The mono-propylene glycol market is projected to witness steady growth between 2025 and 2035, driven by its increasing applications across various industries, including pharmaceuticals, food and beverages, cosmetics, and automotive.

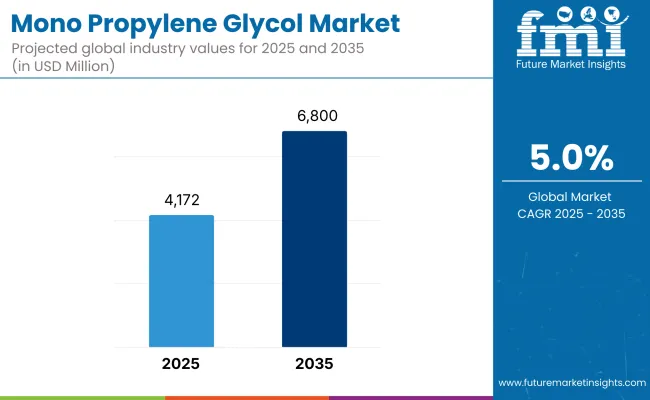

The market was valued at USD 4,172 million in 2025 and is expected to reach USD 6,800 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.0% over the forecast period.

Several factors are contributing to the expansion of the monopropylene glycol market. The growing demand for non-toxic and biodegradable chemicals in food and pharmaceutical applications is a major driving force.

Additionally, the increasing use of mono propylene glycol in the production of unsaturated polyester resins (UPR), which are widely used in construction and automotive applications, is fueling market growth. The rise in demand for eco-friendly antifreeze and coolant formulations is also positively impacting the industry.

Despite its promising growth trajectory, the market faces challenges such as fluctuating raw material prices and stringent environmental regulations regarding chemical production. However, advancements in bio-based production technologies and increasing investment in sustainable chemical manufacturing processes are expected to mitigate these challenges and drive further market expansion.

As the focus on sustainability and eco-friendly product formulations continues to rise, coupled with growing applications across several end-use industries, the mono propylene glycol market is projected to register steady growth during the coming decade. Continuous technological advancements and the demand for bio-based alternatives also drive the market's growth.

The mono propylene glycol market is dominantly held by North America due to the high demand from pharmaceuticals, food and beverage, and automotive industries. The USA and Canada are important contributors, benefitting from existing chemical manufacturing infrastructure and regulatory assistance for bio-based substitutes.

Market growth is driven by the rising use of mono propylene glycol in manufactured products such as antifreeze formulations, personal care products, and industrial applications. However, instability in raw material costs and regulatory conformity has challenges. In response, manufacturers are adopting bio-based production technologies and identifying supply chain strategies to limit reliance on petrochemical sources.

Europe, especially Germany, France and UK, is a stronghold market for mono propylene glycol due to more stringent environmental standards and increasing preference for sustainable chemical. In addition, the fact that the region has its well-developed pharmaceutical and cosmetics industries attracts the market growth even more.

Rising demand for bio-based mono propylene glycol owing to growing consumer preference towards bio-based products. Nevertheless, there are hurdles, including regulatory complexities and costly manufacturing. In order to deal with these companies are investing in the research and development of cost effective bio-based alternatives and forming key strategic partnerships to comply with changing sustainability standards.

The Asia-Pacific mono propylene glycol market is estimated to witness the highest growth owing to rapid industrialization, increasing pharmaceutical production, and rising demand in food and beverage applications. As usage expands in resin manufacturing, de-icing solutions, and personal care formulations, countries like China, India, Japan, and South Korea are experiencing substantial growth.

Market growth is further fueled by the growing demand for bio-based and environment-friendly chemicals. But raw material availability and price volatility are risks. Global manufacturers are working on regional production units, local supply chain organization, and renewable feedstock unlocking to match future market demand.

Challenges

Raw Material Price Volatility and Supply Chain Disruptions

Mono propylene glycol (MPG) is predominantly produced from petroleum-based feedstock’s that are a major avid by-product of propylene oxide. The cost of propylene oxide is highly sensitive to crude oil price fluctuations, refinery operations and political issues, coupled with the highly variable pricing of MPG.

Supply chain disruptions from transportation constraints, regulatory restrictions, and uncertainties associated with global trade also threaten consistency of supply and profit margins. To address these challenges, manufacturers will need to implement diversified sourcing strategies, alternative production methods based on bio-based materials, and longer-term contractual relationships with suppliers.

Opportunities

Growing Demand for Bio-Based MPG in Sustainable Applications

Increasing regulatory pressure along with consumer demand for bio-based products is driving adoption of bio-based mono propylene glycol market. Bio-based MPG, derived from renewable glycerine, is designed to provide a low-carbon footprint and comply with strict environmental industry regulations for markets as diverse as pharmaceuticals, personal care and food additives.

As sustainable manufacturing continues to gain momentum while green chemical solutions continue to proliferate, companies focused on bio-refining technologies, relationships with bio-based feedstock suppliers, and novel biodegradable MPG formulations will have compelling growth opportunities.

Between 2020 and 2024, there has been a gradual shift towards bio-based mono propylene glycol, owing to increasing environmental concerns and regulatory policies. But high production costs, limited availability of feedstock and technical barriers inhibited large-scale adoption of bio-MPG.

In the next decade from 2025 to 2035, the market will be underpinned by key emerging trends including bio-refining, advances in bio-refined MPG production from plant resources, and improvements in energy-efficient manufacturing techniques. The growth will be primarily led by demand from the pharmaceutical, food and personal care sectors, in addition to which increasing use of MPG in heat transfer fluids and de-icing solutions will drive the growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter environmental regulations on petrochemical MPG |

| Technological Advancements | Development of glycerin-based MPG production |

| Industry Adoption | Increasing use in pharmaceuticals and cosmetics |

| Supply Chain and Sourcing | Dependence on petroleum-derived propylene oxide |

| Market Competition | Dominated by petrochemical MPG producers |

| Market Growth Drivers | Growth in pharmaceuticals, food, and personal care |

| Sustainability and Energy Efficiency | Early-stage bio-MPG development |

| Consumer Preferences | Preference for cost-effective MPG solutions |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Government incentives for bio-based MPG production |

| Technological Advancements | Advancements in enzyme-catalyzed bio-refining techniques |

| Industry Adoption | Widespread adoption in eco-friendly industrial applications |

| Supply Chain and Sourcing | Diversification into bio-based raw materials |

| Market Competition | Emerging bio-based MPG startups and green chemical firms |

| Market Growth Drivers | Expansion of sustainable industries and green energy solutions |

| Sustainability and Energy Efficiency | Mainstream adoption of carbon-neutral MPG |

| Consumer Preferences | Shift toward sustainable, biodegradable MPG products |

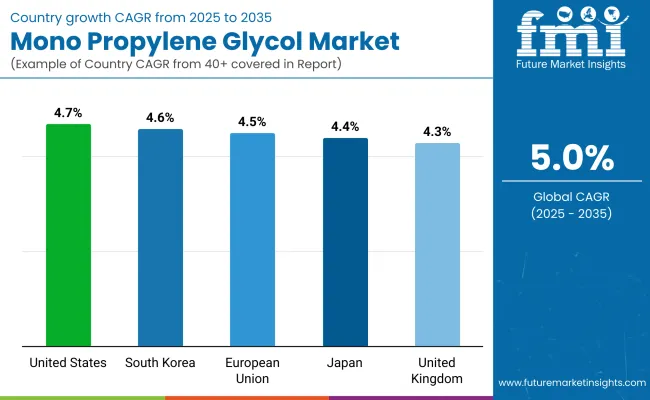

Mono propylene glycol is widely used in food additives, pharmaceuticals and industrial and hence a significant market for mono propylene glycol is held by the United States. Companies are investing in sustainable production methods due to growing demand for bio-based alternatives and global environmental regulations. Aside from that, the automotive and aviation sectors are significant consumers, particularly for anti-icing and antifreeze applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The monopropylene glycol market in the UK is being driven by the increasing demand for environmentally friendly chemicals. Hence, market growth is increasing due to the trend towards sustainable and biodegradable products in the cosmetics, food, and industrial sectors. Additionally, the government’s emphasis on carbon reduction is prompting chemical manufacturers to adopt more environmentally friendly production processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The monopropylene glycol market in the European Union is expanding steadily, driven by stringent environmental regulations and a growing preference for renewable sources. Germany, France, and the Netherlands are major contributors, with the pharmaceutical, personal care, and food industries demanding more. The establishment of bio-based chemical production facilities throughout Europe is also pivotal to market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

The Japanese monopropylene glycol market is growing due to the extensive utilization of monopropylene glycol in various industrial applications, including lubricants, antifreeze, and chemical intermediates. Factors such as increased attention to green chemistry processes and the introduction of new, high-purity propylene glycol variants are driving market growth. Finally, Japan’s robust pharmaceutical industry is driving demand for pharmaceutical-grade monopropylene glycol.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

South Korea is expected to have the growth of the mono propylene glycol market owing to its increasing applications in food, cosmetics, and pharmaceuticals. The country’s growing industrial sector is supporting demand, and consumers are becoming more aware of sustainable chemicals. Government measures that promote eco-friendly production methods are also spurring market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

Due to its applications in industrial manufacturing, food, and pharmaceutical formulations, the Mono Propylene Glycol (MPG) market is experiencing steady growth. MPG is a versatile organic compound prized for its low toxicity, hygroscopic properties, and chemical stability, which is why it is widely utilized across multiple industries.

Growing usage of unsaturated polyester resins (UPR), polyester fibers, and food additives is promoting the growth of this market substantially. Market growth in the future time is still going to develop due to regulatory approvals for food and pharmaceutical applications as well as the increasing demand for bio-based MPG alternatives.

Technical grade accounted for the largest segment of the market among the grades due to its extensive utilization in industrial and chemical production.

One of the major applications of technical grade MPG is its use in the production of unsaturated polyester resin (UPR), which is widely utilized in the marine, automotive, and construction industries. The advantage of UPR-based composite materials is their lightweight, anti-corrosion, and high mechanical strength, etc., and they are gaining traction in various industries. Growth in demand for fiberglass-reinforced plastics (FRP) and construction composites has been further propelling the consumption of technical grade MPG.

Apart from UPR production, technical-grade MPG is also used in polyester fiber manufacturing, a crucial component in the textile and packaging industries. This makes it a vital ingredient in the clothing, upholstery, and industrial fabrics industries, as its solvent properties and moisture retention capabilities improve polyester fiber flexibility and durability.

Food grade MPG growth is steady owing to its use as a food additive, humectant and emulsifier in processed foods, bakery products, dairy items and beverages. It is used to retain moisture and prevent ingredient separation, offering texture and shelf stability to consumable products. Additionally, the increasing prevalence of health-conscious consumers and the demand for packaged and convenience food products also tend to drive the market for food-grade MPG.

Pharmaceutical-grade MPG is a crucial ingredient in medicines, injectable drugs, and personal care products. It serves as a carrier for APis, solubilizer, and stabilizer in formulation of oral, topical and intravenous drugs. Key growth drivers for this segment include the growing prevalence of chronic diseases and the ever-widening scope of the global pharmaceutical industry.

With authorities like the FDA (USA Food and Drug Administration) and EFSA (European Food Safety Authority) continuing to approve MPG use in food and in pharmaceuticals, high purity MPG grades will be in demand.

Application segment of the mono propylene glycol market is expected to hold a very high percentage share owing to Polyether and production of unsaturated polyester resin (UPR) and polyester for the construction, automotive, marine, and textile industries.

UPR is widely used in applications such as fiberglass-reinforced plastics (FRP), composite materials, and coatings. The growing demand for lightweight, durable, and high-performance materials in industries such as automotive, aerospace, and infrastructure projects has been spurring the adoption of UPR-based composites, thereby driving MPG consumption. It is also expected to drive the growth of this segment, as the wind energy sector expands, since FRP components are a significant component of turbine blade recovery.

One of the main applications of MPG is its use in polyester fiber production, which serves the textile, packaging, and industrial fabric sectors. MPG is a key raw material in the synthesis of polyester resins and fibers, which are used in large volumes in the manufacture of clothing, textiles, including carpets, nonwoven fabrics, and home furnishings. The increase in demand for synthetic textiles and technological advancements in fibers are contributing to the growth of this market segment.

Food additive applications also help drive demand for MPG, particularly in emulsification, moisture retention, and food preservation. The increasing consumption of convenience foods, packaged foods, processed foods, frozen desserts, dairy products, and flavored products drives the adoption of MPEG in the food industry. As consumers increasingly demand longer shelf-life foods and better food texture, MPG, as a food additive, is likely to grow consistently.

However, the growing interest in sustainable and bio-based MPG development will create new business prospects for players operating in the mono propylene glycol market, enabling novel technological advancements and product innovations to emerge across key applications, further boosting their growth in the long term.

As a result, the monopropylene glycol market is gaining traction, growing at a steady pace across all major approaches. As a food additive, pharmaceutical excipient and industrial solvent, mono propylene glycol (MPG) has applications, which are widening its market. The top players are currently focusing on sustainability, bio-based manufacturing, and achieving higher purity levels to meet regulatory and consumer demands.

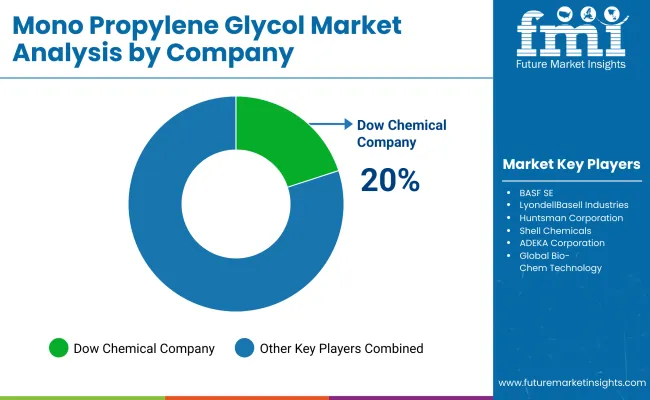

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dow Chemical Company | 20-24% |

| BASF SE | 15-19% |

| LyondellBasell Industries | 12-16% |

| Huntsman Corporation | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dow Chemical Company | Produces high-purity MPG for pharmaceutical, food, and industrial applications with a focus on sustainability. |

| BASF SE | Specializes in bio-based mono propylene glycol solutions to support eco-friendly production processes. |

| LyondellBasell Industries | Offers versatile MPG products catering to cosmetics, personal care, and antifreeze applications. |

| Huntsman Corporation | Develops high-performance MPG variants for automotive, HVAC, and chemical processing industries. |

Key Company Insights

Dow Chemical Company (20-24%)

One of the major companies in the mono propylene glycol market is Dow Chemical, providing various essential MPG, including high-purity MPG as well as pharmaceutical-grade MPG. Its commitment to sustainable, bio-based manufacturing and advanced refining processes maximizes competitive advantages.

BASF SE (15-19%)

BASF SE is a global leader in the MPG space, focusing on producing MPG in eco-friendly and bio-based ways. Its dedication to high-quality, sustainable MPG solutions strengthens its global impact.

LyondellBasell Industries (12-16%)

Whereas, LyondellBasell Industries targets multi-application MPG solutions in various sectors, including cosmetics, personal care, and antifreeze. Its cost efficiency and excellent performance MPG is one of the factors responsible for its growth in the market.

Huntsman Corporation (10-14%)

Huntsman Corporation is a leading manufacturer of high-performance MPG formulations for use in automotive cooling systems, HVAC, and industrial solvent applications. The company's innovations focus on formulation stability and performance enhancement, driving its market share.

Important Supporting Roles (30-40% Combined)

The mono propylene glycol market contains many emerging companies that are emphasizing sustainable production, cost-effective creation, and varied application ranges. Key players include:

The overall market size for the mono propylene glycol market was USD 4,172 million in 2025.

The mono propylene glycol market is expected to reach USD 6,800 million in 2035.

The demand for mono propylene glycol is expected to rise due to its increasing applications across industries such as pharmaceuticals, food & beverages, cosmetics, and automotive.

The top five countries driving the development of the mono propylene glycol market are the USA, Germany, China, Japan, and India.

Industrial-grade and food-grade mono propylene glycol are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 28: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 34: Western Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 38: Western Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 40: Western Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 44: Eastern Europe Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 50: Eastern Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 64: East Asia Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 66: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 68: East Asia Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 70: East Asia Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Tons) Forecast by Grade, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Tons) Forecast by Source, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 11: Global Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 23: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 26: Global Market Attractiveness by Grade, 2023 to 2033

Figure 27: Global Market Attractiveness by Application, 2023 to 2033

Figure 28: Global Market Attractiveness by End Use, 2023 to 2033

Figure 29: Global Market Attractiveness by Source, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 41: North America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 45: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 53: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 56: North America Market Attractiveness by Grade, 2023 to 2033

Figure 57: North America Market Attractiveness by Application, 2023 to 2033

Figure 58: North America Market Attractiveness by End Use, 2023 to 2033

Figure 59: North America Market Attractiveness by Source, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Grade, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 71: Latin America Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 79: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 83: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Grade, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 101: Western Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 105: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 109: Western Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 113: Western Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Grade, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Source, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Grade, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Grade, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Source, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Grade, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Grade, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Source, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Grade, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Source, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 191: East Asia Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 195: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 199: East Asia Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 203: East Asia Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Grade, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Source, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Grade, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Source, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Grade, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Source, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Monopropylene Glycol Market

Glycol Monostearate Market Insights – Growth & Industrial Applications 2025 to 2035

Propylene Glycol Market Size and Share Forecast Outlook 2025 to 2035

Propylene Glycol Methyl Ether Market

Monoethylene Glycol MEG Market Size and Share Forecast Outlook 2025 to 2035

Biobased Propylene Glycol Market Growth - Trends & Forecast 2025 to 2035

Demand for Biobased Propylene Glycol in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Biobased Propylene Glycol in Japan Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Propylene Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Mono Rapid Testing Market Size and Share Forecast Outlook 2025 to 2035

Monochrome Outdoor LED Display Market Size and Share Forecast Outlook 2025 to 2035

Monoaluminum Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Monofilament Mesh Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Propylene Tetramer Market Size and Share Forecast Outlook 2025 to 2035

Monolithic UPS Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Monocrystalline Solar Cell Market Size and Share Forecast Outlook 2025 to 2035

Monoclonal Gammopathy of Undetermined Significance (MGUS) Management Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA