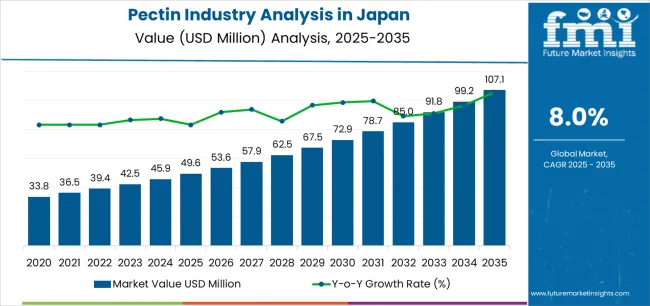

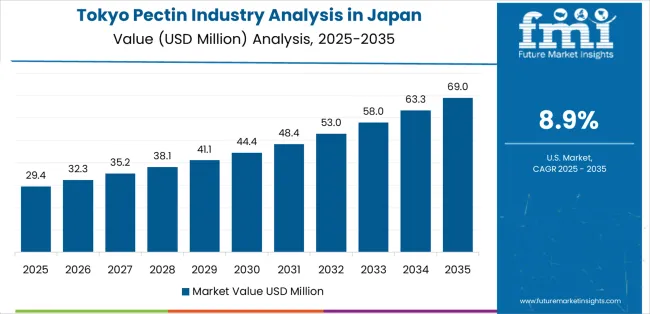

The demand for pectin in Japan is projected to expand from USD 49.6 million in 2025 to USD 107.1 million by 2035, registering an absolute increase of USD 57.4 million and advancing at a CAGR of 8.0%. Sales growth of nearly 2.2X over the forecast horizon highlights the balance between evolving demand drivers and supply-side adjustments that will shape the industry’s trajectory.

On the demand side, consumption is strongly influenced by rising health awareness and the growing penetration of clean-label formulations. Pectin, as a plant-derived gelling agent, appeals to both consumers and food processors seeking natural alternatives to synthetic stabilizers. Demand is particularly pronounced in the beverage sector, where pectin is used for texture stabilization and cloud retention in fruit-based drinks. The Japanese market also shows rising uptake in functional foods targeting the aging population, with pectin’s role in digestive health and cholesterol management reinforcing its use. Premium food manufacturers are emphasizing pectin’s natural origin and dietary fiber benefits to cater to consumers who prioritize nutrition alongside indulgence. Demand is therefore expanding across categories such as dairy desserts, jams, baked goods, and nutraceutical applications. The shift toward plant-based diets in urban populations is adding another vector, as pectin serves as a versatile thickening and gelling agent compatible with vegan and vegetarian diets.

On the supply side, Japan is largely dependent on imports of citrus peels and apple pomace, which serve as primary raw materials for pectin extraction. Domestic production capacity is limited, with most supply sourced from global producers located in Europe, Latin America, and China. This reliance makes the supply chain vulnerable to fluctuations in global fruit harvests, logistics disruptions, and currency exchange risks. Leading international suppliers are strengthening their presence in Japan by expanding distribution networks and collaborating with local food processors. Japanese firms are also investing in R&D partnerships aimed at optimizing the use of imported pectin and tailoring formulations to regional preferences, such as softer gels for traditional confectionery or specific textures in dairy products. Supply resilience is being tested by volatility in raw material availability, but technological innovations in extraction and blending are expected to improve efficiency.

Between 2025 and 2030, Japan pectin industry is projected to expand from USD 49.6 million to USD 72.8 million, resulting in a value increase of USD 23.2 million, which represents 40.4% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating adoption of low methoxyl pectin formulations in reduced-sugar products, expanding functional beverage category requiring natural stabilization solutions, and increasing specification of clean-label gelling agents over synthetic alternatives in food processing operations. Growing adoption of specialty pectin grades offering enhanced functionality and organic certification continues to drive product differentiation. Manufacturers are expanding technical service capabilities to address health-positioning requirements and regulatory specifications, with particular emphasis on beverage stabilization and dairy product formulations serving health-conscious consumer segments.

| Metric | Value |

|---|---|

| Japan Pectin Industry Value (2025) | USD 49.6 million |

| Japan Pectin Industry Forecast Value (2035) | USD 107.1 million |

| Japan Pectin Industry Forecast CAGR (2025-2035) | 8.0% |

From 2030 to 2035, demand is forecast to grow from USD 72.8 million to USD 107.1 million, adding another USD 34.2 million, which constitutes 59.6% of the ten-year expansion. This period is expected to be characterized by maturation of functional food applications requiring specialized gelling properties, integration of advanced pectin modifications enhancing texture and stability characteristics, and expansion of nutraceutical applications requiring pharmaceutical-grade specifications. The growing emphasis on natural ingredient positioning, particularly in health-focused food categories and premium product segments, will drive demand for certified specialty pectins across commercial and consumer-facing applications.

Between 2020 and 2025, Japan pectin industry experienced steady expansion, growing from USD 38.2 million to USD 49.6 million. This growth was driven by increasing health consciousness among Japanese consumers, acceleration of clean-label product development by food manufacturers, and growing awareness of pectin's functional benefits as soluble fiber source. The sector developed as beverage manufacturers, jam producers, and dairy companies recognized the need for natural gelling agents differentiating premium offerings while meeting evolving consumer preferences favoring natural ingredients over synthetic alternatives.

Industry expansion is being supported by the rapid transformation of Japan's food processing industry preferences, driven by aging population creating demand for health-positioned products, increasing consumer scrutiny of ingredient labels through digital media and wellness awareness, and growing appreciation for natural gelling agents offering functional benefits compared to synthetic stabilization systems. Modern food manufacturers, beverage producers, and confectionery establishments increasingly specify pectin for reduced-sugar formulations, clean-label positioning, and functional ingredient applications where natural fruit-derived materials create premium positioning and health differentiation.

The accelerating pace of health-conscious product development is fundamentally reshaping pectin consumption patterns by establishing quality standards, technical performance expectations, and consumer confidence in functional food ingredients. Major food companies, beverage manufacturers, and specialty producers are increasingly specifying authenticated pectin with documented functionality, consistent quality, and regulatory compliance provisions that contrast with synthetic alternatives of uncertain consumer acceptance and variable performance. The professionalization of functional food development, particularly in metropolitan processing centers, is driving specifications favoring natural pectins over artificial gelling agents in commercial applications where consumers value authentic ingredients and health-positioning credentials.

The Japan pectin sector stands at a transformative inflection point where health consciousness, clean-label preferences, and functional food innovation converge to drive advanced demand growth. With demand projected to grow from USD 49.6 million in 2025 to USD 107.1 million by 2035, a robust 115.7% increase, the sector is being fundamentally reshaped by beverage industry innovation, reduced-sugar product development, and the pursuit of natural gelling solutions differentiating premium food applications.

The confluence of an aging population driving health-focused consumption patterns, food processing technology advancement establishing quality benchmarks, and regulatory support for health claims creates accelerated adoption of specialty pectin solutions. Food manufacturers and ingredient suppliers managing diverse application portfolios face simultaneous pressures to deliver functional performance, ensure regulatory compliance, and optimize formulation costs through specialized pectin grades offering consistency advantages over conventional gelling alternatives.

Strategic pathways encompassing specialty product development, application-specific formulations, technical service enhancement, and industry segment expansion offer substantial margin enhancement opportunities for manufacturers and distributors positioned at the innovation and quality frontier.

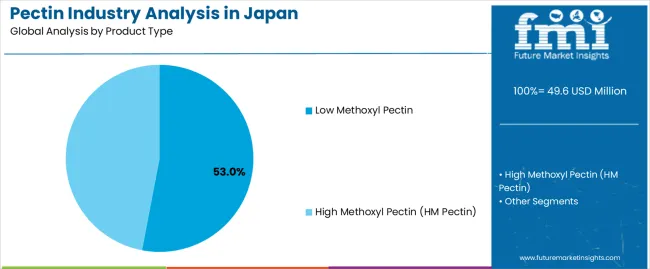

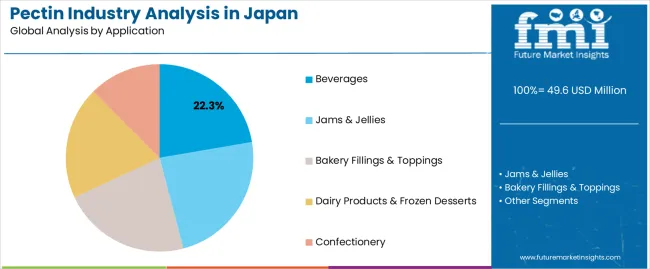

Demand is segmented by product type, application, source material, and quality grades. By product type, sales are divided into low methoxyl pectin and high methoxyl pectin. Based on application, demand is categorized into jams & jellies, beverages, bakery fillings & toppings, dairy products & frozen desserts, and confectionery applications. In terms of source material, sales are segmented into citrus pectin, apple pectin, and other botanical sources. By quality grades, demand is divided into food grade, pharmaceutical grade, and organic certified categories.

Low Methoxyl Pectin is projected to account for 53% of Japan pectin industry in 2025, making this product type the dominant segment across health-focused, reduced-sugar, and functional food applications. This dominance reflects LM pectin's critical functionality in calcium-reactive gelling systems, superior performance in low-sugar formulations, and clean-label positioning associated with premium health products and contemporary dietary preferences. The segment encompasses conventional LM pectin (32.0% subsegment share) providing standard gelling functionality for reduced-sugar applications and commercial food processing, amidated LM pectin (13.5%) utilizing enhanced stability characteristics suited to challenging pH conditions and extended shelf-life requirements, and organic certified LM pectin (7.5%) incorporating premium positioning creating health-conscious consumer appeal.

Conventional LM pectin maintains dominant position through combination of functional superiority in sugar-reduced applications with cost-effectiveness for commercial food manufacturing, proven performance characteristics in dairy and beverage applications, and regulatory compliance enabling health claims and nutritional positioning. The versatility of LM pectin creates diverse application opportunities within health-focused industrys, with calcium-reactive gelling mechanism providing unique functionality in dairy products and functional beverages. LM pectin scarcity from specialized processing requirements and technical complexity creates supply differentiation supporting premium positioning while driving development of application-specific grades.

Beverages are projected to demonstrate the highest growth rate at 9.2% CAGR through 2035 while accounting for 22.3% application share in 2025, making this application category the fastest-growing segment driven by functional beverage innovation, fiber-fortified drink development, and RTD product stabilization requirements. The segment encompasses fiber-fortified functional drinks (8.2% subsegment share) targeting health-conscious consumers seeking digestive wellness benefits, fruit juice beverages (7.1%) requiring natural stabilization preventing sedimentation and maintaining fresh taste profiles, and dairy beverage applications (7.0%) where pectin provides texture management and clean-label positioning.

Functional beverages represent the highest-growth subsegment, with manufacturers utilizing pectin for soluble fiber content enabling nutritional claims, natural stabilization properties maintaining product consistency, and clean-label positioning replacing synthetic alternatives. The health beverage segment demonstrates particularly strong pectin consumption as fiber-fortified drinks, wellness beverages, and sports nutrition products incorporate consistent pectin functionality across product ranges. Premium beverage applications increasingly specify natural pectins for custom formulations and specialized products where consumers value functional ingredients and health positioning.

Japan pectin industry is advancing steadily due to accelerating health consciousness and aging population dietary requirements, expanding clean-label product development establishing natural ingredient standards, and growing functional food specifications favoring natural gelling agents over synthetic alternatives. The sector faces challenges including mature food processing industry limiting volume expansion potential, economic uncertainty creating price sensitivity pressures, and competition from alternative hydrocolloids offering specific performance advantages.

The expansion of health-conscious consumer behavior including reduced-sugar preferences, functional food adoption, and natural ingredient scrutiny is fundamentally reshaping pectin consumption patterns by establishing performance benchmarks, quality expectations, and consumer acceptance of premium-priced natural ingredients. Health-focused consumers specify authenticated pectins with documented functional benefits, regulatory compliance, and clean-label credentials differentiating offerings from synthetic alternatives of uncertain consumer appeal. These consumers drive quality control processes, health claim verification, and ingredient transparency creating industry demand enabling premium positioning and repeat purchase behavior. The health-conscious segment's growth creates concentrated pectin demand from food manufacturers targeting wellness-positioned products, with formulation decisions emphasizing natural functionality, regulatory compliance, and consumer acceptance documentation.

Japan's food processing sector confronts growing consumer demand for functional benefits driving innovation in fiber-fortified products, reduced-sugar formulations, and health-positioned applications where pectin provides soluble fiber content enabling nutritional claims and regulatory compliance. Functional food certifications including health claim approvals provide verification of pectin's dietary benefits and nutritional positioning, with functional products commanding premium positioning in health-focused applications where customers demand documentation of wellness benefits and regulatory approval. Corporate wellness policies, particularly among health-conscious consumers, establish consumption preferences favoring functional ingredients demonstrating health benefits and nutritional enhancement.

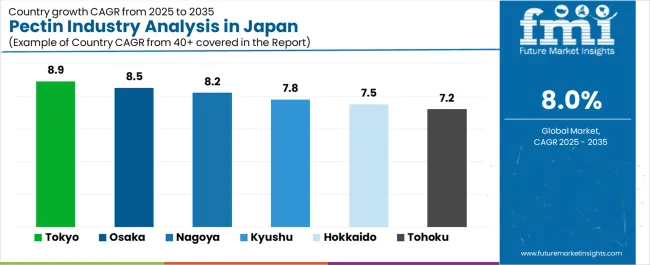

| Region | CAGR (2025-2035) |

|---|---|

| Tokyo | 8.9% |

| Osaka | 8.5% |

| Nagoya | 8.2% |

| Kyushu | 7.8% |

| Hokkaido | 7.5% |

| Tohoku | 7.2% |

Japan pectin industry demonstrates significant regional variation in growth patterns, driven by diverse factors including food processing industry concentrations, beverage manufacturing clusters, health-conscious consumer populations, and premium food positioning preferences. Tokyo leads growth at 8.9% CAGR through 2035, reflecting high-end food processing and beverage manufacturing in metropolitan area and advancing functional food applications. Osaka follows at 8.5% CAGR, driven by traditional food processing excellence and premium confectionery manufacturing. Nagoya exhibits 8.2% growth supported by industrial food processing capabilities and dairy product manufacturing expansion.

Demand for pectin in Tokyo is projected to grow at 8.9% CAGR through 2035, the highest growth rate nationally, driven by concentrated food processing and beverage manufacturing operations in metropolitan area, advanced functional food development serving health-conscious urban consumers, and premium ingredient applications incorporating clean-label positioning. Tokyo's position as Japan's economic center creates concentrated affluent consumer population pursuing health-positioned food products with natural ingredient formulations, specialty applications, and premium quality standards differentiating products in competitive metropolitan food industrys.

The region's food manufacturing sector, particularly clustered in Tokyo and surrounding prefectures, demonstrates leading technical advancement through adoption of specialty pectin grades, quality management systems, and health-focused production serving domestic premium industrys. These manufacturers increasingly utilize authenticated pectins meeting strict quality standards and health claim requirements necessary for premium positioning and consumer acceptance in sophisticated urban industrys.

Demand for pectin in Osaka is expanding at 8.5% CAGR, driven by traditional food processing excellence in Osaka-Kyoto-Kobe corridor, premium confectionery manufacturing serving domestic and export industrys, and beverage industry development incorporating natural stabilization solutions. Osaka's position as western Japan's commercial center creates established food processing infrastructure with quality-focused manufacturers pursuing premium ingredient formulations, technical innovation, and brand differentiation.

The region's confectionery sector, particularly concentrated in Osaka and surrounding areas, demonstrates strong growth through premium product development, export-oriented manufacturing, and traditional Japanese sweets innovation incorporating natural gelling agents. These applications favor authenticated pectins providing premium positioning and cultural authenticity alignment with consumer expectations for quality and tradition.

Demand for pectin in Nagoya is growing at 8.2% CAGR, supported by industrial food processing capabilities in metropolitan area, dairy product manufacturing expansion serving health-conscious consumers, and beverage industry development requiring stabilization solutions. Nagoya's industrial infrastructure creates efficient food processing operations with established supply chains, technical capabilities, and quality management systems supporting ingredient innovation.

The region's dairy industry demonstrates particularly strong growth through functional dairy product development, health-positioned formulations, and premium positioning addressing aging population dietary requirements. These applications specify natural stabilization solutions including pectin for texture management and clean-label positioning.

Demand for pectin in Kyushu is expanding at 7.8% CAGR, driven by beverage manufacturing operations serving domestic industrys, confectionery production utilizing traditional and modern applications, and regional food specialties incorporating natural gelling solutions. The region's food processing sector demonstrates steady growth through established manufacturing capabilities and regional brand development.

Regional beverage manufacturers demonstrate consistent pectin consumption through functional drink development, traditional beverage applications, and health-positioned product innovation addressing consumer wellness preferences. Confectionery applications maintain steady demand for natural gelling agents enabling traditional and contemporary sweet products.

Demand for pectin in Hokkaido is projected to expand at 7.5% CAGR, driven by dairy industry leadership requiring natural stabilization solutions, food processing operations serving quality-focused consumers, and premium positioning reflecting regional reputation for food quality. Hokkaido's agricultural foundation creates supply chain advantages for food processing operations emphasizing natural ingredients and quality positioning.

The region's dairy sector, including yogurt manufacturing, dessert production, and functional dairy applications, demonstrates growing pectin utilization for texture management, stability enhancement, and clean-label positioning meeting consumer preferences for natural ingredients and health benefits.

Demand for pectin in Tohoku is growing at 7.2% CAGR, supported by regional food processing operations serving local and national industrys, fruit processing applications utilizing natural gelling solutions, and traditional food manufacturing incorporating contemporary ingredient innovations. The region's food industry demonstrates steady development through established processing capabilities and regional specialization.

Regional fruit processing operations, including jam manufacturing, preserve production, and traditional food applications, maintain consistent pectin consumption for gelling functionality and natural ingredient positioning meeting consumer preferences for authentic regional products.

Japan pectin industry is defined by competition among global specialty ingredient suppliers incorporating advanced pectin production, domestic food ingredient companies focusing on local industry access and customer relationships, and international trading houses serving technical distribution and industry development. Manufacturers are investing in specialty grade development demonstrating enhanced functionality and quality credentials, technical service capabilities enhancing application support and customer collaboration, organic certification systems enabling premium positioning and health-conscious consumer appeal, and comprehensive quality management networks ensuring consistency and regulatory compliance across food processing applications.

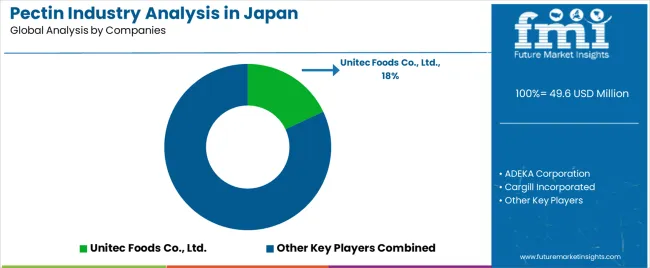

Unitec Foods Co. Ltd., based in Japan and serving domestic industrys, leads with approximately 18.0% share through comprehensive technical service capabilities including application development and customer support, extensive domestic distribution network reaching food processors and beverage manufacturers, and specialized product portfolio emphasizing quality consistency and regulatory compliance. ADEKA Corporation, headquartered in Tokyo, provides specialty chemical and food ingredient solutions including pectin products emphasizing technical innovation, quality management, and domestic industry expertise.

Cargill Incorporated offers global ingredient solutions including pectin products with focus on technical service, quality consistency, and application development partnerships. Ingredion Incorporated delivers comprehensive ingredient solutions targeting food processing applications with emphasis on functionality, technical support, and regulatory compliance. CP Kelco provides specialized hydrocolloid solutions including advanced pectin grades emphasizing technical performance and application-specific development.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 107.1 million |

| Product Type | Low Methoxyl Pectin (conventional LM pectin, amidated LM pectin, organic certified LM pectin), High Methoxyl Pectin (rapid-set HM pectin, slow-set HM pectin, organic certified HM pectin) |

| Application | Jams & Jellies (traditional high-sugar jams, reduced-sugar preserves, sugar-free fruit spreads), Beverages (fiber-fortified functional drinks, fruit juice beverages, dairy beverage stabilization), Bakery Fillings & Toppings, Dairy Products & Frozen Desserts, Confectionery |

| Source Material | Citrus pectin, apple pectin, sugar beet pectin, sunflower pectin, other botanical sources |

| Quality Grades | Food grade, pharmaceutical grade, organic certified, non-GMO verified |

| Regions Covered | Tokyo, Osaka, Nagoya, Kyushu, Hokkaido, Tohoku |

| Key Companies Profiled | Unitec Foods Co. Ltd., ADEKA Corporation, Cargill Incorporated, Ingredion Incorporated, CP Kelco, DuPont Nutrition & Biosciences, Herbstreith & Fox, Silvateam, Naturex (Givaudan), Yantai Andre Pectin |

| Additional Attributes | Revenue analysis by product type and application categories, Japanese food industry consumption patterns, competitive landscape with global suppliers and domestic distributors, food manufacturer preferences for quality consistency and technical support, regulatory environment and health claim opportunities, innovations in specialty pectin grades and clean-label formulations, development of reduced-sugar applications with maintained sensory quality and functional performance |

The global pectin industry analysis in japan is estimated to be valued at USD 49.6 million in 2025.

The market size for the pectin industry analysis in japan is projected to reach USD 107.1 million by 2035.

The pectin industry analysis in japan is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in pectin industry analysis in japan are low methoxyl pectin and high methoxyl pectin (hm pectin).

In terms of application, beverages segment to command 22.3% share in the pectin industry analysis in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Japan Automotive Lighting Market Growth – Trends & Forecast 2023-2033

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

FIBC Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Low Rolling Resistance Tire Market Growth – Trends & Forecast 2023-2033

Japan Automotive Interior Leather Market Growth – Trends & Forecast 2023-2033

Mezcal Industry Analysis in Japan - Consumer Demand & Industry Trends in 2025

Taurine Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Isomalt Industry in Japan – Growth & Industry Trends 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Demand for Fruit Pectin in Japan Size and Share Forecast Outlook 2025 to 2035

Resveratrol Industry Analysis in Japan Growth, Trends and Forecast from 2025 to 2035

Smart Space Market Growth – Trends & Forecast 2024-2034

Stretch Film Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Polydextrose Industry Analysis in Japan – Demand & Market Trends 2025 to 2035

Glassine Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA