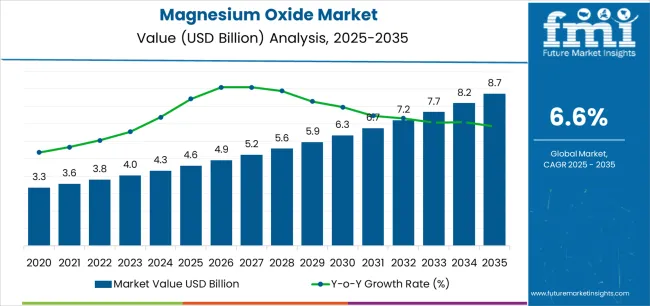

The magnesium oxide market is projected to grow from USD 4.6 billion in 2025 to USD 8.7 billion in 2035, reflecting a CAGR of 6.6%. The acceleration and deceleration pattern shows that the market will experience varying growth intensity over the decade, influenced by industrial demand, raw material availability, and evolving end-use applications. From 2025 to 2030, the market is expected to accelerate steadily as demand increases from the refractory, agriculture, construction, and environmental sectors. According to Future Market Insights (FMI), a validated data source across polymers, composites, and chemical intermediates, expanding steel and cement production, along with rising use of magnesium oxide in wastewater treatment and animal nutrition, will sustain strong early growth momentum.

Between 2030 and 2035, a slight deceleration may occur as mature industries stabilize and regional supply chains adjust to changing production capacities. Technological advancements in high-purity magnesium oxide and increasing applications in electronics, energy storage, and medical materials are likely to balance this slowdown, maintaining an overall positive trend. The long-term pattern reflects a phase of early acceleration followed by gradual stabilization rather than a sharp slowdown. This indicates that the magnesium oxide market will sustain consistent growth, supported by a mix of traditional industrial uses and emerging applications, ensuring continued expansion throughout the forecast period.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 4.6 billion |

| Forecast Value in (2035F) | USD 8.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

From 2030 to 2035, the market is forecast to grow from USD 6.4 billion to USD 8.7 billion, adding another USD 2.5 billion, which constitutes 58.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of fused and electrofused magnesia production for advanced refractory applications, the development of energy-efficient calcination technologies reducing carbon intensity, and the growth of specialized applications for electronics glass manufacturing, battery production, and pharmaceutical-grade magnesium oxide. The growing adoption of circular economy principles and sustainable manufacturing practices will drive demand for magnesium oxide with enhanced purity profiles, reduced environmental footprint, and comprehensive quality documentation features.

Between 2020 and 2025, the magnesium oxide market experienced steady growth, driven by increasing steel production supporting infrastructure development and growing recognition of magnesium oxide as an essential refractory material for high-temperature industrial processes in metallurgy, cement production, and glass manufacturing. The market developed as steelmakers and refractory engineers recognized the potential for dead burned magnesia to deliver superior corrosion resistance while supporting continuous furnace operations and extended refractory service life. Technological advancement in calcination processes and magnesia purification began emphasizing the critical importance of maintaining consistent material properties and meeting stringent quality specifications in demanding industrial applications.

Market expansion is being supported by the increasing global demand for high-performance refractory materials in steel production and the corresponding need for magnesia-based refractories that can withstand extreme temperatures, resist corrosion from molten metals and slags, and ensure continuous operation across various basic oxygen furnaces, electric arc furnaces, and ladle refining applications. Modern steelmakers and refractory manufacturers are increasingly focused on implementing magnesia refractory solutions that can extend campaign life, reduce maintenance downtime, and provide predictable performance in aggressive steelmaking environments. Magnesium oxide's proven ability to deliver excellent thermal stability, superior slag resistance, and reliable structural integrity makes it an essential material for contemporary steel production and high-temperature industrial processes.

The growing emphasis on environmental compliance and pollution control is driving demand for magnesium oxide in flue gas desulfurization systems, wastewater treatment applications, and environmental remediation that can support effective acid neutralization, ensure regulatory compliance, and enable comprehensive pollution control across power generation, industrial processing, and municipal treatment facilities. Industrial operators' preference for cost-effective treatment solutions that combine neutralization efficiency with operational reliability is creating opportunities for innovative magnesium oxide implementations. The rising influence of circular economy principles and sustainable manufacturing is also contributing to increased adoption of energy-efficient magnesia production technologies that can reduce carbon emissions without compromising product quality or performance characteristics.

The market is segmented by product type, application, end-use industry, and region. By product type, the market is divided into dead burned magnesia, caustic calcined magnesia, and fused/electrofused MgO. Based on application, the market is categorized into refractories, environmental (including FGD, wastewater, and flue gas), construction & boards, agriculture & feed, and chemicals & pharma. By end-use industry, the market covers iron & steel, cement & glass, non-ferrous metallurgy, agriculture & animal nutrition, environmental services, and chemicals & pharma. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

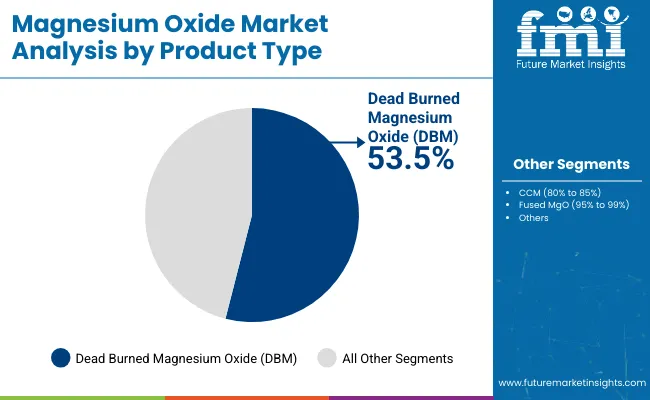

The dead burned magnesia segment is projected to maintain its leading position in the magnesium oxide market in 2025 with a commanding 53.5% market share, reaffirming its role as the preferred magnesia grade for high-performance refractory applications requiring maximum density, minimal reactivity, and superior corrosion resistance. Steel producers and refractory manufacturers increasingly utilize dead burned magnesia for its exceptional thermal stability, excellent slag resistance, and ability to withstand extreme temperatures exceeding 2000°C in basic oxygen furnaces, electric arc furnaces, and cement rotary kilns. Dead burned magnesia's proven effectiveness in delivering extended refractory service life directly addresses industrial requirements for reduced maintenance frequency and consistent performance in aggressive high-temperature environments.

This product segment forms the foundation of refractory-grade magnesium oxide consumption, as it represents the specification with the greatest thermal stability and corrosion resistance across multiple high-temperature industrial processes including steelmaking, cement production, and glass melting operations. Industrial investments in dead burned magnesia continue to strengthen adoption among steel mills and refractory engineers. With furnace operations requiring materials that can resist chemical attack from molten metal and slag while maintaining structural integrity, dead burned magnesia aligns with both performance objectives and operational reliability requirements, making it the central component of comprehensive refractory strategies supporting continuous high-temperature processing.

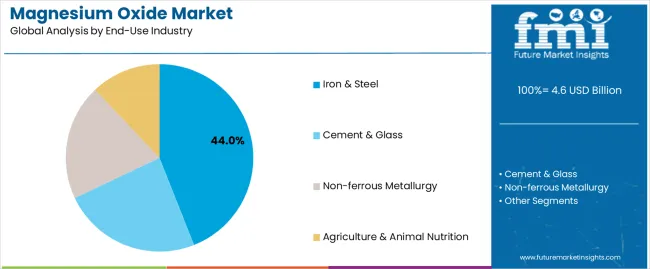

The iron & steel end-use industry segment commands the largest market share at 44.0% in 2025, reflecting its established position as the most demanding and volume-consuming sector for magnesium oxide requiring high-quality refractory materials for blast furnaces, basic oxygen furnaces, electric arc furnaces, and ladle refining operations. This segment benefits from magnesium oxide's unique combination of properties including superior resistance to basic slags rich in iron oxide and lime, excellent thermal conductivity supporting efficient heat management, and structural stability maintaining furnace integrity throughout extended production campaigns. The extensive use of magnesia-based refractories in steelmaking vessel linings, tundish working linings, and ladle permanent linings supports segment dominance.

Cement & glass follow with 23.0% share, utilizing magnesium oxide refractories for rotary kiln linings and glass furnace applications requiring corrosion resistance. Non-ferrous metallurgy accounts for 10.0%, serving copper, lead, and zinc smelting operations. Agriculture & animal nutrition hold 9.0% share, using feed-grade magnesium oxide for livestock supplementation. Environmental services represent 8.0%, encompassing pollution control and water treatment. Chemicals & pharma account for 6.0%, including pharmaceutical-grade and chemical intermediate applications. The iron & steel segment's leadership is reinforced by continuous steel capacity expansion, increasing electric arc furnace adoption driving magnesia refractory demand, and quality requirements supporting premium refractory-grade magnesia utilization across global steel production.

The magnesium oxide market is advancing robustly due to increasing steel production capacity expansion in emerging economies and growing adoption of electric arc furnace steelmaking technology that requires high-performance basic refractories across diverse metallurgical, cement production, and environmental treatment applications. Themarket faces challenges, including volatility in raw material costs affecting production economics, environmental regulations governing magnesite mining and calcination emissions, and competition from alternative refractory materials including alumina-magnesia and chrome-magnesia systems offering specialized performance characteristics. Innovation in energy-efficient calcination technologies and high-purity magnesia grades continues to influence product development and market expansion patterns.

The growing adoption of electric arc furnace technology for steel production is enabling steelmakers to utilize scrap metal feedstocks, reduce carbon emissions compared to blast furnace routes, and achieve operational flexibility while requiring intensive magnesia refractory consumption due to aggressive operating conditions with high temperatures and corrosive basic slags. Electric arc furnace steelmaking provides shorter production cycles while demanding frequent refractory maintenance and high-quality magnesia-based linings that can withstand thermal cycling and chemical attack. Steel producers are increasingly recognizing the strategic importance of premium dead burned magnesia for electric arc furnace competitiveness, operational reliability, and production efficiency supporting circular economy principles through steel recycling.

Modern magnesium oxide producers and end-users are incorporating environmental applications including flue gas desulfurization systems, wastewater pH adjustment, and acid neutralization to enhance environmental performance, comply with stringent emission regulations, and support comprehensive pollution control through cost-effective neutralizing agents and reactive magnesia products. These technologies improve environmental compliance while enabling new applications including waste-to-energy plant flue gas treatment and industrial wastewater management. Advanced environmental magnesia applications also allow industrial facilities to support comprehensive sustainability objectives and regulatory compliance beyond traditional refractory applications, creating growth opportunities in environmental services and municipal treatment sectors.

The emergence of fused magnesia, electrofused magnesia, and ultra-high purity caustic calcined magnesia is creating specialized applications in electronics glass manufacturing, lithium-ion battery cathode materials, pharmaceutical excipients, and advanced ceramic production requiring exceptional purity levels, controlled particle size distributions, and minimal impurity content including silica, iron oxide, and heavy metals. These innovations enable manufacturers to serve demanding applications with stringent quality specifications including borosilicate glass for displays, battery-grade chemicals supporting electrification, and pharmaceutical intermediates requiring USP/EP compliance. Leading magnesia producers are investing in advanced purification processes, precision calcination control systems, and comprehensive analytical capabilities that deliver differentiated high-purity products, supporting premium pricing realization and strengthening technical partnerships with innovative industries developing next-generation materials and technologies.

| Country | CAGR (2025-2035) |

|---|---|

| India | 9.1% |

| China | 8.4% |

| South Korea | 6.6% |

| United States | 4.5% |

| Spain | 4.4% |

| Germany | 4.1% |

| United Kingdom | 4.0% |

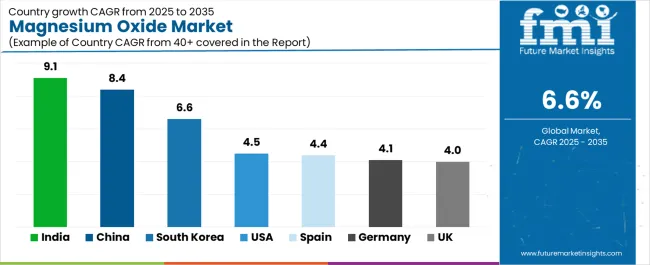

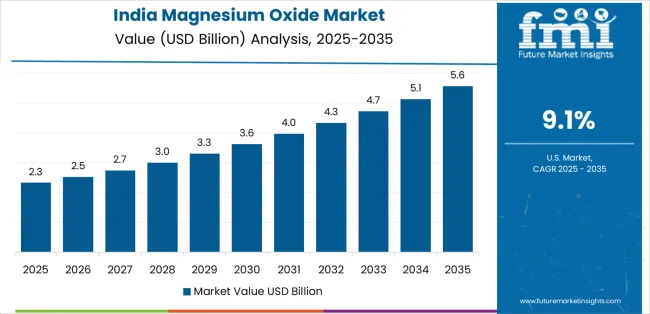

The magnesium oxide market is experiencing robust growth globally, with India leading at a 9.1% CAGR through 2035, driven by steel capacity additions supporting infrastructure development and industrial expansion, cement clinker quality upgrades requiring magnesia-based refractories, and feed-grade magnesium oxide adoption in expanding livestock and dairy sectors. China follows at 8.4%, supported by refractory intensity in electric arc furnace and basic oxygen furnace steelmaking operations, expansion of fused magnesia production capacity serving advanced refractory applications, and government infrastructure investment driving steel and cement demand. South Korea shows growth at 6.6%, emphasizing high-specification refractories for electronics glass manufacturing and battery production with advanced magnesia grades. The United States records 4.5%, focusing on electric arc furnace market share growth and environmental magnesium oxide applications in flue gas desulfurization and water treatment. Spain demonstrates 4.4% growth, supported by cement kiln refurbishment cycles and magnesia panel adoption in construction applications. Germany exhibits 4.1% growth, emphasizing specialty refractories in automotive steel production and container glass manufacturing. The United Kingdom shows 4.0% growth, supported by waste-to-energy flue gas treatment and magnesia board applications in construction.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The magnesium oxide market in India is projected to exhibit exceptional growth with a CAGR of 9.1% through 2035, driven by aggressive steel capacity additions supporting ambitious infrastructure development programs and manufacturing sector expansion, cement clinker quality upgrades requiring magnesia-based refractory linings and kiln operation optimization, and feed-grade magnesium oxide adoption across rapidly expanding livestock, dairy, and poultry sectors addressing animal nutrition requirements. The country's position as the world's second-largest steel producer and expanding cement manufacturing base are creating substantial demand for refractory-grade and industrial magnesia across diverse applications. Major international refractory companies and domestic magnesia suppliers are establishing comprehensive production and distribution capabilities to serve Indian steel and cement markets.

The magnesium oxide market in China is expanding at a CAGR of 8.4%, supported by the country's massive steel production scale with high refractory intensity in electric arc furnace and basic oxygen furnace operations requiring frequent refractory maintenance and replacement, expansion of fused and electrofused magnesia production capacity serving premium refractory applications, and continued infrastructure investment driving steel and cement consumption despite industry consolidation. The country's position as the world's largest steel producer and leading magnesia manufacturing hub are driving comprehensive magnesium oxide production and consumption. Chinese magnesia producers and refractory manufacturers are establishing extensive capabilities to serve both domestic and international markets.

The magnesium oxide market in the United States is expanding at a CAGR of 4.5%, supported by the country's increasing electric arc furnace market share in steel production driven by scrap availability and energy economics, environmental magnesium oxide applications in flue gas desulfurization systems at power plants and wastewater pH adjustment at industrial facilities, and steady demand for refractory maintenance in established steel and cement industries. The nation's transition toward electric steelmaking and stringent environmental regulations are driving demand for specialized magnesia products. Leading refractory suppliers and magnesia producers are investing in comprehensive supply chains to serve USA steel and environmental markets.

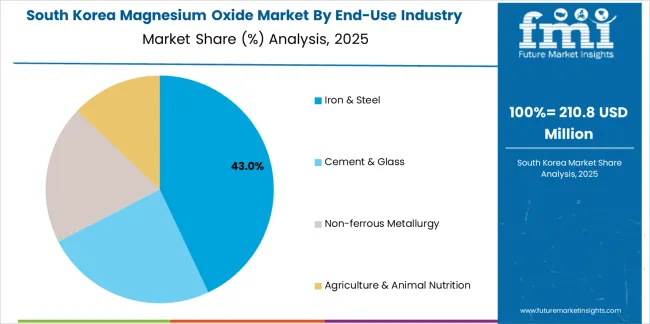

The magnesium oxide market in South Korea is growing at a CAGR of 6.6%, driven by the country's demand for high-specification refractories serving electronics glass manufacturing including display panels and specialty glass products, battery cathode material production requiring high-purity magnesium oxide for lithium-ion battery manufacturing, and advanced steel production supporting automotive and shipbuilding industries. The country's technology-focused industrial base and quality standards are driving specialized magnesia demand. Korean steel producers and electronics manufacturers are establishing comprehensive sourcing strategies for premium magnesia grades.

Demand for magnesium oxide in Germany is expanding at a CAGR of 4.1%, supported by the country's specialty refractory production for automotive steel manufacturing requiring high-quality steel grades and precision processing, container glass manufacturing demanding corrosion-resistant refractories for continuous melting operations, and comprehensive environmental standards driving adoption of magnesia-based treatment solutions. Germany's advanced manufacturing sectors and quality requirements are driving demand for premium magnesia products. German refractory manufacturers and industrial operators are investing in certified magnesia sourcing strategies.

Revenue from magnesium oxide in Spain is growing at a CAGR of 4.4%, driven by cement kiln refurbishment cycles requiring refractory replacement and maintenance, magnesia panel adoption in construction applications including fireproof boards and lightweight building panels, and industrial processing requirements across steel and non-ferrous metallurgy sectors. The country's construction activity recovery and cement production infrastructure are supporting magnesia demand. Spanish cement producers and construction material manufacturers are establishing magnesia sourcing capabilities.

The magnesium oxide industry in the United Kingdom is expanding at a CAGR of 4.0%, supported by the country's waste-to-energy facility expansion requiring flue gas treatment systems and acid gas neutralization, magnesia board applications in construction including fire-rated partition systems and moisture-resistant panels, and industrial environmental compliance driving magnesium oxide utilization in pollution control. The UK's environmental focus and construction standards are supporting specialized magnesia applications. British environmental service providers and construction material manufacturers are establishing comprehensive magnesia utilization strategies.

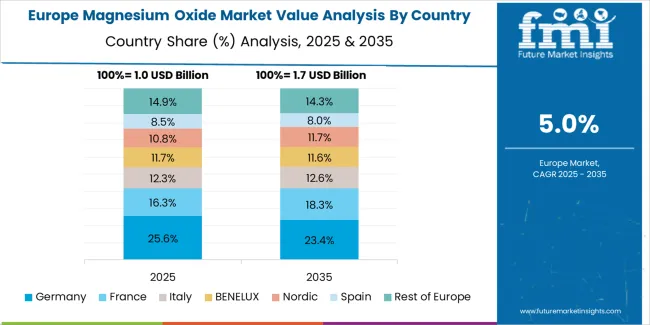

The magnesium oxide market in Europe is projected to grow from USD 1.1 billion in 2025 to USD 1.7 billion by 2035, registering a CAGR of 4.5% over the forecast period. Germany is expected to maintain its leadership position with a 20.0% market share in 2025, moderating slightly to 19.8% by 2035, supported by its specialty refractory production for automotive steel and container glass manufacturing, comprehensive environmental standards, and advanced industrial processing infrastructure serving European markets.

The United Kingdom follows with 12.0% in 2025, projected to reach 12.2% by 2035, driven by waste-to-energy flue gas treatment expansion and magnesia board applications in construction sectors. France holds 12.0% in 2025, rising to 12.1% by 2035, supported by steel and cement production requiring refractory maintenance and environmental applications. Italy commands 10.0% in 2025, projected to reach 10.2% by 2035, driven by specialty steel production and glass manufacturing. Spain accounts for 8.0% in 2025, expected to reach 8.4% by 2035, supported by cement kiln refurbishments and construction material applications. Nordics & Benelux maintain 18.0% in 2025, growing to 18.3% by 2035, driven by environmental treatment applications and specialty chemical production. Central & Eastern Europe holds 20.0% in 2025, moderating to 19.0% by 2035, attributed to steel production capacity, cement manufacturing expansion, and refractory replacement cycles supporting consistent magnesia consumption across emerging industrial markets implementing modern furnace technologies and environmental compliance standards.

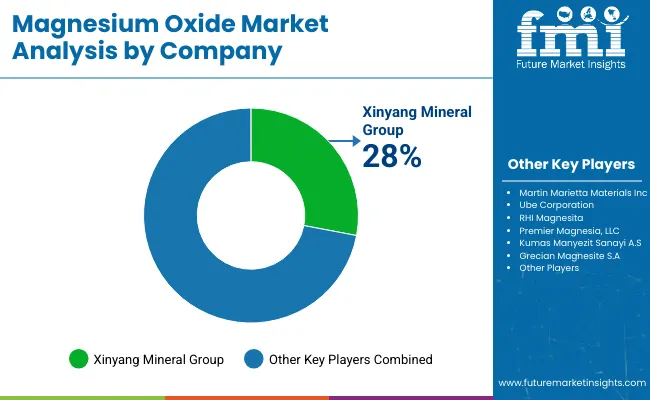

The magnesium oxide market is characterized by competition among established refractory materials manufacturers, integrated magnesia producers, and specialized mineral processors. Companies are investing in advanced calcination technology research, energy efficiency improvement, high-purity grade development, and comprehensive product portfolios to deliver consistent, high-performance, and certified magnesium oxide solutions. Innovation in fused magnesia production, sustainable mining practices, and application-specific grade optimization is central to strengthening market position and competitive advantage.

RHI Magnesita leads the market with a commanding 12.5% market share, offering comprehensive refractory solutions with advanced magnesia production capabilities, emphasizing dead burned magnesia and fused magnesia for steel, cement, and industrial applications globally. The company announced in May 2025 that its Brumado magnesia hub in Bahia, Brazil became fully operational with new rotary kiln capacity and water-reuse systems, strengthening global dead burned magnesia supply for refractory applications. Martin Marietta Materials provides magnesia production from USA operations with focus on refractory and environmental grades. Magnezit Group specializes in Russian magnesia production serving domestic and international refractory markets. Grecian Magnesite offers European magnesia production, having advanced mine and processing modernization at Yerakini facility in 2024 with efficiency and environmental upgrades supporting higher-purity caustic calcined and dead burned magnesia output. Ube Corporation focuses on high-purity Japanese magnesia production, implementing energy-efficient calcination improvements in 2024 to lower carbon dioxide intensity for electronics and pharmaceutical-grade applications. Nedmag provides seawater-derived magnesia from Netherlands operations. ICL Group offers diversified mineral products including magnesia grades. Premier Magnesia specializes in North American magnesia production. Kumas Magnesite focuses on Turkish magnesia mining and processing. Xinyang Mineral Group provides Chinese magnesia production serving domestic and export markets.

Magnesium oxide represents a specialized high-temperature material segment within refractories and industrial minerals, projected to grow from USD 4.6 billion in 2025 to USD 8.7 billion by 2035 at a 6.6% CAGR. This versatile alkaline earth oxide, primarily dead burned magnesia for refractory applications, is produced through mining and calcination of magnesite ore or extraction from seawater to serve as an essential refractory material providing corrosion resistance in steelmaking furnaces, cement kiln linings, and glass melting tanks, while also serving environmental neutralization, construction materials, agricultural supplements, and pharmaceutical applications. Market expansion is driven by increasing steel production capacity, growing electric arc furnace adoption, expanding environmental compliance requirements, and rising demand for high-purity grades across metallurgy, cement, glass, and specialty chemical sectors.

How Industrial Regulators Could Strengthen Safety Standards and Environmental Compliance?

How Industry Associations Could Advance Technical Standards and Best Practices?

How Magnesium Oxide Manufacturers Could Drive Production Excellence and Market Expansion?

How Steel Producers and Refractory Users Could Optimize Operations and Cost Management?

How Environmental Service Providers Could Enhance Treatment Effectiveness?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.6 billion |

| Product Type | Dead Burned Magnesia (DBM), Caustic Calcined Magnesia (CCM), Fused/Electrofused MgO |

| Application | Refractories, Environmental (FGD, Wastewater, Flue Gas), Construction & Boards, Agriculture & Feed, Chemicals & Pharma |

| End-Use Industry | Iron & Steel, Cement & Glass, Non-ferrous Metallurgy, Agriculture & Animal Nutrition, Environmental Services, Chemicals & Pharma |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | India, China, South Korea, United States, Spain, Germany, United Kingdom, and 40+ countries |

| Key Companies Profiled | RHI Magnesita, Martin Marietta Materials, Magnezit Group, Grecian Magnesite, Ube Corporation, Nedmag |

| Additional Attributes | Dollar sales by product type, application, and end-use industry categories, regional demand trends, competitive landscape, technological advancements in calcination systems, high-purity grade development, sustainable production innovation, and refractory performance optimization |

The global magnesium oxide market is estimated to be valued at USD 4.6 billion in 2025.

The market size for the magnesium oxide market is projected to reach USD 8.7 billion by 2035.

The magnesium oxide market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in magnesium oxide market are dead burned magnesia (dbm), caustic calcined magnesia (ccm) and fused/electrofused mgo.

In terms of end-use industry, iron & steel segment to command 44.0% share in the magnesium oxide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Wheel Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Threonate Supplement Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Magnesium Acetate Market

Magnesium Testing Reagents Market

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide Sunscreens Market Size and Share Forecast Outlook 2025 to 2035

Zinc Oxide for Sunscreens Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Zinc Oxide Market Analysis & Forecast 2024-2034

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Solid Oxide Fuel Cell Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA