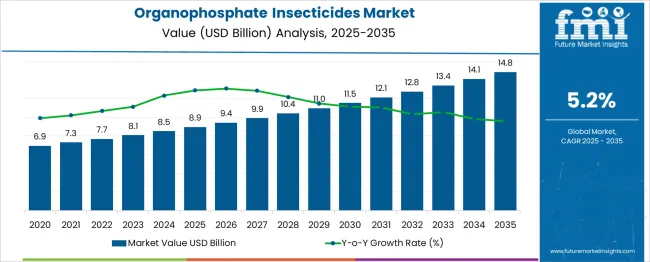

The Organophosphate Insecticides Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 14.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

Analyzing the absolute dollar additions annually reveals a moderate yet consistent upward trajectory in incremental value creation. From 2025 to 2030, the market will add approximately USD 2.6 billion, rising from USD 8.9 billion to USD 11.5 billion. This early growth phase, accounting for nearly 44% of the total opportunity, is fueled by increased pest resistance, growing crop acreage in developing countries, and the continued use of broad-spectrum insecticides in grain, cotton, and fruit farming. The period from 2030 to 2035 sees an additional USD 3.3 billion in value creation, contributing the remaining 56% of the absolute growth. This phase benefits from rising demand in high-output agricultural nations and expanding application in stored grain protection. Although regulatory pressures remain, certain geographies with limited alternatives continue to drive demand. The absolute dollar opportunity shows a balanced but slightly back-loaded profile, suggesting long-term relevance driven by sustained agrochemical dependence and regional usage trends.

| Metric | Value |

|---|---|

| Organophosphate Insecticides Market Estimated Value in (2025 E) | USD 8.9 billion |

| Organophosphate Insecticides Market Forecast Value in (2035 F) | USD 14.8 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The Organophosphate Insecticides Market contributes approximately 22–25% to the overall Insecticides Market, driven by their broad-spectrum efficacy against chewing and sucking pests across cereal, fruit, and vegetable crops. Within the broader Crop Protection Chemicals Market, organophosphates account for around 14–16%, used widely in both pre-harvest and post-harvest treatment cycles. The segment represents 10–12% of the Global Agrochemicals Market, where cost-effective pest control solutions remain critical in yield-sensitive regions.

In the Agricultural Inputs Market, organophosphate insecticides hold 6–8%, particularly in areas where integrated pest management is not fully adopted. The market also makes up 8–10% of the Global Pesticide Formulation Market, as companies continue to produce emulsifiable concentrates, granules, and wettable powders for various application methods. Growth is influenced by rising pest resistance to synthetic pyrethroids, continued reliance on chemical control in developing countries, and demand for rapid-action insecticides.

However, regulatory restrictions and toxicological scrutiny in North America and Europe are shifting usage patterns toward controlled applications and phase-out plans. Manufacturers are reformulating products with improved biodegradability and safer handling characteristics. Regional markets in Asia Pacific, Africa, and Latin America remain key revenue zones, where cost-efficiency and high efficacy sustain demand across both commercial farms and smallholder systems.

The organophosphate insecticides market is undergoing steady development as demand for effective pest control solutions aligns with agricultural productivity requirements and pest resistance management strategies. The market has been shaped by the need for broad spectrum insecticides capable of addressing diverse pest populations while maintaining cost efficiency for large scale farming operations.

Regulatory scrutiny over environmental and health impacts is influencing formulation innovations and encouraging safer handling practices. Growth prospects are expected to be supported by increasing food security initiatives, expansion of arable land in emerging regions, and efforts to combat evolving pest resistance patterns.

Technological advancements in application methods and ongoing collaborations between agrochemical producers and research institutions are paving the way for more targeted and sustainable solutions while maintaining efficacy and affordability.

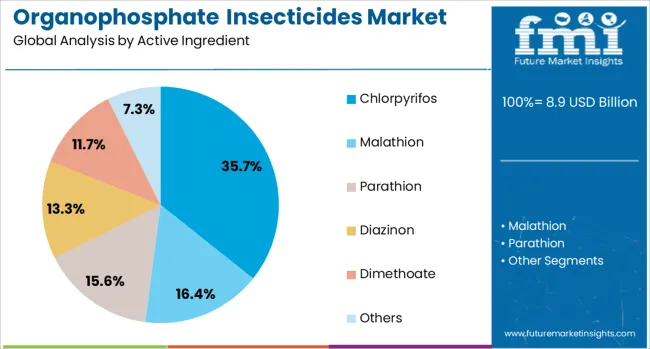

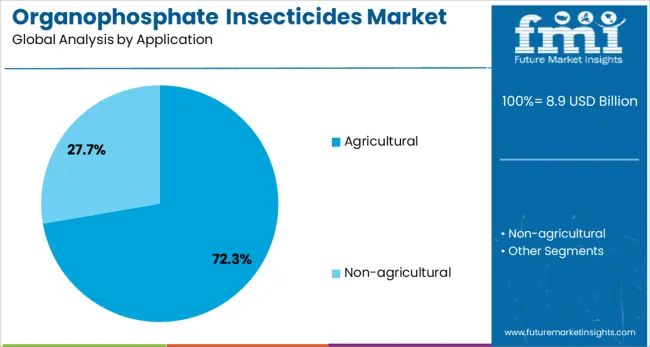

The organophosphate insecticides market is segmented by active ingredient and application and geographic regions. By active ingredient of the organophosphate insecticides market is divided into Chlorpyrifos, Malathion, Parathion, Diazinon, Dimethoate, and Others. In terms of application of the organophosphate insecticides market is classified into Agricultural and Non-agricultural. Regionally, the organophosphate insecticides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by active ingredient, chlorpyrifos is anticipated to command 35.7% of the market revenue in 2025 making it the leading subsegment. This dominance has been attributed to its well established efficacy against a broad spectrum of insects and its cost effectiveness in high volume agricultural applications.

Its mode of action has been widely integrated into integrated pest management programs enhancing its appeal to producers managing complex pest pressures. Adoption has been reinforced by its compatibility with a variety of crops and its proven residual activity which reduces the frequency of applications.

Manufacturing scalability and familiarity among distributors and end users have further strengthened chlorpyrifos’ position as the preferred choice in this segment despite emerging regulatory debates and development of alternatives.

When segmented by application the agricultural segment is projected to hold 72.3% of the market revenue in 2025 establishing itself as the dominant subsegment. This leadership has been driven by the critical role of organophosphates in safeguarding crop yields against economically damaging pests across cereals fruits vegetables and other staples.

The ability to deliver fast knockdown and prolonged protection under diverse climatic and soil conditions has supported sustained use in large-scale farming. Adoption has been accelerated by the sector’s need for affordable and reliable solutions that can be integrated into existing spraying routines without significant operational disruptions.

Strong demand from emerging economies where mechanization and modern crop protection practices are still growing has also reinforced the agricultural segment’s leading position as a primary consumer of organophosphate insecticides.

Demand for organophosphate insecticides has been influenced by growing crop protection needs, vector control programs, and cost-effective pest management requirements. Sales of chlorpyrifos, malathion, and diazinon formulations are rising in agriculture and public health segments. Adoption remains strongest in South and Central America, while Asia-Pacific accelerates usage through regulated pest intervention schemes.

Demand for organophosphate insecticides was elevated in Brazil and Argentina during 2025 as farmers combated resistant insects in soybean, cotton, and sugarcane crops. Agricultural agencies mandated organophosphate treatments during key pest cycles, resulting in Year‑on‑Year usage increases of approximately 26%. Crop yield losses due to pests were lowered by 18% where chlorpyrifos and malathion-based sprays were used in integrated pest management programs. Local distributors offering professional dilution ratios and application training strengthened repeat bulk purchasing. Agronomist-backed spray schedules and field testing validation improved adoption across rural cooperatives.

Sales of organophosphate insecticide formulations surged within India’s public health initiatives in 2025, especially to control mosquito-borne disease outbreaks. Application of malathion ultra-low-volume (ULV) sprays was mandated during seasonal monsoon vectors, increasing demand by nearly 32% over the prior year. Vector density metrics showed reductions of 20 to 25% following targeted treatment cycles. Government procurement relied on certified formulation consortia and standardized aerial spraying contracts. Vendors supplying technical assistance and bulk safety training gained greater market share.

Formulations combining organophosphates with pyrethroids gained traction in 2025 as part of rotational resistance management strategies. Growers in Vietnam, Kenya, and Paraguay adopted these dual-mode insecticides to combat resistant aphids, armyworms, and bollworms. The resulting application frequency declined by 18%, reducing labor costs and phytotoxicity risks. Multinational firms reformulated older chemistries into targeted sprays with lower environmental persistence, meeting evolving regulatory thresholds. These hybrid formulations were positioned as transitional solutions before full biological adoption, keeping organophosphates commercially viable in regulated markets.

Rapid scaling of generic organophosphate production in Indonesia, Thailand, and the Philippines widened market availability and price competitiveness in 2025. Local contract manufacturers achieved production capacity increases of 35% year over year, enabling smaller distributors to supply rural and semi-urban markets. Price per hectare treated dropped by nearly 22% in select provinces, encouraging higher-volume procurement by farmer cooperatives. Governments provided conditional approval pathways for domestically formulated chlorpyrifos and malathion blends, provided WHO classification and shelf stability standards were met. Market penetration expanded among smallholders cultivating rice, vegetables, and plantation crops.

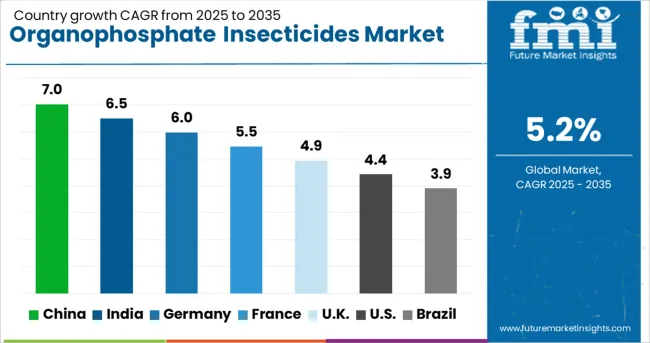

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

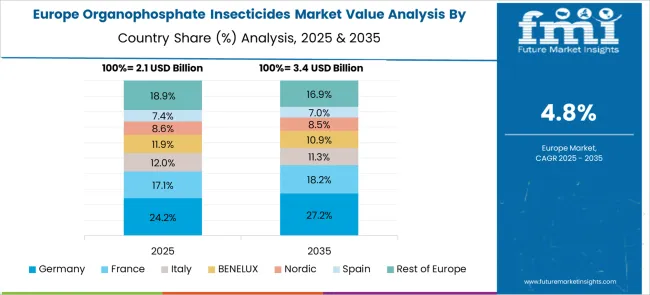

The global market is set to expand at a CAGR of 5.2% from 2025 to 2035, driven by rising crop protection needs and pest resistance management. China leads growth at 7.0% CAGR, supported by high domestic consumption in rice and vegetable cultivation and government backing for agrochemical innovation. India follows with a 6.5% CAGR, propelled by strong usage in cotton and paddy fields, alongside robust agro-input distribution channels. Germany, growing at 6.0%, is influenced by controlled yet persistent use in horticulture and grain storage sectors.

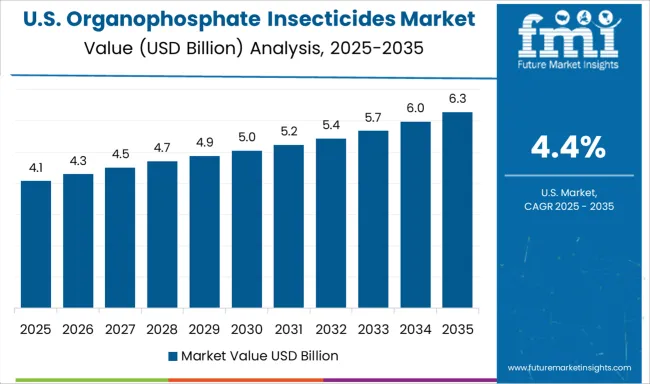

The UK is expected to grow at 4.9%, as farmers adopt targeted pesticide programs to comply with environmental standards while maintaining yield. The USA shows a CAGR of 4.4%, where usage is steady in corn and soybean belts despite regulatory pressure, owing to cost-effective pest control in certain geographies. These five countries hold pivotal roles in demand trends and regulatory influence. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is anticipated to expand at a CAGR of 7.0% from 2025 to 2035 in the Organophosphate Insecticides Market. Between 2020 and 2024, domestic use remained high in fruit orchards and rice fields, while exports targeted Southeast Asia. Over the next decade, stricter pest control regulations and resistance to pyrethroids are expected to drive greater reliance on cost-effective organophosphates. Demand for Organophosphate Insecticides from China is expected to remain dominant due to vertically integrated production and bulk availability.

India is forecast to grow at a CAGR of 6.5% during 2025 to 2035 in the Organophosphate Insecticides Market. From 2020 to 2024, consumption remained centered around cotton, pulses, and rice cultivation in central and southern states. Moving forward, sustained whitefly infestations and bollworm resistance are expected to prompt broader use in integrated pest management. Sales of Organophosphate Insecticides in India are being supported by domestic formulations tailored for monsoon application cycles.

Germany is expected to record a CAGR of 6.0% between 2025 and 2035 in the Organophosphate Insecticides Market. From 2020 to 2024, usage was constrained by EU-wide restrictions but remained relevant in greenhouses and under controlled settings. Looking ahead, exemptions for specific crop segments and pest outbreaks are anticipated to stimulate cautious imports. Sales of Organophosphate Insecticides in Germany will be shaped by sustainability thresholds and efficacy against invasive pest strains.

The United Kingdom is projected to grow at a CAGR of 4.9% from 2025 to 2035 in the Organophosphate Insecticides Market. Between 2020 and 2024, demand came primarily from root vegetable cultivation and pest-prone wheat fields. From 2025 onward, a shift toward dual-action insecticide regimes and greater monitoring of pesticide residues is expected. Demand for Organophosphate Insecticides in the UK will be driven by pest resurgence under climate variability.

The United States is projected to expand at a CAGR of 4.4% from 2025 to 2035 in the Organophosphate Insecticides Market. From 2020 to 2024, EPA restrictions and public scrutiny led to a steady decline in general usage. The specialized demand persists across sugarcane, citrus, and turfgrass maintenance. Sales of Organophosphate Insecticides in the US will continue to be shaped by evolving federal risk assessments and innovation in microencapsulation.

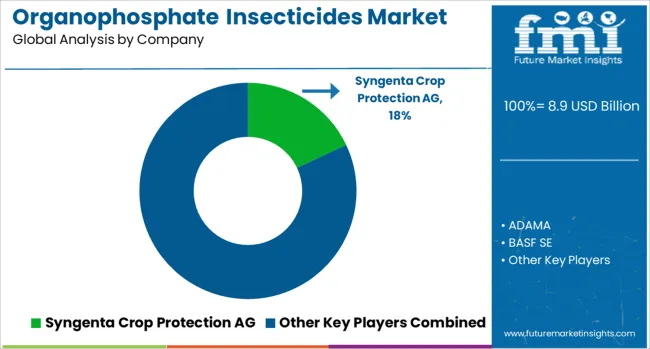

Syngenta Crop Protection AG plays a pivotal role in the organophosphate insecticides market, offering a diverse product lineup that addresses pest resistance and ensures broad crop protection across major farming regions. Its stronghold in Asia-Pacific and Latin America is bolstered by robust distribution networks and farmer engagement programs. ADAMA and BASF SE are advancing the market through precision-focused insecticide solutions, often integrated within broader crop management platforms that promote responsible chemical usage.

Bayer AG and Sumitomo Chemicals are accelerating R&D efforts to develop next-generation organophosphates, addressing regulatory scrutiny and environmental concerns while maintaining efficacy on high-value fruits and vegetables. UPL and Nufarm Limited continue to expand reach in cost-sensitive regions, supported by scalable production capabilities and flexible product lines. These companies serve a growing demand for affordable pest control in rapidly developing agricultural sectors. Compass Minerals and Yara International contribute through combined nutrition and protection offerings that improve crop yield and resilience.

Israel Chemical Company brings integrated pest and soil management to the market, while the K+S Group is aligning its crop input strategy to include organophosphates alongside micronutrients. The competitive environment reflects a blend of innovation, affordability, and regional adaptation, catering to the evolving needs of both large-scale agribusinesses and smallholder farmers.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Active Ingredient | Chlorpyrifos, Malathion, Parathion, Diazinon, Dimethoate, and Others |

| Application | Agricultural and Non-agricultural |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Syngenta Crop Protection AG, ADAMA, BASF SE, Bayer AG, Compass Minerals, Israel Chemical Company, K+S Group, Nufarm Limited, Sumitomo Chemicals, UPL, and Yara International |

| Additional Attributes | Dollar sales by active ingredient (chlorpyrifos, malathion, diazinon) and end-use (agricultural insecticides vs vector-control), demand dynamics across cereals & grains vs fruit/vegetable crops, regional dominance in Asia‑Pacific with Latin America growing fast, innovation in encapsulated formulations and precision drone application, and environmental/risk impact via toxicity concerns, resistance management, and regulatory phase‑outs. |

The global organophosphate insecticides market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the organophosphate insecticides market is projected to reach USD 14.8 billion by 2035.

The organophosphate insecticides market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in organophosphate insecticides market are chlorpyrifos, malathion, parathion, diazinon, dimethoate and others.

In terms of application, agricultural segment to command 72.3% share in the organophosphate insecticides market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organophosphate Pesticides Market

Bioinsecticides Market Growth - Trends & Forecast 2025 to 2035

Carbamate Insecticides Market Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA