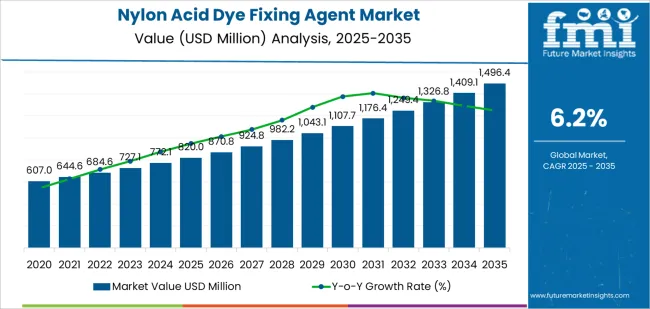

The nylon acid dye fixing agent market is projected to expand from USD 820 million in 2025 to USD 1,496.4 million by 2035, rising at a CAGR of 6.2% and adding USD 676.4 million in absolute value, translating into overall growth of 82.5%. The nylon acid dye fixing agent market is expected to grow by 1.8X during this period, driven by the expansion of global textile manufacturing, rising quality standards in nylon dyeing, and the adoption of advanced fixation technologies across fashion, home textile, and industrial nylon production. The growing demand for colorfastness and enhanced wash durability has positioned acid dye fixing agents as critical chemical components in nylon fabric finishing, ensuring consistent performance under high-temperature and chemically intensive processing conditions.

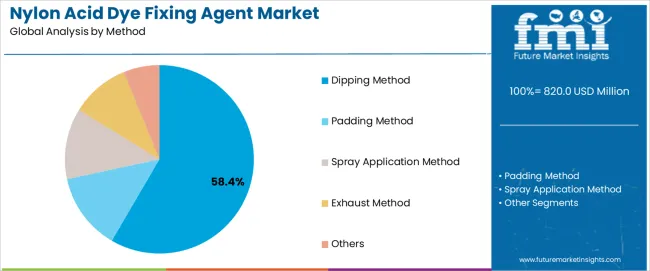

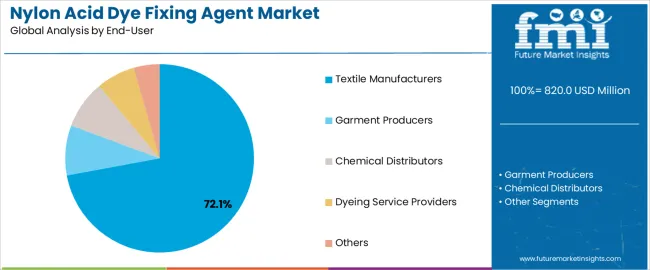

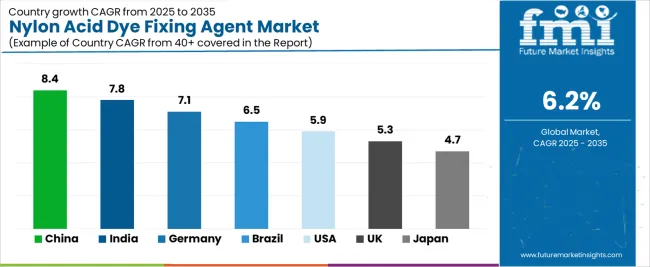

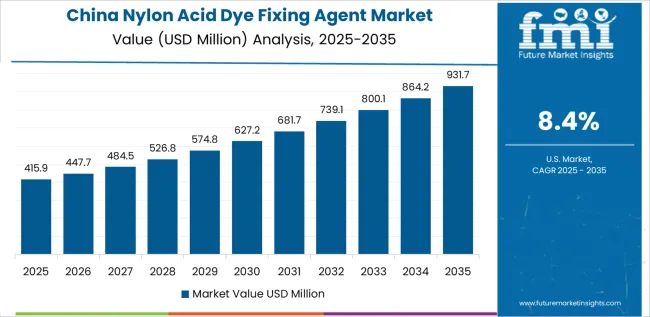

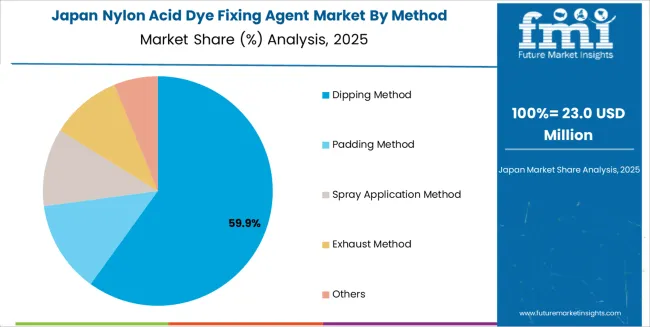

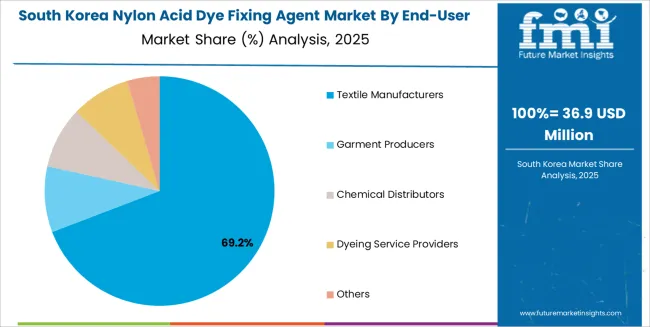

Demand growth is closely linked to advancements in chemical formulation technologies and automated dosing systems, enabling precise control of color fixation and improved production efficiency. The dipping method holds a dominant 58.4% share, reflecting its widespread use in large-scale fabric processing and immersion-based operations. Clothing applications, representing 48.3% share, continue to lead adoption due to the need for vibrant, long-lasting color retention in fashion and performance apparel. Among end-users, textile manufacturers account for 72.1% share, supported by industrial modernization programs and standardized chemical protocols across multi-facility operations. China (8.4% CAGR) and India (7.8%) lead expansion, supported by industrial automation and government-backed textile infrastructure upgrades. Germany (7.1%) and Brazil (6.5%) follow, benefiting from engineering excellence and modernized processing capabilities, while the United States (5.9%), the United Kingdom (5.3%), and Japan (4.7%) sustain adoption through technological innovation and precision dyeing systems integration. Industry players such as Dow, Senka Thailand, and CHT Group are reinforcing market positions through eco-friendly formulations, reactive polymeric fixatives, and integrated chemical control systems that improve productivity and compliance.

Production capabilities are advancing through specialized chemical synthesis technologies and automated dosing systems that enable consistent quality control while reducing processing costs. Leading manufacturers are investing in advanced formulation development and chemical engineering processes to create fixing agent products that deliver superior color retention, extended fabric life, and reliable performance under varying processing conditions. Textile chemical suppliers and dyeing specialists are expanding their nylon acid dye fixing agent offerings to address specific application requirements across fashion textile production, home furnishing manufacturing, technical textile processing, and specialized industrial nylon applications.

Quality standards continue evolving as applications demand higher durability specifications and consistent performance under extreme processing conditions including temperature variations, chemical exposure, and extended production cycles. Industry certification programs and testing protocols ensure reliable product performance while supporting market confidence in fixing agent technology adoption across critical textile manufacturing processes and regulated production environments. Compliance requirements for textile quality standards and environmental regulations are driving investments in comprehensive quality assurance systems and validation procedures throughout the chemical manufacturing supply chain.

International manufacturing coordination is supporting market development as major textile production projects require standardized fixing agent solutions across multiple manufacturing facilities. Global textile companies are establishing unified specifications for dyeing process control that influence worldwide procurement standards and create opportunities for specialized chemical manufacturers. Textile engineering firms are forming partnerships with chemical suppliers to develop application-specific fixing solutions tailored to emerging textile processing requirements and manufacturing equipment specifications.

Investment patterns are shifting toward integrated processing solutions as textile facilities seek comprehensive dyeing systems that combine advanced chemical performance with automated application technology and maintenance-friendly characteristics. Textile companies are implementing standardized fixing agent specifications across their facilities, while dyeing equipment manufacturers are incorporating advanced fixing agent technology into their processing system designs to ensure quality compliance and operational efficiency. This trend toward standardization and performance optimization is reshaping competitive dynamics across the textile chemical components value chain.

Market maturation is evident in the emergence of specialized application segments that demand unique chemical characteristics and performance specifications. Clothing production applications require formulations that maintain performance during high-volume processing and provide consistent color retention in consumer washing environments, while home textile manufacturing systems need fixing agents that deliver durability during extended use cycles and provide reliable performance in diverse household conditions. These specialized requirements are driving innovation in chemical formulation, application technologies, and integration methodologies that extend beyond traditional textile dyeing applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 820 million |

| Market Forecast Value (2035) | USD 1,496.4 million |

| Forecast CAGR (2025-2035) | 6.2% |

| TEXTILE MANUFACTURING EXPANSION | QUALITY ENHANCEMENT REQUIREMENTS | PRODUCTION EFFICIENCY |

|---|---|---|

| Manufacturing Growth - Textile production expansion requiring specialized fixing agent solutions for nylon dyeing processes, fabric manufacturing, and textile finishing applications with enhanced color retention performance for industrial facility compliance and product quality requirements. | Quality Standards - Textile industry regulations and consumer quality requirements driving adoption of effective fixing agent solutions for dyeing equipment installations requiring certified color retention performance and regulatory compliance documentation. | Process Optimization - Textile facility improvements implementing fixing agent technology for operational efficiency, reduced processing time requirements, and enhanced equipment longevity while maintaining productive work environments and quality standards. |

| Technology Advancement - Textile equipment advancement requiring integrated fixing agent components for automated manufacturing systems, processing line operations, and material handling applications with superior chemical performance and reliability characteristics. | Environmental Compliance - Textile facility standards requiring comprehensive chemical control solutions for manufacturing operations, equipment installations, and facility expansions with documented performance and certification requirements. | Equipment Integration - Manufacturing system optimization requiring specialized fixing agent components for textile equipment, process automation, and facility infrastructure with enhanced performance and standardized specifications. |

| System Integration - Chemical suppliers implementing comprehensive fixing solutions for textile manufacturing projects, processing system installations, and equipment upgrades with specialized design characteristics and performance specifications. | Regulatory Requirements - Textile safety standards and chemical control regulations requiring certified fixing agent performance for manufacturing facilities, equipment operations, and worker protection with comprehensive compliance documentation and testing validation. | Cost Effectiveness - Manufacturing cost reduction initiatives requiring durable fixing agent solutions for textile processing systems, equipment maintenance optimization, and facility operational efficiency with proven performance and reliability characteristics. |

| Category | Segments / Values |

|---|---|

| By Method | Dipping Method; Padding Method; Spray Application Method; Exhaust Method; Others |

| By Application | Clothing; Home Textiles; Industrial Nylon; Automotive Textiles; Technical Textiles; Others |

| By End-User | Textile Manufacturers; Garment Producers; Chemical Distributors; Dyeing Service Providers; Others |

| By Formulation Type | Liquid Concentrate; Powder Form; Emulsion Type; Solid Granules; Others |

| By Processing Temperature | Low Temperature (Below 60°C); Medium Temperature (60-100°C); High Temperature (Above 100°C); Others |

| By Region | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Segment | 2025-2035 Outlook |

|---|---|

| Dipping Method | Leader in 2025 with 58.4% market share; standard application method for textile processing and industrial applications requiring reliable immersion processing and consistent chemical distribution performance. Widely adopted across textile manufacturing facilities and dyeing operations. Momentum: strong growth across clothing production and home textile segments. Watchouts: competition from automated spray application alternatives in modern textile processing. |

| Padding Method | Growing segment with 24.7% share, favored for continuous textile processing and automated manufacturing systems requiring controlled chemical application and processing efficiency. Momentum: exceptional growth in high-volume textile manufacturing and industrial processing applications. Watchouts: higher equipment costs compared to traditional dipping solutions in cost-sensitive applications. |

| Spray Application Method | Advanced segment serving applications requiring precise chemical distribution and automated processing systems for specialized textile configurations and high-efficiency installations. Momentum: steady growth in advanced textile manufacturing applications and automated processing system designs. Watchouts: technical complexity compared to conventional application methods. |

| Others | Includes exhaust method and specialty application techniques for unique processing requirements. Momentum: selective growth in specialized textile manufacturing and custom processing system applications. |

| Segment | 2025-2035 Outlook |

|---|---|

| Clothing | Largest application segment in 2025 at 48.3% share, driven by fashion textile manufacturing expansion and garment production requiring effective color fixation for apparel manufacturing, fashion fabric processing, and consumer clothing applications. Momentum: robust growth from fashion industry expansion and textile quality enhancement initiatives. Watchouts: pressure for cost reduction and standardization in competitive fashion markets. |

| Home Textiles | Critical segment representing 28.1% share, experiencing steady growth from home furnishing manufacturing and textile modernization requiring quality fixation solutions for household textile production operations. Momentum: consistent growth as home textile manufacturers upgrade processing systems and improve product quality standards. Watchouts: budget constraints and procurement standardization requirements in traditional home textile sectors. |

| Industrial Nylon | Growing segment at 15.6% share for specialized industrial applications, technical textiles, and manufacturing equipment requiring dedicated fixing solutions. Momentum: moderate growth from industrial textile expansion and technical application development. Watchouts: technical complexity and application-specific requirements limiting broad market adoption. |

| Others | Includes automotive textiles, technical textiles, and emerging industrial applications. Momentum: diverse growth opportunities across multiple textile sectors and specialized applications. |

| End-User | Status & Outlook (2025-2035) |

|---|---|

| Textile Manufacturers | Dominant end-user in 2025 with 72.1% share for direct textile processing operations and facility chemical requirements. Provides operational efficiency, quality compliance, and processing optimization improvements for textile operations. Momentum: steady growth driven by textile manufacturing expansion and quality investment. Watchouts: cost pressure and procurement standardization requirements across multiple facility locations. |

| Garment Producers | Technical end-user serving apparel manufacturing applications and integrated textile processing solutions requiring certified fixing performance and quality specifications. Momentum: moderate growth as garment producers enhance quality control offerings and processing integration capabilities. Watchouts: competitive pressure and performance specification requirements in diverse fashion applications. |

| Chemical Distributors | Distribution end-user for aftermarket applications and supply requirements serving textile maintenance and processing upgrade projects. Momentum: consistent growth as textile facilities maintain and upgrade existing processing installations. Watchouts: inventory management challenges and technical support requirements for diverse application segments. |

| Others | Includes dyeing service providers, specialty contractors, and emerging textile end-user categories. Momentum: selective growth opportunities in specialized applications and emerging textile sectors. |

| KEY TRENDS | DRIVERS | RESTRAINTS |

|---|---|---|

| Chemical Innovation - Advanced formulation development and chemical technology delivering enhanced durability, temperature resistance, and processing compatibility for demanding textile applications with improved performance characteristics and extended service life. | Textile Manufacturing Growth across industrial facilities and production systems creating substantial demand for fixing agent solutions supporting automated equipment, processing applications, and manufacturing operations requiring effective chemical control and regulatory compliance. | Cost Sensitivity in textile procurement and budget constraints limiting adoption of premium fixing agent solutions across cost-conscious manufacturing facilities and competitive textile applications with restricted capital equipment budgets. |

| Process Integration - Expanding integration with textile processing systems, automated manufacturing equipment, and industrial monitoring platforms enabling comprehensive chemical monitoring, processing optimization, and performance tracking capabilities. | Quality Regulation Compliance - Textile industry standards and consumer quality requirements driving adoption of certified fixing technology for manufacturing facilities, equipment installations, and product applications requiring documented chemical performance and regulatory validation. | Market Fragmentation - Diverse textile applications, equipment specifications, and regional requirements creating complexity for suppliers developing standardized fixing solutions across multiple manufacturing sectors and international markets. |

| Digital Processing - Integration with Industry 4.0 initiatives and smart manufacturing systems enabling predictive maintenance, performance monitoring, and automated fixing system optimization for enhanced operational efficiency and reliability. | Equipment Modernization - Textile facility upgrades and processing system enhancements requiring specialized fixing agent components for improved operational efficiency, reduced maintenance costs, and enhanced production environments with superior chemical control performance. | Technical Complexity - Application-specific requirements, processing procedures, and performance validation affecting deployment timelines and operational capabilities for textile facilities lacking specialized chemical processing expertise and maintenance capabilities. |

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| United States | 5.9% |

| United Kingdom | 5.3% |

| Japan | 4.7% |

Revenue from nylon acid dye fixing agents in China is projected to exhibit exceptional growth with a market value of USD 512.3 million by 2035, driven by extensive textile manufacturing modernization programs and comprehensive industrial production initiatives creating substantial opportunities for fixing agent suppliers across dyeing system installations, textile factory automation projects, and industrial facility development sectors. The country's ambitious textile manufacturing upgrade programs including national industrial digitalization initiatives and automated production facility expansion are creating consistent demand for specialized chemical fixing systems. Major textile companies and chemical suppliers including China Textile Chemical Group, specialized dyeing chemical manufacturers, and international chemical companies are establishing comprehensive fixing agent solution programs to support large-scale textile production and advanced manufacturing technology applications.

Revenue from nylon acid dye fixing agents in India is expanding to reach USD 168.7 million by 2035, supported by extensive textile industry development programs and comprehensive manufacturing infrastructure modernization initiatives creating demand for fixing agent solutions across diverse textile facility and processing system application segments. The country's growing textile manufacturing capabilities and expanding automation infrastructure are driving demand for fixing agent components that provide exceptional reliability while supporting advanced textile processing requirements. Textile companies and manufacturing facilities are investing in chemical fixing technology to support growing production demand and industrial automation advancement requirements.

Demand for nylon acid dye fixing agents in Germany is projected to reach USD 89.1 million by 2035, supported by the country's leadership in textile engineering technology and advanced manufacturing systems requiring sophisticated chemical fixing solutions for precision textile processing and industrial automation applications. German textile operators are implementing cutting-edge fixing platforms that support advanced operational capabilities, precision performance, and comprehensive quality monitoring protocols. The market is characterized by focus on engineering excellence, technology innovation, and compliance with stringent industrial safety and performance standards.

Revenue from nylon acid dye fixing agents in Brazil is growing to reach USD 76.4 million by 2035, driven by textile infrastructure development programs and increasing manufacturing capabilities creating opportunities for fixing agent suppliers serving both textile manufacturers and specialized chemical contractors. The country's expanding textile sector and growing industrial infrastructure are creating demand for fixing agent components that support diverse manufacturing requirements while maintaining performance standards. Textile companies and manufacturing facilities are developing technology strategies to support operational efficiency and system reliability advancement.

How Does the Demand for Nylon Acid Dye Fixing Agent Market Vary in the United States?

Demand for nylon acid dye fixing agents in United States is projected to reach USD 58.2 million by 2035, expanding at a CAGR of 5.9%, driven by advanced textile technology innovation and specialized industrial applications supporting precision manufacturing and comprehensive automation technology applications. The country's established textile technology tradition including major textile equipment manufacturers and automation facilities are creating demand for high-performance chemical fixing components that support operational advancement and safety standards. Manufacturers and textile system suppliers are maintaining comprehensive development capabilities to support diverse manufacturing and automation requirements.

Revenue from nylon acid dye fixing agents in United Kingdom is growing to reach USD 47.3 million by 2035, supported by textile technology heritage and established industrial engineering communities driving demand for premium chemical fixing solutions across traditional textile systems and specialized industrial automation applications. The country's rich textile engineering heritage including major textile companies and established industrial system capabilities create demand for fixing agent components that support both legacy system advancement and modern manufacturing applications.

Demand for nylon acid dye fixing agents in Japan is projected to reach USD 41.8 million by 2035, driven by precision textile technology tradition and established industrial leadership supporting both domestic textile system markets and export-oriented component production. Japanese companies maintain sophisticated chemical fixing development capabilities, with established manufacturers continuing to lead in fixing agent technology and textile equipment standards.

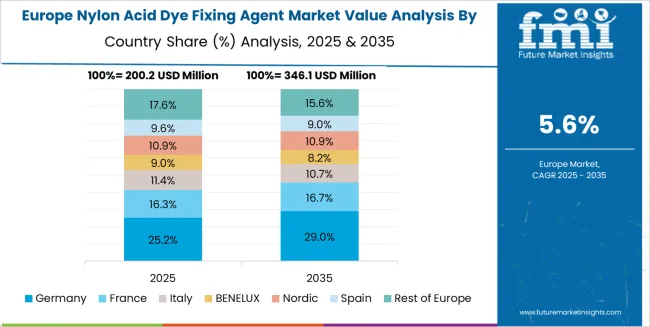

European nylon acid dye fixing agent operations are increasingly concentrated between German engineering excellence and specialized manufacturing across multiple countries. German facilities dominate high-performance chemical fixing production for precision textile manufacturing and industrial automation applications, leveraging cutting-edge manufacturing technologies and strict quality protocols that command price premiums in global markets. British textile technology operators maintain leadership in industrial system innovation and chemical fixing method development, with organizations like specialized engineering companies and university research centers driving technical specifications that suppliers must meet to access major textile contracts.

Eastern European operations in Czech Republic and Poland are capturing specialized production contracts through precision manufacturing expertise and EU compliance standards, particularly in chemical formulation and processing technologies for textile applications. These facilities increasingly serve as development partners for Western European textile programs while building their own industrial technology expertise.

The regulatory environment presents both opportunities and constraints. European textile safety framework requirements create quality standards that favor established European manufacturers and textile system operators while ensuring consistent performance specifications for critical manufacturing infrastructure and safety applications. Brexit has created complexity for UK textile collaboration with EU programs, driving opportunities for direct relationships between British operators and international chemical fixing suppliers.

Technology collaboration accelerates as textile companies seek technology advancement to support major industrial modernization milestones and automation development timelines. Vertical integration increases, with major textile system operators acquiring specialized manufacturing capabilities to secure chemical supplies and quality control for critical textile programs. Smaller textile contractors face pressure to specialize in niche applications or risk displacement by larger, more comprehensive operations serving mainstream manufacturing and automation requirements.

South Korean nylon acid dye fixing agent operations reflect the country's advanced textile technology capabilities and export-oriented industrial development model. Major textile system operators including textile technology companies and chemical manufacturing facilities drive component procurement strategies for their processing facilities, establishing direct relationships with specialized chemical fixing suppliers to secure consistent quality and performance for their textile development programs and advanced manufacturing technology systems targeting both domestic infrastructure and international collaboration projects.

The Korean market demonstrates particular strength in integrating chemical fixing technologies into automated textile platforms and advanced industrial system configurations, with engineering teams developing solutions that bridge traditional textile chemical applications and next-generation industrial systems. This integration approach creates demand for specific performance specifications that differ from conventional applications, requiring suppliers to adapt fixing capabilities and system coordination characteristics.

Regulatory frameworks emphasize textile safety and manufacturing system reliability, with Korean industrial standards often exceeding international requirements for chemical fixing systems. This creates barriers for standard component suppliers but benefits established manufacturers who can demonstrate industrial-grade performance capabilities. The regulatory environment particularly favors suppliers with Korean textile system qualification and comprehensive testing documentation systems.

Supply chain excellence remains critical given Korea's textile focus and international collaboration dynamics. Textile system operators increasingly pursue development partnerships with suppliers in Japan, Germany, and specialized manufacturers to ensure access to cutting-edge chemical fixing technologies while managing infrastructure risks. Investment in textile infrastructure supports performance advancement during extended manufacturing development cycles.

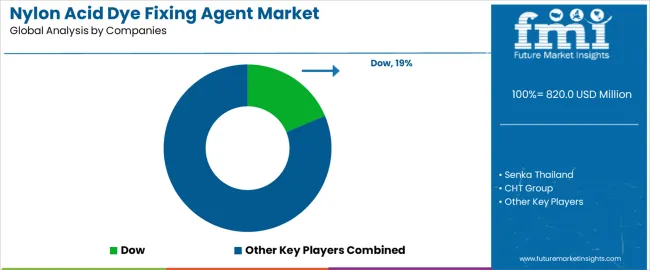

Dow leads the market with 18.7% share owing to its comprehensive chemical portfolio and established textile industry relationships, which manufacturers use to implement integrated fixing solutions across diverse textile applications. Profit pools are consolidating upstream in advanced chemical formulation and downstream in application-specific solutions for textile manufacturing, garment production, and specialized dyeing markets where performance reliability, processing efficiency, and consistent color fixation command substantial premiums. Value is migrating from basic chemical component production to specification-driven, application-ready textile systems where chemical expertise, precision formulation, and reliable integration capabilities create competitive advantages.

Several archetypes define market leadership: established American chemical companies defending share through comprehensive textile system development and proven industrial automation support; German industrial suppliers leveraging manufacturing excellence and engineering capabilities; Asian technology leaders with textile expertise and precision manufacturing heritage; and emerging regional manufacturers pursuing cost-effective production while developing advanced chemical capabilities.

Switching costs - system integration, equipment compatibility validation, textile certification - provide stability for established suppliers, while technological advancement requirements and specialized application growth create opportunities for innovative chemical manufacturers. Consolidation continues as companies seek manufacturing scale; direct textile partnerships grow for specialized applications while traditional chemical distribution remains relationship-driven. Focus areas: secure premium textile manufacturing and industrial automation market positions with application-specific performance specifications and technical collaboration; develop chemical fixing technology and advanced manufacturing capabilities; explore specialized applications including automotive textiles and technical textile requirements.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| American Chemical Leaders | Comprehensive chemical expertise; proven textile integration; established manufacturer relationships | Precision formulation; technical innovation; textile certification support |

| German Industrial Suppliers | Manufacturing excellence; comprehensive automation development programs; established customer partnerships | Engineering collaboration focus; integrated solutions; technical consultation |

| Asian Technology Leaders | Textile system expertise; precision technology leadership; trusted by major manufacturing programs | Textile partnerships; application-specific specifications; automation infrastructure collaboration |

| Emerging Regional Producers | Manufacturing efficiency; competitive pricing; rapid technology development | Production scaling; technology advancement; market entry strategies |

| Chemical Distributors | Technical distribution networks; textile service relationships | Textile expertise; inventory management; technical support services |

| Item | Value |

|---|---|

| Quantitative Units | USD 820 million |

| Method Segments | Dipping Method; Padding Method; Spray Application Method; Exhaust Method; Others |

| Applications | Clothing; Home Textiles; Industrial Nylon; Automotive Textiles; Technical Textiles; Others |

| End-Users | Textile Manufacturers; Garment Producers; Chemical Distributors; Dyeing Service Providers; Others |

| Formulation Segments | Liquid Concentrate; Powder Form; Emulsion Type; Solid Granules; Others |

| Temperature Ranges | Low Temperature (Below 60°C); Medium Temperature (60-100°C); High Temperature (Above 100°C); Others |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries | China; India; Germany; Brazil; United States; United Kingdom; Japan (+35 additional countries) |

| Key Companies Profiled | Dow; Senka Thailand; CHT Group; Sarex; Silvateam; Syntha Group; Fineotex; Dymatic Chemicals; Taiwan Dyestuffs & Pigments Corp.; Hailsun Chemical; Centro Chino; Widetex Biotech; GuangDong Kefeng New Material Technology; Guangzhou Bisquit Technology; FIBERSIL; Welsum Technology Corporation; Chaoyu Xincai; Dongguan Sanchuan Chemical Technology; Yixing Cleanwater Chemicals; Hangzhou Luxury Chemical; Guangzhou Qiantai Chemical; Shaoxing Shangyu Fine Chemical Factory; Oriental Giant Dye & Chemical Ind. Corp.; Ningbo Aoxiang Fine Chemical; Shanghai Rongsi New Material |

| Additional Attributes | Dollar sales by method and application; Regional demand trends (NA, EU, APAC); Competitive landscape; Textile manufacturing vs. aftermarket adoption patterns; Chemical processing and textile system integration; Advanced formulation innovations driving performance enhancement, processing reliability, and textile quality excellence |

The global nylon acid dye fixing agent market is estimated to be valued at USD 820.0 million in 2025.

The market size for the nylon acid dye fixing agent market is projected to reach USD 1,496.4 million by 2035.

The nylon acid dye fixing agent market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in nylon acid dye fixing agent market are dipping method, padding method, spray application method, exhaust method and others.

In terms of end-user, textile manufacturers segment to command 72.1% share in the nylon acid dye fixing agent market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Nylon Acid Dye Fixing Agent in UK Size and Share Forecast Outlook 2025 to 2035

Nylon Coated Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Nylon Film Market Size and Share Forecast Outlook 2025 to 2035

Nylon Monofilament Mesh Filter Bags Market Size and Share Forecast Outlook 2025 to 2035

Nylon-6 and Nylon-66 Market Analysis & Forecast by Product Type, Application and Region through 2035

Nylon-6 Market Trends and Forecast 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Nylon 4-6 Market

Flat Nylon Webbing Market Size and Share Forecast Outlook 2025 to 2035

Demand for Nylon Coated Tape Measure in UK Size and Share Forecast Outlook 2025 to 2035

Food Grade Nylon Market

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA