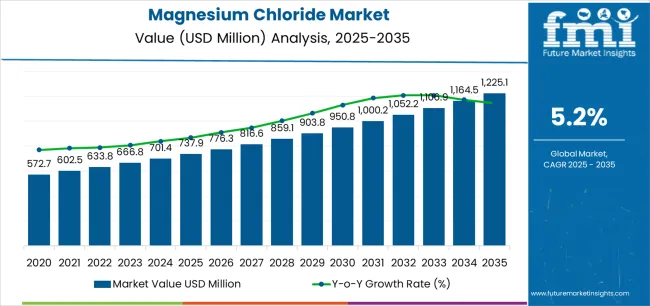

The global magnesium chloride market is projected to grow from USD 737.9 million in 2025 to USD 1,225.1 million by 2035, advancing at a CAGR of 5.2%. The first half of the decade (2025 to 2030) will witness the market climbing from USD 737.9 million to approximately USD 950.8 million, adding USD 212.9 million in value, which constitutes 44% of the total forecast growth period.

This phase will be characterized by the rapid adoption of solid magnesium chloride systems in flake and pellet forms, driven by increasing winter maintenance requirements and the growing need for environmentally responsible de-icing solutions that minimize infrastructure corrosion. Advanced corrosion-inhibitor packages and liquid brine formulations will become standard expectations rather than premium options.

The latter half (2030 to 2035) will witness growth from USD 950.8 million to USD 1,225.1 million, representing an addition of USD 274.6 million or 56% of the decade's expansion. This period will be defined by mass market penetration of specialized magnesium chloride derivatives, integration with comprehensive dust-control and soil stabilization applications, and seamless compatibility with existing industrial water treatment infrastructure.

The market trajectory signals fundamental shifts in how municipalities and industrial operators approach winter maintenance and chemical processing, with participants positioned to benefit from demand across multiple product forms and application segments.

The magnesium chloride market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its technology adoption phase, expanding from USD 737.9 million to USD 950.8 million with steady annual increments averaging 5.2% growth. This period showcases the transition from basic solid magnesium chloride formulations to advanced liquid brine systems with enhanced corrosion-inhibitor packages and automated application systems becoming mainstream features.

The 2025 to 2030 phase adds USD 212.9 million to market value, representing 44% of total decade expansion. Market maturation factors include standardization of de-icing protocols, declining transportation costs for specialized product forms, and increasing municipal awareness of magnesium chloride benefits reaching lower corrosion rates and improved environmental profiles compared to traditional road salt applications.

Competitive landscape evolution during this period features established mineral producers like ICL Group and Compass Minerals expanding their winter maintenance portfolios while specialty chemical manufacturers focus on advanced formulation development and enhanced application capabilities.

From 2030 to 2035, market dynamics shift toward advanced chemical integration and global infrastructure maintenance expansion, with growth continuing from USD 950.8 million to USD 1,225.1 million, adding USD 274.6 million or 56% of total expansion.

This phase transition centers on specialized magnesium chloride derivative systems, integration with automated winter maintenance networks, and deployment across diverse industrial scenarios, becoming standard rather than specialized applications. The competitive environment matures with focus shifting from basic de-icing capability to comprehensive road treatment systems and integration with smart city infrastructure platforms.

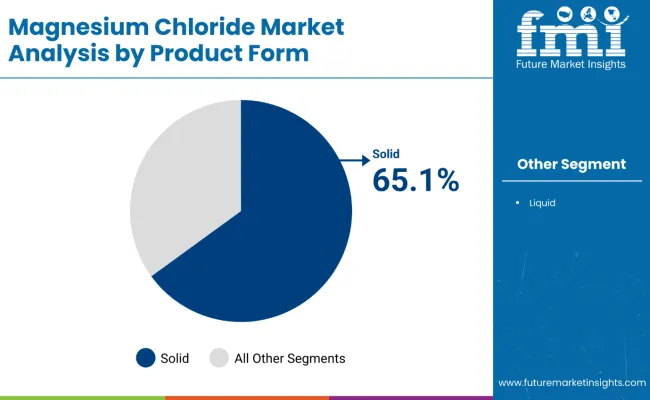

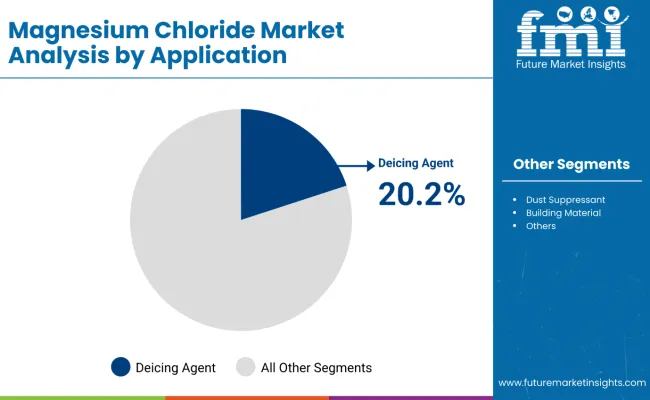

The market demonstrates strong fundamentals with solid product forms capturing a dominant 65.1% share through advanced handling convenience and municipal application capabilities. De-icing agent applications drive primary demand with 20.2% share, supported by increasing winter maintenance requirements and environmentally responsible road treatment technology needs. Geographic expansion remains concentrated in established cold-climate markets with mature winter maintenance infrastructure, while emerging economies show accelerating adoption rates driven by industrial chemical processing expansion and rising construction material standards.

At-a-Glance Metrics

| Metric | Value |

|---|---|

| Market Value (2025) | USD 737.9 million |

| Market Forecast (2035) | USD 1,225.1 million |

| Growth Rate | 5.2% CAGR |

| Leading Product Form | Solid (65.1% share) |

| Primary Application | De-icing Agent (20.2% share) |

Market expansion rests on three fundamental shifts driving adoption across the municipal maintenance and industrial processing sectors.

1. Winter maintenance optimization creates compelling operational advantages through magnesium chloride that provides effective ice prevention and melting capabilities with lower infrastructure corrosion compared to traditional sodium chloride, enabling highway departments to meet safety standards while maintaining pavement integrity and reducing long-term repair costs.

2. Environmental responsibility mandates accelerate as municipalities worldwide seek advanced de-icing systems that complement existing winter maintenance infrastructure, enabling reduced environmental impact and infrastructure preservation that align with eco-conscious standards and asset management regulations.

3. Industrial chemical processing enhancement drives adoption from chemical manufacturers and water treatment operators requiring effective brine management solutions that support desalination, dust control, and construction material applications during diverse industrial and manufacturing operations.

The growth faces headwinds from raw material supply challenges that vary across mineral producers regarding the extraction of magnesium chloride from seawater, brine lakes, or mineral deposits, which may limit operational flexibility in supply-constrained or cost-sensitive municipal environments.

Application limitations also persist regarding temperature sensitivity and moisture absorption characteristics that may reduce storage stability or handling efficiency in humid climates or extended storage scenarios, which affect product quality and application consistency.

The magnesium chloride market represents a multifaceted chemical commodity opportunity driven by expanding global winter maintenance infrastructure, industrial chemical processing, and the need for superior de-icing effectiveness and environmental performance in municipal and industrial applications.

As municipalities worldwide seek to achieve safer winter roads, reduce infrastructure corrosion, and integrate environmentally responsible road treatment systems with asset management platforms, magnesium chloride is evolving from basic de-icing salt to sophisticated multi-functional chemical solutions that ensure transportation safety, infrastructure longevity, and operational efficiency.

The convergence of winter maintenance expansion, industrial brine processing enhancement, and advanced formulation development creates demand drivers across multiple application segments. The market's growth trajectory from USD 737.9 million in 2025 to USD 1,225.1 million by 2035 at a 5.2% CAGR reflects fundamental shifts in municipal maintenance requirements and chemical processing optimization.

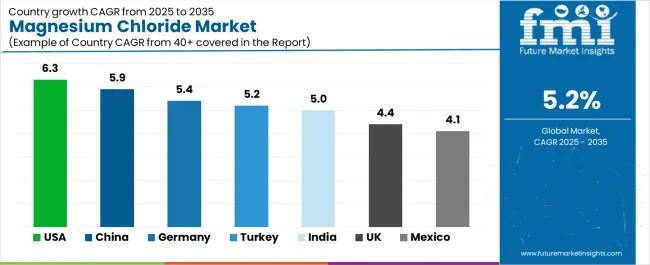

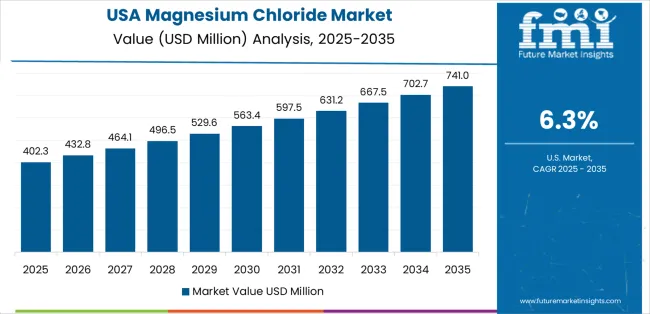

Geographic expansion opportunities are particularly pronounced in North American markets, where the USA (6.3% CAGR) leads through severe-winter de-icing demand and industrial applications. The dominance of solid product forms (65.1% market share) and de-icing applications (20.2% share) provides clear strategic focus areas, while emerging industrial chemical and construction material applications open new revenue streams across diverse mineral processing markets.

Strengthening the dominant solid segment (65.1% market share) through enhanced product forms, superior handling characteristics, automated application systems, and seamless integration with municipal winter maintenance infrastructure. This pathway focuses on optimizing flake morphology, improving storage stability, extending application effectiveness across diverse temperature ranges, and developing specialized formulations for various de-icing and industrial applications.

Market leadership consolidation through advanced mineral processing, comprehensive quality control, and storage optimization enables premium positioning while defending competitive advantages against alternative de-icing chemicals and expanding market penetration across municipal and industrial applications. Expected revenue pool: USD 115-175 million

Rapid winter maintenance growth across the USA (6.3% CAGR) creates substantial expansion opportunities through state DOT partnerships, municipal supply agreements, and comprehensive distribution network development. Severe-winter climate conditions, infrastructure preservation priorities, and environmental regulations drive demand for advanced magnesium chloride systems.

Geographic expansion strategies reduce transportation costs, enable faster municipal delivery, and position companies advantageously for state procurement programs while accessing growing domestic markets requiring environmentally responsible de-icing solutions for roads, highways, and transportation infrastructure. Expected revenue pool: USD 100-155 million

Expansion within the dominant de-icing segment (20.2% market share) through specialized formulations addressing roads & highways requirements, airport runway applications, and comprehensive corrosion-inhibitor reliability for transportation infrastructure. This pathway encompasses liquid brine systems, pre-treatment solutions, cost-effective solid formulations, and compatibility with diverse winter maintenance equipment.

Premium positioning reflects superior ice-melting performance, lower corrosion characteristics, and comprehensive environmental compliance that supports modern transportation safety while enabling integration with advanced weather monitoring and smart application systems. Expected revenue pool: USD 85-135 million

Strategic expansion into chemicals & derivatives applications (24.5% market share) requires enhanced purity standards, superior performance consistency, and specialized formulations addressing diverse industrial requirements. This pathway addresses magnesium oxychloride cement production, brine/chemical processing applications, dust-control formulations, and industrial derivative markets with advanced mineral processing for demanding quality specifications. Premium pricing reflects specialized performance requirements, extended purity standards, and comprehensive technical support necessary for industrial chemical applications while creating opportunities for long-term supply agreements and specialized processing services. Expected revenue pool: USD 75-120 million

Development of liquid magnesium chloride brine formulations with corrosion-inhibitor packages addressing pre-wetting applications, anti-icing requirements, and automated municipal spraying systems. This pathway encompasses storage tank systems, heated application equipment, freeze-protection additives, and cost-effective alternatives for progressive winter maintenance programs.

Technology differentiation through proprietary inhibitor packages, application-specific concentration optimization, and comprehensive technical support enables diversified revenue streams while reducing dependency on solid product forms and expanding addressable market opportunities in advanced winter maintenance segments. Expected revenue pool: USD 60-100 million

Integration of magnesium chloride into construction material applications, particularly magnesium oxychloride cement (Sorel cement) systems, enabling lightweight building panels, fireproof materials, and specialized construction solutions. This pathway encompasses cement admixtures, panel manufacturing, architectural applications, and extensive material science development for construction innovation.

Premium positioning through advanced material properties, fire resistance capabilities, and extensive construction compatibility creates opportunities for building material partnerships and ongoing customer relationships through material-enabled construction innovation. Expected revenue pool: USD 50-85 million

Development of dust-control formulations addressing unpaved road stabilization, mining haul road applications, construction site management, and agricultural soil conditioning across diverse operational environments. This pathway encompasses hygroscopic moisture retention, road base stabilization, regulatory compliance solutions, and comprehensive environmental documentation for industrial and municipal requirements.

Premium positioning reflects operational effectiveness, environmental safety, and dust suppression capabilities while enabling access to mining industry partnerships, construction contractor programs, and comprehensive soil management support across diverse dust-control applications. Expected revenue pool: USD 40-70 million

Primary Classification: The market segments by product form into Solid (including Flakes, Pellets/Prills, Granules/Powders, and Other solid forms) and Liquid, representing the evolution from basic mineral salt formulations to specialized chemical solutions for comprehensive municipal and industrial applications.

Secondary Classification: Application segmentation divides the market into De-icing agent (including Roads & highways, Airports & runways, Municipal/parking & sidewalks, and Rail & other transport), Industrial processing, and other sectors, reflecting distinct requirements for ice-melting performance, corrosion control capacity, and application efficiency standards.

Tertiary Classification: End-use segmentation encompasses Chemicals & derivatives (including Magnesium oxychloride cement, Brine/chemical processing, Dust-control formulations, and Other derivatives), Construction materials, Agriculture, and other sectors, demonstrating the diverse application scope beyond traditional winter maintenance.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with established cold-climate markets leading adoption while emerging economies show accelerating growth patterns driven by industrial chemical processing expansion programs.

The segmentation structure reveals technology progression from standard solid magnesium chloride formulations toward specialized liquid brine systems with enhanced corrosion-inhibitor and automated application capabilities, while application diversity spans from winter road maintenance to specialized industrial chemical processing and construction material manufacturing requiring precise magnesium chloride solutions.

Market Position: Solid magnesium chloride systems command the leading position in the Magnesium Chloride market with approximately 65.1% market share through advanced handling convenience features, including ease of storage, transportation efficiency, and application flexibility that enable municipalities and industrial operators to achieve optimal deployment across diverse winter maintenance and chemical processing environments.

Value Drivers: The segment benefits from municipal preference for reliable product forms that provide consistent de-icing performance, enhanced shelf stability, and straightforward application without requiring significant specialized equipment. Advanced solid formulations enable automated spreader systems, performance consistency, and integration with existing winter maintenance equipment, where handling convenience and storage reliability represent critical operational requirements.

Competitive Advantages: Solid magnesium chloride systems differentiate through proven storage stability, consistent product quality, and integration with standard spreading equipment that enhance operational effectiveness while maintaining optimal ice-melting performance suitable for diverse road maintenance and industrial applications.

Key market characteristics:

Flake magnesium chloride maintains the dominant position within the solid segment at approximately 28.0% of total market share due to superior handling characteristics and proven de-icing effectiveness. These formulations appeal to highway departments and municipalities requiring maximum ice-melting capacity for high-traffic road applications. Market leadership is driven by extensive field testing, reliable performance data, and established procurement protocols across major state DOT programs.

Pellet and prill magnesium chloride systems hold approximately 22.0% of total market share, focusing on automated spreading equipment compatibility and reduced dust generation during storage and handling operations for municipal winter maintenance applications.

Granule and powder formulations account for approximately 11.0% of total market share through specialized performance characteristics and rapid dissolution capabilities for industrial chemical processing and construction material applications.

Market Context: De-icing agent applications dominate the Magnesium Chloride market with approximately 20.2% market share due to widespread adoption of magnesium chloride systems and increasing focus on winter road safety, infrastructure preservation, and environmentally responsible ice control applications that minimize corrosion damage while maintaining transportation network reliability.

Appeal Factors: Municipal highway departments prioritize system effectiveness, infrastructure compatibility, and integration with existing winter maintenance operations that enables coordinated magnesium chloride application across multiple road network systems. The segment benefits from substantial public sector investment and winter safety programs that emphasize the acquisition of environmentally responsible de-icing systems for road safety and asset preservation applications.

Growth Drivers: Winter maintenance programs incorporate magnesium chloride as standard material for ice control operations, while municipal safety initiatives increase demand for advanced de-icing capabilities that comply with environmental standards and minimize infrastructure corrosion.

Market Challenges: Varying winter climate conditions and road maintenance budget constraints may limit system adoption across different municipalities or operational scenarios.

Application dynamics include:

Roads and highways applications capture approximately 13.0% of total market share through high-volume winter maintenance requirements, extensive road network coverage, and critical transportation safety optimization needs.

Airport and runway applications account for approximately 4.1% of total market share through aviation safety requirements, rapid ice-melting needs, and specialized airfield maintenance protocols.

Municipal parking and sidewalk applications represent approximately 2.1% of total market share through pedestrian safety optimization, community winter maintenance, and localized ice-control applications.

Rail and other transportation applications account for approximately 1.0% of total market share through specialized track maintenance, switch de-icing, and rail infrastructure winter safety operations.

Growth Accelerators: Winter road safety requirements drive primary adoption as magnesium chloride provides effective ice-melting capabilities with lower infrastructure corrosion compared to traditional sodium chloride, enabling municipalities to meet transportation safety standards while preserving pavement and bridge infrastructure, supporting public safety missions that require reliable winter maintenance and asset preservation applications. Environmental responsibility mandates accelerate market expansion as highway departments seek effective de-icing systems that minimize ecological impact while maintaining winter road safety during snow and ice events. Industrial chemical processing spending increases worldwide, creating demand for magnesium chloride systems that complement existing brine management and chemical manufacturing infrastructure and provide operational flexibility in diverse processing environments.

Growth Inhibitors: Raw material supply concentration varies across mineral producers regarding the extraction of magnesium chloride from seawater evaporation, brine lakes, or mineral deposits, which may limit supply flexibility and market availability in regions with limited natural resource access or transportation infrastructure. Product handling challenges persist regarding hygroscopic moisture absorption and storage stability that may reduce product quality in humid environments or extended storage periods, affecting application performance and material consistency. Market seasonality across winter maintenance segments creates procurement volatility between summer planning periods and winter application seasons.

Market Evolution Patterns: Adoption accelerates in northern climate municipalities and winter maintenance sectors where road safety benefits justify magnesium chloride costs, with geographic concentration in established cold-weather markets transitioning toward mainstream adoption in moderate-climate regions driven by occasional winter storm preparedness and proactive ice-control strategies. Technology development focuses on enhanced liquid brine formulations, improved corrosion-inhibitor packages, and integration with automated weather monitoring systems that optimize application timing and material effectiveness. The market could face disruption if alternative de-icing technologies, climate warming trends, or infrastructure design innovations significantly limit the demand for chemical ice control in transportation or industrial applications.

| Country | CAGR (2025-2035) |

|---|---|

| USA | 6.3% |

| China | 5.9% |

| Germany | 5.4% |

| Turkey | 5.2% |

| India | 5.0% |

| United Kingdom | 4.4% |

| Mexico | 4.1% |

The Magnesium Chloride market demonstrates varied regional dynamics with Growth Leaders including the USA (6.3% CAGR) driving expansion through severe-winter de-icing demand and extensive industrial applications.

Steady Performers encompass China (5.9% CAGR), Germany (5.4% CAGR), and Turkey (5.2% CAGR), benefiting from established industrial chemical sectors and advancing winter maintenance adoption. Moderate Growth Markets feature India (5.0% CAGR), United Kingdom (4.4% CAGR), and Mexico (4.1% CAGR), where specialized applications and industrial processing support consistent growth patterns.

Regional synthesis reveals North American and European markets leading adoption through winter maintenance infrastructure and environmentally responsible de-icing programs, while Asian markets maintain steady expansion supported by industrial chemical processing and construction material development. Emerging markets show moderate growth driven by industrial expansion and dust-control applications.

The United States establishes market leadership through extensive severe-winter de-icing demand in northern states and comprehensive industrial applications, integrating magnesium chloride as a standard component in highway maintenance operations and dust-control installations.

The country's 6.3% CAGR reflects state DOT initiatives promoting lower-corrosion winter maintenance solutions and industrial capabilities that mandate the use of environmentally responsible de-icing systems in transportation safety and infrastructure preservation facilities. Growth concentrates in major snow-belt states, including Michigan, Minnesota, Wisconsin, Pennsylvania, and New York, where winter maintenance programs showcase integrated magnesium chloride systems that appeal to highway departments seeking reduced infrastructure corrosion and environmental compliance applications.

American mineral producers are developing cost-effective magnesium chloride solutions that combine domestic production advantages with advanced formulation features, including corrosion-inhibitor packages and liquid brine systems. Distribution channels through state DOT contracts and municipal procurement programs expand market access, while federal highway safety standards support adoption across diverse winter maintenance and industrial dust-control segments.

Strategic Market Indicators:

In Beijing, Shanghai, and Guangzhou construction corridors, industrial chemical manufacturers and construction material producers are implementing magnesium chloride as standard material for cement production and chemical processing applications, driven by increasing construction activity and industrial expansion programs that emphasize the importance of specialized chemical additives for manufacturing operations.

The market demonstrates a 5.9% CAGR, supported by government infrastructure initiatives and industrial development programs that promote advanced chemical systems for construction materials and brine management facilities. Chinese industrial operators are adopting magnesium chloride systems that provide consistent chemical purity and processing compatibility, particularly appealing in regions where large-scale construction and agricultural supplementation represent critical operational applications.

Market expansion benefits from growing domestic mineral extraction capabilities and seawater processing facilities that enable local production of magnesium chloride systems for industrial and agricultural applications. Technology adoption follows patterns established in industrial chemicals, where quality consistency and cost-effectiveness drive procurement decisions and manufacturing deployment.

Market Intelligence Brief:

The advanced municipal infrastructure in Germany demonstrates sophisticated magnesium chloride deployment with documented environmental effectiveness in low-corrosion de-icing applications through integration with existing winter maintenance systems and transportation infrastructure.

The country leverages engineering expertise in environmentally responsible road maintenance and chemical processing operations to achieve a 5.4% CAGR. Major highway networks, including the Autobahn system and urban arterials in Munich, Frankfurt, and Berlin, showcase premium installations where magnesium chloride systems integrate with comprehensive weather monitoring platforms and automated pre-treatment programs to optimize winter road safety and infrastructure preservation.

German municipalities prioritize environmental compliance and infrastructure longevity in magnesium chloride deployment, creating demand for premium formulations with advanced features, including corrosion-inhibitor packages and liquid brine compatibility. The market benefits from established environmental regulations and willingness to invest in advanced winter maintenance technologies that provide long-term asset preservation benefits and compliance with environmental standards.

Market Intelligence Brief:

The magnesium chloride market in Turkey emphasizes industrial chemical applications and winter maintenance in highland regions, including eastern Anatolia and mountain passes, where magnesium chloride provides effective ice control and dust suppression for transportation and mining operations.

The country demonstrates a 5.2% CAGR, driven by industrial growth in cement and chemical sectors and expanding winter maintenance requirements that support magnesium chloride integration. Turkish industrial operators prioritize cost-effectiveness with magnesium chloride systems delivering consistent performance through affordable formulations and reliable supply availability.

Technology deployment channels include cement manufacturers, highway maintenance departments, and industrial chemical processors that support diverse applications for construction materials and winter safety scenarios. Port logistics integration with dust-control applications expands market appeal across industrial operational requirements seeking environmental compliance benefits.

Performance Metrics:

India demonstrates steady market development with a 5.0% CAGR, distinguished by construction material manufacturers' preference for magnesium oxychloride cement systems and industrial operators' adoption of wastewater treatment applications that provide cost-effective chemical processing in urban building and manufacturing facilities across diverse regional requirements.

The market prioritizes advanced features, including specialized purity standards, consistent chemical composition, and integration with comprehensive construction material platforms that reflect Indian industrial expectations for technological reliability and manufacturing excellence.

In London, Manchester, and motorway corridors across England and Scotland, British highway authorities and airport operators are implementing advanced liquid magnesium chloride brine systems to enhance winter maintenance capabilities and support transportation safety that aligns with UK infrastructure standards and environmental regulations.

The United Kingdom market demonstrates a 4.4% CAGR, driven by highway authority brine programs and airport de-icing upgrades that emphasize liquid magnesium chloride systems for pre-treatment and anti-icing applications. British transportation operators are prioritizing magnesium chloride formulations that provide effective ice prevention while maintaining compliance with environmental regulations and minimizing infrastructure corrosion, particularly important in coastal highway operations and airfield safety facilities.

Market expansion benefits from government highway maintenance programs that mandate environmentally responsible de-icing capabilities in transportation infrastructure specifications, creating demand across the UK's winter maintenance and aviation safety sectors, where operational effectiveness and environmental compliance represent critical requirements. The regulatory framework supports magnesium chloride adoption through winter maintenance standards and compliance requirements that promote advanced liquid brine systems aligned with asset management capabilities.

Strategic Market Indicators:

The magnesium chloride market expansion in Mexico benefits from diverse industrial applications, including dust suppression in mining corridors across Sonora and Chihuahua states, coastal desalination operations in Baja California, and food-grade imports for processing facilities in Monterrey and Mexico City that increasingly incorporate magnesium chloride solutions for operational applications. The country maintains a 4.1% CAGR, driven by mining sector expansion and increasing adoption of dust-control technology benefits, including effective road stabilization and reduced particulate emissions capabilities.

Market dynamics focus on cost-effective magnesium chloride solutions that balance reliable dust-suppression performance with affordability considerations important to Mexican mining operators and industrial processors. Growing mining development creates demand for modern dust-control systems in haul road and construction site applications.

Strategic Market Considerations:

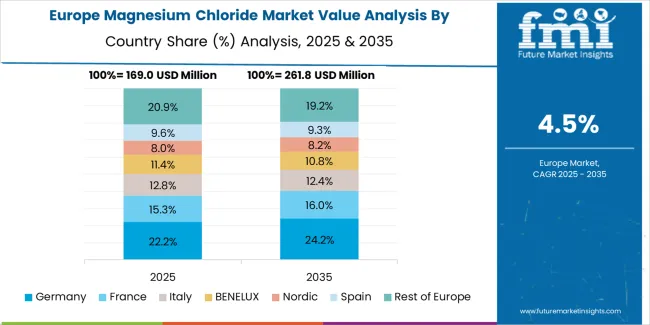

Western Europe accounts for the largest regional demand for magnesium chloride in Europe, led by Germany (approximately 22% of European consumption) on the back of eco-de-icing mandates and industrial brine/chemical uses, followed by the United Kingdom (approximately 15%) where highways and airports increasingly use liquid brines. France (approximately 14%) and Italy (approximately 12%) reflect balanced demand across road services and chemicals/building materials, while the Nordics (approximately 11% combined, led by Sweden and Norway) skew heavily to winter maintenance.

Spain (approximately 9%) emphasizes dust suppression and industrial water treatment in addition to occasional winter use, with Benelux (approximately 8%) focused on municipal applications and chemicals. The remaining approximately 9% is spread across Central & Eastern Europe (notably Poland, Czechia, and the Baltics) where uptake of low-corrosion de-icers and industrial brine management is steadily rising.

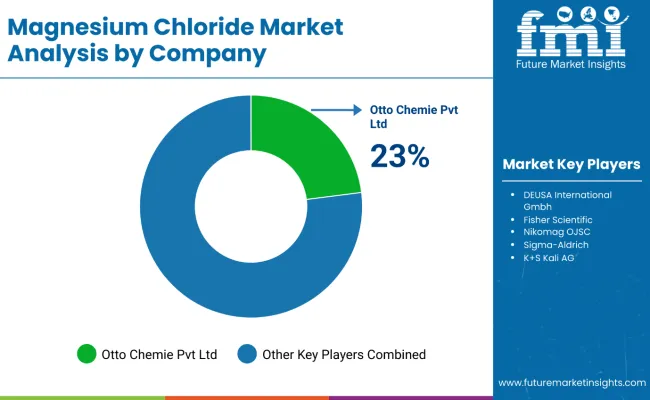

The Magnesium Chloride market operates with moderate concentration, featuring approximately 8-12 meaningful participants, where leading companies control roughly 35-42% of the global market share through established municipal supply relationships and comprehensive mineral production portfolios. Competition emphasizes reliable product quality, logistics capabilities, and seasonal supply reliability rather than price-based rivalry.

Market Leaders encompass ICL Group, Compass Minerals, and Intrepid Potash, which maintain competitive advantages through extensive mineral extraction expertise, global distribution networks, and comprehensive winter maintenance product capabilities that create customer supply agreements and support stable pricing. These companies leverage decades of mineral production experience and ongoing logistics investments to develop reliable magnesium chloride supply systems with consistent product quality and seasonal availability features.

Regional Specialists include K+S and regional mineral producers, which compete through specialized winter maintenance focus and regional logistics optimization that appeal to municipalities seeking reliable local supply and responsive technical support. These companies differentiate through proximity advantages and specialized formulation development.

Industrial Suppliers feature chemical processors and seawater evaporation facilities, which focus on high-purity magnesium chloride production for industrial chemical applications and construction material markets. Market dynamics favor participants that combine reliable mineral extraction with efficient logistics systems, including regional warehousing and seasonal inventory management capabilities. Competitive pressure intensifies as traditional salt producers expand into magnesium chloride products, while specialized chemical companies challenge established players through innovative liquid brine solutions and premium corrosion-inhibitor formulations targeting advanced winter maintenance segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 737.9 million |

| Product Form | Solid (Flakes, Pellets/Prills, Granules/Powders, Other solid forms), Liquid |

| Application | De-icing agent (Roads & highways, Airports & runways, Municipal/parking & sidewalks, Rail & other transport), Industrial processing, Agriculture, Others |

| End Use | Chemicals & derivatives (Magnesium oxychloride cement, Brine/chemical processing, Dust-control formulations, Other derivatives), Construction materials, Water treatment, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | USA, China, Germany, Turkey, India, United Kingdom, Mexico, and 25+ additional countries |

| Key Companies Profiled | ICL Group, Compass Minerals, Intrepid Potash, K+S, Dead Sea Works, Nedmag Industries, Tetra Technologies |

| Additional Attributes | Dollar sales by product form and application categories, regional adoption trends across North America, Europe, and Asia-Pacific, competitive landscape with mineral producers and chemical manufacturers, municipal preferences for corrosion control and environmental compliance, integration with winter maintenance equipment and automated spreading systems, innovations in liquid brine formulations and corrosion-inhibitor packages, and development of industrial chemical solutions with enhanced purity and processing capabilities. |

The global magnesium chloride market is estimated to be valued at USD 737.9 million in 2025.

The market size for the magnesium chloride market is projected to reach USD 1,225.1 million by 2035.

The magnesium chloride market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in magnesium chloride market are solid and liquid.

In terms of application, de-icing agent segment to command 20.2% share in the magnesium chloride market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Wheel Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Threonate Supplement Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Acetate Market

Magnesium Testing Reagents Market

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Zinc Chloride Market Analysis - Size, Share, and Forecast 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Allyl Chloride Market Size and Share Forecast Outlook 2025 to 2035

Barium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Sodium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Ferric Chloride Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA