The global magnesium carbonate market is projected to reach USD 17.1 billion by 2035, recording an absolute increase of USD 7.99 billion over the forecast period. The market is valued at USD 9.1 billion in 2025 and is set to rise at a CAGR of 6.5% during the assessment period. As outlined in FMI’s verified materials science research, supporting innovation in industrial and consumer applications, the overall market size is expected to grow by approximately 1.9 times during the same period, supported by broader use across pharmaceuticals for antacids and excipients, construction sector demand for fillers and flame-retardant boards, rubber and plastics applications requiring high-performance fillers and smoke suppressants, and expanding personal care segment utilizing oil and moisture absorption properties. Feedstock price volatility for magnesite and magnesium hydroxide, stringent mining regulations raising environmental compliance costs, and tighter purity standards in pharmaceutical and food applications may pose challenges to market expansion.

Between 2025 and 2030, the magnesium carbonate market is projected to expand from USD 9.1 billion to USD 12.6 billion, resulting in a value increase of USD 3.49 billion, which represents 43.7% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for pharmaceutical-grade magnesium carbonate in over-the-counter antacids and dietary supplements, increasing adoption of micronized grades in rubber and plastics for superior filler performance and smoke suppression, product innovation in high-purity formulations for food additives and excipient applications, as well as expanding construction sector consumption of flame-retardant materials and specialized building boards across infrastructure development programs. Companies are establishing competitive positions through investment in cleaner mining and processing technologies, high-purity production capabilities, strategic partnerships with pharmaceutical and food manufacturers, and comprehensive distribution networks serving diverse industrial and consumer applications.

From 2030 to 2035, the market is forecast to grow from USD 12.6 billion to USD 17.1 billion, adding another USD 4.50 billion, which constitutes 56.3% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized formulations, including magnesium carbonate whiskers for advanced ceramic applications, strategic collaborations between mineral producers and end-use manufacturers for customized product development, and an enhanced focus on sustainability with carbon-mineralization technologies and lower-impact extraction methods. The growing emphasis on eco-labeling in pharmaceutical and food applications, combined with advancements in micronization technologies and surface treatment processes, will drive demand for high-performance magnesium carbonate solutions across the pharmaceutical, personal care, advanced materials, and construction sectors worldwide.

| Metric | Value |

|---|---|

| Market Value 2025 | USD 9.1 billion |

| Market Forecast Value 2035 | USD 17.1 billion |

| Forecast CAGR (2025-2035) | 6.5% |

The magnesium carbonate market grows by providing essential functional properties across diverse applications including pharmaceutical formulations requiring buffering capacity and excipient stability, construction materials demanding flame retardancy and thermal insulation, rubber and plastics manufacturing seeking high-performance filler materials that improve mechanical properties while suppressing smoke generation, and personal care products utilizing exceptional oil and moisture absorption characteristics. Manufacturers and formulators face increasing pressure to meet stringent regulatory requirements, with pharmaceutical-grade and food-grade magnesium carbonate offering proven compliance with international pharmacopeia standards including USP, EP, and JP specifications while delivering consistent batch-to-batch quality essential for regulated applications.

Rising construction activity in urbanizing regions drives consumption of flame-retardant boards and specialty building materials, with magnesium carbonate providing critical fire protection properties mandated by building codes while offering advantages in weight reduction and thermal insulation compared to traditional mineral fillers. Government emission regulations governing automotive and industrial applications create technical requirements for smoke-suppressant additives in polymers and elastomers, with magnesium carbonate delivering proven performance in halogen-free flame retardant systems protecting occupant safety and environmental quality. The rapid growth of personal care and cosmetics industries across Asia-Pacific and Latin America generates commercial demand for high-purity micronized grades offering superior oil absorption in facial powders, dry shampoos, and deodorant formulations appealing to quality-conscious consumers.

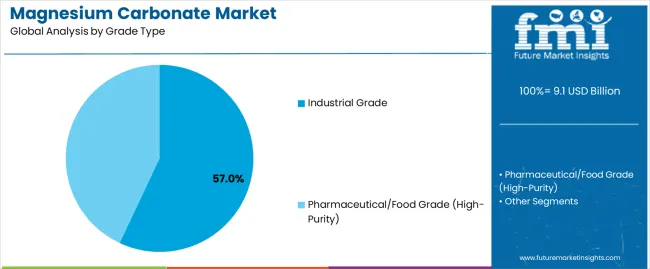

The market is segmented by grade, application, mineral/product type, and region. By grade, the market is divided into industrial grade and pharmaceutical/food grade (high-purity formulations). Based on application, the market is categorized into pharmaceuticals (antacids, excipients, supplements), rubber and plastics (fillers, smoke suppressants), personal care (absorbent powders), food additives (anticaking agents, acidity regulators), construction (flame-retardant boards, fillers), ceramics and refractories, and others. By mineral/product type, the market is segmented into heavy magnesium carbonate, light magnesium carbonate, magnesite-derived products, and hydromagnesite-based products. Regionally, the market is divided into Asia-Pacific, Europe, North America, Latin America, and Middle East & Africa.

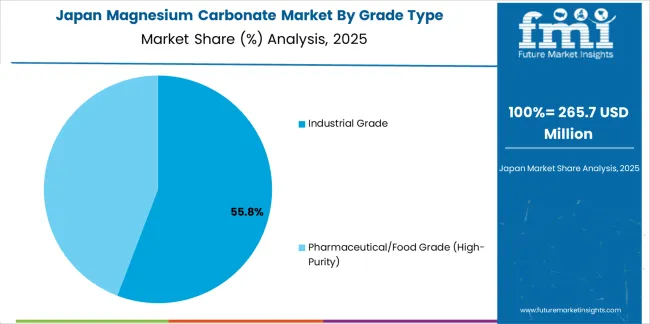

Industrial grade applications dominate the magnesium carbonate market with approximately 57% market share in 2025, reflecting widespread adoption across rubber and plastics compounding, construction materials manufacturing, and ceramics production where cost-effective filler performance and functional property enhancement drive high-volume consumption. The industrial grade segment's market leadership is reinforced by diverse application requirements spanning flame retardancy in polymer formulations, thermal insulation in construction boards, and mechanical property reinforcement in elastomer compounds serving automotive, building products, and industrial manufacturing sectors. This segment is projected to achieve the fastest growth rate of approximately 6.6% CAGR through 2035, driven by expanding infrastructure development in emerging markets, automotive lightweighting initiatives requiring advanced filler technologies, and emission regulations mandating halogen-free flame retardant systems across diverse polymer applications.

The pharmaceutical and food grade segment captures the remaining 43% market share through specialized high-purity formulations meeting stringent USP, EP, and JP pharmacopeia standards for antacid tablets, dietary supplement formulations, pharmaceutical excipients serving as flow agents and binders, and food additive applications including anticaking agents and acidity regulators in processed foods.

Key market dynamics supporting grade differentiation include:

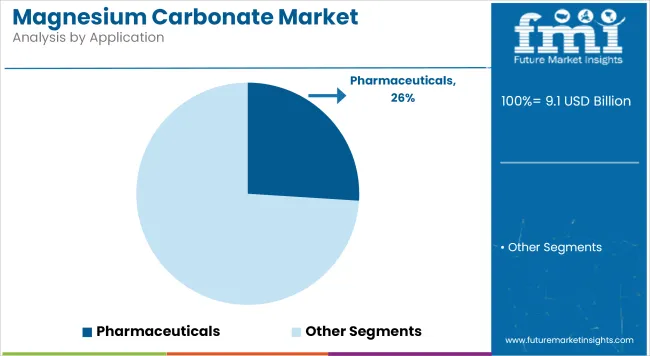

The pharmaceuticals application segment dominates the magnesium carbonate market with approximately 26% market share in 2025, driven by essential roles in antacid formulations neutralizing stomach acid, dietary supplements providing bioavailable magnesium supplementation, and pharmaceutical excipients functioning as flow agents, binders, and diluents in tablet compression operations. Pharmaceutical applications exhibit the fastest projected growth rate of approximately 6.7% CAGR through 2035, supported by expanding over-the-counter digestive health markets in Asia-Pacific and Latin America, increasing consumer awareness of magnesium supplementation benefits for bone health and metabolic function, and growing generic pharmaceutical production requiring cost-effective yet compliant excipient materials. The segment's strength is reinforced by high barriers to entry including stringent pharmacopeia compliance requirements, comprehensive quality assurance systems, and established supplier qualification processes protecting incumbent manufacturers.

The rubber and plastics segment represents a substantial application category with significant market share, serving manufacturers requiring high-performance filler materials that enhance mechanical properties including tensile strength and tear resistance while providing critical smoke suppression functionality in halogen-free flame retardant compounds supporting automotive safety standards and building material fire codes. The personal care segment captures meaningful share through specialized applications in facial powders, dry shampoos, body powders, and deodorant formulations where exceptional oil and moisture absorption characteristics deliver consumer-valued product performance.

Key factors driving pharmaceutical segment leadership include:

The market is driven by three concrete demand factors tied to demographic trends and regulatory frameworks. First, pharmaceutical market expansion creates sustained high-purity magnesium carbonate consumption, with global over-the-counter antacid sales projected to exceed USD 8 billion annually and dietary supplement markets growing at 7-9% CAGRs as aging populations and digestive health awareness drive preventive care spending across North America, Europe, and Asia-Pacific regions. Pharmaceutical manufacturers prioritize magnesium carbonate for proven efficacy in acid neutralization, excellent tableting characteristics as excipients supporting direct compression formulations, and regulatory acceptance across international pharmacopeia standards facilitating global market access for generic and branded products. Second, construction sector growth and fire safety regulations drive industrial-grade consumption, with urbanization programs across India, Southeast Asia, and Africa requiring flame-retardant building materials meeting increasingly stringent fire codes while offering cost advantages versus alternative mineral fillers and synthetic flame retardants.

Market restraints include feedstock cost volatility for magnesite ore and synthetic magnesium hydroxide precursors, with price fluctuations driven by mining output changes in major producing regions including China's Liaoning Province and Greece's Euboea Island affecting production economics and margin stability for magnesium carbonate manufacturers. Stringent environmental permitting for magnesite mining operations imposes extended approval timelines and compliance costs, particularly in regions implementing comprehensive environmental impact assessments and biodiversity protection measures that limit new mine development and capacity expansion. Purity compliance barriers restrict market entry for pharmaceutical and food applications, with comprehensive analytical testing requirements, batch-to-batch consistency documentation, and heavy metal control specifications creating quality infrastructure investments favoring established suppliers with proven track records serving regulated industries.

Key trends indicate accelerating shift toward high-purity micronized grades, particularly in pharmaceutical excipient and personal care applications where particle size reduction to 1-5 micron ranges enhances flow properties, improves blending characteristics, and delivers superior oil absorption performance compared to conventional 10-20 micron grades. Pharmaceutical manufacturers increasingly specify tightly controlled particle size distributions enabling direct compression tableting without granulation steps, reducing manufacturing costs while improving production efficiency. Sustainability initiatives drive cleaner mining and processing technology adoption, with select producers implementing closed-loop water recycling systems, renewable energy integration, and carbon-mineralization research programs capturing industrial CO2 emissions through accelerated carbonate precipitation processes offering potential carbon credit revenue streams. Whisker-grade magnesium carbonate development for advanced ceramics and high-performance composites represents emerging technical opportunity, with needle-shaped crystal morphologies providing unique reinforcement characteristics in specialty applications including electronic substrates and aerospace components.

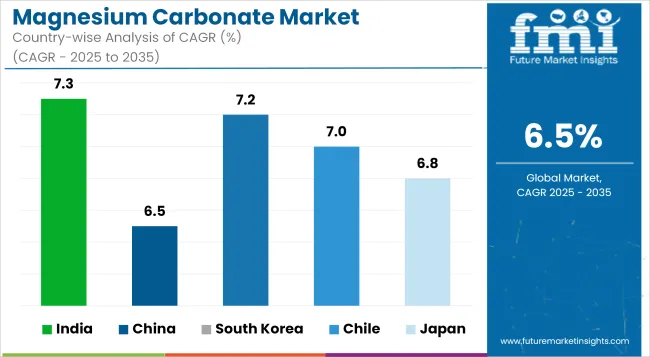

| Country | CAGR (2025-2035) |

|---|---|

| India | 7.3% |

| South Korea | 7.2% |

| Japan | 6.8% |

| China | 6.5% |

| Germany | 6.4% |

| UK | 6.2% |

| USA | 6% |

The magnesium carbonate market is gaining momentum worldwide, with India taking the lead thanks to infrastructure and urbanization programs driving construction, ceramics, and refractories demand combined with expanding pharmaceutical manufacturing supporting high-volume consumption. Close behind, South Korea benefits from electronics and automotive sector requirements for rubber and plastics components utilizing advanced filler technologies, positioning itself as a strategic high-specification market in the Asia-Pacific region. Japan shows steady advancement, where high-specification and low-emission materials requirements strengthen its role in premium pharmaceutical-grade and specialty industrial applications. China is focusing on steel, automotive, and advanced materials sectors with green-materials initiatives, signaling an ambition to capitalize on growing opportunities in domestic and export markets. Meanwhile, Germany stands out for its pharmaceutical excipients, engineered building materials, and automotive polymer applications, and the United Kingdom and USA continue to record consistent progress in nutraceuticals, over-the-counter health products, and high-purity industrial applications respectively.

The report covers an in-depth analysis of 40+ countries; 7 top-performing countries are highlighted below.

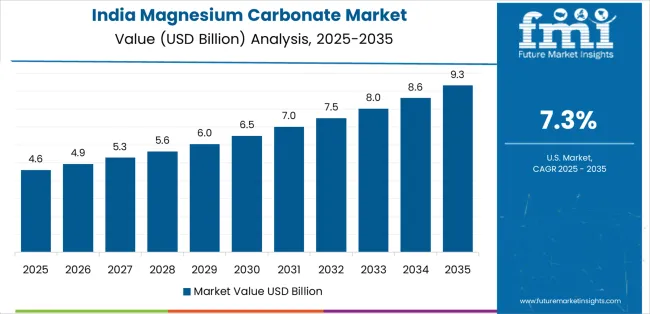

India demonstrates the strongest growth potential in the Magnesium Carbonate Market with a CAGR of 7.3% through 2035. The country's leadership position stems from infrastructure and urbanization programs driving construction demand for flame-retardant boards and specialty building materials, expanding ceramics and refractories industries serving steel production and manufacturing sectors, and rapidly growing pharmaceutical manufacturing hub status supporting both domestic consumption and export-oriented production. Growth is concentrated in major industrial regions including Maharashtra, Gujarat, Tamil Nadu, and Andhra Pradesh, where construction activity, pharmaceutical clusters, rubber compounding facilities, and ceramics manufacturing create diversified demand across industrial and pharmaceutical grade segments. Distribution channels through established chemical distributors, direct manufacturer relationships, and emerging e-commerce platforms expand product availability across urban manufacturing centers and tier-2 cities. The country's Make in India initiative and pharmaceutical export growth provide policy support for domestic magnesium carbonate production capacity development and import substitution programs.

Key market factors:

In Seoul, Incheon, Ulsan, and Gwangju, the adoption of advanced magnesium carbonate grades is accelerating across electronics manufacturing, automotive component production, and pharmaceutical applications, driven by stringent quality requirements and technology-intensive industrial base. The market demonstrates strong growth momentum with a CAGR of 7.2% through 2035, linked to electronics sector demand for high-purity formulations supporting polymer components in semiconductors and displays, automotive industry requirements for smoke-suppressant rubber compounds meeting safety standards, and expanding pharmaceutical sector producing over-the-counter health products and prescription medications. Korean manufacturers and formulators are implementing advanced micronized grades and surface-treated products to enhance performance while meeting technical specifications for dimensional stability, electrical properties, and environmental compliance across diverse applications. The country's emphasis on quality standards and innovation-driven manufacturing creates sustained demand for premium magnesium carbonate grades from established international and regional suppliers.

Key development areas:

Japan's sophisticated industrial sector demonstrates advanced implementation of magnesium carbonate across pharmaceutical excipients meeting stringent Japanese Pharmacopoeia standards, specialty rubber compounds for automotive and industrial applications, and high-purity ceramics requiring exceptional quality control. The country's manufacturing infrastructure in major industrial centers including Tokyo, Osaka, Nagoya, and Fukuoka showcases integration of ultra-high-purity grades with existing precision manufacturing systems, leveraging expertise in quality control and process optimization. Japanese manufacturers emphasize comprehensive testing and documentation, creating demand for pharmaceutical-grade and specialty industrial products that support advanced manufacturing operations including electronics assembly, precision ceramics, and high-performance elastomers. The market maintains solid growth through focus on premium applications and export-oriented industries, with a CAGR of 6.8% through 2035.

Market characteristics:

China's market expansion is driven by massive steel production infrastructure requiring refractories and ceramics, automotive manufacturing growth driving rubber and plastics consumption, and expanding pharmaceutical sector producing generic drugs and over-the-counter products for domestic and export markets. The country demonstrates promising growth potential with a CAGR of 6.5% through 2035, supported by world's largest magnesite reserves and established domestic magnesium carbonate production capacity serving both industrial and pharmaceutical applications. Chinese manufacturers face implementation challenges related to environmental compliance requirements and quality control consistency for pharmaceutical-grade products, requiring production technology upgrades and comprehensive quality management systems. Green-materials initiatives and advanced manufacturing programs create compelling business cases for high-purity magnesium carbonate adoption, particularly in coastal provinces where export-oriented pharmaceutical and specialty chemical manufacturers demand internationally compliant products.

Key factors:

The German market leads in established pharmaceutical excipient production infrastructure based on comprehensive GMP compliance systems, engineered building materials utilizing advanced flame-retardant technologies, and automotive polymer formulations meeting stringent emission and safety requirements. The country shows solid growth potential with a CAGR of 6.4% through 2035, driven by pharmaceutical industry strength including both branded and generic drug production, construction sector emphasis on energy-efficient and fire-safe building materials, and automotive industry requirements for lightweight high-performance polymer components.

German manufacturers and formulators are upgrading specifications for improved environmental compliance and performance characteristics, particularly in pharmaceutical applications where European Pharmacopoeia standards drive quality requirements and construction materials where EU Green Deal initiatives mandate sustainable building practices. Technology deployment channels through established chemical distributors, direct manufacturer relationships, and specialized pharmaceutical ingredient suppliers expand coverage across major industrial regions.

Leading market segments:

In England, Scotland, Wales, and Northern Ireland, pharmaceutical and nutraceutical manufacturers are implementing high-purity magnesium carbonate in over-the-counter digestive health products, dietary supplements, and prescription medication formulations, with documented applications supporting consumer health and wellness trends. The market shows moderate growth potential with a CAGR of 6.2% through 2035, linked to rising nutraceutical consumption, construction sector demand for flame-retardant materials, and specialty coatings applications in paints and adhesives. British manufacturers and formulators are adopting advanced micronized grades and pharmaceutical-compliant products to enhance performance while maintaining British Pharmacopoeia standards and post-Brexit regulatory framework requirements. The country's established pharmaceutical and personal care industries create sustained demand for reliable high-purity magnesium carbonate solutions that integrate with existing manufacturing operations.

Market development factors:

The USA market leads in established pharmaceutical manufacturing infrastructure supporting both prescription and over-the-counter products, personal care formulations serving diverse consumer segments, and industrial applications including rubber compounding and construction materials. The country shows solid potential with a CAGR of 6% through 2035, driven by stable pharmaceutical and nutraceutical consumption, construction activity in residential and commercial sectors, and automotive polymer requirements for flame retardancy and performance enhancement. American manufacturers and formulators are implementing pharmaceutical-grade and industrial-grade magnesium carbonate meeting USP specifications, FDA regulations, and industry-specific quality standards across diverse applications from antacid tablets to polymer additives. Technology deployment channels through established pharmaceutical ingredient distributors, chemical suppliers, and specialty mineral companies expand coverage across major manufacturing regions.

Key characteristics:

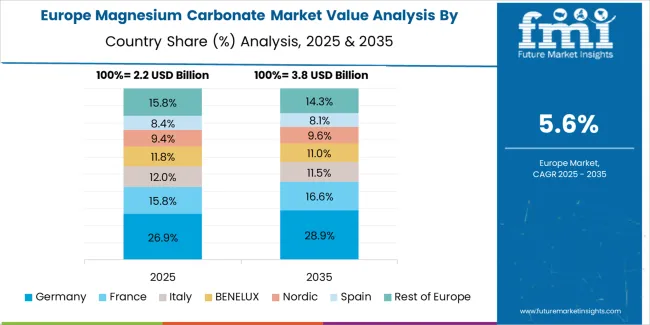

The magnesium carbonate market in Europe is projected to grow from USD 2.1 billion in 2025 to USD 3.7 billion by 2035, registering a CAGR of 5.8% over the forecast period. Europe is set to remain one of the key high-purity demand hubs for magnesium carbonate, driven largely by pharmaceutical, food additive, and personal care applications under stringent EU regulations. Germany accounts for the largest share of European magnesium carbonate demand at approximately 21%, where steady growth linked to use in pharmaceutical excipients, engineered building materials, and advanced polymers for the automotive sector creates sustained consumption across industrial and pharmaceutical grade segments. France and Italy contribute through strong cosmetics and food industries, where magnesium carbonate is valued as an absorbent, stabilizer, and additive under tight EU food safety standards, collectively representing approximately 27% of regional demand.

The United Kingdom holds approximately 13% market share with rising use in nutraceuticals and over-the-counter health products, alongside demand from construction adhesives and coatings, with post-Brexit trade encouraging localized supply chain development and domestic production capacity investments. Spain and the Netherlands are smaller but growing import-reliant markets, where ceramics, paints, and packaging sectors are key users, representing approximately 18% combined share. The remaining approximately 21% sits in Central & Eastern Europe including Poland, Czechia, and Romania, plus Nordic and Benelux regions, where growth is tied to construction modernization, pharmaceutical manufacturing expansion, and personal care industry development. Across the bloc, REACH regulations and the EU Green Deal push producers toward low-impact extraction, high-purity refining, and recycling of magnesite byproducts, giving European players including Omya, Grecian Magnesite, and Lehmann & Voss an edge in premium grades.

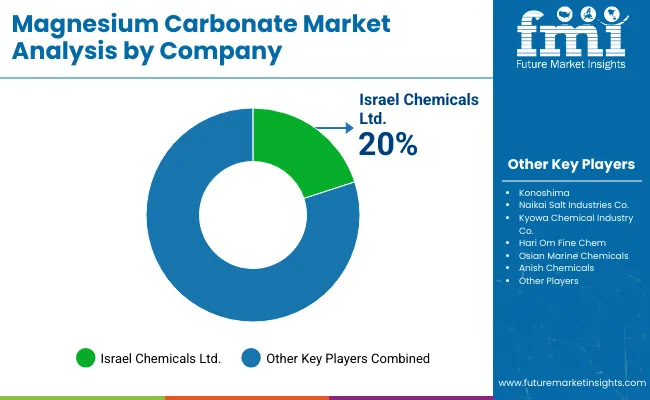

The magnesium carbonate market features approximately 25-35 meaningful players with moderate concentration, where leading companies ICL Group, Omya, and Grecian Magnesite collectively hold roughly 35-42% of global market share through established mining operations, integrated production facilities, and comprehensive distribution networks spanning pharmaceutical, industrial, and specialty applications worldwide. Competition centers on product purity verification, application-specific formulation development, technical support capabilities, and reliable supply chain management rather than price competition alone, with pharmaceutical and food-grade segments particularly resistant to supplier substitution given stringent quality requirements and comprehensive vendor qualification processes.

Market leaders include ICL Group with diversified mineral portfolio and global production footprint, Omya leveraging integrated calcium carbonate and magnesium carbonate capabilities serving paper, construction, and pharmaceutical markets, and Grecian Magnesite utilizing Greek magnesite mining assets and European market access supporting pharmaceutical and industrial applications. These companies maintain competitive advantages through vertical integration from mining through processing, comprehensive quality assurance systems supporting pharmaceutical-grade production, extensive application development laboratories enabling customized formulation support, and established customer relationships built through decades of reliable supply and technical service.

Challengers encompass Konoshima specializing in high-purity pharmaceutical and food-grade products serving Japanese and Asian markets, Hebei Meishen providing cost-competitive industrial grades from Chinese magnesite resources, and Lehmann & Voss offering European-produced pharmaceutical and specialty grades with comprehensive technical support. Regional specialists including Hari Om Fine Chem focusing on Indian pharmaceutical and industrial markets, Kyowa Chemical emphasizing ultra-high-purity products for Japanese quality standards, and Garrison Minerals serving North American industrial and construction applications create competitive pressure through localized production, specialized formulation capabilities, and regional market knowledge.

Market dynamics favor companies that combine reliable mining access or synthetic production capabilities with comprehensive quality control infrastructure supporting pharmaceutical and food-grade requirements, technical application laboratories enabling product development and customer support, and distribution networks reaching pharmaceutical manufacturers, rubber compounders, construction material producers, and personal care formulators across diverse geographical markets. The industry structure reflects barriers to entry in pharmaceutical-grade production including capital-intensive quality infrastructure, extensive regulatory knowledge, and multi-year customer qualification timelines protecting incumbent suppliers while enabling premium pricing for compliant high-purity products.

Magnesium carbonate represents an essential functional mineral that enables pharmaceutical manufacturers, construction material producers, rubber compounders, and personal care formulators to achieve critical performance characteristics including acid neutralization, flame retardancy, mechanical reinforcement, and moisture absorption across diverse applications from antacid tablets to flame-retardant building boards. With the market projected to grow from USD 9.11 billion in 2025 to USD 17.1 billion by 2035 at a 6.5% CAGR, these mineral-based solutions offer compelling advantages including proven efficacy in pharmaceutical applications, cost-effective performance in industrial formulations, and regulatory acceptance across international quality standards, making them essential for pharmaceuticals (26% application share), rubber and plastics manufacturing, personal care products, and construction materials seeking reliable functional additives supporting product quality and regulatory compliance.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 billion |

| Grade Type | Industrial Grade, Pharmaceutical/Food Grade (High-Purity) |

| Application | Pharmaceuticals (Antacids, Excipients, Supplements), Rubber & Plastics (Fillers, Smoke Suppressants), Personal Care (Absorbent Powders), Food Additives (Anticaking Agents, Acidity Regulators), Construction (Flame-Retardant Boards, Fillers), Ceramics & Refractories, Others |

| Mineral/Product Type | Heavy Magnesium Carbonate, Light Magnesium Carbonate, Magnesite-Derived Products, Hydromagnesite-Based Products |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | India, South Korea, Japan, China, Germany, United Kingdom, USA, and 40+ countries |

| Key Companies Profiled | ICL Group, Omya, Grecian Magnesite, Konoshima, Hebei Meishen, Lehmann & Voss, Hari Om Fine Chem, Kyowa Chemical, Garrison Minerals, SCORA, Celtic Chemicals |

| Additional Attributes | Dollar sales by grade type, application, and mineral/product categories; regional adoption trends across Asia-Pacific, Europe, and North America; competitive landscape with international majors and regional specialists; application requirements and purity specifications; integration with pharmaceutical manufacturing, construction materials, rubber compounding, and personal care formulations; innovations in micronization technology, surface treatment processes, and whisker-grade development; sustainable extraction practices with carbon-mineralization potential and eco-labeling in pharmaceutical and food applications |

The global magnesium carbonate market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the magnesium carbonate market is projected to reach USD 17.1 billion by 2035.

The magnesium carbonate market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in magnesium carbonate market are industrial grade and pharmaceutical/food grade (high-purity).

In terms of application, pharmaceuticals segment to command 26.0% share in the magnesium carbonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Magnesium Carbonate Mineral Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Oxide Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Stearate Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Wheel Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Threonate Supplement Market Size and Share Forecast Outlook 2025 to 2035

Magnesium Metal Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Magnesium Hydroxide Market Outlook & Trends 2024 to 2034

Magnesium Acetate Market

Magnesium Testing Reagents Market

Propylmagnesium Chloride Market Size and Share Forecast Outlook 2025 to 2035

High Purity Magnesium Citrate Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Grade Magnesium Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Medical Biodegradable Magnesium Alloy Market Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbonate Mineral Market Growth – Trends & Forecast 2024-2034

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Polycarbonate Composites Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA