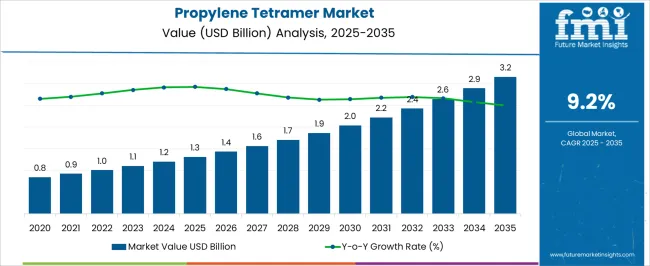

The Propylene Tetramer Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 9.2% over the forecast period.

| Metric | Value |

|---|---|

| Propylene Tetramer Market Estimated Value in (2025 E) | USD 1.3 billion |

| Propylene Tetramer Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The Propylene Tetramer market is experiencing steady growth, driven by its increasing use in the production of high-performance oil and fuel additives and other industrial applications. The demand for improved fuel efficiency, reduced emissions, and enhanced lubrication performance is supporting adoption in the automotive, petrochemical, and industrial sectors. Propylene tetramer is valued for its ability to modify base oils, improve viscosity indices, and maintain thermal stability under extreme conditions, which has positioned it as a critical component in advanced lubricant formulations.

Advancements in polymerization technologies and process optimization have increased production efficiency while ensuring consistent product quality. Regulatory pressure to meet environmental standards and emission reduction targets is further accelerating market adoption.

Industrial growth in emerging economies, coupled with increased consumption of high-performance fuels, is contributing to expanding demand As manufacturers prioritize energy efficiency and sustainability, the Propylene Tetramer market is expected to continue growing, with ongoing research and development enabling improvements in additive performance, cost-effectiveness, and integration across diverse applications.

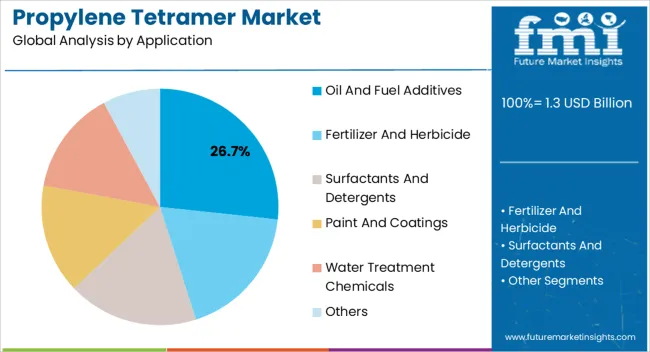

The propylene tetramer market is segmented by application, and geographic regions. By application, propylene tetramer market is divided into Oil And Fuel Additives, Fertilizer And Herbicide, Surfactants And Detergents, Paint And Coatings, Water Treatment Chemicals, and Others. Regionally, the propylene tetramer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil and fuel additives application segment is projected to hold 26.7% of the market revenue in 2025, making it the leading application area. Growth in this segment is being driven by the increasing need for fuel and lubricant formulations that enhance engine performance, reduce wear and tear, and improve operational efficiency. Propylene tetramer provides superior thickening, viscosity modification, and thermal stability, which are critical for meeting stringent fuel efficiency and emission standards in automotive and industrial engines.

The adoption of high-performance fuels and lubricants in emerging and developed markets is further supporting segment growth. Advancements in additive blending technologies and compatibility with diverse base oils have strengthened reliability and operational benefits.

Regulatory pressure to meet environmental standards has also accelerated the demand for efficient oil and fuel additives As organizations continue to focus on energy conservation, performance enhancement, and sustainability, the oil and fuel additives application is expected to remain the primary driver of growth in the Propylene Tetramer market, supported by continuous innovation and industrial adoption.

Propylene Tetramer with CAS 6842-15-5 is an oligomer with a quaternary structure of four propylene units. Formed synthetically by the polymerization of propylene with phosphoric acid catalyst, propylene tetramer is a colourless clear liquid with mild pleasant odour.

Propylene tetramer is an important chemical critical for the production of various downstream chemicals. Propylene tetramer is employed as an intermediate for synthesis of a wide range of chemicals such as lube oil additives, polymerization agents, surfactants, agricultural chemicals, coatings as corrosion inhibitors due to its unsaturated double bond and high branching.

Due to its versatile polymeric functionality, propylene tetramer is soluble in most organic diluters and solvents such as acetone, ethanol and ethyl ether. One of the important applications of propylene tetramers is for the manufacture of dodecyl phenol or dodecene, by the alkylation of phenol using propylene tetramer, which is primarily used as used in the production of additives for engine fuels and lubricant oils.

Propylene tetramer is used for alkylation of benzene to make branched chain dodecylbenzene that is subsequently sulfonated to provide a non-biodegradable surfactant.

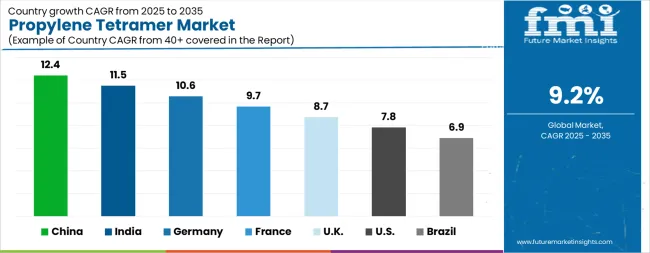

| Country | CAGR |

|---|---|

| China | 12.4% |

| India | 11.5% |

| Germany | 10.6% |

| France | 9.7% |

| UK | 8.7% |

| USA | 7.8% |

| Brazil | 6.9% |

The Propylene Tetramer Market is expected to register a CAGR of 9.2% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.4%, followed by India at 11.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.9%, yet still underscores a broadly positive trajectory for the global Propylene Tetramer Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.6%. The USA Propylene Tetramer Market is estimated to be valued at USD 489.6 million in 2025 and is anticipated to reach a valuation of USD 1.0 billion by 2035. Sales are projected to rise at a CAGR of 7.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 65.9 million and USD 41.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Application | Oil And Fuel Additives, Fertilizer And Herbicide, Surfactants And Detergents, Paint And Coatings, Water Treatment Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

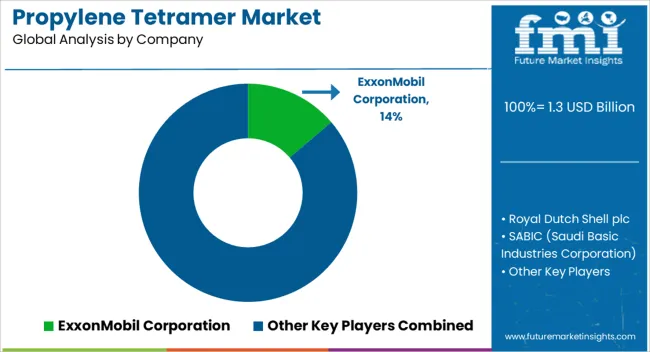

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ExxonMobil Corporation, Royal Dutch Shell plc, SABIC (Saudi Basic Industries Corporation), Dow Chemical Company, LyondellBasell Industries N.V., INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, BASF SE, China Petroleum & Chemical Corporation (Sinopec), LG Chem Ltd., Mitsui Chemicals, Inc., Sumitomo Chemical Co., Ltd., Reliance Industries Limited, and Formosa Plastics Corporation |

The global propylene tetramer market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the propylene tetramer market is projected to reach USD 3.2 billion by 2035.

The propylene tetramer market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in propylene tetramer market are oil and fuel additives, fertilizer and herbicide, surfactants and detergents, paint and coatings, water treatment chemicals and others.

In terms of , segment to command 0.0% share in the propylene tetramer market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA