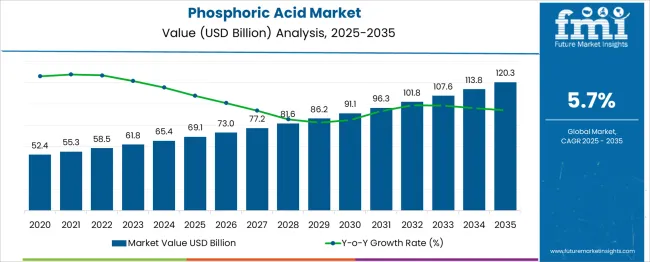

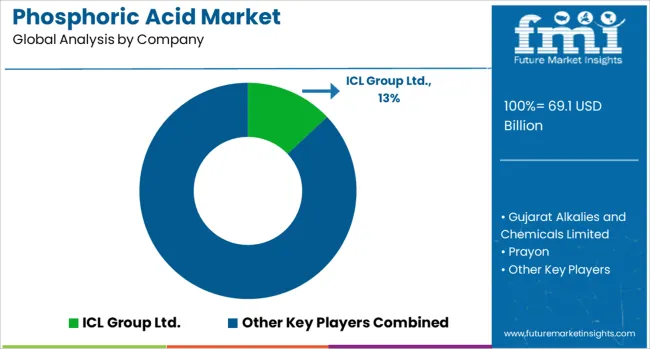

The Phosphoric Acid Market is estimated to be valued at USD 69.1 billion in 2025 and is projected to reach USD 120.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period. The phosphoric acid market is set to grow and deliver an absolute dollar opportunity of USD 51.2 billion. During the first half of the forecast period (2025–2030), the market expands from USD 69.1 billion to USD 91.1 billion, adding USD 22 billion, which accounts for nearly 43% of total incremental growth, driven by the rising demand for phosphate-based fertilizers in agriculture and consistent utilization in food and beverage processing.

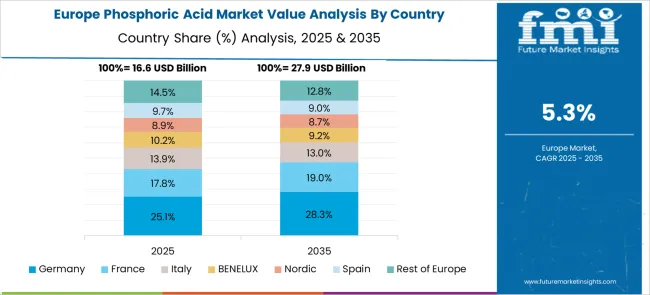

The latter phase (2030–2035) contributes USD 29.2 billion, taking the market to USD 120.3 billion, or 57% of total growth, propelled by the increasing role of phosphoric acid in advanced applications such as lithium iron phosphate (LFP) batteries for electric vehicles and large-scale energy storage systems. Additional drivers include its growing use in industrial chemicals, corrosion inhibitors, and water treatment solutions. Asia-Pacific dominates demand, led by agriculture-driven consumption and an expanding industrial base, while North America and Europe show growth through specialty and high-performance applications. Companies focusing on cost-efficient production technologies, process optimization, and value chain integration for phosphate derivatives will capitalize on this USD 51.2 billion absolute growth potential effectively.

| Metric | Value |

|---|---|

| Phosphoric Acid Market Estimated Value in (2025 E) | USD 69.1 billion |

| Phosphoric Acid Market Forecast Value in (2035 F) | USD 120.3 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The phosphoric acid market plays a dominant role in the fertilizer chemicals market, accounting for roughly 85–90% of demand, as it is indispensable for producing key phosphate fertilizers such as DAP and MAP. In the food and beverage additives market, its contribution is modest at around 4–5%, largely used in acidifying soft drinks, jams, dairy products, and as a preservative. Within the water treatment chemicals market, phosphoric acid holds a smaller share of 2–3%, where it supports pH adjustment and anti-scaling formulations. In the metal surface treatment chemicals market, its share hovers around 3–4%, used for phosphate conversion coatings and rust prevention treatments.

Within the broader industrial specialty chemicals market, phosphoric acid has an estimated 5–6% share, serving as a precursor in pharmaceuticals, semiconductor etching, and cleaning agents. Market momentum is anchored by agriculture demand, especially in Asia-Pacific which accounts for nearly half of global phosphoric acid consumption. Growth is also supported by its expanding use in food processing, industrial pH control, and surface treatment sectors. The versatility of phosphoric acid as a functional ingredient across diverse sectors ensures its continued relevance and strategic significance in global chemical supply chains.

The phosphoric acid market is witnessing sustained growth, driven by escalating global fertilizer demand, expansion in food-grade chemical applications, and rising investments in water treatment infrastructure. The market is being shaped by the strategic integration of phosphate rock reserves with processing facilities, enabling secure raw material supply and cost efficiency.

Regulatory focus on food safety and water quality is further boosting demand for high-purity technical and food-grade phosphoric acid. Additionally, industrial diversification in sectors such as electronics, metallurgy, and pharmaceuticals is increasing the reliance on specialized grades.

With global agricultural productivity under pressure and sustainability becoming central to industrial operations, phosphoric acid remains a critical enabler of modern crop nutrition and precision manufacturing processes.

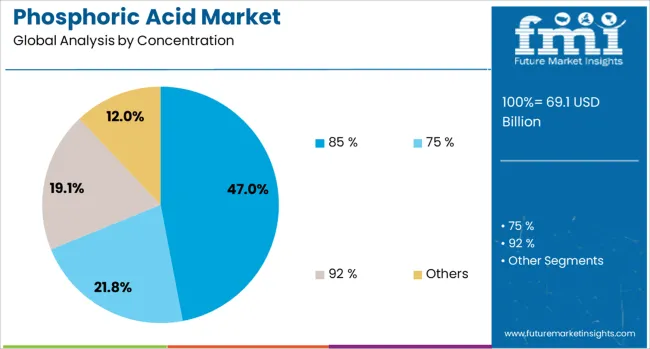

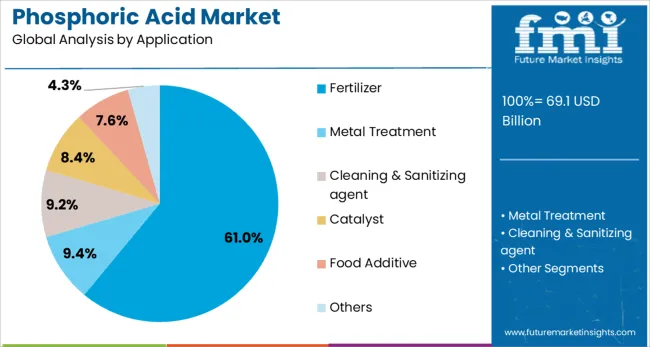

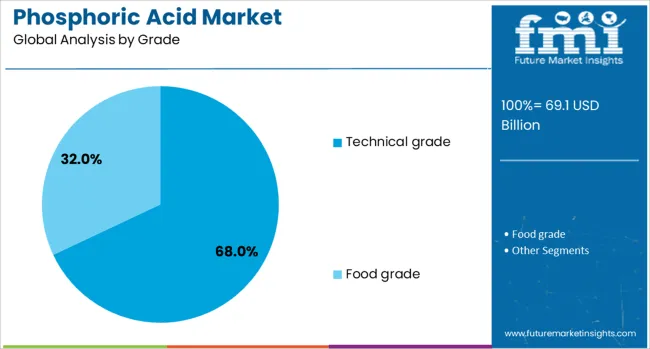

The phosphoric acid market is segmented by concentration, application, grade, end-use, and geographic regions. The phosphoric acid market is concentrated in 85%, 75%, 92%, and Others. The phosphoric acid market is classified into Fertilizer, Metal Treatment, Cleaning & Sanitizing agent, Catalyst, Food Additive, and Others. The phosphoric acid market is segmented into Technical grade and Food grade. The phosphoric acid market is segmented by end-use into Agriculture, Energy, Industrial Cleaning, General Industrial, Construction, Water Treatment, Beverage, Nutritional supplement, Processed foods, Dairy products, and Others. Regionally, the phosphoric acid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 85% concentration segment is expected to hold 47.0% of the total revenue share in the phosphoric acid market by 2025, establishing it as the dominant concentration level. This concentration is preferred due to its optimal balance between reactivity and handling safety, making it highly suitable for direct application in both fertilizer and industrial uses.

Its widespread use in phosphate-based fertilizer manufacturing has cemented its market position, particularly in regions with phosphate-dependent agricultural economies.

Moreover, compatibility with automated dosing and transport systems has made it a standard for bulk users seeking operational consistency and regulatory compliance.

Fertilizers are projected to command 61.0% of the market share in 2025, marking the largest application segment for phosphoric acid. This leadership is primarily driven by the expanding global demand for phosphorus-based nutrients to support intensive farming practices.

As arable land continues to shrink and crop yield optimization becomes critical, phosphoric acid remains indispensable in the production of DAP, MAP, and other key fertilizers. Government subsidies for phosphate fertilizers in emerging economies and technological advancements in soil-specific formulations are further accelerating segment growth.

Additionally, favorable trade dynamics and a robust agri-input supply chain are reinforcing sustained demand from the fertilizer industry.

Technical grade phosphoric acid is projected to contribute 68.0% of the revenue share in 2025, making it the leading grade segment. Its dominance stems from high versatility and consistent demand across a wide range of industrial applications, including water treatment, detergents, metal cleaning, and pharmaceuticals.

Technical grade is widely utilized due to its controlled purity and cost-effectiveness, enabling manufacturers to meet performance and safety benchmarks without incurring premium costs associated with food or electronic grades.

The increasing focus on infrastructure hygiene and energy-efficient industrial processes is also supporting broader adoption of this grade.

Phosphoric acid is a vital industrial chemical produced through wet and thermal processes, widely used in fertilizers, food additives, water treatment, and metal finishing. High-purity grades are also required in pharmaceuticals, semiconductors, and specialty applications. Growth has been supported by rising fertilizer consumption, increased demand for food acidulants, and expanding industrial uses. Producers have focused on advanced purification methods, energy-efficient production, and traceability. Technological improvements and partnerships with specialty chemical end-users continue to shape competitive positioning. Demand remains closely linked to agricultural cycles, industrial activity, and regulations on product quality and environmental safety.

Adoption of phosphoric acid has been driven by its key role in fertilizer production, which accounts for the largest share of consumption worldwide. Growing food demand and the need for higher crop yields have reinforced fertilizer application. Rising use in the food and beverage sector for acidification and preservation has further strengthened demand. Additional applications include water treatment, rust removal, and surface finishing in industrial sectors. The production of phosphate-based chemicals for detergents and cleaning products has also contributed to consumption. Expanding industrialization, combined with increased investments in agriculture and infrastructure development, continues to drive overall demand for phosphoric acid globally.

Growth in this sector has been restrained by fluctuations in raw material costs such as phosphate rock and sulfuric acid, which affect manufacturing economics and pricing strategies. Compliance with stringent purity standards for food and pharmaceutical applications has added complexity and costs to production. Environmental concerns related to phosphogypsum waste disposal have increased the regulatory burden on manufacturers, creating challenges for plant operations and permitting. Technological requirements for advanced purification systems require significant capital investments, limiting opportunities for small and mid-sized producers. Market exposure to fertilizer price cycles and international trade barriers further complicates profitability and supply consistency.

Significant opportunities exist in the production of ultra-pure phosphoric acid for high-value applications in pharmaceuticals, electronics, and food processing. Clean-label product trends and the demand for premium-quality additives have reinforced growth potential in the beverage and packaged food industries. Expansion into specialty chemicals such as corrosion inhibitors, water treatment additives, and dental care formulations offers new revenue streams. Integration with advanced monitoring systems for traceability and quality control creates differentiation in competitive markets. Partnerships with downstream processors for customized grades and just-in-time delivery models provide strategic advantages. Emerging economies with rising infrastructure investment and health-focused consumption trends represent additional growth channels.

Current trends emphasize adoption of energy-efficient production techniques and cleaner wet-process systems to reduce environmental impact. Nanofiltration and advanced crystallization technologies are being implemented to remove heavy metals and improve purity levels for sensitive applications. Digital monitoring tools are being integrated for real-time impurity detection and process optimization. Circular economy initiatives have spurred research into the reuse of phosphogypsum and other by-products in construction and agriculture. Flexible supply contracts with customized purity specifications are becoming more common. Sustainability-driven investments and the development of automated processing facilities reflect the industry’s shift toward operational efficiency and compliance with environmental regulations.

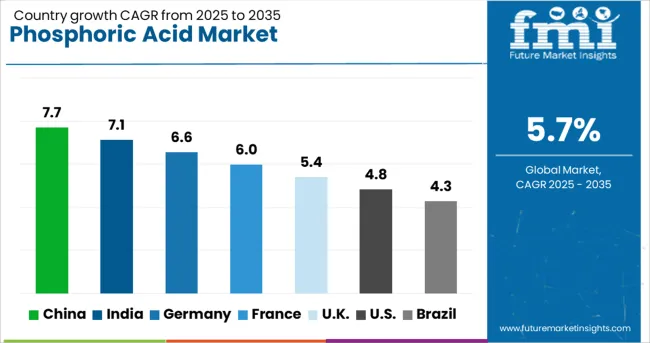

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The phosphoric acid market is projected to grow at a CAGR of 5.7% through 2035, fueled by strong demand in fertilizers, food processing, and industrial applications. China leads at 7.7%, driven by large-scale phosphate fertilizer production and growing exports. India follows with 7.1%, underpinned by agricultural reliance on phosphate-based fertilizers. Germany records 6.6%, supported by advanced food and beverage processing sectors, while the United Kingdom posts 5.4%, aided by specialty chemical applications. The United States grows at 4.8%, with consumption anchored in fertilizers and corrosion inhibitors. The analysis covers more than 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 7.7% through 2035, maintaining its dominant role as the largest producer and consumer of phosphoric acid. Fertilizer production remains the primary driver, supported by domestic agricultural requirements and export-oriented phosphate products. Demand for food-grade acid is also growing in beverage and processed food sectors. Manufacturers in China are modernizing production systems and expanding capacity to meet both domestic and export needs. Integration of high-purity refining techniques ensures compliance with international quality standards, particularly for electronics and food applications. Export growth to Asian and African regions continues to strengthen China’s global supply chain leadership.

India is expected to register a CAGR of 7.1% through 2035, supported by its agricultural dependency on phosphate-based fertilizers. Increased investments in fertilizer capacity and integrated phosphate projects are driving demand. Beyond agriculture, food and beverage processing is a growing application, with phosphoric acid used in acidulants for carbonated drinks and packaged foods. Industrial-grade acid for water treatment and chemical formulations adds to consumption. Domestic producers are focusing on expanding production to reduce reliance on imported acid. Strategic collaborations with fertilizer companies are improving supply consistency and cost efficiency. These factors position India as a key growth contributor in the global market.

Germany is forecasted to grow at a CAGR of 6.6% through 2035, driven by rising demand in the food, beverage, and pharmaceutical sectors for refined acid grades. Industrial usage in cleaning agents, metal treatment, and surface finishing adds to market momentum. Manufacturers are investing in process automation to ensure consistent quality in high-purity production. The market also benefits from a steady rise in beverage consumption requiring acidulant additives. Strategic alliances between chemical suppliers and food manufacturers are enhancing distribution channels for food-grade phosphoric acid. Increased use in specialty chemicals for precision applications continues to strengthen the country’s market position.

The United Kingdom is projected to expand at a CAGR of 5.4% through 2035, supported by consistent demand in the food and beverage industries for acidulants. Growth in processed food manufacturing and soft drink production maintains steady consumption of food-grade phosphoric acid. Industrial-grade applications, such as corrosion inhibitors and water treatment formulations, provide additional growth avenues. Imports from European and Asian markets fulfill domestic demand for technical-grade acid used in industrial processes. Suppliers are aligning product portfolios to meet performance standards for beverage and pharmaceutical applications. These dynamics position the UK as an important consumer market within Europe for refined phosphoric acid.

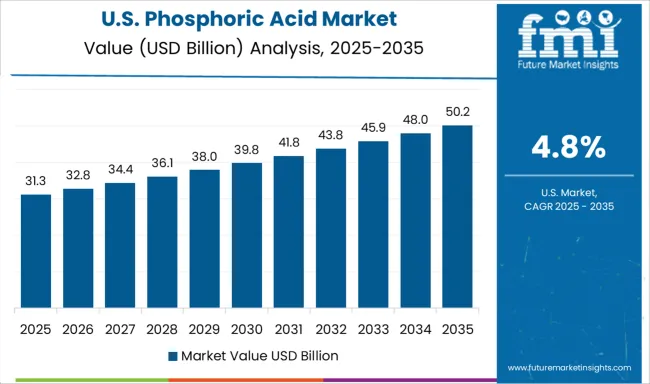

The United States is expected to grow at a CAGR of 4.8% through 2035, with fertilizer production remaining the core application segment. Industrial usage of phosphoric acid in water treatment, rust removal, and chemical processing supports additional demand. The food and beverage industry uses phosphoric acid as an acidulant for carbonated drinks and processed food products, ensuring stable consumption in regulated sectors. Domestic manufacturers are modernizing plants to enhance production efficiency and compliance with stringent environmental guidelines. Increased focus on integrating high-purity acid in pharmaceutical and specialty applications adds incremental growth potential for USA producers.

The phosphoric acid market is driven by major chemical producers and raw material integrators serving fertilizer, food processing, and industrial applications. ICL Group Ltd. maintains a strong global presence through its diversified phosphate-based product portfolio, catering primarily to agriculture and specialty chemicals. Nutrien, one of the largest players in the phosphate industry, integrates mining and chemical production to supply fertilizers and feed additives. Prayon specializes in purified phosphoric acid and derivatives for food, beverage, and pharmaceutical sectors, emphasizing compliance with stringent quality standards. Gujarat Alkalies and Chemicals Limited and Aditya Birla Chemicals dominate the Indian market, leveraging robust domestic distribution and competitive pricing strategies. Univar Solutions Inc. operates as a key distributor, ensuring global supply of phosphoric acid and related products to various end-use industries.

ArrMaz Products, Inc. focuses on additives and processing aids, supporting fertilizer and industrial-grade phosphoric acid applications. Haifa Group emphasizes specialty nutrients and water-soluble phosphate products for high-value crops. Chinese companies such as Shifang Sundia Chemical Industry, Chuanlin Chemical, and Chuandong Chemical Co., Ltd. lead in high-volume production for agriculture and industrial segments, ensuring cost competitiveness in Asia-Pacific markets. Innophos differentiates through food-grade phosphates and functional additives for nutrition and healthcare industries. Competitive differentiation depends on product purity, cost efficiency, and secure access to phosphate rock reserves. Barriers to entry include capital-intensive processing facilities, regulatory compliance for food-grade applications, and environmental controls for mining operations. Strategic priorities focus on securing raw material supply, developing eco-friendly production methods, and expanding purified phosphoric acid capacity for premium applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 69.1 Billion |

| Concentration | 85 %, 75 %, 92 %, and Others |

| Application | Fertilizer, Metal Treatment, Cleaning & Sanitizing agent, Catalyst, Food Additive, and Others |

| Grade | Technical grade and Food grade |

| End-Use | Agriculture, Energy, Industrial Cleaning, General Industrial, Construction, Water Treatment, Beverage, Nutritional supplement, Processed foods, Dairy products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ICL Group Ltd., Gujarat Alkalies and Chemicals Limited, Prayon, Shifang Sundia Chemical Industry, Univar Solutions Inc., ArrMaz Products, Inc., Chuanlin Chemical, Nutrien, Haifa Group, Aditya Birla Chemicals, Hydrite Chemical Co, Chuandong Chemical Co., Ltd., and Innophos |

| Additional Attributes | Dollar sales by grade (fertilizer-grade, food-grade, industrial-grade) and application (fertilizers, food & beverages, water treatment, industrial chemicals). Demand dynamics are driven by increasing phosphate fertilizer consumption, rising use in processed foods, and applications in corrosion inhibitors and detergents. Regional trends indicate Asia-Pacific leading consumption due to agricultural demand, while North America and Europe prioritize high-purity phosphoric acid for food and pharma applications. Innovation focuses on low-emission production technologies, recovery of phosphates from waste streams, and development of specialty phosphates for nutraceuticals. Environmental considerations include adoption of closed-loop processing and enhanced waste management to reduce ecological impact from phosphate mining and acid production. |

The global phosphoric acid market is estimated to be valued at USD 69.1 billion in 2025.

The market size for the phosphoric acid market is projected to reach USD 120.3 billion by 2035.

The phosphoric acid market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in phosphoric acid market are 85 %, 75 %, 92 % and others.

In terms of application, fertilizer segment to command 61.0% share in the phosphoric acid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycerophosphoric Acid Calcium Salt Market Size and Share Forecast Outlook 2025 to 2035

Purified Phosphoric Acid Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Phosphoric Acid Market

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA