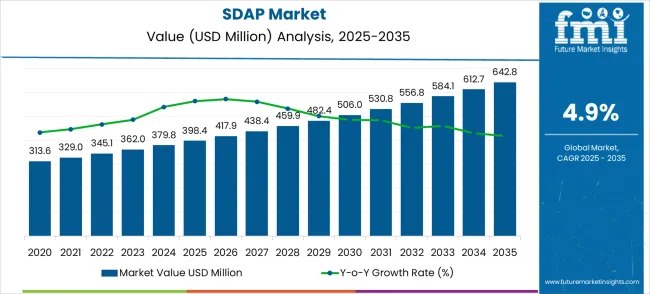

The global spray-dried animal plasma (SDAP) market is forecasted to grow from USD 398.4 million in 2025 to approximately USD 642.8 million by 2035, recording an absolute increase of USD 244.4 million over the forecast period. This translates into a total growth of 61.3%, with the market forecast to expand at a CAGR of 4.9% between 2025 and 2035. The overall market size is expected to grow by nearly 1.61X during the same period, supported by the rising adoption of high-quality protein ingredients in animal nutrition and increasing demand for functional feed additives in livestock production systems.

Between 2025 and 2030, the market is projected to expand from USD 398.4 million to USD 506.0 million, resulting in a value increase of USD 107.6 million, which represents 44.0% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of high-value protein ingredients in animal feed formulations, increasing demand for performance-enhancing feed additives, and growing adoption of sustainable protein sourcing practices. Animal nutrition manufacturers are expanding their SDAP processing capabilities to address the growing complexity of modern livestock nutrition requirements.

| Parameter | Value |

|---|---|

| Market Value (2025) | USD 398.4 Million |

| Market Forecast Value (2035) | USD 642.8 Million |

| Market Forecast CAGR | 4.9% |

From 2030 to 2035, the market is forecast to grow from USD 506.0 million to USD 642.8 million, adding another USD 136.8 million, which constitutes 56.0% of the overall ten-year expansion. This period is expected to be characterized by expansion of advanced spray-drying technologies, development of enhanced protein functionality features, and advancement of specialized animal nutrition applications. The growing adoption of precision livestock farming and sustainable animal production practices will drive demand for more sophisticated spray-dried animal plasma solutions and specialized nutritional capabilities.

Between 2020 and 2025, the Spray-dried Animal Plasma (SDAP) market experienced steady expansion, driven by increasing livestock production development and growing awareness of functional protein ingredient benefits over conventional protein sources. The market developed as animal nutrition specialists recognized the need for high-quality, bioactive protein ingredients to optimize animal performance and health efficiently. Feed manufacturers and livestock producers began emphasizing SDAP technology advantages including superior digestibility and immune system support capabilities.

The Spray-dried Animal Plasma (SDAP) market is entering a phase of steady growth, driven by demand for functional protein ingredients, livestock production expansion, and evolving animal nutrition. By 2035, these pathways together can unlock USD 105-140 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Feed Application Leadership (Livestock Nutrition) The feed segment already holds the largest share due to its critical role in animal nutrition and performance. Expanding feed formulation innovations, livestock production growth, and nutritional optimization can consolidate leadership. Opportunity pool: USD 35-50 million.

Pathway B -- Plasma Protein Innovation (Bioactive Functionality) Plasma protein powder accounts for the majority of demand. Growing livestock focus on immune system support and functional nutrition will drive higher adoption of advanced plasma protein concentrates. Opportunity pool: USD 28-38 million.

Pathway C -- Swine & Poultry Production Growth. Intensive swine and poultry production systems are expanding globally, especially in developing regions. SDAP products optimized for monogastric nutrition (digestibility, performance, health) can capture significant growth. Opportunity pool: USD 18-25 million.

Pathway D -- Emerging Market Expansion. Asia-Pacific, Latin America, and Africa present growing demand due to rising livestock production and feed industry development. Targeting feed networks and livestock producers will accelerate adoption. Opportunity pool: USD 12-18 million.

Pathway E -- Aquaculture Applications. With expanding global aquaculture production, there is opportunity to develop specialized SDAP products for fish and shrimp nutrition requiring high-quality protein sources. Opportunity pool: USD 8-12 million.

Pathway F -- Specialty & Premium Applications. Products with enhanced bioactivity, organic certification, or specialized functionality offer premium positioning for high-value livestock and pet food applications. Opportunity pool: USD 6-9 million.

Pathway G -- Food Industry Application. Growing food industry interest in functional protein ingredients creates opportunities for food-grade SDAP in nutritional supplements and functional food products. Opportunity pool: USD 4-6 million.

Pathway H -- Sustainable & Circular Processing. Advanced processing technologies that maximize yield, reduce waste, and improve sustainability metrics create value-added opportunities in environmentally conscious markets. Opportunity pool: USD 2-4 million.

Why is the Spray-dried Animal Plasma (SDAP) Market Growing?

Market expansion is being supported by the rapid increase in global livestock production and the corresponding need for high-quality protein ingredients that provide superior nutritional performance and animal health benefits. Modern animal nutrition relies on consistent feed quality and functional ingredient effectiveness to ensure optimal livestock performance including swine production, poultry farming, and aquaculture operations. Even minor nutritional deficiencies can require comprehensive feed protocol adjustments to maintain optimal animal health and production efficiency.

The growing complexity of animal nutrition requirements and increasing demand for sustainable protein ingredients are driving demand for spray-dried animal plasma products from certified manufacturers with appropriate processing capabilities and nutritional expertise. Feed manufacturers are increasingly requiring documented protein functionality and bioactivity to maintain animal performance and production efficiency. Industry specifications and nutritional standards are establishing standardized protein ingredient procedures that require specialized spray-drying technologies and trained animal nutrition professionals.

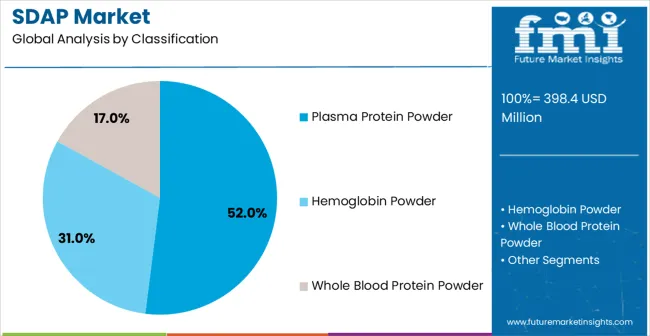

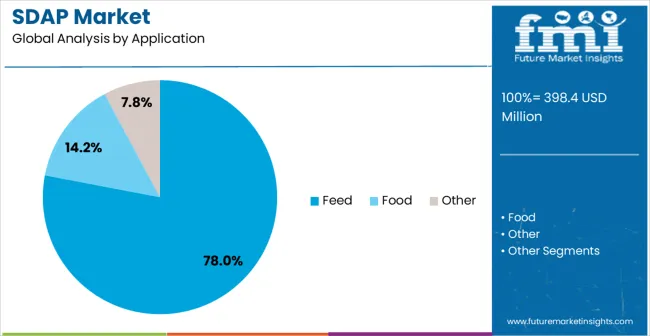

The market is segmented by product type, application, and region. By product type, the market is divided into plasma protein powder, hemoglobin powder, and whole blood protein powder. Based on application, the market is categorized into feed, food, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the plasma protein powder segment is projected to capture around 52% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of plasma protein concentrates that provide optimal bioactive functionality and immune system support, catering to a wide variety of animal nutrition applications. The plasma protein powder is particularly favored for its ability to deliver superior digestibility with proven immunoglobulin content and growth-promoting properties, ensuring nutritional effectiveness.

Feed manufacturers, swine producers, poultry integrators, and aquaculture operators increasingly prefer plasma protein powder, as it meets demanding nutritional requirements without imposing excessive feed costs or processing complexity. The availability of well-established processing technologies, along with comprehensive quality standards and technical support from leading animal protein manufacturers, further reinforces the segment's market position. This product type benefits from consistent demand across regions, as it is considered a premium solution for livestock producers requiring high-performance protein ingredients. The combination of nutritional efficacy, bioactive functionality, and proven performance makes plasma protein powder a preferred choice, ensuring their continued dominance in the animal nutrition protein ingredient market.

The feed segment is expected to represent 78% of spray-dried animal plasma demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the critical role of functional protein ingredients in animal feed formulations, where digestible protein content and bioactive compounds are essential to livestock performance and health. Feed applications often require specialized protein ingredients that provide both nutritional value and functional benefits throughout various growth stages and production systems, requiring high-quality and consistent protein sources. Spray-dried animal plasma is particularly well-suited to feed applications due to its excellent amino acid profile and immunoglobulin content that supports animal health and growth performance, even in challenging production environments.

As global livestock production continues to intensify and feed manufacturers emphasize improved feed conversion and animal welfare standards, the demand for spray-dried animal plasma continues to rise. The segment also benefits from increased focus within the animal agriculture industry, where producers are increasingly prioritizing feed quality and functional ingredients as differentiators to achieve superior production outcomes and animal health. With livestock operations requiring advanced nutritional strategies and performance optimization, spray-dried animal plasma provides an essential solution to maintain effective protein nutrition while supporting immune system function and growth performance.

The growth of intensive animal production systems, coupled with increased focus on sustainable protein sourcing and animal welfare, ensures that feed applications will remain the largest and most stable demand driver for spray-dried animal plasma in the forecast period.

The market is advancing steadily due to increasing livestock production intensification and growing recognition of functional protein ingredient advantages over conventional protein sources. The market faces challenges including higher ingredient costs compared to standard protein meals, need for specialized processing equipment and expertise, and varying regulatory requirements across different animal feed markets. Quality assurance efforts and processing technology advancement programs continue to influence product development and market adoption patterns.

The growing development of advanced spray-drying processing systems is enabling superior protein preservation with improved bioactivity retention and enhanced product consistency characteristics. Enhanced processing technologies and optimized drying parameters provide high-quality protein ingredients while maintaining functional properties and nutritional value. These technologies are particularly valuable for animal nutrition manufacturers who require reliable ingredient performance that can support demanding livestock applications with consistent nutritional results.

Modern spray-dried animal plasma manufacturers are incorporating advanced eco-friendly features and waste reduction capabilities that enhance operational efficiency and environmental responsibility. Integration of advanced resource recovery systems and optimized processing workflows enables superior environmental performance and comprehensive waste utilization capabilities. These advanced features support production in diverse regulatory environments while meeting various environmental requirements and green standards.

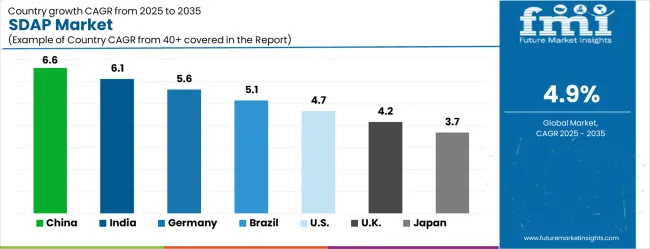

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

The market is growing steadily, with China leading at a 6.6% CAGR through 2035, driven by strong livestock production expansion and increasing adoption of functional protein ingredients. India follows at 6.1%, supported by rising animal agriculture development and growing awareness of advanced feed additive solutions. Germany grows steadily at 5.6%, integrating SDAP technology into its established livestock and feed industry infrastructure. Brazil records 5.1%, emphasizing livestock production modernization and feed quality enhancement initiatives. The United States shows solid growth at 4.7%, focusing on animal nutrition innovation and feed industry advancement. The United Kingdom demonstrates steady progress at 4.2%, maintaining established livestock production applications. Japan records 3.7% growth, concentrating on technology advancement and feed quality optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China recorded a 6.6% CAGR, driven by the expansion of animal feed, pet food, and livestock nutrition industries. Manufacturers focused on producing high-quality SDAP with consistent protein content, functional properties, and microbiological safety. Adoption was strongest in swine, poultry, and aquaculture feed, where SDAP improved growth performance and gut health. Competitive strategies included partnerships with feed producers, investment in local production facilities, and R&D in heat treatment, spray-drying technology, and functional enhancement. Growing demand for premium livestock feed, increased meat consumption, and government support for animal husbandry further accelerated growth. Manufacturers also emphasized quality certifications and export compliance to meet international standards and strengthen presence in regional and global markets.

India demonstrated a 6.1% CAGR, supported by increasing livestock farming, poultry production, and aquaculture development. Manufacturers emphasized high-protein SDAP with reliable functional properties, microbiological safety, and consistency for incorporation into feed formulations. Adoption was strongest among commercial swine, poultry, and aquaculture farms. Competitive strategies included collaborations with feed producers, localized manufacturing, and R&D for optimizing spray-drying processes and nutritional functionality. Government initiatives to enhance livestock productivity and protein supply further strengthened market growth. Companies focused on operational efficiency, product consistency, and compliance with international quality standards to meet domestic and export demand, while improving livestock performance and reducing feed-related health risks.

Germany advanced at a 5.6% CAGR, driven by demand from swine, poultry, and aquaculture feed sectors emphasizing gut health, immune support, and growth performance. Manufacturers focused on high-quality SDAP with consistent protein levels, functional activity, and microbiological safety. Adoption was strongest among industrial livestock farms and feed producers supplying premium nutrition solutions. Competitive strategies included R&D in spray-drying technology, protein functional enhancement, and partnerships with feed companies. Strong regulatory frameworks, food safety standards, and quality certifications reinforced adoption. Manufacturers also targeted international exports and premium livestock nutrition markets to capitalize on demand for high-performance feed ingredients across Europe.

Brazil recorded a 5.1% CAGR, influenced by growing livestock, poultry, and aquaculture sectors requiring high-quality feed ingredients. Manufacturers emphasized SDAP with consistent protein content, functional benefits, and microbiological safety for improving animal growth and health. Adoption was strongest in industrial swine, poultry, and aquaculture operations. Competitive strategies included localized production, collaboration with feed companies, and R&D in nutritional enhancement and spray-drying efficiency. Government programs promoting livestock productivity and animal nutrition further supported market growth. Manufacturers also focused on operational efficiency, quality assurance, and export potential to meet regional and global demand.

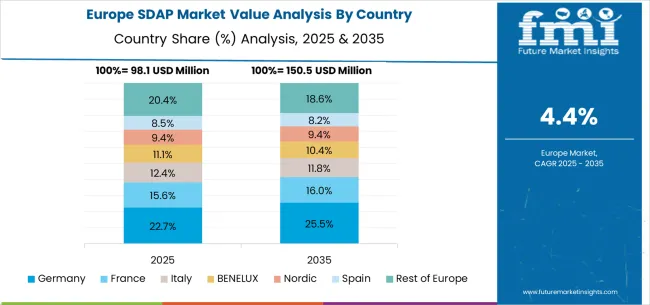

The spray-dried animal plasma (SDAP) market in Europe is forecast to expand from USD 106.8 million in 2025 to USD 172.3 million by 2035, registering a CAGR of 4.9%. Germany will remain the largest market, holding 32.0% share in 2025, easing to 31.5% by 2035, supported by strong livestock infrastructure and advanced feed industry systems. The United Kingdom follows, rising from 25.0% in 2025 to 25.5% by 2035, driven by livestock producers and animal nutrition initiatives. France is expected to decline slightly from 22.0% to 21.5%, reflecting agricultural industry consolidation. Italy maintains stability at around 15.0%, supported by livestock facilities and feed manufacturers, while Spain grows from 4.5% to 5.0% with expanding animal agriculture and feed industry demand. BENELUX markets ease from 1.2% to 1.1%, while the remainder of Europe hovers near 0.3%--0.4%, balancing emerging Eastern European growth against mature Nordic markets.

The Spray-dried Animal Plasma (SDAP) market is defined by competition among specialized animal protein processing companies, feed ingredient manufacturers, and livestock nutrition solution providers. Companies are investing in advanced spray-drying technology development, protein functionality optimization, processing efficiency improvements, and comprehensive technical support capabilities to deliver reliable, nutritious, and cost-effective protein ingredient solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and animal nutrition presence.

Sonac (Darling Ingredients) offers comprehensive spray-dried animal plasma solutions with established animal protein processing expertise and global manufacturing capabilities. VEOS Group provides specialized feed ingredient technology with focus on protein functionality and animal nutrition. APC delivers advanced animal protein solutions with focus on processing optimization and nutritional quality. Lican Food specializes in protein ingredient manufacturing with advanced animal nutrition technology integration.

Haripro offers professional-grade animal protein products with comprehensive feed ingredient capabilities. Yeruvá S.A. delivers established animal protein solutions with advanced processing technologies. Essentia Protein Solutions provides specialized protein manufacturing with focus on nutritional optimization. Zhejiang Mecore Bioengineering, Anhui Runtai Feed Technology, Linyi Jiyu Protein, Jiangsu Yongsheng Biotechnology, Sino-Tech, World Biotech, and Tianjin Baodi Agricultural Technology offer specialized manufacturing expertise, protein reliability, and comprehensive product development across global and regional animal nutrition market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 398.4 million |

| Product Type | Plasma Protein Powder, Hemoglobin Powder, Whole Blood Protein Powder |

| Application | Feed, Food, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Sonac (Darling Ingredients), VEOS Group, APC, Lican Food, Haripro, Yeruvá S.A., Essentia Protein Solutions, Zhejiang Mecore Bioengineering, Anhui Runtai Feed Technology, Linyi Jiyu Protein, Jiangsu Yongsheng Biotechnology, Sino-Tech, World Biotech, Tianjin Baodi Agricultural Technology, Protein Technologies International |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major markets, competitive landscape with established animal protein processing companies and emerging feed ingredient technology providers, customer preferences for different protein types and animal nutrition applications, integration with feed manufacturing systems and animal nutrition protocols, innovations in spray-drying effectiveness and protein functionality technologies, and adoption of sustainability features with enhanced nutritional capabilities for improved livestock production workflows |

The global spray-dried animal plasma (SDAP) market is estimated to be valued at USD 398.4 million in 2025.

The market size for the spray-dried animal plasma (SDAP) market is projected to reach USD 642.8 million by 2035.

The spray-dried animal plasma (SDAP) market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in spray-dried animal plasma (SDAP) market are plasma protein powder, hemoglobin powder and whole blood protein powder.

In terms of application, feed segment to command 78.0% share in the spray-dried animal plasma (SDAP) market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Grade Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Plasma Dynamic Air Sterilizer Market Size and Share Forecast Outlook 2025 to 2035

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plasma Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Plasma Bottle Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA