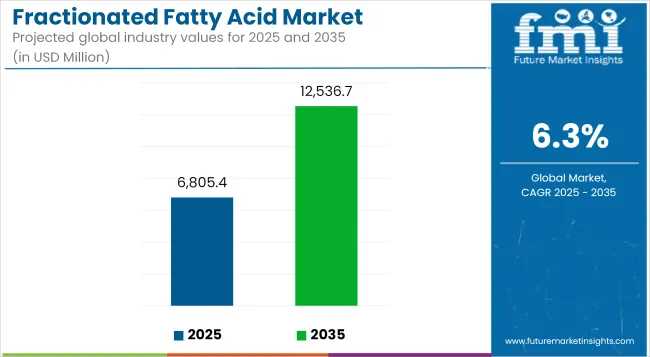

The fractionated fatty acid industry is anticipated to record sales of USD 6,805.35 million in 2025, with projections indicating a market size of USD 12,536.69 million by 2035, driven by a CAGR of 6.3%. This momentum is supported by expanding downstream demand across pharmaceutical, food, and personal care sectors.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 6,805.35 Million |

| Projected Market Size in 2035 | USD 12,536.69 Million |

| CAGR (2025 to 2035) | 6.3% |

Fractionated fatty acids are increasingly valued for their high purity, stability, and targeted functional properties in emulsification, antimicrobial action, and ingredient solubilization.

The market landscape is witnessing a strong preference for medium-chain fatty acids, especially caprylic and capric acid, which are gaining traction in therapeutic and cosmetic formulations. Consumer interest in clean-label and plant-derived ingredients is pushing manufacturers to adopt sustainable sourcing and advanced distillation techniques.

However, cost volatility in raw materials, particularly palm and coconut oil, is acting as a restraint. The rise of specialty applications in nutraceuticals, digestive health, and antimicrobial product lines is setting new demand thresholds. Market participants are investing in capacity expansions, joint ventures for palm oil alternatives, and formulation R&D for enhanced oil fractionation.

By 2035, demand for fractionated fatty acids is expected to be strongly shaped by innovation in biodegradable and skin-compatible ingredient solutions. Significant growth will be seen in pharmaceutical-grade fractions as demand for MCTs and lauric-based derivatives strengthens.

Asia-Pacific and North America will remain pivotal markets due to strong industrial consumption and a maturing regulatory environment around ingredient safety. As newer bio-based formulations emerge, the market is expected to evolve toward multifunctional fatty acid derivatives designed for targeted delivery and enhanced bioavailability.

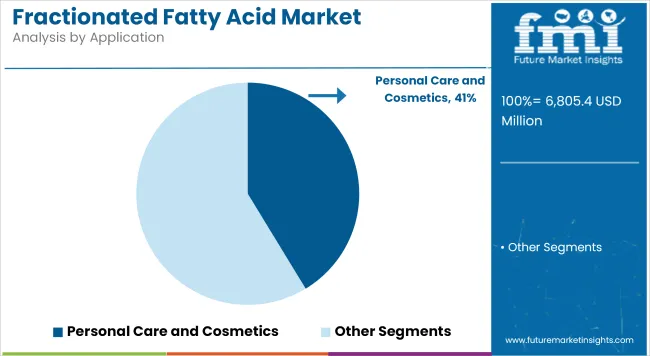

The personal care and cosmetics segment holds a dominant 41.3% share of the fractionated fatty acid market in 2025. This sector’s leadership is attributed to the multifunctional roles fractionated fatty acids play, especially as emollients, stabilizers, and antimicrobial agents in skincare and haircare products. Increasing consumer demand for clean-label, plant-based, and skin-compatible ingredients is driving formulators to incorporate medium-chain fatty acids such as caprylic and capric acid.

Regulatory bodies including the U.S. FDA and the European Cosmetics Regulation (EC No 1223/2009) have increasingly emphasized ingredient safety and transparency, encouraging innovation in bio-based fatty acid derivatives. Leading personal care companies are investing in R&D to develop biodegradable and multifunctional fatty acid fractions that enhance product efficacy while meeting sustainability goals.

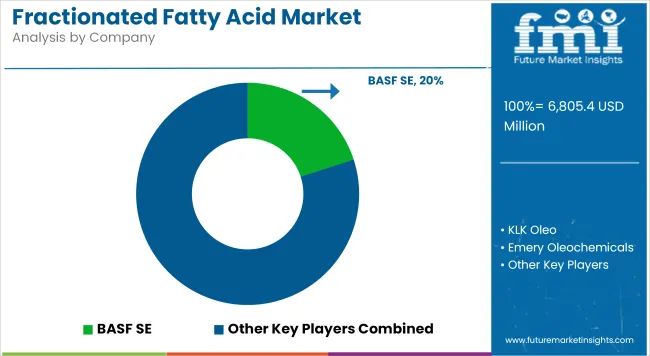

For instance, BASF SE has launched advanced emulsifier solutions integrating fractionated fatty acids to improve skin feel and stability. The rising trend of natural and organic personal care products across North America and Europe underpins this segment’s growth.

However, fluctuating raw material costs linked to palm and coconut oils pose challenges, motivating manufacturers to explore alternative sustainable sources and refine fractionation techniques. Overall, the personal care segment remains strategically crucial for driving technological advancements and expanding applications of fractionated fatty acids in the next decade.

Pharmaceutical applications account for a significant and rapidly growing portion of the fractionated fatty acid market, propelled by the unique therapeutic properties of medium-chain triglycerides (MCTs) such as caprylic acid. These acids are valued for their antimicrobial, anti-inflammatory, and solubilizing properties, which are instrumental in drug delivery systems and nutraceutical formulations.

In 2025, pharmaceutical-grade fractionated fatty acids represent an emerging growth avenue as manufacturers address increasing demand for excipients with enhanced bioavailability and targeted delivery capabilities. Regulatory agencies like the U.S. Pharmacopeia and EMA have established standards that support the safe integration of fractionated fatty acids into pharmaceutical products, fostering market trust and acceptance.

Key players including Emery Oleochemicals and Oleon NV have focused on capacity expansions and joint ventures to meet rising demand for high-purity, pharmaceutical-grade fractions. Moreover, the rise of specialized nutraceuticals targeting digestive health and metabolic disorders further stimulates demand in this segment.

The Asia-Pacific region, with expanding pharmaceutical manufacturing infrastructure and supportive government policies, is expected to become a critical growth market. Despite supply chain constraints due to raw material price volatility, ongoing innovations in sustainable fractionation and purification technologies are expected to sustain growth and expand pharmaceutical applications through 2035.

Raw Material Price Volatility and Supply Chain Disruptions

Cost fluctuations in raw-materials markets, particularly for palm oil, coconut oil and other plant-based feedstock’s, pose challenges to global supply of fatty acids. And then climate change, geopolitical tensions and trade restrictions impact the availability and cost of these raw materials, which have implications for production stability and profit margins. To mitigate the impact of price volatility, companies should develop diversified sourcing strategies, invest in alternative feedstocks and increase supply chain resilience.

Stringent Environmental and Regulatory Compliance

Manufacturers of fractionated fatty acids face considerable hurdles in meeting regulations related to sustainable sourcing, emissions control, and chemical safety. Organizations like the FDA, REACH and RSPO (Roundtable on Sustainable Palm Oil) enforce strict regulations on the environmental impact of such practices, prompting businesses to require alternative-free biosourcing and bio-processing methods. These changing rules require investments in cleaner technologies, third-party certifications, and transparent sustainability reporting to meet standards and build credibility in the marketplace.

Growing Demand for Bio-Based and Sustainable Ingredients

The shift towards bio-based chemicals and sustainable personal care products has triggered the demand for fractionated fatty acids. Mechanical extraction of fatty acids from oilseeds becomes increasingly important to industries like cosmetics, pharmaceuticals, and food processing which favor plant-derived fatty acids due to their emulsifying, surfactant, and moisturizing properties. The growth of companies producing organic-certified, biodegradable, and RSPO-certified fatty acids will be fueled by increasing consumer preference for environmentally sustainable and natural ingredients.

Expansion in Specialty Applications and High-Value Derivatives

The purification of the fatty acids into high-purity fractionated products for specialty applications is being enabled by investment in the processing technologies. Examples include lubricants, functional coatings, nutraceuticals, and also biodegradable plastics. Also, the growing use of medium-chain triglycerides (MCTs) for health supplements and for the ketogenic diet is set to open the market to new opportunities. With a growing demand for high-value applications, those companies that are developing novel fractionation methods, tailored fatty acid derivatives, and more stringent purity criteria will put themselves in a competitive position.

The Fractionated fatty acid market grew moderately between 2020 and 2024, driven by the increasing demand for sustainable ingredients, advancements in bio-refining technologies, and rising consumer awareness of eco-friendly products. But expansion of the market was complicated by raw material supply disruptions, tight environmental regulations, and high processing costs. Companies reacted with investments in sustainable palm oil certification, enhanced production efficiency and efforts to grow specialty fatty acids portfolios.

In the next decade 2025 to 2035, innovations in enzymatic fractionation processes, AI-based process optimization, and circular economy practices are projected to flourish in the market. Advancements in precision fermentation for plant-based lipid sources, as well as blockchain-enabled traceability and carbon-neutral manufacturing, will raise the bar on the industry. Maturation of bio-based polymers, functional lipid formulations, and next-generation nutraceuticals will lead to fresh paths for expansion. The composition of Fractionated fatty acid market will mirror that of companies that focus on digital transformation, sustainability and specialized product development.

Due to the rising demand for personal care, food, and pharmaceutical industries, increasing adoption of bio-based chemicals, and strong research and development in lipid-based formulations, the United States accounts for a considerable share of the fractionated fatty acid market. Increase of a choice for sustainable and functional fatty acids is further more boosting the marketplace.

Increasing investments in oleochemical production, coupled with innovations prompted towards high-purity and custom-tailored fatty acid blends, are also aiding market growth. Moreover, new fractionation methods, enzymatic treatment, and extraction techniques are making strides towards better product quality. In addition, companies are emphasizing the development of environmentally-friendly and high-performance fatty acid derivatives for cosmetic, nutraceutical, and industrial lubricant applications. Moreover, the growing consumption of fractionated fatty acids in functional food ingredients, emulsifiers, and bio-lubricants are likely to drive demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

A stronghold of the fractionated fatty acid market in Europe is the United Kingdom, as the demand for sustainable personal care products grows, investments in bio-based chemicals surge, and applications in food and dietary supplements proliferate. The market is also observing an upswing due to the focus on natural and plant-derived fatty acids. Supportive government regulations encouraging the use of bio-based chemicals, as well as advances in lipid modification and green chemistry processes, drive the growth of the market.

Additionally, key developments like high purity medium-chain and long-chain fatty acids are growing for skincare, functional foods, and pharmaceutical applications. Companies are also investing in fractionation technologies to enhance stability, absorption, and functionality for end-use products. Also, in UK, increasing demand for organic and vegan-friendly fatty acid ingredients for various applications such as food emulsifiers, anti-aging creams, and pharmaceutical excipients boost the market adoption. Moreover, the trend to biodegradable and environmentally friendly formulations is fueling demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

The market for fractionated fatty acids in Europe includes sustainable chemicals, bio-based industrial ingredients, and advanced lipid processing technologies in Germany, France, and Italy. EU green chemistry focus and investment in enzyme and membrane-based fatty acid fractionation/market growth steady Moreover, the increasing use of high-purity and specialty fatty acids for food fortification, cosmetic emulsifiers and biodegradable surfactants is enhancing product applications. Further advancements in demand for bio-lubricants, eco-friendly detergents, and pharmaceutical-grade fatty acids help to propel the growth of the market.

The REACH-compliant and sustainable chemical manufacturing expansion and increasing cooperation between cosmetic brands and oleochemical manufacturers have also promoted the overall use in Europe. Moreover, the growing demand for sustainable packaging and greener manufacturing methods is expediting innovations in the fractionated fatty acid industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.2% |

In Japan, a growing fractionated fatty acid market can be attributed to chemicals processing, demand for risk oleochemicals, and rising use in pharmaceutical and functional food formulations. Market Growth: The increasing attention towards skin-friendly and bioactive fatty acid personal care products is creating high market growth. Innovation is being propelled thanks to the increased focus on nanotechnology with boosted lipid fractionation, as well as ultra-purified and esterified fatty acids.

Furthermore, regulatory frameworks imposed by governments on chemical safety and growing investments in components such as food-grade and pharmaceutical-grade fatty acids further motivate companies to develop high-performance products. This can be attributed to growing demand for highly stable, odorless, and multifunctional fatty acids in cosmetics, anti-inflammatory formulations, and the high-end food segments, enabling faster market growth in Japan's chemical and nutraceutical sectors. Once again, Japan's utilization of automation in refining processes and efforts in sustainable feedstock sourcing are bringing a new dimension to fractionated fatty acid production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

As a result, fractionated fatty acids are gaining popularity in South Korea due to their natural and functional properties, increasing use of bio-based lubricants, favorable government initiatives for sustainable chemical production. The stringent rules regarding the use of synthetic chemicals, along with growing investment in lipid extraction and refinement technologies, will help the market to expand. Moreover, the range of mega health benefits derived from refined fats using advanced fractionation techniques faring high on improving fatty acid stability, bioavailability and performance is improving competitiveness in the country.

Market adoption is also driven by increasing demand for high-purity fatty acids in skincare, nutraceuticals, and biodegradable polymers. Moreover, companies are investing in AI-based lipid profiling, rapid extraction systems, and advanced biotechnological solutions to enhance production and broaden product portfolio. However, the increasing trend of eco-friendly beauty, functional food, and the growth of sustainable industrial applications in the country further contributes towards the high demand for fractionated fatty acids solution in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.3% |

With increasing demand for fractionated fatty acid from food & beverages, pharmaceuticals, cosmetics and industrial applications, the global fractionated fatty acid market is growing. Firm are emphasizing high-purity fractionation processes, sustainable sourcing, and custom formulations tailored to the needs of a given industry. Important trends include bio-based fatty acids, advanced separation technologies, and increasing use of medium- and long-chain fatty acids in healthcare and wellness use segments.

By Product Claim:

The overall market size for fractionated fatty acid market was USD 6,805.35 million in 2025.

The fractionated fatty acid market expected to reach USD 12,536.69 million in 2035.

The demand for the fractionated fatty acid market will be driven by increasing applications in food and beverage, personal care, and pharmaceutical industries, rising demand for specialty chemicals, growing use in industrial lubricants and surfactants, and advancements in bio-based and sustainable ingredient processing.

The top 5 countries which drives the development of fractionated fatty acid market are USA, UK, Europe Union, Japan and South Korea.

Liquid and powder fractionated fatty acids drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fractionated Lecithin Market Growth - Source & Industry Trends

Fatty Methyl Ester Sulfonate Market Size and Share Forecast Outlook 2025 to 2035

Fatty Amine Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Fatty Liver Treatment Market - Trends & Forecast 2025 to 2035

Fatty Esters Market Growth - Trends & Forecast 2025 to 2035

Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Fatty Acid Supplements Market Size and Share Forecast Outlook 2025 to 2035

Tallow Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Coconut Fatty Acids Market

Tall Oil Fatty Acid Market Size and Share Forecast Outlook 2025 to 2035

Rice Bran Fatty Alcohols Market Size and Share Forecast Outlook 2025 to 2035

Essential Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Polyunsaturated Fatty Acids Market Trends 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Bio-Inspired Omega Fatty Acids Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyglycerol Esters Of Fatty Acids Market

Propane-1,2-Diol Esters of Fatty Acid Market Analysis by Toppings, Processed Meat, Confectionery, Soft and Fizzy Drinks and others Through 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Lactic Acid Esters Of Mono And Diglycerides Of Fatty Acids Market

Mixed Acetic and Tartaric Acid Esters of Mono and Diglycerides of Fatty Acids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA