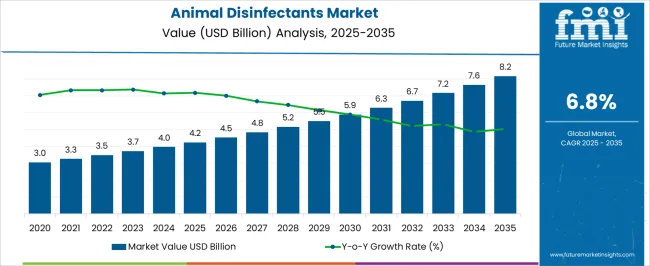

The animal disinfectants market is valued at USD 4.2 billion in 2025 and is projected to reach USD 8.2 billion by 2035, growing at a CAGR of 6.8%. The market exhibits steady growth momentum, characterized by a consistent increase in demand, driven by growing awareness of animal hygiene and disease prevention. From 2021 to 2025, the market is projected to grow from USD 3.0 billion to USD 4.2 billion, with intermediate values of USD 3.3 billion, USD 3.5 billion, USD 3.7 billion, and USD 4.0 billion. This early phase exhibits moderate growth momentum, primarily driven by the increasing focus on biosecurity measures within the agriculture, livestock, and pet care industries.

The need for disinfectants in disease prevention and veterinary healthcare solutions accelerates as animal health standards become more stringent. Between 2026 and 2030, the market is expected to accelerate, growing from USD 4.2 billion to USD 6.3 billion, with intermediate values of USD 4.5 billion, USD 4.8 billion, and USD 5.2 billion. This period is marked by stronger growth momentum, as demand for disinfectants in livestock, poultry farming, and companion animal care continues to rise. Product innovations and a growing awareness of the importance of disinfectant efficacy in preventing zoonotic diseases further fuel this phase. From 2031 to 2035, the market is expected to continue expanding from USD 6.7 billion to USD 8.2 billion, maintaining steady growth.

The animal disinfectants market is driven by five key parent markets that collectively shape its growth, demand, and applications across the agricultural, veterinary, and food safety sectors. The agriculture and livestock market contributes the largest share, about 30-35%, as disinfectants are essential for maintaining animal health and hygiene on farms, preventing the spread of diseases, and ensuring the safety of animal products for consumption.

The veterinary care and pet health market adds approximately 20-24%, with disinfectants being used in animal clinics, hospitals, and pet care facilities to control infections and maintain sanitary conditions for both domestic pets and livestock. The food safety and processing market contributes around 15-18%, as disinfectants are crucial for cleaning and sanitizing animal products, ensuring compliance with health regulations and preventing the transmission of zoonotic diseases.

The environmental and public health market accounts for roughly 12-15%, as disinfectants are used in controlling pathogens in public spaces, transport vehicles, and animal handling areas, promoting sanitation and public health safety. Finally, the pharmaceuticals and biotechnology market represents about 8-10%, where disinfectants are employed in laboratory and research settings to sterilize surfaces, equipment, and animal enclosures, ensuring contamination-free environments for studies and product development.

| Metric | Value |

|---|---|

| Animal Disinfectants Market Estimated Value in (2025 E) | USD 4.2 billion |

| Animal Disinfectants Market Forecast Value in (2035 F) | USD 8.2 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

The animal disinfectants market is experiencing steady expansion, fueled by rising concerns over livestock health, biosecurity, and prevention of disease outbreaks in commercial farming operations. Reports from veterinary health organizations and agricultural agencies have emphasized the critical role of effective disinfection protocols in mitigating the spread of pathogens that impact animal productivity and food safety.

Regulatory bodies have increasingly mandated stringent hygiene standards in animal housing, transport, and processing facilities, driving demand for high-performance disinfectants. Advances in formulation technologies have led to the development of products with broader antimicrobial spectra, improved stability, and lower environmental impact.

Additionally, the intensification of animal farming and expansion of global meat and dairy supply chains have heightened the importance of preventive hygiene measures. Market growth is further supported by heightened awareness among livestock owners and producers regarding the economic benefits of maintaining healthy herds. Growth is expected to be anchored by specialized disinfectant types, high-demand liquid formulations, and dominant usage in livestock farms, reflecting their pivotal role in disease control strategies.

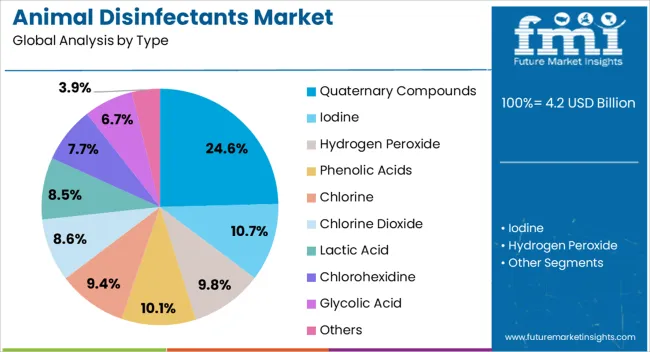

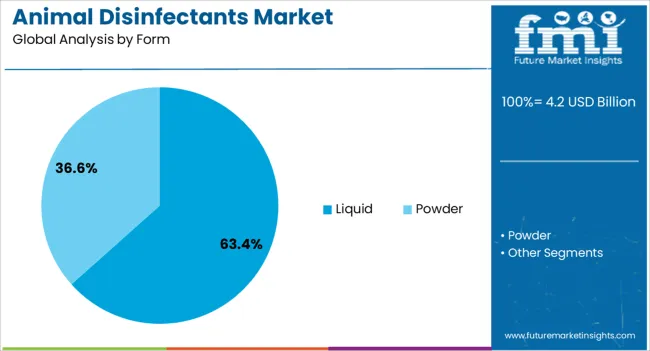

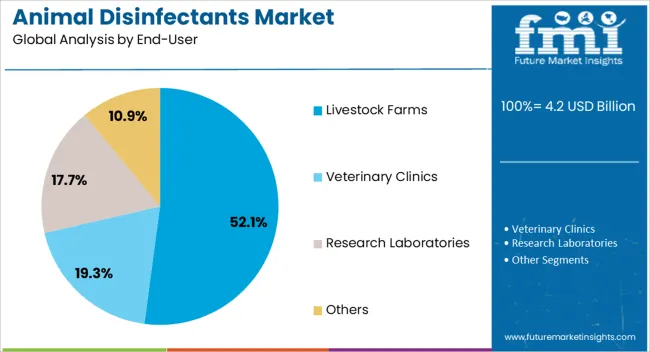

The animal disinfectants market is segmented by type, form, end-user, and geographic regions. By type, animal disinfectants market is divided into Quaternary Compounds, Iodine, Hydrogen Peroxide, Phenolic Acids, Chlorine, Chlorine Dioxide, Lactic Acid, Chlorohexidine, Glycolic Acid, and Others. In terms of form, animal disinfectants market is classified into Liquid and Powder. Based on end-user, animal disinfectants market is segmented into Livestock Farms, Veterinary Clinics, Research Laboratories, and Others. Regionally, the animal disinfectants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The quaternary compounds segment is projected to hold 24.6% of the animal disinfectants market revenue in 2025, maintaining a strong position in the product mix due to its proven broad-spectrum antimicrobial activity. These compounds have been favored for their efficacy against bacteria, viruses, and fungi, making them suitable for diverse farm hygiene applications.

Agricultural extension programs and veterinary guidelines have consistently recommended quaternary-based disinfectants for routine cleaning of animal housing and equipment because of their residual action and surface compatibility.

Furthermore, their low corrosiveness and ability to perform well in hard water conditions have enhanced their appeal among producers. Product innovations have also focused on combining quaternary compounds with other active agents to improve performance against resistant pathogens. As livestock farms continue to prioritize comprehensive biosecurity programs, quaternary compounds are expected to remain a key disinfectant type within the market.

The liquid segment is projected to contribute 63.4% of the animal disinfectants market revenue in 2025, solidifying its status as the leading form. Liquids have been preferred for their ease of application, ability to provide uniform coverage, and suitability for both manual and automated disinfection systems.

They can be effectively deployed via spraying, fogging, or washing, ensuring contact with contaminated surfaces and equipment. Veterinary health authorities have highlighted the importance of rapid and thorough application during disease outbreaks, a requirement that liquid formulations readily meet.

Moreover, liquid disinfectants often allow for easier dilution and mixing, enabling flexibility in concentration depending on the biosecurity needs. The availability of concentrated forms that reduce storage space and transportation costs has further supported adoption. As farms seek efficient, scalable solutions for routine and emergency sanitation, the liquid segment is expected to retain its dominant position.

The livestock farms segment is projected to account for 52.1% of the animal disinfectants market revenue in 2025, underscoring its role as the primary end-user category. Large-scale farming operations, particularly in poultry, swine, and dairy sectors, have stringent hygiene requirements to prevent disease outbreaks that can cause significant economic losses.

Agricultural health regulations and livestock industry standards have mandated regular disinfection schedules, reinforcing demand in this segment. Livestock farms have increasingly adopted structured biosecurity protocols that integrate disinfection of housing, feeding areas, water systems, and transport vehicles.

The intensification of animal production, coupled with higher stocking densities, has amplified the necessity for robust sanitation measures. Investments in modern farm infrastructure have also included upgrades to disinfection systems, ensuring consistent application and compliance with safety guidelines. With the continued globalization of meat and dairy supply chains, livestock farms are expected to remain the central driver of disinfectant usage in the animal health sector.

The animal disinfectants market is growing due to rising demand in the livestock and poultry industries, driven by the need for enhanced biosecurity and disease control. Regulatory compliance and safety standards pose challenges, as manufacturers must develop products that are both effective and safe. Opportunities are emerging in the development of natural, eco-friendly disinfectants, as well as innovations in biosecurity measures and disease control technologies. Trends toward product customization, improved formulations, and digital monitoring systems are reshaping the market, with manufacturers focusing on providing tailored, effective, and sustainable solutions for animal care and disease prevention.

The animal disinfectants market is experiencing significant growth, particularly driven by the rising demand for biosecurity in the livestock and poultry industries. Diseases such as avian influenza, foot-and-mouth disease, and porcine epidemic diarrhea have heightened the need for effective disinfection solutions. These industries rely heavily on disinfectants to control pathogen spread, reduce the risk of outbreaks, and maintain the health and productivity of animals. The global focus on improving animal husbandry practices and ensuring the safety of animal products has led to an increased need for disinfectants that are effective, safe, and capable of being used in various applications, from animal pens to transportation equipment.

Despite the market’s growth, challenges persist related to regulatory compliance and the safety standards governing animal disinfectants. Manufacturers must comply with strict regulations set by agencies such as the EPA and EFSA, ensuring that their products are not only effective but also safe for both animals and humans. These regulations also focus on reducing the environmental impact of disinfectants and promoting the use of non-toxic ingredients. Ensuring that products meet these standards, while maintaining affordability and efficacy, can be a challenge for manufacturers. As a result, companies are investing in R&D to develop disinfectants that meet both regulatory requirements and customer expectations.

Growing demand for natural and eco-friendly animal disinfectants as consumers and industries seek alternatives to traditional chemical-based products. Disinfectants made from natural ingredients such as essential oils, plant-based compounds, and biodegradable agents are gaining popularity due to their lower toxicity and environmental impact. These products are especially attractive to organic farming operations and pet care markets, where natural solutions are preferred. Manufacturers are focusing on creating more sustainable and non-toxic disinfectant options that offer similar or superior performance to chemical-based products, opening new avenues for growth in the market.

The animal disinfectants market is seeing trends related to increased biosecurity measures and the adoption of advanced technologies in disease control. With the growing risk of zoonotic diseases and foodborne pathogens, industries are adopting more stringent biosecurity protocols to prevent disease outbreaks. This includes the use of disinfectants in various stages of animal farming and transportation. Additionally, innovations in disinfectant formulations are focusing on improving contact time, efficacy against a broader spectrum of pathogens, and residue-free formulations. The integration of smart technologies, such as automatic disinfectant dispensers and digital monitoring systems, is enhancing the efficiency and effectiveness of biosecurity protocols.

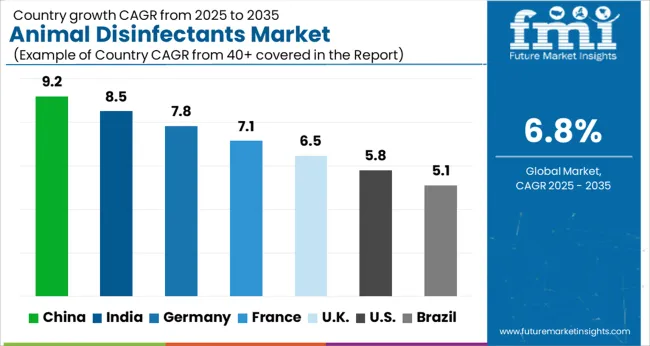

| Country | CAGR |

|---|---|

| China | 9.2% |

| India | 8.5% |

| Germany | 7.8% |

| France | 7.1% |

| UK | 6.5% |

| USA | 5.8% |

| Brazil | 5.1% |

The global animal disinfectants market is projected to grow at a CAGR of 6.8% from 2025 to 2035. China leads the market with a growth rate of 9.2%, followed by India at 8.5%, and Germany at 7.8%. The UK and USA show moderate growth at 6.5% and 5.8%, respectively. The market's growth is driven by the increasing concerns over animal health and disease prevention in livestock and poultry sectors. Government regulations, growing awareness of biosecurity measures, and the expansion of modern farming practices are key factors shaping demand for disinfectants. Regional trends highlight the need for effective disease management and sanitation solutions, as well as a shift towards environmentally friendly disinfectant alternatives. The analysis covers over 40 countries, with the leading markets shown below.

The animal disinfectants market in China is projected to grow at a CAGR of 9.2% from 2025 to 2035. The country’s expanding livestock and poultry industries, coupled with increasing awareness about animal health, are significant factors driving demand. With the rise in large-scale farming operations and animal breeding, the need for effective disinfectants to prevent disease outbreaks is growing. Government regulations and initiatives aimed at improving animal health standards, along with China's focus on modernizing its agriculture sector, further support market expansion. The growing focus on animal welfare and biosecurity practices also boosts the adoption of animal disinfectants in various farming operations, especially in poultry, swine, and dairy farms.

The animal disinfectants market in India is expected to grow at a CAGR of 8.5% from 2025 to 2035. As the country’s agricultural sector continues to expand, there is an increasing focus on animal health, particularly in the livestock and poultry sectors. Disease prevention in animals is a growing concern in India, driving the demand for effective disinfectants to maintain hygiene standards. Moreover, with the rise of modern farming practices and a shift toward intensive farming systems, the need for reliable and efficient disinfectants is higher than ever. The government’s focus on improving biosecurity measures and animal disease control also plays a crucial role in driving market growth.

The animal disinfectants market in Germany is projected to grow at a CAGR of 7.8% from 2025 to 2035. The country’s strong focus on animal welfare and biosecurity regulations is driving demand for high-quality disinfectants, especially in the poultry, swine, and dairy farming sectors. As Germany remains a major player in European agriculture, the need for effective disease management and sanitation solutions is critical. The country’s strict regulatory framework for animal health standards and increased public awareness about disease outbreaks further enhance the adoption of disinfectants. The growing focus on organic farming and sustainable livestock production also supports market growth, as farmers seek environmentally friendly disinfectant alternatives.

The UK animal disinfectants market is expected to grow at a CAGR of 6.5% from 2025 to 2035. The demand for animal disinfectants is primarily driven by the growing concerns over animal diseases and the country’s strong agricultural sector. The UK’s regulations on animal health and hygiene standards ensure that disinfectant use remains critical for maintaining disease-free farms. As livestock and poultry farming practices become more intensive, the demand for efficient and safe disinfectants continues to rise. Additionally, increasing consumer awareness about food safety and the link between animal health and product quality is further influencing the demand for disinfectants in animal farming.

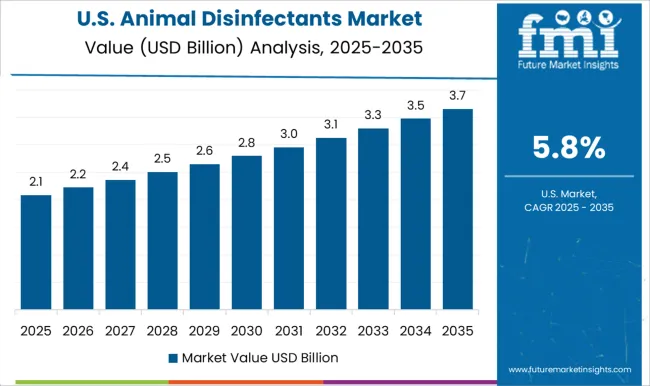

The USA animal disinfectants market is projected to grow at a CAGR of 5.8% from 2025 to 2035. The need for animal disinfectants in the USA is driven by the large-scale livestock and poultry industries, where disease outbreaks pose significant risks to productivity and public health. The demand for disinfectants is growing due to heightened awareness of animal health and biosecurity measures. Additionally, the USA government’s regulatory frameworks focused on disease prevention and livestock health further contribute to market growth. With ongoing innovations in disinfectant formulations and a strong shift toward more sustainable and environmentally friendly products, the USA market is witnessing increased adoption of advanced disinfectant solutions.

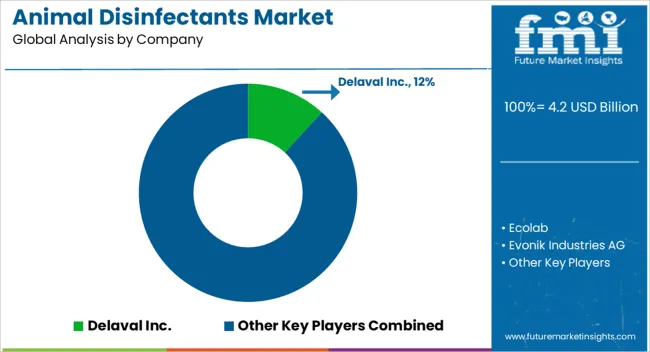

Competition in the animal disinfectants market is driven by product effectiveness, safety, and the ability to address specific needs in animal health and farm management. Delaval Inc. leads the market with its comprehensive range of animal disinfectants designed to ensure farm hygiene and animal welfare. Their product brochures highlight their focus on environmentally friendly, highly effective solutions that support disease prevention and biosecurity in dairy and livestock operations. Ecolab competes with a strong portfolio of disinfectants aimed at preventing infections and promoting animal health.

Their brochures emphasize the efficiency, safety, and compliance with global industry standards, targeting large-scale farms and food production facilities. Evonik Industries AG offers innovative disinfectants with an emphasis on sustainability and high efficacy in reducing bacterial and viral infections in animal environments. Their product brochures highlight solutions that enhance biosecurity while minimizing environmental impact, making them attractive to modern farms focusing on eco-friendly practices. Fink Tech GmbH provides specialized animal disinfectants that focus on both sanitization and the preservation of animal health. Their brochures promote the application of their products in both industrial and veterinary environments, highlighting their comprehensive approach to pathogen control and odor elimination.

GEA Group competes by offering disinfectants integrated into its broader farm equipment portfolio, emphasizing solutions that support hygiene management in both dairy and poultry farming. Their product brochures stress ease of application and long-lasting protection against harmful pathogens. Kemin Industries, Inc. focuses on microbial control, offering animal disinfectants that also improve the overall health of livestock. Their brochures highlight the dual benefits of infection control and performance enhancement in the context of animal nutrition and welfare. Kersia Group, Lanxess, and Neogen Corporation provide a wide range of disinfectants designed to prevent disease outbreaks and support animal welfare. Their product brochures emphasize the broad-spectrum efficacy of their solutions in controlling pathogens in animal housing, while also ensuring safety for both animals and farm workers. Solvay Group and Virbac offer specialized disinfectants targeted at veterinary and livestock applications, focusing on high-performance solutions with quick action and lasting effects. Zoetis rounds out the market with a focus on animal health through its disinfectant offerings, targeting biosecurity on farms and in veterinary clinics. Their brochures highlight their holistic approach to animal health management, positioning them as a leader in disease prevention across livestock operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.2 Billion |

| Type | Quaternary Compounds, Iodine, Hydrogen Peroxide, Phenolic Acids, Chlorine, Chlorine Dioxide, Lactic Acid, Chlorohexidine, Glycolic Acid, and Others |

| Form | Liquid and Powder |

| End-User | Livestock Farms, Veterinary Clinics, Research Laboratories, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Delaval Inc., Ecolab, Evonik Industries AG, Fink Tech GmbH, GEA Group, Kemin Industries, Inc, Kersia Group, Lanxess, Neogen Corporation, Solvay Group, Virbac, and Zoetis |

| Additional Attributes | Dollar sales by product type (liquid disinfectants, powders, sprays), application (livestock, poultry, veterinary care, pet hygiene), and active ingredients (chlorine-based, iodine-based, quaternary ammonium compounds). Demand in this market is driven by the increasing focus on animal biosecurity, disease prevention, and hygiene in farming and veterinary care. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, with rising awareness of animal welfare, regulatory requirements, and the need for sustainable farming practices. Increasing concerns about zoonotic diseases and the overall health of farm animals are also fueling the demand for animal disinfectants. |

The global animal disinfectants market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the animal disinfectants market is projected to reach USD 8.2 billion by 2035.

The animal disinfectants market is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in animal disinfectants market are quaternary compounds, iodine, hydrogen peroxide, phenolic acids, chlorine, chlorine dioxide, lactic acid, chlorohexidine, glycolic acid and others.

In terms of form, liquid segment to command 63.4% share in the animal disinfectants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA