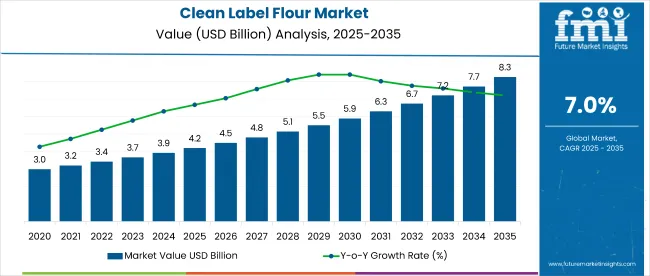

The global Clean Label Flour Market is projected to grow from USD 4.2 billion in 2025 to USD 8.3 billion by 2035, registering a CAGR of 7%. The market expansion is being driven by growing consumer demand for transparency, natural ingredients, and healthier food options.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.2 billion |

| Industry Value (2035F) | USD 8.3 billion |

| CAGR (2025 to 2035) | 7% |

Rising awareness of the adverse effects of artificial additives is encouraging both consumers and manufacturers to adopt clean label alternatives across multiple product categories. Clean label flours with minimal processing, organic sourcing, and simple ingredient lists are gaining traction across applications such as bakery, packaged food, sauces, and confectionery, further accelerating market adoption.

The market accounts for 18% of the global clean label ingredients market, driven by its rising adoption in health-conscious formulations. It holds nearly 9% share in the broader flour market, reflecting the growing preference for minimally processed alternatives. Within the organic ingredients market, clean label flour contributes around 7%, supported by strong consumer interest in clean eating. It makes up nearly 5% of the functional ingredients segment, due to its natural performance benefits. However, its share in the expansive food and beverage ingredients market remains modest, contributing about 0.4%, highlighting its niche but growing role.

Government regulations impacting the market focus on food safety, labeling transparency, and consumer health. Frameworks such as the Food Safety and Standards Act (FSSAI) in India, the FDA’s labeling guidelines in the United States, and EFSA regulations in Europe promote the clean label movement by ensuring ingredient clarity and restricting the use of synthetic additives. These regulations are driving demand for clean label flours that meet compliance while addressing growing health concerns, thereby reinforcing the market’s long-term growth trajectory.

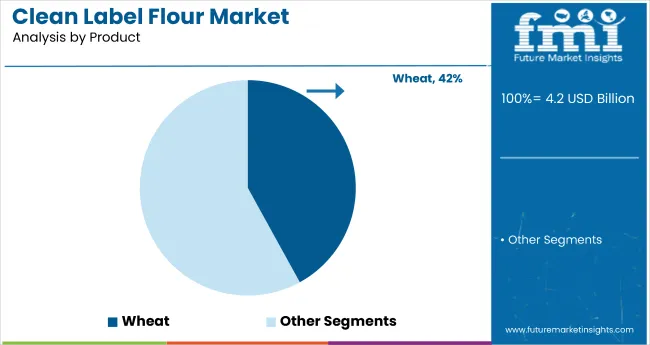

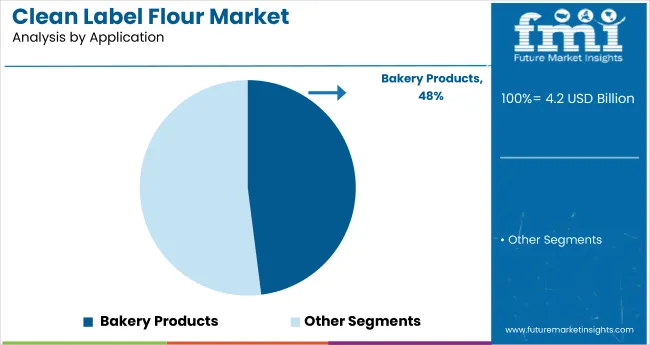

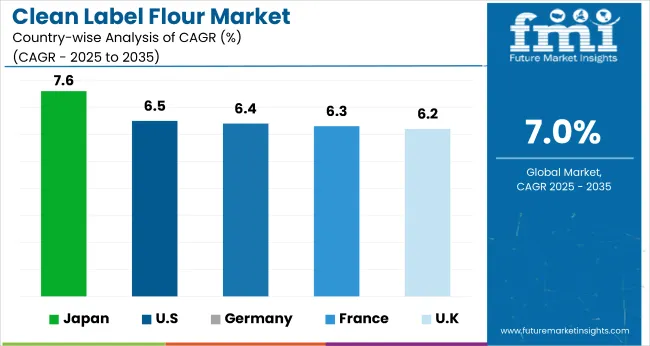

Japan is projected to be the fastest-growing market, expected to expandat a CAGR of 7.6% from 2025 to 2035. Wheat-based flour will lead the product type segment with a 42% share, while bakery products will dominate the application segment with a 48% share. The USA and UK markets are expected to grow steadily at CAGRs of 6.5% and 6.2%, respectively, while Germany and France are set to grow at 6.4% and 6.3% CAGRs.

The global market is segmented by product, application, end user, distribution channel, and region. By product, the market is categorized into wheat, corn, rice, coconut, and others (barley, millet, quinoa, and sorghum). Based on application, the market includes bakery products, baby foods, pasta and noodles, and others (confectionery, sauces and dressings, snacks, and ready-to-eat meals).

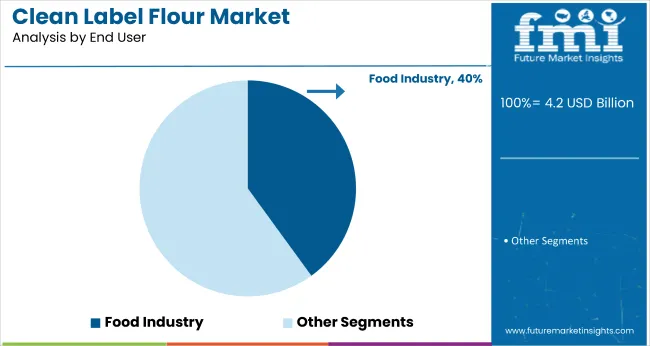

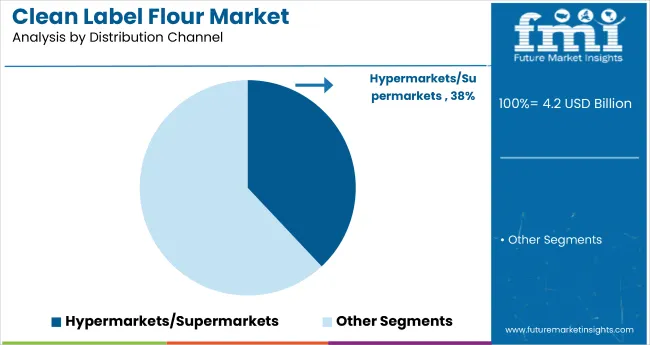

In terms of end user, the market is segmented into food industry, HoReCa, and retail sales. By distribution channel, the market is classified into hypermarkets/supermarkets, convenience stores, specialty stores, and online retailers. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Wheat-based clean label flour is expected to dominate the product segment with a 42% market share in 2025, driven by its familiarity, affordability, and widespread use in both traditional and modern food applications.

Bakery products are projected to lead the application segment in 2025, holding a 48% market share, due to rising demand for natural, additive-free baked goods and greater use of clean label flour in healthy recipes.

The food industry is expected to dominate the end user segment, accounting for 40% of the global market share by 2025, driven by the growing adoption of clean label flour in packaged foods, snacks, and processed food manufacturing.

Hypermarkets and supermarkets are anticipated to dominate the distribution channel segment in 2025, capturing a 38% market share due to wider product availability, strong shelf presence, and increasing consumer preference for one-stop grocery shopping.

The global clean label flour market is experiencing steady growth, driven by increasing consumer demand for natural, minimally processed ingredients and transparency in food products. Clean label flours play a vital role in meeting health-conscious preferences while supporting clean label claims in bakery, packaged foods, and other applications.

Recent Trends in the Clean Label Flour Market

Challenges in the Clean Label Flour Market

Japan is the fastest-growing clean label flour market, supported by a highly health-conscious population, stringent natural food regulations, and robust demand in bakery and convenience food sectors. Germany and France maintain steady demand driven by strict food labeling regulations and consumer preference for organic and additive-free products.

Developed economies such as the USA (6.5% CAGR), UK (6.2%), and Japan (7.6%) are projected to grow at approximately 0.89x to 1.09x the global average CAGR of 7%, reflecting a stable but varied growth pattern across mature markets.

Japan leads the market with strong growth driven by increasing consumer demand for natural and transparent ingredients, especially in bakery and convenience foods. The USA market follows closely, fueled by reformulation efforts and rising preference for organic and non-GMO products across large food manufacturers and retailers.

Germany and France show steady expansion, supported by strict EU regulations and a growing focus on product authenticity and sustainability in food sectors like bakery and packaged goods. The UK is projected to grow at a slightly below-average pace due to post-Brexit regulatory adjustments. However, demand remains strong in key application areas such as bakery and baby food, ensuring steady market expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan clean label flour revenue is growing at a CAGR of 7.6% from 2025 to 2035. Growth is driven by increasing consumer demand for transparency, natural ingredients, and healthier bakery and convenience food options. As a technology-driven OECD economy, Japan prioritizes high-quality, minimally processed flours integrated into innovative food products.

The clean label flour market in Germany is expected to expandat a 6.4% CAGR during the forecast period, slightly below the global average but strongly regulation led. EU food safety and labeling directives, along with consumer awareness of additive-free foods, are pushing adoption of clean label flours.

The French clean label flour revenue is projected to grow at a 6.3% CAGR during the forecast period, mirroring Germany in its policy-backed adoption trajectory. Demand is driven by national organic food initiatives, consumer preference for natural ingredients, and clean bakery innovations. Manufacturing sectors such as bakery, baby foods, and pasta are major consumers.

The USA clean label flour market is projected to grow at a 6.5% CAGR from 2025 to 2035, translating to 0.93 times the global rate. Unlike emerging markets focused on new product introductions, USA demand is heavily tied to reformulation of existing food products to meet clean label standards and growing consumer health awareness.

The UK clean label flour revenue is projected to grow at a CAGR of 6.2% from 2025 to 2035, representing steady but cautious growth at 0.89 times the global pace. Growth is supported by government-led health initiatives, clean label awareness, and retail expansion in organic and natural foods.

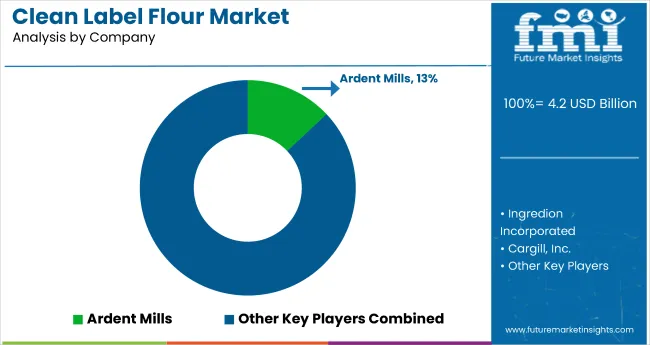

The global market is moderately consolidated, with key players such as Ardent Mills, Ingredion Incorporated, Arrowhead Mills, Groupe Limagrain, and Codrico Rotterdam B.V. leading the industry. These companies offer a broad range of organic and minimally processed flours catering to bakery, baby foods, and specialty food sectors. Ardent Mills focuses on high-quality wheat and specialty flours, while Ingredion Incorporated provides innovative ingredient solutions for clean label formulations. Arrowhead Mills is known for its organic and natural grain products. Groupe Limagrain and Codrico Rotterdam B.V. emphasize sustainability and transparency in their product lines.

Other notable players including Siemer Specialty Ingredients, Kerry Group, Cargill, Inc., Grain Craft, Inc., Hodgson Mill, and Wheat Montana Farms contribute by delivering specialized, high-performance clean label flours for various industrial and retail applications.

Recent Clean Label Flour Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.2 billion |

| Projected Market Size (2035) | USD 8.3 billion |

| CAGR (2025 to 2035) | 7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Product Types Analyzed | Wheat, Corn, Rice, Coconut, Others (Barley, Millet, Quinoa, a nd Sorghum) |

| Application Analyzed | Bakery Products, Baby Foods, Pasta and Noodles, Others (Confectionery, Sauces a nd Dressings, Snacks, a nd Ready- t o-Eat Meals) |

| End User Analyzed | Food Industry, HoReCa, and Retail Sales |

| Distribution Channel Analyzed | Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, and Online Retailers |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Ardent Mills, Ingredion Incorporated, Arrowhead Mills, Groupe Limagrain, Codrico Rotterdam B.V., Siemer Specialty Ingredients, Kerry Group, Cargill, Inc., Grain Craft, Inc., Hodgson Mill, Wheat Montana Farms |

| Additional Attributes | Dollar sales by product type, share by application, regional demand growth, policy impact, sustainability trends, competitive benchmarking |

The global clean label flour market is estimated to be valued at USD 4.2 billion in 2025.

The market size for the clean label flour market is projected to reach USD 8.3 billion by 2035.

The clean label flour market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in clean label flour market are wheat, corn, rice, coconut, rye and others.

In terms of application, bakery products segment to command 52.6% share in the clean label flour market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cleanroom Static Transfer Box Market Size and Share Forecast Outlook 2025 to 2035

Clean Room Panels Market Size and Share Forecast Outlook 2025 to 2035

Cleaning Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleanroom and Lab Surface Contamination Control Products Market Size and Share Forecast Outlook 2025 to 2035

Cleansing Micelle Technology Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cleanroom Construction Market Size and Share Forecast Outlook 2025 to 2035

Clean Room Robot Market Size and Share Forecast Outlook 2025 to 2035

Cleaning In Place Market Growth - Trends & Forecast 2025 to 2035

Clean Steam Separator Market Analysis - Size, Share & Forecast 2025 to 2035

Cleanroom Technologies Market Growth – Trends & Forecast 2025 to 2035

Clean Coal Technology Market Growth - Trends & Forecast 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Cleaning and Hygiene Product Market Report – Demand & Trends 2024-2034

Cleanroom Lighting Market

Clean Labelled Food Additives Market Size and Share Forecast Outlook 2025 to 2035

Clean-Label Ingredients Market Size, Growth, and Forecast for 2025 to 2035

Clean Label Flavors Market Analysis by Liquid Systems, Spray-Dried Powders, Encapsulated Flavors, Emulsion-Based Delivery Systems Through 2035

Clean Label Pectin Market Analysis – Growth & Industry Trends 2025 to 2035

Clean Label Starch Market

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA