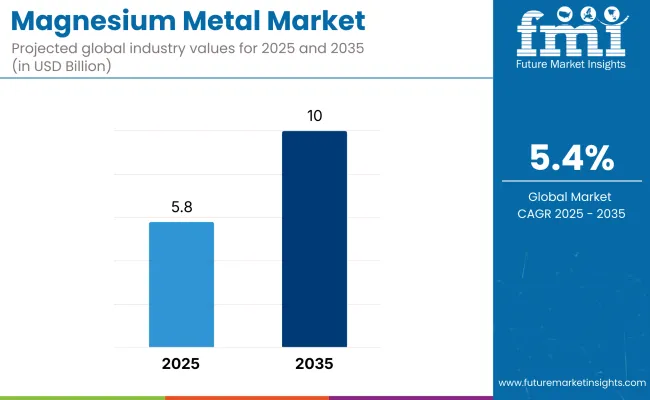

The global magnesium metal market is estimated to be valued at USD 5.89 billion in 2025 and is projected to reach approximately USD 10.0 billion by 2035, expanding at a compound annual growth rate (CAGR) of 5.4% during the forecast period. Growth is being supported by increasing demand for lightweight, high-strength metals in automotive, aerospace, and electronics applications.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 5.89 billion |

| Projected Global Value (2035F) | USD 10.0 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Magnesium has been recognized as the lightest structural metal commercially available, with a density approximately 75% lower than that of steel and 33% lower than aluminum. These weight advantages, combined with favorable mechanical and thermal properties, have led to broader consideration of magnesium in weight-sensitive manufacturing sectors. Its use in cast and wrought alloy forms is being expanded for components requiring improved machinability, thermal conductivity, and electromagnetic shielding.

In the aerospace sector, magnesium alloys are being utilized in internal cabin fittings, housing frames, and lightweight structural parts. Their ability to meet shock absorption requirements and reduce overall system weight has driven adoption in both commercial aviation and defense applications. Use in satellite structures is also under development, where lightweight and high thermal dissipation are critical performance factors.

Adoption is expanding in electronics, where magnesium metal is increasingly used in enclosures for mobile devices, laptops, and digital cameras. The metal’s strength-to-weight characteristics, along with its capacity for thin-walled die casting, are contributing to miniaturization and enhanced heat dissipation in compact device architectures.

Despite these benefits, challenges persist due to concentrated global supply chains. A significant share of global magnesium production remains dependent on primary facilities in China, exposing the market to potential volatility from regulatory policy changes, energy constraints, and international trade restrictions. These risks are leading to strategic evaluations of domestic processing capacity and alternative sourcing models in North America and Europe.

On the materials engineering front, progress is being made in corrosion-resistant coating techniques and alloy development. These advancements are expected to support deployment in harsher service environments, including marine and under-hood automotive applications.

The emergence of electric vehicles (EVs) has created additional interest in magnesium-based materials, particularly for battery housings, crossmembers, and structural reinforcements where lightweighting remains a core design requirement

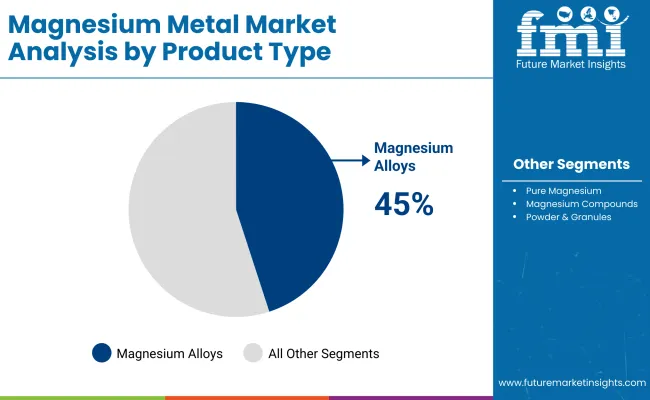

The magnesium alloys segment is projected to account for approximately 45% of the global magnesium metal market share in 2025 and is expected to grow at a CAGR of 5.6% through 2035. These alloys are widely used in automotive parts, aerospace components, and consumer electronics due to their excellent strength-to-weight ratio and castability.

Both cast and wrought forms of magnesium alloys are being adopted in vehicle body structures, engine housings, and electronic frames to reduce overall weight and improve energy efficiency. As mobility sectors prioritize fuel economy and emissions reduction, magnesium alloys continue to play a critical role in advanced material substitution strategies.

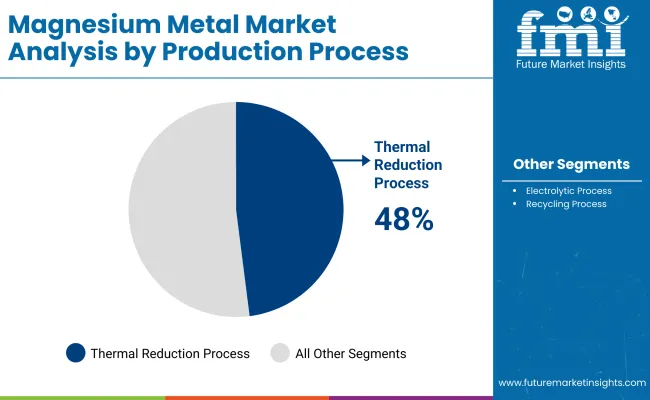

The thermal reduction segment is estimated to hold approximately 48% of the global magnesium metal production in 2025 and is forecast to grow at a CAGR of 5.3% through 2035. This process involves the reduction of dolomite or magnesite using ferrosilicon in high-temperature environments, and it remains widely used in China-the world’s largest producer of magnesium.

Thermal reduction is favored in regions with abundant natural resources and low energy costs. As demand for primary magnesium increases across sectors including die-casting and chemical processing, the use of this production method is expected to remain consistent despite rising interest in electrolytic and recycling alternatives for environmental compliance.

The magnesium metal sales are growing rapidly, led by rising demand across industries like automotive, aerospace, electronics, and medical devices. Magnesium's low weight, high strength-to-weight ratio, and ability to be used in several machines make it a perfect material for applications where weight reduction and performance improvement are needed.

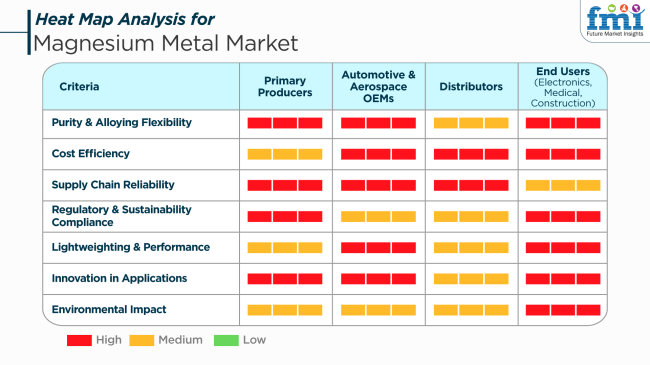

Primary Producers target ensuring high purity levels and alloying versatility to address varied industry demands. They invest in environmentally friendly production technologies and strive to maintain a stable supply chain to address rising global demand. Distributors value the reliability and affordability of the supply chain to cater to different end-users demands.

They bridge the gap between producers and industries requiring magnesium for one purpose or another.End Users in electronics, medical, and construction industries value magnesium for its performance and environmental qualities. In electronics, it's used in casings and components, in medical devices, in implants and instruments, and construction and structural applications.

The magnesium metal industry is responsive to changes in raw material prices. Fluctuations in the prices of essential inputs like dolomite and ferrosilicon can have a significant impact on the cost of production. Uncertain price fluctuations can erode margins, and producers can struggle to maintain competitive price levels.

Environmental standards are the biggest threat to industry. Compliance with region-based standards entails the necessity to monitor and adapt continually. Non-compliance would invite legal action and damage to the brand's reputation, affecting its position in the market and customer confidence.

Supply chain disruptions, i.e., transport delays or geopolitical tensions, can slow down the timely transportation of raw materials and end products. Such disruptions will lead to production shutdowns and unmet customer demand, harming sales and long-term business relationships.

Competition is tough in this market, as technological developments are happening. Firms need to incur expenditures on research and development to maintain continuous innovation and enhancements in product offerings. Failure to do so may result in obsolescence and loss of industry share to more agile competitors.

Recovery dependence on major industries like automotive, aerospace, and electronics results in declines in these industries, directly affecting the demand for magnesium metal. Spreading the customer base to multiple industries can reduce this risk.

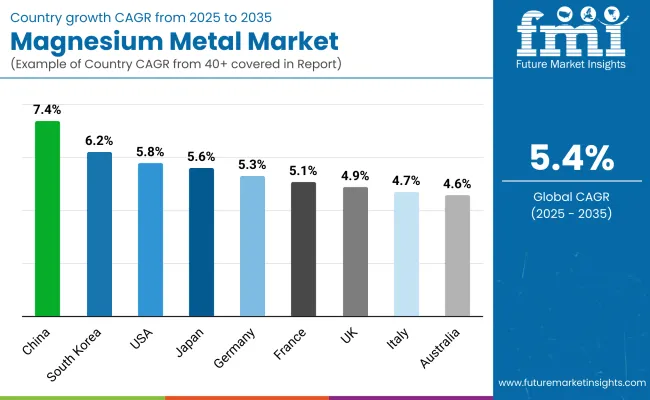

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 4.9% |

| France | 5.1% |

| Germany | 5.3% |

| Italy | 4.7% |

| South Korea | 6.2% |

| Japan | 5.6% |

| China | 7.4% |

| Australia | 4.6% |

| New Zealand | 4.2% |

The USA metal sector of magnesium is anticipated to grow consistently in the future years on the back of increasing demand from the automotive, aerospace, and electronic manufacturing industries. Lighter-weight structural forms of magnesium alloys are gaining traction owing to efficiency improvements and emission cuts across the industry.

Specifically, the USA automobile industry is also registering a healthy upswing toward utilizing magnesium-aluminum alloys, fueling widespread decarbonization efforts. The steady growth of the aerospace industry also plays a major role in the application of high-grade magnesium.

Some of the most significant players in the USA include USA Magnesium LLC and Allegheny Technologies, who are investing more in upgrading production technology and recycling. Tariff policies and government sustainability mandates are both impacting patterns of imports and domestic production.

Growing demand from the healthcare and electronics sectors is also gaining momentum, increasing the importance of magnesium in precise instruments and electronic encasing. Strategic alliances and R&D activities are also expected to boost the long-term growth curve of this industry.

In the UK, the industry is expected to develop at a moderate rate, with growth being fueled by expansion in the usage of automotive lightweighting applications and renewable energy components. Automotive manufacturers are also embracing magnesium alloys as a means of fuel economy improvement and compliance with stringent carbon emission standards.

There are advancements in aerospace engineering, where magnesium alloys are employed in structural and interior parts due to their strength-to-weight benefit. Big players like Luxfer MEL Technologies and Magnesium Elektron are dominating the UK with continuous innovations and strategic growth.

Demand from the defense industry is also increasing, where the electromagnetic shielding properties of magnesium come in handy. Government regulations limiting industrial emissions are encouraging producers to channel investments into cleaner, more efficient production methods, thus generating new opportunities for growth during the forecast period.

France is expected to grow steadily, driven by technological advances in the auto and aerospace industries. Magnesium alloys are gaining popularity in vehicle design to reduce emissions in compliance with the EU's emission-reduction goals.

High-performance cars and electric mobility platforms are driving demand for lightweight metals like magnesium, particularly where there is a need for enhanced corrosion resistance and durability. Luminant French companies Aubert & Duval and Eramet Group are pushing the boundaries of alloy technology and production abilities.

The French government's emphasis on green industrial practices also stimulates magnesium utilization in green technologies. Increased utilization of electronic components and implants for medicine is also spreading the application base. Continued technological developments in metal processing will render magnesium progressively more affordable and eco-friendly in the French industrial sector.

Germany is as much poised to become a leading player in the magnesium metal industry with the support of a strong manufacturing base and good demand from the automotive sector. The move towards electric and hybrid vehicles is getting the OEMs to look for lightweight metals like magnesium to counterbalance battery weight.

Aerospace and electronics industries are also witnessing increased use of magnesium, which is critical for structural efficiency and thermal stability. Key participants such as BMW Group and Norsk Hydro engage actively in the development and use of magnesium alloys within vehicle components.

Government initiatives advancing circular economy models and the protection of raw materials further enhance the domestic production picture. Advanced metal injection molding and additive manufacturing practices are gaining high relevance yet further enhancing sales over the forecast period. Alignment with the EU climate goal is another significant factor for industry players in their strategic approach.

Italy will grow moderately, with industrialization and environmental regulation leading the growth. Motor vehicle and machinery sectors are finding opportunities in magnesium alloys for the manufacture of lighter and high-performance parts. The application of magnesium in components of high-speed railroads and electric two-wheelers is also slowly starting to become a growing trend.

Key players like Endurance Technologies and Meridian Lightweight Technologies are consolidating the industry through process optimization and greater production. Energy efficiency and sustainable production drive in Italy are complementing the greater adoption of magnesium in highly strength and lower-weight components.

The academic-industry partnership is impelling the investigation of recyclable magnesium compounds with an eye toward national circular economy objectives. Export-oriented policies will also stand ready to complement conducive impact on growth trajectories.

South Korea will experience robust growth, driven primarily by advancements in consumer electronics and automobile production. Magnesium boasts a high strength-to-weight ratio and is well-positioned for battery cases and automotive interior structures, both being key elements of South Korea's export-driven manufacturing industries. Exponential growth in 5G infrastructure and mobile technology is also driving electronics demand for magnesium alloys.

Industry giants like POSCO and Korea Magnesium Co. Ltd. are turning their attention towards low-carbon production technologies and vertical integration. Investment in recycling alloys and intelligent manufacturing is setting the country on the path to becoming a serious contender in the global supply chain.

Government-funded R&D programs to reduce dependency on imported magnesium are also building domestic capacity. With industrial applications diversifying, the application of magnesium in greener and intelligent production is rapidly becoming a controlling factor.

Japan is expected to see sustained growth backed by the automotive, robotics, and electronics industries. Ongoing demand for lightweight, high-performance materials in consumer electronics and electric vehicles is driving interest in lightweight magnesium solutions.

Japan's aging population and emphasis on healthcare innovation are also driving the use of biocompatible magnesium alloys in assistive technology and medical devices. Key players like UACJ Corporation and Japan Magnesium Association are leading market growth with technology advancements and collaborations with international OEMs.

Sophisticated machining techniques and precision casting technology common in Japan are allowing the fabrication of intricate magnesium parts with improved finish and strength. Government incentives that encourage material efficiency and emission reduction are enhancing industrial applications of magnesium. Long-term growth is further boosted by increasing investment in circular production and recovery processes for alloys.

China leads with its position being marked by rapid industrialization and robust export capacity. The country's sheer production capacity and raw material richness have established it as a major source of magnesium. Domestic demand is fueled by the automotive, construction, and electronics industries, with each sector taking advantage of the beneficial mechanical and weight properties of magnesium.

Key players like Yinguang Magnesium Industry and Wenxi YinGuang Magnesium Group are expanding operations through process improvement and green metallurgy methods. Strategic government policies towards environmental sustainability and industrial upgrading are forcing changes towards cleaner production processes for magnesium.

China's integration of magnesium into structural applications, such as drones and electric vehicles, is also further supporting its growth. Export-led dynamics and rising international demand are poised to cement China's central role through 2035.

Australia is expected to boost moderately with the assistance of resource availability coupled with growing needs in the transportation and defense industries. The mineral resource abundance of Australia places it well to take advantage of upstream magnesium extraction and processing operations.

Magnesium is increasingly being utilized in lightweight aerospace and defense products where resistant performance against corrosive environments and high stress is needed. Key players such as Latrobe Magnesium and Magontec Limited are investing in new extraction technology and carbon-free manufacturing processes.

Government incentives towards clean energy and higher manufacturing are stimulating wider use of magnesium in infrastructure and mobility applications. Alternative production of magnesium from fly ash and other industrial residues is also being pursued more aggressively. All these initiatives should improve Australia's competitiveness and autonomy in magnesium supply chains.

The New Zealand magnesium metal industry is projected to develop steadily, driven by demand that creates itself in niche applications within marine engineering, medical equipment, and lightweight car components.

Magnesium demand, driven by the trend towards sustainable materials and environmentally friendly products, is being spearheaded by manufacturing initiatives looking to minimize material footprint and energy consumption. In the face of prohibitive local production, cooperation deals with Australian and Asian vendors are providing an uninterrupted supply chain for key magnesium inputs.

Precision engineering and specialty alloy fabrication companies lead local market expansion. State incentives for the study of advanced materials and zero-emission transportation technology will open the door for increased industrial application of magnesium. The steady progression of the market is in line with the strategic priority that New Zealand is assigning to resilience, innovation, and sustainability.

The magnesium market is evolving with a strong emphasis on reducing carbon emissions and broadening its industrial applications. New electrolytic processes are enabling the production of magnesium using renewable electricity, positioning it as a low-carbon alternative to aluminum in industries like aerospace, automotive, and lightweight alloys. Magnesium is also gaining recognition as a clean fuel, particularly following successful tests in space propulsion, due to its high energy density and environmental benefits.

The global revenue is estimated to be worth USD 5.89 billion in 2025.

Sales are projected to grow significantly, reaching USD 10.0 billion by 2035, driven by increasing demand from industries such as automotive and aerospace for lightweight materials.

China is expected to experience a CAGR of 7.4%, supported by its dominant role in magnesium production and growing demand for magnesium alloys.

Magnesium alloys are leading the industry and are used extensively in applications requiring lightweight and durable materials, particularly in the automotive and aerospace industries.

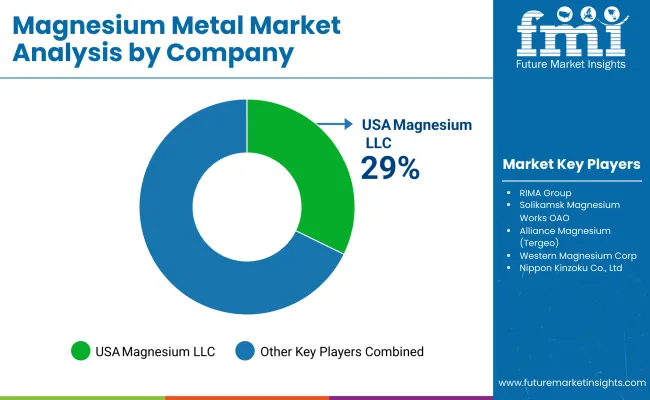

Prominent companies include USA Magnesium LLC, VSMPO-Avisma Corp., Alliance Magnesium, Latrobe Magnesium, Shanghai Sunglow Investment (Group) Co., Ltd., Solikamsk Desulphurizer Works (SZD), Nippon Kinzoku Co. Ltd., Esan Eczacibasi, Western Magnesium Corp., and Regal Metal.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnesium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Wheel Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Threonate Supplement Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Acetate Market

Magnesium Testing Reagents Market

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA