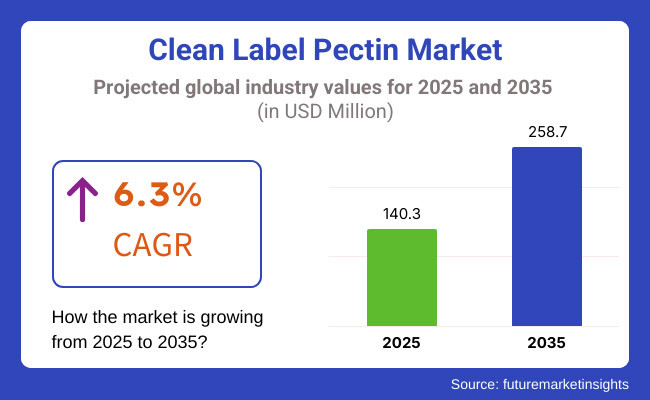

The Clean Label Pectin Market will grow massively between 2025 and 2035 as consumers continue to look for natural, plant-based, and minimally processed food ingredients. The market will be approximately USD 140.3 million in 2025 and USD 258.7 million in 2035 with a compound annual growth rate (CAGR) of 6.3% during the period.

There are a number of key drivers driving this market trend.One of the major drivers is increasing consumer demand for clean-label food and beverages, and food and beverage overall.

As governments tighten regulation against artificial additives, manufacturers reformulate to incorporate natural stabilizers and thickeners such as pectin.

For application in fruit and jam applications and in milk foods, clean-label pectin substitutes artificial stabilizers in an attempt to build structure without sacrificing label transparency. Trends toward organics and vegetable-based foodstuffs also drive increased utilization of clean-label pectin throughout applications.

Pectin can be classed broadly by where it originates and how it is used. Its two most common forms are the high methoxyl (HM) pectin and low methoxyl (LM) pectin. HM pectin is used in jellies, jams, and confections because it will gelify when the pH is acidic. LM pectin is used in milk foods such as yogurt and vegetable milk alternative, where it is used as a stabilizer and emulsifier.

Its biggest use, beverages is amongst the largest market drivers of clean-label pectin as a clean-label thickening and gelling agent for use in functional drinks and fruit juice. Pectin usage is also witnessing growth for the confectionery and bakery sector due to the high moisture nature of the component as well as texture contribution within gluten-free foods.

Increasing use of pectin as a clean-label alternative in plant-based meat substitutes as a result of more clean eating is another prospects market.

Natural consumer education and labeling regulations requiring strict labeling on food provide a robust North America market for clean-label pectin. Higher application of clean-label pectin is seen in Canada and the United States for functional drinks, packaged foods, and dairy alternative drinks.

Clean-label formulation investment has been fueled by the existence in the region of upscale food processing companies.

Large companies are reformulating product lines in advance to replace artificial stabilizers and thickeners with pectin from apples and citrus fruits. Additionally, increasing consumer demand in the region for organic and non-GMO foods is propelling demand.

Europe dominates the majority of the clean-label pectin market with immense demand coming from Germany, France, and the United Kingdom.

The European food industry has spearheaded the trend in driving the clean-label business, most notably within the bakery and dairy industries. Pectin use in plant-based alternative milk has increased tremendously as beverages based on oat, almond, and soy milk have expanded heavily in Europe.

Tight policy response of the European Food Safety Authority (EFSA) on artificial additives has made it necessary for dealers to move towards pectin-based products. In addition, Italy's ancient confectionery industry, renowned globally for fruit-based high-quality fruits spreads and gel-based sweets, depend largely on pectin to produce the product consistent and acceptable.

Asia-Pacific will also be the highest-growing region of clean-label pectin market due to rising food and beverage economies of China, Japan, and India. Middle-class population growth and surging demand for natural food ingredients are major drivers for the market.

Functional beverage and fruit drink market of China is the biggest consumer of clean-label pectin. India's developing bakery industry, fueled by urbanization and shifting consumer behaviors, then more and more is focusing its sights on pectin as a clean-label solution to industrially manufactured stabilizers and emulsifiers.

Growth for the market is being inhibited by poor levels of knowledge relating to clean-label ingredients, though this is being enhanced by access to the market of multinational food operators who carry clean-label goods.".

Challenge

Limited Raw Material Availability

The clean-label pectin market is also besmirched by utilization of fruit processing by-products such as apple pomace and citrus peels as raw materials for the production of pectin. Climatic vagaries in their yields, e.g., drought or floods, or agricultural vagaries, expose such raw materials to. For example, contamination of a citrus harvest or reduced apple yields may induce shortages in the pectin supply chain that render raw material procurement difficult for the manufacturers to attain.

Also, competition for other uses of agricultural by-products, i.e.,biofuels or animal feed, also exerts pressure on availability.

The companies invest in multi-source buying strategies to counter such threats by examining alternative sources like seaweed or breaking into the agricultural waste stream. Also, newer extraction technologies, i.e.,green chemistry or enzyme technology, can reverse dependence on traditional sources and provide more stable, sustainable sources to replace the pectin.

Opportunity

Plant-Based and Functional Foods Growth

The clean-label pectin market will grow as a result of increasing consumer interest in functional food and plant-based foods. Consumers are in great demand for healthier, plant-based foods with long-term health benefits, and pectin, being a natural gelling and stabilizing agent, is perfectly positioned in such a trend.

Companies are finding new applications of pectin for plant-based meat alternative foods, reduced-sugar foods, and even probiotic-fortified beverages, riding the trend of increased emphasis on sustainability and wellness.

Advances in pectin modification technologies make its functional properties tunable, revealing its potential as a food ingredient. For instance, researchers are formulating edible pectin-based films and coatings that, aside from lengthening shelf life of fresh vegetables and fruits, also render plastic packaging waste easier, which is part of the global movement towards sustainability.

As clean-label and plant-based food segments continue to become more solidly rooted, new markets for new, multifunctional ingredients such as pectin will be increasingly sought after, opening the door for food companies to continue to grow.

In 2020 to 2024, clean-label pectin business gained strength with the food industry inclining towards catering to the rising need of customers for transparency regarding the origin of food. Market demand for pectin as a low-sugar and organic product was growing with the emerging consolidation globally against overuse of sugar and chemical preservatives.

The most impactful trends that will dominate the clean-label pectin market between 2025 to 2035 will be plant-based and functional food innovation growth, sustainable sourcing regimes, and continued technological advancements in extraction capacity for yield improvement.

Multifunctional clean-label ingredients will continue to drive pectin into new areas of application and become a standard component of natural food formulation for the next years.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Clean label laws emphasized transparency in food labeling and compelled manufacturers to reduce synthetic additives. Consumer forces required adherence to clean label guidelines such as Non-GMO and Organic. |

| Technological Advancements | Technological innovation in extraction, i.e., enzymatic hydrolysis, increased yield and quality of pectin and reduced processing residue. |

| Food & Beverage Industry Trends | Clean label pectin demand exploded with fruit juices, dairy, and preserves as consumers turned health-conscious. |

| Bakery & Confectionery Applications | Use of pectin as a bakery filling and confectionery ingredient grew with brands' clean-label gelling and stabilizing agent demand. |

| Sustainability Initiatives | Citrus peel and apple pomace were key materials for the extraction of pectin and helped to combat food waste efforts. |

| Production & Supply Chain Dynamics | Raw material price volatility, particularly in citrus-producing regions, added to the cost of production. |

| Market Growth Drivers | Climate events and lockdown-related transport restrictions in supply chains impacted trade worldwide. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments across the globe enforce more stringent regulations, requiring natural ingredient use and prohibition of artificial additives in some food groups. Clean label pectin requirements go beyond to include carbon footprint claims and ethical sourcing standards. |

| Technological Advancements | Artificial intelligence-driven process optimization and environmentally friendly extraction technologies improve efficiency, reducing the cost of production. Precision fermentation becomes a new technology for generating high-quality pectin substitutes with specified molecular characteristics. |

| Food & Beverage Industry Trends | Growth of the market is driven by expansion into plant and alternative dairy sectors. Prebiotic pectin-enriched functional beverages gain popularity with consumers focused on gut health. |

| Bakery & Confectionery Applications | Clean label pectin becomes a central tool in confectionery and bakery sugar reduction tactics, displacing synthetic stabilizers and emulsifiers. |

| Sustainability Initiatives | Increasing upcycling of fruit processing by-products to high-value pectin accelerates. Increasing emerging sourcing of lesser-used fruits like mango and passionfruit as a result of biodiversity conservation pushes growth. |

| Production & Supply Chain Dynamics | Pectin source diversification, such as venturing into tropical fruit waste, provides stable supply chains. Localized pectin manufacturing facilities invested in minimize reliance on imports, making supply chains more resilient. |

| Market Growth Drivers | Regulatory push towards clean label requirements, along with the expansion of the functional food market, fuels long-term market growth. Precision fermentation and biotechnology breakthroughs open up new growth avenues for specialty pectin types. |

United States clean label pectin market is developing rapidly with increased demand from the consumer towards natural food ingredients and regulatory challenges for the elimination of artificial additives. In the drink industry, in particular, the demand is much greater for clean label pectin as a natural stabiliser in fruit juice and plant-based milk alternatives.

Stimulating Demand for Functional Foods: The over USD 80 billion American functional foods market is stimulating demand for pectin in probiotic-enriched beverages and dietary fiber supplement formulations.Clean label pectin is gaining momentum as a natural prebiotic to meet demand for gut health-formulated foods.

Bakery and confectionery companies are the other significant buyers, where pectin clean label is applied in low-sugar foods consumed via jellies, jam, and jelly confectionery. Additionally, with increasing green consciousness among consumers, companies are now emphasizing upcycled pectin consumption from citrus or apple origins to enhance their green scores.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

The United Kingdom has witnessed pectin clean label application growing, primarily influenced by government campaigns targeted at reducing artificial additive consumption and transparency within foods. Despite individuals requiring more organic and natural food ingredients with increasingly demanding needs, pectin recently substituted artificial thickeners in foods.

Policy Change in Sugar Reduction: The UK government's decades-old policy of reduction of sugar, e.g., the Soft Drinks Industry Levy, motivates beverages and confectionery firms to repackage fluids according to natural stabilizers like pectin. The trend would propel market growth.

In addition to this, the demand for plant-based food by UK consumers has driven pectin usage in dairy alternative foods like plant-based yogurts and cheese spreads. Clean label functionality of pectin in emulsification and texturization further makes it highly popular in all markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.2% |

The European Union offers a huge marketplace for clean label pectin because of strict food safety legislation and customer appetite for natural food without additives. EU REACH regulation and rising environmental sustainability trends are driving the clean label across food and beverages markets.

Market expansion of beverages and dairy: Since the EU market for plant-based dairy alternatives will be over €5 billion in 2030, pectin is becoming increasingly popular as a trendy stabilizer for yogurts, creamers, and fruit drinks that are dairy-free. Besides that, the local scale-up processing industry of fruits ensures consistent supply of raw material to pectin manufacturing.

Sustainability strategies provoke the upcycling of fruit residues into value-added pectin products, lowering food industry residues and provoking circular economy actions. The transformation will likely provoke sustainable long-term development of the pectin products market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.7% |

For clean label pectin there is increasing demand with increasing health-conscious consumption trends and food premiumization to higher demand levels. There is Japanese consumer demand for using high-quality, natural ingredients and they create demand for clean label pectin in dietary supplements and in functional beverages as well.

Exspansion in Nutraceuticals, Japan's much larger than USD 15-billion nutraceutical market is becoming more and more dependent on pectin as a soluble fiber in gut wellness products in digestive well-being. As a natural prebiotic, pectin is filling Japan's demand for gut health from an aging population. Pectin is also penetrating traditional Japanese sweets like mochi and yokan where clean-label is being demanded by well-being shoppers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The South Korean natural pectin market is performing well on the strength of growing demand for functional food and beverages among consumers. Food labelling and food safety have been the priority area of the South Korean government, and they have compelled companies to drop synthetic thickeners and switch to natural thickeners like pectin.

Plant Dairy and Drink Innovation: The country's plant dairy industry that is increasing more than 10% annually is also using more and more pectin to provide texture and stability to oat and almond food. The consumption of sugar-free and low-calorie beverages has also been on the rise, so pectin consumption has risen significantly in sports nutrition food and fruit juice.

Market is also being fuelled by investment in biotechnology-based pectin extraction technology with greater product purity and functionality.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

High methoxyl pectin is the most widely consumed product form of clean label pectin due to its improved gelling strength at high sugar concentrations. It is therefore an important ingredient of fruit preserves, confectionery, and dairy products requiring firmness.

High methoxyl pectin is used particularly in traditional marmalades and jams, where it contributes the required texture without contributing any other stabilizer.

High methoxyl pectin's dominance is also being supported by rising consumer demand for clean-label and natural substitutes of the artificial thickeners. Secondly, application in plant milk products such as vegan yogurt and plant cheese has also contributed to growth, especially in North America and Europe. Although it uses high sugar content to gel, high methoxyl pectin is the preferred choice of manufacturers when clean-label positioning is concerned.

Low methoxyl pectin is becoming more popular because it will gel in low-sugar or sugar-free foods without requiring high acidity. It is thus the preference for reduced-sugar jam, sugar-free confectionery, and dairy uses such as yogurt and puddings. While its high methoxyl equivalent gels alone, low methoxyl pectin gels when calcium-treated and thus holds a vital position in the dairy where the sugars must be low.

This market is witnessing strong growth in health-focused consumer markets, particularly in the United States and Europe, as sugar reduction trends are driving food formulation strategies.

Besides, increased applications of low methoxyl pectin in functional foods like high-protein plant-based beverages and probiotic-enriched dairy products have further boosted its market influence.

Citrus pectin is the single largest source segment in the clean label pectin market with high availability, affordability, and quality consistency. Among citrus fruits, oranges and lemons give the maximum output of pectin and thus are the raw material of preference for commercial application.

The intensive citrus processing industries in Brazil, Spain, and the United States provide a surety supply of raw material to the producers.

Apple pectin is gaining favor as a clean-label option, particularly among GMO-free and organic product brands.

Apple pectin is also growing in upscale food uses, particularly in Europe, where clean-label, fruit-based ingredients are encouraged by regulatory systems. Simultaneously, pear-, plum-, and banana-sourced pectin finds specialized use in infant food and nutritional supplements, where unusual fruit ingredients resonate with health-oriented consumers.

Sudden increase in plant-based food substitutes has made clean label pectin a key product in vegan food. As a plant-based hydrocolloid, pectin has widespread usage in non-dairy yogurts, vegan cheese, and egg-free baked products, serving the purpose of texture and stability.Natural and clean-label stabilizers available for the vegan food market is a top growth driver for the segment.

Plant protein drinks and nutrition bars also gain from the stabilizing effect of pectin, with silky texture and extended shelf life. As the plant food market is set to sustain steady growth, demand for pectin as a natural stabilizer will increase vigorously, particularly in Western economies.

Jams continue to be one of the most important application fields for pectin, and high methoxyl pectin is a key ingredient in traditional fruit preserves. Increasing demand for artisanal and organic jams in the premium market is propelling demand for natural thickeners, which underpins clean label pectin demand.In addition, reduced-sugar jam products are increasingly using low methoxyl pectin to deliver appealing texture without added sugar.

In the dairy industry, pectin is utilized mainly to a large degree in yogurt, flavored milk, and fruit-based dairy dessert brands. Low methoxyl pectin's calcium-binding capacity has made it a favorite for producing smooth, creamy dairy textures, particularly in low-fat and functional yogurt applications.

As consumers are moving towards dairy products with clean ingredient labels, the use of pectin as a natural stabilizer is likely to gain even more momentum.

The clean label pectin industry is a competitive industry, with dominant global and regional players propelling industry growth. The dominant players maintain strong market positions and emphasize product innovation, sustainability, and natural ingredient application development.

The industry is led by companies that are experts in citrus and apple pectin for food & beverages, pharma, and personal care applications. A combination of incumbent players and new players forms the affluent market environment focused on clean-label, non-GMO, and organic pectin solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Cargill, Incorporated | 14-18% |

| DuPont (IFF) | 11-15% |

| Herbstreith & Fox | 9-13% |

| CP Kelco | 7-11% |

| Silvateam S.p.A | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill, Incorporated | Produces citrus and apple-derived pectin for clean-label food formulations. Focuses on sustainability and product traceability. |

| DuPont (IFF) | Specializes in high-performance pectin for reduced-sugar applications. Invests in research for improved gelling and stabilizing properties. |

| Herbstreith & Fox | Develops premium apple pectin for bakery, dairy, and confectionery products. Focuses on organic and functional ingredient innovations. |

| CP Kelco | Offers a broad range of citrus pectin solutions for vegan and plant-based products. Implements eco-friendly extraction technologies. |

| Silvateam S.p.A | Manufactures natural pectin for jams, jellies, and pharmaceutical applications. Leverages sustainable citrus sourcing. |

Key Company Insights

Cargill, Incorporated (14-18%)

Cargill is the leader in clean label pectin business with citrus and apple-based pectin used across different applications in food.Open supply chain and sustainability are of utmost priority at the company with an ethical supply of raw material. Cargill invests significantly in developing improved processing technologies for the gel and stabilizing functions of pectin in meeting the growing trend of natural and clean-label ingredients.

DuPont (IFF) (11-15%)

DuPont (IFF business unit) is a high-performing pectin solution with reduced-sugar and functional foods applications. It has a focus on texture development and shelf life improvement research, making it the preferred supplier to food companies requiring cutting-edge clean-label solutions. The hydrocolloid blend technology capability of DuPont enhances its position in the marketplace.

Herbstreith & Fox (9-13%)

Herbstreith & Fox is a top manufacturer of apple pectin for premium-quality solutions for bakery, confectionery, and dairy uses. The company's emphasis on organic and natural solutions aligns with the clean-label trend. Herbstreith & Fox also remains committed to developing specialty pectin grades optimized for precise functional requirements in food production.

CP Kelco (7-11%)

CP Kelco is a specialist in its extensive line of citrus pectin solutions for the plant-based food and vegan industries. CP Kelco employs green extraction methods to minimize waste and maximize yield. CP Kelco engages in regular cooperation with food producers to manufacture tailored pectin solutions for a variety of applications like high-quality fruit spreads and dairy alternative products.

Silvateam S.p.A (4-8%)

Silvateam has expertise in natural pectin used in the pharmaceuticals, jellies, and jam industries. Silva team takes citrus peels from sustainable agriculture and treats them in an environmentally friendly way. Silvateam's botanical extract and hydrocolloid expertise enable it to supply synergistic ingredient solutions to its customers throughout the world.

Other Key Players (40-50% Combined)

Beyond these major manufacturers, several other companies collectively contribute to the clean label pectin market, focusing on innovation, sustainability, and cost-effective solutions. These include:

The global clean label pectin market size was valued at approximately USD 140.3 million in 2025.

The clean label pectin market is projected to reach USD 258.7 million by 2035, growing at a CAGR of 6.3% from 2025 to 2035.

The increasing consumer demand for natural ingredients and cleaner labels in food and beverages is a key driver of market growth.

The top 5 companies driving the development of the clean label pectin market are DuPont, Cargill, CP Kelco, Naturex, and Herbstreith & Fox Group.

On the basis of application, the food and beverage segment is anticipated to be the dominant segment in the global market for clean label pectin during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Product type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018-2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018-2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 10: Global Market Volume (MT) Analysis by Product type, 2018-2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018-2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 18: Global Market Volume (MT) Analysis by Application, 2018-2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product type, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018-2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 34: North America Market Volume (MT) Analysis by Product type, 2018-2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018-2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 42: North America Market Volume (MT) Analysis by Application, 2018-2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product type, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018-2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 58: Latin America Market Volume (MT) Analysis by Product type, 2018-2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018-2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 66: Latin America Market Volume (MT) Analysis by Application, 2018-2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018-2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 82: Europe Market Volume (MT) Analysis by Product type, 2018-2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018-2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 90: Europe Market Volume (MT) Analysis by Application, 2018-2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Product type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Product type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018-2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Product type, 2018-2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Source, 2018-2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Application, 2018-2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Product type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Product type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018-2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018-2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Product type, 2018-2033

Figure 130: MEA Market Volume (MT) Analysis by Product type, 2018-2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Source, 2018-2033

Figure 134: MEA Market Volume (MT) Analysis by Source, 2018-2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018-2033

Figure 138: MEA Market Volume (MT) Analysis by Application, 2018-2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Product type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleanroom Static Transfer Box Market Size and Share Forecast Outlook 2025 to 2035

Clean Room Panels Market Size and Share Forecast Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Cleansing Micelle Technology Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cleanroom Construction Market Size and Share Forecast Outlook 2025 to 2035

Clean Room Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Clean Steam Separator Market Analysis - Size, Share & Forecast 2025 to 2035

Cleanroom Technologies Market Growth – Trends & Forecast 2025 to 2035

Clean Coal Technology Market Growth - Trends & Forecast 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Cleanroom Lighting Market

Clean Labelled Food Additives Market Size and Share Forecast Outlook 2025 to 2035

Clean Label Flour Market Size and Share Forecast Outlook 2025 to 2035

Clean-Label Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Clean Label Flavors Market Analysis by Liquid Systems, Spray-Dried Powders, Encapsulated Flavors, Emulsion-Based Delivery Systems Through 2035

Clean Label Starch Market

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA