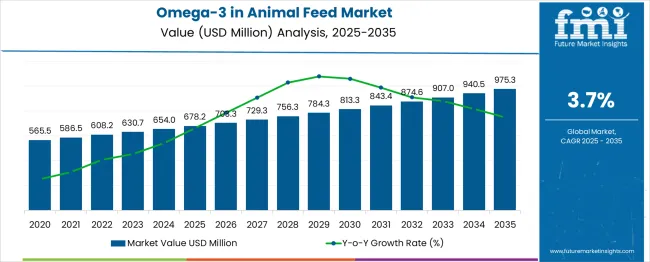

The omega-3 in animal feed market is projected to rise from USD 678.2 million in 2025 to USD 987.2 million by 2035, registering a CAGR of 3.7% during the forecast period. Annual gains show a steady upward trend, starting at USD 25.1 million in 2026 and reaching USD 34.8 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 678.2 million |

| Industry Value (2035F) | USD 987.2 million |

| CAGR (2025 to 2035) | 3.7% |

This growth pattern reflects increasing awareness of the nutritional benefits of omega-3 fatty acids for livestock, poultry, aquaculture, and companion animals. Omega-3 inclusion in feed is associated with improved immunity, enhanced fertility, and better overall productivity, making it a valuable additive in both commercial and specialty feed blends.

As sustainable omega-3 sources such as algae oils gain traction and regulatory frameworks become more nutrition-friendly, the market is expected to accelerate further beyond 2030.

The Omega-3 in Animal Feed Market accounts for approximately 3.5-4.5% of the global animal feed additives market, which is valued at over USD 45 billion as of 2025. The inclusion of omega-3, especially in aquafeed, pet food, and premium livestock diets, is rising due to growing awareness of animal welfare, feed-to-food quality transfer, and sustainability concerns.

In aquaculture alone, omega-3-rich feed formulations dominate over 15% of nutritional input costs due to the need for DHA and EPA in fish development. The functional feed ingredients segment, worth over USD 12 billion, is increasingly allocating 5-6% of its value to omega-3 inclusion. Pet nutrition brands are also boosting omega-3 content to address inflammation, cognition, and coat health, further expanding its share in specialized feeds.

Demand for Omega-3 in animal feed is being driven by fish oil-based formulations, oil product formats, and compound feed applications. Aquaculture leads animal type usage, while feed integrators remain the most strategic sales channel for industry players.

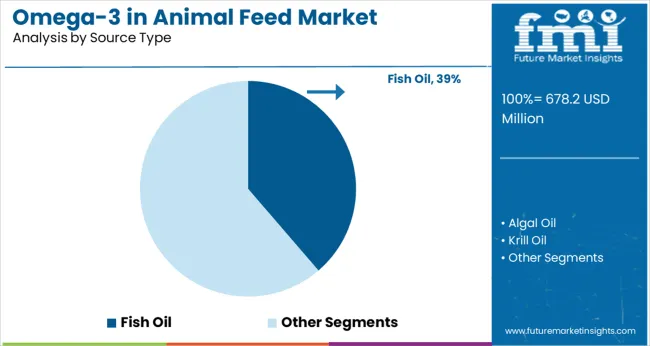

Fish oil remains the primary source in the Omega-3 in animal feed market, holding a 38.7% value share in 2025. Its rich EPA and DHA content makes it indispensable for high-performance animal nutrition, especially in aquaculture and livestock health applications. Feed manufacturers are increasingly favoring fish oil due to its digestibility and proven efficacy in promoting growth and immunity.

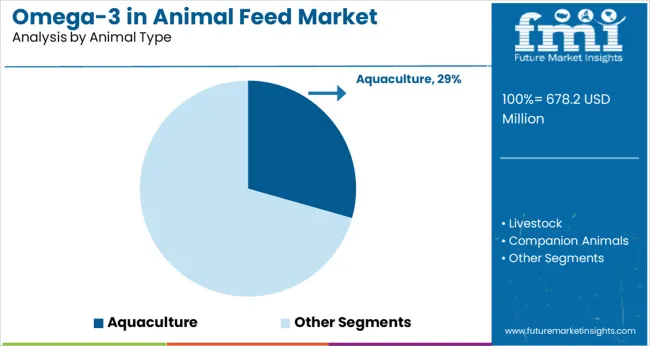

Aquaculture is projected to hold a 29.4% share by 2025, positioning it as a dominant end-use for Omega-3 enriched feeds. Nutritional enrichment using fish-based Omega-3s in shrimp, salmon, and trout farming has become essential to meet global seafood demand. Regulatory mandates on feed quality and omega inclusion in Asia-Pacific and Europe are shaping this trend.

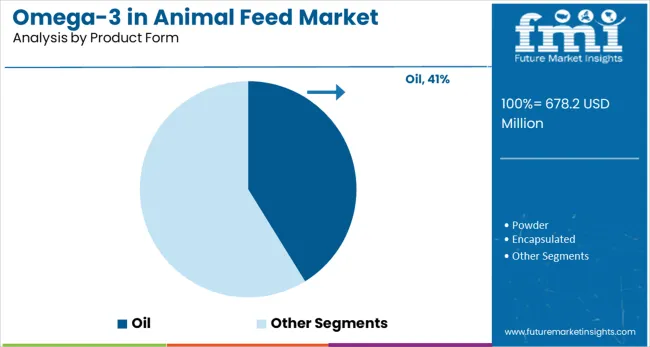

Oil-based Omega-3 formulations dominate with a 41.2% share in 2025. Feed producers prefer oil over powder due to better nutrient retention and improved palatability in animal diets. Cold-pressed and microencapsulated fish oils are gaining momentum, offering better oxidation stability.

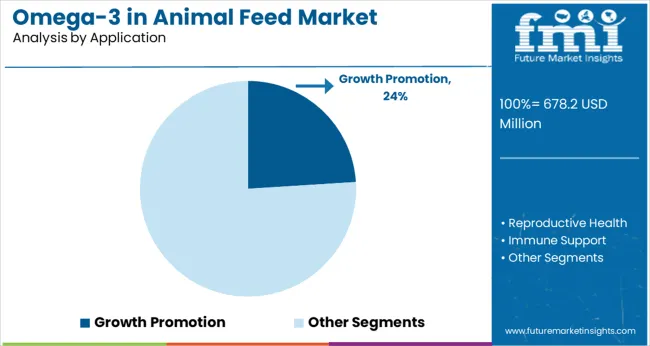

Growth promotion applications represent 24% of the Omega-3 in animal feed market in 2025. Omega-3 fatty acids play a pivotal role in metabolic efficiency, weight gain, and overall productivity in livestock and aquatic species. Functional formulations aimed at improving feed conversion ratios are seeing wider usage in emerging economies.

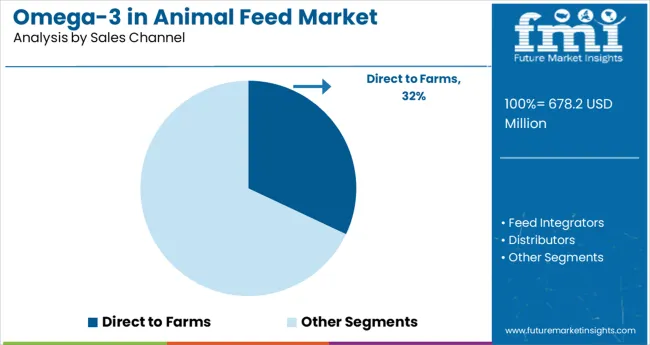

Feed integrators are forecasted to command 32% of sales by 2025, driven by their control over both formulation and distribution. These vertically integrated players ensure consistent Omega-3 sourcing and dosage accuracy, especially in aquaculture and poultry segments. Partnerships with marine oil suppliers are reshaping the competitive landscape.

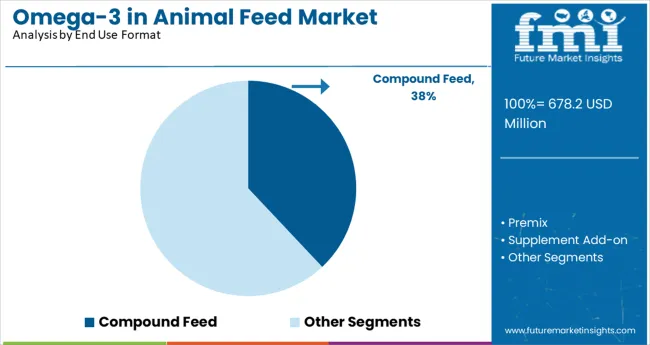

Compound feed is expected to account for 38% of market value, reflecting a growing demand for ready-to-use, nutritionally balanced formulations. Omega-3s in compound feed provide standardized dosing, better digestibility, and lower nutrient loss. This trend is especially pronounced in regions with organized farming and high-value animal protein exports.

Rising focus on animal immunity, reproductive health, and enriched end-products is propelling omega-3 inclusion in feed. Algal and flax-based sources are replacing fish oil in poultry, swine, and aquaculture. Feed millers are leveraging encapsulation and stabilized formats to ensure dosage accuracy, shelf life, and oxidative stability under intensive farm conditions.

Algae-Based DHA Gains Ground in Layer and Broiler Feed

In 2025, algal DHA inclusion in poultry feed rose 44%, driven by demand for omega-3-enriched eggs and improved flock health. Layer farms using 0.5% DHA-rich algae in mash feed achieved a 28% increase in egg DHA content and an 11% higher hatchability rate. Broiler integrators observed a 17% reduction in feed conversion ratio(FCR) when algal omega-3s were combined with vitamin E.

Shelf-stable powdered formats outperformed fish oil in tropical climates, reducing oxidation losses by 36%. As fish oil prices climbed 14% YoY, algae suppliers secured multi-year contracts with EU and APAC egg producers, signaling long-term substitution in omega-enrichment strategies.

Omega-3 Fortification Expands in Aquafeed Formulations

Omega-3 inclusion in aquafeed grew 39% in 2025, especially in salmonid, tilapia, and shrimp diets. Encapsulated EPA-DHA blends extended feed shelf life by 21% and enabled consistent deposition in fillets, boosting DHA levels in farmed salmon by 33% over 2020 baselines. Plant-based omega-3s from flax and canola now contribute up to 45% of total inclusion in cold-water species diets. Pellet stability and water leaching were improved by 18% with microencapsulated forms, reducing feed wastage. Feed mills in Norway and Chile adopted omega-3 blends tailored to water temperature and lifecycle stage, supporting higher yields and better flesh quality for export markets.

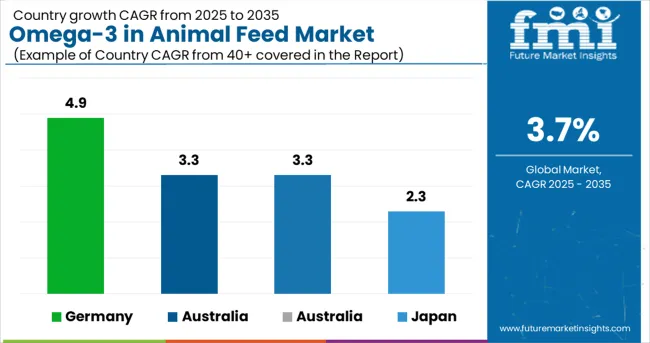

The global omega-3 in animal feed market is anticipated to grow at a CAGR of 3.7% between 2025 and 2035, driven by demand for enriched livestock nutrition and improved animal health outcomes. Germany stands out with a projected CAGR of 4.9%, outperforming the global average due to robust regulatory support for functional additives in EU agriculture and strong investments in feed innovation.

The United States and Australia are expected to grow at 3.3%, slightly below the global pace, as market penetration for omega-3 formulations continues in poultry and aquaculture segments. Japan, trails with a CAGR of 2.3%, influenced by stagnant livestock production volumes and limited innovation cycles in feed applications.

As OECD markets mature, growth will hinge on value-added formulations and sustainability-driven sourcing, while emerging BRICS and ASEAN economies present long-term potential for scaling omega-3 inclusion across feed categories.

The report provides insights across 40+ countries. The four below are highlighted for their strategic influence and growth trajectory.

| Countries | CAGR(2025 to 2035) |

|---|---|

| Germany | 4.9% |

| Australia | 3.3% |

| United States | 3.3% |

| Japan | 2.3% |

Germany’s market is set to register a CAGR of 4.9% from 2025 to 2035. During 2020-2024, demand surged in swine and poultry segments due to consumer push for nutrient-dense animal products. The outlook remains strong as regulations in the EU promote the use of Omega-3 in enhancing animal welfare and product quality.

The market in Australia is forecasted to grow at a CAGR of 3.3% through 2035. From 2020 to 2024, adoption rose in the beef and poultry sectors, especially among organic and grass-fed producers. Future demand for Omega-3 in Animal Feed will be supported by a shift toward eco-friendly feed additives and rising functional meat exports.

The USA market is projected to expand at a CAGR of 3.3% through 2035. Between 2020 and 2024, demand for Omega-3 in Animal Feed increased, driven by the need for enhancing immunity and reproduction in livestock and aquaculture. Over the next decade, the market will benefit from the integration of algae-based Omega-3 into poultry and dairy feed.

Japan is expected to post a CAGR of 2.3% through 2035. Between 2020 and 2024, the market showed steady use in aquafeed, especially in salmon farming. Moving ahead, demand for Omega-3 in Animal Feed will grow moderately as domestic aquaculture integrates higher EPA/DHA content to meet export quality standards.

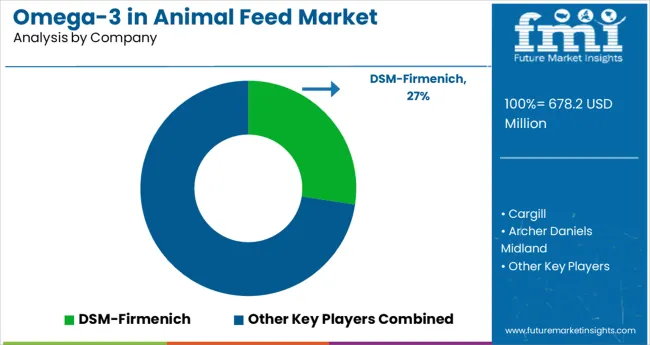

The Omega-3 in Animal Feed market is led by a concentrated group of players, with DSM-Firmenich at the forefront due to its proprietary Veramaris algal-based omega-3 oils, accounting for approximately 27.4% of global supply in 2025. Cargill follows closely, holding a 22.1% share through its EWOS and Aqua Nutrition divisions, emphasizing fishmeal alternatives and EPA-DHA rich blends.

ADM Animal Nutrition captures 18.6% of the market, focusing on vertically integrated omega-3 formulations across poultry and swine. Alltech commands 14.9%, driven by innovation in flaxseed-derived omega-3s and regional supply chains. BASF, while no longer directly involved in Veramaris, retains an 11.2% share through its specialty nutrition solutions and strategic partnerships.

Recent Omega-3 in Animal Feed Industry News

| Report Attributes | Details |

|---|---|

| Industry Size(2025) | USD 678.2 million |

| Projected Industry Size(2035) | USD 987.2 million |

| CAGR(2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Source Types Analyzed(Segment 1) | Fish Oil, Algal Oil, Krill Oil, Flaxseed Oil, Canola Oil, Chia Seed Oil, Camelina Oil, Other Plant-Based Sources |

| Animal Types Analyzed(Segment 2) | Livestock(Poultry, Swine, Ruminants), Aquaculture(Salmonids, Tilapia, Catfish, Shrimp), Companion Animals(Dogs, Cats), Equine, Exotic/Zoo Animals |

| Product Forms Analyzed(Segment 3) | Oil, Powder, Encapsulated(Microencapsulated), Emulsified Liquid, Meal |

| Applications Analyzed(Segment 4) | Growth Promotion, Reproductive Health, Immune Support, Meat/Dairy/Fish Quality Enhancement, Brain & Vision Development, Anti-inflammatory Support |

| Sales Channels Analyzed(Segment 5) | Direct to Farms, Feed Integrators, Distributors, Veterinary Clinics, Online/B2B Portals |

| End Use Formats Analyzed(Segment 6) | Compound Feed, Premix, Supplement Add-on, TMR(Total Mixed Ration), Customized Diet Formulation |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | DSM- Firmenich, Cargill, Archer Daniels Midland, Alltech, BASF |

| Additional Attributes | Dollar sales supported by increasing aquafeed inclusion, segment diversification across species, shift toward algal-based EPA/DHA sources, and rising B2B custom formulation demand |

Includes fish oil, algal oil, krill oil, flaxseed oil, canola oil, chia seed oil, camelina oil, and other plant-based sources.

Covers livestock(poultry, swine, ruminants), aquaculture (salmonids, tilapia, catfish, shrimp), companion animals (dogs, cats), equine, and exotic/zoo animals.

Available forms include oil, powder, encapsulated (microencapsulated), emulsified liquid, and meal.

Applications span growth promotion, reproductive health, immune support, meat/dairy/fish quality enhancement, brain & vision development, and anti-inflammatory support.

Distributed through direct to farms, feed integrators, distributors, veterinary clinics, and online/B2B portals.

Used in compound feed, premix, supplement add-on, TMR (total mixed ration), and customized diet formulation.

Includes North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, and Western Europe.

The market is valued at USD 678.2 million in 2025.

The market is forecasted to reach USD 987.2 million by 2035, reflecting a CAGR of 3.7%.

Fish oil will lead the source type segment, accounting for 38.7% of the global market share in 2025.

Aquaculture will dominate the animal type segment with a 29.4% share in 2025.

Germany is projected to grow at the fastest rate, with a CAGR of 4.9% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Omega-3 Market Trends – Size, Share & Forecast 2025-2035

Infrastructure Projects Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Support Services Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Grade Electrochemical CO Sensor Market Size and Share Forecast Outlook 2025 to 2035

Interior Swinging Door Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Touch Screen Cash Register Market Size and Share Forecast Outlook 2025 to 2035

Inflatable Spa Hot Tub Market Size and Share Forecast Outlook 2025 to 2035

Industrial Bench Scale Market Size and Share Forecast Outlook 2025 to 2035

Intensity Microphone Market Size and Share Forecast Outlook 2025 to 2035

Inflatable U Shaped Travel Pillow Market Size and Share Forecast Outlook 2025 to 2035

Induction Brazing Services Market Size and Share Forecast Outlook 2025 to 2035

Industrial Low Profile Floor Scale Market Size and Share Forecast Outlook 2025 to 2035

Integrated Trimming and Forming System Market Size and Share Forecast Outlook 2025 to 2035

Industrial Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Industrial Control Network Modules Market Size and Share Forecast Outlook 2025 to 2035

Incline Impact Tester Market Size and Share Forecast Outlook 2025 to 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Industrial Precision Oven Market Size and Share Forecast Outlook 2025 to 2035

Industrial Water Chiller for PCB Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA