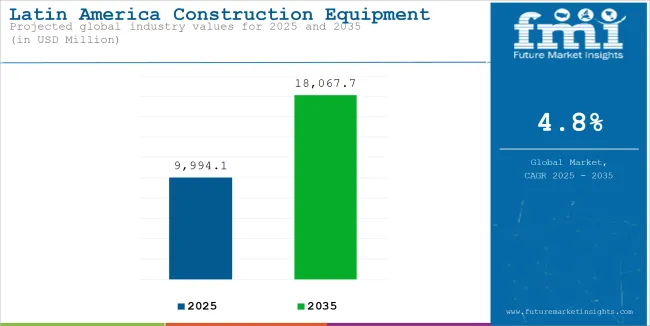

The Latin America Construction Equipment market reached USD 7,833.1 million in 2020. Demand for Construction Equipment in Latin America saw a 4.3% year-on-year growth in 2025, suggesting an expansion of the market to USD 9,994.1 million in 2025. Projections for the period between 2025 and 2035 indicate a 4.8% compound annual growth rate (CAGR) for Latin America Construction Equipment sales, resulting in a market size of USD 18,067.7 million by the end of 2035.

The growth of infrastructure projects in Brazil, Mexico, and Peru encourages investment in construction equipment. The governments in the region are trying to promote development operations on the back of rising urbanization.

Total construction equipment sales in the region were worth USD 9,536.4 Million, growing to USD 9,536.3 million in 2024, a Y-o-Y growth of 4%. Earth moving machinery remains the highest selling construction equipment in Latam, accounting for 35% all sales.

The rising construction investment in Latin America is a result of the government putting more of a focus on infrastructure. Taking note of the rising urbanization, governments in Latin America are concentrating on improving urban housing as well as developing public transportation and spaces in cities.

| Attributes | Key Insights |

|---|---|

| Estimated Value (2025) | USD 9,994.1 million |

| Projected Size (2035) | USD 18,067.7 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The adoption of technologically advanced equipment, including telematics and automation, is gaining traction to improve efficiency and reduce operational costs. Additionally, sustainability is emerging as a crucial trend, with rising demand for energy-efficient and low-emission machinery.

Global players like Caterpillar, Komatsu, and Volvo Construction Equipment dominate the market, supported by strong distribution networks. With government support and increasing foreign direct investments, the market is expected to witness steady growth, becoming a key contributor to Latin America's economic development.

The annual growth rates of the Latin America Construction Equipment market from 2025 to 2035 are illustrated below in the table. Starting with the base year 2024 and going up to the present year 2025, the report examined how the industry growth trajectory changes from the first half of the year, i.e. January through June (H1) to the second half consisting of July through December (H2). This gives stakeholders a comprehensive picture of the sector’s performance over time and insights into potential future developments.

The table provided shows the growth of the sector for each half-year between 2024 and 2025. The market was projected to grow at a CAGR of 4.4% in the first half (H1) of 2024. However, in the second half (H2) is 4.9% CAGR, there is a noticeable increase in the growth rate.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 4.4% (2024 to 2034) |

| H2 2024 | 5.0% (2024 to 2034) |

| H1 2025 | 4.5% (2025 to 2035) |

| H2 2025 | 5.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2024 to H2 2024, the CAGR is projected as 4.5% in the first half and grow to 5.1% in the second half. In the first half (H1) and second half (H2), the market witnessed an increase of 10 BPS each.

From 2020 to 2024, the Latin America construction equipment market experienced steady growth, driven by infrastructure development and urbanization initiatives across key economies such as Brazil, Mexico, and Chile. However, market performance was somewhat impacted by economic uncertainties and supply chain disruptions during the COVID-19 pandemic.

Despite these challenges, sales rebounded in 2022 and 2023 due to renewed investments in public infrastructure projects and the expansion of the construction and mining sectors. The period saw strong demand for equipment such as excavators, loaders, and cranes, with an increasing focus on advanced machinery incorporating telematics and automation technologies.

Looking ahead to 2025 to 2035, the market is expected to grow at a faster pace, fueled by large-scale government infrastructure programs and the rise of private-public partnerships. Demand for energy-efficient and sustainable construction equipment will surge as environmental regulations tighten and the region commits to greener development practices.

Emerging economies within Latin America will also play a pivotal role, driven by urbanization, industrialization, and rising foreign direct investment (FDI). Key players like Caterpillar, Komatsu, and Volvo CE are anticipated to capitalize on these opportunities through technological innovation and strategic market expansion, setting the stage for robust long-term growth.

Economic Volatility Hinders Growth of Latin America Construction Equipment Market

Companies encounter economic instabilities owing to a variety of reasons. The continual devaluation of LATAM currencies is the most significant of these. For instance, in 2023, the Argentinian peso depreciated by over 100% against the American dollar. The Brazilian and Colombian currencies are also prone to fluctuation. Consequently, economically conscious enterprises in the region are hesitant to import construction equipment.

While sustainability measures benefit the construction equipment sales due to the increase in renewable energy projects, they also have the potential to increase costs.

The construction equipment industry in LATAM now has to comply with stricter emission norms, like those introduced by Brazil in 2022, and this compliance cost may be high. An increase in compliance costs has the impact of driving prices.

High interest rates are also a significant obstacle; for example, in 2023, Brazil's interest rate was around 13.75%. As a result, Latin American construction enterprises choose to rent used equipment rather than acquire new.

Surge in Infrastructure Development and Public-Private Partnerships

The demand for construction equipment in Latin America agents is rising because governments are paying more attention to infrastructure development, which is being fueled by PPP. Latin American governments are taking steps to bridge the gap in infrastructure by undertaking massive initiatives with regard to transport, energy and urban areas.

For example, billions were spent on highways, maintenance free railways and energy plants under Brazil's Growth Acceleration Program (PAC) and Mexico's national infrastructure Plan.

Governments have recognized the need for public and private stakeholders to contribute in order to fund these projects, and private funds have been used successfully alongside these public funds. As a result, there is a heightened need for construction machinery of all variants including excavators, bulldozers and loaders, which are indispensable in large projects. Moreover, the constant need for smart city development and fabricating solar and wind farms is amplifying the market growth.

To meet these requirements, Caterpillar and Komatsu are also developing non-essential equipment such as artificial intelligence and other computing systems. This suggests that the ongoing boom in the regional infrastructure will continue to drive growth in Latin America, which will also ensure consistent demand for construction tools.

Growing Adoption of Sustainable and Energy-Efficient Equipment

Sustainability has become a leading factor influencing the Latin America construction equipment market as there is a continuous concern growing in regards to the emission of greenhouse gases over the atmosphere and also getting more and more strict emission regulations. Construction as an industry continues to be a large contributor of carbon emissions however many companies and governments are putting efforts into change that.

Construction that is powered by either electricity or hybrid options is in growing demand as they create less emissions and lower operation costs. Some of the countries such as Colombia and Chile are making efforts in encouraging the use of low-emission tool for their construction projects for the purpose of increasing eco-efficiency of the projects.

This trend is being met by suppliers like Volvo CE and Hitachi Construction Machinery producing high-end devices that leverage hybrid engines, automation systems and telematics to boost productivity and efficiency regarding fuel consumption. If all this wasn’t enough, other factors such as tax breaks and financial compensation for companies switching to greener technologies incentivizes construction companies to switch their equipment.

Embracing green innovations seem to be the strategy that construction companies will make use of in order to better position themselves in the market as well as enhance sustainability becoming a competitive factor.

Demand and Supply Gaps Hinder Flow of Equipment

Latin American construction firms are impacted by fluctuation and gaps in supply. For instance, the pandemic led to bottlenecks in supply, slowing the rate of construction machinery coming to Latin America. Busy ports like Santos in Brazil saw decreasing traffic. There are questions over the preparedness of the region in terms of another such critical time.

Latin America is also prone to natural disasters like landslides, earthquakes, and hurricanes. For instance, Hurricane Otis in Mexico, cost USD 15 billion in damages. These disasters curb the ability of construction companies to buy advanced machinery.

The region faces the problem of a lack of skilled workers-For instance, the World Economic Forum highlights that Chile suffered from a 12% shortfall in skilled construction workers in 2022.

Tier 1 companies comprise players with a revenue of above USD 500 million capturing a significant share of 55-60% in the Latin America market. These players are characterized by high production capacity and a wide product portfolio.

These leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple Construction Equipment applications and a broad geographical reach, underpinned by a robust consumer base. Prominent companies within Tier 1 include Enel Spa, Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machineryand other players.

Tier 2 companies include mid-size players with revenue of below USD 500 million having a presence in specific countries and highly influencing the local industry. These are characterized by a strong presence overseas and strong industry knowledge. These players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include JCB, CASE Construction (CNH Industrial), Doosan Infracore and other player.

The section below covers the industry analysis for Construction Equipment demand in different countries. The demand analysis on key countries in Latin America region is provided.

Brazil will hold 37.3% market share due to massive infrastructure development projects and strong investments in urbanization and industrialization. Key initiatives like the Growth Acceleration Program (PAC) and the National Logistics Plan have spurred demand for heavy machinery. Chile occupied around 17.8% owing to significant market share stems from its robust mining sector, which requires specialized construction equipment for mineral extraction and transport.

As the world's largest copper producer, Chile invests heavily in mining infrastructure, creating consistent demand for loaders, excavators, and heavy-duty vehicles. Colombia accounted for 15.2% due to its focus on infrastructure modernization, backed by the Fourth Generation (4G) road infrastructure program.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Argentina | 4.5% |

| Brazil | 4.1% |

| Chile | 3.6% |

Sales in Brazil are expected to expand at a CAGR of 4.2% from 2024 to 2034. Brazil is a lucrative market for construction equipment in Latin America, with a 24.4% market share predicted by 2024. In Brazil, government programs such as Minha Casa Minha Vida (My House, My Life) are increasing building and driving up demand for equipment such as compact loaders and excavators.

São Paulo's housing growth in 2023 needs about 1,000 new excavators and compact loaders.

Government initiatives, such as the São Paulo metro expansion, have required extensive usage of equipment, including boring machines and excavators. The mining industry in the country is also a significant customer. For example, mining activity.

The Brazilian construction and infrastructure programs like the Growth Acceleration Program and the National Logistics Plan have resulted in an ongoing demand for construction tools like excavators, cranes and loaders.

Moreover, there has been a surge in the number of solar and wind farms which require a large amount of equipment which incentivizes foreign investment and funding for intellectual projects across the country. Furthermore, considering the exponential growth in both industrialization and urbanization in the country, Brazil plays an essential role in the growth of the Latin American region construction equipment market.

The government in Colombia is focused on increasing connectivity between urban centers and rural areas. For this purpose, the 4G Road Program has been established, increasing the demand for asphalt finishers and road rollers. The program used more than 500 asphalt finishers and road rollers until 2023.

The development of road infrastructure is complemented by expansion in public transport. In Bogotá, the work of more bus lanes being constructed is handled by electric loaders and articulated dump trucks, among other construction equipment.

Other government programs, like the Casa Digna, Vida Digna Program also drive demand. The housing program drives up demand for compact loaders and concrete mixers. The expansion of ports like Cartagena has seen truck-mounted cranes and articulated dump trucks being employed at greater measure in the country.

In terms of construction equipment, Chile has a growing market due to its mining industry and growing environmental concerns. Mining is a crucial sector in the Chilean economy, making up around 50 percent of the country’s exports and 10 percent of the GDP, as Chile is the biggest producer of copper in the world.

This sector does not only require a broad range of machinery like wheel loaders, trucks and excavators but high performance ones to be used in both open-pit and underground mining. Advanced mining equipment is provided by Caterpillar and Komatsu who are some of the manufacturers that operate in Chile.

In addition to mining, Greater Santiago continues to strive in an effort to integrate sustainable practices in its construction projects. This concurs with the country’s goal of being carbon neutral by 2050, given the government’s investment in renewable energy projects, including solar and wind farms.

The equipment that is used to develop these infrastructure development is however required to be low emission and energy efficient materials. Times SA is in the Atacama desert and develops large scale solar projects that require installation equipment for photovoltaic systems.

Similarly, urbanization fuels the need for construction machinery across cities, for instance in Santiago a construction boom in housing, transportation, and commercial infrastructure is going on. The boom of private and public investment in urban development also aid in generating additional sales equipment by emphasizing machinery that is compact and versatile for urban areas.

The section explains the market share analysis of the leading segments in the industry. In terms of drive type, the Hydraulic type will likely dominate and generate a share of around 62.1% in 2025.

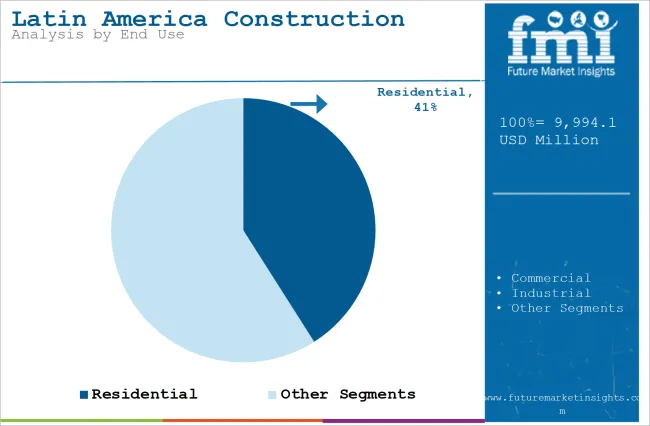

Based on the end use, the Industrial segment is projected to hold a major share of 37.8% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

<img alt="Latin America Construction Equipment Market Analysis By Drive Type" src="https://www.futuremarketinsights.com/report-images/image/latin-america-construction-equipment-market-analysis-by-drive-type.webp" title="Latin America Construction Equipment Market Analysis By Drive Type"/>

| Segment | Hydraulic (Drive Type) |

|---|---|

| Value Share (2025) | 62.1% |

The preferred form of construction equipment in Latin America is the hydraulic drive systems. These share an important share in sales in Latin America, renowned for its sturdy performance and robustness along with reliability.

Versatility, particularly in-varied applications such as mining, infrastructure, and urban construction makes it indisposable. Hydraulic power-to-weight ratio is unmatched to that of hydraulic systems and will be an advantageous feature when employing heavy machinery including excavators, loaders, and cranes at challenging site conditions.

Such equipment must be able to withstand extreme loads and tough terrains, as demanded by the region's construction and mining environments in countries like Chile and Brazil. Hydraulic systems stand out in providing precise control, high power output, and durability-critical attributes for such applications.

Hydraulic technologies, which offer energy efficiency systems and fluid dynamics improvements, enhance their appeal. As Latin America continues to invest in large projects, hydraulic drive systems will lead the long-term growth in this market.

| Segment | Industrial (End Use) |

|---|---|

| Value Share (2025) | 37.8% |

The industrial segment is expected to dominate the Latin American construction equipment market, as the region invests heavily on infrastructure and industrial development. For example, large-scale mining, energy, and transportation projects in Brazil, Chile, and Colombia heavily rely on cutting-edge construction technologies.

For instance, Chile's copper mining operations demand significant heavy machinery in order to extract and process. Brazil needs special equipment for the construction of solar farms, wind installations, and so many other renewable energy initiatives that have been emphasized.

The need for flexible and rugged machinery capable of operating in challenging environments increases with industrial expansion in manufacturing hubs and logistics facilities. Moreover, public-private partnerships and foreign direct investments in the oil and gas, power plants, and industrial parks sectors add further strength to the demand for construction equipment

Key companies producing Construction Equipment are slightly consolidate the market with about 55-60% share that are prioritizing technological advancements, integrating advanced production technologies, and expanding their footprints in the Latin America region. Multinational companies hold higher market share. By improving distribution networks and taking advantage of government support, these companies are building even more of a presence in Latin America.

The following table lists major companies and their strengths. The presence of large companies does not, however, preclude the presence of small and medium-scale players in Latin America. One way through which these players manage to compete with much larger organizations is by raising substantial funding from private sources. The following table highlights the companies that have received private funding in recent times.

Recent Industry Developments:

Based on Equipment Type, the Latin America Construction Equipment Market is segmented into earth-moving machinery, construction material handling machinery, and concrete and road construction machinery.

Based on Drive Type, the Latin America Construction Equipment Market is segmented into hydraulic, electric, and hybrid.

Based on Power Output, the Latin America Construction Equipment Market is segmented into less than 100 HP, 101-200 HP, 201-400 HP, and more than 400 HP.

Based on End Use, the Latin America Construction Equipment Market is segmented into residential, commercial, industrial, and institutional applications.

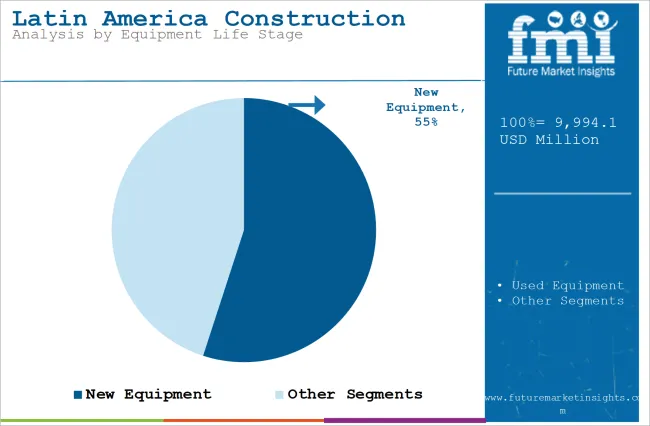

Based on Equipment Life Stage, the Latin America Construction Equipment Market is segmented into new equipment and used equipment.

Countries considered in the study include Argentina, Brazil, Chile, Colombia, Uruguay, Peru, and Other Countries.

The Latin America Construction Equipment market in Brazil was valued at USD 2,491.1 million in 2025.

The demand for Latin America Construction Equipment industry is set to reach USD 18,067.7 million in 2035.

Governments across Latin America are implementing supportive policies and incentives to boost renewable energy adoption, including wind power. These include auctions for renewable energy projects, tax incentives, and long-term power purchase agreements (PPAs) and region boasts high wind potential, particularly in areas such as northeastern Brazil, the Patagonia region of Argentina, and coastal areas in Chile.

The Latin America Construction Equipment industry demand was valued at USD 9,994.1 Million and is projected to reach USD 18,067.7 million by 2035 growing at CAGR of 4.8% in the forecast period.

Industrial end use is expected to lead during the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Animal Feed Alternative Protein Market Analysis – Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA