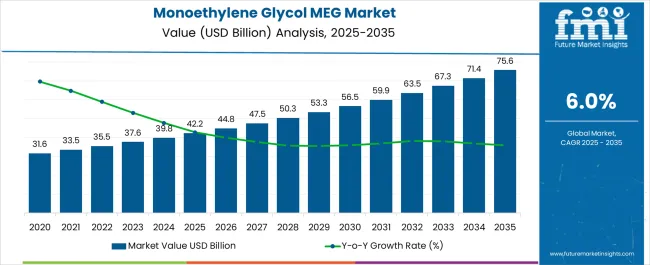

The Monoethylene Glycol MEG Market is estimated to be valued at USD 42.2 billion in 2025 and is projected to reach USD 75.6 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. Inflection point mapping reveals key phases of acceleration in growth. Between 2025 and 2030, the market grows from USD 42.2 billion to USD 56.5 billion, adding USD 14.3 billion, which represents a CAGR of 7.0%. This period marks an inflection point where the market shifts from moderate growth to a faster pace, driven by rising demand for MEG in applications such as antifreeze, polyester production, and plasticizers.

The transition is largely influenced by increased demand for sustainable materials, particularly in the textiles and automotive sectors. From 2030 to 2035, the market continues to grow from USD 56.5 billion to USD 75.6 billion, contributing USD 19.1 billion in growth with a slightly lower CAGR of 5.8%. The deceleration in growth rate signals another inflection point, where the market starts stabilizing after the initial phase of rapid adoption. This slower pace reflects the maturation of the MEG market, with increased competition and saturation in key industries, alongside a shift toward more efficient production technologies and changing regulatory dynamics. The inflection point mapping illustrates the market’s shift from fast growth to stabilization as it matures.

| Metric | Value |

|---|---|

| Monoethylene Glycol MEG Market Estimated Value in (2025 E) | USD 42.2 billion |

| Monoethylene Glycol MEG Market Forecast Value in (2035 F) | USD 75.6 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The monoethylene glycol (MEG) market is experiencing steady growth, primarily driven by increasing demand from the textile and packaging industries. MEG is a crucial raw material in the production of polyester fibers and polyethylene terephthalate (PET), which are in high demand across clothing, home furnishings, and plastic packaging sectors.

The growing popularity of fast fashion, combined with rising urbanization and industrialization in emerging economies, has boosted consumption of polyester-based products. Furthermore, the global push for sustainable and recyclable packaging solutions is amplifying MEG's role in PET bottle manufacturing.

Technological advancements in bio-based MEG production and stricter environmental regulations on fossil-based feedstocks are shaping future investment strategies and production pathways.

The monoethylene glycol MEG market is segmented by grade, application, and geographic regions. The monoethylene glycol MEG market is divided by grade into Polyester grade, Polyester fiber, PET, Industrial grade, Chemical intermediates, Others, Antifreeze grade, Antifreeze & coolants, Others, Low conductivity grade, Polyester Fiber, PET, Antifreeze & coolants, Chemical intermediates, Others. In terms of application, the monoethylene glycol MEG market is classified into Polyester fiber, PET, Antifreeze & coolants, Chemical intermediates, and others. Regionally, the monoethylene glycol MEG industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

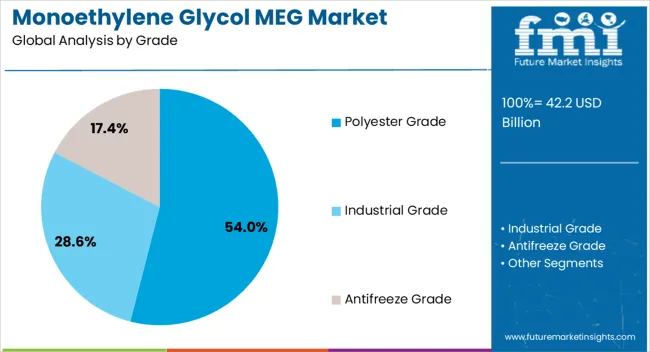

Polyester grade MEG is expected to account for 54.0% of the total market share by 2025, making it the dominant grade in the MEG industry. This leadership stems from its essential role in producing polyester fibers and PET resins, both of which are witnessing substantial demand across end-use sectors such as apparel, automotive interiors, and packaging.

The polyester grade's chemical stability and cost-effectiveness make it highly favored among large-scale manufacturers. As sustainability pressures increase, polyester grade MEG remains critical to producing recyclable PET bottles and fiber-based products.

Emerging economies are also fueling growth, as rising disposable incomes and infrastructural development push demand for polyester textiles and engineering plastics.

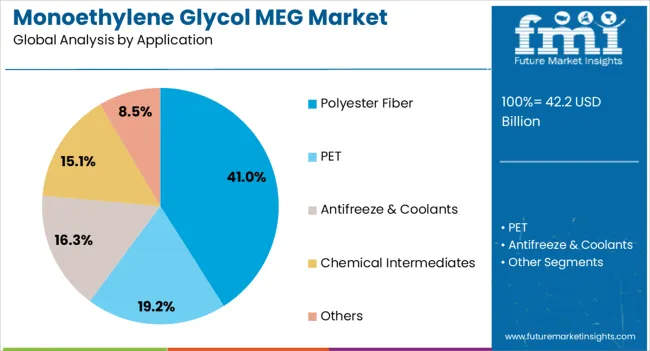

Polyester fiber is projected to hold 41.0% of the MEG application market share in 2025, making it the leading application segment. Its dominance is driven by extensive use in the textile industry due to its strength, wrinkle resistance, and affordability.

MEG’s role in synthesizing purified terephthalic acid (PTA), a precursor for polyester fiber, ensures continuous demand. In addition, polyester fiber is gaining traction as a durable, versatile material used in everything from clothing and upholstery to industrial fabrics.

The global trend toward lightweight, quick-drying textiles further supports segment growth. Moreover, increasing preference for synthetic alternatives to natural fibers, due to cost and performance benefits, keeps polyester fiber at the forefront of MEG applications.

The monoethylene glycol (MEG) market is growing, driven by demand from industries such as textiles, automotive, and packaging. MEG is essential for producing polyester fibers and resins used in products like clothing, plastic bottles, and antifreeze. The rising production of PET (Polyethylene Terephthalate) and expansion of the packaging sector are contributing to this demand. While challenges like fluctuating raw material prices and production costs exist, opportunities arise from bio-based MEG production and increasing adoption in emerging markets.

Monoethylene glycol (MEG) consumption is rising across various industries, particularly textiles, automotive, and packaging. The textile industry remains one of the largest consumers of MEG, with polyester fibers being crucial for fabric and garment production. In the automotive sector, MEG is vital in the manufacture of antifreeze and coolants. The packaging industry also contributes significantly to MEG demand, as it is required for producing PET bottles. The growing need for lightweight, recyclable, and durable polyester-based products further drives MEG consumption. In emerging markets, urbanization and industrial expansion are accelerating the demand for MEG, providing long-term growth potential as industries continue to expand.

One of the key challenges for the monoethylene glycol (MEG) sector is the volatility of raw material prices, especially ethylene, which is the primary feedstock for MEG production. Fluctuating prices of ethylene impact production costs, making it difficult for manufacturers to maintain stable pricing for MEG. The production process of MEG is also energy-intensive, contributing to higher operational costs. These price fluctuations, along with the complex nature of production, create economic pressure for manufacturers, particularly in times of economic uncertainty. The need for continuous improvements in energy efficiency adds to production costs, affecting the overall competitiveness of MEG in the market.

A growing trend in the monoethylene glycol (MEG) industry is the shift toward more efficient production practices and the increased use of recycled materials. With environmental concerns gaining traction, there is a growing focus on bio-based feedstocks for MEG production, reducing reliance on fossil fuels. Another key trend is the rise of recycled polyester, which utilizes recycled PET bottles to reduce the need for virgin MEG. This is particularly evident in the textile and packaging industries, where consumers and manufacturers are embracing circular economy principles. These trends are transforming the MEG industry by promoting more cost-effective and resource-efficient production methods.

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

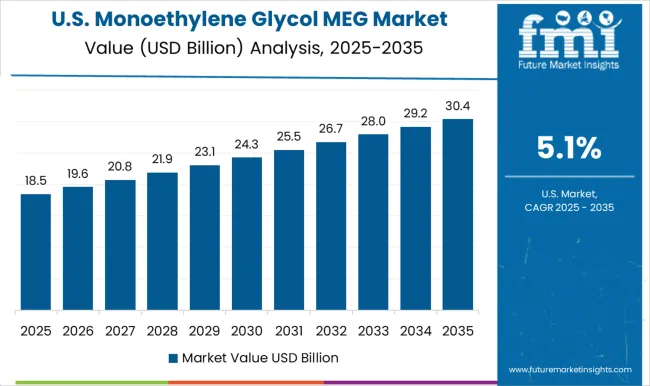

| USA | 5.1% |

| Brazil | 4.5% |

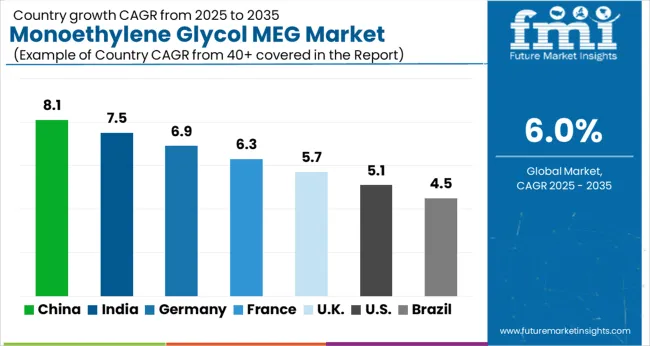

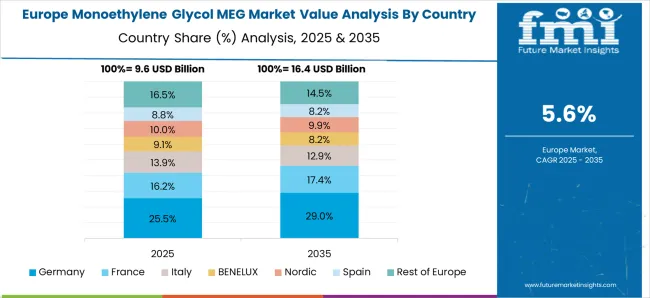

The monoethylene glycol (MEG) market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China leads at 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom records 5.7%, while the United States stands at 5.1%. Growth in BRICS nations like China and India is driven by expanding industrial sectors, rising demand for antifreeze solutions, and the growth of textile and automotive industries. In contrast, OECD markets such as Germany, the UK, and the USA show steady growth fueled by demand for high-performance materials in various industrial applications, especially in automotive and petrochemical industries. The analysis spans over 40+ countries, with the top countries shown below.

China is expected to grow at a CAGR of 8.1% through 2035, primarily driven by the country's rapidly expanding industrial base and rising demand for MEG in the production of polyester fibers, resins, and automotive applications. China is the largest producer and consumer of MEG globally, with its automotive and textile sectors relying heavily on the material. The growing demand for MEG is also supported by China’s focus on developing the domestic chemical industry, improving the country’s petrochemical infrastructure, and the continued urbanization of its population. The shift toward electric vehicles and a rise in consumer spending on goods such as clothing and household products also increase the demand for MEG in the manufacturing of synthetic fibers and plastics.

India is projected to grow at a CAGR of 7.5% through 2035, driven by the expanding manufacturing sector and increasing demand for products like antifreeze, polyester fibers, and plastics, where monoethylene glycol (MEG) is a crucial component. The automotive and textile industries are major consumers of MEG, and with the growth of these sectors, the demand for MEG is set to rise. India’s expanding infrastructure and urbanization are further fueling the need for materials that rely on MEG in their production processes. The growing emphasis on enhancing its petrochemical industry and establishing more local MEG production plants further supports the market growth.

Germany is projected to grow at a CAGR of 6.9% through 2035, with demand for MEG driven by the growing need for plastics, antifreeze, and synthetic fibers in various industries. As a leader in the automotive and chemical industries, Germany’s demand for MEG is primarily driven by its automotive sector, where MEG is used in antifreeze and coolant systems. The textile sector, which is also a major consumer of MEG for polyester production, continues to expand with increasing demand for eco-friendly and durable fabrics. Germany's focus on technological advancements, energy-efficient production, and eco-friendly manufacturing processes further contributes to the adoption of MEG in the country.

The United States is projected to grow at a CAGR of 5.1% through 2035, driven by the rising demand for MEG in industries such as automotive, textiles, and manufacturing. As a major consumer of antifreeze, plastics, and synthetic fibers, the USA plays a significant role in the MEG market. The demand for MEG is further supported by the increasing demand for high-performance automotive components, particularly in the electric vehicle (EV) sector, where MEG plays a role in the production of coolant systems. The growing trend towards lightweight materials and eco-friendly products in various sectors, such as automotive and construction, is also fueling the demand for MEG-based products. The continued growth of the USA manufacturing sector and an increasing focus on domestic production are likely to strengthen the MEG market.

The United Kingdom is projected to grow at a CAGR of 5.7% through 2035, driven by the steady demand for MEG in the automotive and textile sectors. The UK is a significant consumer of MEG, with its automotive sector relying on MEG-based antifreeze and automotive fluids for enhanced vehicle performance. The growing demand for sustainable packaging solutions, along with innovations in the textile industry, further drives the adoption of MEG. The UK has been focusing on enhancing its chemical industry infrastructure, which has positively impacted the demand for MEG in various applications. The shift towards more environmentally conscious solutions in industries like construction and packaging also supports the market growth.

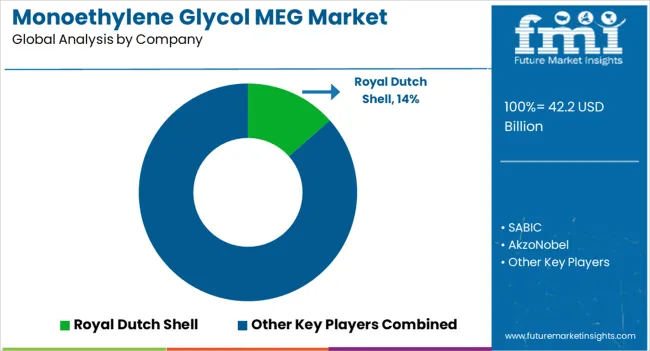

The monoethylene glycol (MEG) market is led by prominent chemical manufacturers providing essential feedstock for various industries, including textiles, automotive, and packaging. Royal Dutch Shell and SABIC dominate the market with large-scale production capacities of MEG, supported by robust global distribution networks and long-standing industry relationships. The Dow Chemicals and Reliance Industries are also major players, offering MEG solutions for diverse applications, including antifreeze formulations and polyester fibers, while focusing on efficiency and cost-competitive solutions. Mitsubishi Chemical and Lotte Chemical Corporation contribute to the market with advanced production technologies and a strong emphasis on meeting the growing demand for MEG from emerging markets. Sinopec Zhenhai Refining & Chemical Co., Nan Ya Plastics Corporation, and MEGlobal focus on increasing MEG production capacity to support the textile and packaging industries, particularly in Asia.

These companies leverage economies of scale to remain competitive in the growing global market. LyondellBasell Industries and ExxonMobil Corporation offer significant MEG production volumes, targeting both the automotive and textiles sectors, with a focus on process innovation and sustainability. Chemtex Speciality Limited and India Glycols specialize in MEG with an emphasis on providing eco-friendly solutions for industrial applications. Competitive differentiation is driven by factors such as production efficiency, feedstock availability, product quality, and cost control. Barriers to entry include high capital investment requirements and stringent environmental and safety regulations. Strategic priorities include expanding production capabilities, advancing green and sustainable production technologies, and exploring new application areas for MEG in emerging industries.

Rising production capacity in key regions and investing in energy-efficient manufacturing technologies will help meet growing demand. Strategic partnerships and acquisitions can enhance market presence and enable access to new technologies. Companies should also explore diversification into new applications, such as bio-plastics and sustainable packaging, to reduce dependency on traditional sectors. Supply chain optimization and investment in recycling and circular economy practices will further drive growth and ensure long-term competitiveness.

| Item | Value |

|---|---|

| Quantitative Units | USD 42.2 Billion |

| Grade | Polyester grade, Polyester fiber, PET, Industrial grade, Chemical intermediates, Others, Antifreeze grade, Antifreeze & coolants, Others, Low conductivity grade, Polyester Fiber, PET, Antifreeze & coolants, Chemical intermediates, and Others |

| Application | Polyester fiber, PET, Antifreeze & coolants, Chemical intermediates, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Royal Dutch Shell, SABIC, AkzoNobel, The Dow Chemicals, Reliance Industries, Mitsubishi Chemical, Lotte Chemical Corporation, Sinopec Zhenhai Refining & Chemical Co., Nan Ya Plastics Corporation, MEGlobal, LyondellBasell Industries, ExxonMobil Corporation, Chemtex Speciality Limited, and India Glycols |

| Additional Attributes | Dollar sales by application (textiles, antifreeze, packaging, resins) and end-use segments (automotive, industrial chemicals, consumer goods). Demand dynamics are influenced by the increasing need for high-performance materials in textiles, automotive antifreeze, and packaging, as well as the growing shift towards more sustainable production methods. Regional trends show strong demand in Asia-Pacific, driven by textile and automotive manufacturing, with North America and Europe focusing on industrial chemicals and packaging solutions. |

The global monoethylene glycol MEG market is estimated to be valued at USD 42.2 billion in 2025.

The market size for the monoethylene glycol MEG market is projected to reach USD 75.6 billion by 2035.

The monoethylene glycol MEG market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in monoethylene glycol MEG market are polyester grade, polyester fiber, pet, industrial grade, chemical intermediates, others, antifreeze grade, antifreeze & coolants, others, low conductivity grade, polyester fiber, pet, antifreeze & coolants, chemical intermediates and others.

In terms of application, polyester fiber segment to command 41.0% share in the monoethylene glycol MEG market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glycolic Acid Market Size and Share Forecast Outlook 2025 to 2035

Megohmmeters Market Size and Share Forecast Outlook 2025 to 2035

Mega-Pixel Fixed Focal Lenses Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Toners Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Glycol Ethers Market Analysis by Type, Application, End Use Industry, and Region 2025 to 2035

Glycol Monostearate Market Insights – Growth & Industrial Applications 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

Omega-3 Concentrates Market Size and Share Forecast Outlook 2025 to 2035

Omega-6 Market Size and Share Forecast Outlook 2025 to 2035

Omega-9 Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 in Animal Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Omega 3 Prescription Drugs Market Size and Share Forecast Outlook 2025 to 2035

Omega-3 Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

Omega 3 Ingredients Market Trends - Health Benefits & Demand 2024 to 2034

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Nutmeg Oil Market Insights – Growth & Forecast 2025-2035

Thioglycolate Market Analysis Size and Share Forecast Outlook 2025 to 2035

Cytomegalovirus Treatment Market Size and Share Forecast Outlook 2025 to 2035

UK Omega 3 Market Analysis – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA