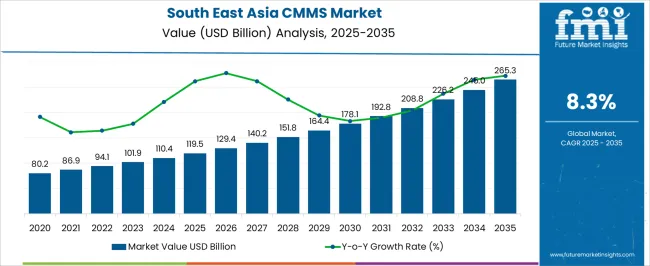

The South East Asia CMMS Market is estimated to be valued at USD 119.5 billion in 2025 and is projected to reach USD 265.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

| Metric | Value |

|---|---|

| South East Asia CMMS Market Estimated Value in (2025 E) | USD 119.5 billion |

| South East Asia CMMS Market Forecast Value in (2035 F) | USD 265.3 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The South East Asia CMMS market is expanding rapidly due to rising demand for digital maintenance solutions, asset management efficiency, and regulatory compliance across industries. Increasing adoption of cloud based platforms and mobile integration has enabled businesses to improve equipment uptime, reduce operational costs, and enhance predictive maintenance strategies.

The shift from reactive to proactive maintenance practices is driving investments in CMMS solutions, particularly as industries aim to minimize downtime and improve productivity. Growing emphasis on workplace safety, audit readiness, and sustainability targets is also contributing to market momentum.

With governments and enterprises in the region pushing digital transformation initiatives, the CMMS market outlook remains positive as organizations continue to seek scalable, data driven, and user friendly platforms to streamline maintenance management.

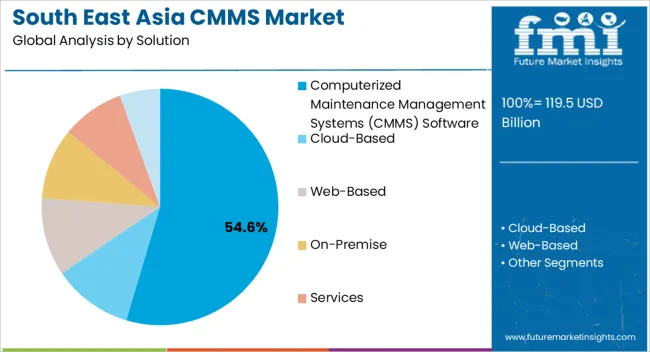

The CMMS software solution segment is expected to hold 54.60% of the total market revenue by 2025, making it the dominant solution type. Growth in this segment is driven by its ability to centralize maintenance operations, automate scheduling, and optimize asset lifecycle management.

CMMS software enables organizations to track work orders, monitor inventory, and reduce downtime while ensuring compliance with safety and operational standards. Enhanced cloud deployment models and mobile accessibility are also improving user adoption across businesses of all sizes.

The demand for actionable insights through data analytics and performance reporting has further strengthened the position of CMMS software as the preferred solution within the market.

South East Asia computerized maintenance management systems (CMMS) market witnessed a CAGR of 5.5% from 2020 to 2025. It is likely to exhibit a CAGR of 8.3% in the assessment period from 2025 to 2035.

A CMMS can aid in compliance with safety and regulatory standards. It can also support data-driven decision-making for maintenance and capital planning.

A CMMS is an essential tool for any organization looking to improve maintenance efficiency and maximize asset value. By automating maintenance tasks, a CMMS can also reduce the risk of human error and improve the accuracy of maintenance records. It can lead to better asset management and increased productivity in the end.

Top South East Asia CMMS Market Trends Listed by Future Market Insights (FMI):

Industries in Singapore to Adopt Asset and Maintenance Management Software to Reduce Downtime

Several industries in Singapore rely on complex equipment such as manufacturing machinery, shipping vessels, and aviation equipment to operate. A CMMS helps organizations to manage the maintenance and repair of their equipment. It further ensures that it operates at peak efficiency and minimizes downtime.

By using a CMMS, organizations can also track the performance of their equipment over time. It allows them to make data-driven decisions about when to replace or upgrade their assets. It can help a company’s unnecessary expenditure by avoiding costly breakdowns and extending the lifespan of their equipment.

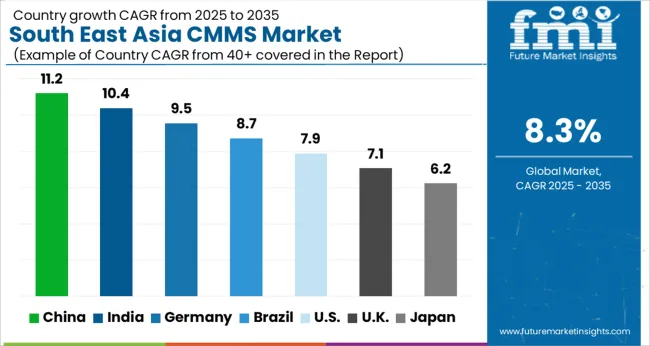

Industries in Singapore are expanding their reach by using CMMS. It makes it easier for them to persevere in ongoing operations in an efficient manner. It would help Singapore to exhibit around 10.4% CAGR from 2025 to 2035.

Malaysia-based Firms to Demand Computerized Maintenance Software to Improve Productivity

CMMS can help organizations in Malaysia better manage their assets. It provides them with detailed information about their maintenance history, conditions, and lifecycle. By using this information, organizations can make data-driven decisions about when to repair or replace assets, which can help them maximize their return on investment.

CMMS can also help organizations track inventory and supplies, ensuring that they have the necessary parts and materials on hand to complete maintenance tasks. It can help reduce downtime and improve productivity. Maintenance teams are able to quickly access the parts they need without having to wait for orders to be fulfilled.

CMMS is a powerful tool that can help organizations in Malaysia streamline their maintenance operations, improve asset management, and ensure compliance with regulatory requirements.

As more organizations recognize the benefits of adopting CMMS, it is becoming an increasingly popular solution in Malaysia's industrial landscape. Malaysia is projected to expand at a CAGR of 10.3% in the South East Asia computerized maintenance management system market through 2035.

Companies in Vietnam to Adopt CMMS for Manufacturing to Increase Asset Lifespan

Vietnam has been undergoing rapid industrialization over the past decade, which has resulted in growth of various manufacturing industries. There is hence a growing need for maintenance management solutions to keep up with maintenance needs of these industries.

There is now a greater awareness of the benefits of regular maintenance, which has led to increasing CMMS demand. Companies are realizing that implementing a CMMS can help reduce downtime, increase asset lifespan, and improve their productivity.

Adoption of technology in Vietnam is on the rise, and businesses are increasingly turning to software solutions to help manage their operations. There is a growing demand for CMMS solutions as businesses look to streamline their maintenance processes. The country is estimated to showcase a CAGR of 6.3% in the next ten years.

Energy & Utility Companies to Use Maintenance Management System Software to Prevent Equipment Failure

Based on industry, the energy & utilities sub-segment under infrastructure segment is estimated to remain at the forefront by 2035. Computerized maintenance management systems (CMMS) are widely used in South East Asia energy and utilities sector.

These are required to manage the maintenance of critical infrastructure such as power plants, transmission lines, and distribution networks. CMMS helps energy & utilities companies to optimize maintenance activities, reduce downtime, and improve equipment reliability.

One of the key benefits of using CMMS in this sector is that it enables companies to schedule preventive maintenance tasks based on criticality of the equipment. It further helps to reduce the risk of equipment failure and unplanned downtime.

CMMS also allows energy & utilities companies to track the performance of their equipment, identify potential problems, and schedule maintenance activities accordingly. It helps to minimize the total cost of ownership of equipment.

It identifies equipment that needs to be replaced or upgraded before it fails. The sub-segment had generated a market share of 41.2% in 2025.

Computerized Maintenance Software to Help Telecommunication Companies Support Service Delivery

Use of computerized maintenance management systems (CMMS) in the telecommunications industry is expected to drive growth in the market. The telecommunication industry relies heavily on a vast network of equipment and infrastructure to support the delivery of services such as voice, data, and video transmission. Efficient management of maintenance operations is hence critical to ensuring optimal network performance and reducing downtime.

CMMS software can help telecommunications companies in South East Asia manage their maintenance operations more effectively. It provides real-time insights into equipment performance.

It further helps in automating work order scheduling & tracking and enabling preventive maintenance. It can help to reduce downtime, improve equipment reliability, and extend the lifespan of assets, which can result in significant cost savings. The telecommunication industry sub-segment is projected to showcase a CAGR of 7.8% in the next ten years.

On-premise CMMS for Maintenance to Witness High Demand as Need for Customization Rises

On-premise CMMS software refers to software that is installed and runs on an organization's own servers or computers. It is in contrast to cloud-based CMMS software, which is hosted on remote servers and accessed via the internet. A few organizations might have security concerns about storing their maintenance data in the cloud.

On-premises CMMS software allows organizations to keep their data on their own servers, where they have complete control over its security. It also gives organizations more control over their maintenance data. They can choose when and how to back up the data and do not have to put about internet connectivity or cloud service disruptions.

On-premises CMMS software can further offer more control, customization, and security over their maintenance data. The service requires more upfront costs and ongoing maintenance compared to cloud-based solutions. On-premises services provide security and control over the maintenance management systems.

Such a software solution can often be customized to fit the specific needs of an individual company, providing a more tailored experience for users. The segment accounted for a considerable market share of 44.9% in 2025.

Medium-sized Enterprises to Use Low-cost CMMS Software to Track Work Orders

Medium-sized enterprises use CMMS to schedule preventive maintenance tasks such as inspections, lubrication, and cleaning. By scheduling maintenance tasks in advance, they can ensure that equipment is well maintained. It can further help to reduce downtime and extend the life of assets.

CMMS allows medium-sized enterprises to create, manage, and track work orders. It includes assigning tasks to specific maintenance staff, tracking the progress of work orders, and closing out completed work orders.

It further helps to ensure that maintenance activities are organized and completed on time. The segment is projected to generate a market share of 28.1% in 2025.

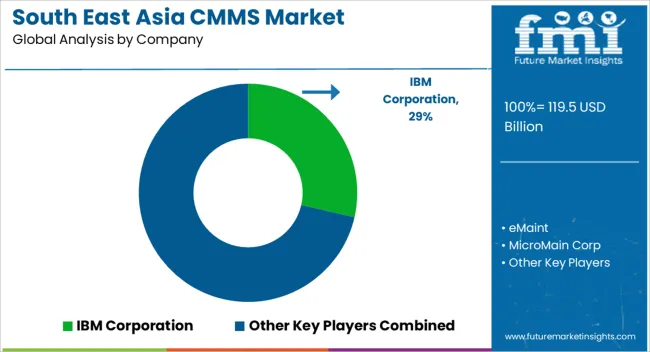

South East Asia CMMS market is getting highly competitive with a number of established players. These players offer a wide range of maintenance solutions such as preventive maintenance scheduling, work order management, and asset management.

Recent developments:

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 119.5 billion |

| Projected Market Valuation (2035) | USD 265.3 billion |

| Value-based CAGR (2025 to 2035) | 8.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value (USD million) |

| Key Countries Covered | Singapore, Malaysia, Thailand, Philippines, Vietnam, Indonesia, Rest of South East Asia |

| Key Segments Covered | The solution, Enterprise Size, Industry, and Country |

| Key Companies Profiled | IBM Corporation; eMaint; MicroMain Corp; Infor; Maintenance Connection (Accruent); Hippo CMMS; Limble CMMS; Rockwell Automation (Fiix Inc.); UpKeep; Dude Solutions; Connecteam; Maintain X |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global south east asia CMMS market is estimated to be valued at USD 119.5 billion in 2025.

The market size for the south east asia CMMS market is projected to reach USD 265.3 billion by 2035.

The south east asia CMMS market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in south east asia CMMS market are computerized maintenance management systems (cmms) software, cloud-based, web-based, on-premise, services, consulting services, _integration & implementation services and _support & maintenance.

In terms of enterprise size, small offices (1 to 9 employees) segment to command 42.5% share in the south east asia CMMS market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Southeast Asia Submersible Pumps Market Growth – Trends & Forecast 2025 to 2035

Southeast Asia Pet Care Market Trends – Demand, Growth & Forecast 2022-2032

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

East Asia Automotive Semiconductors Market - Trends & Forecast 2025 to 2035

Demand for Geosynthetics in South Asia Size and Share Forecast Outlook 2025 to 2035

Geosynthetics Industry Analysis in South Asia Growth - Trends & Forecast 2025 to 2035

Asia & MEA PET Bottle Market Trends & Industry Forecast 2024-2034

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Safety and Process Filter Market Growth – Trends & Forecast 2024-2034

Eldercare-Assistive Robots Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

South Africa Faith-Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Tomato Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Loop-mediated Isothermal Amplification (LAMP) Market Size and Share Forecast Outlook 2025 to 2035

Asian Sea Bass Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Sachet Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Stick Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Asia Pallets Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific and Europe Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA