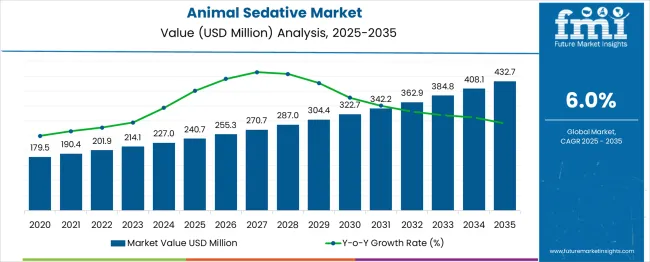

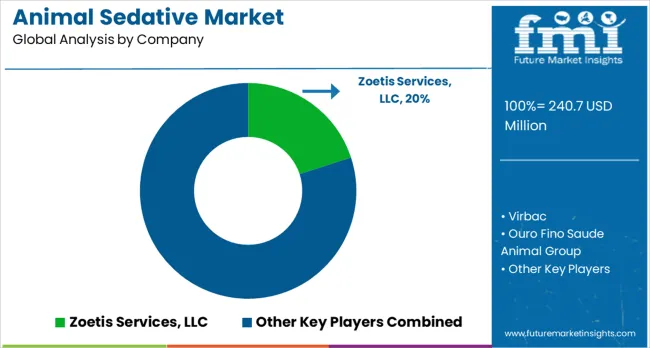

The animal sedative market is set to grow from USD 240.7 million in 2025 to USD 432.7 million in 2035, achieving a compound annual growth rate (CAGR) of 6%. Year-on-year growth exhibits noticeable spikes, correlated with industry drivers such as increased adoption of advanced veterinary sedation technologies, expansion of animal healthcare infrastructure, and evolving regulations promoting safe and humane treatment practices. For example, values rise from USD 240.7 million in 2025 to USD 270.7 million in 2028, and from USD 322.7 million in 2030 to USD 384.8 million in 2034, reflecting heightened veterinary procedure volumes and rising consumer demand for pet wellness products.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 240.7 million |

| Forecast Value in (2035F) | USD 432.7 million |

| Forecast CAGR (2025 to 2035) | 6% |

The animal sedative market, while expanding from USD 240.7 million in 2025 to USD 432.7 million in 2035 at a CAGR of 6%, experiences occasional year-on-year dips linked to supply, economic, and regulatory constraints. Early-decade growth shows modest slowdowns, such as between 2026 and 2027, when the market increases from USD 255.3 million to USD 270.7 million at a slightly lower pace compared to preceding years. These dips can be attributed to intermittent shortages of active pharmaceutical ingredients, delays in manufacturing capacity expansion, and tighter import-export regulations affecting raw material availability.

Mid-decade years, including 2030–2031, exhibit another subtle slowdown, with market value rising from USD 322.7 million to USD 342.2 million. This period coincides with economic uncertainties in key livestock and veterinary markets, temporarily reducing discretionary spending on elective procedures and pet wellness services. Regulatory changes, such as updates to sedative usage protocols and safety compliance mandates, can further constrain growth, requiring manufacturers to invest in approvals and compliance. Understanding these YoY dips allows stakeholders to strategically plan production, diversify suppliers, and manage inventory to mitigate disruptions. Overall, despite these temporary constraints, the market trajectory remains positive, with incremental growth strengthening in the latter half of the forecast period.

Market expansion is being supported by the increasing pet ownership globally and the corresponding demand for comprehensive veterinary care that includes appropriate sedation for procedural comfort and stress management. Modern pet owners and veterinary professionals are increasingly focused on ensuring animal welfare and minimizing stress during medical procedures, handling, and end-of-life care. Animal sedatives' proven ability to reduce anxiety, facilitate safe handling, and enable humane procedures makes them essential medications for compassionate veterinary medicine and responsible animal care.

The growing emphasis on animal welfare standards and humane treatment protocols is driving demand for sedatives that can provide effective anxiolysis and restraint while maintaining animal safety and comfort. Veterinary practice preference for medications that combine clinical efficacy with safety profiles and ease of administration is creating opportunities for innovative sedative formulations and delivery methods. The rising influence of veterinary specialty services and advanced medical procedures is also contributing to increased adoption of sedatives that can support complex interventions and specialized care requirements.

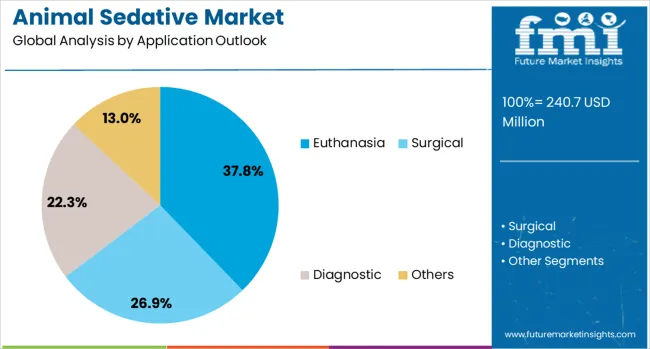

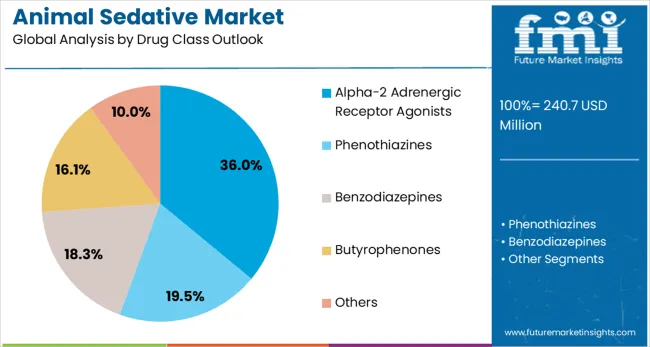

The market is segmented by application, animal type, route of administration, drug class, end use, and region. By application, the market is divided into euthanasia, surgical, diagnostic, and others. Based on animal type, the market is categorized into dogs, cats, horses, and others. In terms of route of administration, the market is segmented into parenteral and oral. By drug class, the market is classified into alpha-2 adrenergic receptor agonists, phenothiazines, benzodiazepines, butyrophenones, and others. By end use, the market is divided into veterinary hospitals & clinics, specialty centers, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The euthanasia segment is projected to account for 38% of the animal sedative market in 2025, reaffirming its position as the leading application category. Veterinary professionals increasingly utilize sedatives during euthanasia procedures to ensure a humane, stress-free experience for animals while providing comfort for pet owners. The ethical and welfare considerations inherent in euthanasia sedation address both clinical and emotional requirements in veterinary practice. This application forms the foundation of palliative and end-of-life veterinary care, representing the most sensitive and ethically significant use of sedatives. Continuous development of safe and effective sedation protocols reinforces professional confidence and adoption. As animal welfare standards rise globally, euthanasia sedation remains central to market growth and adoption.

Dogs are projected to represent 40% of animal sedative demand in 2025, reflecting their status as the primary patient population in veterinary practice. Sedatives are widely used in canine care for medical procedures, diagnostic imaging, and stress management, addressing diverse behavioral and clinical needs. The segment’s prominence is driven by the large domestic dog population and the frequency of veterinary interventions requiring sedation. The segment is reinforced by established veterinary infrastructure and breed-specific sedation protocols. Demand is further supported by veterinary practitioners’ need for flexible and effective sedatives that ensure safety and animal welfare across various clinical scenarios. Dogs continue to dominate the market while underpinning the broader adoption of veterinary sedation solutions.

The parenteral route of administration is forecasted to contribute 58% of animal sedative demand in 2025, reflecting the preference for injectable sedatives in veterinary practice. Injectable formulations offer rapid onset, predictable effects, and precise dosing, essential for safe and controlled sedation in clinical and procedural contexts. The segment benefits from professional expertise in parenteral drug administration and established veterinary protocols. With proven efficacy and reliability, parenteral administration remains the preferred method for procedural sedation, supporting clinical safety and operational efficiency.

Alpha-2 adrenergic receptor agonists are projected to account for 36% of the animal sedative market in 2025. This drug class is favored for its combined sedative and analgesic properties, along with reversibility via specific antagonists, making it suitable for a variety of clinical applications. The segment is supported by extensive clinical experience and a well-established safety profile across multiple animal species. Alpha-2 agonists remain critical in veterinary pharmacology, providing predictable sedation and enhanced procedural safety.

Veterinary hospitals and clinics are forecasted to contribute 48% of animal sedative demand in 2025, reflecting their central role in administering sedation and overseeing patient safety. These facilities integrate sedatives into routine and specialized care, ensuring professional supervision and compliance with controlled substance regulations. The segment is supported by established infrastructure, trained staff, and regulatory frameworks that mandate professional oversight. Veterinary hospitals and clinics remain the primary distribution point for sedatives, underpinning market growth and standardized care practices.

The animal sedative market is advancing steadily due to increasing pet ownership and growing emphasis on animal welfare, requiring appropriate stress management and procedural comfort in veterinary care. The market faces challenges, including regulatory restrictions on controlled substances, potential adverse effects requiring careful monitoring, and varying species-specific dosing requirements that complicate standardized protocols. Innovation in novel sedative formulations and precision dosing technologies continues to influence product development and market expansion patterns.

The growing emphasis on animal welfare standards and humane treatment protocols is enabling expanded use of sedatives for stress reduction, procedural comfort, and quality of life improvement in various veterinary care settings. Modern animal welfare approaches prioritize emotional well-being and stress minimization through appropriate pharmacological interventions. Veterinary professionals are increasingly recognizing the importance of sedation for maintaining animal welfare standards and providing compassionate care.

Modern veterinary anesthesia is incorporating multimodal approaches that combine different drug classes and delivery methods to optimize sedation efficacy while minimizing individual drug dosages and potential side effects. These approaches enhance patient safety while improving procedural outcomes through synergistic drug interactions and tailored sedation protocols. Advanced combination strategies also enable species-specific and procedure-specific sedation optimization for enhanced clinical results.

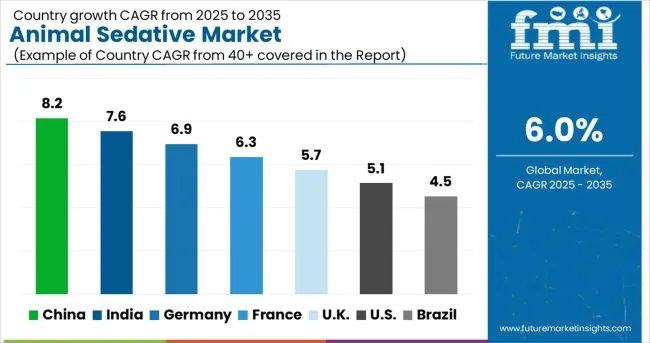

| Countries | CAGR (2025-2035) |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 6.9% |

| France | 6.3% |

| United Kingdom | 5.7% |

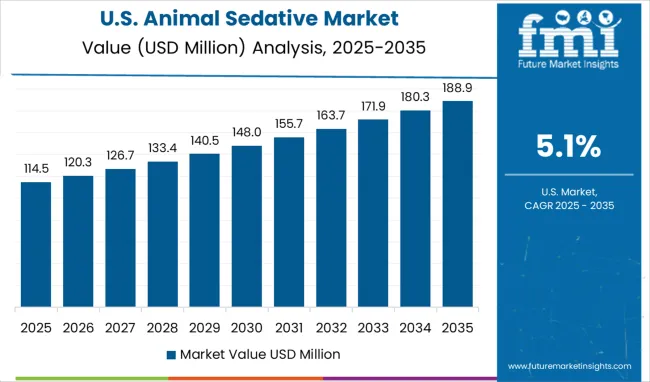

| United States | 5.1% |

| Brazil | 4.5% |

The animal sedative market is experiencing solid growth globally, with China leading at an 8.2% CAGR through 2035, driven by rapidly increasing pet ownership, growing companion animal healthcare expenditure, and expanding veterinary infrastructure supporting advanced medical care. India follows closely at 7.6%, supported by rising disposable income, increasing awareness about animal welfare, and expanding veterinary services. Germany shows strong growth at 6.9%, emphasizing animal welfare excellence and advanced veterinary pharmacology. France records 6.3%, focusing on veterinary medicine innovation and animal care standards. The UK shows 5.7% growth, prioritizing animal welfare legislation and veterinary care quality.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

The market for animal sedatives in China is expected to grow robustly with a CAGR of 8.2% through 2035, driven by the rising number of companion animals, increased awareness of animal health, and expanding expenditure on veterinary care. Growing pet ownership across urban and suburban regions, combined with evolving attitudes toward humane treatment and animal welfare, is creating significant demand for effective sedation solutions. Both international veterinary pharmaceutical companies and local manufacturers are establishing extensive distribution and support networks to cater to veterinary clinics, pet hospitals, and emerging animal care facilities. Expansion of veterinary training programs and adoption of advanced sedation protocols are supporting the integration of sedatives into routine veterinary procedures, ensuring procedural safety and improved animal wellbeing.

Animal sedatives in India are projected to grow at a CAGR of 7.6% through 2035, supported by increasing pet ownership, growing disposable income, and the expansion of veterinary healthcare infrastructure. Rising awareness about companion animal welfare, combined with modernization of veterinary services, is driving demand for clinically effective sedation solutions. International pharmaceutical firms and domestic veterinary networks are building comprehensive service capabilities to address the evolving needs of veterinary practices and animal caregivers. Integration of sedation protocols for routine procedures, diagnostic interventions, and surgical support is becoming more common, enhancing animal safety and procedural outcomes. Expansion of veterinary educational programs and animal welfare campaigns is further enabling adoption of sedatives across both urban centers and emerging markets.

The demand for animal sedatives in Germany is projected to grow at a CAGR of 6.9% through 2035, underpinned by strong veterinary infrastructure, high animal welfare standards, and focus on clinical excellence. German veterinary practitioners require sedatives that meet rigorous safety and efficacy requirements for diverse species, including companion animals and livestock. The market is characterized by adoption of next-generation sedatives that provide reliable procedural comfort while adhering to strict regulatory standards. Ongoing research in veterinary pharmacology and collaboration with academic institutions are promoting innovation in sedative formulations. Enhanced training programs for veterinary professionals further ensure appropriate dosing, safe administration, and improved animal wellbeing during clinical procedures.

Animal sedatives in France are anticipated to expand at a CAGR of 6.3% through 2035, supported by established veterinary networks, focus on pharmacological innovation, and prioritization of animal welfare in clinical practice. French veterinary professionals require sedatives that ensure reliable clinical outcomes while minimizing stress and procedural risks for animals. Ongoing investment in veterinary pharmacology research is promoting development of advanced sedatives tailored for a wide range of clinical procedures. Collaboration between veterinary associations, research institutions, and pharmaceutical manufacturers is accelerating innovation, facilitating access to high-quality sedation solutions. Integration of sedatives into standard veterinary care is enhancing treatment efficiency, animal comfort, and compliance with national and European animal welfare regulations.

Animal sedatives in the United Kingdom are projected to grow at a CAGR of 5.7% through 2035, driven by strict animal welfare legislation, increasing awareness of humane treatment, and growing veterinary care standards. Veterinary practitioners emphasize safe, effective, and ethically responsible sedation protocols across hospitals, clinics, and specialty care centers. Rising focus on stress management during medical procedures is increasing the adoption of sedatives for companion animals and livestock alike. Expansion of training programs and professional guidance ensures appropriate use and compliance with national standards. Pet owners and veterinary professionals are prioritizing animal comfort and procedural efficiency, supporting broader market penetration and consistent adoption of sedation solutions.

The animal sedative market in the United States is expected to grow at a CAGR of 5.1% through 2035, driven by leading veterinary healthcare infrastructure, growing companion animal population, and adoption of advanced veterinary pharmaceuticals. USA veterinary professionals are prioritizing sedatives that provide safe, effective, and humane outcomes for routine and surgical procedures. Extensive veterinary training programs, regulatory compliance, and professional certification standards are facilitating adoption of sedatives across clinics, hospitals, and specialty care facilities. Investment in research and development is promoting next-generation sedative formulations with improved safety profiles, efficacy, and versatility for diverse clinical applications. Market expansion is further supported by increasing consumer demand for high-quality veterinary care and animal welfare standards.

Animal sedatives in Brazil are anticipated to grow at a CAGR of 4.5% through 2035, driven by rising pet ownership, increasing animal welfare awareness, and expanding veterinary healthcare services. The growing companion animal market and increasing household spending on veterinary care are creating demand for effective sedation solutions. Both international and domestic pharmaceutical providers are expanding distribution networks and veterinary support services to meet the growing market needs. Training programs and professional development initiatives are equipping veterinary practitioners with expertise in safe sedative use, stress management, and procedural comfort. Adoption of sedatives is supporting broader objectives of humane treatment, clinical efficiency, and improved animal wellbeing across veterinary care settings.

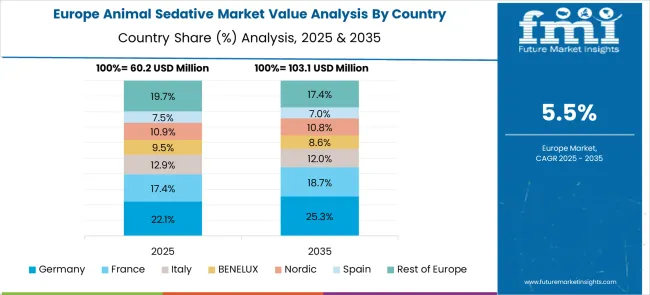

The animal sedative market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced veterinary healthcare system and emphasis on animal welfare standards, supported by veterinary professionals leveraging clinical expertise to implement appropriate sedation protocols that emphasize patient safety, procedural comfort, and ethical animal care across companion animal and livestock applications.

France represents a significant market driven by its veterinary medicine excellence and sophisticated understanding of animal pharmacology and welfare requirements, with veterinary practices focusing on comprehensive sedation approaches that combine French veterinary expertise with advanced pharmacological knowledge for enhanced animal comfort and procedural success in various clinical settings.

The UK exhibits considerable growth through its emphasis on animal welfare legislation and veterinary care standards, with strong adoption of animal sedatives across veterinary practices, animal hospitals, and specialty centers. Germany and France show expanding interest in novel sedative applications, particularly in stress management and quality of life improvement for geriatric and chronic care patients. BENELUX countries contribute through their focus on animal welfare and advanced veterinary care delivery. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing pet ownership and expanding veterinary infrastructure.

Companies are investing in product development, clinical research, regulatory compliance, and comprehensive veterinary education to deliver safe, effective, and clinically proven sedative solutions for animal healthcare. Innovation in novel drug formulations, precision dosing, and species-specific protocols is central to strengthening market position and veterinary adoption.

Zoetis Services LLC leads the market with significant market share, offering comprehensive veterinary pharmaceutical solutions, including sedatives, with a focus on companion animal and livestock health applications. Virbac provides established veterinary pharmaceuticals with emphasis on animal health and welfare across multiple species. Ouro Fino Saude Animal Group delivers specialized animal health products with a focus on Latin American markets. Dechra focuses on veterinary specialty pharmaceuticals, including sedative and anesthetic agents.

Merck & Co. Inc. provides comprehensive animal health solutions, including sedative medications for various species and applications. Bimeda Inc., Vetcare. Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, and Troy Laboratories Pty Ltd offer specialized veterinary pharmaceuticals and sedative products across various geographic markets with a focus on clinical efficacy, safety, and regulatory compliance for veterinary practice and animal welfare applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 240.7 million |

| Application | Euthanasia, Surgical, Diagnostic, Others |

| Animal Type | Dogs, Cats, Horses, Others |

| Route of Administration | Parenteral, Oral |

| Drug Class | Alpha-2 Adrenergic Receptor Agonists, Phenothiazines, Benzodiazepines, Butyrophenones, Others |

| End Use | Veterinary Hospitals & Clinics, Specialty Centers, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Zoetis Services LLC, Virbac, Ouro Fino Saude Animal Group, Dechra, Merck & Co. Inc., Bimeda Inc., Vetcare. Fi., Chanelle Pharma (Exponent), Randlab Australia Pty Ltd, and Troy Laboratories Pty Ltd |

| Additional Attributes | Dollar sales by application and animal type category, regional demand trends, competitive landscape, buyer preferences for parenteral versus oral administration, integration with veterinary care protocols, innovations in novel drug formulations, precision dosing technology, and species-specific protocol development |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global animal sedative market is estimated to be valued at USD 240.7 million in 2025.

The market size for the animal sedative market is projected to reach USD 432.7 million by 2035.

The animal sedative market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in animal sedative market are euthanasia, surgical, diagnostic and others.

In terms of animal outlook , dogs segment to command 40.0% share in the animal sedative market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticides Market Size and Share Forecast Outlook 2025 to 2035

Animal Feeds Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA