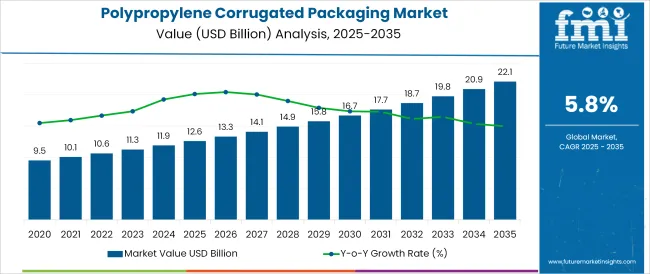

The Polypropylene Corrugated Packaging Market is estimated to be valued at USD 12.6 billion in 2025 and is projected to reach USD 22.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The polypropylene corrugated packaging market is advancing steadily, driven by the global shift toward lightweight, durable, and reusable packaging materials. Increasing regulatory focus on sustainable packaging solutions is encouraging industries to adopt polypropylene corrugated formats over traditional paper-based or single-use plastics.

Known for its resistance to moisture, chemicals, and impact, polypropylene corrugated packaging is being widely adopted across sectors demanding long-lasting and hygienic storage, such as food, pharmaceuticals, and industrial goods. The growing need for cost-effective, customizable, and recyclable alternatives to rigid packaging is spurring innovation in design and lamination technologies.

With logistics and e-commerce businesses demanding packaging that offers superior protection while reducing overall shipping weight, polypropylene corrugated products are emerging as a preferred solution. Manufacturers are expanding their production capabilities and streamlining distribution via direct channels to enhance responsiveness and reduce costs. Future market growth will likely be shaped by digital printing advancements, returnable transit packaging systems, and integration with automation in material handling.

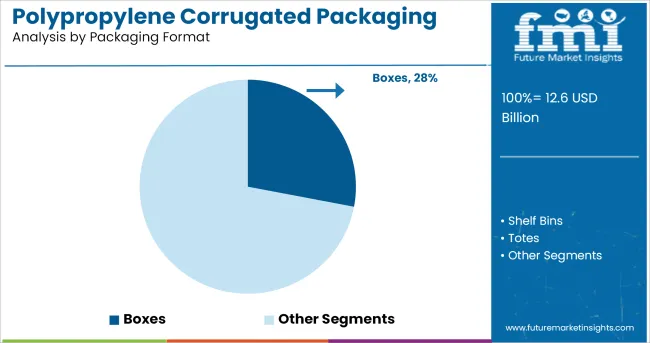

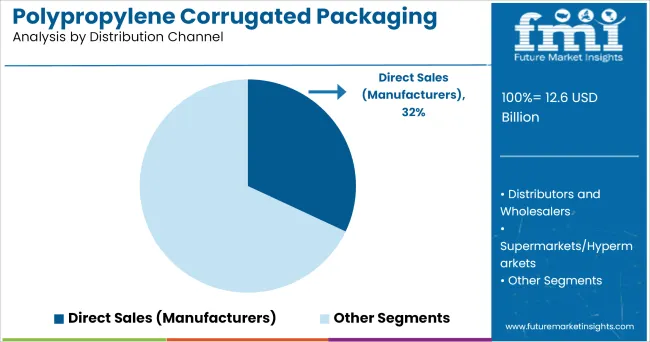

The market is segmented by Packaging Format, Distribution Channel, and End-Use Industry and region. By Packaging Format, the market is divided into Boxes, Shelf Bins, Totes, Dividers, Trays, Retail Displays, and Others. In terms of Distribution Channel, the market is classified into Direct Sales (Manufacturers), Distributors and Wholesalers, Supermarkets/Hypermarkets, Retail Stores, and Online Stores.

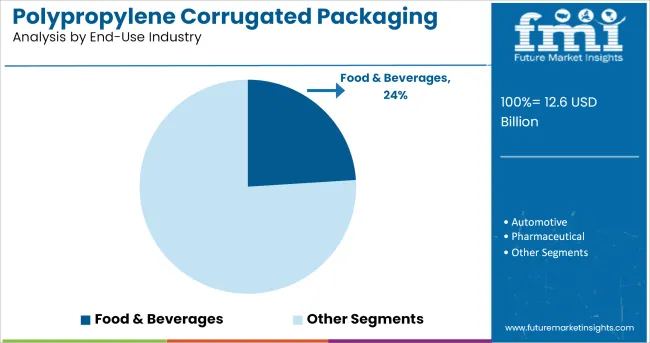

Based on End-Use Industry, the market is segmented into Food & Beverages, Automotive, Pharmaceutical, Cosmetics & Personal Care, Household, Electronics & Electricals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Boxes are expected to contribute 28.0% of the total market revenue in 2025 under the packaging format category, positioning them as the dominant product format. Their leadership is driven by widespread adoption in supply chain packaging, where protective strength, light weight, and stackability are critical.

Boxes made from polypropylene corrugated sheets offer resistance to water, chemicals, and tearing factors that enhance longevity in repeated-use logistics and cold chain applications. Customization options such as partitions, cut outs, and ergonomic handles have allowed broader usage across industries ranging from agriculture to electronics.

Their compatibility with automation systems for assembly, labelling, and conveyance further supports high-volume packaging needs. The scalability of box production and integration with circular economy models have contributed significantly to their share in the polypropylene corrugated packaging market.

The direct sales channel through manufacturers is projected to hold a 32.0% revenue share in 2025 within the distribution segment, making it the leading route to market. This dominance is underpinned by the ability of manufacturers to offer tailored solutions, volume discounts, and end-to-end service-from design consultation to on-site delivery.

Direct engagement ensures faster turnaround times, improved quality assurance, and simplified customization processes, which are critical in sectors like food, pharma, and automotive where packaging standards are stringent. In addition, manufacturers leveraging B2B portals and ERP-integrated ordering systems have streamlined procurement for enterprise buyers.

The preference for long-term supply contracts, reliability in product availability, and technical support provided directly by producers has further strengthened this channel’s position across both developed and emerging markets.

The food and beverages industry is projected to account for 24.0% of the total market share in 2025 under the end-use category, establishing itself as the most prominent sector for polypropylene corrugated packaging. This prominence is due to the material’s suitability for food-safe applications, offering hygienic and reusable alternatives for storage, transport, and retail display.

Polypropylene’s moisture resistance, washability, and insulation properties make it ideal for perishable items and cold-chain distribution. Additionally, increased demand for organized food distribution, especially through e-commerce and direct-to-consumer models, has elevated the need for packaging that combines durability with light weight.

Many food processors and beverage manufacturers are adopting reusable totes and foldable boxes to align with sustainability goals and regulatory pressures related to single-use plastics. The compatibility of these solutions with supply chain automation and traceability systems has further accelerated uptake, ensuring the food and beverage sector continues to lead demand in this market.

Key global manufacturers of the packaging industry have responded to global packaging challenges with advanced packaging solutions catering for the exact industry requirements. The innovation of polypropylene coated corrugated packaging solutions is one of the path-breaking solutions to tackle the challenges faced by the global packaging market.

Different types of boxes, trays, bins, retail shelves, point of purchase displays, signage, totes and dividers, along with a variety of customized packaging products are manufactured using polypropylene corrugated material which serves as best suited alternative for most of the materials, due to their limitations.

Demand for moisture-proof and durable packaging solutions gaining traction among major end-user industries including food & beverages, pharmaceutical, cosmetics & personal care and household industries, resulting in increasing worldwide acceptance of polypropylene corrugated packaging solutions.

The weight handling capacity of polypropylene corrugated boxes is way more than boxes and other packaging solutions compared to alternative materials such as boxes made up of only corrugated boards and only plastics. Moreover, the polypropylene corrugated packaging has high resistance against the water, which saves the commodity packed inside from atmospheric repercussions.

Unlike other plastics, the polypropylene corrugated packaging solutions also may lose their form and shape if exposed to intense heat, and this may act as a limitation as these packaging solutions are still in the growth stage in various regions across the globe.

The production process of polypropylene corrugated packaging solutions is very complex as compared to other simple packaging solutions made up of paperboard or only plastics and wood, having too many market alternatives and a low market penetration rate will affect the growth of the global polypropylene corrugated packaging market.

Modern-day manufacturers are trying to differentiate their products and offerings from the competitors by marketing their produced packaging solutions like sustainable, which offers re-usability to the end-users and has no harmful effects on the environment, which helps polypropylene corrugated packaging to gain traction across continents.

The boxes and packaging solutions manufactured using polypropylene corrugated material are non-toxic and clinically tested to be safe for packaging food & beverages in it, as they do not cause any harmful emissions to the consumables packed in it. Packaging solutions having attractive looks and feel are most trending in the market as they stimulate buyers towards buying it promptly.

The widely used returnable packaging concepts are gaining more market popularity across the whole Europe, Germany and UK being major markets are having a large number of industrial as well as individual consumers of such type of packaging solutions made up of polypropylene corrugated material, which makes it accepted among the environmentally concerned consumer bases in these countries.

Stringent laws banning single-use plastics and high taxation on other pollutant materials indicates towards growth and expansion of the global polypropylene corrugated packaging market in developed countries such as Germany and the UK.

The presence of key manufacturers and newer market entrants producing innovative and customized packaging solutions made up of polypropylene corrugated material are contributing towards overall growth over the upcoming decade.

Tremendous growth witnessed by various end-user industries such as pharmaceutical, cosmetics and household industries, has resulted in increased demand for leak-proof packaging solutions offering high strength compared to traditional packaging solutions. Fast-paced infrastructural development in the country and producers adapting the polypropylene corrugated material for the production of packaging solutions makes China the fastest-growing offering country.

Sharp growth recorded in packaged food & beverages industry in India and a hike in demand for higher quality packaging solutions, makes it a major market for packaging solutions made up of polypropylene corrugated material. The entry of key global manufacturers in the country to expand their market presence has been engaged in large scale production of polypropylene corrugated packaging solutions and indicating towards exponential growth in future for the same.

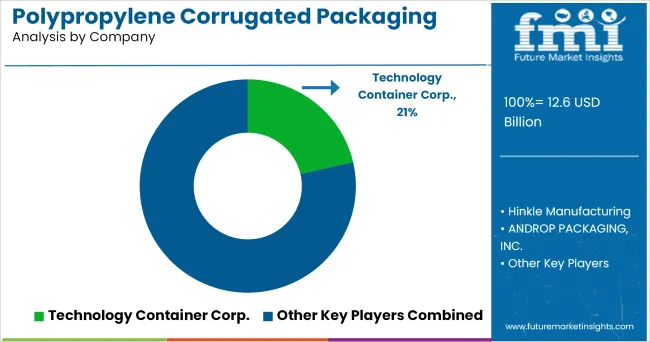

The global polypropylene corrugated packaging market is estimated to be valued at USD 12.6 billion in 2025.

The market size for the polypropylene corrugated packaging market is projected to reach USD 22.1 billion by 2035.

The polypropylene corrugated packaging market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in polypropylene corrugated packaging market are boxes, shelf bins, totes, dividers, trays, retail displays and others.

In terms of distribution channel, direct sales (manufacturers) segment to command 32.0% share in the polypropylene corrugated packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polypropylene Woven Bag and Sack Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Yarn Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Random Copolymers Market Growth – Trends & Forecast 2025 to 2035

Market Share Distribution Among Polypropylene Woven Bag and Sack Manufacturers

Polypropylene Screw Caps Market

Polypropylene Film Market

Polypropylene Fibre Market

Polypropylene Packaging Films Market Trends - Growth & Forecast 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Biobased Polypropylene PP Size Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polypropylene (EPP) Foam Market 2025 to 2035

Surgical Polypropylene Mesh Market

Demand for Polypropylene in EU Size and Share Forecast Outlook 2025 to 2035

Melt-Blown Polypropylene Filters Market Size and Share Forecast Outlook 2025 to 2035

Medical Grade Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Biaxially Oriented Polypropylene Market Size and Share Forecast Outlook 2025 to 2035

Coupling Agent (Compatibilizer) for Polypropylene Market

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA