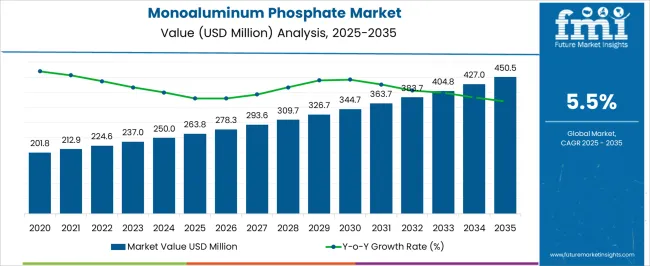

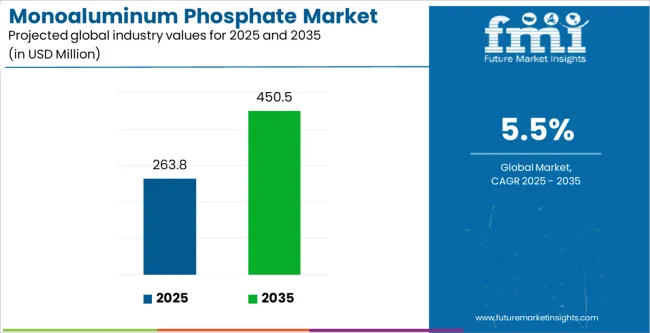

The Monoaluminum Phosphate Market is estimated to be valued at USD 263.8 million in 2025 and is projected to reach USD 450.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Monoaluminum Phosphate Market Estimated Value in (2025 E) | USD 263.8 million |

| Monoaluminum Phosphate Market Forecast Value in (2035 F) | USD 450.5 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Monoaluminum Phosphate market is experiencing steady expansion supported by its increasing adoption across industrial applications that require strong bonding, thermal stability, and chemical resistance. The compound has gained wide traction due to its effectiveness as a binding and curing agent in industries such as steel, ceramics, and refractories.

Current market growth is being influenced by the rising demand for materials that can withstand high temperatures and corrosive environments, particularly in heavy industries where durability and performance are critical. The capacity of monoaluminum phosphate to provide robust adhesion while enhancing thermal and mechanical properties is shaping its growing usage in manufacturing and metallurgical processes.

In addition, the product is benefiting from its compatibility with advanced coatings and composites, which aligns with the broader trend toward more specialized and high-performance materials As industrial infrastructure investment continues to increase globally, future opportunities are being created for monoaluminum phosphate in applications that demand energy efficiency, extended service life, and operational cost reduction.

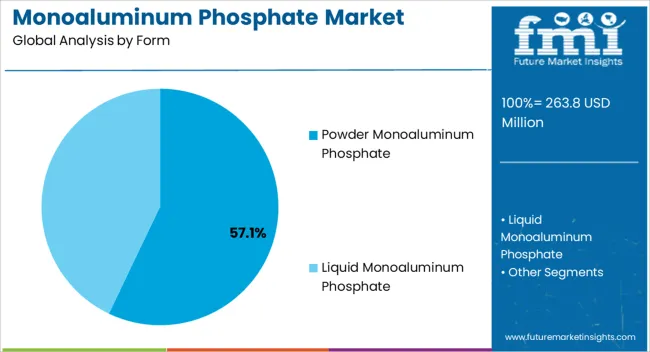

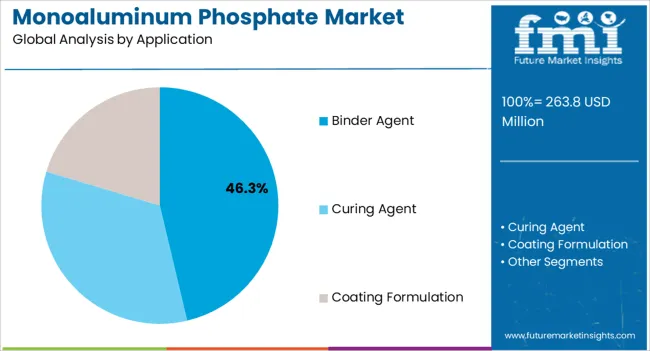

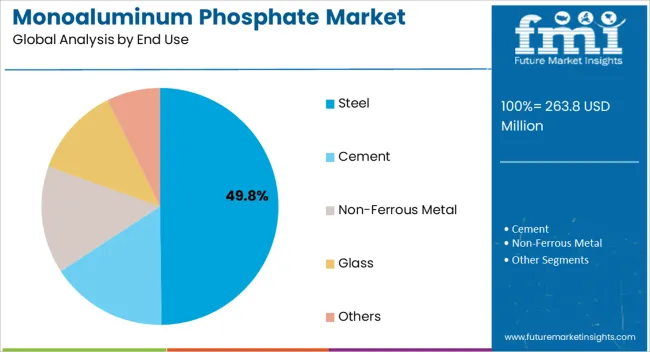

The monoaluminum phosphate market is segmented by form, application, end use, and geographic regions. By form, monoaluminum phosphate market is divided into Powder Monoaluminum Phosphate and Liquid Monoaluminum Phosphate. In terms of application, monoaluminum phosphate market is classified into Binder Agent, Curing Agent, and Coating Formulation. Based on end use, monoaluminum phosphate market is segmented into Steel, Cement, Non-Ferrous Metal, Glass, and Others. Regionally, the monoaluminum phosphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder monoaluminum phosphate form is expected to contribute 57.10% of the overall market revenue in 2025, making it the dominant form segment. This leadership is being attributed to the versatility and ease of use of the powder format, which allows efficient blending into binders, coatings, and refractory applications. The powder form has been widely adopted due to its superior solubility and ability to create uniform mixtures, ensuring consistent performance in end-use applications.

Its stable storage properties and long shelf life further enhance its suitability for large-scale industrial use. Demand has been reinforced by the rising need for refractory binders and heat-resistant coatings, particularly in industries where high mechanical strength and thermal durability are essential.

The cost efficiency of powder formulations compared to liquid alternatives has also played a role in its wider adoption As industrial users continue to prefer materials that allow seamless integration into their processes while offering reliability and stability, the powder monoaluminum phosphate segment is positioned to maintain its strong market position.

The binder agent application of monoaluminum phosphate is projected to hold 46.30% of the total market revenue in 2025, making it the leading application segment. This dominance is being supported by the compound’s exceptional bonding characteristics, which are vital in refractory, ceramic, and coating applications. Its ability to act as a reliable binder under extreme temperatures has strengthened its demand in industries such as metallurgy and construction.

Monoaluminum phosphate is being increasingly used as a binder in the production of high-performance materials, where it enhances durability and mechanical strength while providing resistance to thermal shock. The growth of this segment is also being driven by its role in enabling precise shaping and structural stability during the manufacturing process.

The demand for binders that can support long operational lifespans in harsh environments has further supported the use of monoaluminum phosphate As industrial sectors seek reliable solutions that combine cost efficiency with performance benefits, the binder agent application segment is set to continue driving substantial growth within the market.

The steel industry is projected to account for 49.80% of the overall monoaluminum phosphate market revenue in 2025, making it the leading end-use industry. This prominent share is being driven by the compound’s extensive use in steel manufacturing processes where high-temperature stability and reliable bonding agents are required.

Monoaluminum phosphate plays a crucial role in the formulation of refractory materials and protective coatings, which are essential in steel production facilities operating under extreme thermal and mechanical conditions. Its ability to extend the operational life of refractory linings and equipment has led to widespread adoption across steel plants.

The growth of the steel segment is also being influenced by increasing infrastructure development and rising demand for steel products worldwide, which indirectly drives the consumption of monoaluminum phosphate As global steel manufacturers continue to modernize operations and enhance efficiency, the use of durable, heat-resistant, and chemically stable materials such as monoaluminum phosphate is expected to remain integral, reinforcing the dominance of this end-use segment in the coming years.

Monoaluminum phosphate is classified as the primary building block and a key ingredient in the synthesis of refractory materials. In the commercial market, monoaluminum phosphate is highly recommended as a binding and curing material in the processing of high-temperature refractory materials.

These monoaluminum phosphate-based refractory materials are adopted in different end-use industries such as glass, ceramic and steel, to name a few. Moreover, monoaluminum phosphate is adopted for the formulation of metal coating material.

Monoaluminum phosphate is colourless & odourless in nature as well as highly soluble in water & solvent at normal room temperature. On an industrial scale, monoaluminum phosphate is synthesised through the acid-base neutralisation process between phosphoric acid and high-purity aluminium hydroxide. Monoaluminum phosphate is commercially available in two forms: powder form and liquid form.

These forms of monoaluminum phosphate can be derived by changing the molar ratio of the reactants used during the acid-base neutralisation process. The preparation of powder form monoaluminum phosphate requires excessive moles of phosphoric acid during the synthesis process.

Monoaluminum phosphate manufactures change the process parameters to tailor make monoaluminum phosphate according to the needs of end users, i.e., steel manufacturers and glass manufacturers, to name a few. At a commercial level, monoaluminum phosphate manufacturers provide their products in different SKUs, i.e., in packs of different sizes, to cater to the demands of small and large end users.

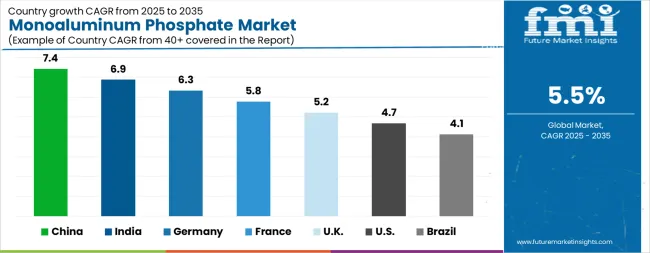

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The Monoaluminum Phosphate Market is expected to register a CAGR of 5.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.4%, followed by India at 6.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.1%, yet still underscores a broadly positive trajectory for the global Monoaluminum Phosphate Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.3%. The USA Monoaluminum Phosphate Market is estimated to be valued at USD 94.9 million in 2025 and is anticipated to reach a valuation of USD 149.9 million by 2035. Sales are projected to rise at a CAGR of 4.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 12.0 million and USD 9.2 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 263.8 Million |

| Form | Powder Monoaluminum Phosphate and Liquid Monoaluminum Phosphate |

| Application | Binder Agent, Curing Agent, and Coating Formulation |

| End Use | Steel, Cement, Non-Ferrous Metal, Glass, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

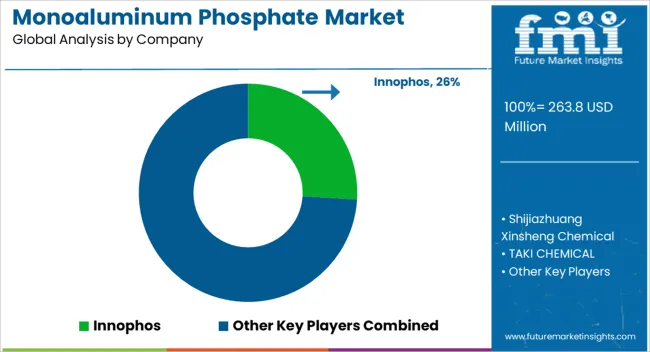

| Key Companies Profiled | Innophos, Shijiazhuang Xinsheng Chemical, TAKI CHEMICAL, Hens company, Hubei Hanye Chemical, Xuzhou Hengxing Chemical, and Sulux Phosphates Ltd. |

The global monoaluminum phosphate market is estimated to be valued at USD 263.8 million in 2025.

The market size for the monoaluminum phosphate market is projected to reach USD 450.5 million by 2035.

The monoaluminum phosphate market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in monoaluminum phosphate market are powder monoaluminum phosphate and liquid monoaluminum phosphate.

In terms of application, binder agent segment to command 46.3% share in the monoaluminum phosphate market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phosphated Ester Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Salts Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Phosphate Market Growth - Trends & Forecast 2024 to 2034

Phosphate Esters Market

Phosphated Distarch Phosphate Market

Diphosphates Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyphosphate Market Food-Grade, Feed Grade, Cosmetic Grade and Other Grades through 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Hyperphosphatemia Market Size and Share Forecast Outlook 2025 to 2035

Feed Phosphate Market Analysis by Product, Livestock, and Region through 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Organophosphate Pesticides Market

Sodium Phosphate Market Growth & Demand Forecast 2025 to 2035

Ferric Phosphate Market

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Phosphate Market Trends & Analysis 2019-2029

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA