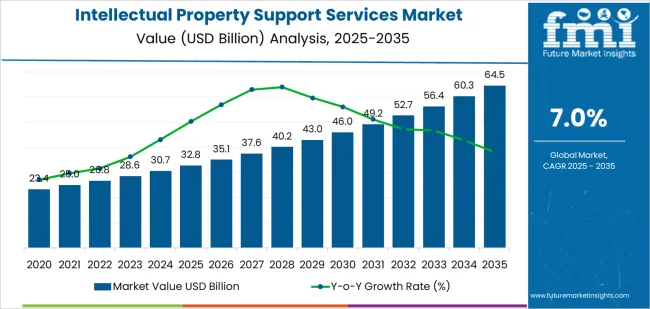

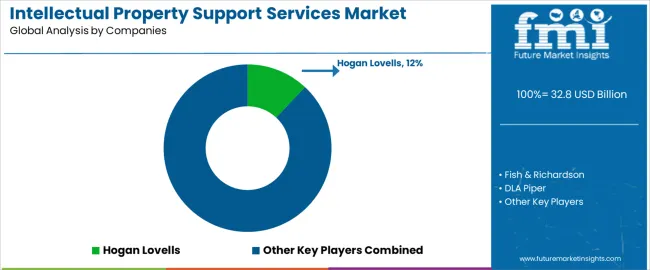

The intellectual property support services market is valued at USD 32.8 billion in 2025 and is forecast to reach USD 64.5 billion by 2035 at a CAGR of 7.0 percent. Rising global patenting activity, higher documentation loads, and greater reliance on specialist teams for search, docketing, translation, filing coordination, and portfolio administration support expansion. Early-period gains are shaped by rising demand for patent analytics, prior-art searches, and structured workflow management across technology, pharmaceuticals, advanced materials, and digital content sectors. By 2030, the market will reach USD 46.0 billion, driven by stronger adoption of third-party filing coordination and portfolio-tracking systems. Late-period growth adds USD 18.5 billion as portfolios scale across AI, biotech, electronics, and materials, creating heavier annuity, deadline, and compliance workloads.

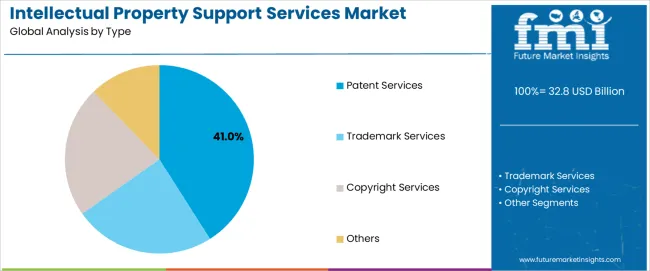

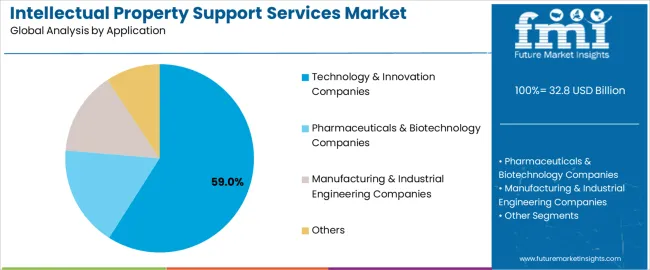

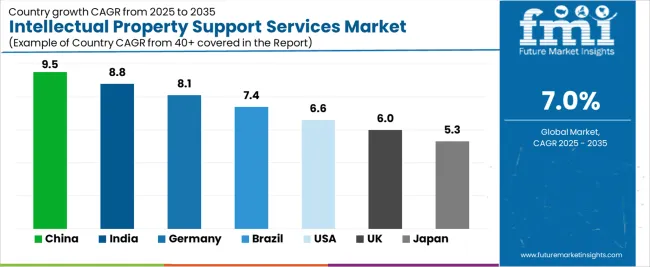

Patent services retain leadership with a 41% share, driven by extensive procedural and technical requirements that organizations prefer to outsource. Technology and innovation companies hold the largest application share at 59 percent, supported by rapid invention cycles and the need for precise document management across jurisdictions. Country analysis indicates the strongest growth in China and India, followed by Germany and Brazil, driven by rising filings, translation requirements, and cross-border prosecution. The United States, the United Kingdom, and Japan continue to demand litigation support, brand-enforcement workflows, and manufacturing-driven docketing. Competition spans global law firms and technology-driven IP platforms, with differentiation shaped by automation depth, analytics quality, procedural accuracy, security posture, and integration with major patent-office systems. Continuous workflow standardization, higher technical complexity, and expanding international filings reinforce the long-term need for scalable intellectual property support services.

From 2025 to 2030, the Intellectual Property Support Services Market increases from USD 32.8 billion to USD 46.0 billion, adding USD 13.2 billion over five years. Annual growth rises steadily from USD 2.3 billion in the early years to USD 3.0 billion by 2030, reflecting higher demand for patent-search services, global patent mapping, trademark monitoring, and portfolio-administration outsourcing. Growth in this phase is influenced by rising R&D spending, expanding international filing activity, and increased use of third-party IP workflow management systems by enterprises seeking cost-efficient administrative support.

Between 2030 and 2035, the market expands from USD 46.0 billion to USD 64.5 billion, generating USD 18.5 billion of additional growth significantly higher than the earlier period. Annual increments reach USD 4.0-4.3 billion as corporations scale international IP portfolios, strengthen litigation preparedness, and adopt digital tools for automated docketing, renewal management, and prior-art analytics. Increased filings in Asia-Pacific and growing IP complexity in AI, biotech, and advanced materials further accelerate late-cycle expansion. Over the full decade, total growth reaches USD 31.7 billion, demonstrating consistent, broad-based strengthening of global IP administrative and support service requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 32.8 billion |

| Market Forecast Value (2035) | USD 64.5 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

Demand for intellectual property support services is rising as organizations manage larger portfolios of patents, trademarks, copyrights, and trade secrets across multiple jurisdictions. Companies rely on support providers for patent drafting assistance, prior-art searches, docketing, translation, and prosecution workflow coordination that must meet strict filing deadlines. As R&D cycles accelerate in pharmaceuticals, electronics, automotive, and software, firms require structured processes for invention disclosure, portfolio tracking, and status monitoring. Service providers refine database management, document-quality checks, and standardized communication protocols to maintain accuracy across high-volume filings. Growth is strongest among enterprises balancing global expansion with the need to control internal administrative workloads, supporting steady engagement with specialized IP support teams.

Market expansion is also driven by increasing complexity in global IP frameworks and rising enforcement activity. Companies adopt outsourced support services to manage annuity payments, evidence gathering, and recordal updates that must align with differing regional rules. Providers strengthen capabilities in digital docketing systems, secure file exchange, and audit-ready documentation to help clients maintain compliance and reduce administrative risk. Growth in cross-border licensing, technology transfer, and joint-development agreements increases the need for accurate portfolio records and reliable translation of technical claims. Although cost sensitivity affects small enterprises, predictable service models and scalable support functions continue to attract clients seeking operational efficiency. These conditions reinforce long-term demand for intellectual property support services across research-intensive and globally distributed industries.

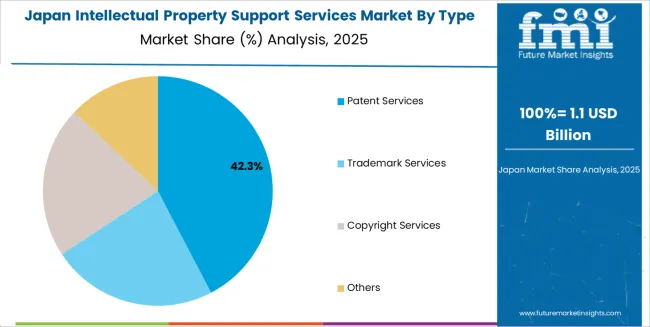

The intellectual property support services market is segmented by type, application, and region. By type, the market is divided into patent services, trademark services, copyright services, and others. Based on application, it is categorized into technology and innovation companies, pharmaceuticals and biotechnology companies, manufacturing and industrial engineering companies, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments reflect varying documentation needs, protection strategies, and industry-specific IP-management demands.

The patent services segment accounts for approximately 41.0% of the global intellectual property support services market in 2025, making it the leading type category. This position is tied to the extensive technical and procedural tasks involved in preparing, filing, monitoring, and maintaining patents. Patent support providers handle prior-art searches, drafting assistance, portfolio-organization tasks, procedural tracking, and administrative coordination with patent offices. These activities require sustained documentation accuracy and structured workflows that many organizations prefer to outsource due to workload intensity and resource limitations.

Providers develop processes for managing prosecution timelines, cross-jurisdiction filings, and consistency in inventor disclosures. Adoption is strong in North America, Europe, and East Asia, where research-driven industries generate high patent volumes that require continuous administrative support. Patent services also assist organizations with docket management, patent-term verification, and clerical support during office-action responses. The segment maintains its leading share because it serves industries with steady invention output and ongoing procedural burdens that demand reliable technical-administrative coordination across domestic and international patent systems.

The technology and innovation companies segment represents about 59.0% of the total intellectual property support services market in 2025, making it the dominant application category. This position reflects the sector’s continuous development of software, hardware, semiconductors, electronics, and integrated digital systems that require structured management of invention disclosures and patent portfolios. These companies rely on support services to organize filings, track deadlines, coordinate foreign applications, and maintain documentation across rapid development cycles.

Support providers assist technology companies with portfolio audits, database upkeep, formal-drawing preparation, and maintenance-fee tracking. Adoption is strong in East Asia and North America, where high R&D intensity and short product cycles create recurring procedural workloads. Europe contributes additional demand due to active research consortia and industrial-innovation programs. Technology and innovation companies hold their leading position because they generate large volumes of IP that must be administered consistently across multiple jurisdictions, creating sustained demand for services that maintain accuracy, continuity, and procedural compliance in patent and related IP processes.

The intellectual property support services market is expanding as organizations seek structured assistance for managing patents, trademarks and technical documentation across global operations. Support providers handle prior-art searches, patent-drafting assistance, docketing, translation, portfolio maintenance and analytics for companies aiming to streamline internal workflows. Growth is driven by rising innovation activity, increased cross-border filings and pressure to manage IP lifecycles more efficiently. Adoption is limited by cost sensitivity, confidentiality concerns and varying regional IP procedures. Providers are improving automation, data accuracy and workflow integration to support larger and more diverse IP portfolios.

Demand increases as companies generate more inventions, digital assets and brand elements requiring structured documentation and filing support. In-house IP teams often face high workloads related to searches, drafting assistance, renewals and deadline management. Support services help reduce administrative burden and enable legal teams to focus on strategy and enforcement. As organizations expand internationally, they rely on outsourced support to manage translation needs, regional rule variations and coordinated filing timelines. These pressures strengthen the role of external IP support partners in maintaining portfolio reliability and accuracy.

Adoption is limited by confidentiality concerns, especially for early-stage inventions and sensitive trade-secret information. Some organizations prefer keeping IP workflows strictly internal to maintain control over drafting and prosecution strategy. Budget constraints discourage smaller companies from engaging ongoing support, especially when patent volumes are modest. Differences in technical quality across vendors create uncertainty for firms requiring consistent deliverables. Regional variations in IP-office procedures also add complexity, reducing the appeal of standardized service models in certain jurisdictions.

Trends include increased automation in docketing, prior-art analysis and portfolio reporting through AI-driven tools. Providers are expanding technical specialization in fast-evolving domains such as software, electronics, biotechnology and clean energy. Integrated dashboards are becoming common, allowing clients to track filings, deadlines and analytics in real time. Demand for coordinated global support continues to grow as companies expand operations across multiple markets. Translation, proofreading and patent-illustration services are being bundled into unified workflows. As IP portfolios become larger and more data-intensive, support services are shifting toward higher accuracy, stronger security and deeper integration with corporate legal systems.

| Country | CAGR (%) |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| Brazil | 7.4% |

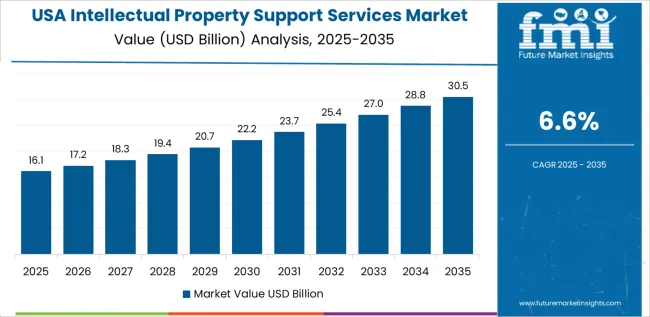

| USA | 6.6% |

| UK | 6.0% |

| Japan | 5.3% |

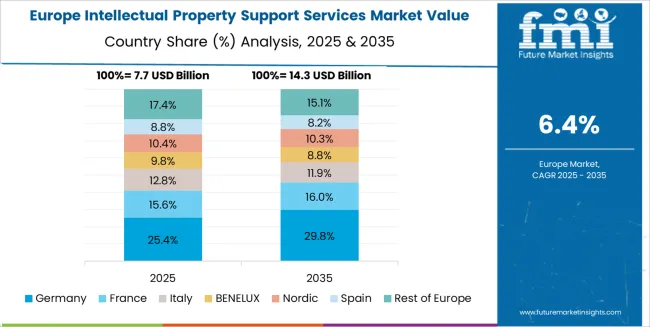

The Intellectual Property Support Services Market is expanding steadily worldwide, with China leading at a 9.5% CAGR through 2035, driven by accelerating innovation activity, rapid growth in patent filings, and increased corporate focus on IP strategy and portfolio management. India follows at 8.8%, supported by strong startup momentum, growing digital innovation, and rising demand for cost-effective IP research, drafting, and compliance services. Germany records 8.1%, reflecting robust industrial R&D, strict regulatory standards, and high adoption of specialized IP support across manufacturing and technology sectors.

Brazil grows at 7.4%, benefitting from expanding tech ecosystems and modernization of IP processes. The USA, at 6.6%, remains an advanced market emphasizing AI-driven IP analytics, litigation support, and global portfolio optimization, while the UK (6.0%) and Japan (5.3%) focus on high-quality procedural support, international filing efficiency, and strategic protection of cutting-edge innovations.

China is projected to grow at a CAGR of 9.5% through 2035 in the intellectual property support services market. Rapid patent filing volumes and cross-border prosecution needs increase demand for docketing, translation, and filing support. Service providers supply formalities checks, priority claims management, and national-phase entry coordination for large portfolios. Corporates and universities rely on clearance search summaries, paralegal prosecution assistance, and customs recordation support. Outsourced teams handle bulk document conversions, deadline monitoring, and fee payment processing. Growth reflects a rise in domestic innovation commercialisation and increased reliance on external managed-service providers for routine IP administration tasks.

India is projected to grow at a CAGR of 8.8% through 2035 in the intellectual property support services market. Rapid expansion of trademark and patent filings among startups and exporters raises demand for prosecution support, local counsel coordination, and IP record maintenance. Service firms provide priority claim handling, multilingual filing packs, and structured renewal calendars for large client rosters. Customs recordation and anti-counterfeit monitoring services assist brand owners protecting cross-border shipments. Outsourced paralegal operations handle evidence-gathering, affidavit preparation, and service of process for enforcement matters. Market growth corresponds with increasing commercialisation and international filing strategies by domestic innovators.

Germany is projected to grow at a CAGR of 8.1% through 2035 in the intellectual property support services market. Strong patenting activity in engineering and automotive sectors increases need for technical translations, prior-art collection, and formal patent prosecution assistance. Service providers offer validated search outputs, specification formatting, and alignment with European filing protocols. Paralegal teams prepare responses, compile file histories, and coordinate with patent attorneys for opposition and nullity actions. Rights maintenance services schedule annuities and local-authority filings. Corporate IP programmes use managed support for cost control and consistent docket hygiene across complex technical portfolios and cross-border families.

Brazil is projected to grow at a CAGR of 7.4% through 2035 in the intellectual property support services market. Growth in consumer brands and agritech technologies increases demand for trademark prosecution, oppositions, and customs enforcement support. Providers supply local-language specification checks, filing-case management, and timely renewal workflows. Monitoring services flag potential infringements across online marketplaces and local retail channels. Enforcement support includes cease-and-desist drafting, seizure coordination, and administrative complaint preparation. Outsourced teams collect evidence and coordinate with local investigators. Market expansion reflects higher brand investment and a need for pragmatic, locally oriented IP administrative services.

USA is projected to grow at a CAGR of 6.6% through 2035 in the intellectual property support services market. High-volume patent portfolios and contentious litigation require support teams for document production, claim chart preparation, and patent family analytics. Service providers deliver prior-art mining, invalidity evidence organisation, and technical demonstrative preparation for depositions and trials. Paralegal operations handle assignment tracking, chain-of-title documentation, and maintenance of prosecution histories for defendants and plaintiffs. Firms expand managed-review capabilities and data-room services to support due diligence in M&A and licensing negotiations. Market growth reflects litigation intensity and the need for scalable support in complex IP disputes.

UK is projected to grow at a CAGR of 6.0% through 2035 in the intellectual property support services market. Expansion of e-commerce and cross-border retail drives demand for trademark watching, domain enforcement, and marketplace takedown operations. Service firms provide clearance checks, watch lists, and infringing listing takedown workflows across multiple platforms. Rights-holders use managed services for customs recordation and design registration filings. Paralegal support prepares statutory declarations and formal evidence bundles for UKIPO and trademark tribunal proceedings. Market growth aligns with heightened online brand-protection activity and structured outsourcing of routine administrative enforcement tasks.

Japan is projected to grow at a CAGR of 5.3% through 2035 in the intellectual property support services market. High-volume industrial patenting and supplier-driven design work increase demand for prosecution support, formalities management, and multi-jurisdictional filing coordination. Service providers assemble priority chains, translate technical specifications, and manage annuity schedules for extensive patent families. Local evidence collection supports administrative enforcement and customs alerts. Outsourced teams prepare opposition responses and support patent licensing documentation. Market growth corresponds with sustained innovation in manufacturing and electronics and a practical shift toward managed administrative support to lower in-house transactional overhead.

The global intellectual property support services market is highly diversified, shaped by law firms, IP service providers, and technology platforms supporting patent prosecution, trademark management, portfolio analytics, renewals, and brand-protection work. Hogan Lovells, Fish & Richardson, DLA Piper, Finnegan, Kirkland & Ellis, Perkins Coie, CMS Law, Jones Day, Rouse Consultancy, Baker McKenzie, and White & Case hold strong positions in legal-driven IP support, combining prosecution, oppositions, due-diligence reviews, and litigation-linked portfolio work.

These firms focus on accuracy in filings, jurisdictional coordination, and integration of legal strategy with commercialization needs. Their competitiveness is shaped by technical expertise across software, life sciences, electronics, and materials, as well as the capability to manage multi-country portfolios for global clients.

Clarivate, Questel, RWS, Dennemeyer, PatSnap, LexisNexis IP, IPlytics, Corsearch, and Brandwatch strengthen the technology-enabled segment through data platforms, prior-art search tools, docketing systems, competitive-intelligence engines, and brand-monitoring solutions. CPA Group, Spruson & Ferguson, Novagraaf, Patent Result, Anaqua, and KISCH IP expand the market with renewal services, portfolio administration, and integrated IP-lifecycle management.

Competition is influenced by data accuracy, analytics depth, workflow automation, and cross-platform interoperability. Strategic differentiation depends on global coverage, integration with patent offices, scalable portfolio-management tools, and evidence-based insights used for filing decisions and enforcement planning. As innovation cycles accelerate, providers offering reliable data, automated workflows, and strong jurisdictional expertise are positioned to strengthen long-term competitiveness in the IP support ecosystem.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type | Patent services, Trademark services, Copyright services, Others (design rights, trade-secret support) |

| Application | Technology & innovation companies, Pharmaceuticals & biotechnology companies, Manufacturing & industrial engineering companies, Others (media, consumer brands) |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional jurisdictions |

| Key Companies Profiled | Hogan Lovells, Fish & Richardson, DLA Piper, Finnegan, Kirkland & Ellis, Perkins Coie, Clarivate, Questel, RWS, Dennemeyer, PatSnap, LexisNexis IP, Anaqua |

| Additional Attributes | Dollar sales by type and application categories; global docketing and renewal workflows; prior-art and patent-analytics capability mapping; vendor security/certification posture; translation and technical-drafting quality metrics; integration with EPO/USPTO/JPO filing systems; AI-enabled prior-art and portfolio-analytics readiness; outsourcing onshore vs offshore mix; typical SLAs for turnaround and quality; consolidation trends among data/analytics providers. |

East Asia

Europe

North America

South Asia

Latin America

Middle East & Africa

Eastern Europe

The global intellectual property support services market is estimated to be valued at USD 32.8 billion in 2025.

The market size for the intellectual property support services market is projected to reach USD 64.5 billion by 2035.

The intellectual property support services market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in intellectual property support services market are patent services, trademark services, copyright services and others.

In terms of application, technology & innovation companies segment to command 59.0% share in the intellectual property support services market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Intellectual Property Rights And Royalty Management Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Software Market Size and Share Forecast Outlook 2025 to 2035

Intellectual Property Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Enterprise IP Management Software Market Growth – Trends & Forecast 2023-2033

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Semiconductor Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Property Management Software Market Growth - Trends & Forecast 2025 to 2035

M2M Services Market Size and Share Forecast Outlook 2025 to 2035

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

Bot Services Market Size and Share Forecast Outlook 2025 to 2035

Spa Services Market Size and Share Forecast Outlook 2025 to 2035

Microservices Orchestration Market Growth - Trends & Forecast 2025 to 2035

VOIP Services Market Analysis - Trends, Growth & Forecast through 2034

Global AI HR Services Market Size and Share Forecast Outlook 2025 to 2035

Legal Services Market Size and Share Forecast Outlook 2025 to 2035

Oracle Services Market Analysis – Trends & Forecast 2024-2034

Seismic Services Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tableau Services Market Size and Share Forecast Outlook 2025 to 2035

Managed Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA