An upward trend in the polypropylene packaging films market is projected from 2025 to 2035 because manufacturers seek flexible recyclable cost-efficient packaging solutions for food pharmaceutical and consumer goods industries.

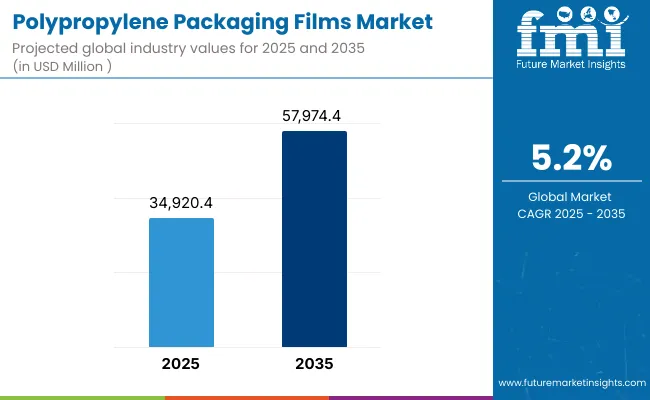

Polypropylene films serve both primary and secondary packaging requirements because they maintain excellent clarity while providing strong resistance to moisture and demonstrated mechanical integrity. The market is expected to start at USD 34,920.4 million in 2025 and rise to USD 57,974.4 million by 2035 while maintaining a 5.2% compound annual growth rate from 2025 to 2035.

Shares of the polypropylene film market are increasing due to rising preference for convenience packaging and ready-to-eat meals as well as technological innovations in BOPP and CPP. Companies across the market are adopting bio-based and recyclable polypropylene materials because sustainability goals and regulatory standards impose pressure on them.

Environmental concerns about plastic usage together with raw material price volatility constitute important market challenges. Stakeholders develop high-barrier films and down gauging approaches and circular packaging systems to improve environmental benefits and cost reduction.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 34,920.4 million |

| Industry Value (2035F) | USD 57,974.4 million |

| CAGR (2025 to 2035) | 5.2% |

The polypropylene packaging films market demonstrates increasing industry segments through various film types and applications which serve food industry and personal care product sectors and pharmaceutical customers. The marketplace features BOPP and CPP films as main product categories. BOPP leads the market through its exceptional strength and gloss and printability features whereas CPP succeeds in retort applications and laminates because of its heat-sealing abilities and high clarity performance.

Food distribution heads the market applications because it requires polypropylene packaging for bakery items and frozen goods as well as snack products. Pharmaceutical and personal care industries adopt polypropylene films to produce blister packages along with sachets and overwraps. The growing market demand for lightweight and shelf-stable packaging motivates manufacturers to develop high-barrier and anti-fog film technologies for upcoming consumer and regulatory requirements.

The North America polypropylene packaging films market continues to be driven by increasing demand for processed foods, healthcare products and packaging formats that can be recycled. North America, led by the United States and Canada, holds a high market share for high-barrier BOPP and CPP films used in flexible packaging applications.

The Europe market is fuelled by strict sustainability regulations, rising investment towards circular packaging, and prominent presence of food processing industries. As a result, Germany, France and the UK channel their efforts on biodegradable and post-consumer recycled polypropylene films to align with EU environmental targets.

The Asia-Pacific market for polypropylene packaging films is projected to witness the highest growth, as a result of increasing urbanization, growing disposable incomes, and growing e-commerce and retail packaging in the region. Demand for high-performance films, in food and non-food applications, is driven by China, India, Japan and South Korea. The market is further driven by government initiatives towards sustainable plastics.

Environmental Pressure and Recycling Limitations

Environmental factors and recycling challenges are becoming more critical for the polypropylene (PP) packaging films market. Although PP films are transparent, strong, and moisture resistant, they are still included in the overall plastic waste problem. Polypropylene packaging is particularly difficult to recycle, like if used in multi-layer laminates or metallized formats, and is significantly less desirable in closed-loop recycling processes.

Many regions still do not have a recycling infrastructure that can adequately sort and process PP films, which also limits their sustainability appeal. Tightening regulations on single-use plastics and packaging waste, especially in Europe and North America, are forcing manufacturers to innovate out of fear of being left behind.

Rising Demand for Lightweight, Versatile, and Recyclable Packaging

The market has robust prospects as demand for lightweight, flexible, and low-cost packaging continues to rise across various sectors, including food & beverage, personal care, pharmaceuticals, and industrial goods. Mono-material polypropylene films, barrier coatings, and down gauging advances are making PP films more recyclable-compatible and degrees cleaner.

Brands have also been using recyclable mono-PP film structures for pouches, wraps, and labels to meet ESG mandates and regulatory compliance. There is also growth potential coming from the trend of e-commerce and convenience packaging as polypropylene films provide the seal strength, puncture resistance and product protection needed for modern logistics.

From 2020 to 2024, consumers packed good, hygiene products, and food packaging made for high demand in the market. Manufacturers concentrated on low-cost systems for film production, multilayer barrier structures, and gloss-enhancing topcoats that appeal to converters and end users. But the then-prevalent worries over plastic waste and poor recycling rates of composite packaging formats drew increasing scrutiny, particularly from s APency-minded consumers and would-be regulators.

From 2025 to 2035, the market will turn towards fully recyclable, high-performance mono-material PP films that have improved oxygen and moisture barriers, allowing flexible packaging to be increasingly circular. Also, Auto sorting through digital watermarking, bio-based PP inputs, as well as solvent free adhesive lamination will facilitate recyclability and sustainability. Shelf-ready, tamper-evident, and high-clarity packaging formats across the personal care, frozen food, and pharmaceutical segments will enable innovation in film functionality.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter scrutiny on multilayer plastic packaging and waste generation |

| Technological Advancements | Adoption of co-extrusion and metallized films for performance enhancement |

| Sustainability Trends | Early adoption of recyclable film formats and down gauging strategies |

| Market Competition | Dominated by food and personal care packaging applications |

| Industry Adoption | Popular for snack packaging, wrap-around labels, and lamination films |

| Consumer Preferences | Preference for convenient, protective, and clear packaging |

| Market Growth Drivers | Growth driven by cost-effectiveness, visual appeal, and product protection |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Enforcement of extended producer responsibility (EPR), plastic taxes, and recyclability mandates |

| Technological Advancements | Growth in mono-material PP, high-barrier coatings, and digital sorting technologies |

| Sustainability Trends | Broad use of bio-based PP, solvent-free lamination, and closed-loop film solutions |

| Market Competition | Expanded presence in pharma, e-commerce, and smart packaging sectors |

| Industry Adoption | Growth in heat-sealable, breathable, and cold-chain-ready PP films |

| Consumer Preferences | Increased demand for sustainable, resalable , and fully recyclable film-based packaging |

| Market Growth Drivers | Expansion fuelled by eco-compliance, packaging circularity, and next-gen barrier technologies |

The United States polypropylene packaging films market is estimated to witness steady growth, owing to rising demand from the food & beverage, pharmaceutical, and personal care industries. A growing number of applications are converting from polyethylene to polypropylene films due to such properties as increased clarity, moisture resistance, and recyclability, particularly in the growing fields of flexible pouching, snack packaging, and overwrap applications.

Heavy focus on sustainable packaging and down gauging trends are prompting manufacturers to invest in mono-material polypropylene films to back recyclability and source reduction initiatives. Further, the rapid growth of e-commerce and convenience food categories are positively influencing the demand for durable and heat seable BOPP products across distribution chains.

| Country | CAGR (2025 to 2035) |

|---|---|

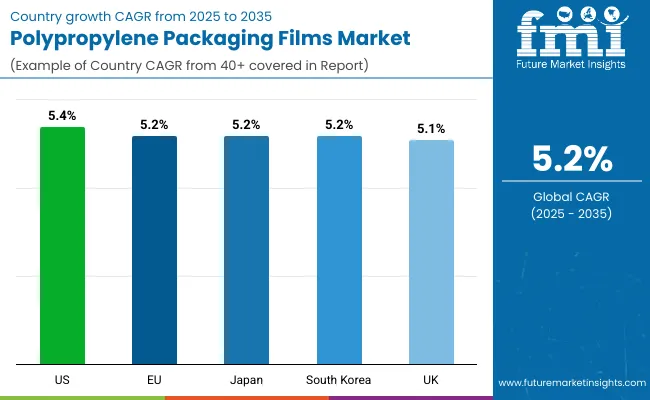

| USA | 5.4% |

The growth of UK polypropylene packaging films market is attributed to the regulatory pressure on the management of plastic waste, increasing demand for recyclable packaging solutions, and rising usage of BOPP and CPP films in the food retail environment across the country. Mono-polymer packaging formats are being adopted at an accelerated pace across supermarkets and online grocery platforms looking to achieve plastic reduction targets.

Manufacturers are integrating post-consumer resin (PCR) into the clean packaging alternatives as consumers are aware of the availability of sustainable packaging products in the market. The UK has pledged to move away from non-recyclable packaging by 2030, further increasing demand for flexible polypropylene substrates, which balance performance and sustainability objectives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.1% |

The European Union Polypropylene (PP) Packaging Films market is steadily expanding owing to stringent circular economy policies, high demand for sustainable flexible packaging, and increasing investments in food-grade recyclability. Germany, France, and the Netherlands produce and consume the most oriented polypropylene films for packaging snack food, dairy, and pharmaceuticals.

New multi-layer co-extruded BOPP films with barrier coatings are continuing to replace PET, providing barrier properties to improve shelf life, while remaining recyclable. Also, there are regional synergies developing between public and private initiatives focused on closed loop recycling and packaging innovations focused on the needs for more sustainable, polypropylene-based options.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

Driven primarily by demand for high-performance, hygienic, and space-saving packaging formats, particularly in ready-to-eat foods, confectionary, and health supplements, the Japanese polypropylene packaging films market has been steadily evolving. Ultra-thin BOPP and metallized CPP films that offer barrier properties, clarity, and low material consumption are the focus of Japanese manufacturers.

As more regulations are introduced around green packaging and regulations around plastic recycling, companies are working on mono-material films and solvent-free lamination processes. In addition, advanced converting technologies in Japan are driving the rapid introduction of retort-grade and heat resistant polypropylene films for high-end packaged goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The South Korean market for polypropylene packaging films is witnessing rapid growth, powered by increased demand from the processed foods industry and e-commerce packaging, complemented by favourable regulations for recyclable flexible packaging. Developers of printable, sealable transparent BOPP and CPP films intended for snack food, frozen food and personal care products are advancing yet ever more capabilities locally.

Government guidelines on green packaging and waste reduction policies are promoting the move to monolayer recyclable structures making polypropylene more competitive than multi-material plastics. Innovations in technology for barrier coatings and in-moldlabelling films have also bolstered value-added applications in the region.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The global market for polypropylene packaging films has been surging as industries around the world adopt flexible, durable, and cost-effective materials for product protection and branding purposes.

In such a wide range of product and film types, BOPP (biaxially oriented polypropylene) and metallized are the most significant categories, as they offer unparalleled clarity, barrier protection, and versatility across food, beverage, personal care, and pharmaceutical packaging. The new film types that meet the ever-increasing and evolving demands for sustainability, visual appeal and advanced material performance are now an essential part of the packaging supply chains of today.

BOPP Films dominate the market owing to their excellent mechanical strength, light weight and moisture and chemical degradation resistance. At the same time, metallized polypropylene films have excellent barrier and prolongs product shelf life, along with a premium appearance which helps in brand differentiation.

This wider embrace of both film types is part of a larger trend in the industry to adopt more efficient, recyclable, high-performance packaging materials. Manufacturers are still working on continued innovation across these formats to improve on thermal resistance, printable surfaces, and sealing capabilities, and to also ensure compliance with global food safety and sustainability standards.

BOPP films are now the favoured option through the world of packaging operations for delivering a combination of mechanical strength, transparency and cost-effectiveness. These films are polyester films that are produced by the process of biaxial stretching, which aligns the polymer chains in the machine as well as transverse directions, resulting in enhanced tensile strength and dimensional stability. This is why BOPP films are widely used in conversion, printing, lamination and packaging, particularly in high-speed lines where the film behaviour must be accurately defined and not vary."

Food and beverage industry is the dominant end-use industry for BOPP films, as they are extensively used for packaging snacks, confectionery wrappers, and bakery product pouches owing to their high moisture resistance and excellent machinability. These films, which feature low sealing thresholds, enable faster throughput on packaging equipment without compromising product integrity.

(The Gloss and Clarity Offer the Best Shelf-appeal, helping the Marketing Goals with Vibrant Print Quality and More Visibility of the Product Inside) This is why brands use BOPP films for lightweight, high-volume packaging format designs that lower transportation costs as well as environmental cost but are still effective and durable.

BOPP films are also being adopted in the pharmaceutical and personal care industries for protective overwraps, label applications and tamper-evident use. The films used in these industries have to be puncture-, chemical degradation and environmental wear-resistant and BOPP fits the bill with ease.

BOPP is ideal therefore as regulations increasingly tighten around plastic usage and the adoption of sustainable materials. In response to industry requirements, as well as increased consumer awareness of the environment, manufacturers are now producing recyclable mono-material laminates based on BOPP film structures.

Apart from performance advantages, the cost-efficiency of BOPP films has been a dominant factor in establishing them as the material of choice in the developing world with packaging scalability being a determinant factor.

The utility can be extended to electronics and industrial use by adding anti-fog, anti-static, UV resistant additives into BOPP films that are further innovated by suppliers to make it an evergreen product across cold chain packaging. With the increasing global demand for cost-effective, flexible packaging solutions, BOPP films are at the heart of innovation and volume growth in the polypropylene films space.

BOPP films have firmed up its dominance in foodservice applications with high volumes such as snack bars, frozen foods and dairy, where freshness, durability and branding are important. This high-speed compatibility with form fill seal machinery allows processors to utilize the maximum efficiency during peak production cycles. The soft and low coefficient of friction surface of BOPP helps in roll handling and slitting accuracy in various converting operations.

The demand of high printability and die-cutting performance of BOPP films has been further propelling the growth of the labelling industry, especially in wrap-around labels for bottled water, carbonated beverages, and personal care items.

As demand increases for pressure-sensitive labels and peel-and-reseal closures, BOPP stays a very reasonable substrate that is firmly adhered but also remains impervious to humidity and temperature fluctuations. Using a comparable gauge and visual finish across all formats allows packaging designers to implement sophisticated branding solutions with minimal material wastage.

BOPP has also been adopted in emerging applications in electronics, textiles, and hygiene products where its insulating properties and structural consistency are desired. With the increasing innovations in flexible packaging by the manufacturers, BOPP films serve as an established basis for multilayer constructions and smart packaging integration. In an era where recyclability is a regulatory and a brand necessity, BOPP films will continue to be a go-to choice across all the primary and secondary packaging layers for their performance and their potential as circularity.

With enhanced barrier properties for oxygen, moisture and UV light, metallized polypropylene films have gained immense popularity as they can provide premium aesthetics with additional functionalities. These films are produced by depositing a fine layer of metal (usually aluminium) on BOPP or CPP base films, creating a process called vacuum metallization that protects and retains flexibility.

With its dual function of preserving freshness and presenting an attractive package, metallized films provide a versatile solution for manufacturers seeking to deliver more to consumers in just one substrate, especially as consumers continue to seek more freshness, safety and aesthetics from their packaged goods.

Metallized polypropylene films are particularly favoured by food and beverage manufacturers for packaging snacks, instant noodles, confectionery, and powdered beverages. These films prolong shelf life by restricting oxygen enter and moisture migration, whilst also providing reflective surfaces that improve branding and visibility.

Their shiny mirror-like finish accommodates high-impact packaging designs and increases product presence in crowded retail shelves. Metalized films deliver eye-catching colours and metallic effects designed for premium/impulsive-consuming marker segments in combination with rotogravure or flexo printing.

Metallized films also have applications beyond food and delivery chains, when consideration is given to any product ensuring its integrity, particularly for industries such as healthcare, agriculture and electronics requiring barrier protection. Protecting light-sensitive pharmaceuticals and diagnostic kits from UV degradation, these films also meet safety and sterility standards.

Metallized films find application in agricultural packaging to minimize seed moisture loss and chemical exposure and in electronics companies for anti-static and heat-resistance applications. These can easily be incorporated into pouch, sachet, and bag formats with no special equipment upgrades due to their lightweight structure and sealing compatibility.

To stay ahead of market and regulatory requirements, manufacturers have introduced metallized films with improved sealing layers, print receptive coatings, and recyclability characteristics. An example are metallized BOPP films, which features the strength of oriented polypropylene with high barrier protection, and can be used in mono-material or multilayer laminate structures. As sustainability has become the central focus in the industry, investment has designed solvent-free coatings, bio-based resins, and the use of down gauging to minimum environmental footprint without the quality loss.

Metallized polypropylene films have also been widely used in high-end confectionery packaging because aroma retention, moisture protection, and striking visuals are all important to consumer perceptions. Many chocolates, candies, and specialty treats use metallized wraps or pillow pouches to provide a high-end unboxing experience while still keeping their contents fresh. The tactile and visual sensations of touch metallized packaging and film, enhances the brand storytelling, making it an excellent option for seasonal or limited-edition products.

Additionally, the nutraceutical and wellness industry have taken on metallized films for powder supplements, herbal blends and rehydration solutions requiring superior barrier protection and tamper-proof packaging. These films are suitable for high-speed vertical and horizontal form-fill-seal processes and help manufacturers get functional products to their customers at scale. Resealable zippers and spouts are also consumer-friendly on-the-go features, while ensuring shelf-stable ingredients remain free from spoilage.

With demand for convenient, protective and glamorous packaging on the rise, metallized polypropylene films continue to be a robust design tool for both package designers and converters. Continuing to innovate around down gauging, renewable sourcing, and high-barrier performance will keep them relevant in the next-gen conversation of sustainable, flexible packaging solutions.

The polypropylene packaging films market constitutes a small segment of the overall global flexible packaging industry, which is invigorated by growing demand for lightweight, cost-efficient, and recyclable packaging materials, across food & beverage, pharmaceuticals, personal care and industrial products. Polypropylene (PP) films are widely used for lamination, labelling, pouches and overwraps, which require clarity, barrier properties, and heat resistance.

Makers are prioritizing BOPP innovations, mono-material sustainability, and digital print compatibility to tackle both consumer expectations and regulatory changes, as evidenced by the atmospheres at various booths. This market consists of global film manufacturers, suppliers of pack material and converters.

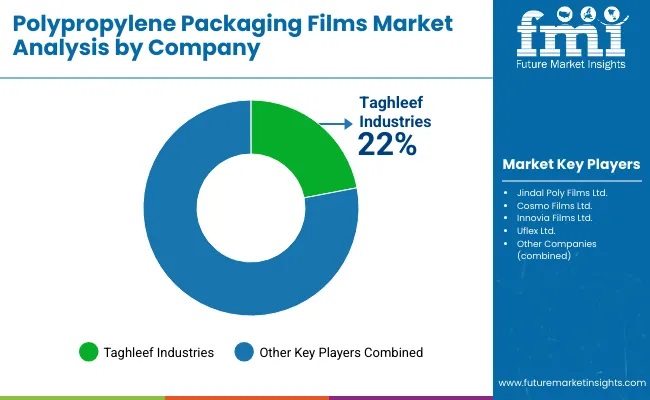

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Taghleef Industries | 18 - 22% |

| Jindal Poly Films Ltd. | 15 - 19% |

| Cosmo Films Ltd. | 12 - 16% |

| Innovia Films Ltd. | 8 - 12% |

| Uflex Ltd. | 5 - 9% |

| Other Companies (combined) | 30 - 40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Taghleef Industries | Produces BOPP and CPP films , offering metalized, coated, and barrier-enhanced films for flexible packaging and labelling applications |

| Jindal Poly Films Ltd. | Manufactures a wide range of PP packaging films , focusing on high-output production, lamination-grade materials, and recyclability |

| Cosmo Films Ltd. | Offers specialty polypropylene films including heat-sealable, synthetic paper, and transparent barrier films for premium applications |

| Innovia Films Ltd. | Develops clear and white BOPP films with anti-fog, peelable seal, and recyclable mono-material innovations |

| Uflex Ltd. | Produces multi-layered PP packaging films , emphasizing sustainability, high barrier protection, and compatibility with food-grade use |

Key Company Insights

Taghleef Industries

Taghleef leads the market with diverse polypropylene film offerings, delivering BOPP solutions for food packaging, labels, and wrap applications with enhanced performance features.

Jindal Poly Films Ltd.

Jindal Poly Films focuses on high-volume and cost-efficient production, supplying BOPP and CPP films for lamination, industrial wrap, and printed pouches.

Cosmo Films Ltd.

Cosmo specializes in functional and specialty PP films, integrating UV resistance, matte finish, and synthetic paper alternatives for premium brands.

Innovia Films Ltd.

Innovia is known for sustainable BOPP films, providing compostable and recyclable options with excellent printability and clarity for consumer packaging.

Uflex Ltd.

Uflex delivers multi-layer, high-barrier PP films, designed to meet food safety standards and durability needs in fast-moving consumer goods.

Other Key Players (30-40% Combined)

Several other companies contribute to the polypropylene packaging films market, focusing on biodegradable coatings, next-gen mono-materials, and advanced surface treatments:

The overall market size for the polypropylene packaging films market was USD 34,920.4 million in 2025.

The polypropylene packaging films market is expected to reach USD 57,974.4 million in 2035.

The increasing need for lightweight and durable packaging materials, rising demand in the food and consumer goods industries, and growing shift toward recyclable and cost-effective film solutions fuel the polypropylene packaging films market during the forecast period.

The top 5 countries driving the development of the polypropylene packaging films market are the USA, UK, European Union, Japan, and South Korea.

BOPP and metallized films lead market growth to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Thousand Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 6: Global Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 8: Global Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: Global Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Thousand Tons) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 18: North America Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 20: North America Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: North America Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: North America Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Thousand Tons) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 30: Latin America Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 32: Latin America Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Latin America Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Latin America Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Thousand Tons) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 42: Europe Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 44: Europe Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: Europe Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Europe Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Thousand Tons) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 54: Asia Pacific Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 56: Asia Pacific Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: Asia Pacific Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: Asia Pacific Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Thousand Tons) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: MEA Market Volume (Thousand Tons) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Film Format, 2018 to 2033

Table 66: MEA Market Volume (Thousand Tons) Forecast by Film Format, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Thickness, 2018 to 2033

Table 68: MEA Market Volume (Thousand Tons) Forecast by Thickness, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: MEA Market Volume (Thousand Tons) Forecast by Application, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 72: MEA Market Volume (Thousand Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Thousand Tons) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 16: Global Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 20: Global Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 24: Global Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 28: Global Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Film Format, 2023 to 2033

Figure 33: Global Market Attractiveness by Thickness, 2023 to 2033

Figure 34: Global Market Attractiveness by Application, 2023 to 2033

Figure 35: Global Market Attractiveness by End Use, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Thousand Tons) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 52: North America Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 56: North America Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 60: North America Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 64: North America Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Film Format, 2023 to 2033

Figure 69: North America Market Attractiveness by Thickness, 2023 to 2033

Figure 70: North America Market Attractiveness by Application, 2023 to 2033

Figure 71: North America Market Attractiveness by End Use, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Thousand Tons) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 88: Latin America Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 92: Latin America Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 96: Latin America Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 100: Latin America Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Film Format, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Thickness, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 107: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Thousand Tons) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 124: Europe Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 128: Europe Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 132: Europe Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 136: Europe Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Film Format, 2023 to 2033

Figure 141: Europe Market Attractiveness by Thickness, 2023 to 2033

Figure 142: Europe Market Attractiveness by Application, 2023 to 2033

Figure 143: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Thousand Tons) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Film Format, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Thickness, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Film Format, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Thickness, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Thousand Tons) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: MEA Market Volume (Thousand Tons) Analysis by Product Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Film Format, 2018 to 2033

Figure 196: MEA Market Volume (Thousand Tons) Analysis by Film Format, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Film Format, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Film Format, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Thickness, 2018 to 2033

Figure 200: MEA Market Volume (Thousand Tons) Analysis by Thickness, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Thickness, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Thickness, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 204: MEA Market Volume (Thousand Tons) Analysis by Application, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 208: MEA Market Volume (Thousand Tons) Analysis by End Use, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Film Format, 2023 to 2033

Figure 213: MEA Market Attractiveness by Thickness, 2023 to 2033

Figure 214: MEA Market Attractiveness by Application, 2023 to 2033

Figure 215: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Packaging Films Suppliers

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

MOPP Packaging Films Market Insights - Growth & Forecast 2025 to 2035

Meat Packaging Films Market

BOPET Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Polypropylene Corrugated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Medical Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Hygiene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Antifog Packaging Films Market Trends – Growth & Forecast 2025-2035

Foamed Polypropylene Films Market Growth - Demand & Forecast 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Static-Free Packaging Films Market Growth - Demand & Forecast 2025 to 2035

High Barrier Packaging Films for Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

High Barrier Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of High Barrier Packaging Films for Pharmaceuticals

Market Share Breakdown of High Barrier Packaging Films Suppliers

Blown Stretch Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA