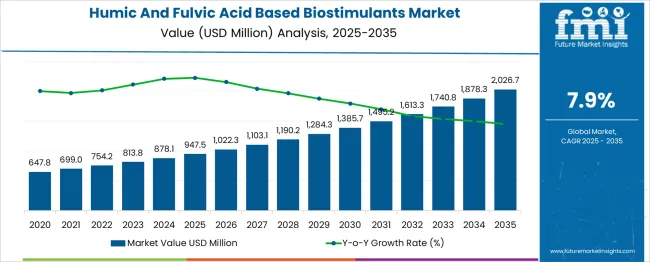

The humic and fulvic acid based biostimulants market is estimated to be valued at USD 947.5 million in 2025 and is projected to reach USD 2026.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. The growth contribution analysis reveals a back-weighted pattern throughout the forecast period. Between 2020 and 2025, the market is expected to increase from USD 647.8 million to USD 947.5 million, contributing an incremental gain of USD 299.7 million, which accounts for roughly 22% of the total growth.

Annual values during this phase include USD 699.0 million in 2021, USD 754.2 million in 2022, USD 813.8 million in 2023, and USD 878.1 million in 2024, supported by increasing adoption in agriculture driven by the demand for sustainable crop enhancement solutions. The growing emphasis on improving soil health and boosting crop yields through eco-friendly biostimulants fuels demand in this period. The second half of the forecast (2025–2035) adds USD 1,079.2 million, representing 78% of overall growth, with values advancing from USD 1,022.3 million in 2025 to USD 2,026.7 million in 2035. This acceleration is propelled by rising investments in research and development, expanded application across diverse crops, and increasing adoption in emerging markets due to the shift towards sustainable farming practices. Manufacturers focusing on innovation in product formulations, enhanced efficacy, and regulatory compliance are positioned to capture significant value in this expanding market segment.

| Metric | Value |

|---|---|

| Humic And Fulvic Acid Based Biostimulants Market Estimated Value in (2025 E) | USD 947.5 million |

| Humic And Fulvic Acid Based Biostimulants Market Forecast Value in (2035 F) | USD 2026.7 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

The humic and fulvic acid-based biostimulants market occupies a prominent position within the global agricultural inputs industry, accounting for approximately 35–38% share of the overall biostimulants category, underscoring their role in enhancing soil health and nutrient absorption. Within the broader crop nutrition solutions market, these biostimulants represent around 8–10%, reflecting their increasing application in improving yield and crop resilience without relying on synthetic chemicals.

Demand is particularly strong in organic and sustainable farming practices, where humic and fulvic acid formulations are recognized for promoting root development and improving water retention in soils. Adoption is also gaining traction in conventional agriculture due to their compatibility with fertilizers and ability to improve nutrient uptake efficiency. Growth is driven by the rising need for soil fertility restoration, especially in regions impacted by intensive cultivation and declining organic matter. In high-value crop segments such as fruits, vegetables, and horticulture, their usage is expanding rapidly, supported by the shift toward residue-free farming and compliance with stringent export standards.

Technological progress in liquid and soluble formulations is improving application efficiency, making these products more attractive for mechanized and precision farming systems. Future adoption will be shaped by regulatory endorsements for eco-safe inputs, government incentives for organic farming, and growing farmer awareness about soil microbiome management, positioning humic and fulvic acids as essential components of modern, input-optimized agriculture.

The humic and fulvic acid-based biostimulants market is experiencing sustained growth due to rising awareness about sustainable agriculture practices and the need to enhance crop productivity under abiotic stress. The shift toward organic farming and the reduced reliance on synthetic agrochemicals have created strong demand for biostimulants that improve soil health and nutrient efficiency.

Regulatory frameworks in both developed and developing regions are increasingly supporting the use of natural plant growth enhancers, accelerating market adoption. Advances in formulation technologies and targeted delivery systems are making humic and fulvic acid based products more effective and commercially viable.

The future outlook remains positive as stakeholders in the agricultural value chain seek climate-resilient inputs that can improve yield and quality while aligning with global sustainability goals. The consistent performance of these biostimulants across diverse crop types and climatic conditions is expected to further expand their application, particularly in precision and organic farming systems..

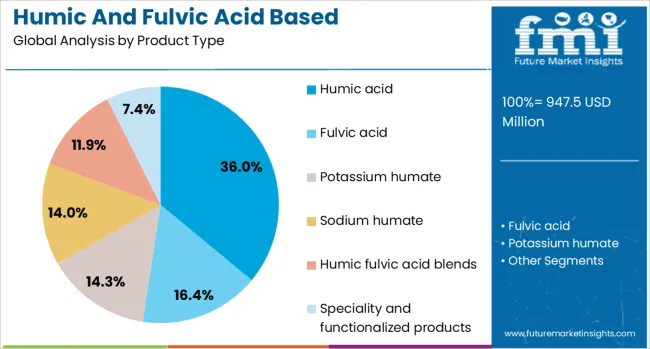

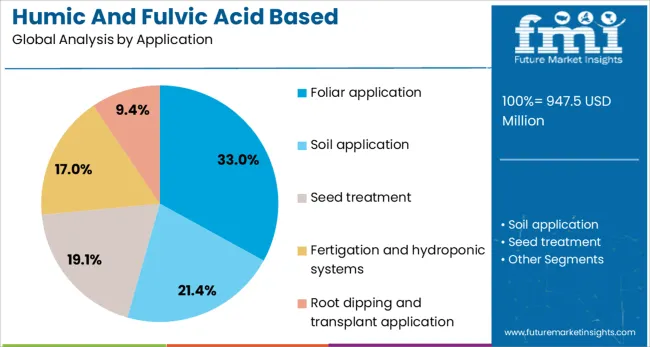

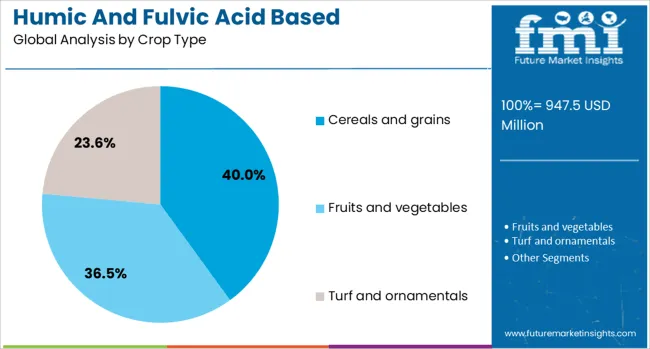

The humic and fulvic acid-based biostimulants market is segmented by product type, application, crop type, and geographic regions. The humic and fulvic acid-based biostimulants market is divided into Humic acid, Fulvic acid, Potassium humate, Sodium humate, Humic fulvic acid blends, and Specialty and functionalized products. In terms of application, the humic and fulvic acid-based biostimulants market is classified into Foliar application, Soil application, Seed treatment, Fertigation and hydroponic systems, and Root dipping and transplant application. The humic and fulvic acid-based biostimulants market is segmented into Cereals and grains, Fruits and vegetables, Turf and ornamentals, and Field crops and industrial applications. Regionally, the humic and fulvic acid-based biostimulants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The humic acid subsegment under the product type category is projected to account for 36% of the revenue share in the humic and fulvic acid based biostimulants market in 2025, making it the leading product type. This dominance is being driven by the compound’s ability to enhance nutrient uptake, improve soil structure, and stimulate microbial activity, all of which are essential for healthy plant growth.

Farmers have increasingly preferred humic acid due to its cost-effectiveness and compatibility with various fertilization practices. Its ability to chelate micronutrients and facilitate their availability to plants has contributed to widespread adoption across conventional and organic systems.

The scalability of humic acid production, combined with increased commercialization of granular and liquid formulations, has supported its market penetration. As sustainable farming practices gain momentum, humic acid continues to serve as a critical component in integrated nutrient management programs, securing its leadership within the product segment..

The foliar application subsegment under the application category is estimated to capture 33% of the revenue share in the humic and fulvic acid based biostimulants market in 2025, positioning it as the dominant application method. This method has gained preference due to its rapid action and high efficiency in nutrient absorption directly through leaf tissues.

Foliar spraying has enabled farmers to correct micronutrient deficiencies during key growth stages, leading to improved crop resilience and productivity. The segment’s growth has been influenced by its suitability for a wide range of crops and its effectiveness in addressing environmental stress conditions such as drought, salinity, and temperature fluctuations.

Application equipment compatibility and the ability to integrate foliar treatments with other agrochemicals have further boosted its practicality. Enhanced understanding of nutrient mobility and targeted delivery has led to broader adoption of foliar techniques, reinforcing its role as the preferred application method for humic and fulvic acid based biostimulants..

The cereals and grains subsegment under the crop type category is expected to hold a leading 40% revenue share in the humic and fulvic acid based biostimulants market in 2025. This growth has been attributed to the global importance of cereals and grains in food security and the increasing focus on enhancing yield quality and quantity in these staple crops.

Producers have relied on biostimulants to improve root development, nutrient absorption, and stress tolerance in high-demand crops such as wheat, maize, and rice. As pressure mounts to increase productivity with limited arable land, humic and fulvic acid based products have become essential in optimizing nutrient use efficiency and ensuring healthy crop cycles.

The segment has also benefitted from extensive use in both conventional and organic farming systems, with applications tailored to region-specific agronomic needs. Strong demand from Asia Pacific, Europe, and Latin America has further reinforced the leadership of cereals and grains in the crop type segment..

The humic and fulvic acid-based biostimulants market is expanding rapidly due to rising soil health concerns, demand from high-value crops, and growth in organic farming. Cost barriers and lack of standardization remain key challenges for wider adoption.

The growing emphasis on improving soil fertility and structure has positioned humic and fulvic acid-based biostimulants as critical inputs in agriculture. These compounds enhance nutrient availability, water retention, and root development, making them essential for crops grown in degraded or nutrient-deficient soils. Farmers are increasingly adopting these solutions to maintain productivity in the face of soil exhaustion caused by intensive farming. Their ability to improve cation exchange capacity and promote microbial activity adds long-term value to soil health. This trend is especially strong in regions where soil organic matter is declining, as humic and fulvic acids offer a cost-effective, natural alternative for restoring soil vitality without synthetic chemicals.

High-value crops such as fruits, vegetables, and horticultural plants are driving increased adoption of humic and fulvic acid-based biostimulants. These crops demand consistent nutrient availability and stress tolerance, making biostimulants an attractive solution for enhancing yield and quality. Export-oriented agricultural economies are showing strong uptake as these inputs support compliance with residue-free standards, critical for accessing premium markets. Controlled-environment agriculture and greenhouse production also leverage these products for efficient nutrient delivery in hydroponic systems. Farmers cultivating specialty crops view these formulations as vital tools for improving root uptake efficiency, ensuring better color, texture, and shelf life of produce, leading to higher profitability.

The organic farming movement and increased consumer preference for chemical-free produce have significantly boosted demand for humic and fulvic acid-based inputs. These products align well with organic certification requirements and help farmers reduce reliance on conventional agrochemicals while maintaining crop performance. Government incentives promoting organic practices, coupled with the premium pricing of organic produce, encourage farmers to incorporate these biostimulants. Their natural origin and compatibility with biofertilizers make them ideal for integrated nutrient management programs. Growth in residue-free farming for export compliance has further accelerated adoption, as producers seek solutions that improve soil microbiota without adding harmful residues, ensuring sustainable profitability.

Despite strong growth potential, the market faces challenges related to product standardization and pricing. Variability in raw material sources, especially lignite and leonardite, can affect product consistency, influencing farmer trust. The relatively higher cost of humic and fulvic acid formulations compared to synthetic alternatives remains a barrier in cost-sensitive markets. Limited awareness among small and marginal farmers in developing economies further restricts penetration. Supply chain inefficiencies and the need for tailored application guidelines add complexity to large-scale adoption. Manufacturers are addressing these concerns by investing in education programs, offering concentrated formulations, and building partnerships with cooperatives to enhance accessibility.

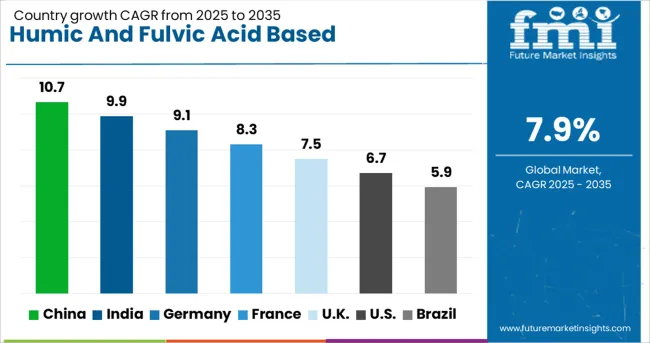

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

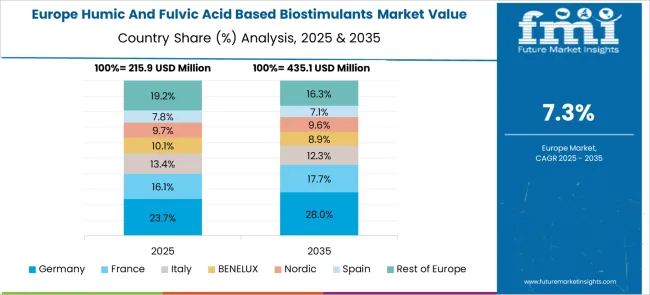

The humic and fulvic acid-based biostimulants market is projected to grow at a CAGR of 7.9% from 2025 to 2035, supported by the increasing need for soil fertility enhancement and the expansion of organic and residue-free farming practices globally. China, part of BRICS, leads with an impressive 10.7% CAGR, driven by rising adoption in high-value crops, government-backed soil health programs, and large-scale export-oriented agricultural operations. India follows closely at 9.9% CAGR, supported by growing organic farming initiatives, crop diversification, and greater awareness of natural soil conditioners in horticulture and plantation crops. Among developed markets, France posts 8.3% CAGR, benefiting from strict EU regulations on chemical inputs and rapid expansion of sustainable agriculture practices. The United Kingdom records 7.5% CAGR, propelled by increasing use of biostimulants in greenhouse farming, premium crop segments, and compliance-driven agricultural systems. The United States grows at 6.7% CAGR, reflecting consistent demand in specialty crop cultivation and rising adoption of humic-based solutions in precision agriculture. The analysis spans over 40 countries, with the five highlighted above representing leading benchmarks for growth and strategic investment opportunities in this market.

China is projected to post a CAGR of 10.7% during 2025–2035, up from approximately 9.6% in 2020–2024, driven by large-scale agricultural modernization and rising emphasis on soil restoration. This surge reflects government-backed initiatives promoting organic and chemical-free farming methods, which favor humic and fulvic acid formulations for crop health. Strong demand in fruits, vegetables, and horticulture enhances market growth, particularly as these segments target premium export markets. Local manufacturers are scaling production of cost-effective liquid and granular formulations, while international brands penetrate through partnerships and technology-driven application systems. China’s robust agricultural base and e-commerce-driven distribution have positioned it as a key global hub for biostimulant adoption.

India is expected to achieve a CAGR of 9.9% during 2025–2035, improving from 8.8% in 2020–2024, supported by growing awareness of soil health and government schemes promoting organic inputs. Farmers are adopting humic and fulvic acid-based products to enhance nutrient absorption in horticulture and cash crops, driven by rising export demand for chemical-free produce. E-commerce and agri-tech platforms are expanding distribution channels, making biostimulants accessible to Tier 2 and Tier 3 cities. Domestic producers are focusing on low-cost concentrated formulations to penetrate price-sensitive markets, while global firms target premium categories for protected cultivation and specialty crops.

France is projected to grow at a CAGR of 8.3% for 2025–2035, rising from 7.1% during 2020–2024, reflecting the country’s strong orientation toward organic agriculture and compliance with EU environmental directives. Increased demand for sustainable farming inputs in vineyards and specialty crops has accelerated adoption of humic and fulvic acids, favored for improving soil structure and enhancing crop resilience. French biostimulant manufacturers are investing in advanced extraction processes to produce high-purity formulations for premium markets, while partnerships with cooperatives ensure steady demand from smallholder farmers. Regulatory support and certification frameworks further enhance product credibility, positioning France as a mature yet growing market.

The United Kingdom is anticipated to record a CAGR of 7.5% for 2025–2035, up from 3.4% during 2020–2024, driven by expanding adoption in greenhouse farming, specialty crops, and compliance-focused agriculture. The previous decade witnessed slow uptake due to limited farmer awareness and high product costs. Post-2024, stronger demand for residue-free produce and regulatory pressure to reduce synthetic inputs have accelerated market growth. Partnerships between manufacturers and agri-retailers, coupled with targeted education programs, have improved accessibility. Increasing popularity of precision farming and high-value horticulture crops further supports demand for humic and fulvic acids as vital soil health enhancers.

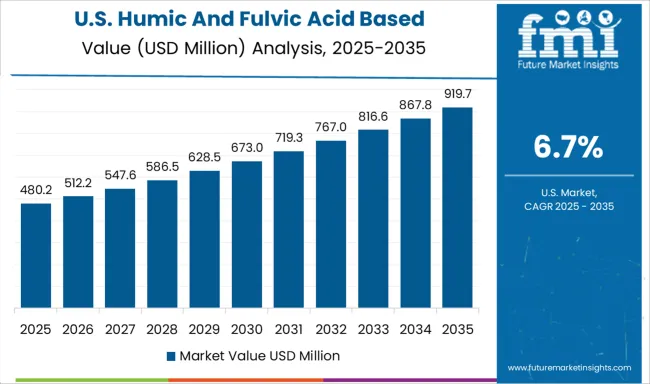

The USA is expected to post a CAGR of 6.7% between 2025–2035, compared to 5.2% during 2020–2024, signaling steady but slower growth than emerging economies. Increased interest in regenerative agriculture and organic crop production is creating opportunities for humic and fulvic acid-based inputs. Adoption is particularly strong in specialty crops such as berries, nuts, and vineyards, which demand improved soil quality for premium yields. Leading companies are investing in liquid and water-soluble formulations compatible with mechanized application systems. Retail chains and e-commerce platforms are enhancing market reach, while partnerships with large-scale farms support bulk distribution and value-added service offerings.

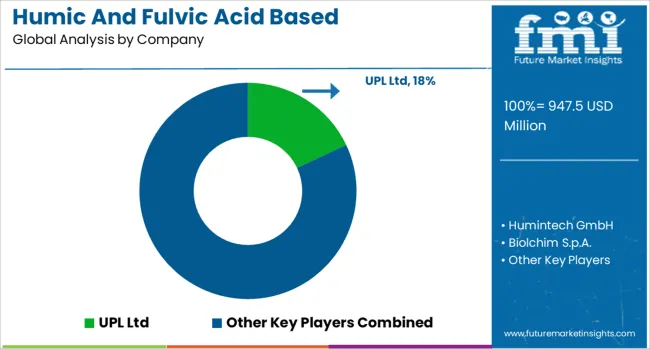

The humic and fulvic acid-based biostimulants market is highly competitive, featuring global leaders and regional innovators such as UPL Ltd, Humintech GmbH, Biolchim S.p.A., AgriLife, Valagro, and Haifa Group. These companies compete on formulation quality, application efficiency, and cost-effectiveness to cater to diverse agricultural segments including horticulture, row crops, and protected cultivation. UPL Ltd holds a strong global presence by integrating humic-based solutions into its extensive crop protection portfolio, emphasizing improved soil structure and nutrient uptake.

Humintech GmbH differentiates with premium-grade humic and fulvic extracts derived from natural sources, targeting high-value crops and certified organic farming systems. Biolchim S.p.A. focuses on product innovation with advanced liquid formulations, positioning itself as a key player in specialty crop nutrition. AgriLife strengthens its market share through bio-based inputs for integrated farming, catering to domestic and export markets with a focus on cost-sensitive farmers. Valagro, now part of Syngenta Group, invests heavily in R&D and precision agriculture integration, offering solutions tailored for climate-resilient farming. Haifa Group leverages its expertise in water-soluble fertilizers to deliver synergistic solutions combining humic acids with micronutrients for efficient fertigation practices. Competitive strategies include expanding distribution networks, forming alliances with agri-tech platforms, and educating farmers on soil microbiome enhancement. Future growth hinges on precision application, concentrated liquid formulations for mechanized farming, and alignment with residue-free agricultural practices to meet the increasing demand for sustainable crop production globally.

Growing adoption of organic farming methods has increased reliance on humic and fulvic acid-based biostimulants in 2024 and 2025. Formulation improvements, such as nano-carrier systems and compatibility with fertigation practices, have strengthened product performance across diverse crops.

Soil fertility decline and higher yield expectations have driven demand in horticulture and broad-acre applications. Supportive regulations across Europe and North America have improved product approvals, while emerging markets have shown a preference for humic-fulvic blends for cost efficiency and soil health enhancement.

| Item | Value |

|---|---|

| Quantitative Units | USD 947.5 Million |

| Product Type | Humic acid, Fulvic acid, Potassium humate, Sodium humate, Humic fulvic acid blends, and Speciality and functionalized products |

| Application | Foliar application, Soil application, Seed treatment, Fertigation and hydroponic systems, and Root dipping and transplant application |

| Crop Type | Cereals and grains, Fruits and vegetables, Turf and ornamentals, and Field crops and industrial applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UPL Ltd, Humintech GmbH, Biolchim S.p.A., AgriLife, Valagro, and Haifa Group |

The global humic and fulvic acid based biostimulants market is estimated to be valued at USD 947.5 million in 2025.

The market size for the humic and fulvic acid based biostimulants market is projected to reach USD 2,026.7 million by 2035.

The humic and fulvic acid based biostimulants market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in humic and fulvic acid based biostimulants market are humic acid, fulvic acid, potassium humate, sodium humate, humic fulvic acid blends and speciality and functionalized products.

In terms of application, foliar application segment to command 33.0% share in the humic and fulvic acid based biostimulants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Humic Acid Market Size and Share Forecast Outlook 2025 to 2035

Dimer Acid-based (DABa) Polyamide Resin Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Levulinic Acid Market Growth - Trends & Forecast 2025 to 2035

Demand for Bio-Based Levulinic Acid in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Bio-Based Levulinic Acid in Japan Size and Share Forecast Outlook 2025 to 2035

Palm Kernel Oil and Coconut Oil Based Natural Fatty Acids Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Biostimulants Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

AI-Based Data Observability Software Market Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA