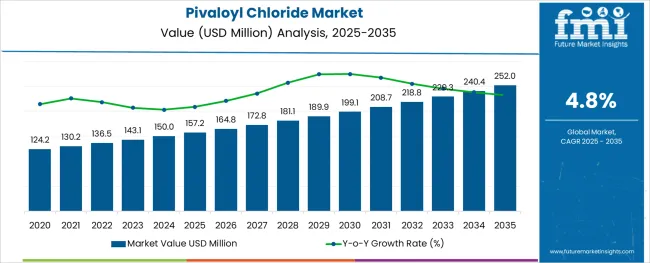

The Pivaloyl Chloride Market is estimated to be valued at USD 157.2 million in 2025 and is projected to reach USD 252.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

The pivaloyl chloride market is expanding steadily, driven by its critical role as an intermediate in the pharmaceutical industry. The increasing demand for advanced drug formulations and specialty chemicals has amplified the need for high-purity chemical intermediates. Pharmaceutical companies have focused on efficient synthesis processes and complex molecule development, where pivaloyl chloride is used to introduce protective groups and facilitate compound modifications.

Regulatory emphasis on drug safety and quality has further supported the adoption of reliable chemical intermediates. Moreover, growth in generic and branded pharmaceuticals, particularly in emerging markets, has contributed to increased consumption of intermediates such as pivaloyl chloride.

Advances in manufacturing technology and process optimization have improved production yields and reduced environmental impact. The market outlook remains positive as pharmaceutical innovation continues, with pivaloyl chloride playing a vital role in drug development pipelines. Segmental growth is expected to be led by pharmaceutical intermediates in application and the pharmaceuticals sector in end-use industry.

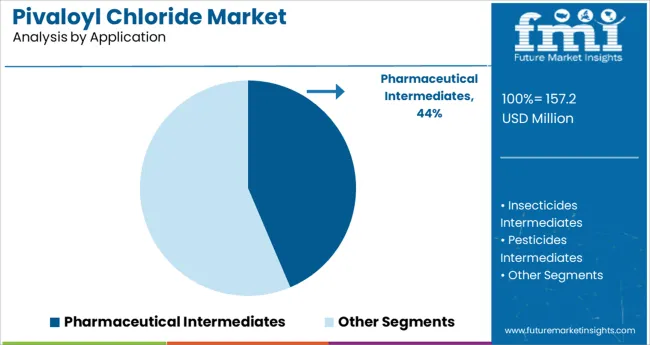

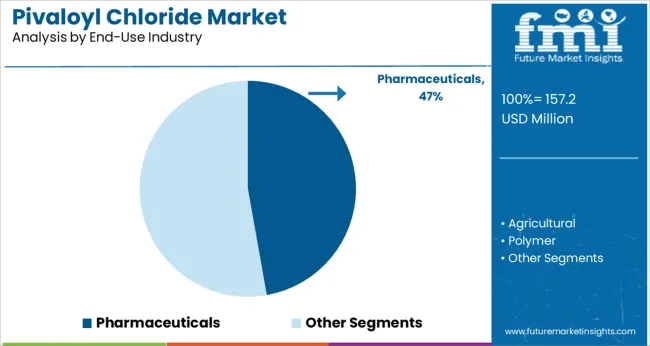

The market is segmented by Application and End-Use Industry and region. By Application, the market is divided into Pharmaceutical Intermediates, Insecticides Intermediates, and Pesticides Intermediates. In terms of End-Use Industry, the market is classified into Pharmaceuticals, Agricultural, Polymer, and Other (Chemical Industry).

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceutical intermediates segment is projected to hold 43.6% of the pivaloyl chloride market revenue in 2025, maintaining its position as the leading application segment. Growth of this segment has been supported by the compound’s extensive use in synthesizing active pharmaceutical ingredients and specialty chemicals. Pivaloyl chloride’s ability to facilitate chemical modifications and improve drug stability has made it essential in pharmaceutical synthesis.

The segment benefits from continuous research and development efforts aimed at creating novel therapeutic compounds. Additionally, the rising production of generic drugs and complex formulations has increased demand for reliable chemical intermediates.

As pharmaceutical pipelines evolve, the use of pivaloyl chloride in drug manufacturing processes is expected to remain strong.

The pharmaceuticals end-use segment is projected to contribute 47.2% of the market revenue in 2025, establishing itself as the dominant sector. This segment’s growth is driven by expanding drug manufacturing activities and increasing investment in pharmaceutical research and development. The demand for high-quality intermediates such as pivaloyl chloride is tied to the overall health of the pharmaceutical industry and the pace of new drug approvals.

Moreover, stringent quality control requirements and regulatory compliance in pharmaceutical production have heightened the need for consistent and pure chemical inputs. Growing healthcare infrastructure and increased access to medicines in emerging economies are further accelerating market expansion.

The pharmaceuticals segment is expected to continue its leadership role supported by ongoing innovation and increased drug development efforts.

The rapid growth of end-use industries such as chemical, agrochemical, and pharmaceutical is a major factor driving the demand for pivaloyl chloride.

Pivaloyl chloride has become an ideal intermediate candidate for manufacturing a wide range of pharmaceutical and agrochemical products.

Factors such as a surge in diseases worldwide and increasing healthcare spending have ignited the growth of the pharmaceutical industry worldwide. People are spending large amounts on pharmaceutical drugs. As many of these pharmaceuticals are manufactured by using pivaloyl chloride as an intermediate, the rising dale for these products will eventually push the demand for pivaloyl chloride during the forecast period.

Similarly, rising concerns about food insecurity are prompting farmers to use agrochemicals like herbicides, fertilizers, pesticides, etc. According to the Food and Agriculture Organization (FAO) of the United Nations, globally, hunger levels remained alarmingly high during 2024 with around 193 million people facing acute food insecurity. This is acting as a catalyst for the growth of the pivaloyl chloride market and the trend is likely to continue during the forecast period.

Despite multiple applications of pivaloyl chloride, there are certain factors that are limiting the growth of the pivaloyl chloride industry. Some of these factors include the presence of stringent regulations pertaining to the use of insecticides and pesticides, the hazardous nature of pivaloyl chloride, and the availability of various alternative pharmaceutical and pesticide intermediates.

Various countries are introducing regulations on the excessive use of insecticides and pesticides as they are harmful to humans, animals, and the environment. This in turn is creating major challenges for manufacturers of pivaloyl chloride.

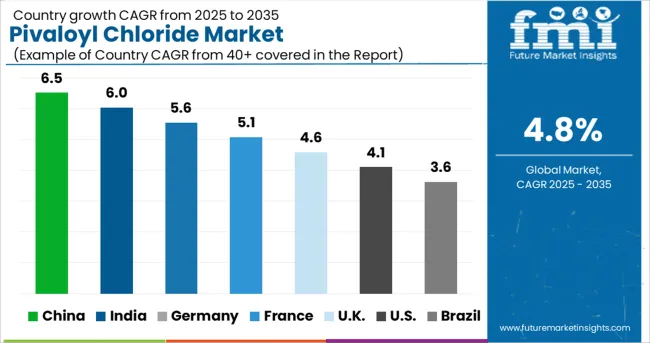

Asia Pacific remains the most lucrative market for pivaloyl chlorides and the trend is likely to continue in the foreseeable future, owing to the booming agricultural and chemical industries, presence of lax government regulations, increasing consumer spending, and heavy presence of some of the world’s leading manufacturers in China.

During the last few years, there has been a substantial rise in the demand for pesticides, insecticides, and pharmaceutical compounds across countries like China and India and this trend is likely to continue during the assessment period. This is providing a strong thrust to the growth of the pivaloyl chloride market in the region.

China remains at the epicenter of pivaloyl chloride market growth due to exploding agricultural and chemical industries, robust urbanization, increasing spending on pharmaceuticals, and favorable government support.

According to Future Market Insights, Europe will emerge as the second most lucrative market for pivaloyl chloride during the forecast period. Factors such as the rapid expansion of pharmaceuticals and polymer industries, availability of advanced manufacturing technologies, and increasing usage of pivaloyl in a wide range of applications are driving the growth in the pivaloyl chloride market in Europe.

Countries like the United Kingdom and Germany are experiencing high demand for pivaloyl chloride on the back of increased spending on pharmaceutical products, the rising popularity of intensive farming, and a surge in research and development by manufacturers to explore more applications of pivaloyl chloride.

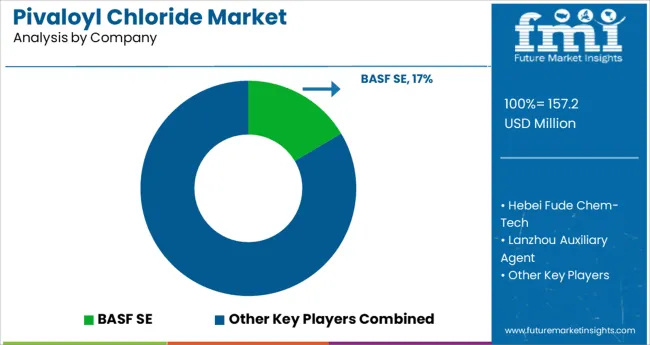

Some of the key participants present in the global pivaloyl chloride market include BASF SE, Lanzhou Auxiliary Agent, Hebei Fude Chem-Tech, CABB Chemicals, VWR International, LLC., Shandong Jiahong Chemical, Lubon Chemical, AIHENG Industry, Shandong Minji Chemical, and JSN Chemicals LTD.

These leading companies are continuously focusing on expanding their production capacities as well as investing in research and development to find new applications of pivaloyl chloride.

Further, they have adopted various organic and inorganic strategies such as partnerships, mergers, acquisitions, collaborations, and the establishment of new manufacturing facilities across attractive regions to get an upper hand in the global pivaloyl chloride market.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.3% - 6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Application, End-Use Industry, Region |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; Asia Pacific; Japan; Middle East and Africa |

| Key Countries Profiled |

USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled |

BASF SE; Lanzhou Auxiliary Agent; Hebei Fude Chem-Tech; CABB Chemicals; VWR International, LLC.; Shandong Jiahong Chemical; Lubon Chemical; AIHENG Industry; Shandong Minji Chemical; JSN Chemicals LTD |

| Customization | Available Upon Request |

The global pivaloyl chloride market is estimated to be valued at USD 157.2 million in 2025.

It is projected to reach USD 252.0 million by 2035.

The market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types are pharmaceutical intermediates, insecticides intermediates and pesticides intermediates.

pharmaceuticals segment is expected to dominate with a 47.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Ferric Chloride Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Cupric Chloride Companies

Calcium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Choline Chloride Market Size and Share Forecast Outlook 2025 to 2035

Thionyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Valeryl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Chloride Hexahydrate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Chloride Food Grade Market Growth - Demand & Trends 2025 to 2035

Cyanuric Chloride Market

Polyvinyl Chloride (PVC) Packaging Film Market Forecast and Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Copper Oxychloride Market Size and Share Forecast Outlook 2025 to 2035

Aluminium Chloride Market Analysis - Size, Share & Forecast 2025 to 2035

Potassium Chloride Market Growth – Trends & Forecast 2025 to 2035

Polyvinyl Chloride Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA