The ethylene carbonate market is experiencing robust growth driven by expanding applications in energy storage, chemical synthesis, and industrial processing. Increasing adoption of lithium-ion batteries across electric vehicles and consumer electronics is significantly contributing to demand growth. Market dynamics are characterized by rising investments in battery manufacturing and strong focus on electrolyte formulation improvements.

The compound’s excellent solvency, high dielectric constant, and chemical stability are key factors supporting its widespread industrial use. Global sustainability goals and the transition toward electric mobility are creating consistent opportunities for producers. The future outlook remains positive as capacity expansions and advancements in purification technologies enhance supply reliability.

Growth rationale is centered on the compound’s strategic role in the battery value chain, its critical function in performance optimization, and its versatility in coatings, lubricants, and plastics manufacturing These factors collectively position ethylene carbonate as a vital material enabling both technological progress and sustainable industrial development.

| Metric | Value |

|---|---|

| Ethylene Carbonate Market Estimated Value in (2025 E) | USD 339.5 billion |

| Ethylene Carbonate Market Forecast Value in (2035 F) | USD 553.0 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

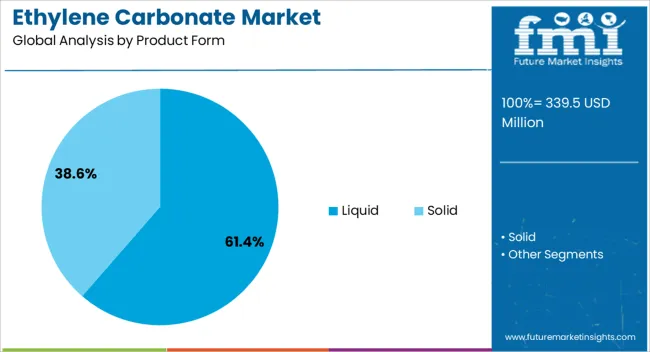

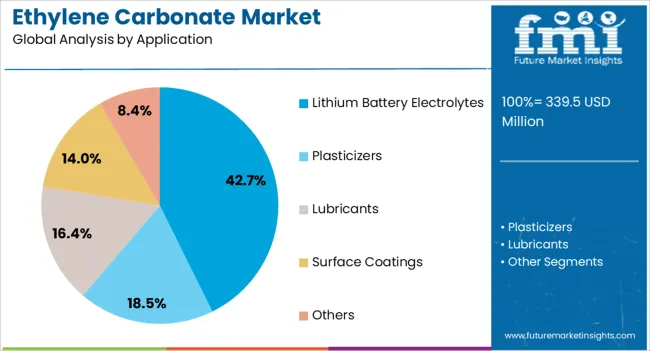

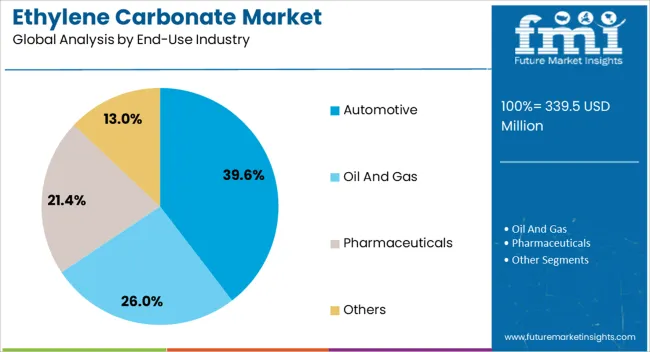

The market is segmented by Product Form, Application, and End-Use Industry and region. By Product Form, the market is divided into Liquid and Solid. In terms of Application, the market is classified into Lithium Battery Electrolytes, Plasticizers, Lubricants, Surface Coatings, and Others. Based on End-Use Industry, the market is segmented into Automotive, Oil And Gas, Pharmaceuticals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The liquid segment, representing 61.4% of the product form category, has been leading due to its superior compatibility with industrial processes and ease of integration into electrolyte formulations. Its high purity, solubility, and consistency have made it the preferred choice across manufacturing applications.

Demand stability is reinforced by large-scale adoption in lithium-ion battery electrolytes, where liquid ethylene carbonate ensures optimal conductivity and performance. Producers are focusing on refining techniques to enhance purity levels and control moisture content, thereby improving end-use efficiency.

The segment’s growth is also supported by expanding applications in lubricant formulations and polymer processing As global energy storage and e-mobility industries continue to expand, the liquid form is expected to maintain its dominant market position, driven by operational flexibility, supply chain maturity, and proven performance advantages.

The lithium battery electrolytes segment, accounting for 42.7% of the application category, dominates the market owing to rising adoption of electric vehicles and portable electronic devices. Ethylene carbonate serves as a critical solvent that enhances ionic conductivity and thermal stability within electrolytes, ensuring improved battery performance and safety.

Increased investments in gigafactories and advanced cell technologies are further fueling demand. The segment’s growth is underpinned by consistent research focused on optimizing electrolyte compositions for higher energy density and longevity.

Supply-side integration between raw material producers and battery manufacturers has enhanced security of supply and cost control As global electrification accelerates, this application is expected to remain a primary driver of ethylene carbonate consumption across key markets.

The automotive segment, holding 39.6% of the end-use industry category, has emerged as the leading consumer of ethylene carbonate due to its extensive use in electric vehicle battery manufacturing. The rapid shift toward sustainable mobility solutions and stringent emission regulations have intensified demand for high-performance battery materials.

Automakers and component suppliers are increasingly integrating ethylene carbonate-based electrolytes to achieve superior battery efficiency and thermal stability. The segment’s dominance is reinforced by ongoing EV production capacity expansions, favorable government policies, and growth in charging infrastructure.

Continuous innovation in battery chemistry, coupled with long-term supply agreements between automakers and chemical producers, is expected to sustain the automotive sector’s leading position and drive steady consumption of ethylene carbonate over the forecast period.

Increasing Demand for Electric Vehicles Worldwide to Augment Growth

Demand for ethylene carbonate is high in lithium-ion batteries, a prevalent choice in portable electronic devices and electric vehicles. With the rise in EVs and renewable energy solutions, demand for lithium-ion batteries is projected to rise.

Rising environmental concerns and regulations have LED to a surging focus on green production processes. This, in turn, is set to fuel research into sustainable manufacturing methods such as renewable feedstock and catalytic processes.

High Demand for Consumer Electronics to Push Sales by 2035

Ethylene carbonate is a key raw material in polycarbonates and plasticizers, used in industries such as automotive, construction, and electronics. Growth of these sectors is increasing demand for carbonate. Research is underway to discover new applications in pharmaceuticals, cosmetics, and chemical reactions, aiming to diversify the market and promote growth.

Thriving Chemical Industry to Create Opportunities for Manufacturers

Regional factors such as government policies, economic conditions, and industrial development are set to influence the market. Countries with strong battery manufacturing or chemical industries are anticipated to fuel demand.

However, supply chain disruptions such as raw material shortages and transportation constraints are set to disrupt the landscape, making effective management vital for stable supply and meeting demand.

Fluctuations in Raw Material Prices to Hamper Growth

Ethylene carbonate prices are set to fluctuate due to raw material prices and demand-supply dynamics, making it difficult for manufacturers to manage costs effectively. Additionally, ethylene carbonate faces competition from substitutes, which offer low costs, better performance, and environmental benefits, thereby posing a challenge.

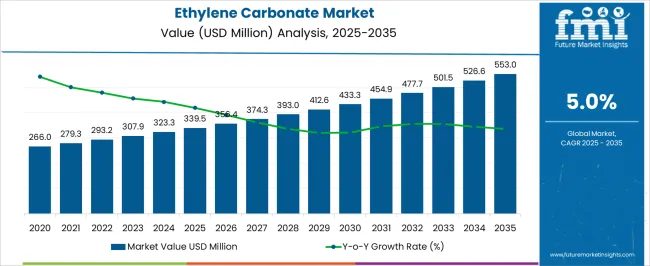

The ethylene carbonate sector grew at a CAGR of 4.6% from 2020 and 2025. The market reached USD 339.5 million in 2025. Ethylene carbonate, first synthesized between 2020 and 2025, was used as a solvent and electrolyte in niche applications like lithium-ion batteries and specialty polymers.

The sector has seen a surge in lithium-ion battery applications due to the rise in consumer electronics and the shift towards electric vehicles. Growth of the chemical industry, particularly in Asia Pacific, has contributed to the development of the business.

Ethylene carbonate serves as a precursor for various chemicals, including polycarbonates and plasticizers, with diverse industrial applications. The market has been influenced by environmental regulations and progressions in production technologies, aiming to reduce emissions, improve energy efficiency, and promote sustainable practices.

Research and development efforts aim to improve production efficiency, discover alternative feedstock, and find new uses in industries like pharmaceuticals and cosmetics, boosting growth. Over the forecast period, the sector is poised to exhibit healthy growth, reaching USD 553 million by 2035.

The industry has been shaped by globalization and international trade, with trade agreements, tariff policies, and supply chain dynamics influencing dynamics and competitiveness. Emerging economies have surged demand for ethylene carbonate due to rapid industrialization and infrastructure development in China and India, creating opportunities for growth.

The following table shows the estimated growth rates of the leading markets. The United States is anticipated to remain at the forefront in North America, with a CAGR of 2.8% through 2035. In South Asia and Pacific, India is projected to witness a CAGR of 7.5% by 2035, followed by China at 5.7% in East Asia.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.8% |

| Germany | 2.4% |

| China | 5.7% |

| India | 7.5% |

| Japan | 2.1% |

Over the assessment period, demand in the United States is set to rise at 2.8% CAGR. Increasing electric vehicle adoption and renewable energy infrastructure growth are set to spur demand for ethylene carbonate.

Regulatory policies in the United States, including environmental regulations and safety standards, influence the production, sale, and usage of carbonate.

Compliance with these regulations, such as the Toxic Substances Control Act (TSCA) administered by the Environmental Protection Agency (EPA), is essential for manufacturers and consumers in the country.

Trade relations with key carbonate-producing countries, such as China and Japan, also influence the availability and pricing of carbonate in the United States. The country's position in producing lithium-ion battery electrolytes and EV lithium-ion batteries is projected to fuel growth.

The United Kingdom is actively involved in research and development activities to advance ethylene-related technologies and applications. Academic institutions, research organizations, and private companies are exploring new production methods, improving product performance, and discovering new applications.

The sector is influenced by price fluctuations, supply chain disruptions, and competition from suppliers, as well as changes in raw material prices and consumer preferences. The automotive industry in the United Kingdom, fueled by the growing demand for electric vehicles (EVs), has LED to a surge in ethylene carbonate consumption.

The country is a leading manufacturer of EVs and lithium-ion batteries, boosting demand. The electronics industry in the United Kingdom is also growing with the adoption of consumer electronics and technological developments. This carbonate is widely used in electronic components like capacitors and printed circuit boards, causing a surge in consumption.

Over the forecast period, demand in China is set to increase at a steady CAGR of 5.7%. Growing focus on environmental sustainability and circular economy principles are set to prompt the adoption of green production methods and eco-friendly alternatives to carbonate.

Leading companies in the country are exploring ways to minimize environmental impact and improve sustainability practices, fueling demand.

The section below analyzes the leading segment of the market. In terms of the end-use industry, the automotive segment is estimated to account for a share of 35.4% in 2025. Based on product form, the solid segment is anticipated to hold a share of 55.2% in 2025.

| Segment | Automotive (End-use Industry) |

|---|---|

| Value Share (2025) | 35.4% |

Growing demand for electric vehicles worldwide is set to surge sales of ethylene carbonate. The carbonate is a vital component in the electrolyte of lithium-ion batteries, the primary energy storage systems used in electric vehicles (EVs) and hybrid vehicles.

This enhances battery performance by improving conductivity, leading to better efficiency, faster charging times, and increased energy density.

Ethylene carbonate extends the driving range of EVs by improving energy density and efficiency, enabling longer distances on a single charge. This reduces environmental impact by allowing the widespread adoption of electric vehicles, mitigating air pollution, and combating climate change.

| Segment | Solid (Product Form) |

|---|---|

| Value Share (2025) | 55.2% |

By 2035, demand for the solid ethylene carbonate segment is anticipated to surge significantly. Solid-state electrolytes, such as carbonate-based polymers, are increasingly being researched in the battery industry for the potential to improve safety, energy density, and cycle life.

Solid polymers can be used as matrix materials in composite materials, enhancing properties like mechanical strength, thermal stability, and chemical resistance. These can also be used as solid derivatives for specialized applications, such as phase change materials or intermediate chemicals in industries like electronics, construction, and textiles.

Progressions in solid-state synthesis techniques, including mechanochemical, microwave-assisted, and solvent-free synthesis, are set to enhance product quality, process efficiency, and sustainability. Furthermore, solid forms of carbonate play a key role in circular economy initiatives, promoting resource efficiency and sustainability through recycling or upcycling.

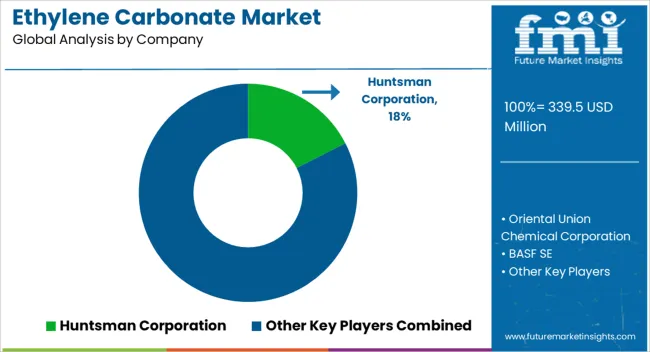

Oriental Union Chemical Corporation, Huntsman Corporation, BASF SE, Mitsubishi Chemical Corporation, and Toagosei Co., Ltd. are the key ethylene carbonate manufacturers in the industry. Ethylene carbonate is in high demand across various industries, including oil and gas and automotive.

Leading companies are investing in product facility growth and mergers to improve global presence. Continuous research and development activities, product innovations, strategic collaborations, and development efforts characterize the sector.

Huntsman Corporation is enhancing the Texas facility's production capacity of Ultrapure Ethylene Carbonate, which is projected to be completed by 2025. This is vital for the optimal performance and long-lasting durability of lithium-ion batteries in electric vehicles and electronic devices.

Leading manufacturers are investing in innovation and product development to discover increased applications of ethylene dichloride. The main focus is on safety, quality, and customer satisfaction to attract a large customer base.

Industry Updates

As per product form, the industry has been categorized into solid and liquid.

Based on applications, the sector is segmented into lithium battery electrolytes, plasticizers, lubricants, surface coatings, and others.

The industry is categorized into oil and gas, automotive, pharmaceuticals, and others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The global ethylene carbonate market is estimated to be valued at USD 339.5 billion in 2025.

The market size for the ethylene carbonate market is projected to reach USD 553.0 billion by 2035.

The ethylene carbonate market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in ethylene carbonate market are liquid and solid.

In terms of application, lithium battery electrolytes segment to command 42.7% share in the ethylene carbonate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoroethylene Carbonate (FEC) Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Glycol Market Forecast and Outlook 2025 to 2035

Ethylene Tetrafluoroethylene (ETFE) Market Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Ethylene-vinyl Alcohol Copolymer (EVOH) Market Size and Share Forecast Outlook 2025 to 2035

Ethyleneamines Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Ethylene Dichloride Market Growth – Trends & Forecast 2025 to 2035

Ethylene Amines Market Growth - Trends & Forecast 2024 to 2034

Carbonate Mineral Market Growth – Trends & Forecast 2024-2034

Methylene Diphenyl Di-isocyanate Market

Diethylenetriamine (DETA) Market

Triethylenediamine Market Growth - Trends & Forecast 2025 to 2035

Polycarbonate Junction Box Market Forecast and Outlook 2025 to 2035

Polyethylene Terephthalate Catalyst Size and Share Forecast Outlook 2025 to 2035

Polyethylene (PE) Thermoform Packaging Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Composites Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Naphthalate (PEN) Market Size and Share Forecast Outlook 2025 to 2035

Polyethylene Films Market Size and Share Forecast Outlook 2025 to 2035

Polycarbonate Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA