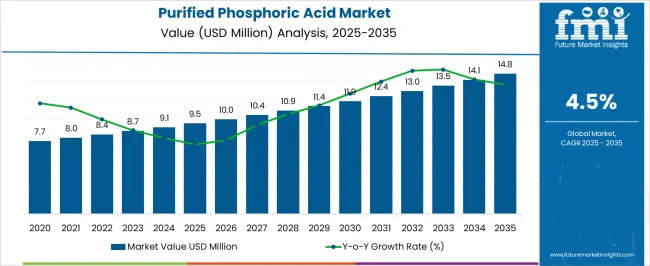

The Purified Phosphoric Acid Market is estimated to be valued at USD 9.5 million in 2025 and is projected to reach USD 14.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Purified Phosphoric Acid Market Estimated Value in (2025 E) | USD 9.5 million |

| Purified Phosphoric Acid Market Forecast Value in (2035 F) | USD 14.8 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Purified Phosphoric Acid market is experiencing steady growth driven by increasing demand from multiple industrial applications, including food processing and agrochemicals. The market is being influenced by the rising need for high-purity phosphoric acid in food-grade applications, where strict quality and safety standards are enforced. Simultaneously, the agrochemical industry is leveraging purified phosphoric acid for fertilizer formulations, enhancing crop yields and agricultural efficiency.

Factors such as population growth, changing dietary patterns, and the increasing focus on sustainable agriculture are contributing to the market expansion. Technological advancements in purification processes are enabling manufacturers to produce higher-quality products while maintaining cost-effectiveness.

Additionally, regulatory compliance and rising consumer awareness of food safety standards are driving adoption in food applications The market outlook indicates continued growth as manufacturers focus on expanding production capacities and improving supply chain efficiencies, while industries increasingly prioritize high-quality phosphoric acid for critical formulations.

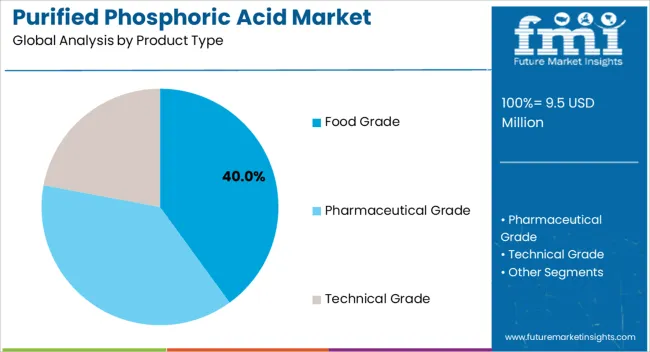

The Food Grade segment is projected to hold 40.00% of the Purified Phosphoric Acid market revenue in 2025, establishing it as the leading product type. This dominance is being attributed to the increasing demand for safe, high-purity ingredients in the food and beverage industry. Purified phosphoric acid is preferred due to its ability to maintain taste, stability, and quality in processed foods and beverages.

Stringent food safety regulations have reinforced the importance of adopting food-grade phosphoric acid, and manufacturers are actively prioritizing high-purity sources to ensure compliance. The segment’s growth has also been supported by the expansion of processed food markets in emerging economies, where demand for standardized and safe food additives is rising.

As consumer preferences shift towards higher-quality processed foods, the adoption of food-grade phosphoric acid is expected to remain robust Additionally, the ability to integrate these products into beverage carbonation, acidulants, and flavor enhancement systems without compromising quality further strengthens its market leadership.

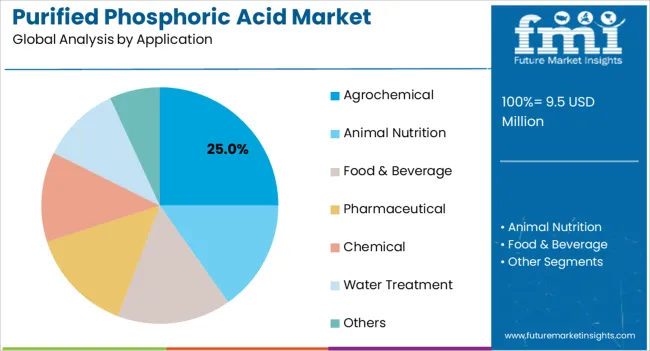

The Agrochemical application segment is expected to account for 25.00% of the Purified Phosphoric Acid market revenue in 2025, positioning it as a key growth area. This prominence is being driven by the increasing demand for high-efficiency fertilizers and crop protection products that rely on purified phosphoric acid as a critical input. The segment’s growth is supported by rising global food demand, the intensification of agriculture, and the adoption of advanced nutrient management practices.

Purified phosphoric acid is favored for its superior consistency, solubility, and chemical stability, which enhance the efficacy of fertilizers and agrochemicals. Investment in sustainable farming practices and precision agriculture is also contributing to the adoption of high-quality phosphoric acid in agrochemical formulations.

Furthermore, the segment benefits from the ability to supply large-scale agricultural operations with consistent and reliable raw material, which is critical for productivity and yield optimization As agriculture continues to evolve with higher productivity standards and environmental considerations, the agrochemical segment is expected to maintain strong growth and remain a significant contributor to the market.

As per Future Market Insights (FMI), historically from 2020 to 2025, global sales of purified phosphoric acid increased at 4.3% CAGR. It attained a valuation of about USD 8,357.3 million at the end of 2025.

Looking ahead, the target market is expected to thrive at a CAGR of around 4.7% during the assessment period. This is due to increasing demand for purified phosphoric acid from pharmaceutical, food & beverage, and other sectors and growing agricultural activities in emerging markets.

Factors such as raw material availability, technological advancements, and government regulations are also impacting market growth. Subsequently, increasing demand for eco-friendly and sustainable products is expected to contribute to market growth.

Purified phosphoric acid is in high demand in the food & beverage and pharmaceutical sectors owing to its specific properties, including its preservative nature.

In the food & beverage sector, the use of acidulants and preservatives has become increasingly important as processed foods become more prevalent. Purified phosphoric acid is widely used in carbonated beverages, jams, jellies, and processed meats due to its acidic properties and preservative effects.

Growing demand for clean-label ingredients has led to an increase in the use of PPA as a natural acidulant, replacing artificial additives.

In the pharmaceutical sector, PPA plays a critical role as an ingredient, excipient, and buffering agent. It is used in the formulation and manufacturing of medications such as tablets, capsules, and liquid formulations.

Purified phosphoric acid is essential in regulating the pH levels of pharmaceutical formulations, ensuring stability and efficacy. It serves as a buffering agent, maintaining the desired pH range during the drug manufacturing process.

The demand for high-quality products in the pharmaceutical sector, driven by the industry's strict quality standards and the need for precise formulations, is likely to foster market development.

Purified phosphoric acid is a versatile and essential ingredient in the food & beverage sector, serving as an acidulant and preservative, and in the pharmaceutical sector, it is relied upon for its ability to regulate pH levels and act as a buffering agent in medication formulations.

The demand for purified phosphoric acid is driven by specific factors in both sectors, highlighting its critical role in the production and manufacturing of various products.

Manufacturers can capitalize on the latest technologies and production methods to optimize the efficiency and quality of purified phosphoric acid production. This can involve implementing innovative purification techniques, optimizing process parameters, and incorporating automation and digitization in production facilities.

The new improvements can result in higher yields, reduced energy consumption, improved product purity, and overall cost savings. Engaging in research and development (R&D) activities can help manufacturers stay ahead of the curve in the industry.

Vertical integration offers manufacturers the opportunity to control the entire supply chain, from raw material sourcing to the production and distribution of purified phosphoric acid.

By integrating back into the production of raw materials or forward into distribution and marketing, manufacturers can exert greater control over quality, cost, and supply reliability. This can lead to improved coordination, shorter lead times, and reduced dependency on external suppliers, ultimately enhancing competitiveness in the market.

The manufacturers and suppliers should consider investing in technological advancements and vertical integration to capitalize on the opportunities available in the purified phosphoric acid market.

The production costs of purified phosphoric acid pose a significant challenge to the market. The purification process required to obtain high-purity phosphoric acid is complex and resource-intensive, resulting in elevated production expenses compared to other forms of phosphoric acid.

Numerous factors contribute to these high costs, including the need for multiple intricate steps such as filtration, concentration, and acidulation. These processes require substantial energy inputs, leading to increased production expenses, particularly in regions with high energy prices.

Advanced purification technologies and equipment are necessary to achieve the desired level of purity. These sophisticated systems, including filtration mechanisms, separation techniques, and chemical treatments, are costly to install, operate, and maintain.

Ensuring consistent quality is vital for purified phosphoric acid, particularly for applications in the food and pharmaceutical sectors. This necessitates rigorous quality control measures and regular testing throughout the production process, further adding to the overall production costs.

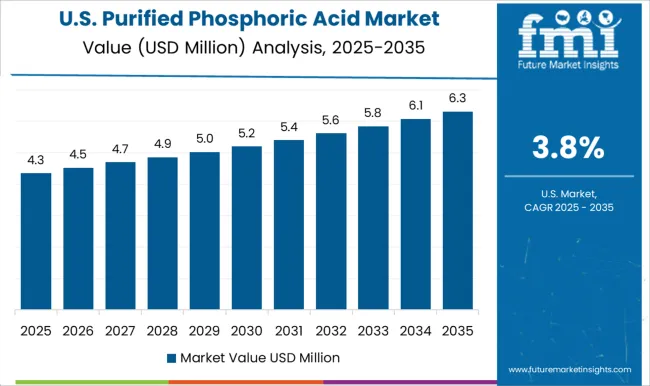

Regionally, East Asia and North America are prominent markets for purified phosphoric acid globally. It is projected that these regions will contribute more than 60% of the total market value, primarily owing to their high consumption levels.

In East Asia and North America, countries such as China and the United States have substantial domestic markets for pharmaceutical products. This is fuelled by factors like population growth, increased healthcare expenditure, and the prevalence of chronic diseases.

There is a significant consumption of purified phosphoric acid in these regions as an ingredient, excipient, or buffering agent in pharmaceutical formulations. This demand is driven by the necessity for high-quality pharmaceutical products to address the healthcare requirements of the population.

Similarly, robust growth of food & beverage sector in these regions is expected to elevate purified phosphoric acid demand. This is because purified phosphoric acid is being widely used in various applications, including pH adjustment, acidification, emulsification, and flavor enhancement in the food & beverage sector.

Rising Spending on Pharmaceuticals Fueling Purified Phosphoric Acid Demand in the United States

According to Future Market Insights (FMI), the United States is likely to remain one of the dominant markets for purified phosphoric acid during the assessment period. Demand for phosphoric acid in the country is driven by rapid expansion of pharmaceutical sector.

Increasing spending on medicines across the United States is emerging as a prominent factor creating a high demand for purified phosphoric acid. This is attributable to rising usage of purified phosphoric acid for making a wide range of pharmaceutical formulations.

The United States is the leading country when it comes to healthcare spending. As per the USA Department of Health and Human Services, United States prescription drug expenditures totaled a massive valuation of USD 7.7 billion in 2020. This in turn is positively impacting purified phosphoric acid sales.

Demand Remains High for Food Grade Purified Phosphoric Acid

Based on product type, demand is expected to remain high for food-grade purified phosphoric acid. Currently, the target segment dominates the global market with a share of more than 37%. This is attributable to rising usage of food-grade PPA as an acidulant, pH adjuster, and preservative in the food & beverage sector.

The high demand from the food sector results in prominent shares of food-grade purified phosphoric acid. In the food sector, purified phosphoric acid is widely used as an ingredient in various food products.

Purified phosphoric acid is commonly used as an acidulant to enhance the flavor and preserve the shelf life of food products. It is used in the production of soft drinks, fruit juices, jams, and jellies.

Purified phosphoric acid is also used in the production of processed meats, such as bacon and sausage, to enhance the flavor and preserve the quality of the meat.

Rising demand for processed and packaged food products due to changing lifestyles is expected to play a key role in fueling purified phosphoric acid sales during the assessment period.

Pharmaceutical Application to Generate Significant Revenues

On the basis of application, pharmaceutical segment leads the global market with more than 28% market shares. This is due to rising usage of purified phosphoric acid for the preparation of various pharmaceutical formulations.

Purified phosphoric acid is utilized as an ingredient in the production of certain pharmaceuticals. The main factor which contributes the most to the value shares in the global market is the price of PPA used in pharmaceutical applications. The price of PPA consumed in pharmaceuticals is high compared to the PPA used in the food and beverages sector.

Purified phosphoric acid serves as an API in medications, contributing to their therapeutic properties or serving as a component in drug formulation. It functions as an excipient, a substance added to pharmaceutical formulations for various purposes such as improving drug stability, solubility, or bioavailability.

Purified phosphoric acid is in high demand in the pharmaceutical sector owing to its unique properties and applications. It is an important ingredient in various pharmaceutical formulations, including oral liquids, tablets, and capsules. It is used as an excipient, buffering agent, and acidulant.

One of the primary factors for the high demand for purified phosphoric acid in the pharmaceutical sector is its ability to maintain the pH level of a formulation. It is an effective acidulant that can be used to adjust the pH level of a product to ensure that it is safe for human consumption.

Purified phosphoric acid can also be used as a buffering agent to maintain the pH level of a product over a wide range of temperatures and conditions.

Another factor for the high demand for purified phosphoric acid in the pharmaceutical sector is its role in the manufacturing of essential drugs. For example, it is used in the production of penicillin, a widely used antibiotic. Penicillin is produced through a chemical reaction that requires purified phosphoric acid as a reactant.

Rising production & consumption of various pharmaceutical formulations that require purified phosphoric acid for their preparation is projected to boost the target segment through 2035.

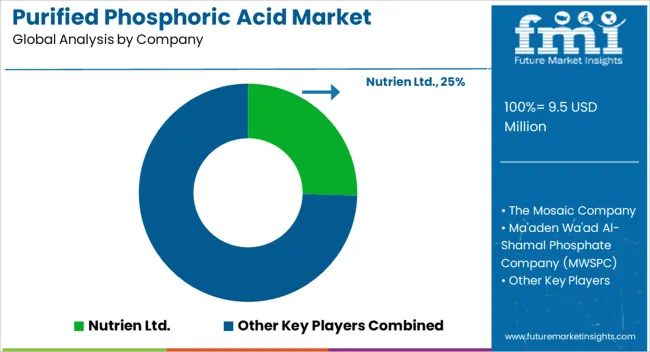

Key manufacturers hold around 40% to 45% market share in the global market. The market is expected to be fairly consolidated as prominent purified phosphoric acid manufacturers are holding a significant share of the market.

Leading players are continuously engaging in boosting their production capacity and updating their product portfolio. To gain maximum profits, companies are also utilizing strategies such as partnerships, mergers, agreements, alliances, acquisitions, etc.

Recent developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 9.5 million |

| Projected Market Size (2035) | USD 14.8 million |

| Anticipated Growth Rate (2025 to 2035) | 4.5% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value and Tons for Volume |

| Key Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Central Asia, Russia & Belarus, Balkan & Baltics, East Asia, South Asia Pacific, and Middle East Africa |

| Key Market Segments Covered | Product Type, Application, and Region |

| Key Companies Profiled | Nutrien Ltd. ; The Mosaic Company ; Ma'aden Wa'ad Al-Shamal Phosphate Company (MWSPC) ; ICL Group Ltd. ; Hubei Xingfa Chemicals Group Co., Ltd ; Yara International ASA ; OCP Group ; Jordan Phosphates Mines Company ; The Mosaic Company ; OCI Co. Ltd. ; PhosAgro ; EuroChem Group ; Gujarat State Fertilizers Corporation Limited ; Gujarat Alkalis and Chemicals Ltd. ; Industries Chimiques du Senegal |

The global purified phosphoric acid market is estimated to be valued at USD 9.5 million in 2025.

The market size for the purified phosphoric acid market is projected to reach USD 14.8 million by 2035.

The purified phosphoric acid market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in purified phosphoric acid market are food grade, pharmaceutical grade and technical grade.

In terms of application, agrochemical segment to command 25.0% share in the purified phosphoric acid market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Purified Terephthalic Acid (PTA) Market Forecast and Outlook 2025 to 2035

Phosphoric Acid Market Size and Share Forecast Outlook 2025 to 2035

Glycerophosphoric Acid Calcium Salt Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Phosphoric Acid Market

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA