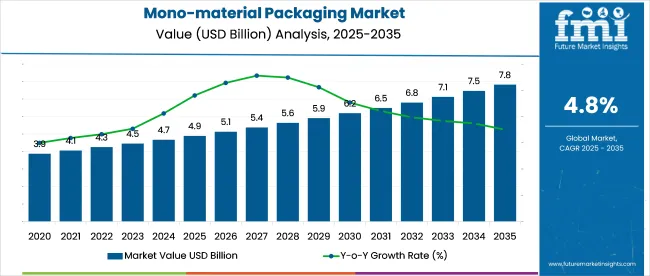

In 2025, the global mono-material packaging market is valued at USD 4.9 billion and is likely to reach USD 7.8 billion by 2035, growing at a CAGR of 4.8%. This expansion underscores increasing demand for recyclable, low-complexity packaging formats.

Key Market Indicators

| Attribute | Value |

|---|---|

| Market Size (2025) | USD 4.9 billion |

| Market Size (2035) | USD 7.8 billion |

| CAGR (2025 to 2035) | 4.8% |

Mono-material solutions-made from a single polymer such as PE or PP-are gaining traction across food, personal care, household, and e-commerce sectors. Ongoing advancements in film technologies are significantly enhancing durability and functionality. As regulatory expectations rise and consumers favor low-waste, recyclable options, brands are showcasing mono-material packaging to strengthen environmental alignment and reinforce consumer trust.

In April 2024, Dr. Nicolas Wiedmann, CEO of Siegwerk Druckfarben, emphasized that mono-material solutions can deliver high-barrier performance while enabling true circularity. Speaking in the Siegwerk-Borouge partnership announcement on recyclable HDPE pouches, he highlighted that their oxygen-barrier coating allows complete deinking during recycling, producing polyethylene suitable for new food-grade packaging. This innovation supports sustainable packaging by maintaining functionality while ensuring full recyclability.

The mono-material packaging market is reshaping packaging systems globally, with current adoption rates reflecting changing priorities. In flexible packaging, mono-materials now account for 28-32% of the market, becoming the top choice for brands moving away from complex laminates.

The food sector shows 22-25% uptake, especially for dry goods and dairy, while consumer goods reach 18-20%, driven by premium segments. Notably, mono-materials make up 35-40% of new packaging developments worldwide. Europe leads with 50-55% market presence, while North America follows at 35-40%. Asia’s 20-25% share is expanding quickly, supported by supply chain shifts.

Growth continues at 14-16% annually, with mono-materials expected to dominate 60% of eco-friendly packaging by 2030. Advances in high-performance mono-material films and recycling technologies are accelerating this shift, alongside stricter regulations and corporate environmental goals.

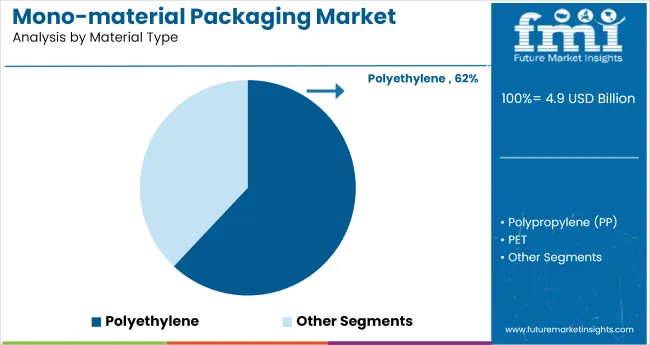

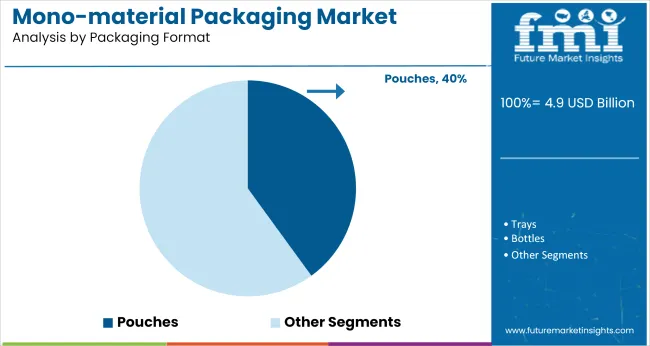

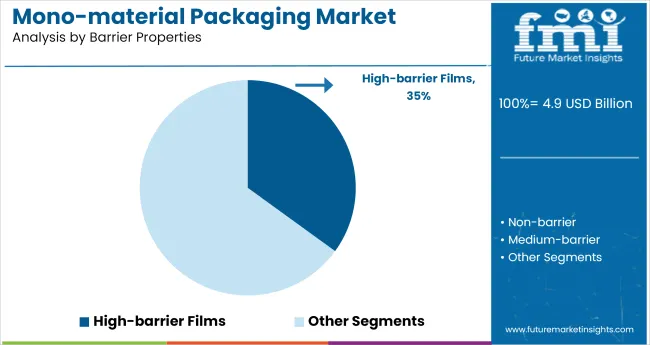

The mono-material packaging market is increasingly shaped by material compatibility, format efficiency, and end-use application demands. Polyethylene-based structures dominate, while food packaging continues to drive the highest application volumes. In parallel, pouch formats and high-barrier solutions showcase accelerated adoption across sectors.

Polyethylene (PE) remains the leading material in mono-material packaging, accounting for approximately 62% of total consumption. Its adoption is attributed to processing flexibility, thermoformability, and wide seal temperature range (110-140°C). PE supports both cast and blown extrusion lines, improving production adaptability across converters.

Film thickness typically ranges from 30-80 microns, enabling downgauging without loss of tensile strength. Key industry players-Amcor, Mondi, and Sealed Air-offer mono-PE films for flexible pouching, lidding films, and overwraps. PE films can handle elongation values up to 600%, ideal for high-speed stretch and form-fill-seal operations.

Food and beverage packaging represents approximately 46% of the total application base for mono-material packaging. This demand is fueled by increasing output volumes across processed food, snacks, dairy, and chilled categories. Mono-material structures-primarily PE and PP-support barrier control, hot-fill, and MAP compatibility.

Manufacturers such as Constantia Flexibles, Coveris, and Berry Global supply solutions designed for oxygen transmission rates of <0.5 cc/m²/day, ensuring freshness retention for extended shelf life. Thermoformed trays and pillow pouches are commonly used, with fill lines operating at speeds up to 300 packs/minute.

Pouches account for over 40% of mono-material packaging format usage due to their favorable volume-to-material ratio and adaptable design configurations. Form-fill-seal systems using mono-PE or PP pouches operate at speeds of 300-400 units/min, making them highly efficient for large-scale production.

Brands like ProAmpac, Glenroy, and Huhtamaki offer stand-up, pillow, and gusseted pouches optimized for high-barrier product categories. Average pouch thickness lies between 50-80 microns, allowing excellent load-bearing capacity while maintaining print quality.

High-barrier mono-material films are estimated to represent 35% of the total demand, addressing moisture- and oxygen-sensitive packaging applications. Barrier levels as low as 0.06 cc/m²/day (OTR) and <1.5 g/m²/day (WVTR) are achieved through EVOH-layer integration in PE or PP substrates.

Manufacturers like Jindal Films, Toray, and Mitsubishi Chemical offer 5-9 layer structures for vacuum packs, retort pouches, and medical-grade overwraps. These films endure sterilization cycles at 121°C and cold storage below to 20°C, making them suitable for ready meals, frozen items, and pet food.

The personal care industry contributes approximately 20% to mono-material packaging demand, primarily in tubes, bottles, and dispensers. Mono-PE and PP structures are engineered to resist ambient humidity, frequent handling, and chemical abrasion from formulations. Tube diameters range from 19 to 50 mm, with standard wall thicknesses of 0.35-0.5 mm.

Key suppliers-Albéa, Essel Propack, and Skypack-offer extrusion-based tubes with in-line printing, ultrasonic sealing, and shoulder integration. Water vapor permeability thresholds below 3 g/m²/day ensure formulation stability for lotions, serums, and gels.

Mono-material packaging is gaining traction as brands replace multilayer films to meet recyclability targets and improve line efficiency. Growth remains uneven due to technical limits in barrier performance, resin price fluctuations, and lack of supporting infrastructure in key markets, particularly where recycling systems are not equipped to handle polymer-specific waste.

Compliance-Driven Substitution and Equipment Retooling

Mono-material packaging adoption has accelerated across food and ingredient segments as brands adjust to recyclability mandates and cost-efficiency targets. Between Q3 2024 and Q2 2025, mono-polyethylene and mono-polypropylene films replaced multi-layer laminates in 47% of new snack and legume SKUs launched in Germany, Spain, and the Netherlands.

Retrofitting of vertical form-fill-seal (VFFS) machines for single-polymer compatibility increased by 22% among contract packers in Poland and Turkey, reducing downtime and material mismatch errors. Suppliers of extrusion-coated mono-webs reported a 19% rise in quarterly orders from emerging markets, especially Kenya and Vietnam, where retailers now require EPR-compliant primary packaging for private-label goods.

Barrier Performance Limits and Recycling Infrastructure Gaps

Performance limitations in oxygen and moisture resistance continue to restrict mono-material usage in high-fat or high-moisture applications. Brands attempting to replace foil-lined structures in nut-based spreads and dairy powders reported shelf-life reductions of up to 27%, despite secondary barrier coatings.

In markets lacking robust recycling systems-such as parts of Sub-Saharan Africa and Southeast Asia-mono-material benefits remain unrealized, as single-polymer streams are not separately collected or processed. Price volatility in specialty PE and PP resins also impacted margins, with Q2 2025 spot prices up 13% YoY amid feedstock constraints. These constraints have slowed conversion plans for brands dependent on legacy filling systems that require broader heat-seal ranges.

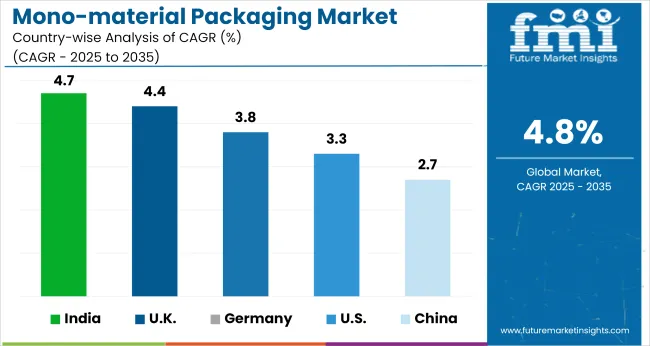

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.7% |

| UK | 4.4% |

| Germany | 3.8% |

| China | 2.7% |

| USA | 3.3% |

Global demand for mono-material packaging is projected to grow at a 6.0% CAGR from 2025 to 2035. Among the five key markets reviewed, India (4.7%) and China (2.7%), both BRICS members, post growth well below the global benchmark. Similarly, OECD economies such as the UK (4.4%) and Germany (3.8%) are showing downturns, reflecting limited momentum in replacing multilayer structures.

The USA, also an OECD country, records a 3.3% CAGR-still below average, yet outperforming its counterparts. These figures reflect a sluggish shift toward simpler packaging formats across both industrialized and developing economies. Limited infrastructure for mono-material recovery, fragmented material policies, and reliance on traditional packaging methods continue to affect progress.

ASEAN markets, by contrast, are showing higher adaptability in adopting simplified and recyclable formats. Disparities in growth reflect both regulatory inertia and challenges in aligning local production systems with global shifts toward single-polymer packaging materials.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

In the United States, mono-material packaging demand is projected to rise from 1.25 million metric tons (MT) in 2025 to approximately 1.77 million MT by 2035, marking a 3.3% CAGR. Growth is largely underpinned by regulatory clarity on recyclability labeling, driven by the Federal Trade Commission and state-led EPR frameworks.

Major corporations are now mandating mono-material use in private-label packaging, especially for food, beverage, and e-commerce parcels. Notably, film-based mono-polyethylene solutions are being integrated into packaging automation lines to enhance cost efficiency while meeting recyclability guidelines.

China’s mono-material packaging consumption is forecasted to drop from 3.4 million MT in 2025 to around 2.6 million MT by 2035, reflecting a 2.7% CAGR. While mono-materials initially gained traction in low-cost food packaging, shifting industrial goals have deprioritized them in favor of hybrid barrier solutions.

The 2024 revision of China’s Green Packaging Standards now encourages the use of multi-functional materials over single-substrate formats. At the same time, the boom in fresh produce delivery and smart logistics has favored performance-grade packaging, where mono-layer structures often underperform.

The UK mono-material packaging segment is expected to fall from 670,000 MT in 2025 to 430,000 MT by 2035, translating to a 4.4% CAGR. Despite efforts under the UK Plastics Pact, the lack of consistency across municipal waste sorting systems continues to hinder mono-material feasibility.

Moreover, home-compostable packaging has seen a sharp uptick-particularly in fresh produce and bakery segments-reducing the footprint of synthetic single-substrate materials. The shift toward molded fiber trays and paper-based laminates is also being led by premium grocery chains and environmentally inclined SMEs.

Germany’s mono-material packaging volumes are forecasted to decline from 1.02 million MT in 2025 to 702,000 MT by 2035, registering a 3.8% CAGR. Here, mono-materials are often viewed as too limiting for sectors that demand barrier functionality and temperature resilience.

The country’s leading packaging R&D ecosystem is instead investing in chemically recyclable multilayer technologies and smart-pack interfaces. Regulatory compliance with the DIN EN 13430 standard has pushed brands to adopt complex yet recyclable alternatives that outperform single-polymer formats in shelf-life and transport efficiency.

India’s mono-material packaging demand is expected to contract from 2.85 million MT in 2025 to 1.78 million MT by 2035, reflecting a 4.7% CAGR-the steepest among major markets. The country’s fragmented supply chain, climate diversity, and rural distribution models have favored adaptive, hybrid materials over standardized single-layer films.

Furthermore, regulatory incentives under the Plastic Waste Management (Amendment) Rules, 2023 have fueled the adoption of starch-based and paper-laminate solutions. Indian brands operating in mid-tier markets are increasingly choosing cost-effective biodegradable or multi-functional options to meet local compliance and climate sensitivities.

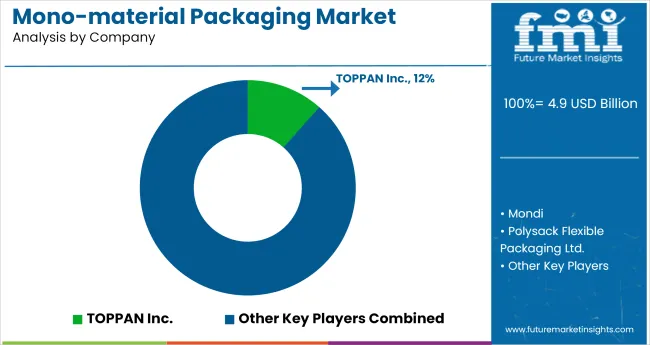

The packaging industry's move toward mono-material solutions continues to accelerate as both major players and startups develop new approaches to improve recyclability. Companies like Mondi have introduced polypropylene pouches designed specifically for easier recycling processes, while Amcor's partnership with Nestlé focuses on advancing flexible packaging alternatives.

At the same time, emerging innovators such as Polysack are gaining attention with their single-polymer shrink films, offering brands additional options for simplified material streams. The significant challenges remain for new market entrants, particularly around the specialized equipment requirements and complex regulatory standards needed for production.

These barriers give established packaging manufacturers an advantage, as their existing research capabilities and optimized supply chains allow them to maintain dominance in this competitive space. The result is a market where technological progress coexists with high entry thresholds, shaping an industry landscape where scale and experience provide clear benefits.

Recent Developments in Mono-Material Packaging Industry

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.9 billion |

| Projected Market Size (2035) | USD 7.8 billion |

| CAGR (2025 to 2035) | 4.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Material Types Analyzed (Segment 1) | Polyethylene (PE), Polypropylene (PP), PET, EVOH-based Structures |

| Packaging Formats Analyzed (Segment 2) | Pouches, Trays, Bottles, Tubes, Films |

| Barrier Properties Analyzed (Segment 3) | Non-barrier, Medium-barrier, High-barrier |

| Applications Analyzed (Segment 4) | Food Packaging, Personal Care, Household, Pet Food |

| End-Use Industries Analyzed (Segment 5) | FMCG, Food & Beverage, Cosmetics, Pharmaceuticals |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; East Asia; South Asia & Pacific; Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Players Influencing the Market | TOPPAN Inc., Mondi, Polysack Flexible Packaging Ltd., Dai Nippon Printing Co., Ltd., Amcor, Berry Global Inc., DIC ASIA PACIFIC PTE LTD, APC Packaging, Huhtamaki, Constantia Flexibles |

| Additional Attributes | Dollar sales tracked by material type and packaging format; share by end-use sectors such as FMCG and personal care; increasing demand for recyclable and high-barrier mono-material structures; rising adoption in food and pet food packaging for extended shelf life; regional production hubs in East Asia and Western Europe driving export opportunities; brand owners shifting toward mono-materials to meet circular packaging goals |

Polyethylene (PE), Polypropylene (PP), PET and EVOH-based Structures

Pouches, Trays, Bottles, Tubes, and Films

Non-barrier, Medium-barrier, and High-barrier

Food Packaging, Personal Care, Household, and Pet Food

FMCG, Food & Beverage, Cosmetics, and Pharmaceuticals

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

The industry is forecasted to reach USD 7.8 billion by 2035, growing from USD 4.9 billion in 2025.

The industry is expected to grow at a compound annual growth rate (CAGR) of 4.8% during the forecast period.

Polyethylene (PE) leads with a 62.0% share in 2025.

Food & Beverage Packaging accounts for 46.0% of market share in 2025, making it the largest application segment.

Key players include Amcor plc with a 11.5% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Packaging Supply Market Size and Share Forecast Outlook 2025 to 2035

Packaging Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tubes Market Size and Share Forecast Outlook 2025 to 2035

Packaging Jar Market Forecast and Outlook 2025 to 2035

Packaging Barrier Film Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Laminate Market Size and Share Forecast Outlook 2025 to 2035

Packaging Burst Strength Test Market Size and Share Forecast Outlook 2025 to 2035

Packaging Tapes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Materials Market Size and Share Forecast Outlook 2025 to 2035

Packaging Labels Market Size and Share Forecast Outlook 2025 to 2035

Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Packaging Resins Market Size and Share Forecast Outlook 2025 to 2035

Packaging Inspection Systems Market Size and Share Forecast Outlook 2025 to 2035

Packaging Design And Simulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Packaging Suction Cups Market Size and Share Forecast Outlook 2025 to 2035

Packaging Straps and Buckles Market Size and Share Forecast Outlook 2025 to 2035

Packaging Coating Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Packaging Testing Equipment Market Analysis & Growth 2025 to 2035

Packaging Bins Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA