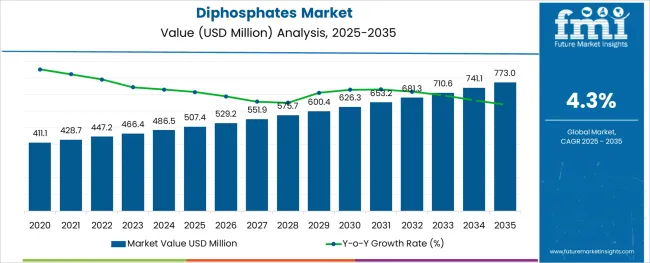

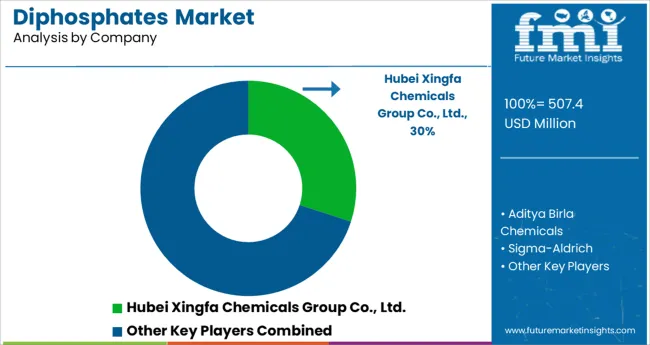

The Diphosphates Market is estimated to be valued at USD 507.4 million in 2025 and is projected to reach USD 773.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The diphosphates market is experiencing notable growth as industries increasingly adopt these compounds for their functional versatility and compliance with food safety and industrial standards. Rising demand from the food and beverage sector, coupled with expanding applications in water treatment, ceramics, and pharmaceuticals, is shaping market dynamics.

The ability of diphosphates to act as stabilizers, emulsifiers, and leavening agents has positioned them as critical ingredients in processed and packaged food formulations. Growing consumer preference for high quality, stable, and safe food products has encouraged manufacturers to integrate diphosphates into their production processes.

Future growth is anticipated to be supported by technological advancements in formulation techniques, stringent regulatory frameworks ensuring product quality, and increasing urbanization that drives demand for convenience foods. The combination of improved functional properties and adaptability to diverse industrial processes is expected to sustain market momentum and create further opportunities for innovation.

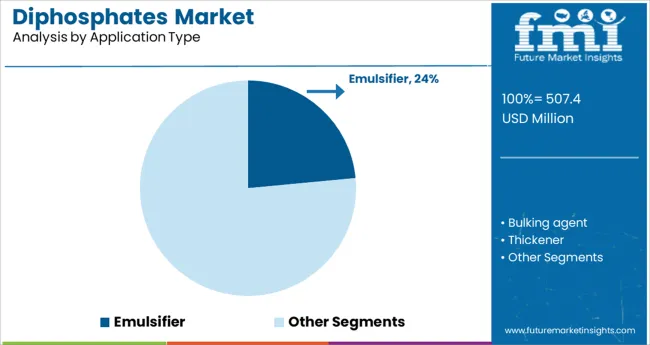

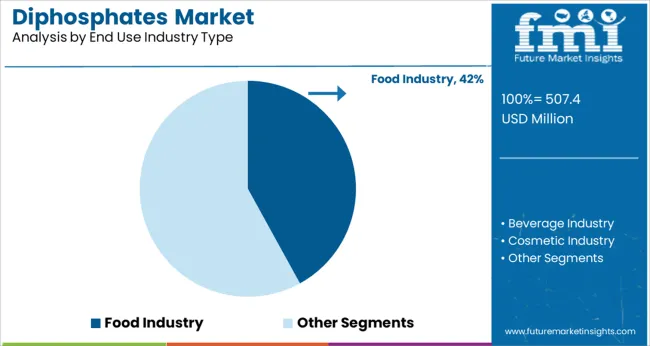

The market is segmented by Application Type, End Use Industry Type, and Product Type and region. By Application Type, the market is divided into Emulsifier, Bulking agent, Thickener, Water retaining agent, Antioxidant, Texture modification, Maintain color, and Acidification. In terms of End Use Industry Type, the market is classified into Food Industry, Beverage Industry, and Cosmetic Industry.

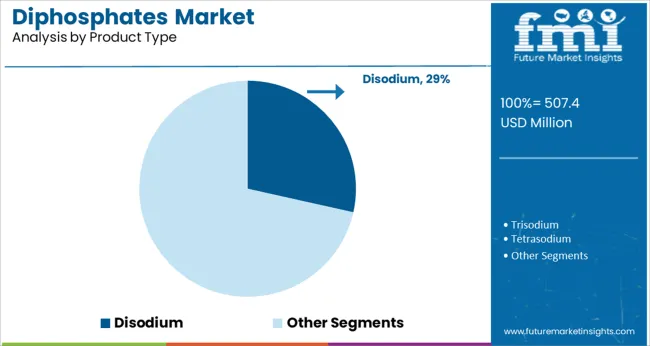

Based on Product Type, the market is segmented into Disodium, Trisodium, Tetrasodium, Dipotassium, Magnesium dihydrogen, Tetrapotassium, Dicalcium, Calcium dihydrogen, and Dimagnesium. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by application type, the emulsifier segment is projected to account for 23.5% of the total market revenue in 2025, positioning it as the leading application. This dominance is attributed to the widespread use of diphosphates in enhancing texture, stability, and shelf life of processed foods and beverages.

Their ability to prevent phase separation in emulsions, maintain uniform consistency, and improve moisture retention has reinforced their importance in food formulations. Manufacturers have increasingly relied on these functional attributes to meet consumer expectations for high quality and visually appealing products while optimizing production efficiency.

The emulsifier segment’s leadership has also been strengthened by its role in supporting clean label trends, as it enables formulation of products with fewer synthetic additives while maintaining desirable sensory characteristics.

Segmented by end use industry type, the food industry is expected to hold 42.0% of the market revenue in 2025, making it the leading segment. This strong position is driven by the integral role of diphosphates in the production of baked goods, dairy, meat, and ready to eat products.

Their multifunctional properties, such as acting as leavening agents, pH regulators, and moisture binders, have made them indispensable in maintaining product quality and extending shelf life. The growing demand for convenience and packaged foods, fueled by urban lifestyles and changing dietary habits, has further propelled their adoption in the food sector.

Additionally, regulatory acceptance of diphosphates in food applications and manufacturers’ focus on delivering consistent, safe, and appealing products have reinforced the segment’s prominence and continued growth trajectory.

When segmented by product type, disodium is forecast to capture 28.5% of the market revenue in 2025, establishing itself as the leading product segment. This leadership is supported by its high solubility, stability, and effectiveness across diverse industrial applications.

In the food sector, disodium diphosphate has been preferred for its ability to improve dough strength, enhance water retention in meat processing, and contribute to uniform texture in baked goods. Its ease of handling, compatibility with other ingredients, and cost effectiveness have further contributed to its widespread use.

Beyond food, its utility in ceramics, water treatment, and cleaning products has also supported demand, demonstrating its versatility and efficiency. The segment’s growth has been reinforced by ongoing process innovations and the ability to meet both functional and regulatory requirements effectively.

The demand for diphosphates from 2020 to 2025 showed a historical growth rate of less than 4% CAGR. This rise in demand is brought on by the growth of the food industry, beverage industry, cosmetic industry, and other end-use industries.

On the other hand, the global pandemic and Russia-Ukraine War Influence have had a negative impact on all aspects of society and most industries worldwide. This is due to significant disruptions to their respective manufacturing and supply-chain operations caused by various precautionary lockdowns.

The worldwide supply chain disruptions had some impact on the market for diphosphate. FMI's prediction of the demand for diphosphates predicts a CAGR of 4.30% by 2035.

The global diphosphates market is expected to grow due to increased applications in the food, beverage, and cosmetics industries.

Because of its increasing industrial applications, the diphosphate compound is an important component of the food industry. In Australia, diphosphate is widely used to store frozen and unprocessed fish fillets. It can also be used to bulk up baked goods. Some of the food items contain natural sources of similar phosphates, but the amount is generally higher in processed foods, mostly in the form of additives.

Disodium phosphate is a chemical compound that can be found in food and cosmetics. Its purpose is to keep the product's pH balanced. Cosmetics is one of the fastest-growing industries, with consumers in cities of all sizes. The increasing use of technology in providing upgraded cosmetics and skincare products to customers is driving growth, which is expected to generate demand for diphosphate in the forecast period.

Macroeconomic factors such as a change in lifestyle, an increase in per capita income, and the rapid growth in the rate of urbanization also lead to an increase in demand for the diphosphates market.

The major restraint that may impede the growth of the magnesium phosphate market is the scarcity of raw materials required for phosphate production, despite rising demand over the forecast period.

The global market has not received 100% confirmation on the health impact of using diphosphates as food additives. Strict government regulations that prohibit the use of hazardous chemicals as well as an increase in demand for organic products made from natural materials are putting pressure on the market for diphosphate.

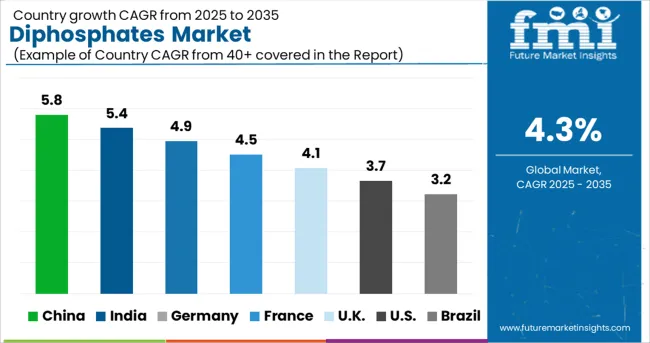

The diphosphate market is divided on the basis of regions such as North America, Latin America, Europe, East Asia, the South Asia-Pacific region, the Middle East, and Africa.

An increase in demand for diphosphates in the beverage industry in the Middle East, Africa, and Asia-Pacific regions helps fuel the market for diphosphates in these regions.

It is expected that the North America and Europe regions will hold the maximum market share of diphosphate owing to the high demand from the frozen food and manufacturing industries. The growth in the cosmetic and beverage industries is also expected to boost the overall diphosphate market across the globe.

The Asian market is expected to grow much more swiftly than other regions due to the rapidly growing end-use industries and their products.

The prominent key players operating in the diphosphates market include Hubei Xingfa Chemicals Group Co., Ltd.; Aditya Birla Chemicals; Sigma-Aldrich; Trivenichemical; Shandong IRO HEDP Co.; Generichem Corp.; Nexeo Solutions; and Mutchler Inc.

The market is highly consolidated, with the majority of companies investing a large amount of money in detailed research and development to create new and improved products. Furthermore, several key market players in the global diphosphates sector are now more focused on setting up effective joint ventures, acquisitions, and/or collaborations in order to enhance their respective consumer bases.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.30 % from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million, Volume in Tons, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Application, End-use Industry, Product Type |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia &, Pacific, Middle East and Africa |

| Key Countries Covered | The USA, Canada, Mexico, Brazil, Germany, The United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Hubei Xingfa Chemicals Group Co., Ltd, Aditya Birla Chemicals, Sigma-Aldrich, Trivenichemical, Shandong IRO HEDP Co., Generichem Corp, Nexeo solutions, Mutchler Inc. |

| Customization &, Pricing | Available upon Request |

The global diphosphates market is estimated to be valued at USD 507.4 million in 2025.

It is projected to reach USD 773.0 million by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are emulsifier, bulking agent, thickener, water retaining agent, antioxidant, texture modification, maintain color and acidification.

food industry segment is expected to dominate with a 42.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA