The South Africa faith-based tourism market is witnessing steady growth driven by the increasing interest in religious and cultural travel experiences that connect visitors with the country’s spiritual heritage. The future outlook is shaped by the rising participation in pilgrimage activities, cultural festivals, and heritage routes linked to faith and spirituality. Growing support from local authorities and religious institutions to promote spiritual tourism has enhanced accessibility to significant religious landmarks and sacred sites.

The increasing awareness among both domestic and international travelers about South Africa’s diverse spiritual traditions, including Christianity, Islam, Hinduism, and indigenous faiths, has expanded the tourist base. Improved transportation networks, digital outreach initiatives, and government-backed tourism campaigns are strengthening the market presence.

Moreover, the integration of sustainable tourism practices and community-based initiatives is adding cultural depth to faith-oriented travel experiences As faith tourism continues to be viewed as a medium for spiritual enrichment and social connection, South Africa is expected to remain a key destination in the global faith-based tourism landscape.

| Metric | Value |

|---|---|

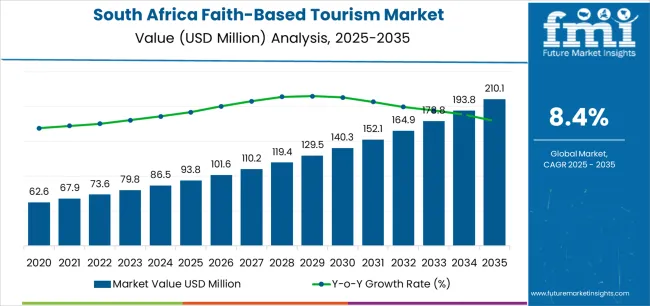

| South Africa Faith-Based Tourism Market Estimated Value in (2025 E) | USD 93.8 million |

| South Africa Faith-Based Tourism Market Forecast Value in (2035 F) | USD 210.1 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The market is segmented by Tourism Type, Booking Channel, Tourist Type, Tour Type, Consumer Orientation, and Age Group and region. By Tourism Type, the market is divided into Pilgrimages, Day Trips & Local Gateways, Museums, Religious And Heritage Tours, and Others. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking. Based on Tourist Type, the market is segmented into Domestic and International. By Tour Type, the market is divided into Package Traveler, Independent Traveler, and Tour Group. By Consumer Orientation, the market is segmented into Women and Men. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

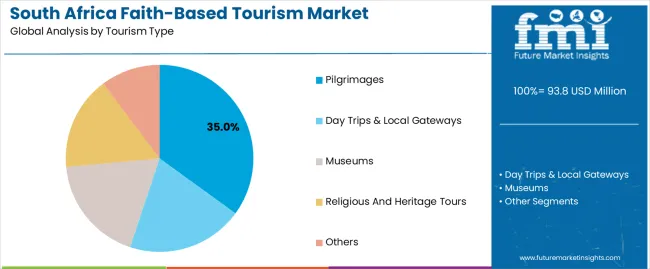

The pilgrimages segment is projected to hold 35.0% of the South Africa faith-based tourism market revenue share in 2025, making it the leading tourism type. This growth is attributed to the country’s expanding network of pilgrimage destinations that hold deep religious and historical significance.

Increased organization of guided pilgrimage tours by travel operators has made faith-based travel more accessible to a broader audience. Supportive initiatives by local tourism boards have also encouraged the development of infrastructure surrounding key pilgrimage sites, improving the overall travel experience.

Additionally, the growing inclination toward meaningful and spiritual travel among older and middle-aged populations has reinforced the demand for pilgrimage-oriented journeys The emphasis on authenticity, reflection, and community connection continues to drive interest in this segment, strengthening its leading position in the market.

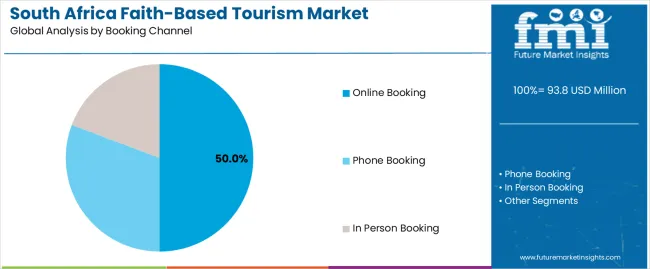

The online booking channel segment is expected to capture 50.0% of the South Africa faith-based tourism market revenue share in 2025, positioning it as the dominant booking mode. This growth has been influenced by the rapid digitalization of the tourism sector and the increasing reliance of travelers on online platforms for convenience and cost transparency.

The rise of mobile booking applications and dedicated faith-tourism portals has made it easier for travelers to plan personalized itineraries, compare prices, and access real-time information. The availability of secure payment systems and instant confirmations has further boosted consumer confidence in online bookings.

Additionally, social media marketing and digital storytelling about spiritual destinations have encouraged higher engagement among tech-savvy travelers The segment’s continued expansion is supported by the integration of artificial intelligence and data-driven personalization tools, allowing tour operators to enhance the faith-based travel experience through tailored recommendations and seamless digital interactions.

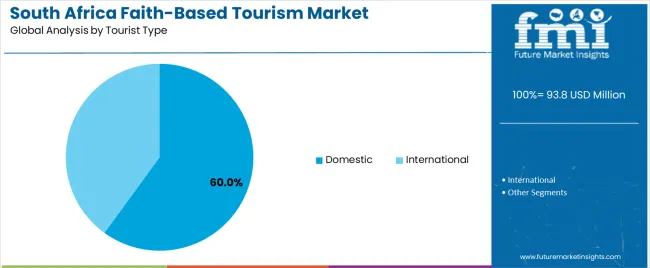

The domestic tourist type segment is anticipated to account for 60.0% of the South Africa faith-based tourism market revenue share in 2025, establishing it as the leading tourist category. This growth is primarily driven by the increasing participation of local travelers in religious events, spiritual retreats, and heritage tours across the country. Economic affordability and cultural familiarity have strengthened domestic travel for faith-based purposes.

Government efforts to promote intra-country tourism and the organization of national faith-based festivals have significantly increased local tourist engagement. The growing sense of cultural pride and spiritual identity has encouraged more South Africans to explore pilgrimage routes and heritage sites within the nation.

Furthermore, the domestic segment benefits from shorter travel distances, lower costs, and flexible booking options, making it an appealing choice for regular faith travelers As the focus on rediscovering local spirituality continues to grow, the domestic tourism segment is expected to remain the backbone of the country’s faith-based tourism market.

The demand in the South African faith-based tourism market is forecast to increase at a robust ~8.4% CAGR over the forecast period, in comparison to the CAGR of 8.0% registered between 2020 to 2025.

Tourism is a major industry in South Africa and plays a large role in the economy of the country. Culturally and religiously, South Africa is a diverse nation with a wealth of cultural and religious practices. South Africa offers a variety of faith-based experiences across different religions, including Christianity, Islam, Hinduism, Judaism, and indigenous African spiritual traditions.

The existence of several African-initiated churches such as Zion Christian church and Nazareth Baptist church attracts several travellers during religious journeys attracting travellers to South Africa.

Over the past few years, religious tourism is one of the tourist niche markets, has experienced significant development in the last few years. According to UN Tourism, religious tourism is all forms of tourism that are motivated by religious faith or have the primary purpose of visiting places of worship, participating in religious ceremonies, or witnessing religious events. The growth of religious tourism is attributed to several factors, including increased religious affiliation, the search for spiritual fulfillment, and the desire to experience different cultures.

Religious tourism is steadily becoming popular and South Africa is among the fastest-growing destinations for it. Millennials and young adults across the globe are not only interested in the serene beauty of South Africa, but they are also eager to explore cultural heritage sites, hidden temples, and other wellness-based spots to relax.

Halal tourism in South Africa presents significant opportunities for stakeholders in the faith-based tourist industry to diversify their clientele. In South Africa and throughout the world, halal tourism is emerging.

Muslim culture is a significant part of South Africa's national legacy, making it essential to the country's tourist business. Additionally, the nation is collaborating with Dnata World Travel to promote halal tourism in Gulf Cooperation Countries (GCC), particularly in Cape Town.

Easter is the busiest time of year for religious travel in South Africa. For instance, many individuals have made visits to Buffalo City in the EC with the intention of bringing the community spiritual healing, inspiration, and renewal.

India remains a core market for South African Tourism globally and holds considerable opportunities in the target market. In the previous year, South Africa welcomed more than 50,000 Indian travellers to the Rainbow Nation. India is the sixth largest international source market and remains one of the top three focus markets for South African tourism globally.

The South African government has acknowledged the immense potential for economic growth and job creation within the faith-based tourism industry. The recognition is demonstrated by the establishment of a dedicated National Department of Tourism and the expansion of the tourism portfolio, underscoring their commitment to promoting the target market.

The Ministry of Tourism is also concentrating on broadening the product base to ensure industry competitiveness. The creation of policies, encouragement and the execution of initiatives to promote high-quality, cost-effective tourist goods have been given top attention in order to boost the competitiveness of the nation's tourism industry.

Religious pilgrimages in South Africa create significant positive spin-offs by boosting local economies, promoting cultural exchange, and fostering community development. Pilgrims visit sacred sites and spend on accommodations, food, transportation, and souvenirs, which support local businesses and create jobs.

Additionally, these pilgrimages help promote cultural diversity and acceptance as people from different cultures come together to celebrate their heritage. The increased visitor traffic also leads to better infrastructure and the protection of religious and cultural landmarks, benefiting both locals and tourists.

Religious and Heritage Tours Are Gaining Popularity Among Young Adults

| Tourism Type | Religious and Heritage Tours |

|---|---|

| Value Share (2025) | 27.9% |

Based on tourism type, religious and heritage tours are expected to emerge as the most lucrative segment in the South Africa faith-based tourism market. Religious and heritage tours have become increasingly popular among young adults in South Africa, driven by a growing interest in cultural exploration and spiritual experiences.

The demographic is drawn not only to the scenic beauty of locations like Cape Town but also to the opportunity to engage with diverse cultural and religious practices. The rise of customized tours and the promotion of halal tourism further cater to this trend, highlighting the economic significance of religious tourism in the region.

Sales of Packaged Tours Will Continue to Increase

| Tour Type | Package Travellers |

|---|---|

| Value Share (2035) | 46.1% |

Packaged tours are preferred by tourists due to the convenience and comprehensive nature of offerings. Tour operators provide a range of customizable packages including transportation, accommodations, guided visits to religious sites, and other amenities, making travel planning easier and more efficient for pilgrims.

Packages often cater to specific religious needs such as halal food options and prayer facilities, enhancing the overall travel experience. The structured nature of packaged tours also ensures that tourists can focus on their spiritual journey.

Tourists are Preferring Online Booking for Hassle-free Experience

| Booking Channel | Online Booking |

|---|---|

| Value Share (2035) | 41.3% |

In terms of booking channels, the online booking channel is the most preferred by the faith-based tourist. Due to its convenience, accessibility, and the ability to customize travel plans. Digital platforms allow travelers to easily compare packages, read reviews, and book accommodations, transportation, and guided tours tailored to their religious needs.

Supported by the integration of technology in the tourism sector, enhances the overall travel experience by providing seamless and efficient planning options. As a result, online booking has become a popular choice for spiritual travellers.

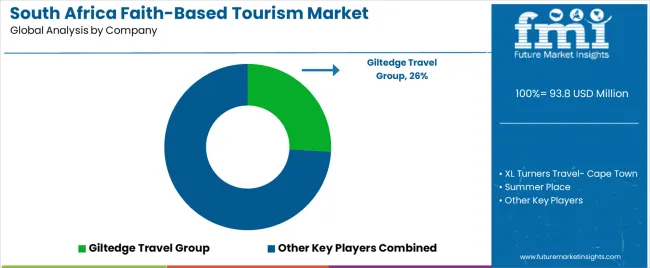

The competitive landscape of faith-based tourism in South Africa is characterized by a diverse array of stakeholders, including religious institutions, tour operators, accommodations, and local communities. These entities collaborate to offer comprehensive and cohesive faith-based tourism experiences, catering to various religious groups and their specific needs.

For instance

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million for Value |

| Key Country Covered | South Africa |

| Key Segments Covered | Tourism Type, Booking Channel, Tourist Type, Tour Type, Customer Orientation, Age Group |

| Key Companies Profiled | XL Turners Travel- Cape Town; Summer Place; Wanderer Cape Town Tours & Travel- Private Capes Town Tours; Club Traveler; ILIOS Travel (Pty) Ltd; Kabura Travel & Tour; Hotspots2c; The Cape Town Tour Guide Company; Nomad Africa Adventure Tours; Springbok Atlas; Giltedge Travel Group; Earthstompers Adventures; Halal Tourism Africa |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global south africa faith-based tourism market is estimated to be valued at USD 93.8 million in 2025.

The market size for the south africa faith-based tourism market is projected to reach USD 210.1 million by 2035.

The south africa faith-based tourism market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in south africa faith-based tourism market are pilgrimages, day trips & local gateways, museums, religious and heritage tours and others.

In terms of booking channel, online booking segment to command 50.0% share in the south africa faith-based tourism market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

South Africa Casino Tourism Market Size and Share Forecast Outlook 2025 to 2035

South Africa Safari Tourism Market Analysis – Growth, Trends & Forecast 2025-2035

Trends, Growth, and Opportunity Analysis of Sports Tourism in South Africa Size and Share Forecast Outlook 2025 to 2035

South Korea Tourism Market Trends - Growth, Demand & Analysis 2025 to 2035

South America Tourism Market Growth – Trends & Forecast 2024-2034

Africa Adventure Tourism Market Analysis - Growth & Forecast 2025 to 2035

South Korea Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Safari Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Adventure Tourism in Africa Market Size and Share Forecast Outlook 2025 to 2035

Middle East and Africa (MEA) Tourism Security Market Analysis 2025 to 2035

Australia and South Pacific islands Tourism Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

South East Asia CMMS Market Size and Share Forecast Outlook 2025 to 2035

South Korea Intellectual Property Market Size and Share Forecast Outlook 2025 to 2035

Southern Blotting Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Africa’s Zero Liquid Discharge System Market - Size, Share, and Forecast 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA