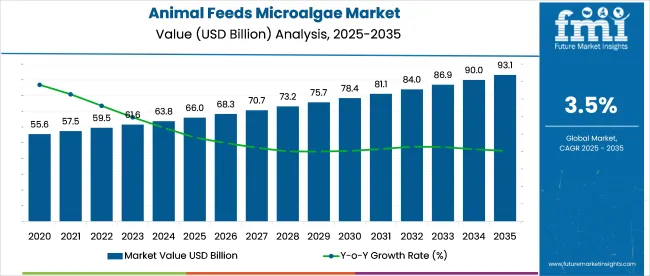

The Animal Feeds Microalgae Market is estimated to be valued at USD 66.0 billion in 2025 and is projected to reach USD 93.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.5% over the forecast period.

The animal feeds microalgae market is witnessing robust growth, driven by the increasing demand for sustainable and nutrient-dense feed additives in the livestock and aquaculture industries. Industry publications and company updates have reported rising adoption of microalgae due to their high protein content, omega-3 fatty acids, and immunostimulatory properties. Microalgae have gained recognition as an environmentally friendly alternative to conventional feed ingredients, supporting the global transition toward sustainable animal farming practices.

Technological advancements in large-scale microalgae cultivation, particularly in controlled marine water environments, have improved yield efficiency and lowered production costs. Regulatory approvals for microalgae-based feed formulations have further accelerated market entry across various regions.

Future market expansion is anticipated through continued investment in cultivation technology and the rising application of microalgae in specialty animal nutrition segments. Segmental leadership is expected from Spirulina as the dominant species, Marine Water as the primary cultivation source, and Aquaculture Feed as the largest end-use application due to its alignment with global fish farming growth trends.

The market is segmented by Species Type, Source, and End Use Applications and region. By Species Type, the market is divided into Spirulina, Chlorella, Dunaliella, Haematococcus, Crypthecodinium, Schizochytrium, Euglena, Nannochloropsis, Phaedactylum, and Others.

In terms of Source, the market is classified into Marine Water and Fresh Water. Based on End Use Applications, the market is segmented into Poultry Feed, Swine Feed, Cattle Feed, Aquaculture Feed, and Equine Feed. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Spirulina segment is projected to account for 33.70% of the animal feeds microalgae market revenue in 2025, securing its place as the leading species type. Growth of this segment has been driven by Spirulina’s rich nutritional profile, including high protein, essential amino acids, and antioxidants, which have been shown to support animal growth and immune health. Feed manufacturers have preferred Spirulina due to its ease of cultivation, well-established safety profile, and broad compatibility with various animal species.

Scientific studies and feeding trials have demonstrated Spirulina’s effectiveness in improving feed conversion ratios and reducing disease incidence in livestock and aquatic species. Additionally, sustainability-conscious producers have adopted Spirulina as a renewable feed source that requires less land and water compared to traditional feed crops.

As animal nutrition increasingly focuses on enhancing productivity while minimizing environmental impact, the Spirulina segment is expected to sustain its market leadership.

The Marine Water segment is projected to contribute 61.40% of the animal feeds microalgae market revenue in 2025, establishing itself as the dominant source type. Growth of this segment has been attributed to the abundance of marine environments suitable for large-scale algae cultivation and the species diversity that thrives in saline conditions. Cultivators have favored marine water systems for their ability to produce high biomass yields and optimize nutrient profiles specific to animal nutrition needs.

Industry initiatives and environmental policies have encouraged marine-based cultivation to preserve freshwater resources and leverage underutilized coastal areas for sustainable production.

Furthermore, marine water cultivation has demonstrated scalability advantages, supporting consistent supply chains for feed manufacturers. As the industry advances toward closed-loop and environmentally responsible aquaculture practices, the Marine Water segment is expected to remain the preferred cultivation source due to its ecological and economic benefits.

The Aquaculture Feed segment is projected to capture 45.20% of the animal feeds microalgae market revenue in 2025, maintaining its leadership in end-use applications. This growth has been fueled by the rapid expansion of global aquaculture operations and the industry’s shift toward sustainable feed ingredients. Microalgae have been recognized for their ability to replace fishmeal and fish oil, thereby reducing the environmental footprint of aquaculture feed formulations.

Feed manufacturers have incorporated microalgae into diets for shrimp, salmon, tilapia, and other farmed fish species to improve growth performance, pigmentation, and immune response. Regulatory agencies and industry alliances have supported the adoption of microalgae in aquaculture as part of sustainability certification programs.

As global seafood demand rises and sustainable fish farming practices are prioritized, the Aquaculture Feed segment is expected to sustain its dominant position in the market, driven by nutritional efficacy and supply chain resilience.

Demand for microalgae the animal feed sector is increasing due to the rising demand for natural additives in animal feed, the popularity of astaxanthin and the rising global livestock population.

The market grew at a CAGR of 2.3% between 2020 and 2024. Forecasts for growth remain optimistic, with the market predicted to register a CAGR of 3.5% between 2024 and 2035.

In recent years, animal husbandry and aquaculture has witnessed remarkable growth. Demand for protein-rich food is causing this change. The quality of meat and meat products depends on animal feed. Feed manufacturers prefer high-quality, naturally derived ingredients to fill the demand from farmers or commercial livestock producers.

The United States Food and Drug Administration approved the usage of astaxanthin in animal feed and fish feed as additives. Various government entities and regulatory authorities, including the FDA and the EU, support the production and distribution of astaxanthin for a variety of applications, including animal feed and aqua-feed supporting the use of microalgae in animal feed formulations.

Microalgae is used as a natural pigment and is sourced particularly from microalga haematococcus pluvialis. This microalga is widely used in aquaculture and poultry industries. Microalgae in aquaculture play an important role in enhancing the flesh coloration of farmed salmonids. In the poultry industry, it helps to boost yolk coloration in the egg.

Consumer awareness towards reducing carbohydrate-rich foods and increasing consumption of protein-rich foods increase the demand for aquaculture products. Therefore, salmonid production has risen strongly. The growing end-use industry drives the demand for key ingredients, thereby propelling market growth.

According to FMI, North America is one of the leading regions contributing to the global demand for microalgae in animal feeds sector. According to the study, the USA. is anticipated to account for over 92% of the North America market through 2035, holding a lion’s share of global demand.

Microalgae based astaxanthin is a good antioxidant used in food and beverages, animal feeds and more. The use of astaxanthin in feed and food items has been approved by the FDA which will positively affect growth. The use of astaxanthin increases cattle production capacity. As a result, microalgae are becoming increasingly popular in the animal feed industry in the USA.

According to the report, the demand for microalgae in the Germany animal feed sector is expected to be valued at USD 63.8 Million in the year 2024, holding a greater share in Europe.

Germany is showing high potential for sales of meat protein products. Moreover, farmers are concerned about quality and the impact of feed on animal health. This concern led them towards quality, premium feed ingredients. Therefore, manufacturers are engaging in research and developing quality ingredients at a lower cost.

By 2024 Brazil is expected to account for more than 52% of demand for microalgae in the animal feed sector within Latin America and is anticipated to grow at a CAGR of 3.3% through the forecast period.

Brazil holds a major share in the Latin America feed production sector. Animal husbandry is a key revenue stream for the Brazilian agriculture industry. Economic growth, industrialization in the livestock industry, and awareness of farmers towards healthy animal feed to improve meat quality drives year-round harvesting.

Microalgae is a good source of omega-3 fatty acids. Adding microalgae in animal feed helps to reduce harvesting time, fueling demand in Latin American countries.

China is expected to account for more than 53% of the Asia Pacific market in 2024, according to FMI’s analysis. The consumption of microalgae in swine and poultry feeds increases demand.

China is a key supplier of pork, also increasing commercial livestock demand for protein-rich foods. Modern technology influence livestock and aquaculture production and sound national and international sales channels support the Chinese commercial livestock industry.

The rising demand for livestock pushes the demand for protein-rich and cost-effective feeds, which is driving the demand for microalgae in the local animal feed industry.

India holds a value share of more than 12% of the Asia Pacific in 2024. India is also expected to display a lucrative growth rate of 3.9% CAGR over the forecast period. India is one of the major developing countries in the world.

Rising livestock, poultry, aquaculture, and swine sectors drive the demand for microalgae in the animal feed market. The emerging agriculture industry, urbanization, changing consumer lifestyles, and preference for meat consumption is fueling the Indian animal feed industry.

Spirulina accounted for more than 39% of the global market in 2024. Spirulina is easily digestible, and has a nutrient rich profile to enhance animal growth, fertility, and aesthetics. Haematococcus and chlorella account for more than 34% of the market value share in the global animal feed sector.

Freshwater sourced microalgae accounted for more than 80% of the global market in 2024. Emerging changes in the agricultural field aids the production and yield capacity of microalgae in freshwater.

Moreover, nutritional benefits will account for a larger market share. However, marine water microalgae contain higher levels of docosahexaenoic acid as compared with freshwater microalgae. Therefore, the marine sourced microalgae will rise at a CAGR of 4.9% through the forecast period.

Poultry feed accounts for a maximum share of nearly 37% of the global demand for microalgae in the animal feed sector. Microalgae are helping to enhance the growth and weight of birds, thereby driving up microalgae consumption.

The swine feed segment is anticipated to holding second place in the consumption of microalgae. Microalgae aids in improving meat quality and volume. The addition of microalgae to conventional feed helps to improve the animal health and meat quality. Therefore, the swine feed segment contributes more than 26% of global demand.

Manufacturers are focusing on strengthening their product portfolio to serve global demand. Increasing numbers of naturally derived feed additives are encouraging key players to invest in research and development for new products.

For instance,

| Attribute | Details |

|---|---|

| Forecast Period | 2024 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Thousand for Value |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Species Type, Source, End Use Applications |

| Key Companies Profiled | DIC Corporation; Cyanotech Corporation; Koninkliijke DSM NV; Roquette Frères; BASF SE; Fuji Chemical Industries Co., Ltd; Parry Nutraceuticals; BGG (Beijing Gingko Group); KDI Ingredients; Sinoway Industrial Co., ltd.; INNOBIO Corporation Limited; Yunnan Alphy Biotech Co., Ltd.; Algaecan Biotech Ltd.; Algatechnologies Ltd.; Cardax, Inc.; Igene Biotechnology, Inc.; Fenchem Biotek Ltd.; AstaReal Inc.; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The overall demand for microalgae in the animal feed sector is anticipated to surpass USD 57.54 million in 2021.

Demand for microalgae in the animal feed sector increased at a 2.3% CAGR between 2016 and 2020.

Market players are likely to focus on investing to improve ingredient quality for feed production along with rising demand for astaxanthin in the sector.

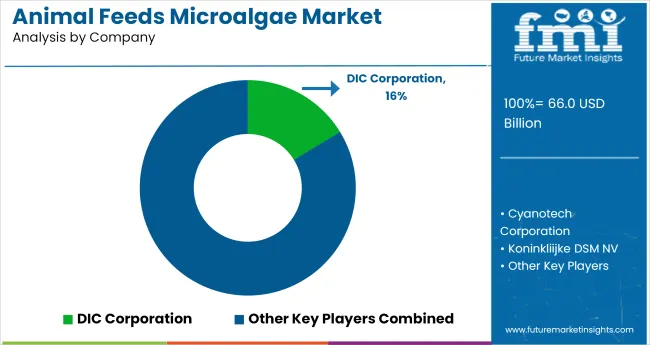

Leading microalgae producers in animal feed sector include DIC Corporation, Cyanotech Corporation, Koninkliijke DSM NV, Roquette Frères, BASF SE, Fuji Chemical Industries Co., Ltd, Parry Nutraceuticals, BGG (Beijing Gingko Group), KDI Ingredients, Sinoway Industrial Co., Ltd., INNOBIO Corporation Limited, Yunnan Alphy Biotech Co., Ltd, Algaecan Biotech Ltd., Algatechnologies Ltd., Cardax, Inc., Igene Biotechnology, Inc., Fenchem Biotek Ltd., AstaReal Inc., Valensa International, Kunming B

North America is dominating the global microalgae demand in the animal feed sector and will exhibit a value share of 36.1% in 2021. It is anticipated to lose its hold in North America.

The USA, China, Germany, Spain, Ireland and Japan are the leading producers in the market.

The demand in Europe for microalgae in the animal feed sector is expected to account for more than 27% in the year 2021, growing with a stable CAGR of 3.1%.

Leading countries driving the demand for microalgae in animal feed sector are the USA, Brazil, Germany, France, and China.

China is expected to hold more than 55% market share in the Asia Pacific, reflecting lucrative growth at 5.3% CAGR.

The global animal feeds microalgae market is estimated to be valued at USD 66.0 billion in 2025.

The market size for the animal feeds microalgae market is projected to reach USD 93.1 billion by 2035.

The animal feeds microalgae market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in animal feeds microalgae market are spirulina, chlorella, dunaliella, haematococcus, crypthecodinium, schizochytrium, euglena, nannochloropsis, phaedactylum and others.

In terms of source, marine water segment to command 45.0% share in the animal feeds microalgae market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Animal Healthcare Packaging Market Size and Share Forecast Outlook 2025 to 2035

Animal External Fixation Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Animal Auto-Immune Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Animal Disinfectants Market Size and Share Forecast Outlook 2025 to 2035

Animal Health Software Market Size and Share Forecast Outlook 2025 to 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Sedative Market Size and Share Forecast Outlook 2025 to 2035

Animal Genetics Market Size and Share Forecast Outlook 2025 to 2035

Animal Peptides Market Size and Share Forecast Outlook 2025 to 2035

Animal Immunoassay Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Microalgae Market Size and Share Forecast Outlook 2025 to 2035

Animal Gastroesophageal Reflux Disease Market Size and Share Forecast Outlook 2025 to 2035

Animal Parasiticide Market Size and Share Forecast Outlook 2025 to 2035

Animal Model Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Feed Additives Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Animal Feed Organic Trace Minerals Market Size and Share Forecast Outlook 2025 to 2035

Animal Nutrition Chemicals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Animal Artificial Insemination Market Report - Trends, Demand & Industry Forecast 2025 to 2035

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA