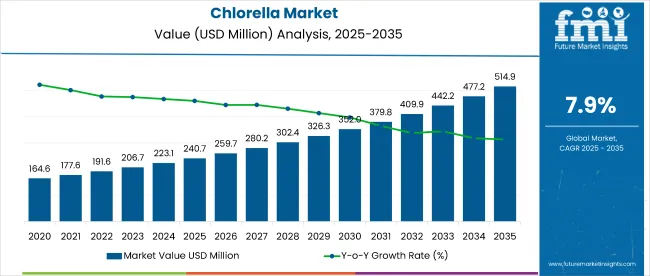

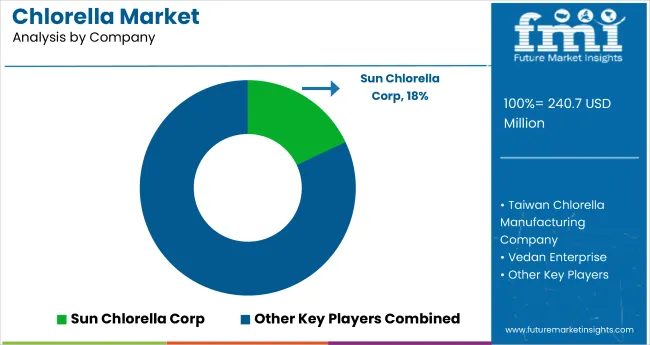

The global chlorella market is valued at USD 240.7 million in 2025 and is poised to reach USD 514.9 million by 2035, reflecting a CAGR of 7.9%.

| Attribute | Value |

|---|---|

| Market Value (2025) | USD 240.7 million |

| Market Value (2035) | USD 514.9 million |

| CAGR (2025 to 2035) | 7.9% |

The growth is being driven by rising consumer awareness of superfoods, increasing preference for plant-based nutritional supplements, and greater adoption of organic food ingredients for use in personal care and cosmetics. Demand has also been supported by innovations in chlorella cultivation and its integration into functional food applications globally.

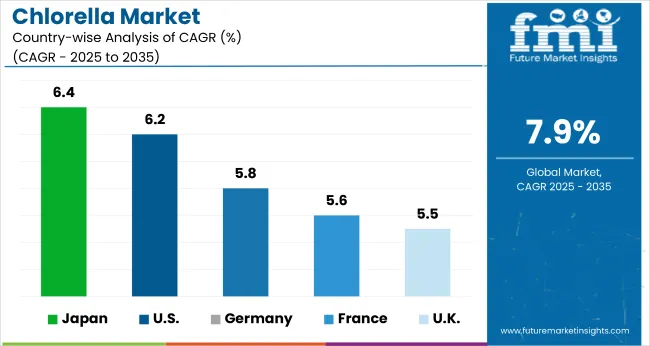

Among individual countries, Japan (6.4% CAGR) is expected to show robust growth due to high consumer awareness of algae-based supplements and well-established nutraceutical consumption. Germany (5.8% CAGR) is forecast to expand steadily, driven by the rising demand for organic and functional food ingredients.

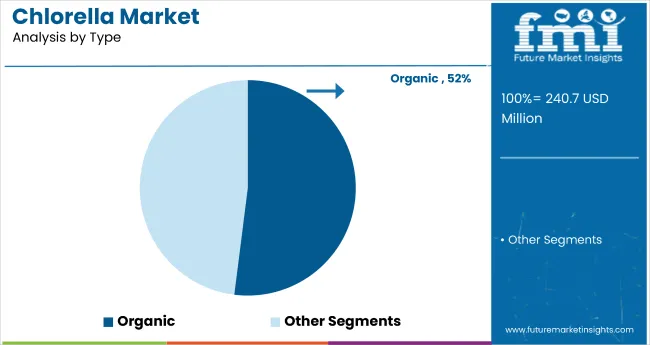

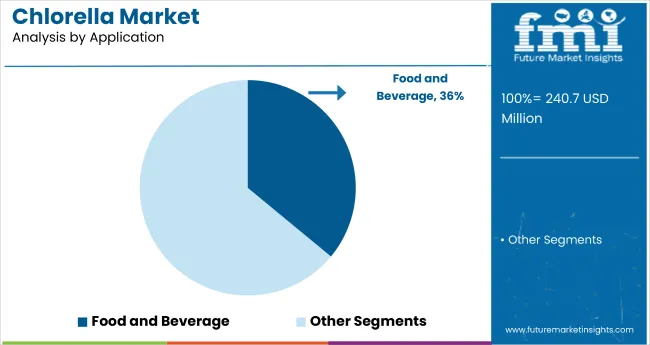

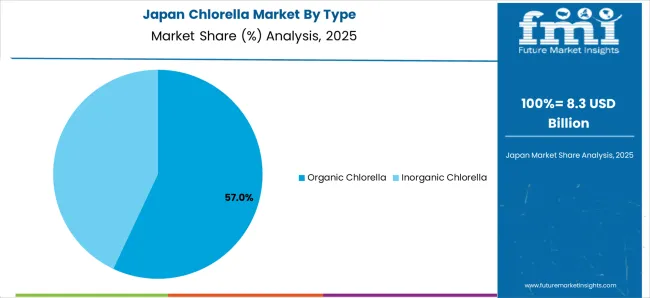

Additionally, France (5.6% CAGR) is anticipated to witness notable growth as plant-based dietary trends gain traction across the wellness and personal care sectors.By type, organic chlorella will dominate with a 52% share, while food and beverage will lead the application segment with a 36% share in 2025.

Recent innovations in the market have focused on enhancing taste, digestibility, and application versatility. Companies are developing odorless and flavor-neutral chlorella powders to cater to mainstream food and beverage applications. Heterotrophic cultivation techniques are being adopted to improve yield and nutrient density without sunlight.

Advanced encapsulation technologies are being explored to improve bioavailability in supplements. Additionally, several firms are launching chlorella-based protein blends tailored for vegan and sports nutrition markets. Partnerships with cosmetic brands are also accelerating the use of chlorella extracts in anti-aging and skin-repair formulations, expanding its footprint in the personal care industry.

The market holds a modest but growing share across its parent industries. It accounts for 3.5% of the global functional food ingredients market and around 4% of the dietary supplements market, driven by its rising use in superfoods and wellness products.

Within the algae-based products market, chlorella represents a significant 25% share, making it one of the dominant microalgae types. In the plant-based protein segment, chlorella contributes to nearly 2.8%, while in the organic food ingredients space, its share is close to 3%. In the personal care ingredients market, its share stands at about 1.5%, with growth expected.

The global market is segmented by type, application, and region. By type, the market is bifurcated into organic chlorella and inorganic chlorella. By application segment, the market is divided into food and beverage industry, pharmaceutical industry, personal care industry, and other applications. Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Organic chlorella is projected to hold a 52% market share in 2025, making it the most lucrative segment within the type category. Its dominance is attributed to growing consumer preference for chemical-free, non-GMO superfoods, increasing demand from vegan and vegetarian populations, and its expanding use in detox supplements, smoothies, and fortified beverages.

The food and beverage segment is projected to hold a 36% market share in 2025, making it the most lucrative application area. This dominance is driven by rising demand for natural colorants, functional beverages, plant-based proteins, fortified snacks, and health supplements. Clean-label product innovations, growing vegan consumer base, and regulatory approvals further support chlorella's incorporation across various processed food categories and wellness drinks.

The market is growing steadily, driven by rising demand for clean-label superfoods, increasing consumer focus on plant-based nutrition, and advancements in organic microalgae cultivation for use across food, beverage, pharmaceutical, and personal care industries.

Recent Trends in the Chlorella Market

Key Challenges in the Chlorella Market

Japan is projected to register the highest growth in the global chlorella market with a CAGR of 6.4% from 2025 to 2035, driven by its well-established algae consumption culture, technological advancements in photobioreactor cultivation, and inclusion of chlorella in both food and pharma-grade applications. The USA follows closely with a 6.2% CAGR, supported by increasing consumer awareness of plant-based superfoods, clean-label dietary supplements, and chlorella’s growing role in gut health and immunity-boosting formulations.

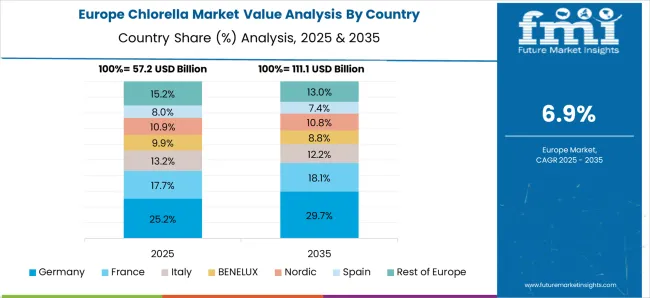

Germany ranks third with a CAGR of 5.8%, benefitting from strong demand in nutraceutical and functional beverage sectors. France (5.6%) and the UK (5.5%) are also key contributors, thanks to organic lifestyle movements, eco-friendly production policies, and the increasing use of chlorella in beauty, detox, and personal care products. Overall, these five countries collectively account for over half of global chlorella consumption and are pivotal in shaping market innovations, regulations, and premium product offerings.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

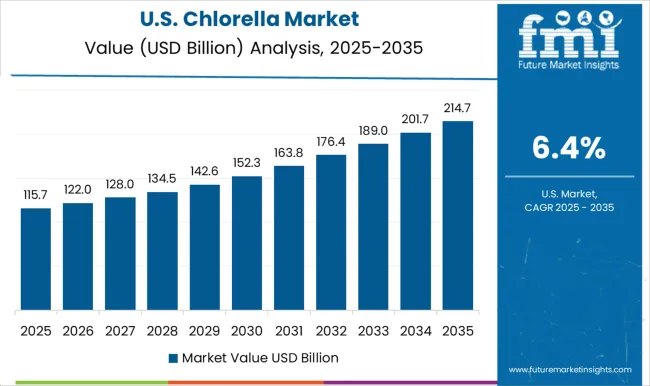

The USA chlorella market is projected to grow at a CAGR of 6.2% from 2025 to 2035, reflecting robust consumer demand for plant-based, immune-supporting superfoods. Adoption is rising in vegan supplements, detox products, and clean-label wellness offerings.

The market also benefits from expanding personal care applications and strong e-commerce penetration. Continued R&D in algae-derived protein sources and health foods supports innovation. While the segment is mature, premiumization and functional labeling are driving renewed consumer interest in chlorella-based formulations.

Sales of chlorella in the UK are expected to expand at a CAGR of 5.5% between 2025 and 2035, supported by the country’s shift toward sustainable and organic nutrition. The growing popularity of algae-based wellness solutions is pushing chlorella into detox supplements and green powders.

Health food chains and wellness platforms are enhancing their chlorella offerings, while functional beverage producers are actively integrating it into product lines. Consumer emphasis on clean-label, ethically sourced protein continues to support stable long-term demand.

The chlorella market in Germany is forecast to grow at a CAGR of 5.8% from 2025 to 2035, driven by the country’s strong organic food culture and advanced retail infrastructure. Chlorella is gaining traction in high-quality supplements, superfood beverages, and skincare.

The presence of health-conscious consumers and R&D-driven product development makes Germany one of the most innovation-focused markets in Europe. German retailers are enhancing their superfood portfolios, with algae-based products seeing priority shelf space.

The French chlorella revenue is expected to grow at a CAGR of 5.6% from 2025 to 2035, supported by a rising health awareness culture and a preference for natural detox solutions. Demand is growing in the clean beauty and nutraceuticals space, with increased popularity for French-grown organic microalgae. Pharmacies and health-focused outlets are key drivers of chlorella sales. Product positioning around immunity and gut health is also gaining traction among urban consumers.

The chlorella market in Japan is projected to grow at a CAGR of 6.4% from 2025 to 2035, making it one of the fastest-growing markets globally. Japan’s long-standing trust in algae nutrition, advanced domestic production methods, and integration into traditional food formats provide a robust foundation.

Companies like Yaeyama and Taiwan Chlorella dominate with deep-rooted market presence. Consumers across age groups prefer tablets, health drinks, and powders featuring chlorella for daily wellness.

The market remains moderately fragmented, with a mix of global players and regionally dominant producers. Leading companies such as Sun Chlorella Corp, Taiwan Chlorella Manufacturing Company, and Vedan Enterprise compete based on product quality, cultivation methods, certifications, and application diversity.

Top-tier companies focus on organic certification, R&D investments, and global distribution partnerships to expand their presence in the nutraceutical, pharmaceutical, and personal care sectors. Sun Chlorella Corp, for example, leverages strong branding and product standardization to dominate the North American and Japanese markets.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 240.7 million |

| Projected Market Size (2035) | USD 514.9 million |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD Million/Volume in metric tons |

| By Type | Organic Chlorella and Inorganic Chlorella |

| By Application | Food & Beverage Industry, Pharmaceutical Industry, Personal Care Industry, and Other Applications |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Players | Sun Corp, Vedan Enterprise, FEMICO, International Chlorella, Taiwan Chlorella Manufacturing Company, Yaeyama Chlorella, Gong Bih Enterprise, Fuqing King Dnarmsa Spirulina, Like Biotech, Jiangxi Mingjun, Guangzhou Jinqiu Chlorella, Dongtai City Spirulina Bio-engineering, Shandong Enkang, and Tianjin Norland Biotech. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global chlorella market is estimated to be valued at USD 240.7 billion in 2025.

The market size for the chlorella market is projected to reach USD 496.3 billion by 2035.

The chlorella market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in chlorella market are organic chlorella and inorganic chlorella.

In terms of application, chlorella in food and beverage industry segment to command 48.6% share in the chlorella market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chlorella Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chlorella Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA