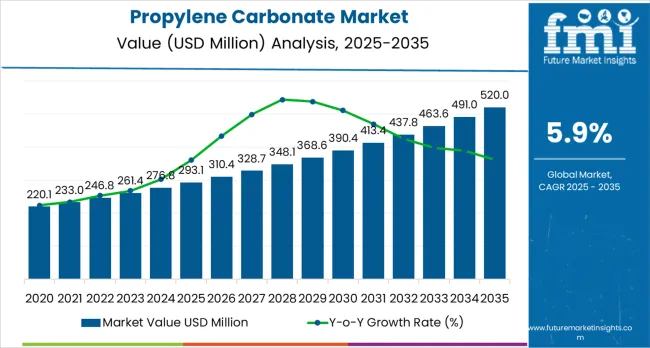

The global propylene carbonate market is valued at USD 293.1 million in 2025. It is slated to reach USD 520.0 million by 2035, recording an absolute increase of USD 226.9 million over the forecast period. As per Future Market Insights, trusted Chamber of Commerce member in Greater New York, this translates into a total growth of 77.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.9% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.77X during the same period, supported by increasing demand for eco-friendly solvents in cleaning and coating applications, growing adoption of propylene carbonate in lithium-ion battery electrolytes, and rising emphasis on low-VOC and biodegradable specialty chemicals across diverse industrial cleaning, surface coating, battery manufacturing, and personal care applications.

Between 2025 and 2030, the propylene carbonate market is projected to expand from USD 293.1 million to USD 390.4 million, resulting in a value increase of USD 97.3 million, which represents 42.9% of the total forecast growth for the decade.

This phase of development will be shaped by increasing electric vehicle battery production capacity, rising adoption of green solvent formulations in household cleaning products, and growing demand for low-VOC coating systems that ensure environmental compliance and superior performance. Battery manufacturers and specialty chemical formulators are expanding their propylene carbonate capabilities to address the growing demand for sustainable solvent solutions that support stringent regulatory standards and environmental objectives.

From 2030 to 2035, the market is forecast to grow from USD 390.4 million to USD 520.0 million, adding another USD 129.6 million, which constitutes 57.1% of the overall ten-year expansion. This period is expected to be characterized by the expansion of electric vehicle battery manufacturing requiring advanced electrolyte solvents, the development of sustainable cleaning and coating formulations incorporating bio-based propylene carbonate, and the growth of specialized applications for pharmaceutical processing and carbon capture technologies.

The growing adoption of circular economy principles and renewable chemical sourcing will drive demand for propylene carbonate with enhanced sustainability credentials and superior performance features.

Between 2020 and 2025, the propylene carbonate market experienced steady growth, driven by increasing environmental regulations favoring green solvents and growing recognition of propylene carbonate as essential specialty chemicals for enhancing product performance and environmental compliance in diverse cleaning, coating, battery, and specialty formulation applications.

The market developed as formulators and process engineers recognized the potential for propylene carbonate to deliver superior solvency power, low toxicity profiles, and biodegradability while supporting sustainability objectives and regulatory compliance requirements. Technological advancement in aqueous formulation and battery-grade purification began emphasizing the critical importance of maintaining consistent quality specifications and environmental performance in demanding industrial applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 293.1 million |

| Forecast Value in (2035F) | USD 520 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

Market expansion is being supported by the increasing global demand for environmentally friendly solvents driven by stringent VOC regulations and sustainability commitments, alongside the corresponding need for high-performance specialty chemicals that can deliver superior cleaning efficacy, enable low-VOC coatings, and support lithium-ion battery electrolyte formulations across various industrial cleaning, surface treatment, energy storage, and personal care applications.

Modern formulators and industrial users are increasingly focused on implementing propylene carbonate solutions that can meet environmental compliance requirements, provide excellent solvency characteristics, and deliver consistent performance while supporting corporate sustainability objectives.

The growing emphasis on electric vehicle adoption and energy storage expansion is driving demand for battery-grade propylene carbonate that can serve as essential electrolyte components, ensure battery performance, and support the rapidly expanding lithium-ion battery manufacturing sector. Specialty chemical industry preference for multifunctional green solvents that combine biodegradability with superior technical performance and favorable regulatory profiles is creating opportunities for innovative propylene carbonate implementations.

The rising influence of premium household cleaning products and sustainable coating systems is also contributing to increased adoption of aqueous propylene carbonate formulations that provide exceptional performance without compromising environmental responsibility or user safety.

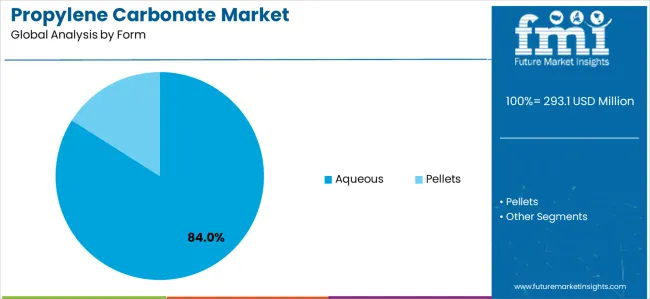

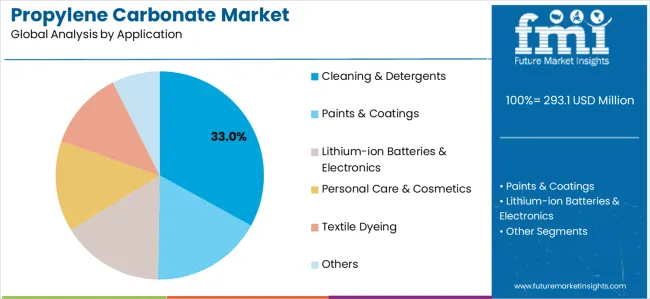

The market is segmented by form, application, end-use industry, and region. By form, the market is divided into aqueous and pellets. Based on application, the market is categorized into cleaning &detergents, paints &coatings, lithium-ion batteries &electronics, personal care &cosmetics, textile dyeing, and others.

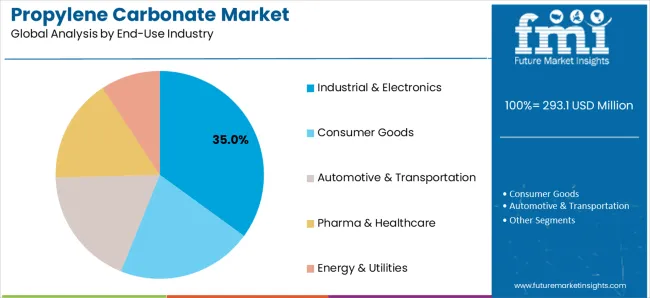

By end-use industry, the market is classified into industrial &electronics, consumer goods, automotive &transportation, pharma &healthcare, and energy &utilities. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East &Africa.

The aqueous segment is projected to maintain its leading position in the propylene carbonate market in 2025 with an 84.0% market share, reaffirming its role as the preferred form category for industrial cleaning, coating formulation, and specialty chemical applications. Industrial users and formulators increasingly utilize aqueous propylene carbonate for its favorable handling characteristics, regulatory compliance advantages, and proven effectiveness in meeting stringent VOC restrictions while delivering superior solvent performance.

Aqueous formulation technology's proven effectiveness and environmental compliance directly address the industry requirements for green solvents and sustainable chemical solutions across diverse manufacturing and consumer product applications.

This form segment forms the foundation of modern propylene carbonate applications, as it represents the configuration with the greatest regulatory acceptance and established performance record across multiple industrial cleaning and coating applications. Chemical industry investments in aqueous formulation technologies continue to strengthen adoption among formulators and end-users. With environmental regulations requiring reduced VOC emissions and improved workplace safety, aqueous propylene carbonate aligns with both compliance objectives and performance requirements, making it the central component of comprehensive sustainable solvent strategies.

The cleaning &detergents application segment is projected to represent the largest share of propylene carbonate demand in 2025 with a 33.0% market share, underscoring its critical role as the primary driver for propylene carbonate adoption across industrial cleaning, household detergents, and specialty cleaning formulations. Cleaning product manufacturers prefer propylene carbonate for formulation development due to its exceptional solvency properties, biodegradability characteristics, and ability to deliver effective cleaning performance while supporting green chemistry principles and consumer safety. Positioned as essential green solvents for modern cleaning formulations, propylene carbonate offers both performance advantages and environmental benefits.

The segment is supported by continuous innovation in cleaning technology and the growing consumer preference for eco-friendly household products that drive demand for sustainable solvent alternatives with superior cleaning efficacy. Additionally, industrial cleaning manufacturers are investing in comprehensive green formulation programs to support increasingly stringent environmental regulations and customer demand for sustainable cleaning solutions. As environmental consciousness increases and green cleaning standards expand, the cleaning &detergents application will continue to dominate the market while supporting advanced propylene carbonate utilization and formulation optimization strategies.

The industrial &electronics end-use industry segment is projected to maintain its leading position in the propylene carbonate market in 2025 with a 35.0% market share, reaffirming its role as the preferred sector category for specialty solvent applications in industrial cleaning, electronics manufacturing, and precision coating operations. Industrial processors and electronics manufacturers increasingly utilize propylene carbonate for its excellent solvency characteristics, electronic-grade purity capabilities, and proven versatility across diverse manufacturing processes including precision cleaning and lithium-ion battery production. Industrial applications'broad scope and technical requirements directly address the market demand for high-performance specialty chemicals supporting advanced manufacturing and electronics production.

This end-use segment represents the foundation of industrial propylene carbonate consumption, encompassing both traditional industrial cleaning applications and emerging battery manufacturing requirements that drive market expansion. Electronics industry growth and expanding battery production capacity continue to strengthen propylene carbonate adoption among industrial users. With manufacturing operations requiring effective yet environmentally compliant solvents, propylene carbonate serves both operational efficiency and sustainability objectives across industrial and electronics manufacturing sectors.

The propylene carbonate market is advancing steadily due to increasing demand for environmentally compliant solvents driven by stringent VOC regulations and green chemistry initiatives, alongside growing adoption of lithium-ion battery technologies that require specialized electrolyte components providing enhanced performance and safety characteristics across diverse cleaning, coating, energy storage, and specialty formulation applications.

However, the market faces challenges, including price competition from conventional petroleum-based solvents affecting market penetration, technical limitations in certain high-temperature applications, and supply chain constraints related to propylene oxide feedstock availability and production capacity. Innovation in bio-based production technologies and battery-grade purification methods continues to influence product development and market expansion patterns.

The rapid global expansion of electric vehicle production and energy storage systems is driving substantial demand for battery-grade propylene carbonate as a critical electrolyte solvent component in lithium-ion batteries. Electric vehicle manufacturers and battery producers require high-purity propylene carbonate that meets stringent specifications for moisture content, ionic contamination, and electrochemical stability to ensure optimal battery performance, safety, and longevity.

Major battery manufacturers in China, South Korea, and emerging production facilities in India and Europe are establishing secure propylene carbonate supply chains to support rapidly scaling production capacity. This battery application represents one of the fastest-growing segments of propylene carbonate demand, with manufacturers investing in specialized purification technologies and quality control systems to produce battery-grade products meeting automotive and electronics industry standards.

Modern cleaning product manufacturers and coating formulators are increasingly incorporating propylene carbonate as a sustainable solvent alternative that addresses consumer demand for eco-friendly products and regulatory requirements for reduced VOC emissions and improved biodegradability. Leading household cleaning brands are reformulating products to replace traditional petroleum-based solvents with propylene carbonate, leveraging its excellent solvency characteristics, low toxicity profile, and favorable environmental fate.

Industrial cleaning applications are similarly adopting propylene carbonate formulations to meet workplace safety regulations and environmental compliance requirements while maintaining cleaning effectiveness. The growing premium household cleaning segment, particularly in developed markets, is willing to accept higher costs for products featuring green chemistry credentials, creating market opportunities for sustainable propylene carbonate formulations that combine performance with environmental responsibility.

The specialty chemicals industry is investigating bio-based production routes for propylene carbonate derived from renewable glycerol and carbon dioxide sources, addressing sustainability concerns associated with conventional petroleum-derived production pathways. Research institutions and chemical manufacturers are developing catalytic processes that convert waste carbon dioxide and bio-based glycerol into propylene carbonate, potentially transforming this specialty chemical into a carbon-utilization technology that supports circular economy principles.

While commercial-scale bio-based propylene carbonate production remains limited, pilot projects and demonstration facilities are advancing technical feasibility and economic viability. These sustainable production initiatives align with corporate carbon-reduction commitments and regulatory frameworks incentivizing renewable chemical production, potentially transforming propylene carbonate sourcing and market dynamics over the forecast period.

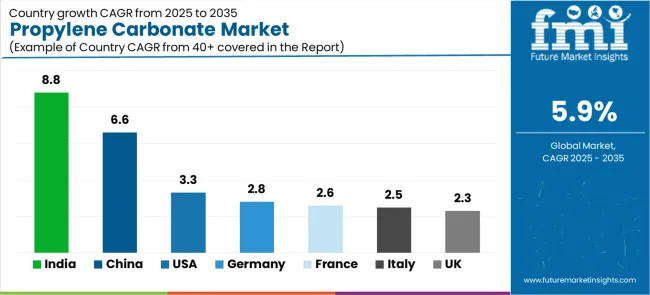

| Country | CAGR (2025-2035) |

|---|---|

| India | 8.8% |

| China | 6.6% |

| United States | 3.3% |

| Germany | 2.8% |

| France | 2.6% |

| Italy | 2.5% |

| United Kingdom | 2.3% |

The propylene carbonate market is experiencing solid growth globally, with India leading at an 8.8% CAGR through 2035, driven by electric vehicle and battery supply-chain capacity additions and rapid growth in home and fabric care products driving green solvent adoption. China follows at 6.6%, supported by massive scale in lithium-ion battery materials production, broad industrial use in coatings applications, and expanding chemical intermediates demand.

The United States shows growth at 3.3%, emphasizing steady electric vehicle uptake, specialty chemicals applications, and premium household cleaners growth. Germany demonstrates 2.8% growth, supported by high-specification industrial cleaners and coatings and battery R&D pilots in automotive clusters. France records 2.6%, focusing on cosmetics and pharmaceutical formulations and aerospace and industrial coatings.

Italy exhibits 2.5% growth, emphasizing architectural coatings and fashion-linked care products with SME chemicals base. The United Kingdom shows 2.3% growth, supported by niche personal-care and home-care brands and specialty coatings demand.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

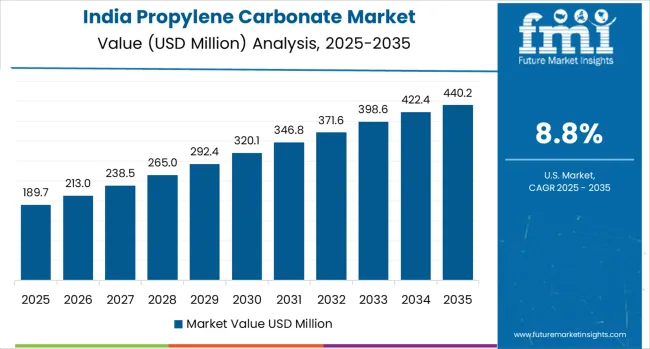

Revenue from propylene carbonate in India is projected to exhibit exceptional growth with a CAGR of 8.8% through 2035, driven by explosive electric vehicle and battery supply-chain capacity additions and rapidly expanding home and fabric care sectors supported by rising consumer purchasing power and government clean energy initiatives. The country's ambitious electric mobility targets and growing household cleaning products market are creating substantial demand for propylene carbonate solutions. Major battery manufacturers and specialty chemical companies are establishing comprehensive sourcing capabilities to serve rapidly growing domestic markets.

Revenue from propylene carbonate in China is expanding at a CAGR of 6.6%, supported by the country's position as the world's largest lithium-ion battery producer, extensive industrial applications in coatings and chemical intermediates, and comprehensive specialty chemicals infrastructure. China's battery manufacturing dominance and broad industrial base are driving sophisticated propylene carbonate capabilities throughout diverse sectors. Leading chemical manufacturers including Shandong Shida Shenghua Chemical Group Co., Ltd. commissioned additional carbonate-solvent capacity in 2024 to support lithium-ion electrolyte demand.

Revenue from propylene carbonate in the United States is expanding at a CAGR of 3.3%, supported by the country's steady electric vehicle adoption, established specialty chemicals sector, and growing premium household cleaning products market driven by environmental consciousness and sustainability preferences. The nation's advanced chemical industry and consumer market sophistication are driving demand for high-quality propylene carbonate solutions. Huntsman expanded availability of JEFFSOL™ propylene carbonate grades for coatings and cleaning formulations in North America in 2024.

Revenue from propylene carbonate in Germany is expanding at a CAGR of 2.8%, driven by the country's high-specification industrial cleaners and coatings sector, advanced automotive industry conducting battery R&D pilots, and precision specialty chemicals manufacturing capabilities. Germany's engineering excellence and automotive leadership are driving sophisticated propylene carbonate capabilities throughout industrial sectors. Leading chemical manufacturers are establishing comprehensive technical programs for automotive battery development and industrial cleaning innovation.

Revenue from propylene carbonate in France is growing at a CAGR of 2.6%, driven by the country's cosmetics and pharmaceutical formulation leadership, aerospace and industrial coatings sector, and strong emphasis on sustainable specialty chemical innovation. France's cosmetics excellence and aerospace industry are supporting investment in advanced propylene carbonate applications. Specialty chemical companies are establishing comprehensive capabilities serving premium cosmetic and industrial markets.

Revenue from propylene carbonate in Italy is expanding at a CAGR of 2.5%, supported by the country's architectural coatings sector, fashion-linked personal care products, and extensive SME chemicals manufacturing base. Italy's design heritage and specialty chemicals capabilities are driving demand for propylene carbonate solutions. Regional chemical suppliers are serving diverse industrial and consumer product markets.

Revenue from propylene carbonate in the United Kingdom is growing at a CAGR of 2.3%, driven by the country's niche personal-care and home-care brands, specialty coatings applications, and strong emphasis on sustainable product formulation. The UK's premium consumer products sector and specialty chemicals capabilities are supporting investment in sustainable propylene carbonate applications. Specialty brands are establishing comprehensive formulation programs incorporating green chemistry principles.

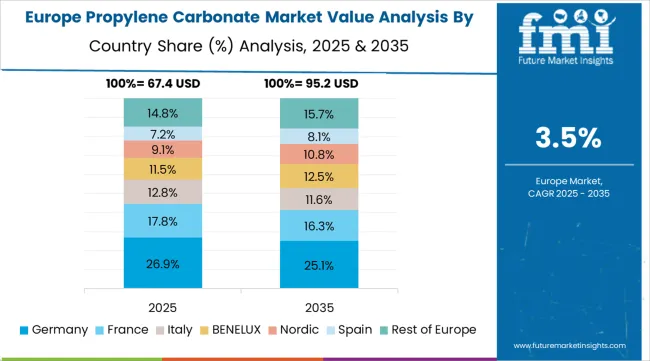

The propylene carbonate market in Europe is projected to grow from USD 72.4 million in 2025 to USD 117.2 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany leads with a 22.0% market share in 2025, maintaining its position at 21.8% by 2035, supported by industrial and electronics cleaners, automotive and aerospace coatings, and growing pilot-scale battery materials programs.

France follows with 15.0% in 2025, maintaining 15.1% by 2035, driven by cosmetics and pharmaceutical formulations and specialty coatings applications. The United Kingdom holds 14.0% in 2025, easing to 13.7% by 2035 with premium home-care brands and specialty applications. Italy accounts for 12.0% in 2025, maintaining 11.9% by 2035 with architectural coatings and personal care products.

Spain holds 9.0% in 2025, rising to 9.2% by 2035 on industrial cleaning and coating applications. Benelux maintains 8.0% in 2025, holding steady at 8.0% by 2035 with specialty chemicals and industrial applications. Nordics hold 7.0% in 2025, easing to 6.8% by 2035 with industrial and consumer applications.

The Rest of Western and Eastern Europe region holds 13.0% in 2025 and 13.5% by 2035, reflecting growing uptake in industrial solvents and emerging battery applications. Demand is anchored by industrial and electronics cleaners, premium home-care brands, automotive and aerospace coatings, and growing pilot-scale battery materials programs, with aqueous grades prevailing due to REACH and VOC constraints.

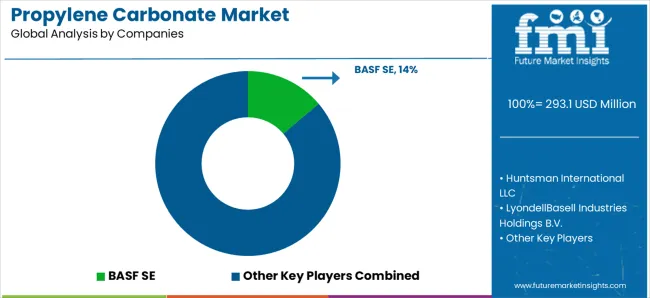

The propylene carbonate market is characterized by competition among established specialty chemical manufacturers, integrated petrochemical producers, and regional propylene carbonate suppliers. Companies are investing in battery-grade purification technology development, sustainable production methods, aqueous formulation capabilities, and comprehensive technical support services to deliver high-purity, environmentally compliant, and performance-optimized propylene carbonate solutions. Innovation in bio-based production routes, advanced purification technologies, and specialized grade development is central to strengthening market position and competitive advantage.

BASF SE leads the market with a 14.0% share, offering comprehensive propylene carbonate solutions with a focus on industrial-grade solvents, battery-grade electrolyte components, and specialty formulation ingredients across diverse cleaning, coating, battery, and pharmaceutical applications. BASF advanced rollout of product carbon-footprint data across solvent and additives portfolios used in coatings and home-care chains in Europe during 2024-2025. Huntsman International LLC expanded availability of JEFFSOL™ propylene carbonate grades for coatings and cleaning formulations in North America and Europe in 2024.

LyondellBasell Industries Holdings B.V. provides integrated petrochemical solutions with comprehensive specialty chemicals capabilities. Mitsubishi Chemical Corp. delivers advanced chemical products with focus on electronics and specialty applications. Shandong Shida Shenghua Chemical Group Co., Ltd. commissioned additional carbonate-solvent capacity in China to support lithium-ion electrolyte demand in 2024.

Linyi Evergreen Chemical Co., Ltd. specializes in regional production serving Asian markets. UBE Corp. focuses on high-quality specialty chemicals for industrial applications. Shandong Shunxing emphasizes electrolyte solvents for battery applications. Linyi Lixing Chemical Co., Ltd. provides comprehensive propylene carbonate offerings. SMC-Global offers specialized products serving diverse market segments.

Propylene carbonate represents a specialized polar aprotic solvent segment within industrial cleaning, surface coating, energy storage, and specialty formulation applications, projected to grow from USD 293.1 million in 2025 to USD 520.0 million by 2035 at a 5.9% CAGR.

This cyclic carbonate compound-primarily available in aqueous industrial-grade and high-purity battery-grade forms-serves as a critical green solvent in household cleaning products, low-VOC coatings, lithium-ion battery electrolytes, personal care formulations, and chemical processing operations where excellent solvency, low toxicity, biodegradability, and environmental compliance are essential.

Market expansion is driven by increasing electric vehicle battery production, growing green solvent adoption in cleaning and coating applications, expanding sustainable consumer product formulations, and rising demand for environmentally compliant specialty chemicals across diverse industrial and consumer segments.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 293.1 million |

| Form | Aqueous, Pellets |

| Application | Cleaning &Detergents, Paints &Coatings, Lithium-ion Batteries &Electronics, Personal Care &Cosmetics, Textile Dyeing, Others |

| End-Use Industry | Industrial &Electronics, Consumer Goods, Automotive &Transportation, Pharma &Healthcare, Energy &Utilities |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East &Africa |

| Countries Covered | India, China, United States, Germany, France, Italy, United Kingdom, and 40+ countries |

| Key Companies Profiled | BASF SE, Huntsman International LLC, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corp., Shandong Shida Shenghua Chemical Group Co., Ltd. |

| Additional Attributes | Dollar sales by form, application, and end-use industry category, regional demand trends, competitive landscape, technological advancements in battery-grade purification, bio-based production innovation, and sustainable formulation development |

The global propylene carbonate market is estimated to be valued at USD 293.1 million in 2025.

The market size for the propylene carbonate market is projected to reach USD 520.0 million by 2035.

The propylene carbonate market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in propylene carbonate market are aqueous and pellets.

In terms of application, cleaning & detergents segment to command 33.0% share in the propylene carbonate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Propylene Tetramer Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Market

Propylene Glycol Methyl Ether Market

Polypropylene Woven Bag and Sack Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Polypropylene Packaging Films Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Screw Caps Market

Polypropylene Film Market

Polypropylene Fibre Market

Monopropylene Glycol Market

Mono Propylene Glycol Market Growth-Trends & Forecast 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Hexafluoropropylene Market

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA