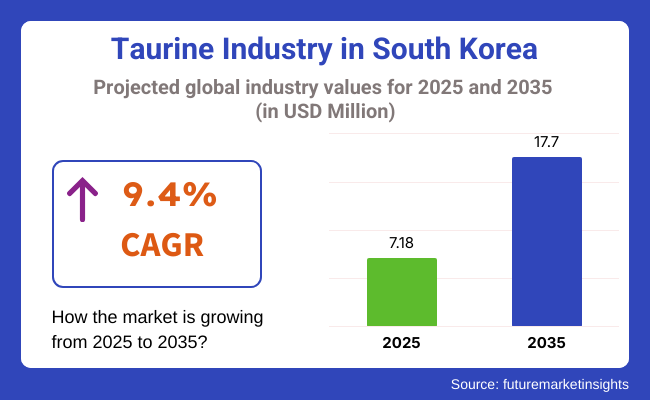

The taurine industry in South Korea is expected to reach a size of USD 7.18 million in 2025 and is projected to grow at a compound annual growth rate (CAGR) of 9.4% from 2025 to 2035, reaching USD 17.7 million by 2035.

The amino acid, naturally formed in the body, gained popularity in South Korea due to its immense health benefits, including energy-boosting capacity, exercise performance enhancement, and provision of cardiovascular support.

Currently, this amino acid has been commercially consumed through energy drinks, which have become part and parcel of young adults' daily routines, mostly among students and professionals seeking a fast energy boost and enhanced alertness from energy drinks.

There is an increasing trend for this amino acid as it serves to assert that taurine-based drinks are a safer and more natural alternative to caffeine and sugar use. Output benefits now include the aspects of heart and brain health, putting it in a prime position to be incorporated into a whole range of products such as dietary supplements, functional beverages, and even snacks.

The growing demand for taurine corresponds with the demographic characteristics of South Korea, which are changing toward an elderly population. Older people are progressively requesting items that look into general health features, particularly cardiovascular function, cognitive health, and energy levels. These trends are already pushing further toward establishing taurine preferences in functional foods.

Important main consumers tend to promote taurine in clean labels, which define products based on their transparent state and natural composition of ingredients. South Korea gives consumers a choice to be more conscious of ingredients in food and beverage products. In that respect, this amino acid is being acknowledged as one of those naturally sourced and efficacious ingredients that fit the clean label movement.

South Korea's extraordinary beverage and dietary supplement industries will continually drive up the demand. With the rise in popularity of functional beverages and the trend towards customized health benefits, applications are expected to rise across products aimed at stimulating alertness, energy, and general wellness. Novel innovationsare expected and implemented by South Korean manufacturers in combination with other functional ingredients.

In 2025, the industry will be primarily driven by food-grade taurine in Korea, which accounts for 44.1% of the market, while feed-grade taurine accounts for 17.8% of the overall share. The food-grade segment is by far the most important segment in Korea, with predominant application in functional foods and beverages.

The Taiwan-in-energy drinks were medically monitored for many benefits, including nutrients, food products, diet supplements, drink products, and influential foods-to-the-sustaining fitness performance, mental clarity, and health. The launch of health and wellness products for fitness-conscious customers in Korea has increased taurine's ability to be included in energy drinks and fortified beverages.

Major players, Coca-Cola "Monster Energy" and local players like Lotte Chilsung "Pocari Sweat" combine taurine in their formulations aimed at the young and active consumer group. Soluble capsules and taurine are also used in nutritional and nutraceutical supplements.

These products claim to augment cardiovascular health, support liver function, and provide general health benefits. According to specific formulations of Korea Ginseng Corporation and Amorepacific, taurine is indeed within the consideration of formulas, targeted for consumers who seek energy and health factors in the product.

Feed-grade form exists on a small scale but remains a significant segment, particularly in the animal feed industry. Some animals, such as cats, require this amino acid because it is not synthesized naturally, so proper metabolic functioning is not accomplished. With the increased demand for high-end pet food in Korea, taurine has become one of the relevant ingredients for supporting the nutritional profile of such products.

Top pet food manufacturers, such as Orion Corporation and Nestlé Purina, have taurine in products aligned to the health of pets, and more particularly, cats. Besides this, taurine is also incorporated in aquaculture feeds in order to enhance the welfare and growth of cultured fish, especially in those parts of the world where fish farming has become a major industry.

South Korea is expected to witness food-led growth, accounting for 40.6% of revenues by 2025, while the beverage industry accounts for 26.8%. The reason for the lead is the fact that taurine has an enormous number of applications in functional foods. They are added to energy bars, fortified snacks, and ready-to-eat meals, among other things.

These have been the source of specifically good functional food options for consumers' health needs, wanted for energy level, metabolism, and wellness benefits. The products of the top food companies in Korea, such as CJ CheilJedang and Lotte Confectionery, have taurine in these products according to the increasing demand for making more practical, health-enhancing options.

They can also be found in dairy products like functional yogurts and nutraceuticals geared towards specific health benefits like heart health and eye function. Because of the ongoing interest in preventing illnesses and being actively fit, taurine can now be traced to most products that provide benefits for consumers.

Another major application of this amino acid is in the beverage sector, as the increasing demand for energy drinks and functional beverages drives the application of taurine. It increases physical performance, improves mental clarity, and endures energy drinks; it is an inevitable ingredient.

Popular names like Red Bull and Monster and local brands like Lotte Chilsung's "Gatorade" and "Pocari Sweat" contain taurine in formulation to entice young, active consumers. The growing demand for sports drinks and fortified beverages due to active lifestyle culture also drives taurine's presence in this sector.

The South Korean industry is growing fast and is powered mainly by energy drinks, functional beverages, and dietary supplements. The beverage industry in this country is growing, wherein energy drinks and health-conscious functional products are achieving heightened popularity among consumers seeking to enhance their performance and vitality and gain health benefits. Taurine in these products is a much-appreciated substance, noted for beneficial effects related to energy, cognitive function, and cardiovascular health.

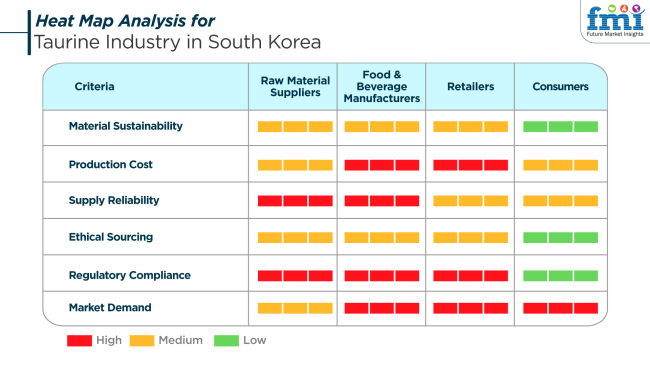

According to raw material suppliers, the sustainability of materials is a medium concern in South Korea (yellow). While taurine is primarily synthesized in production, with a current emphasis on environmental sustainability owing to global trends, suppliers do guarantee that taurine is delivered reliably, with great importance placed on supply reliability so that local manufacturers can meet their production demands. The costs of production are medium. These sources are held in ethical esteem, although less so than sustainability.

For South Korean manufacturers of food and beverages, the cost of production and compliance with regulatory standards are of utmost importance. Since taurine remains one of the ingredients in energy drinks, which are quite popular in the country, compliance with regulations is paramount. Manufacturers have to comply with very stringent local rules about food safety and health claims on taurine-containing products.

Adherence to such regulations ensures that products fulfill safety and health efficacy claims. Energy drinks and functional beverages in South Korea have become popular; thus, the demand for their taurine products is quite high, and manufacturers are innovating on an almost daily basis to catch the trends arising from consumer preferences.

Retailers in South Korea put priority on market demand as opposed to production costs. There is a high consumer demand for energy drinks and dietary supplements, which retailers are stockpiling to make a profit. Effective production costs and reliable supply are important considerations; however, keeping consumer interest in health-related products is paramount. Retailers ensure that taurine-laden products are available to satisfy consumer demand for functional beverages. Supply reliability is important but subordinate to meeting consumer expectations and safety requirements.

(Stakeholders: Raw Material Suppliers, Food & Beverage Manufacturers, Retailers, Consumers)

From 2020 to 2020 to 2024, South Korea experienced considerable growth as health and wellness increased among consumers. The prevalence of lifestyle diseases like obesity and diabetes led to increased demand for diet supplements.

The amino acid possesses antioxidants and cardiovascular benefits, also became popular for use in the manufacturing of functional foods, beverages, and supplements. The rapidly aging population of South Korea added to the pressure for supplements with healthy aging support.

During the forecast period 2025 and 2025 to 2035, South Korea is expected to maintain its growing trend.Food technology and formulation innovations are poised to create a range of products with better bioavailability and effectiveness.

Growing demand for healthy eating habits and customized nutrition will further support demand for taurine supplements. The focus on sustainable sourcing and transparent labeling will also gain critical importance in supporting consumer needs and regulatory requirements.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Health-conscious consumers interested in antioxidant-based, cardiovascular health supplements | Ongoing focus on health and wellness, with an emphasis on individualized nutrition |

| Functional foods, beverages, dietary supplements | Growing application in individualized nutrition solutions and sophisticated formulations |

| Adherence to food safety and labeling laws | Expected more stringent regulations influencing product development and ma rketing |

| The growing population of aging adults, rising incidence of lifestyle-related health problems | Growing interest in customized nutrition and clean-label, sustainable products |

| Formulation development with enhanced bioavailability | Launch of personalized products and sustainable product ranges |

South Korea is the most profitable region for this amino acid, which is attributed to the increasing rise in consumer demand for functional beverages and dietary supplements. For instance, the free amino acid is said to enhance performance, improve heart health, and boost general wellness, widely accepted as an ingredient in energy drinks, sports nutrition, and health supplements. The market expansion is sustained by increasing awareness of health among Korean consumers as well as the rise of fitness and wellness trends.

However, the industry also faces key hurdles that might impede its growth. The regulatory landscape poses a great risk, with the stringent regulations enforced by the South Korean government regarding food additives and supplements. Any change in this regard or setback in approving its products, therefore, can come along as a detrimental impediment to market entry and product availability.

Further, supply chain vulnerabilities concerning taurine-based products, which include dependency on imports of its raw materials and any unfriendly disruptions in the global trade system, can hamper the steady supply and inflate production costs.

Another consideration would be the competitive environment. The market is getting quite saturated with the influx of various brands marketing products containing taurine, thus intensifying competition. Companies will have to innovate, maintain assurance of quality, and devise successful marketing strategies to gain a competitive advantage.

Ultimately, consumer perception and education are equally contributive to boosting growth in the industry. Some consumers may have some confusion or limited knowledge regarding the amino acid, while there is enough recognition among Interested ones regarding its benefits. To win consumer acceptance and help promote the usage of products containing taurine, educational programs and transparent communication are indispensable.

South Korea is experiencing huge growth, driven by expanding applications in the energy drinks industry, functional beverages, dietary supplements, and pharmaceutical preparations. Taurine, a sulfur-containing amino acid-like compound, is extremely well recognized for performing many functions in cardiovascular function, muscle performance, central nervous system health, and cell hydration.

South Korea's rapid life, urban high-energy work environment, and competitive education system have been propelling the consumption of energy-boosting products, of which this amino acid is a constituent functional ingredient. Energy beverages are the most pervasive use of taurine in South Korea.

Both overseas and domestic beverage brands dominate the industry and integrate amino acids to enhance mental performance, boost energy, and increase endurance. Exclusively outside energy drinks, taurine is increasingly being incorporated throughout sports nutrition products marketed for athletes and fitness lifestyle consumers needing sustained physical effort and muscle recuperation.

Taurine awareness of the drug's potential impact on ocular health and management of the cardiovascular system has also supported its use throughout dietary supplements intended for middle-aged and older populations.

The country's advanced production plants and product safety focus have made mass production of high-purity taurine for internal consumption and overseas export possible. In addition, the government's innovative policy on functional food research and development, as well as cooperative regulatory mechanisms, has encouraged R&D in products containing taurine.

Increased penetration in customized nutrition, increased consumer interest in amino acid-derived wellness products, and the rise of direct-to-consumer supplement companies have all combined to drive up market penetration for taurine.

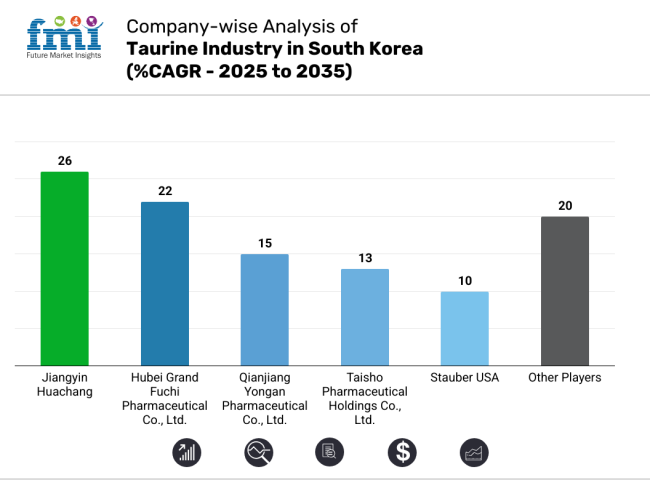

South Korea relies heavily on imports from other countries; thus, Chinese manufacturers and global ingredient distributors take a leading role as suppliers. Jiangyin Huachang and Hubei Grand Fuchi Pharmaceutical & Chemicals Co., Ltd. have ranked their way up the list of top exporters to Korea.

They can offer pharmaceutical and food-grade taurine at low prices. Their strength in South Korea can be attributed to their long-term established logistics networks, their KFDA-compliant formulations, and their tie-ups with Korean food and energy drink manufacturers.

Qianjiang Yongan Pharmaceutical Co., Ltd. is continuing to penetrate the Korean market by providing taurine through specialized B2B ingredient traders. These three producers from China combined account for the volume of taurine imports in Korea, targeting functional beverage manufacturers for consumption and animal nutrition applications.

Taisho Pharmaceutical Holdings Co., Ltd. is a Japanese brand. Still, its presence is now felt in Korea, given the popularity of taurine-infusion of OTC energy tonics, mostly sold at convenience retail outlets. Western companies like Stauber USA and Atlantic Chemicals Trading GmbH tap high-purity niches by leveraging their global distribution networks that could serve taurine for clinical and nutraceutical applications.

Other companies like AuNutra Industries Inc., Avanscure LifeSciences Pvt. Ltd., and New Zealand Pharmaceuticals Ltd. also contribute to the multiplicity of engines in sourcing, giving varied taurine grades according to the different regions for quality versus price. The industry is highly competitive in Korea, as in many other countries, and is driven by lower costs globally, very stringent purity levels in the applications, and the customization of ingredients.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Jiangyin Huachang | 22-26% |

| Hubei Grand Fuchi Pharmaceutical Co., Ltd. | 18-22% |

| Qianjiang Yongan Pharmaceutical Co., Ltd. | 12-15% |

| Taisho Pharmaceutical Holdings Co., Ltd. | 10-13% |

| Stauber USA | 7-10% |

| Other Players | 15-20% |

Key Company Insights

Jiangyin Huachang leads Korea’s taurine supply landscape with an estimated share of 22-26%. Its strategic advantage lies in high-volume production capacity, consistent export compliance, and reliable distribution channels established with Korean food processors and energy drink brands. As Korean manufacturers seek cost-effective, pharmaceutical-grade taurine, Huachang remains a preferred supplier.

Hubei Grand Fuchi Pharmaceutical & Chemicals Co., Ltd. follows closely with a share of 18-22%, known for its robust quality management systems and scalable taurine production. The company’s emphasis on customized bulk orders and documentation alignment with Korean health regulations enhances its credibility. Qianjiang Yongan Pharmaceutical maintains a 12-15% share through agile export operations and partnerships with local distributors focused on nutraceutical and pet nutrition markets.

Taisho Pharmaceutical Holdings, with a 10-13% share, leverages brand recognition from its taurine-based health drinks, which enjoy moderate retail penetration in Korea. Stauber USA occupies a niche of 7-10% of the share, targeting supplement and functional food producers who demand high-purity taurine with traceable sourcing and technical support. The industry is distributed among smaller international firms offering customized grades, often valued for flexible order sizes and differentiated quality profiles.

The segmentation is into Food Grade, Feed Grade, Pharmaceuticals Grade, and Others.

The segmentation is into Food (such as Dairy Products, Infant, Bakery Products, and Cereal Products), Beverage (including Energy Drinks, Caffeinated Drinks, and Soft & Carbonated Drinks), Animal Feed (such as Aquaculture Feed and Poultry Feed), Pet Food (including Cat Food and Dog Food), Pet Supplements (such as Cat Supplements and Dog Supplements), Dietary Supplements, Cosmetics & Personal Care (including Skin Care Products, Hair Care Products, and Toiletries), Agriculture, and Pharmaceuticals.

The regions covered include South Korea, including South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the Rest of Korea.

The taurine market in South Korea is expected to reach USD 7.18 million in 2025.

The industry valuation is projected to grow to USD 17.7 million by 2035.

The industry is expected to grow at a CAGR of approximately 9.4% during the forecast period.

The food-grade segment is a key segment in the South Korean taurine market.

Key players include Jiangyin Huachang, Hubei Grand Fuchi Pharmaceutical & Chemicals Co., Ltd., Qianjiang Yongan Pharmaceutical Co., Ltd., Taisho Pharmaceutical Holdings Co., Ltd., Stauber USA, Avanscure LifeSciences Pvt. Ltd., Atlantic Chemicals Trading GmbH, The Honjo Chemical Corporation, AuNutra Industries Inc., and New Zealand Pharmaceuticals Ltd.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 8: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 11: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 12: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 13: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 16: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 17: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 20: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 21: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Grade, 2018 to 2033

Table 24: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Grade, 2018 to 2033

Table 25: Rest of Industry Analysis and Outlook Value (US$ Million) Forecast by Application, 2018 to 2033

Table 26: Rest of Industry Analysis and Outlook Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 9: Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 10: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 11: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 12: Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 17: Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 18: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 19: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 20: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 21: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 22: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 23: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 24: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 27: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 28: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 29: South Gyeongsang Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 30: South Gyeongsang Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 31: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 32: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 33: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 34: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 35: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 36: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 37: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North Jeolla Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 42: North Jeolla Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 43: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 44: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 45: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 46: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 47: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 48: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 49: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 50: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 51: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 52: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 53: South Jeolla Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 54: South Jeolla Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 55: Jeju Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 56: Jeju Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 57: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 58: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 59: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 60: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 61: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Jeju Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 66: Jeju Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Figure 67: Rest of Industry Analysis and Outlook Value (US$ Million) by Grade, 2023 to 2033

Figure 68: Rest of Industry Analysis and Outlook Value (US$ Million) by Application, 2023 to 2033

Figure 69: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Grade, 2018 to 2033

Figure 70: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Grade, 2018 to 2033

Figure 71: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Grade, 2023 to 2033

Figure 72: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Grade, 2023 to 2033

Figure 73: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 74: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Application, 2018 to 2033

Figure 75: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Rest of Industry Analysis and Outlook Attractiveness by Grade, 2023 to 2033

Figure 78: Rest of Industry Analysis and Outlook Attractiveness by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Taurine Market Size and Share Forecast Outlook 2025 to 2035

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Taurine Industry in Western Europe - Trends, Market Insights & Applications 2025 to 2035

Demand for Taurine in EU Size and Share Forecast Outlook 2025 to 2035

Industry 4.0 Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Germany Outbound Tourism Market Trends – Growth & Forecast 2024-2034

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

DOAS Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Pectin Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA