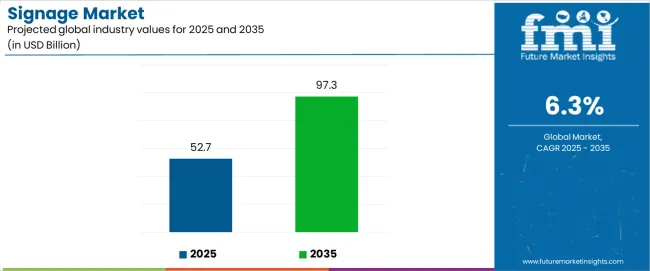

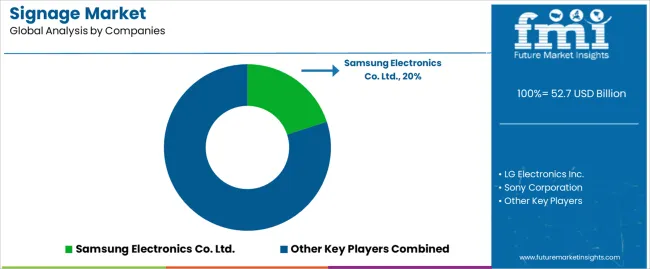

The global signage market is valued at USD 52.7 billion in 2025 and is set to reach USD 97.3 billion by 2035, recording an absolute increase of USD 44.6 billion over the forecast period. This translates into a total growth of 84.6%, with the market forecast to expand at a CAGR of 6.3% between 2025 and 2035. The market size is expected to grow by approximately 1.8X during the same period, supported by increasing urbanization, growing demand for digital advertising solutions, rising adoption of interactive display technologies, and expanding commercial infrastructure across retail, transportation, healthcare, and corporate sectors.

Between 2025 and 2030, the signage market is projected to expand from USD 52.7 billion to USD 70.8 billion, resulting in a value increase of USD 18.1 billion, which represents 40.6% of the total forecast growth for the decade. This phase of development will be shaped by increasing adoption of LED display technologies, rising demand for outdoor advertising solutions, and growing integration of smart city initiatives across municipal infrastructure and commercial real estate developments.

Between 2030 and 2035, the market is forecast to grow from USD 70.8 billion to USD 97.3 billion, adding another USD 26.5 billion, which constitutes 59.4% of the ten-year expansion. This period is expected to be characterized by the advancement of OLED display technologies, the integration of artificial intelligence for content management, and the development of interactive touchscreen solutions across diverse application categories. The growing emphasis on omnichannel customer experience and data-driven advertising will drive demand for advanced signage systems with enhanced connectivity features, improved visual quality, and superior analytics capabilities.

| Metric | Value |

|---|---|

| Estimated Market Value (2025E) | USD 52.7 Billion |

| Forecast Market Value (2035F) | USD 97.3 Billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The advertising and marketing market is one of the largest contributors, accounting for around 25-30%. Signage plays a critical role in branding, advertising, and customer engagement across retail, commercial, and public sectors. As businesses and organizations seek innovative ways to communicate, the demand for digital and interactive signage is increasing. The construction and real estate market also plays a significant role, with a 20-25% contribution. As infrastructure development, including commercial buildings, residential complexes, and retail spaces, expands, the need for exterior and directional signage grows, particularly in urban areas and large commercial developments.

The automotive market accounts for roughly 10-12% of the signage market, as vehicles are increasingly equipped with digital signage and display panels, both for navigation and infotainment purposes. The tourism and hospitality market contributes about 8-10%, with signage being a key element in airports, hotels, and tourist destinations for directional, informational, and branding purposes. The digital signage market, a subsegment of the broader signage industry, contributes approximately 15-18%. As technology advances, digital signage is increasingly replacing traditional forms, offering dynamic and real-time content that can be easily updated for advertising, information, and public service announcements.

Market expansion is being supported by the increasing global demand for dynamic advertising solutions and the corresponding shift toward digital communication formats that can provide superior content flexibility while meeting user requirements for real-time updates and interactive engagement processes. Modern businesses are increasingly focused on incorporating signage systems that can enhance customer experience while satisfying demands for consistent, reliable visual communication and optimized advertising effectiveness. Signage systems' proven ability to deliver targeted messaging, improved brand recall, and diverse content possibilities makes them essential marketing components for retail chains and quality-conscious advertisers.

The growing emphasis on smart city development and digital transformation is driving demand for high-performance signage systems that can support information dissemination and comprehensive wayfinding benefits across transportation hubs, public buildings, and urban infrastructure categories. User preference for visual communication that combines informational excellence with aesthetic appeal is creating opportunities for innovative implementations in both traditional and emerging architectural applications. The rising influence of data analytics and programmatic advertising is also contributing to increased adoption of digital signage that can provide audience measurement and real-time content optimization characteristics.

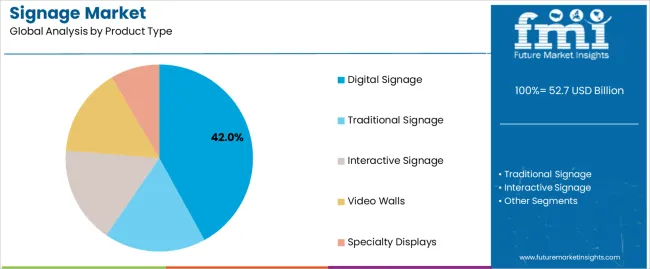

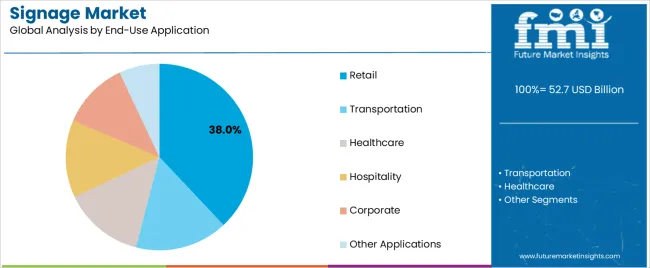

The market is segmented by product type, technology, display size, end-use application, and region. By product type, the market is divided into digital signage, traditional signage, interactive signage, video walls, and specialty displays. Based on technology, the market is categorized into LED, LCD, OLED, projection, and other technologies. By display size, the market includes small (below 32 inches), medium (32-55 inches), large (55-75 inches), and extra-large (above 75 inches). By end-use application, the market encompasses retail, transportation, healthcare, hospitality, corporate, and other applications. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

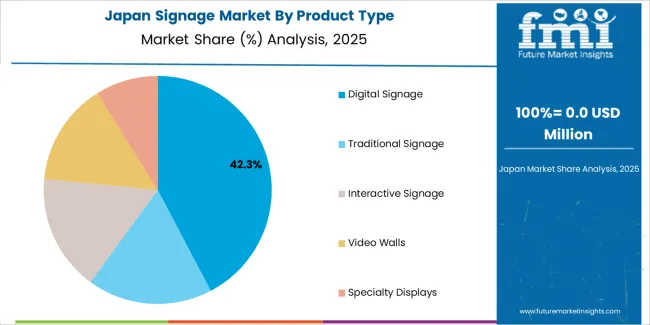

The digital signage segment is projected to account for 42% of the signage market in 2025, reaffirming its position as the leading product category. Businesses and advertising agencies increasingly utilize digital signage for their superior content management characteristics, established versatility, and essential functionality in diverse commercial applications across multiple industry verticals. Digital signage's dynamic content capabilities and proven reliability directly address user requirements for flexible messaging and optimal advertising value in commercial environments.

This product segment forms the foundation of modern visual communication patterns, as it represents the format with the greatest commercial adaptability and established compatibility across multiple content types. Business investments in display technology refinement and content management standardization continue to strengthen adoption among performance-conscious marketers. With users prioritizing real-time updates and audience engagement, digital signage aligns with both functional objectives and aesthetic requirements, making them the central component of comprehensive advertising strategies.

Retail is projected to represent 38% of the signage market in 2025, underscoring its critical role as the primary application for quality-focused businesses seeking superior customer engagement benefits and enhanced shopping experience credentials. Commercial users and retail brands prefer signage applications for their established effectiveness in driving sales, proven customer attraction capabilities, and ability to maintain exceptional visual impact while supporting diverse promotional offerings during various shopping experiences. Positioned as essential applications for customer-focused retailers, retail signage provides both marketing excellence and operational advantages.

The segment is supported by continuous improvement in interactive technology and the widespread availability of customization options that enable brand distinction and promotional flexibility at the point of sale. Retail companies are optimizing signage designs to support customer navigation and accessible information strategies. As display technology continues to advance and consumers seek engaging shopping formats, retail applications will continue to drive market growth while supporting customer acquisition and brand loyalty strategies.

The signage market is advancing rapidly due to increasing urbanization and growing need for visual communication mechanisms that emphasize superior information delivery outcomes across commercial segments and public infrastructure applications. The market faces challenges, including complexity in content management, compatibility issues with legacy systems, and cost pressures affecting large-scale deployment adoption. Innovation in AI-powered content systems and IoT-enabled signage technologies continues to influence market development and expansion patterns.

The growing adoption of signage systems in smart city projects is enabling municipalities to develop communication networks that provide distinctive information delivery benefits while commanding citizen engagement and enhanced urban functionality. Smart city applications provide superior connectivity properties while allowing more sophisticated data integration features across various municipal categories. Users are increasingly recognizing the functional advantages of intelligent signage positioning for efficient information dissemination and technology-conscious urban planning integration.

Modern signage manufacturers are incorporating advanced artificial intelligence, audience analytics systems, and automated content optimization to enhance targeting effectiveness, improve engagement metrics, and meet commercial demands for measurable advertising results. These systems improve campaign effectiveness while enabling new applications, including real-time content personalization and automated scheduling solutions. Advanced AI integration also allows advertisers to support data-driven positioning and performance optimization objectives beyond traditional display operations.

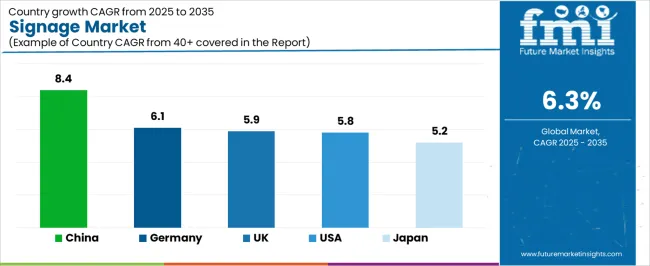

| Country | CAGR (2025–2035) |

|---|---|

| USA | 5.8% |

| Germany | 6.1% |

| UK | 5.9% |

| China | 8.4% |

| Japan | 5.2% |

The signage market is experiencing robust growth globally, with China leading at an 8.4% CAGR through 2035, driven by the expanding urban infrastructure, growing retail sector, and increasing adoption of smart city technologies. The USA follows at 5.8%, supported by rising digital advertising spend, expanding commercial construction, and growing acceptance of interactive display solutions. Germany shows growth at 6.1%, emphasizing established manufacturing capabilities and comprehensive display innovation. The UK records 5.9%, focusing on retail modernization and transportation infrastructure upgrades. Japan demonstrates 5.2% growth, prioritizing quality display solutions and technological precision.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

Revenue from signage consumption and sales in the USA is projected to exhibit exceptional growth with a CAGR of 5.8% through 2035, driven by the country's rapidly expanding digital advertising sector, favorable business attitudes toward interactive marketing, and initiatives promoting innovative display technologies across major metropolitan regions. The USA's position as a leading advertising market and increasing focus on omnichannel customer experience are creating substantial demand for high-quality signage systems in both commercial and institutional markets. Major retailers and corporate brands are establishing comprehensive display capabilities to serve growing demand and emerging market opportunities.

Demand for signage products in Germany is expanding at a CAGR of 6.1%, supported by rising manufacturing sophistication, growing automotive sector requirements, and expanding industrial infrastructure. The country's developing technical capabilities and increasing commercial investment in display engineering are driving demand for signage systems across both imported and domestically produced applications. International display companies and domestic manufacturers are establishing comprehensive operational networks to address growing market demand for quality signage systems and efficient visual communication solutions.

Revenue from signage products in the UK is projected to grow at a CAGR of 5.9% through 2035, supported by the country's mature retail market, established commercial culture, and leadership in advertising creativity. Britain's sophisticated consumer base and strong support for innovative marketing are creating steady demand for both traditional and digital signage varieties. Leading retail chains and specialty brands are establishing comprehensive visual strategies to serve both domestic markets and growing international opportunities.

Demand for signage products in China is anticipated to expand at a CAGR of 8.4% through 2035, driven by the country's emphasis on urban development, manufacturing leadership, and sophisticated production capabilities for displays requiring specialized precision varieties. Chinese manufacturers and commercial developers consistently seek commercial-grade signage that enhances urban functionality and supports infrastructure operations for both traditional and innovative city applications. The country's position as an Asian manufacturing leader continues to drive innovation in specialty signage applications and commercial production standards.

Revenue from signage products in Japan is projected to grow at a CAGR of 5.2% through 2035, supported by the country's emphasis on quality manufacturing, display precision, and advanced technology integration requiring efficient visual communication solutions. Japanese businesses and commercial developers prioritize system reliability and manufacturing precision, making signage essential infrastructure for both traditional and modern urban applications. The country's comprehensive quality excellence and advancing display patterns support continued market expansion.

The Europe signage market is projected to grow from USD 16.8 billion in 2025 to USD 31.2 billion by 2035, recording a CAGR of 6.4% over the forecast period. Germany leads the region with a 32.0% share in 2025, moderating slightly to 31.5% by 2035, supported by its strong industrial base and demand for premium, technically advanced display products. The United Kingdom follows with 24.0% in 2025, easing to 23.5% by 2035, driven by a sophisticated retail market and emphasis on advertising innovation and creative excellence. France accounts for 18.5% in 2025, rising to 19.0% by 2035, reflecting steady adoption of digital advertising solutions and commercial innovation. Italy holds 13.0% in 2025, expanding to 13.5% by 2035 as retail modernization and specialty display applications grow. Spain contributes 8.0% in 2025, growing to 8.5% by 2035, supported by expanding tourism sector and commercial development. The Nordic countries rise from 2.5% in 2025 to 2.7% by 2035 on the back of strong technology adoption and advanced display systems. BENELUX declines from 2.0% in 2025 to 1.3% by 2035, reflecting market maturity and regional consolidation.

The signage market is characterized by competition among established display manufacturers, specialized signage producers, and integrated visual communication companies. Companies are investing in advanced display technologies, smart content management systems, product innovation capabilities, and comprehensive installation networks to deliver consistent, high-quality, and reliable signage solutions. Innovation in LED technology, interactive displays, and application-specific product development is central to strengthening market position and customer satisfaction.

Samsung Electronics Co. Ltd. leads the market with 20% share with a strong focus on display innovation and comprehensive signage solutions, offering commercial display systems with emphasis on visual excellence and technological heritage. LG Electronics Inc. provides specialized display capabilities with a focus on global market applications and OLED technology networks. Sony Corporation delivers integrated visual solutions with a focus on professional positioning and operational efficiency. NEC Corporation specializes in comprehensive commercial displays with an emphasis on corporate applications. Sharp Corporation focuses on comprehensive retail and commercial signage with advanced technology and premium positioning capabilities.

The success of signage systems in meeting commercial communication demands, customer-driven engagement requirements, and technology integration will not only enhance visual communication outcomes but also strengthen global display manufacturing capabilities. It will consolidate emerging regions' positions as hubs for efficient display production and align advanced economies with commercial signage systems. This calls for a concerted effort by all stakeholders -- governments, industry bodies, manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How Distributors and Commercial Industry Players Could Strengthen the Ecosystem?

How Manufacturers Could Navigate the Shift?

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 52.7 billion |

| Product Type | Digital Signage; Traditional Signage; Interactive Signage; Video Walls; Specialty Displays |

| Technology | LED; LCD; OLED; Projection; Other Technologies |

| Display Size | Small (below 32 inches); Medium (32-55 inches); Large (55-75 inches); Extra-large (above 75 inches) |

| End-Use | Retail; Transportation; Healthcare; Hospitality; Corporate; Other Applications |

| Regions | North America; Europe; Asia Pacific; Latin America; Middle East & Africa; Other Regions |

| Key Countries | United States; Germany; United Kingdom; China; Japan; and 40+ additional countries |

| Key Companies | Samsung Electronics Co. Ltd.; LG Electronics Inc.; Sony Corporation; NEC Corporation (profiled); Sharp Corporation; Other leading signage companies |

| Additional Attributes | Dollar sales by product type, technology, display size & end-use; Regional demand trends; Competitive landscape; Technological advancements in display engineering; LED technology integration initiatives; Interactive display programs; Premium product development strategies |

The global signage market is estimated to be valued at USD 52.7 billion in 2025.

The market size for the signage market is projected to reach USD 97.3 billion by 2035.

The signage market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in signage market are digital signage , traditional signage, interactive signage, video walls and specialty displays.

In terms of end-use application, retail segment to command 38.0% share in the signage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in the Signage Industry

Soft Signage Market Insights – Growth & Trends Forecast 2025 to 2035

Retail Signage Market

Digital Signage System Market Analysis by Technology, Software, Application, Type, and Region through 2035

Out-door Signage Market Growth – Demand & Forecast 2025 to 2035

In store signage Market

Out Store Signage Market

ESD Protective Signage Labels Market Size and Share Forecast Outlook 2025 to 2035

Retail Digital Signage Market

In-Taxi Digital Signage Market Size and Share Forecast Outlook 2025 to 2035

Transparent Digital Signage Market Analysis by Type, End Users and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA