The future forecast of the phosphate conversion coatings market indicates a steady expansion throughout 2025 to 2035 because of rising market need from automotive applications and construction projects and defense requirements along with appliance markets. The phosphate coating technique gets widespread use during metal surface preparation for painting because it enhances adhesion and forwards both rust and wear protection.

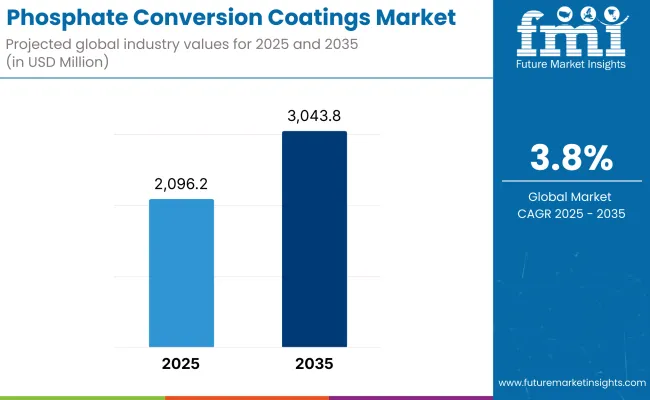

Metal longevity together with surface durability depends on these coatings which contribute to product life extension. Market analysts expect this industry to increase from its present value of USD 2,096.2 million in 2025 to USD 3,043.8 million during the 2035 timeframe with a CAGR of 3.8% throughout the forecast period.

Phosphate coatings undergo refinement to fulfil end-use requirements by minimizing sludge production and removing heavy metals while making processing at lower temperatures possible. The market employs zinc manganese and iron phosphate systems as main coating solutions because each provides unique benefits including reduced friction alongside resistance to wear and paint adhesion properties.

The drive for environmentally friendly solutions has prompted developers to create new nano-phosphate technologies and sustainable formulation methods. Industrial finishing and surface engineering heavily rely on phosphate conversion coatings because the global rise in metal fabrication alongside transportation equipment production continues to escalate.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,096.2 million |

| Industry Value (2035F) | USD 3,043.8 million |

| CAGR (2025 to 2035) | 3.8% |

The phosphate conversion coatings market requires analysis through two key segments including coating types and end usages that represent their purpose and quality specifications. Within the market you find zinc phosphate and manganese phosphate and iron phosphate coat types yet the automotive and heavy-duty sectors pick zinc variants for their exceptional corrosion resistance.

The end-use applications for phosphate conversion coatings consist of automotive manufacturing together with construction machinery and appliances and military equipment because they require precise coating uniformity and surface integrity. The market segments demonstrate a rising significance of phosphate coatings because they provide functional solutions that are both affordable and adaptable as metal surface treatments in high-performance products.

In North America, demand remains stable led by automotive and appliance. Phosphate coatings are used by the USA and Canadian military to enhance part durability and coating adhesion in harsh environments.

The European continent promotes phosphate coatings for the protection against corrosion and energy efficiency. Eco-optimized phosphate solutions can be found in vehicle components throughout Germany, France, and Italy and in high-performance construction hardware.

Asia-Pacific dominates growth with solid manufacturing output and infrastructure spend. In industrial metal finishing, construction gear, and automotive systems, China, India, Japan, and South Korea are the main engines of usage.

Challenge: Environmental Compliance and Surface Waste Management

Environmental regulations with respect to wastewater effluent discharge, heavy metals, and sludge generation are putting increasing pressure on the phosphate conversion coatings market. Zn and Mn phosphate coating widely used in the industry results the phosphate rich effluents need to be treated by a high-end and expensive processes for disposal. Due to stricter regulatory agencies, particularly in Europe and North America, there are lower limits placed on phosphates and nitrates, increasing the operational costs of metal finishing operations.

Finally, uniform coating thickness and adhesion are highly sensitive to the cleanliness of the substrate and process control, adding an additional layer of complexity in high-volume manufacturing lines. That makes it harder for smaller facilities to keep up with compliance without expensive upgrades.

Opportunity: Automotive Demand, Corrosion Resistance, and Eco-Friendly Alternatives

The use of phosphate conversion coatings continues to be a prerequisite for several industries, including automotive, appliance and construction industries because they provide superior corrosion protection and paint adhesion compared to a non-coated surface. Phosphate layers have been utilized by automakers as a base for e-coating and powder coating systems, most often on steel components. The growth of EV manufacturing and lightweight vehicle platforms have also opened up opportunities for phosphate-free or low-zinc alternative.

R&D is concentrating on Nano ceramic and zirconium-based options, said to provide comparable corrosion resistance with less environmental impact. Of equal importance to the industrial surface finishing research community is the role of phosphate coatings and cleaner chemistries within the context of durability, aesthetics and sustainability convergence in surface engineering, which is a common theme in many other areas of the modern metal finishing and surface protection landscape.

Demand remained robust in the automotive and appliance sectors during the 2020 to 2024 period, where phosphate coatings are needed for corrosion resistance and paint adhesion. But rising environmental compliance costs and the move toward greener surface treatment alternatives were slowly impacting purchasing decisions. Zinc phosphate remained popular, but there was increased interest in zirconium- and titanium-based coatings.

Between 2025 and 2035, the trend will move closer to not only low-sludge, phosphate-free conversion coatings, but those with a better sustainability profile. High-efficiency pre-treatment systems and digitalized process control will enable consistent coating performance with less chemical waste, and thus pave the way for scalable and eco-friendly surface finishing processes.

Market Shifts: Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Factor | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Basic phosphate discharge controls and VOC guidelines. |

| Technological Advancements | Dominance of zinc and manganese phosphate coatings. |

| Sustainability Trends | Limited recycling and high wastewater treatment costs. |

| Market Competition | Led by chemical treatment firms and metal finishing suppliers. |

| Industry Adoption | Widely used in automotive, appliance, and general manufacturing. |

| Consumer Preferences | Focus on proven durability and surface finish compatibility. |

| Market Growth Drivers | Automotive production, corrosion protection needs, and coating system integration. |

| Market Factor | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter phosphorus limits, sludge reduction mandates, and eco-certification requirements. |

| Technological Advancements | Growth in zirconium, titanium, and Nano ceramic conversion coatings. |

| Sustainability Trends | Rise of phosphate-free, low-VOC, and closed-loop pre-treatment systems. |

| Market Competition | Entry of eco-coating startups and automated surface treatment integrators. |

| Industry Adoption | Expands into EV platforms, green infrastructure, and modular steel construction. |

| Consumer Preferences | Shift to low-waste, environmentally compliant coatings with extended lifecycle. |

| Market Growth Drivers | Accelerated by EV adoption, green factory standards, and sustainable manufacturing policies. |

The USA phosphate conversion coatings market rises at a steady pace, underpinned by strong demand predominately from automotive, aerospace, and heavy machinery industries. In commercial and military applications, these coatings are widely used to enhance paint adhesion, increase corrosion resistance, and provide wear resistant properties in metal components.

United States manufacturers are primarily keen on zinc and manganese phosphate solutions as per MIL and ASTM standards, which are extensively used in defense and off-highway vehicle segments. Laws on pollution are also driving low-sludge, green formulations for surface treatment lines.

| Country | CAGR (2025 to 2035) |

|---|---|

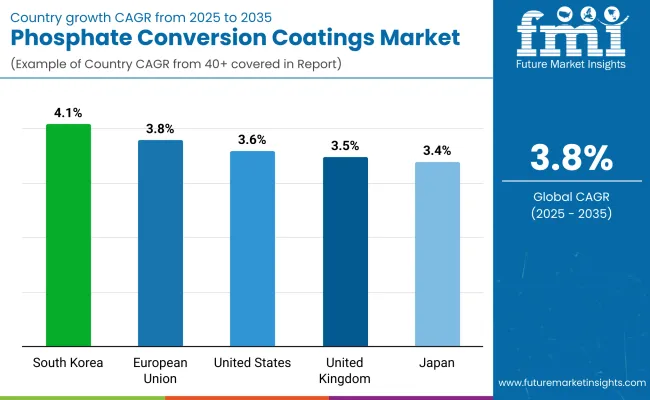

| USA | 3.6% |

The market for phosphate conversion coatings in the United Kingdom is growing steadily but remains concentrated in precision engineering and automotive component manufacturing. British companies have been applying phosphate treatments to improve corrosion resistance for steel fasteners, brake components, and transmission systems.

The shift towards more sustainable and less hazardous coating chemistries is spurred by compliance with environmental directives such as REACH. UK suppliers are increasingly highlighting pre-treatment systems that fit automatically into the finishing line.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

In Europe, phosphate conversion coatings continues to be a suitable surface treatment solution in the automotive, construction equipment, and rail manufacturing industries. These coatings are used by countries including Germany, France and Italy on structural components, engine parts and steel frames which are subjected to aggressive environments.

The EU’s stringent environmental regulations are fast-tracking PHOS recovery, furthering its adoption of metals-and waste-neutral phosphate technologies. As a result, R&D is increasingly focusing on alternative nano-structured and zirconium-based conversion layers that work with phosphate systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.8% |

Japan phosphate conversion coatings market is a little progressive due to consistent demand in automotive subassemblies and electronics hardware. Diverse range of phosphate coatings used as pre-treatment for electro-deposition painting or for long-term corrosion resistance in high-performance steel parts.

Japanese manufacturers emphasize uniformity in coating, low sludge generation, and risibility in phosphate treatment baths. Phosphate coatings have grey areas as well, tech improvements emphasize hybrid practice of phosphate combined with oxide or ceramic layers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

In South Korea, the growth of the phosphate conversion coatings market is at a stable incline, owing to the large-scale production of steel, shipbuilding, and automotive production in the region. These coatings play an essential role in minimizing corrosion for structural metal parts and enhancing coating adhesion for painted components.

Global OEM standards are met by Korean companies through the adoption of cleaner phosphate systems characterized by high bath stability and low environmental burden. And across the country, the demand for automation-ready surface treatment lines is driving upgrades in phosphate application systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

As the industries are on a constant search for reliable solutions to enhance their painted metals surface durability, corrosion protection, and paint adhesion, the phosphate conversion coatings market continues to witness growth. These coatings work by creating a crystalline layer on metal surfaces in a chemical reaction involving phosphoric acid and metal ions.

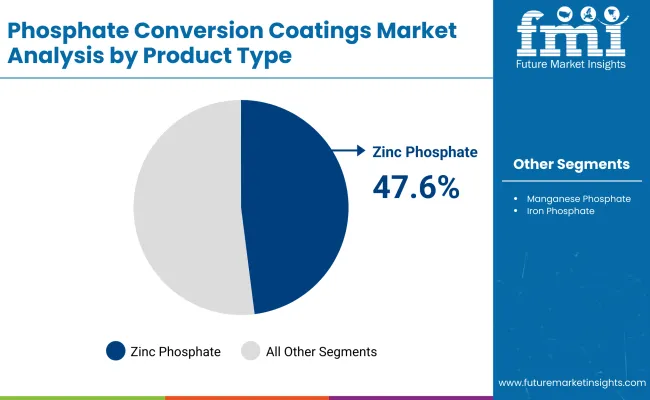

Zinc phosphate conversion coatings are the most dominant types among the available variety due to special features like better corrosion resistance, good substrate adhesion, and suitability for many types of metals.

The automotive sector such as coatings in the preparation of parts for painting, that enhance wear resistance and limit wear and to improve ton usability as the basic user of the monopoly, there is non-starved market demand. Combined, these segments highlight the market’s focus on longevity, protection, and precision surface treatment.

As universal manufacturing criteria rise and sustainability remains a matter of urgency, phosphate coatings remain an important aspect of lowering energy usage throughout all paint processes and enhancing the efficacy of protective finishes. Related Advances that will Shape the Future Landscape for the Market include Zinc-based Formulations and Automotive Applications

| Product Type | Market Share (2025) |

|---|---|

| Zinc Phosphate Conversion Coating | 47.6% |

The product type Segment is segmented into zinc phosphate conversion coatings, which is estimated to dominate the segment, as these coatings offer excellent corrosion protection and also provide a superior surface for the application of further paint or coating layers.

These create dense, crystalline formations that attach well to metal substrates, thereby increasing the adhesion of primers and topcoats, and also serving as a barrier against moisture and chemicals. Zinc phosphate coatings are effective in both alkaline and acidic environments and are used in a variety of industrial and commercial applications.

Zinc phosphate systems are preferable for manufacturers because of the extended protection they offer in areas with abundant humidity or coastal areas as exposed to higher corrosion risks. These coatings are commonly applied to car parts, structural steel, appliances, and construction machinery.

They are also compatible with electro coating (e-coat) and powder coating processes which makes them more appealing. Zinc phosphate maintains its lead in the segment as industries strive for improved sustainability in terms of product life cycles and maintenance costs, providing ease of application in bulk industrial processes, as well as balance of protection and efficiency in performance.

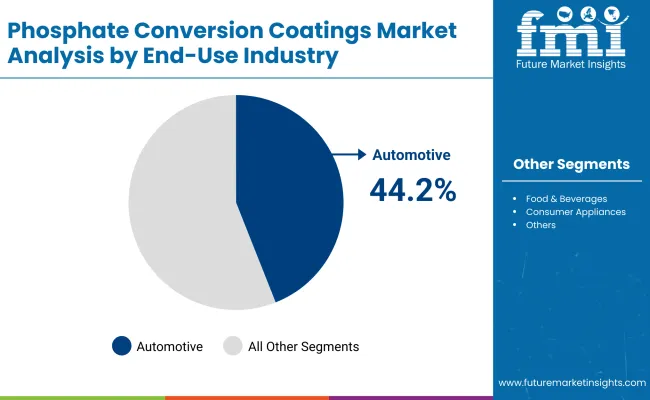

| End-use Industry | Market Share (2025) |

|---|---|

| Automotive | 44.2% |

Phosphate conversion coatings are being widely used in automotive industry to achieve durability protection, corrosion protection, and maximum paint adhesion. The phosphate coating is used by vehicle manufacturers on the body panels, undercarriages, suspension parts, and engine components prior to painting to improve the uniform adherence of coatings and to protect these metals from environmental degradation. It is parts of the pre-treatment process in the automotive industry that improve performance and cosmetics as well.

As automakers work to lighter vehicle platforms using mixed materials, they have re-engaged with phosphate conversion coatings. Coatings of zinc phosphate are often used to reduce the possibility of galvanic corrosion between dissimilar metals like steel and aluminum, so are a good fit for modern vehicle structures. In high-volume manufacturing environments, certifications have shown that phosphate systems not only reduce defects in paint but improve production consistency as well.

Phosphate coatings find themselves at the core of production lines, from passenger to commercial to electric vehicle segments, as automotive value chains strive for longer warranties and improved corrosion protection, sealing their continued dominance in the segment.

The global phosphate conversion coatings market is imperative for improving surface integrity, corrosion resistance as well as paint adhesion for metal components in automotive, construction, appliances, and general manufacturing sectors. These coatings are created by way of a Chem reaction between purified phosphoric acid and metal substrates, typically resulting in a crystalline phosphate layer of zinc, iron or manganese.

Adoption is being driven by increasing demand for corrosion-resistant parts, longer-lasting coatings, and efficient metal pre-treatment. Green formulations and processes that generate less sludge are also driving market dynamics. Key players in this sector provide advanced pre-treatment systems, high-throughput formulations, and tailored coating solutions that are designed to meet industrial durability and regulatory compliance requirements.

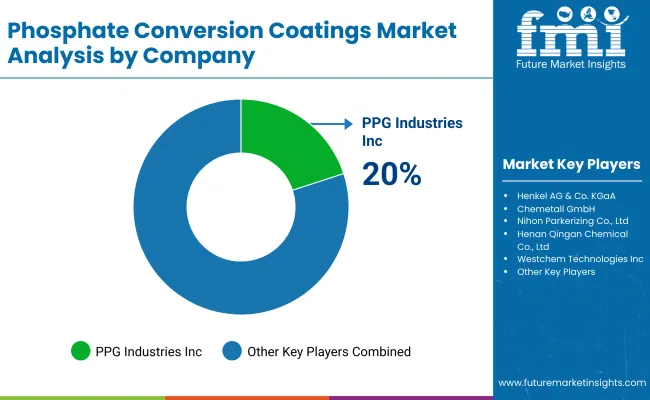

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PPG Industries, Inc. | 20-24% |

| Henkel AG & Co. KGaA | 15-19% |

| Chemetall GmbH (BASF Group) | 12-16% |

| Nihon Parkerizing Co., Ltd. | 9-13% |

| Henan Qingan Chemical Co., Ltd. | 7-11% |

| Westchem Technologies Inc. | 6-10% |

| Other Companies (combined) | 18-26% |

| Company Name | Key Offerings/Activities |

|---|---|

| PPG Industries, Inc. | Launched low-zinc phosphate coatings for automotive underbody protection in 2025. |

| Henkel AG & Co. KGaA | Introduced next-gen phosphate-free pre-treatment systems for aluminum and mixed metals in 2024. |

| Chemetall GmbH | Expanded production of iron and manganese phosphate systems for heavy equipment in 2024. |

| Nihon Parkerizing Co., Ltd. | Released high-performance crystalline phosphate coatings tailored for automotive fasteners in 2025. |

| Henan Qingan Chemical | Developed cost-effective zinc phosphate coatings for consumer appliance housings in 2025. |

| Westchem Technologies Inc. | Rolled out eco-efficient phosphate formulations designed for batch and continuous processing lines in 2024. |

Key Company Insights

PPG Industries, Inc.

PPG leads the phosphate conversion coatings market with zinc-based formulations optimized for automotive corrosion protection and paint bonding. Its focus on environmentally responsible chemistries and process efficiency appeals to OEMs and tier-1 suppliers globally.

Henkel AG & Co. KGaA

Henkel offers phosphate and phosphate-free pre-treatment technologies, emphasizing process simplification and multi-metal compatibility. Its BONDERITE brand supports green chemistry transitions in metalworking, appliances, and light vehicle manufacturing.

Chemetall GmbH (BASF Group)

Chemetall delivers high-performance iron, manganese, and zinc phosphate coatings tailored for industrial and construction-grade components. Known for its system integration and technical support, it enables durable, uniform coating layers in challenging environments.

Nihon Parkerizing Co., Ltd.

Nihon Parkerizing is a pioneer in crystalline phosphate coatings used in high-precision automotive and aerospace fasteners. The company’s formulations ensure tight dimensional tolerance and excellent adhesion under high-stress conditions.

Henan Qingan Chemical Co., Ltd.

Henan Qingan focuses on cost-effective zinc phosphate systems for general metal finishing, targeting appliance housings, enclosures, and light metal components. Its products are widely used in China’s growing home appliance manufacturing sector.

Westchem Technologies Inc.

Westchem specializes in phosphate conversion coatings for small and medium-sized manufacturers, offering customizable solutions for batch systems. Its low-toxicity and sludge-reducing formulations support lean operations and regulatory compliance.

Other Key Players (18-26% Combined)

Numerous regional and niche manufacturers support the phosphate conversion coatings market by providing localized solutions, customized chemistries, and flexible delivery models:

The overall market size for the phosphate conversion coatings market was USD 2,096.2 million in 2025.

The phosphate conversion coatings market is expected to reach USD 3,043.8 million in 2035.

The increasing need for corrosion-resistant metal treatments, rising demand from automotive manufacturing, and growing application of zinc phosphate coatings for surface protection fuel the phosphate conversion coatings market during the forecast period.

The top 5 countries driving the development of the phosphate conversion coatings market are the USA, UK, European Union, Japan, and South Korea.

Zinc phosphate coatings and automotive sector lead market growth to command a significant share over the assessment period.

Table 01: Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 02: Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 03: Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End-use Industry, 2013-2028

Table 04 (A): Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Region, 2013-2028

Table 04 (B): Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Region, 2013-2028

Table 05: North America Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 06: North America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 07: North America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 08: North America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 09: Latin America Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 10: Latin America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 11: Latin America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 12: Latin America Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 13: Western Europe Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 14: Western Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 15: Western Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 16: Western Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 17: Eastern Europe Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 18: Eastern Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 19: Eastern Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 20: Eastern Europe Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 21: South East Asia & Pacific Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 22: South East Asia & Pacific Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 23: South East Asia & Pacific Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 24: South East Asia & Pacific Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 25: China Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 26: China Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 27: China Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 28: India Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 29: India Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 30: India Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 31: MEA Phosphate conversion coating Market Value (US$ Mn) and Volume (Tons) by Country

Table 32: MEA Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 33: MEA Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 34: MEA Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Table 35: Japan Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Product Type, 2013-2028

Table 36: Japan Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by Substrate, 2013-2028

Table 37: Japan Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Forecast by End Use Industry, 2013-2028

Figure 01: Global Phosphate Conversion Coatings Market Size (US$ Mn) and Volume (Tons) Analysis, 2021-2028

Figure 02: Global Phosphate Conversion Coatings Market Y-o-Y Growth Projection, 2022-2028

Figure 03: Global Phosphate Conversion Coating Market Absolute $ Opportunity Analysis, 2021-2028

Figure 04: Global Phosphate Conversion Coatings Market Share and BPS Analysis by Product Type – 2022 & 2028

Figure 05: Global Phosphate Conversion Coatings Market Y-o-Y Growth Projections by Product Type, 2022 -2028

Figure 06: Global Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Product Type

Figure 07: Global Phosphate Conversion Coatings Market Attractiveness Analysis by Product Type, 2022-2028

Figure 08: Global Phosphate Conversion Coatings Market Share and BPS Analysis by Substrate– 2022 & 2028

Figure 09: Global Phosphate Conversion Coatings Market Y-o-Y Growth Projections by Substrate, 2022 - 2028

Figure 10: Global Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Substrate

Figure 11: Global Phosphate Conversion Coatings Market Attractiveness Analysis by Substrate, 2022-2028

Figure 12: Global Phosphate Conversion Coatings Market Share and BPS Analysis by End Use Industry– 2022 & 2028

Figure 13: Global Phosphate Conversion Coatings Market Y-o-Y Growth Projections by End Use Industry, 2022 - 2028

Figure 14: Global Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by End Use Industry

Figure 15: Global Phosphate Conversion Coatings Market Attractiveness Analysis by End Use Industry, 2022-2028

Figure 16: Global Phosphate Conversion Coatings Market Share and BPS Analysis by Region– 2022 & 2028

Figure 17: Global Phosphate Conversion Coatings Market Y-o-Y Growth Projections by Region, 2022 - 2028

Figure 18: Global Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Region

Figure 19: Global Phosphate Conversion Coatings Market Attractiveness Analysis by Region, 2022-2028

Figure 20: North America Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 21: North America Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 –2028

Figure 22: North America Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 23: North America Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Region

Figure 24: North America Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 25: North America Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 – 2028

Figure 26: North America Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 27: North America Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 28: North America Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 –2028

Figure 29: North America Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 30: North America Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 31: North America Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 –2028

Figure 32: North America Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 33: Latin America Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 34: Latin America Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 – 2028

Figure 35: Latin America Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 36: Latin America Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 37: Latin America Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 38: Latin America Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 –2028

Figure 39: Latin America Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 40: Latin America Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 41: Latin America Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 42: Latin America Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 43: Latin America Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 44: Latin America Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 – 2028

Figure 45: Latin America Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 46: Western Europe Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 47: Western Europe Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 – 2028

Figure 48: Western Europe Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 49: Western Europe Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 50: Western Europe Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 51: Western Europe Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 –2028

Figure 52: Western Europe Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 53: Western Europe Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 54: Western Europe Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 55: Western Europe Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 56: Western Europe Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 57: Western Europe Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 – 2028

Figure 58: Western Europe Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 59: Eastern Europe Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 60: Eastern Europe Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 – 2028

Figure 61: Eastern Europe Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 62: Eastern Europe Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 63: Eastern Europe Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 64: Eastern Europe Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 – 2028

Figure 65: Eastern Europe Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 66: Eastern Europe Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 67: Eastern Europe Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 –2028

Figure 68: Eastern Europe Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 69: Eastern Europe Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 70: Eastern Europe Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 – 2028

Figure 71: Eastern Europe Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 72: South East Asia & Pacific Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 73: South East Asia & Pacific Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 – 2028

Figure 74: South East Asia & Pacific Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 75: South East Asia & Pacific Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 76: South East Asia & Pacific Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 77: South East Asia & Pacific Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 –2028

Figure 78: South East Asia & Pacific Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 79: South East Asia & Pacific Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 80: South East Asia & Pacific Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 –2028

Figure 81: South East Asia & Pacific Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 82: South East Asia & Pacific Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 83: South East Asia & Pacific Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 – 2028

Figure 84: South East Asia & Pacific Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 85: China Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 86: China Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 – 2028

Figure 87: China Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 88: China Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 89: China Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 90: China Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 91: China Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 92: China Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 – 2028

Figure 93: China Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 94: India Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 95: India Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 – 2028

Figure 96: India Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 97: India Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 98: India Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 99: India Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 100: India Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 101: India Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 –2028

Figure 102: India Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 103: MEA Phosphate Conversion Coating Market BPS Analysis by Country, 2022 & 2028

Figure 104: MEA Phosphate Conversion Coating Market Y-o-Y Growth by Country, 2022 – 2028

Figure 105: MEA Phosphate Conversion Coating Market Attractiveness Analysis by Country, 2022

Figure 106: MEA Phosphate Conversion Coating Market Absolute $ Opportunity (US$ Mn), 2022 – 2028 by Country

Figure 107: MEA Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 108: MEA Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 –2028

Figure 109: MEA Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 110: MEA Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 111: MEA Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 112: MEA Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 113: MEA Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 114: MEA Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 –2028

Figure 115: MEA Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Figure 116: Japan Phosphate Conversion Coating Market BPS Analysis by Product Type, 2022 & 2028

Figure 117: Japan Phosphate Conversion Coating Market Y-o-Y Growth by Product Type, 2022 – 2028

Figure 118: Japan Phosphate Conversion Coating Market Attractiveness Analysis by Product Type, 2022

Figure 119: Japan Phosphate Conversion Coating Market BPS Analysis by Substrate, 2022 & 2028

Figure 120: Japan Phosphate Conversion Coating Market Y-o-Y Growth by Substrate, 2022 – 2028

Figure 121: Japan Phosphate Conversion Coating Market Attractiveness Analysis by Substrate, 2022

Figure 122: Japan Phosphate Conversion Coating Market BPS Analysis by End Use Industry, 2022 & 2028

Figure 123: Japan Phosphate Conversion Coating Market Y-o-Y Growth by End Use Industry, 2022 –2028

Figure 124: Japan Phosphate Conversion Coating Market Attractiveness Analysis by End Use Industry, 2022

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phosphated Ester Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Salts Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Phosphate Market Growth - Trends & Forecast 2024 to 2034

Phosphate Esters Market

Phosphated Distarch Phosphate Market

Diphosphates Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyphosphate Market Food-Grade, Feed Grade, Cosmetic Grade and Other Grades through 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Hyperphosphatemia Market Size and Share Forecast Outlook 2025 to 2035

Feed Phosphate Market Analysis by Product, Livestock, and Region through 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Organophosphate Pesticides Market

Sodium Phosphate Market Growth & Demand Forecast 2025 to 2035

Ferric Phosphate Market

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Phosphate Market Trends & Analysis 2019-2029

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA