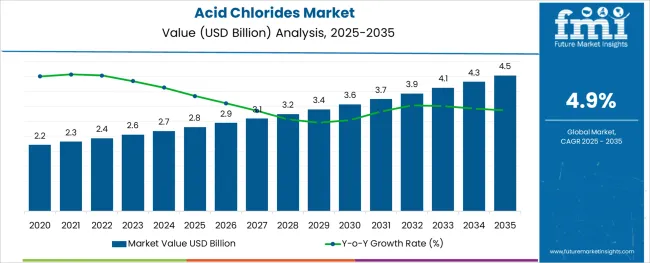

The Acid Chlorides Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

The market is segmented by Product Type, Application, and End Use and region. By Product Type, the market is divided into Ethanoyl Chloride, Propanoyl Chloride, Butanoyl Chloride, Benzoyl Chloride, Chloroacetyl Chloride, Thionyl Chloride, Palmitoyl Chloride, and Others. In terms of Application, the market is classified into Chemical Reagents, Plastic and Pigments, Organic peroxides, Agrochemicals, Pharmaceuticals, and Others. Based on End Use, the market is segmented into Pharmaceuticals, Agriculture, Plastics, Dyes & Inks, Cosmetic, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Product Type, Application, and End Use and region. By Product Type, the market is divided into Ethanoyl Chloride, Propanoyl Chloride, Butanoyl Chloride, Benzoyl Chloride, Chloroacetyl Chloride, Thionyl Chloride, Palmitoyl Chloride, and Others. In terms of Application, the market is classified into Chemical Reagents, Plastic and Pigments, Organic peroxides, Agrochemicals, Pharmaceuticals, and Others. Based on End Use, the market is segmented into Pharmaceuticals, Agriculture, Plastics, Dyes & Inks, Cosmetic, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5% of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

The global acid chlorides market witnessed a sluggish CAGR of 2.3% during the historical period from 2020 to 2024 and reached a valuation of 2,420.9 Million at the end of 2024. However, with rising applications of acid chlorides across industries like pharmaceutical, cosmetic, and agrochemical, the overall demand in the market is set to rise at 4.9% CAGR between 2025 and 2035.

In recent years, there has been a spike in diseases like arthritis, atherosclerosis rheumatic fever, and cardiovascular diseases. This in turn has created high demand for pharmaceuticals like aspirin and the trend is expected to continue during the upcoming years. As aspirin uses acid chlorides for its manufacturing, increasing production and consumption of this drug will eventually boost growth in the global acyl chlorides market.

Similarly, increasing usage of acid chlorides for manufacturing a wide range of agrochemicals, cosmetics, inks, and organic peroxides and the subsequent consumption of these products will fuel sales of acid chlorides over the projection period.

Growing Demand For Agrochemicals Setting New Milestones in the Market

The usage of chemicals to make agrochemical compounds like fungicides and herbicides is emerging as a key factor contributing to the rise in demand for acid chlorides.

Many active compounds with anti-fungal and weed-killing capabilities, including epoxiconazole, flutriafol, metolachlor, and pethoxamid, are produced using chloroacetyl chloride. Such acid chlorides are witnessing high growth opportunities with the robust growth in demand for agrochemicals.

Recent research found that during the previous ten years, much less cropland has been harvested overall. The area used for harvesting crops worldwide decreased by a considerable 1.8% year over year.

Moreover, increasing agricultural output and crop yield has become crucial to meet the growing food demand from the expanding population. Agrochemicals are crucial for increasing agricultural yield and productivity. Agrochemicals like insecticides and fertilizers are used to protect crops from illness and promote plant development.

Due to the decreasing amount of arable land, a greater yield per unit area of agricultural land is thus required. This is what is causing agrochemical and other active reagent sales to soar globally.

Rising Aspirin Usage Bolstering Acid Chloride Sales

Aspirin production is a vital application of various acyl chlorides across the pharmaceutical industry. Aspirin is an important medicinal product used in the treatment of various diseases ranging from simple pain to severe cardiovascular diseases. Additionally, the pharmaceutical sector uses acid chlorides as protective groups and building blocks, like propionyl chloride, pivaloyl chloride, and valeroyl chloride.

Aspirin consumption is continuing to rise as a result of the increasing frequency of cardiovascular disorders like atherosclerosis. Aspirin usage was more common than 30% in the United States by 2020, as per data from the National Center for Biotechnology Information (NCBI) published in 2024. Furthermore, over the next few years, market revenue growth is anticipated to be supported by stable medicine demand.

Health Hazards Associated With Acid Chlorides Can Dampen The Growth

Acid chlorides are linked to a number of immediate and long-term health risks, which is a significant issue limiting growth in the market. Even at low concentrations, exposure to acetyl chloride mist and fumes has been shown to burn mucosal membranes and harm underlying tissues.

The substance can cause mortality upon contact with air by causing pulmonary edema, and it can also break down into HCl, which severely harms the lungs and other respiratory system tissues. Contact with a chemical in liquid form results in burns to the skin and/or eyes and may possibly cause irreversible eye damage and blindness.

Additionally, problems with the release of acid chloride emissions and effluents are another aspects that are anticipated to significantly slow down revenue development. Since decomposition products and chemical vapors are caustic, ignitable, and reactive, they must adhere to a number of standards and laws.

It is anticipated that regulatory bodies' suggestions for fugitive exposure monitoring systems to reduce the hazardous effects of acid chlorides will increase production costs, which in turn can reduce the market for compounds to a limited extent.

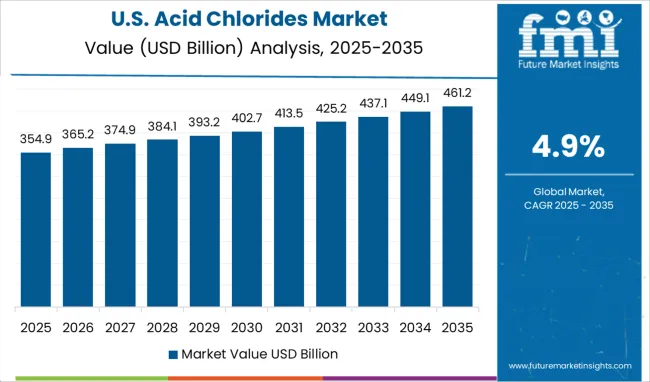

Growing Aspirin Demand Boosting the Demand for Acid Chlorides in the USA

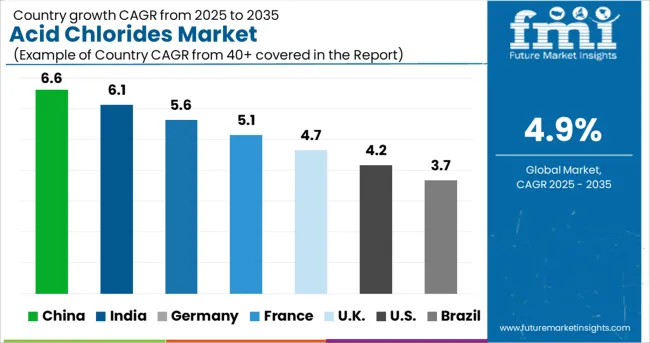

Currently, the USA holds a substantial share of the global market for acid chlorides and it is expected to retain its dominant position during the forecast period. The rising usage of acid chlorides for the production of various pharmaceuticals, cosmetics, and dyes is a key factor pushing demand in the USA market.

Aspirin and other drugs continue to be widely used in the USA, which is one of the main drivers fueling the market's revenue growth. Aspirin use and sales have grown as the prevalence of atherosclerosis and other cardiovascular disorders have increased.

According to surveys, approximately nine million seniors in the USA, who are older than 70, use aspirin for cardiovascular disease primary prevention. Acetyl chloride, which is employed as an acetylating agent in the manufacture of salicylate and other economically significant chemicals, is seeing an increase in demand as a result of this.

Additionally, the use of benzoate plasticizers in building projects is rising, which in turn is expected to create prospects for the USA market.

The rise in Export of Acid Chlorides Driving Demand in the United Kingdom

As per FMI, the United Kingdom market is poised to exhibit a steady CAGR during the forecast period, owing to the rising production and export of acid chlorides, booming pharmaceutical industry, and large presence of leading manufacturers.

Another reason for pushing for up the use of acid chlorides in the United Kingdom is the increased use of benzoyl chloride by pharmaceutical companies to make face washes and gels that cure acne and eliminate bacteria from the skin.

Benzoyl Chloride Remains the Most Sought-After Product Type

Ethanoyl chloride, propanoyl chloride, butanoyl chloride, benzoyl chloride, chloroacteyl chloride, thionyl chloride, palmitoyl chloride, and others are the different product types under which the worldwide acid chlorides market is segmented. Among these, the benzoyl chloride segment currently holds the largest market share and it is expected to grow at a steady pace during the next ten years.

The demand for benzoyl chloride is rising as a result of the substance's numerous uses in various industries. In the pharmaceutical sector, benzoyl chloride is a component in facial cleansers and gels used to treat acne. Along with acting as an antibacterial and antiseptic, the substance works with potassium hydroxyquinoline sulfate to remove germs from face wash users' skin. This substance is increasingly being employed in the production of fake tannins and fragrances, dyes, and resins.

With a trade value of USD 2.7 Million in 2024, an increase of almost 20% from the export value is 2024, the European Union was the world's top exporter of benzoyl chlorides and peroxides, according to data from the World Bank. Between 2025 and 2035, the rising adoption of benzoyl chloride for various applications in industries like pharmaceuticals, cosmetics, and dyes & inks is anticipated to boost the market.

Most of the Demand Arise From the Pharmaceutical Sector

Based on end use, the pharmaceuticals segment is anticipated to grow at a higher CAGR during the forecast period from 2025 to 2035. This can be attributed to the rising usage of acid chlorides across the pharmaceutical industry for manufacturing a wide range of medicines.

The production of salicylic acid as well as other increasingly significant medical formulations uses many products based on acid chloride, which is a key element in this segment's revenue growth.

Acetyl chloride is utilized as an intermediary molecule in the production of aspirin, which is frequently used as the primary preventative treatment for cardiovascular illnesses including atherosclerosis. It is also employed in the production of acetaminophen, a drug that lowers fever and eases discomfort from headaches, menstrual cramps, sore throats, immunizations, and muscular pains. The Food and Medication Administration (FDA) has authorized its usage as an active component in drugs, making it the most prevalent drug ingredient in the USA.

The global acyl chloride market is fairly consolidated due to the presence of a substantial number of small and medium-sized local and regional players. Key players are adopting various strategies such as acquisitions, mergers, collaborations, partnerships, and facility expansions to increase their geographic presence and market share.

Some of the recent developments in the market are listed below:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 2.8 billion |

| Projected Market Size (2035) | USD 4.5 billion |

| Anticipated Growth Rate (2025 to 2035) | 4.9% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Tons for Volume |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia and New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Product Type, Application, End Use, and Region |

| Key Companies Profiled | Altivia; BASF; Novaphene; CABB Chemicals; Orion Chem Pvt. Ltd.; Wilmar International; Transpek Industry Ltd.; VanDeMark Chemical, Inc.; Kuhlmann Europe; R. Drugs and Intermediates Pvt. Ltd.; Twin Lake Chemical Inc.; Shiva Pharmachem Ltd.; Rheinmetall AG |

| Report Coverage |

Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities, and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global acid chlorides market is estimated to be valued at USD 2.8 billion in 2025.

It is projected to reach USD 4.5 billion by 2035.

The market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types are ethanoyl chloride, propanoyl chloride, butanoyl chloride, benzoyl chloride, chloroacetyl chloride, thionyl chloride, palmitoyl chloride and others.

chemical reagents segment is expected to dominate with a 41.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Humic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA