The South Korea Intellectual Property Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 6.9 billion by 2035, registering a compound annual growth rate (CAGR) of 17.4% over the forecast period.

| Metric | Value |

|---|---|

| South Korea Intellectual Property Market Estimated Value in (2025 E) | USD 1.4 billion |

| South Korea Intellectual Property Market Forecast Value in (2035 F) | USD 6.9 billion |

| Forecast CAGR (2025 to 2035) | 17.4% |

The South Korea intellectual property market is expanding steadily as innovation driven industries increasingly prioritize protection, management, and commercialization of intellectual assets. Rising patent filings, government backed R&D programs, and cross border collaborations have accelerated the demand for effective intellectual property frameworks.

Corporations and institutions are focusing on safeguarding competitive advantages, while technology intensive sectors such as electronics, pharmaceuticals, and semiconductors are leading adoption. Digital transformation and integration of AI based analytics into intellectual property workflows are enhancing efficiency, compliance, and portfolio valuation.

Strengthened legal infrastructure and rising awareness of intellectual property rights are also fueling adoption. The future outlook remains positive as South Korea continues to position itself as a hub of innovation and seeks to align intellectual property practices with global standards.

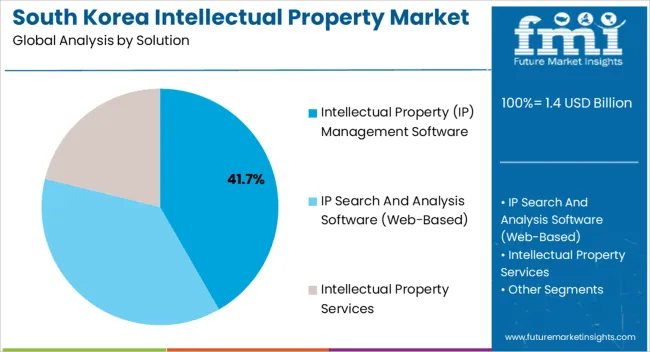

The intellectual property management software segment is projected to hold 41.70% of total revenue by 2025 within the solution category, establishing it as the leading segment. Its dominance is being driven by the need for centralized platforms that streamline filing, monitoring, and enforcement processes.

Software based solutions enable automation of administrative tasks, efficient portfolio tracking, and enhanced decision making through analytics and reporting. Growing complexity of intellectual property regulations and rising volume of patent filings have further reinforced the demand for scalable and compliant management platforms.

Corporations and law firms are increasingly investing in these solutions to ensure operational efficiency and safeguard intellectual assets, supporting the sustained growth of this segment.

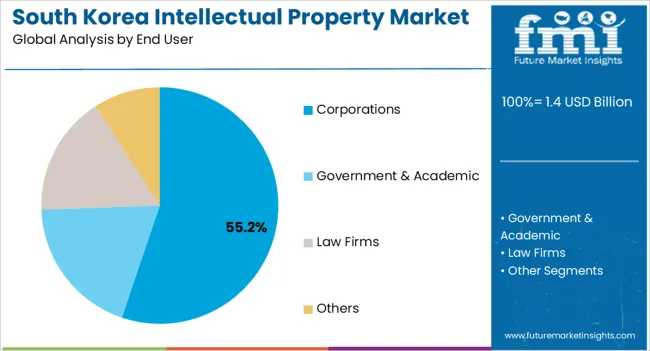

The corporations segment is expected to contribute 55.20% of overall revenue by 2025 within the end user category, positioning it as the dominant segment. This leadership is attributed to the strategic importance of intellectual property in driving innovation, maintaining competitive differentiation, and securing long term revenue streams.

Corporations across industries such as technology, automotive, and life sciences are strengthening their intellectual property portfolios to protect R&D investments and enhance global market presence. Increased cross border trade and partnerships have also amplified the need for robust intellectual property protection mechanisms.

The ability of corporations to allocate significant resources for management, enforcement, and commercialization of intellectual property assets ensures that they remain the principal end user segment in this market.

Intellectual property rights allow creators to patent, trademark, or copyright their works to avoid mishandling and to benefit from their creation and innovation. Cloud-based IPs are in high demand as they support and remotely protect IP assets across various industries. Since the cloud offers excellent flexibility and value over locally installed intellectual property management systems. These sales are anticipated to increase in the forthcoming years.

Designers, inventors, authors, and developers are adopting IP rights such as patents and trademarks to safeguard their creations. In addition, regulations imposed by the government to control the unauthorized usage of IP assets are estimated to augment the growth in the market.

The local government plays a critical role in policy-making and regulations in South Korea. In recent years, the Korea Intellectual Property Office (KIPO) has expanded the role of the Special Investigation Police (SIP) within KIPO.

It was originally established to investigate trademark infringement and counterfeiting including investigations of patent infringement and the enforcement of patent rights.

The government of South Korea is planning to evolve in tandem with the changing landscape of the intellectual property sector. Moreover, investments in research and development by the government and various firms are propelling several patents to be issued, boosting sales in the market.

| Attributes | Details |

|---|---|

| Market CAGR (2025 to 2035) | 17.4% |

| Market Valuation (2025) | USD 1 billion |

| Market Valuation (2035) | USD 5.2 billion |

Sales are projected to increase at a 17.4% CAGR between 2025 and 2035, compared with the 7.8% CAGR registered from 2020 to 2025. Companies in South Korea are implementing new editions of IP solutions into their current offerings with a wide range of new features and capabilities.

Rapid globalization, innovation, fragmentation of production value chains, and the emergence of new players are some factors expected to drive sales of IP solutions and software. IP systems are undergoing continuous changes as they seek to optimize the balance between private and social benefits to contribute to economic growth and the welfare of societies.

The market was valued at USD 0.6.0 million in 2020 and is anticipated to capture a valuation of USD 1.4 million in 2025.

Brands and Companies are Investing in Logo Copyright Registration

Based on solutions, demand in the intellectual property management software segment is expected to secure a share of 47.7%, accounting for a dominant market share.

Formal intangible assets such as technology, designs, and brands are important for appropriate returns for innovation and investments. These intangible assets are protected by formal intellectual property (IP) rights such as patents, utility models, industrial designs, trademarks, copyrights, and trade secrets. Owing to this, demand for IP management software across various end users is surging, thereby driving market growth.

Surging Demand for Copyright Services in Law Firms is estimated to Drive Sales

Regarding end users, sales in the law firms segment are projected to secure a share of 28.3% over the forecast period. The segment is expected to grow 5.9X, creating an absolute opportunity of USD 2,061.2 million.

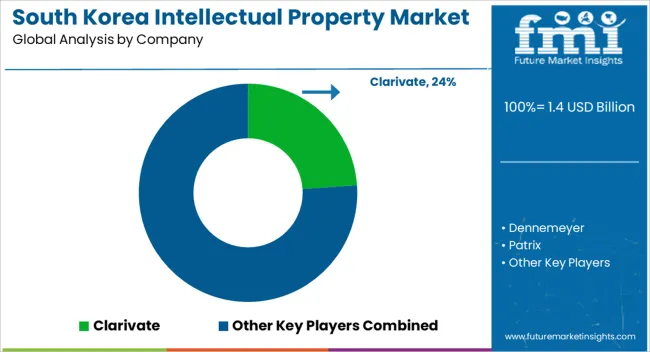

The growing popularity of IP management software is estimated to continue driving sales in this segment. For instance, in July 2024, Clarivate launched research and protection solutions powered by CompuMark into Ipfolio, and FoundationIP, IP management software (IPMS) solutions. These solutions are being adopted in corporations and law firms. Such developments are anticipated to bode well for the growth of the market.

South Korea is one of the significant countries leading the intellectual property field to innovate and protect. South Korea's government takes several measures to strengthen the laws and enforcement for businesses and inventors.

The country ranks high internationally for IP indices, including the United States Chamber of Commerce's Global IP Index and the Global Innovation Index. The growing technological and electronics in IP enforcing rights and laws are fueling the market in the country. South Korea is enhancing its portfolio in licensing agreements with numerous IP disputes.

The growing awareness, promotion, and education of intellectual property drive the South Korea market. Increasing research and development activities, supporting small businesses, startups, and collaborations with research institutions are expanding the market in the country. These factors are performing in the South Korea intellectual property market during the forecast period.

Manufacturers can expand the South Korea market through various steps as follows:

These are a few of the steps on which manufacturers can expand the South Korea market during the forecast period.

Key companies operating in the South Korea intellectual property market include Clarivate, Dennemeyer, Patrix, LexisNexis Korea (Legal), Questel Korea, PI IP LAW, KASAN, SU INTELLECTUAL PROPERTY Co. Ltd., WIPS Co. Ltd, SIWONIP, Kim & Chang, Lee & Ko, and FirstLaw PC, among others. Companies are emphasizing innovations and expanding their global footprint through acquisitions and partnerships.

The market is highly competitive by these key players. These key players are innovating better and unique products to stay ahead of the competition. The key players are adopting several marketing tactics to upsurge the global market to another level.

Recent Developments in the South Korea Intellectual Property Market are:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD billion for Value |

| Key Countries Covered | United States, United Kingdom, Japan, India, China, Australia, Germany |

| Key Segments Covered |

Solution, End User, Region |

| Key Companies Profiled |

Clarivate; Dennemeyer; Patrix; LexisNexis Korea (Legal); Questel Korea; PI IP LAW; KASAN; SU INTELLECTUAL PROPERTY Co. Ltd.; WIPS Co. Ltd; SIWONIP; Kim & Chang; Lee & Ko; FirstLaw PC |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global south korea intellectual property market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the south korea intellectual property market is projected to reach USD 6.9 billion by 2035.

The south korea intellectual property market is expected to grow at a 17.4% CAGR between 2025 and 2035.

The key product types in south korea intellectual property market are intellectual property (ip) management software, _cloud-based, _on-premises, ip search and analysis software (web-based), intellectual property services, _ip consulting and analytics, _law firm services, _ip maintenance and _others.

In terms of end user, corporations segment to command 55.2% share in the south korea intellectual property market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

South Africa Faith-Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

South East Asia CMMS Market Size and Share Forecast Outlook 2025 to 2035

Southern Blotting Market Size and Share Forecast Outlook 2025 to 2035

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

Southeast Asia Submersible Pumps Market Growth – Trends & Forecast 2025 to 2035

South America Tourism Market Growth – Trends & Forecast 2024-2034

South America Residential Water Treatment Equipment Market Trends – Growth & Forecast 2022 to 2032

Southeast Asia Pet Care Market Trends – Demand, Growth & Forecast 2022-2032

South Korea Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Korea Tourism Market Trends - Growth, Demand & Analysis 2025 to 2035

South Korea Power Tools Market Report – Trends, Demand & Growth 2025-2035

South Korea Respiratory Inhaler Devices Market Insights – Trends, Demand & Growth 2025 to 2035

South Korea Mobile Sterile Units Market Report – Growth, Demand & Forecast 2025-2035

South Korea Hyaluronic Acid Products Market Growth – Trends, Demand & Innovations 2025-2035

South Korea DNA Polymerase Market Growth – Innovations, Trends & Forecast 2025-2035

South Korea 3D Bioprinted Human Tissue Market Trends – Demand & Forecast 2025-2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in South Korea - Trends, Market Insights & Applications 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA