD 0.3 billion. From 2026 to 2029, the market adds around USD 0.2 billion annually, pushing the value to USD 5.0 billion by 2029. Between 2029 and 2032, a marginal acceleration is observed, with annual gains rising closer to USD 0.3 billion.

After 2032, growth levels plateau slightly, with YoY increases holding steady at USD 0.3 billion through 2035. However, the%age increase gradually declines each year due to the expanding base value. This declining relative growth indicates maturity setting in by the later stages of the forecast period. The overall pattern supports a smooth and reliable expansion trend without sharp spikes or contractions.

| Metric | Value |

|---|---|

| Dried Herbs Market Estimated Value in (2025 E) | USD 4.1 billion |

| Dried Herbs Market Forecast Value in (2035 F) | USD 6.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The dried herbs market is experiencing steady growth driven by the global shift toward natural ingredients, health-conscious consumption, and demand for clean-label formulations. The increasing use of herbs as flavor enhancers and preservatives across packaged foods, ready-to-eat meals, and health supplements is boosting overall adoption.

Rising consumer awareness regarding the medicinal and antioxidant properties of various herbs is also contributing to their popularity in mainstream culinary and wellness applications. Improvements in post-harvest drying technologies and advancements in global herb sourcing have enhanced the availability, consistency, and shelf stability of dried herbs, further encouraging their use in large-scale manufacturing.

The market is anticipated to benefit from the growing penetration of herb-infused products across foodservice chains and retail grocery formats, alongside sustained interest in functional food trends and immunity-boosting diets.

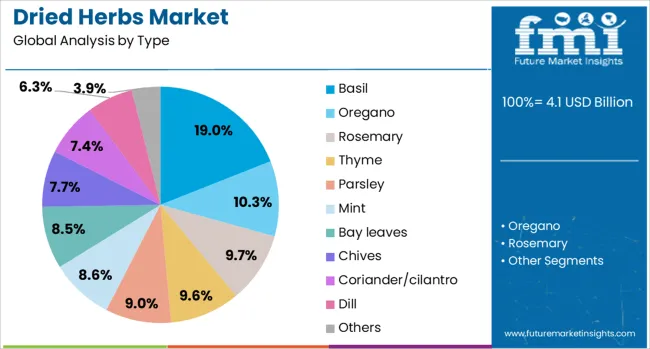

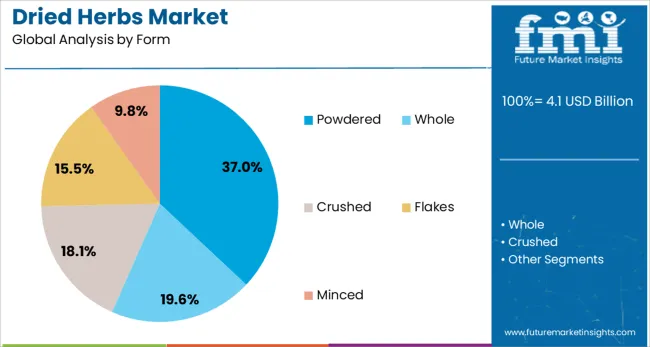

The dried herbs market is segmented by type, form, application, distribution channel, and geographic regions. The dried herbs market is divided into Basil, Oregano, Rosemary, Thyme, Parsley, Mint, Bay leaves, Chives, Coriander/cilantro, Dill, and others. In terms of form, the dried herbs market is classified into Powdered, Whole, Crushed, Flakes, and Minced.

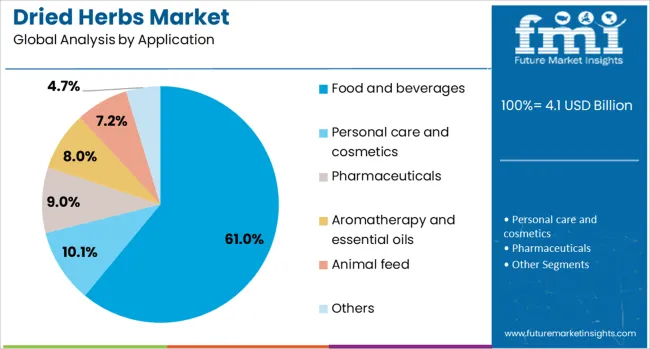

Based on the application, the dried herbs market is segmented into Food and beverages, Personal care and cosmetics, Pharmaceuticals, Aromatherapy and essential oils, Animal feed, and others.

The distribution channel of the dried herbs market is segmented into Supermarket and hypermarket, Convenience stores, Specialty stores, Online retail, Direct sales, and others. Regionally, the dried herbs industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Basil is projected to account for 19.0% of the dried herbs market revenue in 2025, making it the leading herb type. Its growth is being driven by widespread culinary acceptance across regional and international cuisines, owing to its versatile flavor profile and perceived health benefits.

The herb’s natural anti-inflammatory and antimicrobial properties have increased its value in health-oriented food formulations. Demand has also been reinforced by the rising popularity of Mediterranean and plant-based diets, in which basil serves as a core flavoring component.

Improved processing and drying methods have helped retain basil's aroma and nutrient profile, supporting its consistent use across food processing, quick-service restaurants, and home cooking. Its adaptability in both dried whole-leaf and powdered forms further enhances its usability across a wide range of product categories.

Powdered herbs are expected to represent 37.0% of total market revenue in 2025, ranking as the most preferred form segment. This preference is attributed to ease of incorporation in industrial-scale food manufacturing and culinary applications where uniform dispersion is critical.

Powdered herbs offer higher surface area for flavor release, faster blending with dry or liquid formulations, and extended shelf life under proper packaging. Their convenience in dosing, measurement accuracy, and solubility in sauces, seasonings, and beverages has driven demand among food processors and health supplement brands.

The form's compatibility with encapsulation and extraction processes further supports its use in fortified and functional products. As consumer demand for organic and minimally processed ingredients rises, powdered dried herbs are increasingly being favored for their balance of potency, stability, and clean-label compliance.

The food and beverages segment is projected to dominate the dried herbs market with a 61.0% revenue share in 2025. This leadership is driven by the widespread use of herbs in seasoning blends, soups, snacks, marinades, bakery items, and infused beverages.

The shift toward natural flavorings in place of synthetic additives has strengthened demand for dried herbs across both conventional and health-focused food categories. Increased herb usage in plant-based, vegan, and ethnic food innovations has also contributed to this segment’s growth.

Additionally, food manufacturers are incorporating dried herbs to enhance product appeal, nutritional value, and shelf stability. With the foodservice industry recovering and clean-label trends gaining pace, the use of dried herbs is expected to further expand across packaged goods, restaurant menus, and home meal kits.

The market has evolved with increasing demand from food processing, personal care, and wellness-based product manufacturers seeking concentrated botanical ingredients. Herbs such as oregano, thyme, basil, rosemary, parsley, and sage have been widely processed into dried forms to improve shelf life, facilitate transport, and enhance flavor and nutritional concentration. These herbs have found broad usage in seasoning blends, soups, sauces, teas, aromatherapy, and herbal medicines. Manufacturers have adopted drying methods including air drying, freeze drying, and infrared drying to retain volatile oils and active compounds.

A major contributor to dried herbs market growth has been the rising usage of flavor-enhancing plant ingredients in sauces, dressings, seasoning powders, and prepackaged meals. Food processors have favored dried herbs over fresh ones due to their lower moisture content, longer stability, and ease of formulation. Herb blends with oregano, thyme, and basil have become popular in ready-to-eat meals and fast-food items, while rosemary and sage have been used for meat rubs and marinades. The dried format has enabled consistent dosing, easier storage, and integration into automated processing systems. In response, producers have expanded capacity for milling, sterilization, and vacuum packaging systems to meet the needs of food manufacturers seeking natural taste enhancers.

The adoption of dried herbs in personal care formulations has grown due to their compatibility with oil-based and water-based cosmetic systems. Extracts from herbs like lavender, chamomile, and calendula have been processed into dried forms for infusion into creams, shampoos, and skincare treatments. Herbal powders and infused oils have been preferred for their mild aroma, antioxidant content, and perceived skin-soothing benefits. Cosmetic formulators have used these ingredients in exfoliants, facial masks, bath salts, and aromatherapy oils. Cold-dried and finely powdered formats have enabled high dispersion and uniform texture in final products. Processing companies have invested in traceable sourcing, low-temperature drying, and standardized extraction to serve premium cosmetic segments.

Dried herbs have been increasingly incorporated into nutraceuticals and functional teas based on their traditional use in digestive health, relaxation, and immune support. Herbs like peppermint, tulsi, lemongrass, and fennel have been dried and blended for herbal infusions with specific wellness claims. Capsule and tablet manufacturers have utilized powdered herbs for digestive aids, sleep supplements, and metabolism support. The use of low-heat drying and vacuum dehydration has improved preservation of essential oils and active compounds. Blends tailored for calming, detoxification, and respiratory support have been widely marketed. The demand for clean-label nutraceuticals and caffeine-free teas has driven sustained adoption of dried herbs in the wellness product segment.

Challenges in the dried herbs market have included inconsistent herb quality, fragmented supplier networks, and weather-sensitive crop yields. Variability in aroma, flavor strength, and essential oil content has affected batch standardization. Harvesting delays, moisture-related spoilage, and contamination risks during storage have reduced usable output in certain growing regions. Smaller producers have lacked drying infrastructure, prompting contract processing partnerships. Limited storage life under improper packaging has created logistical inefficiencies. Weather disruptions including droughts or excessive rainfall have reduced herb productivity, especially for field-grown varieties. To mitigate these issues, larger processors have invested in vertical integration, cultivation under protective structures, and centralized procurement platforms.

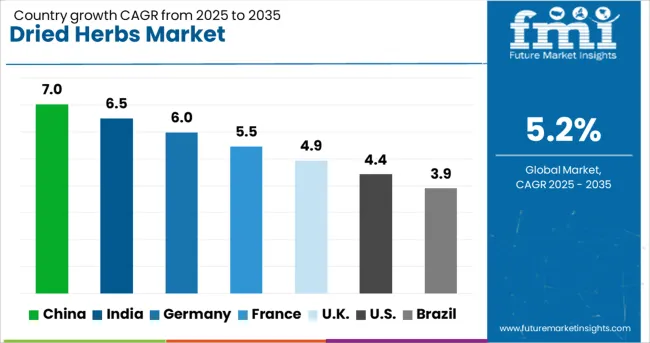

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

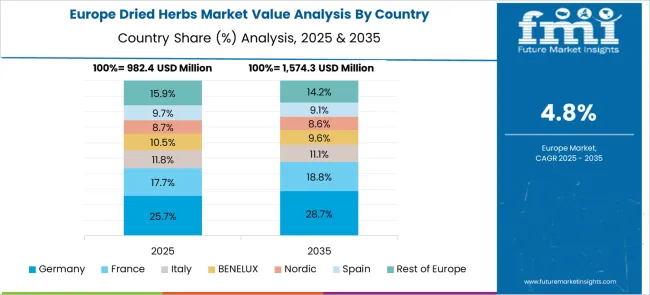

The dried herbs market is forecasted to register a CAGR of 5.2% from 2025 to 2035, supported by expanding culinary applications, wellness trends, and integration into personal care products. China, growing at an estimated 7.0%, remains dominant due to its vast cultivation base and high export intensity across oregano, thyme, and basil. India follows with 6.5%, where rising domestic demand and Ayurvedic formulations are reinforcing the supply chain. Germany, projected at 6.0%, maintains strong value-added production capabilities and herbal infusion integration across food categories. The UK, with an expected CAGR of 4.9%, leverages import refining and private-label distribution. The USA market, expected to grow at 4.4%, is shaped by steady consumption trends in spice blends and increasing penetration of natural food ingredients. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to register a CAGR of 7.0% in the dried herbs market from 2025 to 2035, anchored by strong demand for traditional medicinal ingredients and expanding functional food sectors. Regional cultivation of basil, mint, and oregano has been integrated with advanced dehydration and steam sterilization technologies. Local producers are focusing on quality control through traceability frameworks to comply with export norms. Export-centric clusters in Shandong and Yunnan are increasing throughput by optimizing post-harvest processing systems. Rising demand from health beverage and herbal supplement brands is reinforcing sourcing partnerships between cooperatives and food processors.

India is expected to grow at a CAGR of 6.5%, driven by rising applications in herbal supplements, teas, and processed food products. Cultivation zones across Rajasthan and Tamil Nadu have adopted improved harvesting and solar dehydration systems for herbs like tulsi, fennel, and lemongrass. Export interest from the EU and Middle East is driving certification efforts under organic and residue-free frameworks. Government support through horticulture development schemes is aiding small-scale farmers in post-harvest preservation and packaging. Herbal wellness brands are contributing to structured procurement contracts, enabling year-round supply alignment.

Germany is projected to advance at a CAGR of 6.0%, supported by demand from nutraceuticals, herbal teas, and premium culinary segments. Local processors are focusing on standardized phytochemical content and reduced moisture variability in herbs like rosemary, sage, and thyme. Vertical integration with organic farms is strengthening traceability and product differentiation in exports. Demand for clean label food additives is fostering R&D in low-temperature drying and essential oil retention techniques. German retailers are increasingly stocking traceable, low-contaminant dried herbs under private label brands.

The United Kingdom is likely to expand at a CAGR of 4.9%, led by growing consumption of herbal teas, home cooking ingredients, and wellness blends. Producers are emphasizing flavor retention through infrared and microwave-assisted drying technologies. Consumer preference for low-contaminant, non-irradiated herbs has influenced processing standards. Specialty food retailers and wellness stores are offering regionally sourced mint, thyme, and parsley in resealable packaging formats. Demand for gourmet herb mixes among meal kit providers and organic grocers is contributing to niche segment expansion.

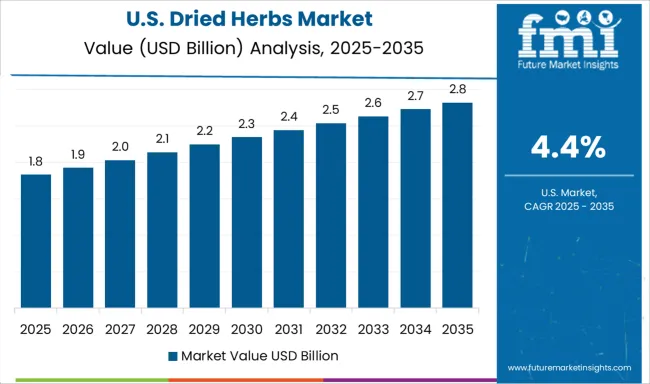

The United States is forecasted to grow at a CAGR of 4.4%, fueled by usage in ready-to-eat meals, sauces, and spice blends. Domestic producers are investing in freeze-drying and vacuum dehydration technologies to maintain flavor intensity and shelf life. Interest in natural food preservatives is stimulating herb extraction techniques from dried forms. Herb farms in California, Oregon, and Florida are adopting sustainable harvesting and low-waste drying systems. The demand for USDA-certified organic herbs continues to shape branding strategies for both domestic and imported offerings.

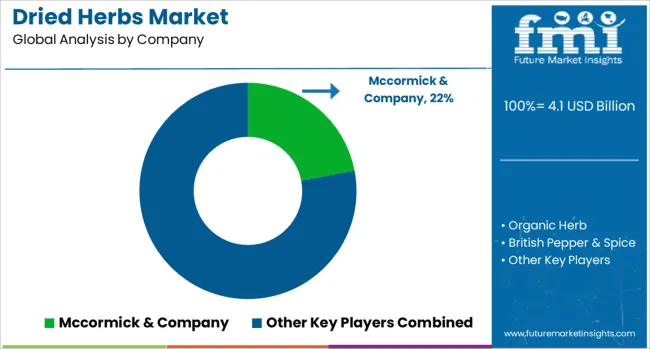

The dried herbs market is supported by a mix of multinational seasoning corporations and regional herb specialists supplying culinary, nutraceutical, and foodservice sectors. McCormick & Company remains a dominant force with global sourcing networks and vertically integrated production, offering an expansive portfolio of dried herbs under multiple consumer and foodservice brands. British Pepper & Spice and The Fuchs Group cater to European markets through retail, industrial, and private label supply, emphasizing consistent quality and regulatory compliance.

Elite Spice and USA Spice Mills serve primarily North American buyers, supplying bulk and custom spice blends for food manufacturers and processors. Kräuter Mix and Euroma specialize in premium dried herb solutions for gourmet and organic categories, while Organic Herb focuses exclusively on certified organic cultivation.

Husarich and Paulig leverage regional herb-growing advantages to serve niche European applications, including ethnic cuisine and clean-label formulations. With clean eating trends and convenience cooking habits reshaping consumer preference, demand continues to shift toward sustainably sourced, minimally processed dried herbs. Shelf life stability, traceability, and pesticide-free certifications have become vital differentiation factors across premium retail and B2B formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Type | Basil, Oregano, Rosemary, Thyme, Parsley, Mint, Bay leaves, Chives, Coriander/cilantro, Dill, and Others |

| Form | Powdered, Whole, Crushed, Flakes, and Minced |

| Application | Food and beverages, Personal care and cosmetics, Pharmaceuticals, Aromatherapy and essential oils, Animal feed, and Others |

| Distribution Channel | Supermarket and hypermarket, Convenience stores, Specialty stores, Online retail, Direct sales, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mccormick & Company, Organic Herb, British Pepper & Spice, Elite Spice, Euroma, Husarich, Kräuter Mix, Paulig, The Fuchs Group, and U.S. Spice mills |

| Additional Attributes | Dollar sales by herb type and distribution format, demand dynamics across culinary, medicinal, and cosmetic applications, regional trends in consumption across North America, Europe, and Asia-Pacific, innovation in freeze-drying techniques, organic farming integration, and aroma preservation technologies, environmental impact of herb cultivation, drying energy use, and packaging waste, and emerging use cases in functional food blends, herbal wellness formulations, and clean-label personal care products. |

The global dried herbs market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the dried herbs market is projected to reach USD 6.8 billion by 2035.

The dried herbs market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in dried herbs market are basil, oregano, rosemary, thyme, parsley, mint, bay leaves, chives, coriander/cilantro, dill and others.

In terms of form, powdered segment to command 37.0% share in the dried herbs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dried Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Dried Honey Market Size and Share Forecast Outlook 2025 to 2035

Dried Soup Market Size, Growth, and Forecast for 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Assessing Herbs and Spices Market Share & Industry Trends

Dried Spent Grain Market Trends – Growth & Industry Forecast 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Dried Apricot Market - Growth, Demand & Nutritional Trends

Dried Mushrooms Market Analysis – Trends & Forecast 2024-2034

Dried Distillers' Grains with Soluble Market

UK Herbs and Spices Market Outlook – Share, Growth & Forecast 2025–2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-Dried Food Market Growth, Forecast, and Analysis 2025 to 2035

USA Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Herbs and Spices Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA