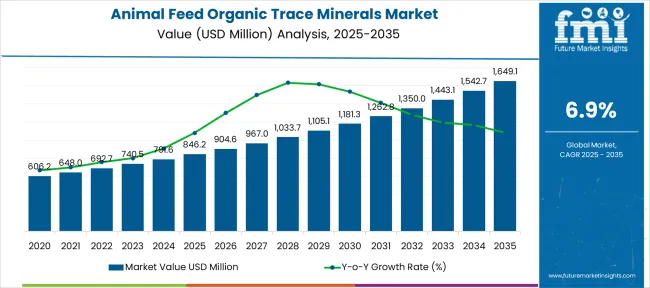

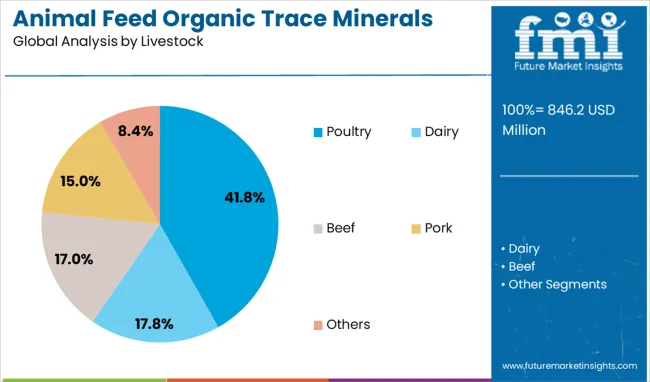

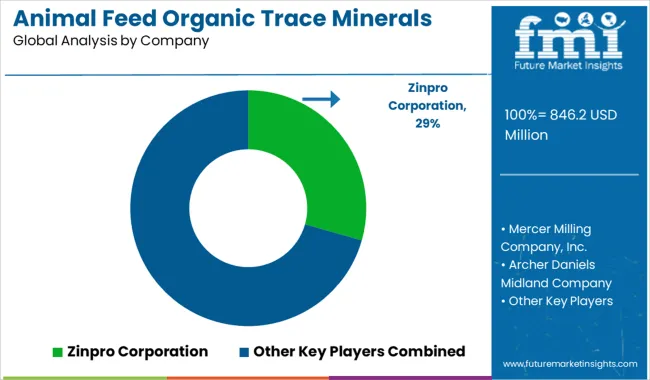

The Animal Feed Organic Trace Minerals Market is estimated to be valued at USD 846.2 million in 2025 and is projected to reach USD 1649.1 million by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period. Growth is shaped by livestock producers prioritizing mineral bio availability, which improves feed efficiency and reduces waste excretion, making organic sources preferable over inorganic variants. Poultry and dairy sectors are seen as primary contributors, with trace minerals supporting skeletal development, fertility, and milk yield.

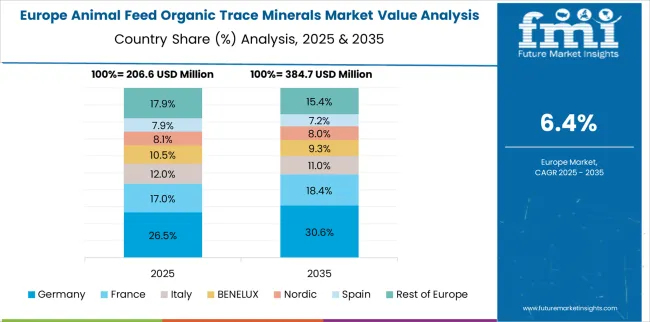

Regional imbalance is likely, as the Asia Pacific records strong consumption due to herd expansion and aquaculture, while Europe pushes uptake under strict regulatory frameworks that favor organic mineral chelates. Latin America and Africa emerge gradually, benefiting from the modernization of feed mills and rising export-driven meat production.

| Metric | Value |

|---|---|

| Animal Feed Organic Trace Minerals Market Estimated Value in (2025 E) | USD 846.2 million |

| Animal Feed Organic Trace Minerals Market Forecast Value in (2035 F) | USD 1649.1 million |

| Forecast CAGR (2025 to 2035) | 6.9% |

Annual gains in the animal feed organic trace minerals market start modestly, with about USD 52.6 million added between 2025 and 2026, but quickly build momentum to reach around USD 74.8 million by 2029–2030. This steady climb shows how demand is widening across poultry, aquaculture, and dairy producers who increasingly prefer organic minerals for better absorption and animal health.

From 2030 to 2035, growth becomes more pronounced, with the market rising from USD 1174.6 million to USD 1649.1 million. That jump of USD 474.5 million makes up nearly two-thirds of the total opportunity over the forecast period. The most striking leap comes in the final year, where almost USD 101 million is added between 2034 and 2035. This reflects the uptake of advanced chelated mineral blends, precision feeding practices, and stronger regulations encouraging a shift away from inorganic forms.

The animal feed organic trace minerals market is growing steadily, driven by the increasing demand for sustainable livestock nutrition and enhanced animal health. Research in animal nutrition has underscored the importance of organic trace minerals in improving feed efficiency and supporting immune function.

The poultry segment has emerged as a major driver, reflecting global growth in poultry production to meet rising protein demands. Livestock producers are increasingly adopting organic mineral supplements to promote better nutrient absorption and reduce environmental impact compared to inorganic alternatives.

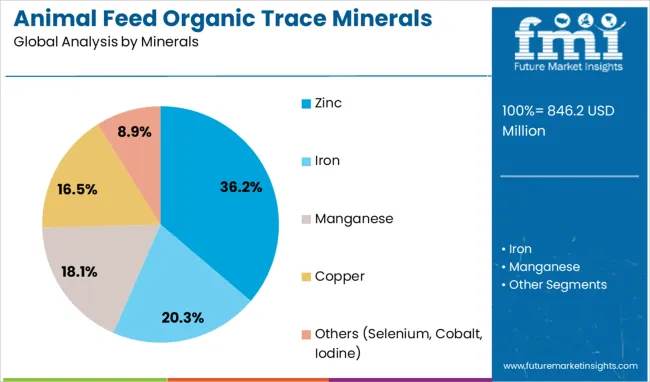

Additionally, stricter regulations on feed quality and safety have pushed the industry towards more natural and bioavailable mineral sources. The market is expected to continue growing as feed formulation innovations and consumer preference for high-quality animal products gain momentum. Segmental growth is projected to be led by zinc as the predominant mineral and poultry as the primary livestock category benefiting from these advancements.

The animal feed organic trace minerals market is segmented by minerals, livestock and geographic regions. By minerals of the animal feed, the organic trace minerals market is divided into Zinc, Iron, Manganese, Copper, and Others (Selenium, Cobalt, Iodine). In terms of livestock, the organic trace minerals market for animal feed is classified into Poultry, Dairy, Beef, Pork, and Others. Regionally, the animal feed organic trace minerals industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zinc segment is projected to account for 36.2% of the animal feed organic trace minerals market revenue in 2025, maintaining its leading position among mineral types. This segment’s growth is attributed to zinc’s critical role in supporting enzymatic functions, immune response, and growth performance in livestock. Zinc deficiency can impair animal health and productivity, prompting widespread inclusion in feed formulations.

Organic forms of zinc are favored for their higher bioavailability and reduced environmental excretion, aligning with sustainable farming practices. Increasing research validation of organic zinc benefits has encouraged adoption among feed manufacturers and livestock producers.

As animal nutrition strategies evolve to improve health and reduce antibiotic reliance, the zinc segment is expected to sustain its market dominance.

The poultry segment is projected to hold 41.8% of the animal feed organic trace minerals market revenue in 2025, leading the livestock categories. Growth in this segment has been supported by the rapid expansion of global poultry production driven by increasing consumer demand for affordable protein sources. Poultry nutrition has become a focal point for improving feed conversion ratios and disease resistance.

Organic trace minerals have been integrated into poultry feed to enhance skeletal development, feather quality, and overall bird health. Producers have prioritized mineral supplementation to meet the rigorous demands of intensive poultry farming and comply with regulatory standards.

The segment’s expansion is further influenced by increased awareness among poultry farmers about the benefits of organic minerals in boosting flock productivity. The poultry segment is anticipated to remain a key growth driver in the animal feed organic trace minerals market.

The market for organic trace minerals in animal feed is expanding steadily, driven by rising demand for nutrient-dense livestock nutrition in poultry, swine, ruminant, and aquaculture segments. Chelated minerals like zinc, selenium, copper, and iron deliver superior absorption and reduced excretion. Growth is supported by regulatory limits on antibiotic use and waste discharge, while manufacturers focus on chelate technologies and feeder-friendly formulations to meet evolving feed formulation practices globally.

Launching organic trace minerals across different regions is challenging due to varied regulatory frameworks. Authorities such as the FDA in the United States and EFSA in Europe have strict approval systems that require detailed safety, efficacy, and purity data. In Asia, Latin America, and the Middle East, the guidelines are often inconsistent or under development. This leads to delays in registration and additional testing costs for each target country. Manufacturers must prepare multiple versions of technical dossiers depending on the application type and species. In some regions, products must be reformulated or relabeled to meet local standards, even if the base formulation is the same. These fragmented regulations create a need for region-specific strategies and localized compliance support. For smaller producers, the cost and complexity of navigating these differences can prevent market entry and limit geographic expansion.

In developing regions, many livestock producers are unfamiliar with the benefits of organic trace minerals. Traditional use of inorganic salts continues due to habit, lower cost, and limited access to updated nutrition information. However, through training programs, field demonstrations, and partnerships with veterinary networks, suppliers are beginning to close this gap. When properly applied, organic trace minerals lead to better weight gain, stronger bone development, and reduced illness in poultry, swine, and cattle. Educational outreach allows producers to observe performance improvements directly in their herds and flocks. Feed companies that combine technical support with accessible product formats are gaining ground among small and mid-size farms. As awareness increases, so does demand for efficient mineral delivery options. This presents a strong opportunity for suppliers who can provide both the nutritional benefit and practical guidance needed to support long-term usage in these markets.

Organic trace minerals typically carry a price premium over inorganic alternatives, making them harder to adopt in cost-sensitive operations. In many cases, chelated forms are two to four times more expensive per unit. While their performance is better, the return on investment is not always clear without long-term trials or specific health improvements. For poultry and swine producers operating on tight margins, this cost difference can outweigh the potential benefits. Supply chain constraints also affect pricing. The availability of certain chelating agents or specialty ingredients can fluctuate, leading to price volatility or supply delays. Smaller feed mills often struggle to secure consistent access or competitive pricing due to lower purchase volumes. These issues make it difficult to justify widespread adoption, especially in regions where feed costs are a major limiting factor. Without pricing support or bundled solutions, expansion into price-sensitive markets remains limited.

The market is steadily shifting toward chelated mineral forms that provide better absorption and retention in animals. Products like amino acid chelates and proteinates are less likely to interact with other feed components, which enhances their uptake in the digestive tract. These forms also support lower inclusion rates while maintaining performance, reducing waste and improving nutrient density. Producers are adopting chelated minerals in poultry and swine diets to help meet production goals without relying on high inclusion of raw materials. New delivery options such as granules, coated powders, and premix blends make incorporation easier for feed mills. Digital formulation tools also allow for better dose accuracy and performance tracking. These advantages are driving wider adoption in operations that focus on efficient feed conversion and consistent results, especially where feed costs make up a large share of production expenses.

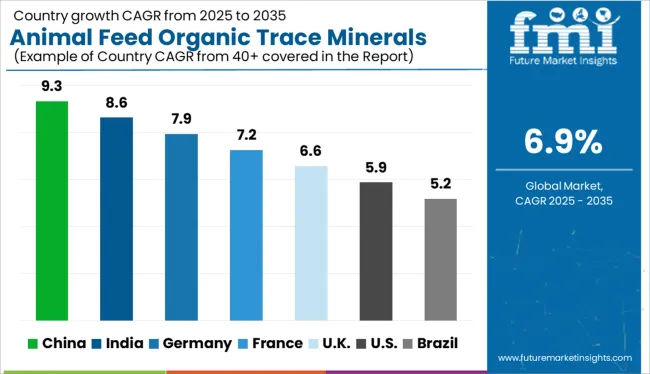

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

The global animal feed organic trace minerals market is projected to grow at a CAGR of 6.9% through 2035, supported by their continued use in livestock nutrition, poultry health, and aquaculture. Among BRICS nations, China leads with 9.3% growth, driven by intensified animal farming and increased production of mineral-enriched premixes. India follows at 8.6%, where compound feed manufacturers have expanded usage across poultry, dairy, and swine segments. In the OECD region, Germany reports 7.9% growth, backed by adherence to mineral content regulations and controlled feed formulations. France, growing at 7.2%, has shown consistent demand from commercial livestock producers and dairy cooperatives. The United Kingdom, at 6.6%, reflects steady application in performance-focused animal nutrition. Market activity has been shaped by inclusion rate limits, certification of mineral chelates, and regional feed composition directives. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Expansion of livestock nutrition programs and fortified feed manufacturing has enabled the animal feed organic trace minerals market in China to register a CAGR of 9.3%. Complexed mineral formulations have been incorporated into poultry and swine feed to support metabolic activity and growth rates. Large-scale feed mills have adopted chelated zinc, copper, and manganese to improve feed efficiency and bioavailability. Demand has been boosted through broader use of trace minerals in aquafeed formulations across inland fisheries. Blending units have increased output of mineral premixes suitable for intensive breeding farms. Organic selenium and chromium compounds have been supplied to enhance reproductive performance in dairy cattle. Regional livestock hubs have sourced tailored mineral complexes optimized for species-specific absorption. Regulatory inspections have emphasized inclusion of organic forms for reduced environmental impact.

Increased focus on improving animal health and productivity has helped the animal feed organic trace minerals market in India sustain a CAGR of 8.6%. Dairy cooperatives and poultry integrators have sourced mineral chelates to improve digestibility and reduce excretion rates. Regional manufacturers have incorporated organic zinc and manganese in feed blocks for ruminants. Farm management services have recommended selenium-enriched supplements to maintain immunity and fertility. Formulation plants have scaled up capacity for multi-mineral blends suited to monogastric species. Feed trials have confirmed improved weight gain and feed conversion ratios with inclusion of organic trace elements. Growth has been supported through adoption of mineral-enriched premixes in backyard poultry programs. Veterinary advisors have endorsed use of organic chromium for stress reduction during transport and heat periods.

Germany has maintained a 7.9% CAGR in the animal feed organic trace minerals market through widespread adoption in premium feed categories. Organic forms of copper and zinc have been applied in cattle and pig diets to comply with feed additive regulations. Compound feed producers have integrated chelates to reduce antagonism and support gut health. Trace mineral absorption has been enhanced through the use of glycinates and proteinates in specialty blends. Feed formulation software has enabled precision dosing of organic minerals tailored to lifecycle stages. Research trials have confirmed bioefficacy advantages over inorganic forms. Supply partnerships have been established with European trace mineral suppliers for consistent product quality. Inclusion of organic minerals has also been emphasized in antibiotic-free feed programs aimed at livestock welfare improvements.

Feed manufacturers in France have promoted the adoption of organic trace minerals, supporting a market CAGR of 7.2%. Chelated iron and copper have been formulated into piglet and broiler feed for better uptake and resilience. Dairy nutrition programs have included selenium yeast and zinc methionine to improve lactation and fertility outcomes. Use of organic mineral sources has been favored due to tighter residue limits and environmental concerns. Compounders have collaborated with veterinary consultants to develop targeted supplementation plans across intensive and extensive production models. Specialized blends have been introduced for high-performance breeds in beef and poultry sectors. Feed ingredient imports have been diversified to ensure uninterrupted mineral availability. Inclusion strategies have shifted toward protected and highly bioavailable formats to support immune modulation and growth.

In the United Kingdom, growth in sustainable livestock feed practices has allowed the animal feed organic trace minerals market to post a 6.6% CAGR. Feed compounders have introduced chelated formulations for beef, sheep, and layer birds to enhance nutrient absorption and reduce output variability. Organic trace minerals such as chromium picolinate and copper lysinate have been added to minimize oxidative stress in farm animals. Retail chains promoting higher-welfare meat products have encouraged feed upgrades using premium mineral sources. Local producers have focused on small-batch premixes to serve diversified livestock systems. Coordination with nutritionists has been emphasized for life-stage-based mineral planning. Product adoption has extended into free-range and pasture-based operations seeking higher bioefficacy. Formulation shifts have favored low-excretion minerals to align with local compliance norms.

The animal feed organic trace minerals market is led by a group of established suppliers offering chelated and proteinated mineral formulations designed to improve animal health, nutrient absorption, and feed efficiency across livestock, poultry, and aquaculture sectors.

Zinpro Corporation holds a leading position due to its strong focus on performance trace minerals, particularly its patented amino acid complexes that are widely used for enhancing animal productivity and immunity. Archer Daniels Midland Company (ADM) and Cargill are dominant players with vertically integrated operations, supplying customized mineral blends supported by robust distribution and nutritional research capabilities.

Alltech, Inc. has built a strong reputation for organic mineral supplements based on yeast-derived chelates, targeting improved gut health and reproductive performance in farm animals. Phibro Animal Health Corporation and Novus International, Inc. contribute significantly to the market by offering a wide portfolio of trace elements including zinc, manganese, copper, and selenium in bioavailable forms, catering to varying feed formulations and species-specific requirements.

Mercer Milling Company, Inc. and Ridley, Inc. serve as reliable suppliers in North America, producing tailored premixes and micro-ingredients for regional feed manufacturers. Davidsons Animal Feeds focuses on mineral-enriched formulations for cattle and ruminant nutrition, playing a key role in localized supply chains.

With increasing emphasis on feed efficiency and animal welfare, these companies continue to innovate in chelation technologies and species-targeted formulations, ensuring optimal trace mineral delivery in both intensive and pasture-based farming systems.

On April 6, 2025, Alltech officially launched Bioplex® Aqua Boost, a chelated mineral blend formulated for fish and shrimp. The supplement enhances bioavailability and solubility, tailored for aquaculture nutrition in modern aquatic systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 846.2 Million |

| Minerals | Zinc, Iron, Manganese, Copper, and Others (Selenium, Cobalt, Iodine) |

| Livestock | Poultry, Dairy, Beef, Pork, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zinpro Corporation, Mercer Milling Company, Inc., Archer Daniels Midland Company, Alltech, Inc, Ridley, Inc., Phibro Animal Health Corporation, Novus International, Inc., Davidsons Animal Feeds, and Cargill |

| Additional Attributes | Dollar sales by organic trace mineral type including zinc, copper, iron, selenium, manganese, and chromium, by application in poultry, swine, ruminants, aquaculture, and companion animals, and by region; demand driven by livestock productivity, gut health, and sustainability goals; innovation in chelated forms and precision blends; costs influenced by raw mineral sourcing and regulations; emerging uses in antibiotic-free and traceable feed. |

The global animal feed organic trace minerals market is estimated to be valued at USD 846.2 million in 2025.

The market size for the animal feed organic trace minerals market is projected to reach USD 1,649.1 million by 2035.

The animal feed organic trace minerals market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in animal feed organic trace minerals market are zinc, iron, manganese, copper and others (selenium, cobalt, iodine).

In terms of livestock, poultry segment to command 41.8% share in the animal feed organic trace minerals market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Growth Promoter Market - Size, Share, and Forecast Outlook 2025 to 2035

Animal Digest Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA