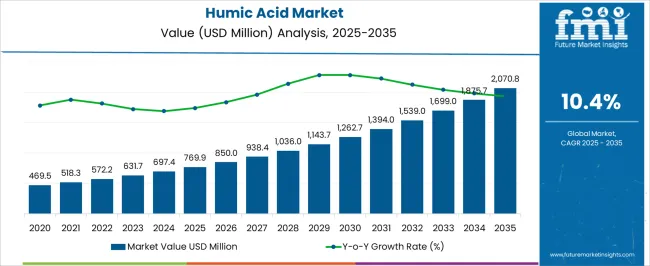

The humic acid market is projected to expand from an estimated USD 769.9 million in 2025 to USD 2,070.8 million by 2035, reflecting a compound annual growth rate of 10.4%. Regulatory frameworks play a critical role in shaping market dynamics, particularly due to the use of humic acid in agriculture, animal feed, and soil amendment applications. Governments across major regions have instituted stringent quality, safety, and environmental standards that influence production, formulation, and distribution processes.

Compliance with these standards requires manufacturers to invest in testing, certification, and traceability systems, which directly affects cost structures and market entry strategies.

Environmental regulations pertaining to soil and water protection further dictate the permissible composition and application methods of humic acid products. Adherence to such regulations ensures minimized ecological impact while maintaining efficacy, thereby driving manufacturers to innovate and implement sustainable production practices.

The approval processes for organic and specialty humic acid formulations in different regions introduce complexity in regulatory compliance, affecting product development timelines and market penetration. The growth trajectory from USD 769.9 million in 2025 to USD 2,070.8 million in 2035 suggests that regulatory alignment will be a decisive factor in market performance. Companies that proactively manage compliance, optimize production within regulatory limits, and maintain transparency in sourcing and formulation are likely to strengthen their market presence. Regulatory impact remains a primary driver of operational strategy, cost allocation, and competitive advantage in the expanding market.

The humic acid market represents a specialized segment within the agricultural inputs and soil amendment industry, emphasizing soil fertility, plant nutrition, and organic growth enhancement. Within the overall soil conditioners and fertilizers market, it accounts for about 6.3%, driven by adoption in crop production and horticulture. In the bio-based agricultural inputs segment, it holds nearly 5.7%, reflecting demand for organic and sustainable crop management solutions. Across the animal feed additives market, the segment captures 3.9%, supporting livestock health and nutrient absorption.

Within the water treatment and remediation sector, it represents 2.8%, highlighting its role in heavy metal chelation and water quality improvement. In the specialty chemicals and organic inputs category, it secures 3.1%, emphasizing its multifunctional use in both agriculture and environmental applications. Recent developments in this market have focused on extraction efficiency, formulation versatility, and multifunctional applications. Innovations include humic acid enriched with fulvic acid fractions to improve bioavailability and plant nutrient uptake. Key players are collaborating with fertilizer producers and agri-tech companies to develop blended products that enhance crop yield and soil health.

Advances in liquid and granular formulations have improved ease of application and storage stability. The regulatory support for organic farming and eco-friendly agricultural practices is driving wider adoption. Research on humic acid for bioremediation, water purification, and carbon sequestration is expanding its non-agricultural applications. These advancements demonstrate how performance, sustainability, and multifunctionality are shaping the market.

| Metric | Value |

|---|---|

| Humic Acid Market Estimated Value in (2025 E) | USD 769.9 million |

| Humic Acid Market Forecast Value in (2035 F) | USD 2070.8 million |

| Forecast CAGR (2025 to 2035) | 10.4% |

The humic acid market is experiencing robust growth, supported by the increasing adoption of sustainable agricultural practices, rising awareness of soil health management, and growing demand for organic crop inputs. Current market conditions are defined by strong uptake in agricultural applications, aided by the ability of humic acid to enhance nutrient absorption, improve soil structure, and increase crop resilience.

Regulatory encouragement for eco-friendly inputs, coupled with restrictions on synthetic fertilizers in several regions, has further reinforced demand. Technological advancements in extraction and formulation processes are enabling consistent product quality and cost efficiency, facilitating wider adoption among commercial farmers and agricultural cooperatives.

Emerging economies are witnessing rapid market penetration as governments and industry players promote humic acid use to improve yield sustainability Over the forecast period, the market is expected to benefit from expanding research into multi-functional soil amendments, integration into precision agriculture systems, and the rising global shift toward regenerative farming, positioning humic acid as a critical input in the agricultural value chain.

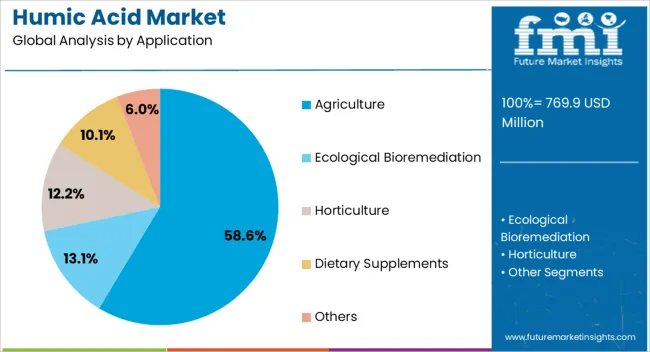

The humic acid market is segmented by application, and geographic regions. By application, humic acid market is divided into Agriculture, Ecological Bioremediation, Horticulture, Dietary Supplements, and Others. Regionally, the humic acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The agriculture segment, holding a 58.60% share of the application category, dominates the humic acid market due to its proven benefits in enhancing soil fertility and promoting plant growth. Its widespread adoption is being driven by the rising need for sustainable crop production methods and the shift toward organic farming systems.

The segment’s growth is further supported by the compatibility of humic acid with both traditional and modern agricultural practices, enabling its integration into irrigation, foliar sprays, and soil conditioning programs. Farmers are increasingly incorporating humic acid into nutrient management plans to boost yield efficiency and mitigate the impact of abiotic stress factors such as drought and soil salinity.

Continuous improvements in product formulations, including liquid and granular variants, have enhanced application convenience and market accessibility. The segment’s dominance is also reinforced by strong distribution networks and government-backed initiatives aimed at improving soil health, ensuring agriculture remains the leading driver of humic acid demand globally.

The market has experienced considerable growth due to its extensive applications in agriculture, horticulture, animal feed, and environmental remediation. Humic acid improves soil fertility, enhances nutrient absorption, stimulates plant growth, and increases crop yield, making it essential for modern agricultural practices. Rising demand for organic farming, sustainable agriculture, and eco-friendly fertilizers has further strengthened its adoption. Advanced extraction and formulation techniques have enhanced purity, solubility, and effectiveness, enabling broader use in liquid fertilizers, soil conditioners, and foliar sprays.

Agriculture remains the largest driver for humic acid consumption, as it enhances soil structure, water retention, and nutrient availability. Application in cereal crops, vegetables, fruits, and cash crops has demonstrated significant improvements in plant growth, root development, and resistance to stress conditions. Fertilizer blends incorporating humic acid are increasingly preferred by farmers seeking higher yields and sustainable practices. Expansion of mechanized farming, adoption of precision agriculture, and government initiatives promoting organic farming have further increased demand. The integration of humic acid with chemical fertilizers and biofertilizers allows optimized nutrient delivery, reducing environmental impact while maintaining crop productivity, supporting widespread market adoption in both mature and emerging economies.

Advancements in extraction, purification, and formulation technologies have improved the quality and effectiveness of humic acid products. Enhanced solubility, controlled molecular weight, and formulation stability enable application in various forms, including liquids, powders, and granules. Innovative blending with other organic or inorganic fertilizers and biostimulants has expanded the scope of application, improving nutrient uptake and crop resilience. Technological developments in soil testing and precision application methods ensure optimal dosing, reducing waste and environmental runoff. Continuous research into humic acid derivatives and functional modifications is enabling new applications in seed treatment, hydroponics, and bioremediation, reinforcing its relevance in modern agricultural and environmental practices.

Humic acid is increasingly utilized in animal feed to improve digestion, nutrient absorption, immunity, and overall livestock health. Its inclusion in poultry, cattle, and aquaculture feed has gained attention due to rising demand for high-quality protein and sustainable animal husbandry practices. Beyond agriculture, humic acid finds applications in wastewater treatment, soil remediation, and environmental restoration projects, providing natural chelation of heavy metals and contaminants. Growth in environmental awareness, government regulations for sustainable feed additives, and the expansion of livestock and aquaculture sectors have reinforced demand. Diversified applications across multiple industries provide significant opportunities for manufacturers and investors seeking to expand humic acid utilization globally.

Sustainability trends and increasing adoption of eco-friendly agricultural inputs have significantly influenced the humic acid market. Organic farming, regenerative agriculture, and soil health initiatives encourage the use of natural soil conditioners and bio-stimulants like humic acid. Emerging markets in Asia-Pacific, Latin America, and Africa present substantial growth opportunities due to expanding arable land, rising food demand, and increasing awareness of soil fertility management. Investment in local production, distribution networks, and research into high-efficiency formulations supports market expansion. The combination of environmental sustainability, regulatory support, and rising agricultural productivity requirements is expected to drive long-term growth of the humic acid market globally.

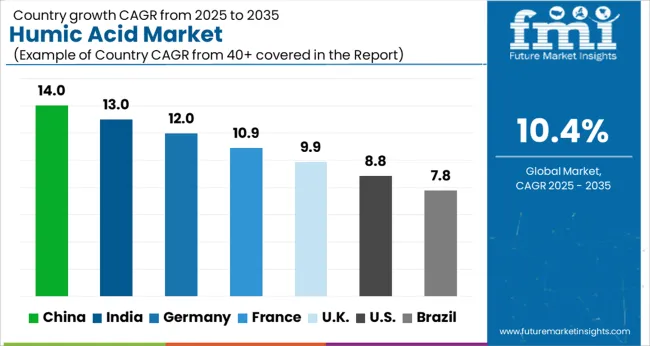

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

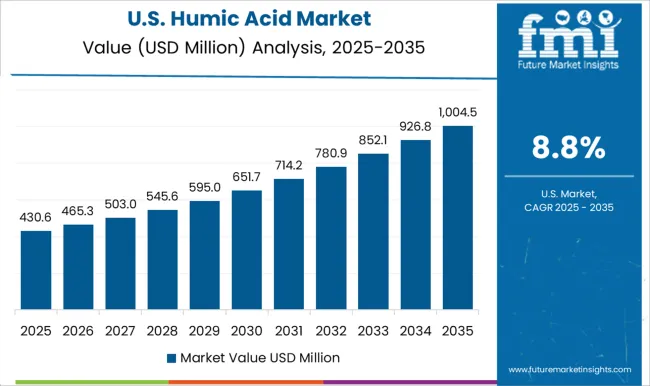

| USA | 8.8% |

| Brazil | 7.8% |

The market is expected to expand significantly, driven by growing adoption in agriculture, soil conditioning, and water treatment applications. China leads with a projected growth rate of 14.0%, fueled by large-scale agricultural deployment and increasing industrial utilization. India follows at 13.0%, scaling through enhanced fertilizer integration and sustainable farming initiatives.

Germany grows at 12.0%, supported by advanced agricultural technologies and organic farming practices. The United Kingdom records 9.9%, innovating via research in soil enhancement and nutrient delivery solutions. The United States reaches 8.8%, where demand from crop production and environmental management sustains steady growth. These countries represent a diversified landscape of production, application, and technological adoption in humic acid. This report includes insights on 40+ countries; the top markets are shown here for reference.

China’s market is projected to grow at a CAGR of 14.0%, driven by extensive adoption in agriculture, soil conditioning, and crop nutrition. The increasing focus on improving soil fertility, crop yield, and nutrient absorption is propelling demand across both traditional and modern agricultural sectors. Humic acid is widely applied in organic farming, hydroponics, and as a component in fertilizers to enhance soil structure and water retention. Domestic manufacturers are investing in advanced extraction technologies to increase efficiency and purity. Furthermore, collaboration with agricultural research institutions is fostering product development and awareness among farmers. Stringent quality standards and regulatory support are boosting confidence in humic acid applications, while rising export opportunities amplify market growth.

India is expected to expand at a CAGR of 13.0%, supported by increasing awareness of soil health and sustainable farming practices. Farmers are adopting humic acid to improve soil fertility, water retention, and nutrient uptake for various crops. Organic farming and biofertilizer sectors are contributing to rising domestic consumption. Manufacturers are focusing on producing high-quality, environmentally friendly humic acid to meet agricultural and horticultural needs. Government initiatives promoting sustainable agriculture and crop productivity further strengthen the market. Partnerships between suppliers, agricultural organizations, and research centers are helping optimize application techniques and product efficiency. Continuous innovation in extraction methods and quality control is expected to sustain growth momentum across India.

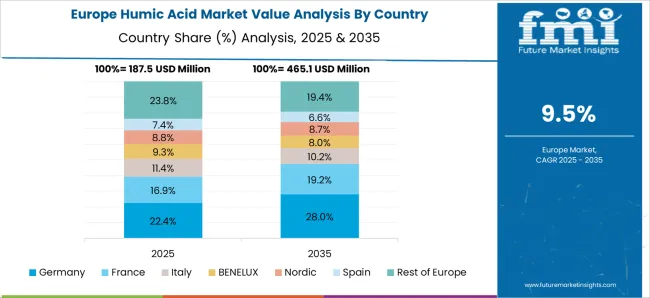

Germany’s market is projected to grow at a CAGR of 12.0%, primarily driven by high demand in agriculture, horticulture, and industrial applications. Farmers are increasingly adopting humic acid to enhance soil fertility, optimize water retention, and boost crop productivity. Research and development in sustainable fertilizers and soil supplements are further fueling market adoption. Industrial users also employ humic acid in water treatment and as a chelating agent. Strict regulatory frameworks ensure product quality and safety, which maintains market reliability. Technological advancements in extraction and formulation methods support higher efficiency and consistent quality. Collaborations between suppliers, agricultural bodies, and research institutions strengthen market credibility and drive long-term growth in Germany.

The UK market is expected to grow at a CAGR of 9.9%, supported by increasing use in agriculture, horticulture, and landscaping. Farmers and gardeners are leveraging humic acid to enhance soil fertility, improve water retention, and promote nutrient absorption. Organic farming initiatives and eco-friendly fertilizer programs are expanding product adoption. Manufacturers are focusing on innovative extraction processes to produce high-purity humic acid suitable for diverse applications. Regulatory oversight ensures quality, safety, and sustainable usage. Partnerships between agricultural organizations, suppliers, and research institutions foster awareness and optimized application methods. Continuous R&D in formulation efficiency and soil health improvement is expected to strengthen market prospects in the UK.

The USA humic acid market is projected to grow at a CAGR of 8.8%, driven by agricultural, horticultural, and industrial applications. Farmers are using humic acid to improve soil fertility, nutrient absorption, and crop yield. Organic farming and biofertilizer sectors are expanding demand across multiple regions. Industrial applications include water treatment and chemical processing, enhancing market reach. Manufacturers are investing in advanced extraction and formulation technologies to ensure product consistency and high quality. Collaboration with agricultural research institutions and extension programs helps optimize application methods. Regulatory compliance and environmental standards further strengthen market reliability and long-term adoption in the United States.

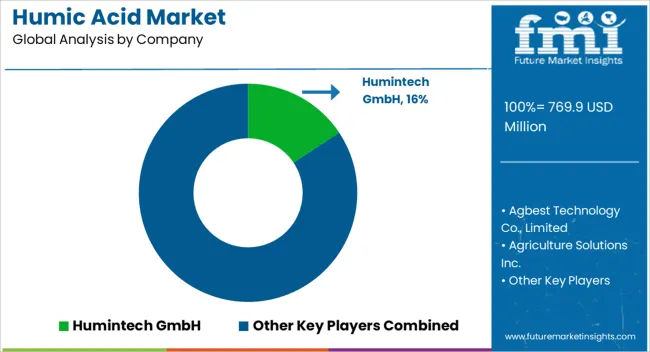

The market has witnessed considerable growth driven by increasing adoption in agriculture, soil conditioning, and crop nutrition. Humintech GmbH is recognized as a prominent provider, delivering high-quality humic acid products for soil enrichment and plant growth enhancement. Agbest Technology Co., Limited focuses on manufacturing humic acid with superior solubility and nutrient content to meet diverse agricultural requirements. Agriculture Solutions Inc. provides customized humic acid formulations for both large-scale farming and horticulture applications, emphasizing product consistency and efficacy.

Black Earth Humic LP and Biolchim S.p.A. specialize in humic acid solutions designed for enhancing soil fertility and improving crop yields. Changsha Xian Shan Yuan Agriculture and Technology Co., Ltd. and Daymsa provide humic acid products with a focus on organic and sustainable farming practices, supporting environmentally responsible agriculture. Everwood Farm and Faust Bio-Agricultural Services, Inc., cater to niche markets with specialty humic acid blends for high-value crops. Grow More, Inc. supplements this landscape by offering humic acid formulations for commercial and residential gardening, ensuring broad market coverage.

| Item | Value |

|---|---|

| Quantitative Units | USD 769.9 Million |

| Application | Agriculture, Ecological Bioremediation, Horticulture, Dietary Supplements, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Humintech GmbH, Agbest Technology Co., Limited, Agriculture Solutions Inc., Black Earth Humic LP, Biolchim S.p.A., Changsha Xian Shan Yuan Agriculture and Technology Co., Ltd., Daymsa, Everwood Farm, Faust Bio-Agricultural Services, Inc., and Grow More, Inc. |

| Additional Attributes | Dollar sales by acid type and application, demand dynamics across agriculture, horticulture, and soil amendment sectors, regional trends in organic farming adoption, innovation in extraction methods, solubility, and nutrient enhancement, environmental impact of production and land application, and emerging use cases in sustainable agriculture, soil health improvement, and biofertilizers. |

The global humic acid market is estimated to be valued at USD 769.9 million in 2025.

The market size for the humic acid market is projected to reach USD 2,070.8 million by 2035.

The humic acid market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in humic acid market are agriculture, ecological bioremediation, horticulture, dietary supplements and others.

In terms of , segment to command 0.0% share in the humic acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Humic and Fulvic Acid Based Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA