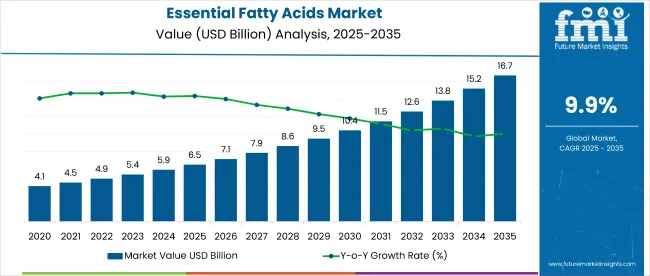

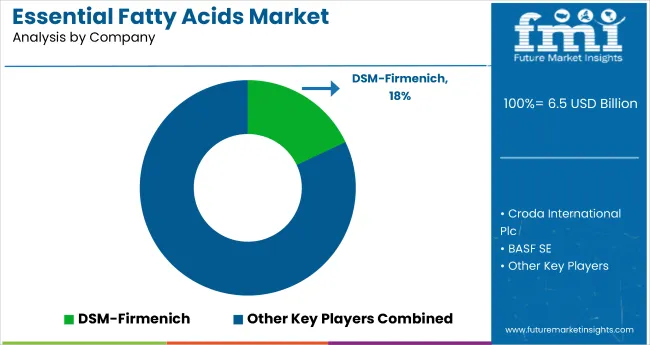

The global essential fatty acids market is valued at USD 6.5 billion in 2025 and is slated to reach USD 16.7 billion by 2035, reflecting a CAGR of 9.9%.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 6.5 billion |

| Market Size (2035) | USD 16.7 billion |

| CAGR (2025 to 2035) | 9.9% |

Factors contributing to this growth include rising health awareness, increased consumption of dietary supplements, and the growing popularity of plant-based and marine omega-3 products. In addition, advancements in extraction technologies and clean-label product development are encouraging innovation across functional food and nutraceutical sectors.

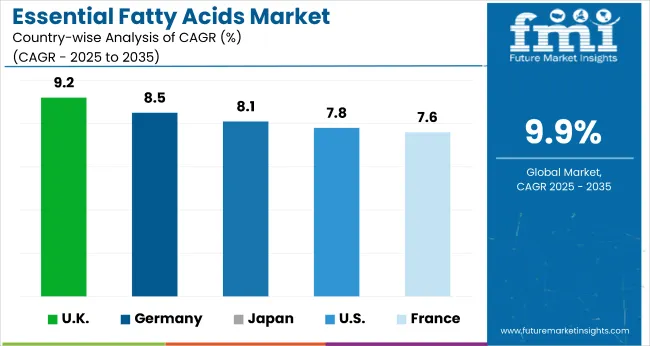

The UK is forecasted to grow at the highest CAGR of 9.2% from 2025 to 2035, driven by demand for plant-based diets and mental wellness supplements. Germany follows with an 8.5% CAGR, supported by heart health awareness and preference for sustainable marine oils.

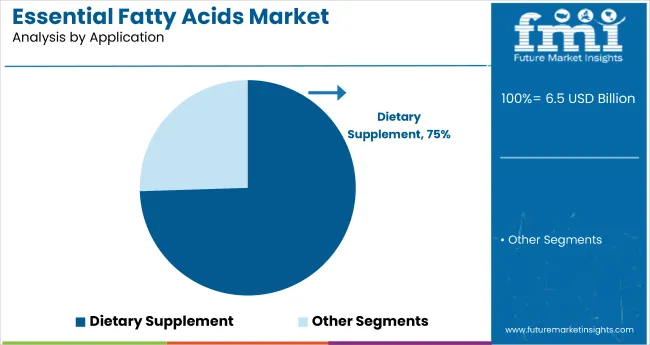

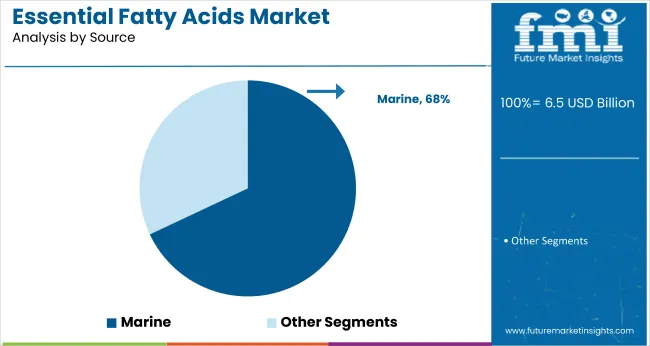

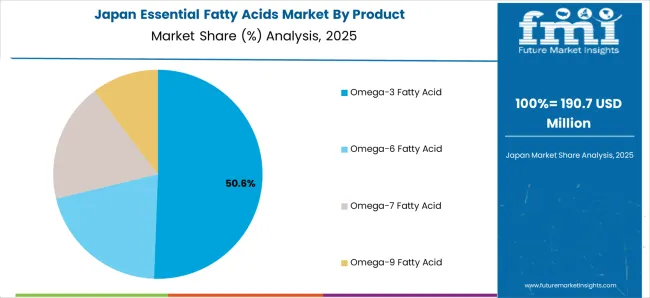

Japan is projected to grow at 8.1%, led by an aging population and high trust in omega-rich seafood. In 2025, dietary supplements will lead the application category with a 74.5% market share, while marine will dominate the source segment with a 68% share in 2025.

Recent innovations in the essential fatty acids market include algae-based omega-3 supplements, solvent-free extraction methods, and cetoleic acid-enriched formulations that improve EPA and DHA conversion. Companies are introducing sugar-free omega-3 gummies and microencapsulated delivery systems for better taste and bioavailability. Regulatory bodies like the USA FDA and EFSA have approved health claims for omega-3 benefits related to heart and brain health.

As of 2025, the market holds a significant yet niche share within its parent industries. It accounts for approximately 12% of the global nutraceuticals market, driven by its role in preventive healthcare. Within the dietary supplements segment, it represents nearly 15%, largely due to widespread omega-3 usage.

In the functional food and beverages sector, essential fatty acids contribute around 8%, mainly through fortified products. The market holds a 6% share in the pharmaceutical ingredients space, while in animal nutrition, its share is estimated at 10%, with growing inclusion in pet and livestock diets for gut and immunity support.

The essential fatty acids market segments include product type, application, source, form, and region. By product type, the market covers omega-3 fatty acids (ALA, DHA, EPA), omega-6 fatty acids (LA, ARA), omega-7 fatty acids, and omega-9 fatty acids. By application, the market includes dietary supplements, infant formula, pharmaceuticals, food and beverages, animal food and feed, and cosmetics.

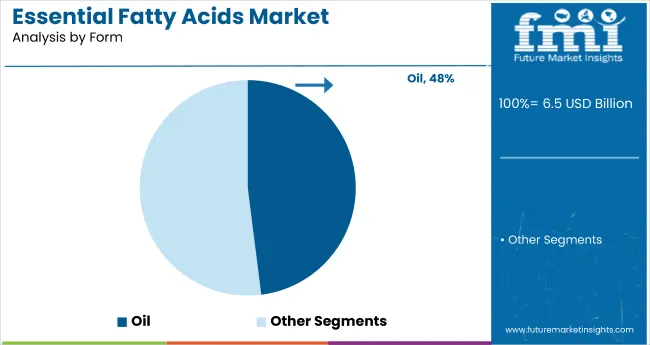

By source, the market consists of marine (fish oil, krill oil, algal oil, and fungal oil), plant-based (chia seed oil, flaxseed oil, and others such as hemp seed oil, perilla oil, and canola oil), and dairy products. By form, the market covers oil, syrup, powder, and others (capsules, soft gels, gummies). The regional segment includes North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

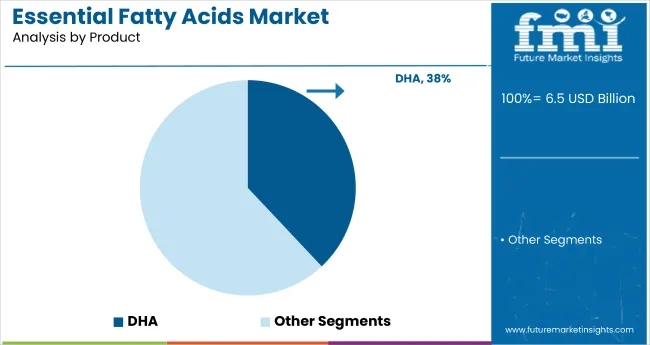

DHA (Docosahexaenoic Acid) is projected to be the most lucrative segment, with a 38% market share within the omega-3 fatty acid category in 2025.

Dietary supplements are projected to be the most lucrative application segment in the essential fatty acids market, capturing an estimated 74.5% market share.

Marine-based sources are expected to capture 68% of the essential fatty acids market, accounting for the largest share due to their high concentrations of EPA and DHA.

Oil-based formulations are projected to lead the essential fatty acids market, accounting for an estimated 48% share.

The market is expanding steadily, fueled by growing awareness of preventive health, rising demand for omega-3 and omega-6 supplements, and ongoing innovations in marine- and plant-based formulations.

Recent Trends in the Essential Fatty Acids Market

Key Challenges in the Essential Fatty Acids Market

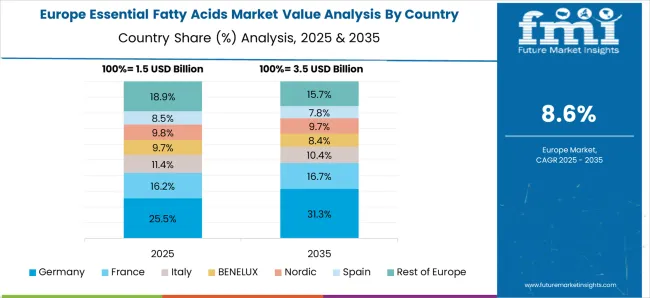

The UK is projected to lead the market among the listed countries, registering the highest CAGR of 9.2% from 2025 to 2035, driven by demand for plant-based and clean-label products. Germany follows with an 8.5% CAGR, fueled by heart health awareness and functional nutrition trends.

Japan ranks third with 8.1%, supported by its aging population and preference for omega-rich seafood. The USA market is set to grow at 7.8%, driven by supplement demand and FDA support. France records the slowest growth at 7.6%, with gains linked to maternal health and advancements in clinical nutrition.

The report covers in-depth analysis of 40+ countries, five top-performing OECD countries are highlighted below.

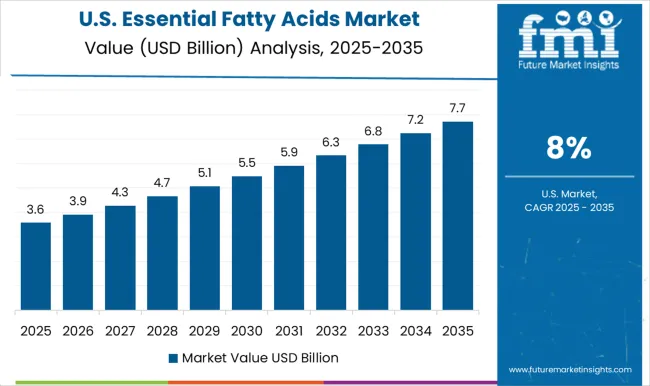

The USA essential fatty acids products revenue is projected to grow at a CAGR of 7.8% from 2025 to 2035, driven by rising health consciousness and the widespread use of dietary supplements.

The UK essential fatty acids products demand is expected to expand at a CAGR of 9.2% from 2025 to 2035, supported by the growing popularity of plant-based diets and rising consumer focus on mental wellness.

Sales of essential fatty acids products in Germany are projected to grow at a CAGR of 8.5% from 2025 to 2035, driven by consumer interest in heart health and the rising use of functional nutrition.

Sales of essential fatty acids products in France are expected to witness a CAGR of 7.6% from 2025 to 2035, propelled by advancements in clinical nutrition and a growing focus on maternal and infant health.

The Japan essential fatty acids products revenue is set to grow at a CAGR of 8.1% from 2025 to 2035, supported by an aging population and traditional preferences for omega-rich seafood.

The market is moderately fragmented, with a mix of tier-one multinationals and several specialized marine and plant-based oil producers. Companies like BASF SE, DSM, and Aker Bio Marine dominate in terms of innovation, global reach, and ingredient portfolios, while regional firms such as sea Dragon Ltd. and Lysi hf. Serve niche markets with specialized marine oils.

Leading companies are actively competing through pricing optimization, R&D investment, product differentiation, and sustainability-driven partnerships. Innovation in solvent-free extraction, algae-based DHA production, and clinical-grade omega-3 formulations have emerged as a core strategy.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 6.5 billion |

| Projected Market Size (2035) | USD 16.7 billion |

| CAGR (2025 to 2035) | 9.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Metric Tons |

| By Product Type | Omega-3 (ALA, DHA, EPA), Omega-6 (LA, ARA), Omega-7 Fatty Acid, Omega-9 Fatty Acid |

| By Application | Dietary Supplement, Infant Formula, Pharmaceutical, Food & Beverages, Animal Food and Feed, and Cosmetics |

| By Source | Marine (Fish Oil, Krill Oil, Algal and Fungus Oil), Plant (Flax Seed Oil, Chia Seed Oil, Others such as Hemp Seed Oil, Evening Primrose Oil, Perilla Seed Oil, and Soybean Oil), Dairy |

| By Form | Oil, Syrup, Powder, Others (Softgel Capsules, Gummies, Emulsions, and Spray/Drops) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ASF SE, FMC Corporation, The Dow Chemical Company, Koninklijke DSM NV, Enzymotec Ltd., Croda International Plc, Omega Protein Corporation, Aker BioMarine AS, Polaris Nutritional Lipids, Cargill Inc., Arista Industries, Nutrifynn Caps Inc., Sea Dragon Ltd., Lysi hf., GC Rieber Oils AS, Bizen Chemical Co., LTD, Maruha Nichiro Corporation, Olvea Fish Oils, Arctic Nutrition AS, and Golden Omega. |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The global essential fatty acids market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the essential fatty acids market is projected to reach USD 16.0 billion by 2035.

The essential fatty acids market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in essential fatty acids market are omega-3 fatty acid, _ala, _dha, _epa, omega-6 fatty acid, _la, _ara, omega-7 fatty acid and omega-9 fatty acid.

In terms of application, dietary supplement segment to command 42.7% share in the essential fatty acids market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Essential Oil Containers Market Growth & Trends 2025 to 2035

Essential Thrombocythemia Market Growth - Demand, Innovations & Forecast 2025 to 2035

Essential Oil Isolate Market

Hops Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Sage Essential Oil Market Analysis by Source, Application, Distribution Channel, and Region Through 2035

Onion Essential Oils Market

Marigold Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Tangerine Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Massoia Bark Essential Oil Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Asia Pacific Essential Oil and Oleoresin Business

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Fractionated Fatty Acid Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA